Market Overview:

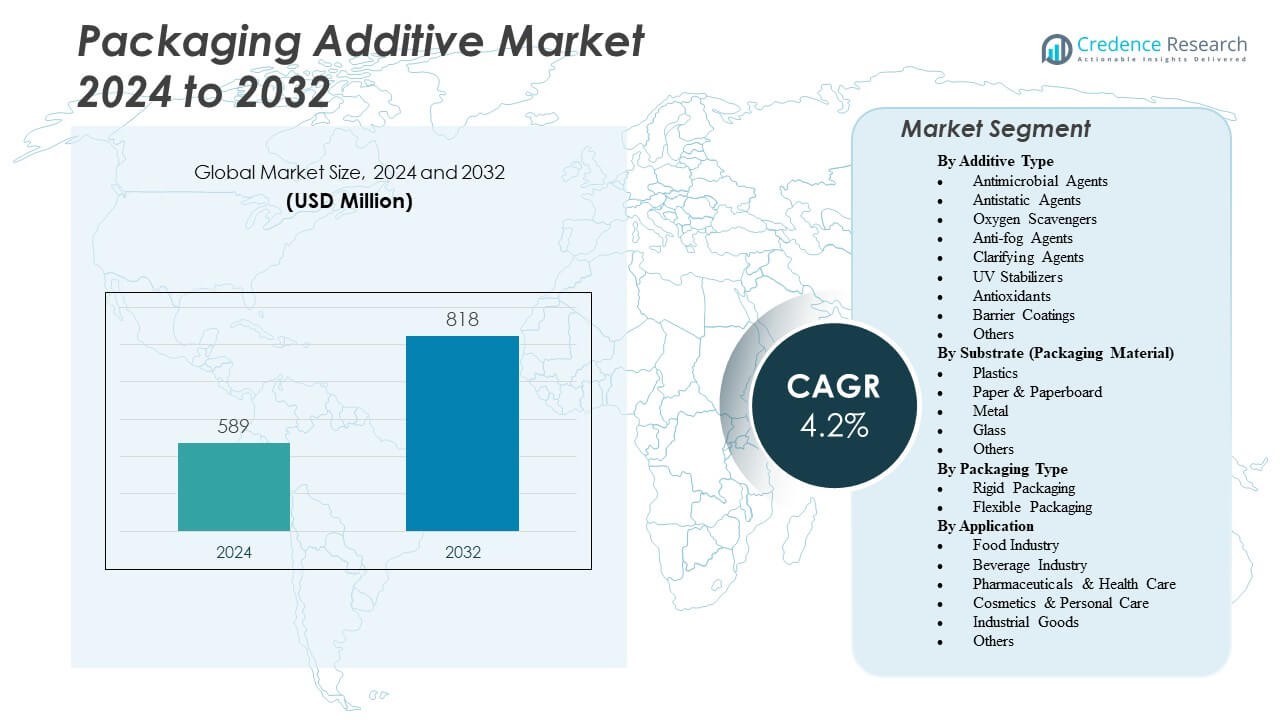

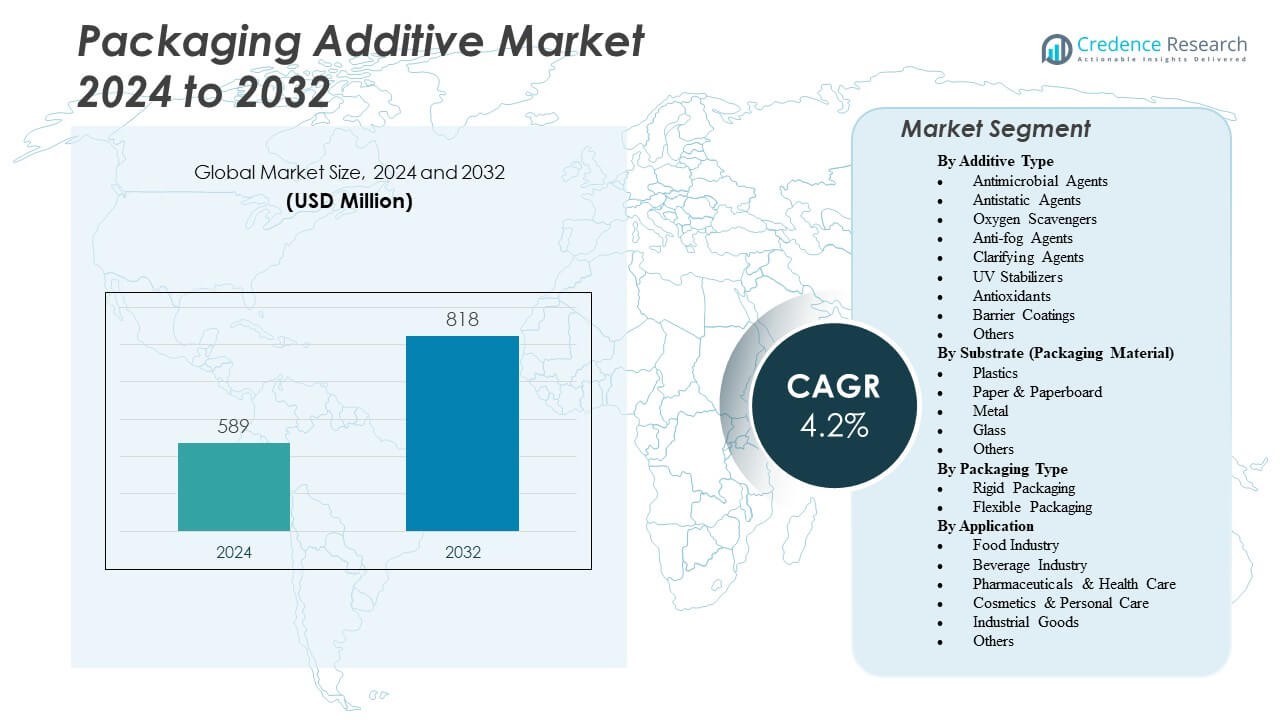

The Packaging Additive Market is projected to grow from USD 589 million in 2024 to an estimated USD 818 million by 2032, with a compound annual growth rate (CAGR) of 4.2% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Packaging Additive Market Size 2024 |

USD 589 Million |

| Packaging Additive Market, CAGR |

4.2% |

| Packaging Additive Market Size 2032 |

USD 818 Million |

The market is driven by rising demand for longer shelf life, enhanced product safety, and improved aesthetics across the food, pharmaceutical, and personal care industries. As consumers increasingly prioritize convenience and product sustainability, manufacturers are adopting additives like antioxidants, antimicrobials, and UV stabilizers to extend product life and preserve quality. Technological advancements in packaging materials and the shift toward eco-friendly and recyclable packaging are further accelerating the use of functional additives. Regulatory support for sustainable packaging standards also contributes to expanding adoption.

Regionally, North America leads the Packaging Additive Market due to its established food and healthcare sectors and early adoption of advanced packaging technologies. Europe follows closely, with strong environmental regulations encouraging the use of biodegradable and additive-enhanced packaging. Meanwhile, the Asia-Pacific region is emerging as a high-growth market, driven by rapid industrialization, expanding retail infrastructure, and rising demand for packaged consumer goods in countries such as China and India. These developments, combined with rising awareness of food safety and shelf-life extension, are propelling regional market expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Packaging Additive Market was valued at USD 589 million in 2024 and is projected to reach USD 818 million by 2032, growing at a CAGR of 4.2%.

- Rising demand for extended shelf-life and food safety in packaged products is a key driver accelerating additive adoption.

- The pharmaceutical sector’s strict regulatory compliance and stability requirements are boosting the use of specialized packaging additives.

- Sustainability trends are encouraging the use of bio-based additives compatible with recyclable and biodegradable materials.

- Regulatory complexities and cost pressures in emerging markets act as barriers to wider adoption of advanced additives.

- North America leads the Packaging Additive Market due to strong food and healthcare sectors and early innovation adoption.

- Asia-Pacific is emerging as the fastest-growing region, supported by rising consumption, industrialization, and flexible packaging demand.

Market Drivers:

Rising Consumer Demand for Extended Shelf-Life and Food Safety

The Packaging Additive Market benefits from a growing global demand for packaged foods with extended shelf lives and improved safety features. Consumers prioritize freshness and protection from contamination, especially in perishable food and beverage categories. This behavior pushes manufacturers to incorporate oxygen scavengers, antimicrobial agents, and moisture regulators into packaging materials. It boosts the need for advanced additive formulations that maintain food quality during transportation and storage. Retailers also require longer shelf stability to reduce waste and improve inventory cycles. The food industry’s expansion into ready-to-eat and frozen meals further drives additive usage. It strengthens the need for smart preservation solutions tailored to product sensitivity. The Packaging Additive Market gains momentum as safety becomes a core purchasing factor.

- For instance, Mitsubishi Gas Chemical Co., Inc. developed the first-ever PFAS-free AGELESS oxygen absorber for the food industry, which effectively reduces oxygen levels in sealed packaging to as low as 0.1%, supporting freshness and spoilage prevention in products like dairy, baked goods, and ready-to-eat meals.

Growth of the Pharmaceutical Sector and Regulatory Compliance Needs

The Packaging Additive Market benefits from stringent regulations and demand for compliance in pharmaceutical packaging. Drugs and biologics require specialized packaging that preserves potency and protects from environmental exposure. Additives such as UV blockers and anti-counterfeit agents support these functional needs. Pharmaceutical firms increasingly invest in additive-enhanced blister packs, vials, and pouches to maintain drug stability. Regulatory agencies mandate clear labeling and contamination prevention, accelerating innovation in protective packaging. The pharmaceutical supply chain’s complexity reinforces the value of durable packaging materials. It promotes demand for heat-resistant, tamper-evident, and non-reactive additive blends. The Packaging Additive Market sees strong traction due to this critical sector’s compliance-driven requirements.

Rising Environmental Awareness and Adoption of Sustainable Packaging

The Packaging Additive Market grows through increased investment in sustainable, biodegradable, and recyclable materials enhanced with additives. Consumers expect environmentally responsible packaging without compromising product integrity. Biodegradable plastics benefit from stabilizers, anti-fog agents, and slip additives that improve usability and durability. Regulations targeting single-use plastics compel producers to enhance renewable material performance through specialized additive integration. Brands position sustainable packaging as a competitive advantage, reinforcing demand for performance-enhancing solutions. Recycled content packaging requires compatibilizers and anti-block additives for process efficiency. It ensures circular packaging retains functionality comparable to virgin alternatives. The Packaging Additive Market aligns with the sustainability trend by offering additive solutions for eco-compliant packaging.

- For instance, BASF launched the Irganox 1076 FD BMBcert line in September 2023, offering a TÜV-certified biomass-balanced antioxidant made with renewable feedstocks that reduces the product’s carbon footprint by up to 60% compared to conventional alternatives, without compromising performance

Innovation in Functional Additives Enhancing Performance Across Applications

The Packaging Additive Market advances through ongoing innovation in high-performance additives tailored to niche applications. Research drives development in barrier coatings, clarity enhancers, and anti-static agents to support specific packaging formats. Flexible packaging benefits from slip and anti-block agents that improve processability. Rigid packaging integrates UV absorbers and clarifying additives to enhance visual appeal and shelf presence. Emerging applications in electronics and sensitive equipment packaging demand precise additive formulations for static dissipation and mechanical stability. Functional additives improve packaging safety, handling, and resilience without increasing material costs significantly. It supports diverse packaging demands in food, healthcare, and industrial applications. The Packaging Additive Market gains depth through these application-specific performance enhancements.

Market Trends:

Integration of Smart and Interactive Packaging Technologies

The Packaging Additive Market is evolving with the growing integration of smart packaging components like thermochromic, photochromic, and color-indicator additives. These enable interactive packaging that visually indicates freshness, temperature changes, or tampering. Smart additives support QR code functionality and augmented reality features that enhance consumer engagement. Consumer brands deploy these elements to differentiate products and improve traceability. Food, pharmaceutical, and luxury sectors are leading adopters of smart additive-enabled solutions. It allows enhanced consumer communication and ensures product authenticity. Interactive packaging creates a tech-enabled marketing layer through visual cues and data capture. The Packaging Additive Market is redefining packaging as an information and experience medium.

Shift Toward Mono-Material and Recyclable Packaging Formats

The Packaging Additive Market is impacted by the transition to mono-material packaging for better recyclability and reduced environmental footprint. Brand owners and converters prefer additive-enhanced polyethylene or polypropylene formats over multi-material laminates. These materials rely on compatibilizers, processing aids, and optical enhancers to achieve performance parity with traditional multilayer designs. Retail and FMCG brands drive this shift to meet recyclability standards and minimize material separation issues. It requires new additive formulations that balance sealing integrity and transparency in single-polymer systems. The market sees increased investment in sustainable additive systems compatible with high-volume recycling streams. The Packaging Additive Market responds by tailoring solutions to support circular packaging goals.

- For example, Amcor’s AmLite portfolio is another high-profile launch these fully recyclable mono-material solutions combine high-barrier properties with custom printable formats, directly targeting industry demands for improved circularity and reduced material separation requirements.

Expansion of High-Barrier Packaging Across Diverse Sectors

The Packaging Additive Market is trending toward high-barrier materials that resist oxygen, moisture, and UV degradation. The food and healthcare sectors lead this movement to maintain product stability and integrity during long distribution cycles. Metallized films and coated materials integrate anti-microbial and gas-scavenging additives to enhance barrier properties. High-barrier pouches and wraps are gaining popularity in ready meals, dairy, and pharmaceuticals. It allows manufacturers to extend shelf life without chemical preservatives. Innovation in barrier coatings and multilayer film technology fuels this trend. The Packaging Additive Market supports growing demand for active and passive barrier enhancement across rigid and flexible packaging.

- For example, cellulose nanomaterials (CNMs), such as TEMPO-oxidized cellulose nanofibrils, have demonstrated oxygen transmission rates below 1 cc/m²/day in dry conditions, making them suitable for sustainable barrier coatings in food and pharmaceutical packaging.

Rising Demand for Customization and Aesthetic Packaging Features

The Packaging Additive Market adapts to increased brand focus on customized aesthetics and consumer appeal. Visual impact is key in competitive retail environments, prompting use of gloss enhancers, matte agents, and anti-fog additives. Additives help achieve desired finishes while preserving mechanical performance. Luxury and cosmetic brands rely on optical brighteners and UV absorbers for packaging that communicates premium quality. Customizable textures and finishes are being integrated without increasing packaging thickness or compromising sustainability. Packaging design trends in e-commerce and retail channels reinforce aesthetic differentiation. The Packaging Additive Market evolves to meet this demand for personalized packaging experiences.

Market Challenges Analysis:

Complexity in Regulatory Compliance and Material Compatibility

The Packaging Additive Market faces challenges in complying with diverse and evolving regulatory standards across regions. Food safety, pharmaceutical packaging, and consumer health regulations require strict validation of additive composition and migration levels. Additive manufacturers must demonstrate safety, efficacy, and stability under multiple use scenarios. It complicates global product deployment, especially in cross-border packaging operations. Inconsistent regulations across North America, Europe, and Asia increase compliance burdens for multinational suppliers. Material compatibility issues also hinder additive adoption, particularly with biodegradable substrates. Packaging developers must balance performance and compliance without introducing contamination risks. The Packaging Additive Market requires rigorous testing and documentation to address regulatory scrutiny.

Cost Sensitivity and Scalability Constraints in Emerging Markets

The Packaging Additive Market contends with pricing pressures and low-margin packaging operations in developing economies. Many small and medium enterprises hesitate to adopt premium additives due to cost concerns. Although additives improve performance, their added cost is often difficult to pass on to price-sensitive end-users. Market scalability is restricted by lack of access to advanced processing equipment required for certain additives. Distributors in emerging regions face challenges in inventory management, technical training, and customer education. Without sufficient technical support, adoption remains limited to top-tier packaging converters. The Packaging Additive Market must address these limitations through cost-effective innovations and local support networks.

Market Opportunities:

Rising Investment in Biodegradable and Renewable Packaging Solutions

The Packaging Additive Market holds strong growth potential through its alignment with global sustainability goals. As industries adopt bioplastics and renewable materials, they require specialized additives to achieve commercial functionality. Slip agents, anti-fog compounds, and stabilizers designed for bio-based substrates open new avenues for innovation. Consumer and legislative support for eco-friendly packaging motivates R&D investment in natural and compostable additive blends. Countries across Europe and Asia-Pacific are implementing policies that prioritize biodegradable packaging. It drives demand for additives that maintain performance while enabling environmental compliance. The Packaging Additive Market stands to benefit from this shift in material sourcing and disposal practices.

Emergence of High-Growth Sectors Like E-commerce and Ready-to-Eat Meals

The Packaging Additive Market sees expanding opportunities from the booming e-commerce and convenience food sectors. Packaging for these segments demands high durability, tamper resistance, and visual clarity. Functional additives such as anti-scratch agents, sealing enhancers, and oxygen scavengers support these critical needs. Ready-to-eat and single-serve formats also require lightweight yet protective packaging enhanced through additives. The growing consumer shift toward on-the-go consumption and digital retail platforms creates new product categories. Brands actively explore functional packaging to improve user experience and delivery efficiency. The Packaging Additive Market can capitalize on these trends by developing targeted additive solutions for these dynamic end-use verticals.

Market Segmentation Analysis:

By additive types, the Packaging Additive Market features a diverse range of additive types tailored to specific performance requirements across packaging applications. Antimicrobial agents lead the segment due to their critical role in food safety and shelf-life extension. UV stabilizers, antioxidants, and oxygen scavengers follow, addressing degradation and contamination risks in sensitive products. Anti-fog agents and clarifying additives support visual clarity and aesthetic value in transparent packaging formats. Barrier coatings and antistatic agents contribute to product protection and handling efficiency across logistics and retail environments.

- For example, Gaia 505 AB and Gaia 704 AB, developed by Phoenix Plastics, are specialized antimicrobial masterbatches used in polyolefin packaging applications. These additives inhibit the growth of bacteria and fungi, contributing to food safety and shelf-life extension.

By substrate, plastics dominate the Packaging Additive Market owing to their widespread use in flexible and rigid packaging. Paper & paperboard are gaining traction due to sustainability demands and growing preference for fiber-based materials. Metal and glass substrates require specialized additives for sealing and stability, particularly in beverage and pharmaceutical packaging. The market supports innovations that enhance the recyclability and performance of each substrate type.

- For example, BASF, DOW, and Songwon Industrial have released bespoke additive portfolios for PE and polypropylene (PP) that target clarity, strength, and shelf-life.

By packaging type, Flexible packaging holds the largest share by packaging type, driven by its lightweight, cost-efficient, and versatile nature across consumer goods. Rigid packaging continues to serve high-barrier and premium applications.

By application, the food industry is the leading segment, followed by pharmaceuticals and personal care. The Packaging Additive Market supports safety, preservation, and functionality in each of these segments through precise additive integration. It responds to changing consumer needs, regulatory shifts, and brand strategies aimed at packaging performance and sustainability.

Segmentation:

By Additive Type

- Antimicrobial Agents

- Antistatic Agents

- Oxygen Scavengers

- Anti-fog Agents

- Clarifying Agents

- UV Stabilizers

- Antioxidants

- Barrier Coatings

- Others

By Substrate (Packaging Material)

- Plastics

- Paper & Paperboard

- Metal

- Glass

- Others

By Packaging Type

- Rigid Packaging

- Flexible Packaging

By Application

- Food Industry

- Beverage Industry

- Pharmaceuticals & Health Care

- Cosmetics & Personal Care

- Industrial Goods

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America holds the largest share in the Packaging Additive Market, accounting for 34.6% of the global revenue in 2024. It benefits from a mature packaging industry, stringent regulatory frameworks, and high demand for advanced packaging in food, pharmaceuticals, and personal care sectors. The presence of major additive manufacturers and packaging converters further strengthens regional market leadership. Consumer preference for sustainable and functional packaging drives innovation in additive formulations across the U.S. and Canada. The region also leads in smart packaging adoption, boosting demand for specialty additives. The Packaging Additive Market in North America continues to grow through strategic investments and regulatory alignment.

Europe represents the second-largest regional market, holding 28.3% share in 2024. Countries such as Germany, France, and the UK contribute significantly due to strong environmental policies and packaging sustainability goals. The EU’s circular economy initiatives push for biodegradable and recyclable packaging formats supported by performance-enhancing additives. European packaging firms invest in research and development to meet compliance requirements while improving packaging appeal and durability. Growth in organic food, pharmaceuticals, and luxury goods supports the need for additive-enriched solutions. The Packaging Additive Market in Europe gains momentum through innovation aligned with environmental mandates.

Asia-Pacific holds a 25.7% market share and is the fastest-growing region in the Packaging Additive Market. Rapid industrialization, urbanization, and rising consumption of packaged goods in countries like China, India, and Indonesia fuel demand. Expanding middle-class populations and changing lifestyles increase the uptake of ready-to-eat meals and personal care products. It boosts the need for advanced, safe, and durable packaging supported by functional additives. Domestic packaging manufacturers increasingly adopt global standards, driving additive integration. The Packaging Additive Market in Asia-Pacific is poised for long-term growth through infrastructure development and evolving consumer preferences.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- BASF SE

- Clariant AG

- Arkema

- ALTANA AG

- AkzoNobel N.V.

- Evonik Industries AG

- Croda International Plc

- Songwon Industrial Co. Ltd.

- Lubrizol Corporation

- Henkel AG & Co. KGaA

- Huber Group

- PPG Industries, Inc.

- Sun Chemical Corporation

- Flint Group

- Solvay S.A.

Competitive Analysis:

The Packaging Additive Market features a mix of global and regional players competing on innovation, cost efficiency, and product performance. Key companies such as BASF SE, Clariant AG, Evonik Industries, and SABIC lead the market with diverse additive portfolios and strong R&D capabilities. These firms focus on sustainability, offering biodegradable and food-safe additives tailored to emerging regulations. Strategic partnerships, acquisitions, and product launches support competitive positioning and global reach. Regional players in Asia-Pacific are gaining ground through localized production and low-cost solutions. The Packaging Additive Market experiences moderate consolidation, with top players investing in smart and functional additives to capture niche segments. It remains dynamic with continuous material and formulation innovation.

Recent Developments:

- In March 2025, ALTANA AG achieved significant double-digit growth and continued to invest heavily in future-proof specialty chemicals, including packaging additives. The company reported notable investment into innovative solutions for the packaging market, further cementing its role as a key player focusing on both growth and sustainability

- In May 2024, Clariant AG launched AddWorks PPA, a PFAS-free polymer processing aid line, targeting improved sustainability for packaging manufacturers. The company also introduced AddWorks PKG 158, a highly efficient antioxidant designed for color protection in polyolefins containing recycled material—addressing both the push toward recyclability and enhanced aesthetic performance in packaging.

- In June 2025, AkzoNobel N.V. emphasized its packaging industry leadership by publishing new sustainability reporting and showcasing its latest innovations in can packaging, positioning itself at the forefront of sustainable packaging coatings development.

Market Concentration & Characteristics:

The Packaging Additive Market demonstrates moderate to high concentration, with a few multinational corporations holding significant market share. It reflects strong innovation intensity and frequent product differentiation across additive categories. The market includes a range of products such as slip agents, UV stabilizers, antimicrobial additives, and anti-fog compounds. It serves multiple packaging formats, including flexible, rigid, and specialty solutions. Entry barriers remain high due to regulatory requirements, formulation complexity, and capital-intensive production processes. It favors companies with integrated supply chains and strong distribution networks. The Packaging Additive Market emphasizes performance, compliance, and sustainability across competitive offerings. Companies invest heavily in research to develop multifunctional additives that meet both environmental and technical demands. The market continues to evolve with growing interest in bio-based and recyclable packaging solutions.

Report Coverage:

The research report offers an in-depth analysis based on Additive Type, Substrate (Packaging Material), Packaging Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Packaging Additive Market is expected to benefit from increased demand for advanced food preservation solutions driven by changing consumer preferences.

- Growth in e-commerce and direct-to-consumer channels will boost the need for durable, additive-enhanced packaging.

- The market will witness rising adoption of bio-based additives to support global sustainability goals.

- Demand for antimicrobial and anti-counterfeit additives will expand in pharmaceutical and healthcare packaging.

- Continued innovation in smart packaging will drive the development of interactive and functional additive systems.

- Emerging markets in Asia-Pacific and Latin America will offer significant growth opportunities due to expanding consumer goods sectors.

- Integration of additive technologies into recyclable and mono-material packaging formats will gain traction.

- Advancements in additive compatibility with biodegradable substrates will enable broader adoption of eco-friendly packaging.

- Regulatory support for low-impact packaging materials will influence product innovation and market expansion.

- Collaborations between additive manufacturers and packaging converters will accelerate tailored product development.