Market Overview

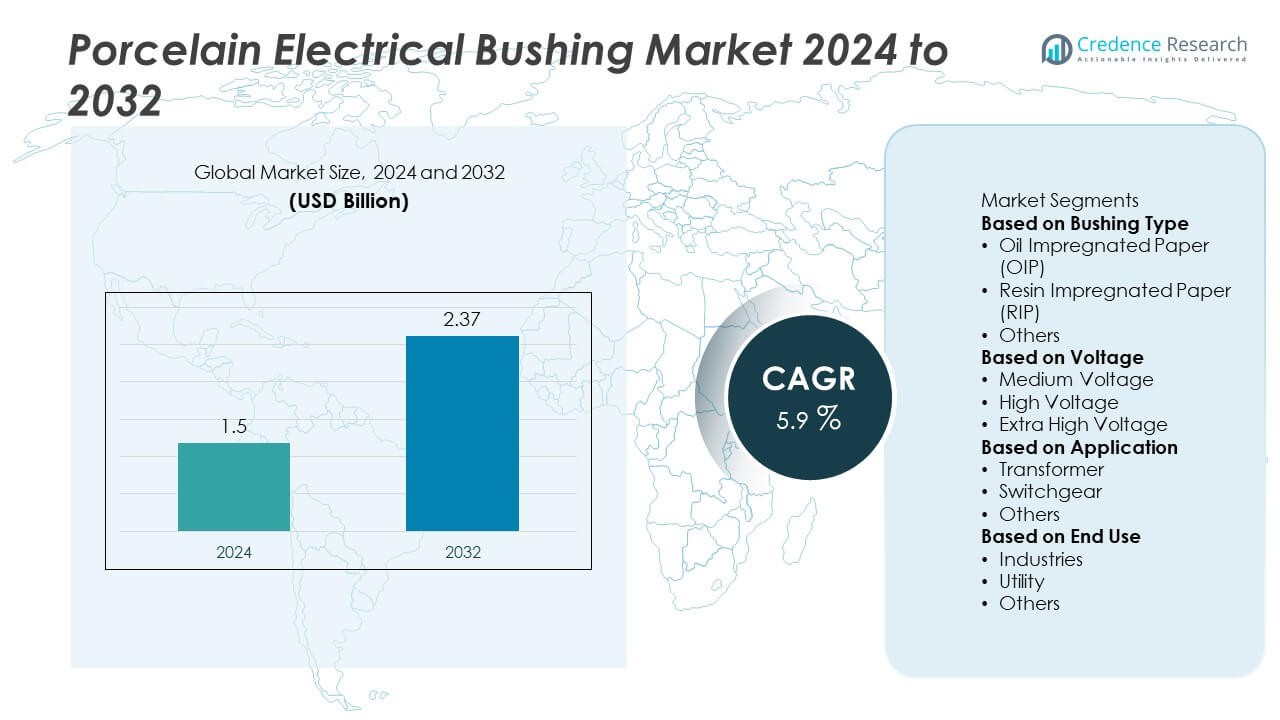

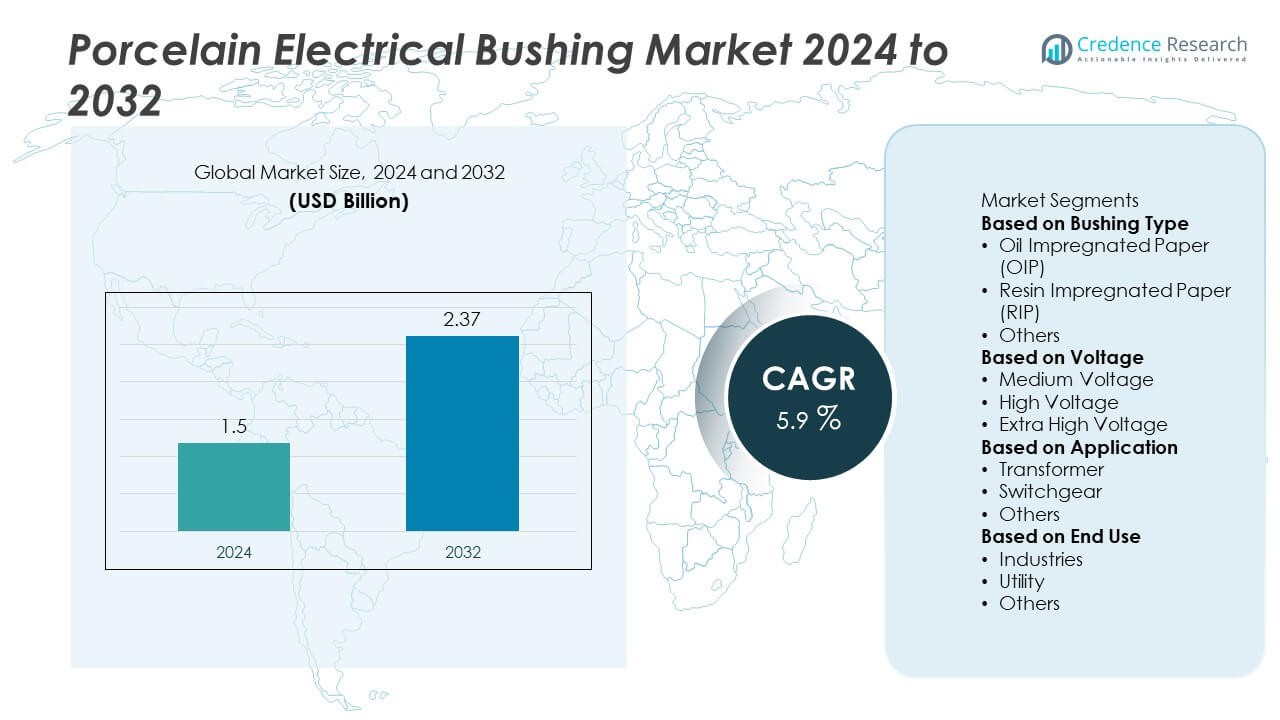

The Porcelain Electrical Bushing Market was valued at USD 1.5 billion in 2024 and is projected to reach USD 2.37 billion by 2032, growing at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Porcelain Electrical Bushing MarketSize 2024 |

USD 1.5 Billion |

| Porcelain Electrical Bushing Market, CAGR |

5.9% |

| Porcelain Electrical Bushing Market Size 2032 |

USD 2.37 Billion |

The Porcelain Electrical Bushing market is led by top players including Hitachi Energy, Barberi Rubinetterie Industriali, Hubbell, Jiangxi Johnson Electric, GIPRO, CG Power and Industrial Solutions, Elliot Industries, ABB, Eaton, and General Electric. These companies strengthen their presence through advanced product designs, strategic partnerships with utilities, and investments in high-voltage and extra-high-voltage applications. Asia-Pacific led the market with 38% share in 2024, driven by large-scale electrification and ultra-high-voltage projects, while Europe held 27% share, supported by stringent safety standards and grid modernization. North America accounted for 23%, propelled by replacement of aging infrastructure and renewable energy integration.

Market Insights

Market Insights

- The Porcelain Electrical Bushing market was valued at USD 1.5 billion in 2024 and is projected to reach USD 2.37 billion by 2032, growing at a CAGR of 5.9% during the forecast period.

- Oil Impregnated Paper (OIP) bushings dominated with 56% share in 2024, supported by their reliability and wide adoption in high-voltage transformers, while transformers accounted for 58% share among applications, reflecting their central role in power infrastructure.

- A key trend is the rising adoption of hybrid insulation designs and extra-high-voltage bushings, driven by renewable integration and long-distance transmission projects, creating new opportunities for manufacturers.

- Leading companies such as Hitachi Energy, ABB, Eaton, General Electric, Hubbell, CG Power and Industrial Solutions, Barberi Rubinetterie Industriali, Elliot Industries, Jiangxi Johnson Electric, and GIPRO focus on technology improvements, sustainability, and global expansion to maintain competitiveness.

- Asia-Pacific led with 38% share in 2024, followed by Europe at 27% and North America at 23%, while Latin America held 7% and Middle East & Africa accounted for 5%, reflecting balanced global demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Bushing Type

Oil Impregnated Paper (OIP) bushings dominated the porcelain electrical bushing market in 2024, holding 56% share. Their leadership is driven by long-standing reliability, cost-effectiveness, and suitability for high-voltage transformers and switchgear. Utilities prefer OIP bushings due to proven dielectric performance and wide availability across transmission networks. Resin Impregnated Paper (RIP) bushings followed with 31% share, supported by increasing demand for environmentally friendly, low-maintenance alternatives. The remaining 13% share came from other types, including hybrid and advanced insulation bushings designed for specialized applications where compact design and reduced fire risk are required.

- For instance, ABB manufactures OIP bushings for power transformers rated up to 800 kV with current carrying capacity exceeding 4,000 A, ensuring stable dielectric performance and long service life in high-voltage grids.

By Voltage

High voltage bushings led the market in 2024 with 49% share, reflecting their widespread use in transmission networks and power transformers. Demand is fueled by the global expansion of grid infrastructure, renewable energy integration, and replacement of aging high-voltage assets. Medium voltage bushings accounted for 36% share, primarily driven by industrial and distribution grid applications. Extra high voltage (EHV) bushings represented 15% share, with adoption supported by ultra-high-voltage projects in Asia-Pacific and Europe. The dominance of high voltage bushings highlights their critical role in supporting reliable long-distance electricity transmission.

- For instance, Hitachi Energy offers various series of bushings for applications in transmission substations and large power transformers, including some designed for voltages up to 550 kV with partial discharge levels below 5 pC.

By Application

Transformers remained the largest application segment in 2024, securing 58% share of the porcelain electrical bushing market. Their dominance is linked to continuous demand for transmission and distribution transformers in expanding grid networks. Switchgear followed with 29% share, driven by urban infrastructure development, industrial applications, and integration of renewable energy systems. Other applications, including circuit breakers and specialized high-voltage equipment, contributed 13% share. The dominance of transformers reflects the central role of bushings in ensuring insulation and current flow reliability, particularly in large-scale utility and industrial operations.

Key Growth Drivers

Expansion of Transmission and Distribution Networks

The global expansion of transmission and distribution networks is a major growth driver for the porcelain electrical bushing market. With rising electricity demand, particularly in developing regions, utilities are investing in grid upgrades and new installations. Porcelain bushings are essential for transformers and switchgear in high-voltage and extra-high-voltage applications, ensuring safe current transfer. Their proven durability and cost-effectiveness make them the preferred choice for large-scale projects. Growing electrification in Asia-Pacific, Africa, and the Middle East continues to support stable demand for these components.

- For instance, CG Power and Industrial Solutions manufactures Oil Impregnated Paper (OIP) condenser bushings up to 800 kV, which are used in India’s transmission projects to support grid expansion.

Integration of Renewable Energy Projects

The integration of renewable energy sources, such as wind and solar, requires reliable grid infrastructure, boosting demand for porcelain bushings. High-voltage transformers and switchgear play a central role in connecting renewable generation to national grids. Porcelain bushings provide robust insulation and performance in harsh outdoor environments, making them vital for renewable installations. Increasing investments in offshore wind and utility-scale solar projects worldwide drive adoption. This trend reinforces the critical role of porcelain bushings in enabling energy transition while maintaining grid reliability.

- For instance, Hitachi Energy delivered dry-type resin-impregnated synthetic (RIS) or composite bushings for offshore wind substations in Europe, rated up to 420 kV, ensuring reliable insulation under high humidity and marine exposure.

Replacement of Aging Power Infrastructure

Aging grid infrastructure in developed regions is fueling demand for replacement of old equipment, including electrical bushings. Many transmission transformers and switchgear installed decades ago are nearing end-of-life, requiring refurbishment or replacement. Porcelain bushings, with their high mechanical strength and established reliability, remain the preferred choice for retrofit projects. Utilities in North America and Europe are investing heavily in modernizing infrastructure to meet higher load requirements and safety standards. This replacement cycle is expected to be a consistent growth driver over the forecast period.

Key Trends & Opportunities

Shift Toward Hybrid Insulation Designs

A key trend is the growing shift toward hybrid insulation bushings that combine porcelain with resin-based or polymeric insulation. These designs improve fire resistance, reduce maintenance, and enhance operational safety. While OIP bushings continue to dominate, hybrid systems are increasingly preferred in urban and industrial environments with stringent safety standards. Manufacturers are capitalizing on this opportunity by developing advanced hybrid solutions that balance performance, cost, and environmental compliance. The gradual adoption of hybrid technologies represents a significant opportunity for innovation in the market.

- For instance, GIPRO produces custom epoxy resin bushings rated up to 40.5 kV with very low partial discharge levels, offering robust, gas-tight insulation for medium-voltage switchgear.

Growth of Extra High Voltage Applications

The demand for extra-high-voltage (EHV) bushings is rising as countries expand their long-distance transmission capabilities. Projects in Asia-Pacific and Europe, including UHVDC (ultra-high-voltage direct current) networks, drive this trend. Porcelain bushings in the EHV range provide reliable insulation and mechanical performance under extreme conditions. This segment offers opportunities for manufacturers to capture niche, high-value contracts. With growing energy interconnections and renewable integration, demand for EHV bushings is expected to remain strong, reinforcing the importance of advanced porcelain bushing designs.

- For instance, ABB supplied condenser bushings for the Changji–Guquan UHVDC project in China, which transmit electricity at 1,100 kV DC. The bushings use Resin Impregnated Paper (RIP) technology and were designed to withstand extreme operating conditions, ensuring reliable operation in ultra-high-voltage transmission lines.

Key Challenges

Competition from Polymer and Composite Bushings

The porcelain electrical bushing market faces strong competition from polymer and composite bushings, which offer lightweight designs, reduced risk of explosion, and lower maintenance. These alternatives are gaining traction in modern grids where space constraints and safety concerns are critical. While porcelain maintains dominance in high-voltage applications, rising adoption of composites poses a long-term challenge. Manufacturers must differentiate through cost-effectiveness, durability, and performance to maintain market share against these emerging substitutes.

High Installation and Maintenance Costs

Porcelain bushings require specialized handling, installation, and periodic maintenance, adding to overall infrastructure costs. Their heavy weight increases transportation and installation complexity compared to lighter polymeric alternatives. Utilities in cost-sensitive regions may prefer low-maintenance or lighter options despite porcelain’s proven reliability. Additionally, potential risks of oil leakage in OIP bushings add to service costs. These challenges create barriers to adoption in some markets, pressuring manufacturers to optimize cost structures and improve product efficiency to remain competitive.

Regional Analysis

North America

North America held 23% share of the porcelain electrical bushing market in 2024, driven by replacement demand in aging power infrastructure and expansion of renewable integration projects. The U.S. leads with significant investments in upgrading high-voltage transmission networks, while Canada contributes through modernization of hydroelectric facilities. Mexico’s growth is linked to rising industrial demand and cross-border energy projects. Regional utilities prioritize bushings with proven reliability and safety standards, supporting steady demand. Replacement cycles, coupled with renewable grid connections, continue to reinforce North America as a consistent growth market during the forecast period.

Europe

Europe accounted for 27% share of the market in 2024, supported by stringent regulatory standards and advanced power grid modernization programs. Germany, France, and the U.K. lead demand, focusing on sustainable, high-voltage projects and renewable integration. Eastern European nations contribute growth through investments in transmission and distribution infrastructure. The region emphasizes environmentally compliant technologies, favoring resin-impregnated designs alongside traditional porcelain solutions. With strong investments in offshore wind projects and cross-border transmission links, Europe continues to rely on porcelain bushings for long-term durability and safety in grid and industrial applications.

Asia-Pacific

Asia-Pacific dominated the porcelain electrical bushing market in 2024 with 38% share, reflecting large-scale expansion of power generation and transmission capacity. China remains the leading consumer due to extensive investments in ultra-high-voltage projects, while India is accelerating adoption through rapid electrification and renewable integration. Japan and South Korea add demand through advanced industrial and urban infrastructure. Cost-effective manufacturing capabilities and high infrastructure spending across the region reinforce dominance. Asia-Pacific’s leadership is expected to continue, driven by grid expansion, electrification of rural areas, and large-scale renewable projects requiring high-voltage porcelain bushings.

Latin America

Latin America represented 7% share of the porcelain electrical bushing market in 2024, led by Brazil and Mexico. Regional demand is fueled by expanding transmission and distribution projects, industrialization, and growth in renewable energy installations. Brazil’s hydroelectric sector plays a major role in sustaining porcelain bushing adoption, while Mexico supports demand through rising manufacturing and automotive industries. Economic challenges and cost pressures, however, limit broader adoption across smaller economies. Despite these constraints, steady investment in energy infrastructure and grid reliability ensures gradual growth, making Latin America an emerging but stable market segment.

Middle East & Africa

The Middle East & Africa accounted for 5% share of the porcelain electrical bushing market in 2024, supported by large-scale infrastructure and energy projects. Saudi Arabia and the UAE lead demand with high-voltage transmission projects tied to urban development and renewable integration. South Africa drives adoption through ongoing investments in utilities and industrial power systems. Limited local manufacturing leads to reliance on imports, creating opportunities for global suppliers. With growing demand for durable, high-performance bushings in harsh environments, the region is expected to see gradual but steady growth over the forecast period.

Market Segmentations:

By Bushing Type

- Oil Impregnated Paper (OIP)

- Resin Impregnated Paper (RIP)

- Others

By Voltage

- Medium Voltage

- High Voltage

- Extra High Voltage

By Application

- Transformer

- Switchgear

- Others

By End Use

- Industries

- Utility

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Porcelain Electrical Bushing market is shaped by leading players such as Hitachi Energy, Barberi Rubinetterie Industriali, Hubbell, Jiangxi Johnson Electric, GIPRO, CG Power and Industrial Solutions, Elliot Industries, ABB, Eaton, and General Electric. These companies focus on developing advanced porcelain bushing technologies that meet the demands of high-voltage, medium-voltage, and extra-high-voltage applications. Strategies include expanding manufacturing capacities, investing in R&D for improved insulation and reliability, and forming partnerships with utilities and transformer manufacturers. Sustainability and compliance with international safety standards are central to their innovation agendas. Regional players emphasize cost-effective solutions to compete in price-sensitive markets, while global companies leverage strong distribution networks and technical expertise to maintain dominance. With rising grid expansion, renewable integration, and modernization projects, competition remains intense, pushing manufacturers to differentiate through durability, performance, and long-term lifecycle value.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hitachi Energy

- Barberi Rubinetterie Industriali

- Hubbell

- Jiangxi Johnson Electric

- GIPRO

- CG Power and Industrial Solutions

- Elliot Industries

- ABB

- Eaton

- General Electric

Recent Developments

- In July 2025, Eaton updated its liquid-immersed distribution transformer manual, listing LV/HV porcelain bushings and options such as arcing horns for HV porcelain bushings.

- In 2025, Hitachi Energy published guidance on “future-ready” bushings for next-gen switchgear, highlighting compliance with modern insulation systems and test standards.

- In 2025, Hubbell (Electro Composites brand) introduced SDC LV all-epoxy bushings, expanding its solid-bushing line for utility gear.

- In December 2024, Elliott Industries was acquired by Power Grid Components; Elliott continues producing apparatus bushings/insulators for pad-mount and substation equipment.

Report Coverage

The research report offers an in-depth analysis based on Bushing Type, Voltage, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for porcelain electrical bushings will rise with expansion of transmission and distribution networks.

- Renewable energy integration will increase adoption in high-voltage transformers and switchgear.

- Replacement of aging power infrastructure will remain a key driver in developed regions.

- Hybrid insulation designs combining porcelain with resin systems will gain wider acceptance.

- Extra-high-voltage bushings will see growth as long-distance transmission projects expand.

- Asia-Pacific will maintain leadership due to large-scale electrification and infrastructure projects.

- Europe will sustain demand through stringent safety standards and grid modernization initiatives.

- North America will focus on replacing outdated bushings and integrating renewable capacity.

- Manufacturers will invest in advanced designs to enhance durability and reduce maintenance needs.

- Competition from polymer and composite alternatives will drive differentiation through reliability and lifecycle performance.

Market Insights

Market Insights