Market Overview:

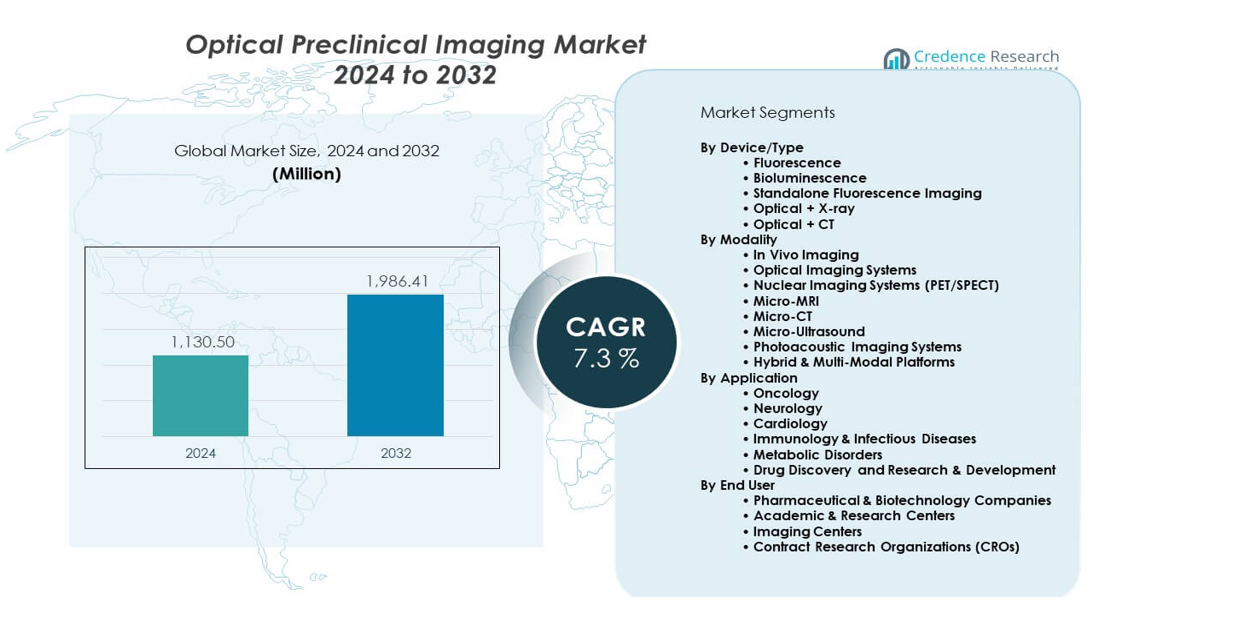

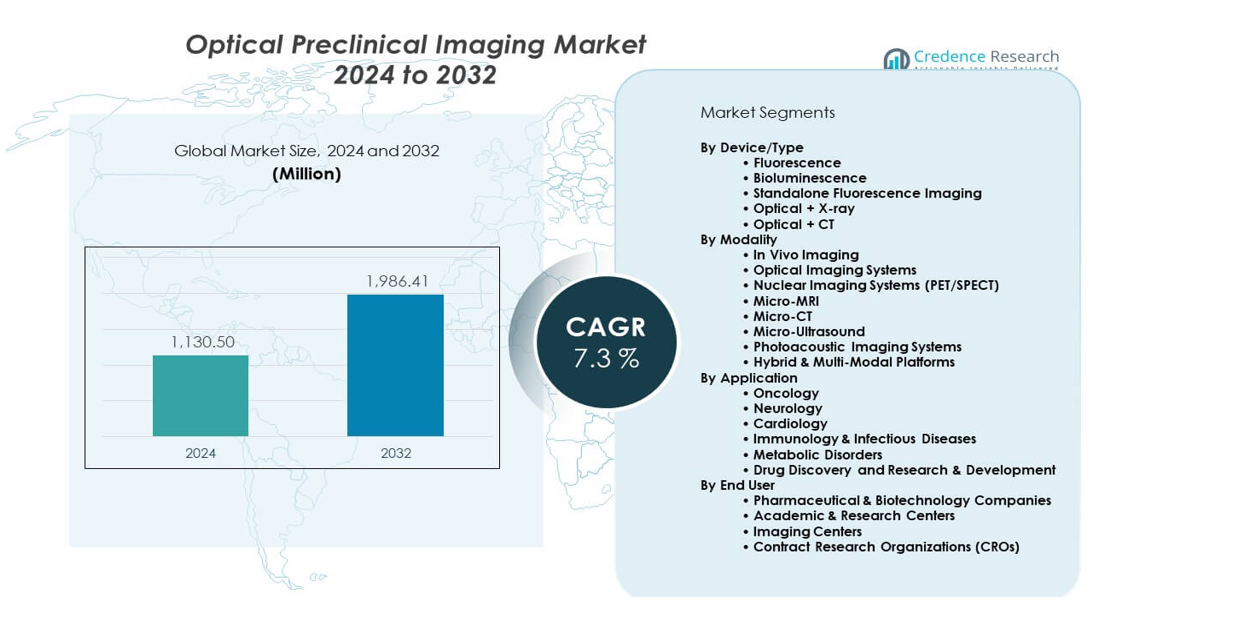

The Optical Preclinical Imaging Market is projected to grow from USD 1,130.5 million in 2024 to USD 1,986.41 million by 2032, with a CAGR of 7.3% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Optical Preclinical Imaging Market Size 2024 |

USD 1,130.5 million |

| Optical Preclinical Imaging Market, CAGR |

7.3% |

| Optical Preclinical Imaging Market Size 2032 |

USD 1,986.41 million |

Growing adoption of non-invasive imaging tools drives steady interest across research labs. Scientists prefer optical systems for clear molecular tracking and faster study cycles. Pharma teams use these platforms to support deeper drug development goals. Strong demand for early-stage disease models lifts system installations worldwide. New imaging modes improve clarity across small-animal studies. Labs value the safer workflows offered by optical platforms. Continuous innovation keeps buyers engaged across oncology and neurology projects. Expanding R&D budgets strengthen long-term adoption in advanced research centers.

North America leads due to strong research funding and widespread use in drug discovery. Europe follows because academic institutes invest heavily in imaging upgrades. Asia Pacific emerges fast with rising biomedical research in China and India. Japan and South Korea expand capacity through technology-focused programs. Latin America builds slow but steady growth with new university labs. The Middle East advances through targeted health research investments. Regional momentum grows where infrastructure and scientific programs advance together.

Market Insights:

- The Optical preclinical imaging market is valued at USD 1,130.5 million in 2024 and is projected to reach USD 1,986.41 million by 2032, advancing at a 7.3% CAGR.

- North America holds 38%, Europe holds 29%, and Asia-Pacific holds 23%, supported by strong research ecosystems and advanced imaging adoption.

- Asia-Pacific, with 23% share, remains the fastest-growing region due to rising biomedical investment and expanding preclinical programs.

- In vivo imaging leads the modality structure with over 35% share, driven by broad use in disease modelling.

- Pharmaceutical and biotechnology companies dominate end-user contribution with around 40% share, backed by intensive drug discovery workflows.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Use of Non-Invasive Molecular Imaging

The Optical preclinical imaging market grows due to wider use of non-invasive tools across research labs. Scientists depend on optical platforms to track biological activity with greater clarity. Teams prefer these systems because they reduce study interruptions during long projects. Drug developers use the method to validate early therapeutic signals with stronger confidence. R&D programs gain value when imaging supports deeper molecular insight. It helps research groups shorten cycle times in disease model studies. Labs choose systems that deliver faster setup and cleaner output. Continuous upgrades in imaging software lift adoption across academic and commercial centers.

- For instance, PerkinElmer’s IVIS Spectrum system supports multiplex fluorescence and bioluminescence imaging and is used in global research installations, enabling high-resolution non-invasive tracking.

Strong Expansion of Oncology and Immunology Research

The Optical preclinical imaging market benefits from rapid growth in studies linked to cancer and immune disorders. Researchers depend on optical platforms to monitor tumor growth in real time. Teams value the ability to visualize immune cell behavior with stronger accuracy. Drug candidates show clearer performance trends when tracked through optical modes. Labs improve screening workflows through stable fluorescence and bioluminescence tools. It supports deeper exploration of complex disease pathways. Demand rises where research groups scale immunotherapy programs. Academic institutes strengthen system investments due to rising project volumes.

- For instance, Bruker’s In-Vivo Xtreme platform enables high-sensitivity tumor tracking with a CCD camera capable of detecting signals as low as single-photon levels, supporting oncology and immunology trials globally.

Growing Preference for Faster Data Acquisition and High Workflow Efficiency

The Optical preclinical imaging market advances with demand for faster output and cleaner interpretation. Labs prioritize systems that cut time spent on repetitive imaging cycles. Researchers choose solutions that support seamless animal handling in controlled settings. Better workflow alignment supports smooth screening of multiple drug classes. Teams gain stronger confidence when platforms deliver consistent reproducibility. It offers users a path toward higher throughput without data loss. Adoption rises across centers focused on accelerated pipeline movement. Broader system modernization drives long-term interest among global users.

Increased Demand for Cost-Effective Imaging Alternatives in Early Research

The Optical preclinical imaging market expands where teams seek economical tools for early experimentation. Labs select optical systems because support costs stay low compared with complex platforms. Researchers maintain steady output without frequent maintenance stops. It gives smaller institutes access to reliable imaging capability. Programs run more studies within tight budgets when optical solutions are used. Institutes rely on these tools to improve screening success rates. Academic labs adopt systems to widen experimental scope. Cost stability encourages long-term retention of optical platforms.

Market Trends:

Shift Toward AI-Linked Image Processing and Automated Analysis

The Optical preclinical imaging market observes a strong rise in AI-linked processing across labs. Teams use automated systems to label patterns with higher clarity. AI tools help researchers remove noise from complex molecular visuals. It supports faster reading of multi-layered results. Drug developers use automation to compare large data groups with improved structure. Labs value tools that limit manual adjustments inside workflow cycles. Strong interest grows in models that detect early biological changes. The trend pushes vendors to combine software intelligence with hardware precision.

- For instance, Fujifilm’s acquisition of AI-driven imaging firm Inspirata brought digital pathology algorithms that process up to 1,000 whole-slide images per hour, strengthening automated interpretation in preclinical workflows.

Adoption of Multimodal Imaging Platforms Across Research Programs

The Optical preclinical imaging market benefits from a shift toward multimodal platforms that merge several detection modes. Labs prefer integrated systems because they deliver broader biological context in one cycle. Teams use hybrid tools to match fluorescence data with complementary signals. It allows clearer tracking of complex disease patterns. Researchers gain deeper understanding of treatment effects with improved accuracy. Combined imaging reduces the need for separate equipment across projects. Integration also supports more flexible handling of diverse research goals. Market players invest in solutions that unify optical and complementary technologies.

- For instance, MILabs’ VECTor multimodal platform integrates optical, CT, PET, and SPECT in a single system and offers sub-0.6 mm PET spatial resolution, enabling precise multimodal alignment.

Rise in Demand for Portable and Compact Imaging Systems

The Optical preclinical imaging market moves toward compact systems designed for smaller labs. Teams choose portable platforms to reduce space concerns in busy research environments. Lightweight systems improve mobility during multi-group studies. It supports flexible project scheduling where equipment rotation is required. Labs rely on compact designs to avoid large infrastructure upgrades. Portable units help new institutes adopt imaging technologies without heavy setup. Demand increases across teaching facilities seeking accessible learning tools. Vendors release updated designs to meet these shifting expectations.

Stronger Adoption of High-Sensitivity Probes and Advanced Contrast Agents

The Optical preclinical imaging market progresses due to wider use of high-sensitivity probes in molecular tracking. Research teams depend on improved probes to reveal signals that older tools missed. New contrast agents help labs detect early biological changes with higher reliability. It supports deeper evaluation of pathways across oncology and neurology. Development programs align with rising interest in targeted imaging chemistry. Teams benefit from stable signal behavior during longer studies. Labs choose agents that improve clarity across repeated cycles. Vendors expand portfolios to match new research requirements.

Market Challenges Analysis:

High Cost of Advanced Imaging Equipment and Technical Integration

The Optical preclinical imaging market faces challenges linked to high system cost during upgrades. Research teams struggle to secure funding for advanced optical platforms. Complex integration with existing workflows slows adoption across smaller labs. It places pressure on institutions with limited infrastructure. Teams need skilled staff to manage sensitive tools and data workflows. Training gaps limit broad use across early-stage research groups. Maintenance needs raise long-term expenses for budget-tight centers. Price pressure continues to restrict access in developing regions.

Data Interpretation Barriers and Limited Standardization Across Research Workflows

The Optical preclinical imaging market experiences obstacles tied to inconsistent data patterns across labs. Researchers face difficulty aligning results from varied imaging models. It complicates collaborative studies that depend on unified parameters. Lack of standard imaging protocols weakens cross-team comparisons. Labs struggle when advanced software tools require steep learning curves. Interpretation errors rise when workflows differ across institutions. Growing data volume increases complexity in analysis and reporting. Standardization gaps slow progress toward broader adoption.

Market Opportunities:

Growing Potential in Personalized Medicine and Targeted Drug Programs

The Optical preclinical imaging market gains strong opportunity through targeted therapy development. Labs use optical methods to match imaging with treatment design. Teams identify early biomarker changes that guide precision medicine. It supports programs that explore patient-specific disease models. Demand rises where drug developers expand niche therapeutic areas. Institutes adopt imaging to refine early investigational strategies. Broader research interest supports rapid technology placement. Vendors gain room to scale new optical solutions.

Expansion in Emerging Research Hubs and Academic Infrastructure Growth

The Optical preclinical imaging market benefits from rising investments in new scientific centers. Countries with expanding biomedical programs adopt optical platforms at faster pace. Academic institutes upgrade labs to support global research partnerships. It helps newer regions gain competitive scientific capacity. Skilled workforce development improves adoption confidence. More universities introduce advanced imaging training tracks. Strengthening infrastructure broadens market reach. Vendors gain long-term growth opportunity across new geographies.

Market Segmentation Analysis:

Device/Type Breakdown

The Optical preclinical imaging market expands through strong demand for fluorescence and bioluminescence platforms due to their high sensitivity and clear signal output. Standalone fluorescence systems gain traction in small research units that seek simple workflows. Optical + X-ray and Optical + CT combinations attract buyers that need structural and functional alignment in one workflow. It supports multi-angle visualization for complex disease studies and improves precision in longitudinal models.

- For instance, TriFoil Imaging’s InSyTe FLECT system delivers 360-degree fluorescence tomography with spatial resolution below 1 mm, supporting high-fidelity molecular mapping.

Modality Insights

The Optical preclinical imaging market gains momentum from in vivo imaging systems that help teams study real-time biological activity. Optical imaging units remain widely used for routine molecular tracking across oncology and neurology. Nuclear solutions such as PET and SPECT offer deeper functional insight in hybrid workflows. Photoacoustic tools grow interest due to improved penetration depth. Micro-MRI, micro-CT, and micro-ultrasound strengthen adoption across multimodal labs that require complementary data.

- For instance, MR Solutions’ cryogen-free 3T and 7T preclinical MRI scanners reduce operational costs by eliminating liquid helium and support <100 μm resolution for integrated multimodal studies.

Application Landscape

The Optical preclinical imaging market secures strong demand from oncology programs that need rapid tumor tracking and treatment-response mapping. Neurology follows due to deeper study of neurodegenerative pathways. Cardiology and metabolic research adopt optical tools for monitoring molecular changes with minimal disruption. Immunology and infectious disease programs expand usage in vaccine and pathogen studies. Drug discovery teams depend on optical systems to validate lead molecules with higher clarity.

End User Outlook

The Optical preclinical imaging market grows through strong adoption by pharmaceutical and biotechnology companies that rely on high-throughput workflows. Academic and research centers remain key users due to strong grant-driven projects. Imaging centers expand capacity to support specialized studies. Contract research organizations widen use of optical tools to attract global clients that seek quick screening cycles.

Segmentation:

By Device/Type

- Fluorescence

- Bioluminescence

- Standalone Fluorescence Imaging

- Optical + X-ray

- Optical + CT

By Modality

- In Vivo Imaging

- Optical Imaging Systems

- Nuclear Imaging Systems (PET/SPECT)

- Micro-MRI

- Micro-CT

- Micro-Ultrasound

- Photoacoustic Imaging Systems

- Hybrid & Multi-Modal Platforms

By Application

- Oncology

- Neurology

- Cardiology

- Immunology & Infectious Diseases

- Metabolic Disorders

- Drug Discovery and Research & Development

By End User

- Pharmaceutical & Biotechnology Companies

- Academic & Research Centers

- Imaging Centers

- Contract Research Organizations (CROs)

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Leadership and Structural Strength

The Optical preclinical imaging market holds its largest share in North America due to strong research spending and mature imaging infrastructure. Academic institutes and biotechnology hubs expand imaging capacity across multiple disease programs. It benefits from early access to hybrid and multimodal platforms driven by strong vendor presence. Pharmaceutical clusters integrate optical systems into specialized R&D units. Government-backed research funding supports broader preclinical adoption across cancer and immunology programs. CRO networks across the US scale demand for high-throughput imaging services. The region maintains its leadership through early technology uptake and consistent innovation cycles.

Europe’s Solid Position Backed by Academic and Clinical Research

The Optical preclinical imaging market maintains a high share in Europe supported by strong clinical translation programs. Research institutes in Germany, the UK, and France adopt advanced fluorescence and bioluminescence systems. It grows due to consistent funding for oncology and neurology pathways. CROs in Western Europe expand multimodal imaging services to meet global project demand. Eastern Europe builds traction through rising investment in preclinical infrastructure. Academic centers strengthen collaborations with technology vendors for next-generation imaging projects. Market presence remains strong due to structured research frameworks.

Asia-Pacific as the Fastest Growing Regional Cluster

The Optical preclinical imaging market records rapid expansion in Asia-Pacific, driven by growing biomedical activity in China, Japan, and South Korea. Academic and government-backed laboratories upgrade imaging platforms to support cancer and infectious disease research. It gains scale due to rising investment in translational research programs. India and Singapore widen adoption through structured biotech growth plans. Pharmaceutical manufacturing hubs expand demand for in vivo and hybrid imaging tools. Research talent in the region strengthens adoption of multimodal systems. Growth accelerates where national health research priorities align with imaging capability.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Bruker Corporation (US)

- PerkinElmer, Inc. (US)

- Fujifilm Holdings Corporation (Japan/US)

- Mediso Ltd. (UK)

- Milabs B.V. (Netherlands)

- MR Solutions (UK)

- TriFoil Imaging (US)

- BioTek Instruments (Agilent Technologies) (US)

- Vieworks Co., Ltd. (South Korea)

- Berthold Technologies GmbH & Co. KG (Germany)

Competitive Analysis:

The Optical preclinical imaging market shows strong rivalry among global vendors that invest in advanced multimodal systems and AI-enabled tools. Companies compete by expanding product ranges that support fluorescence, bioluminescence, and hybrid imaging. It strengthens innovation cycles through partnerships with research institutes, CROs, and pharmaceutical clients. Vendors focus on higher sensitivity, faster acquisition, and compact system design to gain an edge. Market competition rises where players integrate software analytics with molecular imaging platforms. New releases focus on workflow automation and improved disease-model visualization. Competitive pressure remains high due to rapid technology turnover and expanding regional demand.

Recent Developments:

- In October 2025, Mediso completed the installation of an AnyScan TRIO-TheraMAX SPECT/CT at the Department of Nuclear Medicine at Heidelberg University Hospital in Germany. This installation was officially announced on October 2-3, 2025, through PRNewswire and verified news sources. The TheraMAX system is specifically designed for theranostic imaging and targets radioisotopes emitting alpha and beta particles with co-emission of high and ultra-high energy gamma photons.

- In March 2025, PerkinElmer launched the QSight 500 LC/MS/MS system at Pittcon 2025 in Boston. In July 2025, the system received the Labmate Award for Excellence in the “Innovation of the Year for a product or service” category. The award recognized the system’s ability to handle challenging sample matrices with exceptional reliability and cost efficiency.

- In February 2024, Bruker Corporation announced the acquisition of Spectral Instruments Imaging LLC, a leader in preclinical in-vivo optical imaging systems. This acquisition was officially published on February 5-6, 2024, through Business Wire and the company’s official investor relations website. The acquisition complements Bruker’s Preclinical Imaging portfolio by filling a technology gap and broadening its range of preclinical solutions for disease research with advanced bioluminescence (BLI), fluorescence (FLI), and X-ray imaging systems.

Report Coverage:

The research report offers an in-depth analysis based on Device/Type, Modality, Application, End User, and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for multimodal platforms grows due to cross-discipline research needs.

- Hybrid imaging tools gain wider acceptance across oncology pipelines.

- AI-supported image processing becomes a standard feature in R&D labs.

- Portable optical units expand reach across small and mid-size institutes.

- Strong investment boosts adoption in Asia-Pacific research hubs.

- High-sensitivity probes drive deeper disease-model visualization.

- CRO expansion increases use of optical systems for rapid studies.

- Academic institutes adopt more advanced fluorescence platforms.

- Research partnerships fuel faster development of integrated tools.

- Digitized workflows support large-sample analysis across global projects.