Market Overview:

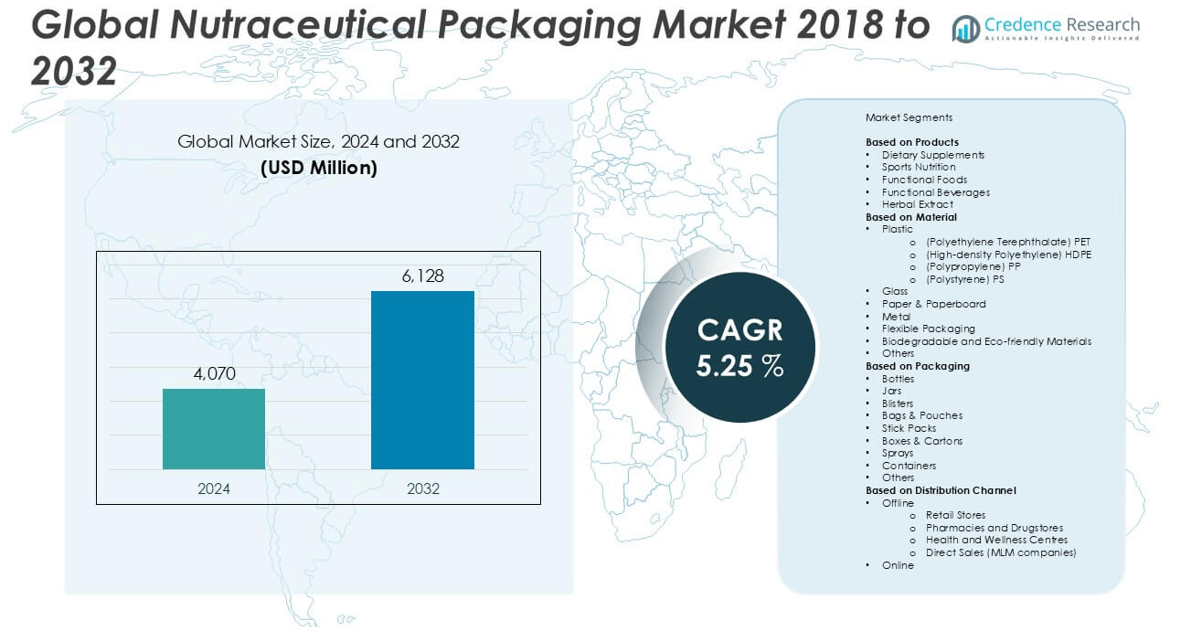

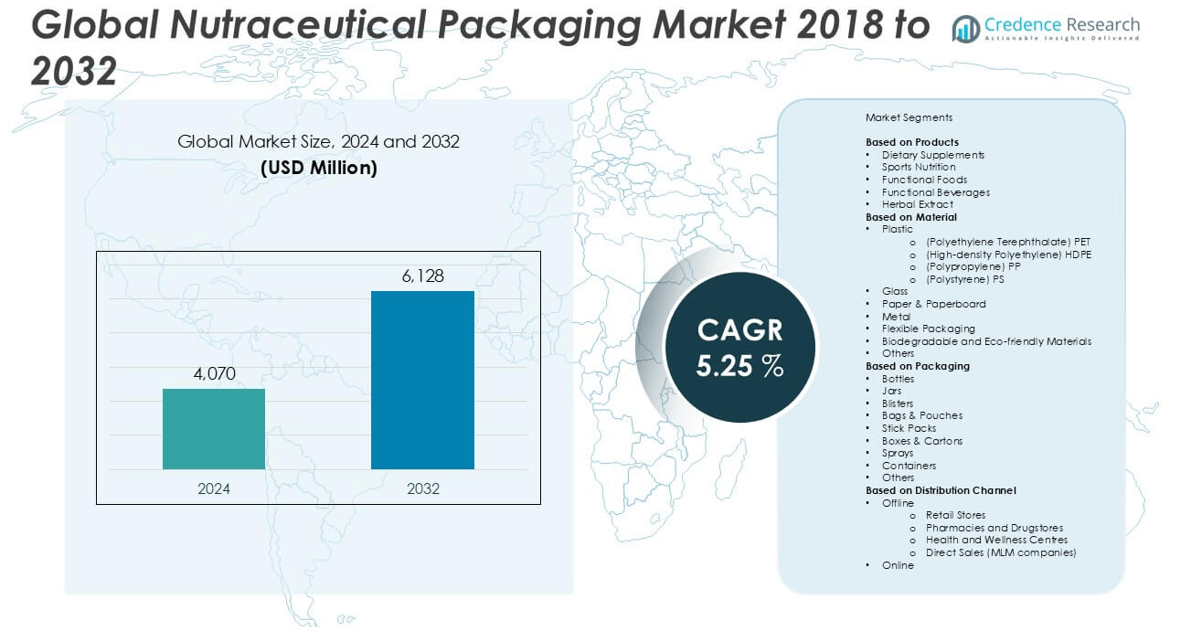

The Nutraceutical Packaging market size was valued at USD 4,070 million in 2024 and is anticipated to reach USD 6,128 million by 2032, at a CAGR of 5.25% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Nutraceutical Packaging Market Size 2024 |

USD 4,070 million |

| Nutraceutical Packaging Market, CAGR |

5.25% |

| Nutraceutical Packaging Market Size 2032 |

USD 6,128 million |

The nutraceutical packaging market is dominated by key players such as Amway, Nestlé Health Science, Abbott Laboratories, Bayer AG, Glanbia Plc, ALPLA Werke, Alpha Packaging, and Graham Packaging Company. These companies leverage advanced packaging technologies, strong distribution networks, and innovative material solutions to maintain a competitive edge. Their focus on product integrity, sustainability, and consumer convenience has helped shape industry standards. North America emerged as the leading region in 2024, capturing 35% of the global market share, driven by high consumer demand for dietary supplements and functional foods, strict regulatory compliance, and a mature healthcare infrastructure.

Market Insights

- The Nutraceutical Packaging market was valued at USD 4,070 million in 2024 and is projected to reach USD 6,128 million by 2032, growing at a CAGR of 5.25% during the forecast period.

- Increasing health awareness and demand for dietary supplements and functional foods are driving market growth, especially in urban populations seeking preventive healthcare solutions.

- Sustainable and biodegradable packaging materials are gaining traction as consumers and regulators push for eco-friendly alternatives; smart and convenient packaging formats are also trending.

- North America leads the market with a 35% share, followed by Asia Pacific at 28% and Europe at 25%; the dietary supplements segment holds the largest share due to its wide consumer base and product diversity.

- Market growth is restrained by fluctuating raw material costs and complex regulatory standards across regions, which challenge manufacturers in maintaining compliance and profitability.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Products

The nutraceutical packaging market is segmented by products into dietary supplements, sports nutrition, functional foods, functional beverages, and herbal extracts. Among these, dietary supplements emerged as the dominant sub-segment in 2024, accounting for the largest market share. This dominance is driven by rising consumer awareness about preventive healthcare, increasing geriatric population, and growing demand for immunity-boosting products. The popularity of capsules, tablets, and soft gels necessitates secure and compliant packaging, further propelling segment growth. Additionally, the increasing global preference for nutritional additives and personalized nutrition supports the expanding use of specialized packaging in the dietary supplement sector.

- For instance, Abbott Laboratories developed its Ensure range with 13 grams of high-quality protein and 26 essential vitamins and minerals, requiring highly specific multilayer barrier packaging to preserve nutrient stability over 12 months without refrigeration.

By Material:

Based on material, the market includes plastic (PET, HDPE, PP, PS), glass, paper & paperboard, metal, flexible packaging, biodegradable and eco-friendly materials, and others. Plastic, particularly PET, leads the market due to its lightweight, durability, cost-effectiveness, and high barrier properties, accounting for the largest share in 2024. PET bottles and containers are extensively used in packaging powders, liquids, and capsules across product categories. However, increasing environmental concerns and government regulations are encouraging the adoption of biodegradable and eco-friendly materials, which are expected to register the fastest growth during the forecast period, as brands shift toward sustainable and recyclable solutions.

- For instance, ALPLA Group launched a PET packaging solution containing 100% post-consumer recycled content (PCR) and achieved the production of over 5 billion PCR-based PET bottles globally by 2023, substantially reducing the use of virgin plastic in nutraceutical packaging.

By Packaging:

The nutraceutical packaging market by type includes bottles, jars, blisters, bags & pouches, stick packs, boxes & cartons, sprays, containers, and others. Bottles represent the dominant packaging type, holding the highest market share in 2024. Their versatility, ease of use, and protective characteristics make them ideal for a wide range of products, especially dietary supplements and functional beverages. Bottles offer excellent barrier protection and dosing accuracy, supporting their wide adoption. Meanwhile, blister packs and stick packs are gaining popularity due to their convenience, tamper-evidence, and portion control features, particularly for single-serve and travel-friendly packaging formats.

Market Overview

Rising Demand for Health and Wellness Products

The growing consumer focus on health, immunity, and preventive care is significantly driving demand for nutraceuticals, thereby boosting the packaging market. Consumers are increasingly opting for dietary supplements, functional foods, and beverages to maintain wellness, particularly after the COVID-19 pandemic. This shift has led to the proliferation of diverse nutraceutical products requiring safe, convenient, and compliant packaging. As the market expands globally, especially in developed regions, packaging formats that ensure product integrity, shelf life, and user convenience are becoming critical enablers of brand growth.

- For instance, Nestlé Health Science increased its global distribution of Boost nutritional drinks, producing over 150 million units annually, each using oxygen-barrier bottle packaging to maintain product efficacy during extended shelf life across 50+ countries.

Innovation in Packaging Materials and Technologies

Technological advancements in packaging materials and formats have become a key growth catalyst. The introduction of moisture-resistant, tamper-evident, and barrier-enhanced materials improves product stability and enhances shelf life. Smart packaging solutions—such as RFID tags, QR codes, and temperature-sensitive indicators—are gaining traction for real-time tracking and authenticity verification. Moreover, biodegradable and recyclable packaging innovations address environmental concerns and regulatory pressures. These innovations not only meet compliance standards but also help brands differentiate and appeal to eco-conscious consumers.

- For instance, Amcor developed AmLite Ultra Recyclable, a high-barrier polyolefin film used in nutraceutical sachets and blister applications, enabling full recyclability while preserving shelf life of up to 24 months for moisture-sensitive supplements.

Expansion of E-commerce and Direct-to-Consumer Channels

The rising penetration of e-commerce and direct-to-consumer (DTC) channels is transforming the nutraceutical packaging landscape. Online platforms require packaging that ensures product safety during transit, ease of handling, and extended shelf life. Rigid and flexible packaging formats that are lightweight, durable, and tamper-proof are increasingly preferred. Additionally, attractive and informative packaging helps build brand recognition in a highly competitive online market. The growing trend of subscription-based nutraceutical models also reinforces demand for compact, resealable, and user-friendly packaging formats.

Key Trends & Opportunities

Shift Toward Sustainable and Eco-Friendly Packaging

Sustainability has emerged as a key trend, prompting manufacturers to adopt eco-friendly packaging solutions. Consumers are demanding recyclable, biodegradable, and compostable materials to reduce environmental impact. This shift is driving innovation in paper-based containers, bio-plastics, and plant-based films. Regulatory frameworks across regions, such as the EU Green Deal and plastic bans in Asia, are further encouraging green packaging adoption. Brands adopting sustainability in their packaging not only reduce environmental footprints but also strengthen customer loyalty and market positioning.

- For instance, Danone transitioned its Actimel and Alpro brands to plant-based packaging in Europe, replacing over 500 million plastic lids annually with paper-based alternatives, effectively eliminating 1,000 metric tons of plastic per year.

Growing Personalization and Premiumization in Packaging

Personalized packaging is gaining momentum as brands aim to create a more engaging consumer experience. From targeted product labeling and dosing instructions to customized aesthetics, packaging is becoming a tool for consumer connection. Additionally, premium packaging that reflects product quality and brand value is in demand, particularly in high-end supplements and functional beverages. Features such as embossing, metallic finishes, and minimalist designs are increasingly used to attract discerning consumers, offering significant differentiation in a crowded marketplace.

- For instance, VitaCup, a personalized supplement coffee brand, utilizes digitally printed flexible packaging with over 60,000 unique variations per production run, enabling personalized formulations and label data for D2C consumers with minimal packaging waste.

Key Challenges

Stringent Regulatory Compliance and Labeling Requirements

The nutraceutical packaging market faces challenges from evolving regulatory standards, especially regarding product labeling and safety disclosures. Different regions impose specific rules on health claims, ingredient declarations, and allergen warnings, making compliance complex for global brands. Non-compliance can result in penalties, product recalls, or damaged brand reputation. Packaging must therefore meet not only marketing and functional objectives but also strict legal standards, adding complexity and cost to product development and distribution.

Volatile Raw Material Costs and Supply Chain Disruptions

Fluctuations in raw material prices—especially for plastics, aluminum, and biodegradable alternatives—pose a significant challenge for manufacturers. Rising oil prices, geopolitical tensions, and disruptions in global logistics have led to inconsistent supply and higher production costs. These uncertainties impact pricing strategies and margins, forcing companies to continuously adapt sourcing strategies and explore alternative materials. Smaller manufacturers, in particular, may face difficulties in maintaining profitability while meeting quality and sustainability demands.

Balancing Aesthetic Appeal with Functional Efficiency

As competition intensifies, brands aim to offer packaging that is both visually appealing and functionally effective. However, balancing these two aspects remains a challenge. Overemphasis on design can compromise factors such as durability, shelf life, and regulatory compliance. Conversely, highly functional packaging may lack the visual differentiation needed to stand out on crowded retail or digital shelves. Achieving the right blend of aesthetics, performance, and cost-efficiency requires strategic material choices and advanced design capabilities.

Regional Analysis

North America

North America held the largest share in the nutraceutical packaging market in 2024, accounting for approximately 35% of the global revenue. The region’s growth is driven by high consumer awareness of health supplements, a robust functional food industry, and stringent packaging regulations ensuring product safety and labeling accuracy. The United States dominates the regional market with a strong presence of major nutraceutical brands and advanced packaging manufacturers. Moreover, the rising trend of personalized nutrition and the growth of e-commerce channels are fueling demand for innovative, tamper-evident, and eco-friendly packaging formats across North America.

Europe

Europe captured nearly 25% of the global nutraceutical packaging market share in 2024. The region is characterized by strong regulatory oversight, sustainability-focused packaging standards, and high demand for functional foods and herbal supplements. Countries such as Germany, France, and the UK are leading markets due to aging populations and a well-established health-conscious consumer base. European consumers increasingly favor biodegradable and recyclable packaging materials, prompting companies to innovate with eco-friendly alternatives. Additionally, the region’s active engagement in circular economy initiatives is influencing both material choice and packaging design, contributing to the market’s consistent growth.

Asia Pacific

Asia Pacific accounted for approximately 28% of the global nutraceutical packaging market in 2024 and is projected to register the fastest growth over the forecast period. Rapid urbanization, increasing disposable income, and growing health awareness in countries like China, India, Japan, and South Korea are key market drivers. The expanding middle class and rising demand for dietary supplements and functional beverages are further boosting regional consumption. Moreover, government support for healthcare infrastructure and domestic manufacturing, along with the surge in online retail platforms, is accelerating the need for efficient, protective, and visually appealing packaging solutions across the region.

Latin America

Latin America held about 7% of the global nutraceutical packaging market in 2024. The market is gradually expanding due to increasing health consciousness and the growing popularity of dietary supplements and herbal extracts. Brazil and Mexico lead regional demand, supported by an improving regulatory environment and a rise in middle-class consumers seeking preventive healthcare solutions. However, the market faces challenges such as inconsistent supply chains and limited adoption of advanced packaging technologies. Nevertheless, growing investments in domestic nutraceutical production and packaging innovation offer substantial opportunities for market expansion in the coming years.

Middle East & Africa

The Middle East & Africa region accounted for around 5% of the global nutraceutical packaging market in 2024. Market growth is supported by rising awareness of lifestyle diseases, increasing urbanization, and a shift toward preventive healthcare. The Gulf Cooperation Council (GCC) countries, particularly the UAE and Saudi Arabia, are witnessing increased consumption of health supplements, which is driving demand for quality packaging. However, limited manufacturing infrastructure and dependence on imports restrict market scale. Ongoing investments in healthcare and retail modernization are expected to boost packaging standards and adoption, making the region an emerging growth area in the nutraceutical sector.

Market Segmentations:

By Products

- Dietary Supplements

- Sports Nutrition

- Functional Foods

- Functional Beverages

- Herbal Extract

By Material

- Plastic

- (Polyethylene Terephthalate) PET

- (High-density Polyethylene) HDPE

- (Polypropylene) PP

- (Polystyrene) PS

- Glass

- Paper & Paperboard

- Metal

- Flexible Packaging

- Biodegradable and Eco-friendly Materials

- Others

By Packaging

- Bottles

- Jars

- Blisters

- Bags & Pouches

- Stick Packs

- Boxes & Cartons

- Sprays

- Containers

- Others

By Distribution Channel

- Offline

- Retail Stores

- Pharmacies and Drugstores

- Health and Wellness Centres

- Direct Sales (MLM companies)

- Online

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the nutraceutical packaging market is characterized by the presence of both global and regional players striving to enhance product differentiation, sustainability, and technological innovation. Key companies such as Amway, Nestlé Health Science, Abbott Laboratories, Bayer AG, and Glanbia Plc maintain strong market positions through integrated supply chains and wide product portfolios. These players are actively investing in advanced packaging formats like tamper-evident, moisture-resistant, and eco-friendly materials to meet evolving consumer preferences and regulatory standards. Meanwhile, packaging specialists such as ALPLA Werke, Alpha Packaging, and Graham Packaging focus on material innovation, lightweight designs, and customized solutions to support nutraceutical brands. Strategic collaborations, mergers, and acquisitions are common as companies aim to expand their regional footprint and technical capabilities. Additionally, the growing demand for direct-to-consumer delivery models has encouraged investments in smart and convenient packaging formats. As sustainability becomes central to brand positioning, players adopting circular packaging solutions gain a competitive edge.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Orgin Pharma Packaging

- Glanbia, Plc

- Medifilm AG

- PontEurope

- Nestlé Health Science

- Alpha Packaging

- CSB Nutrition Corporation

- Nutra Solutions USA

- Arizona Nutritional Supplements LLC

- Abbott Laboratories

- Law Print & Packaging Management Ltd.

- Wasdell Packaging Group

- Flex-pack

- Vantage Nutrition

- American Nutritional Corporation

- ALPLA Werke Alwin Lehner GmbH & Co KG

- Container & Packaging Supply Inc.

- Bayer AG

- Comar

- Amway

- Moluded Packaging Solutions Limited

- Graham Packaging Company

Recent Developments

- In April 2025, a company-wide sustainability initiative, eco-friendly portfolio of products was unveiled by Premium Label and Packaging Solutions and received a silver Ecovadis certification badge.

- In January 2025, TricorBraun announced the acquisition of Veritiv Containers, which aimed to grow the primary packaging offering and provide customers with expanded services and supply chain options. TricorBraun’s acquisition significantly expands its North American presence, enhancing its distribution capabilities with seven new warehouses and over 500,000 square feet of additional storage space. This strategic move is expected to bolster the company’s extensive supply chain network, reinforcing its position as an industry leader in packaging solutions.

- In December 2024, At CpHI & PMEC 2024 in Delhi, ACG Engineering, a branch of ACG, a provider of integrated manufacturing solutions to the international pharmaceutical and nutraceutical sectors, showcased its revolutionary ADAPT X feeder.

- In December 2024, Sonoco Products company completed its acquisition of Eviosys, Europe’s top food can and closure manufacturer from KPS Capital Partners.

- In October 2024, Berry Global launched ClariPPil fully recyclable polypropylene (PP) pill bottles for healthcare applications.

- In July 2024, Smurfit Kappa has completed its acquisition of WestRock, forming Smurfit Westrock, one of the world’s largest packaging companies.

Market Concentration & Characteristics

The Nutraceutical Packaging Market exhibits moderate concentration, with a mix of established global players and emerging regional manufacturers competing across various product segments. It reflects a fragmented structure due to the diversity of applications, materials, and packaging formats. Leading companies maintain strong positions by offering customized, compliant, and sustainable packaging solutions aligned with consumer demand and regulatory standards. It favors innovation in material science, particularly in biodegradable and recyclable formats, due to rising environmental concerns. The market emphasizes functionality, safety, and shelf life, especially for dietary supplements and functional foods. It also shows growing alignment with e-commerce requirements, including durability and ease of transport.

Report Coverage

The research report offers an in-depth analysis based on Products, Material, Packaging, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The nutraceutical packaging market will continue to grow steadily, driven by rising global demand for dietary supplements and functional foods.

- Sustainable and biodegradable packaging materials will gain greater adoption due to increasing environmental awareness and regulatory pressure.

- Demand for tamper-evident, moisture-resistant, and child-resistant packaging will rise to ensure product safety and compliance.

- E-commerce growth will influence packaging design, favoring formats that are durable, lightweight, and consumer-friendly.

- Smart packaging technologies such as QR codes and tracking features will become more prevalent to improve traceability and customer engagement.

- Personalization in packaging will increase as brands focus on consumer-specific health needs and direct-to-consumer models.

- Asia Pacific will witness the fastest market growth due to expanding health-conscious populations and increasing disposable income.

- Manufacturers will invest more in flexible packaging formats to cater to convenience-oriented consumer preferences.

- Regulatory alignment across regions will influence packaging innovations focused on label accuracy and product transparency.

- Strategic partnerships between packaging firms and nutraceutical companies will strengthen supply chains and accelerate innovation.