Market Overview

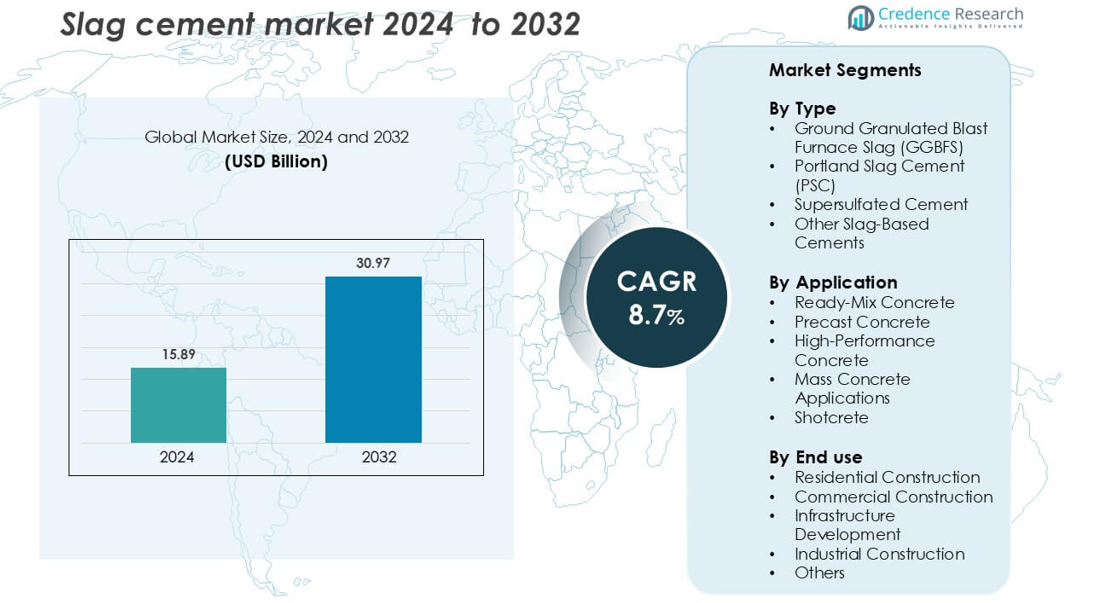

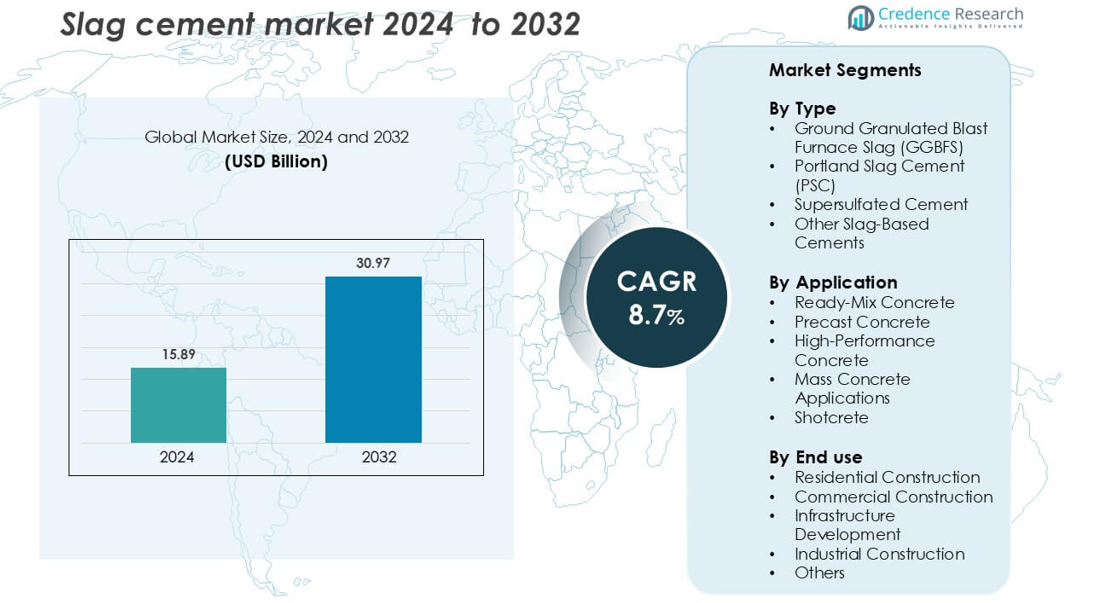

Slag cement market size was valued USD 15.89 billion in 2024 and is anticipated to reach USD 30.97 billion by 2032, at a CAGR of 8.7 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Slag Cement Market Size 2024 |

USD 15.89 billion |

| Slag Cement Market, CAGR |

8.7% |

| Slag Cement Market Size 2032 |

USD 30.97 billion |

The slag cement market is led by major players such as Heidelberg Materials AG, Ecocem, Balaha Group Cementation India Pvt. Ltd. and Ashtech India. These companies leverage extensive production capacities, strategic acquisitions, and strong regional presences to maintain market dominance. In 2024, North America held the largest market share, with the United States accounting for over 85% of global slag cement consumption. This dominance is driven by significant infrastructure investments and stringent environmental regulations that favor sustainable building materials. Asia-Pacific is expected to be the fastest-growing region, propelled by rapid urbanization and increasing demand for eco-friendly construction solutions. Companies are focusing on technological advancements and sustainable practices to maintain competitiveness in this evolving market.

Market Insights

- The global slag cement market was valued at approximately USD 15.89 billion in 2024 and is projected to reach around USD 30.97 billion by 2032, growing at a compound annual growth rate (CAGR) of 8.7% through 2032.

- North America held the largest market share in 2024, driven by substantial infrastructure investments and stringent environmental regulations favoring sustainable construction materials.

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, propelled by rapid urbanization, industrialization, and increasing demand for eco-friendly building materials.

- The residential construction segment reflecting a strong preference for durable and sustainable building materials in housing projects.

- Key players in the slag cement market include Heidelberg Materials AG, Ecocem, Balaha Group Cementation India Pvt. Ltd., and Ashtech India, who are focusing on technological advancements and sustainable practices to maintain competitiveness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Ground Granulated Blast Furnace Slag (GGBFS) dominates the slag cement market with the largest share due to its superior strength, durability, and reduced permeability, making it ideal for critical infrastructure projects like bridges and marine structures. Its use also supports sustainable construction by lowering the carbon footprint of concrete. Portland Slag Cement (PSC) follows, valued for enhanced workability and resistance to chemical attacks, particularly in marine and aggressive environments. Supersulfated Cement, though niche, offers low heat of hydration and high sulfate resistance, making it suitable for mass concrete applications, while other slag-based cements serve specialized uses.

- For instance, in 2009, when JSW Cement first began operations at Vijayanagar, the grinding facility had a much smaller capacity of 0.6 million tons per annum (MTPA).

By Application

Ready-Mix Concrete leads the application segment with the highest adoption, driven by consistent quality, reduced labor costs, and suitability for residential, commercial, and infrastructure projects. Precast Concrete benefits from slag cement’s enhanced strength and durability, supporting modular building construction and infrastructure components. High-Performance Concrete incorporating slag cement offers superior durability and strength, meeting the requirements of high-rise and industrial structures. The growing emphasis on sustainable, resilient materials fuels adoption across all these applications.

- For instance, Holcim’s current product line, including its low-carbon ECOPlanet and ECOPact materials, uses recycled and supplementary cementitious materials like slag to reduce its carbon footprint.

By End Use

Residential Construction remains the dominant end-use segment, supported by urbanization and demand for durable, eco-friendly housing solutions. Commercial Construction follows, with slag cement enhancing the longevity and performance of offices, retail spaces, and other establishments. Infrastructure Development leverages slag cement for roads, bridges, and public works due to its environmental and chemical resistance. Industrial Construction also benefits from cost-effective, durable solutions in factories and warehouses, while other sectors such as agricultural and environmental projects diversify the market’s reach.

Key Growth Drivers

Environmental Regulations and Sustainability Initiatives

Stringent environmental regulations and sustainability initiatives are pivotal in promoting the adoption of slag cement. Governments worldwide are implementing policies to reduce carbon emissions, encouraging the use of eco-friendly construction materials. Slag cement, particularly Ground Granulated Blast Furnace Slag (GGBFS), significantly lowers the carbon footprint of concrete, aligning with global climate objectives. This regulatory push is driving the demand for slag cement in various construction projects, including infrastructure and residential developments.

- For instance, Substituting Portland cement with GGBFS is a well-established method for reducing the embodied carbon in concrete. Traditional cement manufacturing is highly carbon-intensive, and using by-products like GGBFS is a key decarbonization strategy.

Growing Infrastructure Development

The rapid expansion of infrastructure projects, especially in emerging economies, is a significant growth driver for the slag cement market. Large-scale projects such as roads, bridges, and airports require durable and high-performance materials. Slag cement’s enhanced strength and durability make it an ideal choice for these applications. Additionally, initiatives like China’s Belt and Road and India’s Smart Cities Mission further propel the demand for slag cement in infrastructure development.

- For instance, The UltraTech’s parent company, notes that UltraTech has 395 ready-mix concrete plants in 155 cities, making it the largest concrete manufacturer in India.

Cost Advantages Over Traditional Cement

Slag cement offers cost advantages over traditional Portland cement, making it an attractive option for construction projects. Its use can lead to reduced material costs and improved long-term performance. The economic benefits, coupled with its environmental advantages, are driving its adoption in various construction sectors. This cost-effectiveness is particularly appealing in regions with budget constraints and a focus on sustainable development.

Key Trends and Opportunities

Integration of Supplementary Cementitious Materials (SCMs)

The integration of supplementary cementitious materials (SCMs) like fly ash and silica fume with slag cement is a growing trend. This blend enhances the performance characteristics of concrete, such as increased strength and durability. Innovations in SCM formulations are opening new application areas for slag cement, expanding its market potential. These advancements contribute to the development of high-performance concrete solutions for various construction needs.

- For instance, Holcim’s R&D center in Lyon has developed ternary blends combining slag, fly ash, and silica fume, achieving compressive strength levels above 90 MPa at 28 days.

Adoption of Carbon Capture and Utilization (CCU) Technologies

The adoption of carbon capture and utilization (CCU) technologies in cement production is an emerging opportunity. Integrating CCU with slag cement production can further reduce the carbon footprint of concrete. Companies are investing in CCU technologies to enhance the sustainability of their products. This integration aligns with global efforts to decarbonize the construction industry and meet stringent environmental standards.

- For instance, in February 2021, CEMEX announced it was awarded a grant from the U.S. Department of Energy to develop and engineer a pilot CCU system at its Victorville plant. The goal is to develop a cost-competitive solution for capturing carbon and transforming it into marketable products.

Key Challenges

Supply Chain Disruptions and Regional Availability Constraints

Supply chain disruptions and regional availability constraints pose challenges to the slag cement market. The sourcing of slag as a by-product from steel manufacturing can be inconsistent, affecting the supply of raw materials. Additionally, logistical issues and infrastructure limitations can hinder the distribution of slag cement, particularly in remote or developing regions. These factors can lead to price fluctuations and supply shortages, impacting market stability.

Standardization and Quality Control Issues

Standardization and quality control issues are significant challenges in the slag cement market. Variations in the chemical composition of slag from different sources can affect the consistency and performance of the final product. Ensuring uniform quality and adherence to international standards is crucial for the widespread adoption of slag cement. Addressing these issues requires collaboration among industry stakeholders and investment in quality assurance processes.

Regional Analysis

North America

In 2024, North America led the global slag cement market, capturing over 40% of the market share. The United States, in particular, accounted for approximately 85% of this share, driven by stringent environmental regulations and a strong emphasis on sustainable construction practices. The demand for slag cement is further bolstered by significant infrastructure projects, including roads, bridges, and commercial buildings, which require durable and eco-friendly materials. Major players like Holcim and Heidelberg Materials have strengthened their presence through strategic expansions and partnerships, further solidifying North America’s leadership in the slag cement market.

Asia-Pacific

Asia-Pacific is poised to be the fastest-growing region in the slag cement market, with China, India, and Southeast Asian nations leading the way. The region’s rapid urbanization, large-scale infrastructure projects, and government initiatives promoting sustainable construction are driving the demand for slag cement. China’s Belt and Road Initiative and India’s Smart Cities Mission are notable examples of projects that utilize slag cement for their durability and environmental benefits. The increasing adoption of green building materials and technologies further supports the growth of the slag cement market in this region.

Europe

Europe holds a significant share of the global slag cement market, estimated at around 20% in 2024. Countries like Germany, France, and the United Kingdom are at the forefront, driven by stringent environmental standards and a strong emphasis on sustainable construction practices. The use of slag cement aligns with the European Green Deal and other regional initiatives aimed at reducing carbon emissions in the construction industry. Additionally, advancements in cement blending technologies and the integration of slag cement in sustainable building certifications contribute to the region’s market share.

Latin America

Latin America accounts for approximately 7% of the global slag cement market, with Brazil and Mexico being the primary contributors. The region’s growing infrastructure development, urbanization, and increasing awareness of sustainable construction materials are driving the demand for slag cement. Government policies and initiatives promoting green building practices further support the adoption of slag cement in construction projects. However, challenges such as supply chain constraints and regional availability of slag may impact the market’s growth potential.

Middle East & Africa

The Middle East and Africa region holds about 8% of the global slag cement market share. Countries like the United Arab Emirates, Saudi Arabia, and South Africa are investing heavily in infrastructure projects, including roads, bridges, and residential developments, which require durable and sustainable materials. The adoption of slag cement is encouraged by government regulations promoting eco-friendly construction practices and the need for materials that can withstand harsh environmental conditions. Despite these drivers, challenges such as limited local production and high import costs may affect the market’s growth in certain areas.

Market Segmentations:

By Type

- Ground Granulated Blast Furnace Slag (GGBFS)

- Portland Slag Cement (PSC)

- Supersulfated Cement

- Other Slag-Based Cements

By Application

- Ready-Mix Concrete

- Precast Concrete

- High-Performance Concrete

- Mass Concrete Applications

- Shotcrete

By End use

- Residential Construction

- Commercial Construction

- Infrastructure Development

- Industrial Construction

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The global slag cement market is characterized by a competitive landscape featuring several prominent players. Leading companies include Heidelberg Materials AG, Ecocem, Balaha Group Cementation India Pvt. Ltd., Ashtech India, DONG SON RESOURCES CO. LTD, Fico YTL Vietnam, Boral Ltd., Betolar Plc, Astrra ChemicalsLimited. These firms dominate through extensive production capacities, strategic acquisitions, and a strong presence in key regions. North America holds a significant share of the market, with the United States accounting for over 85% of the global slag cement consumption in 2024. This dominance is attributed to robust infrastructure investments and stringent environmental regulations that favor sustainable building materials. Asia-Pacific is anticipated to be the fastest-growing region, driven by rapid urbanization and increasing demand for eco-friendly construction solutions. Companies are focusing on technological advancements and sustainable practices to maintain competitiveness in this evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Heidelberg Materials AG

- Ecocem

- Balaha Group

- Cementation India Pvt. Ltd.

- Ashtech India

- DONG SON RESOURCES CO. LTD.

- Fico YTL Vietnam

- Boral Ltd.

- Betolar Plc

- Astrra Chemicals

Recent Developments

- In April 2025, Ecocem entered into an agreement with TITAN Group to jointly develop and deploy a custom version of its scalable low-carbon cement technology (ACT) targeting the Greek market first.

- In December 2024, Adani group owned Ambuja Cements had announced the merger with Sanghi Industries and Penna Cement Industries with itself, which strengthened its position in the market of India.

- In October 2024, Buzzi SpA took over 50% stake in NCPAR from Grupo Ricardo Brennand, acquiring five fully integrated cement plants and two grinding centers in Brazil.

- In September 2024, Heidelberg materials North America announced completion of a new slag cement plant in Houston, Texas, with a through put of approximately 500 000 tons annually

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The global slag cement market is projected to reach approximately USD 30.97 billion by 2032, growing at a compound annual growth rate (CAGR) of 8.7% from 2024.

- North America currently holds the largest market share, driven by significant infrastructure investments and stringent environmental regulations.

- Asia-Pacific is anticipated to be the fastest-growing region, fueled by rapid urbanization and increasing demand for sustainable construction materials.

- Rising costs of traditional clinker-based cement are prompting a shift towards more cost-effective and eco-friendly alternatives like slag cement.

- Technological advancements in cement blending and grinding processes are enhancing the performance and efficiency of slag cement

- Integration of slag cement into sustainable building certifications is increasing its adoption in green construction projects.

- Collaborations between the steel and cement industries are facilitating the efficient use of slag as a supplementary cementitious material.

- Government initiatives promoting circular economy practices are encouraging the use of industrial by-products like slag in cement production.

- The development of high-performance concrete formulations incorporating slag cement is expanding its application in demanding construction projects.

- Ongoing research into cost-effective activation methods for slag is expected to further reduce production costs and enhance market competitiveness.