Market Overview

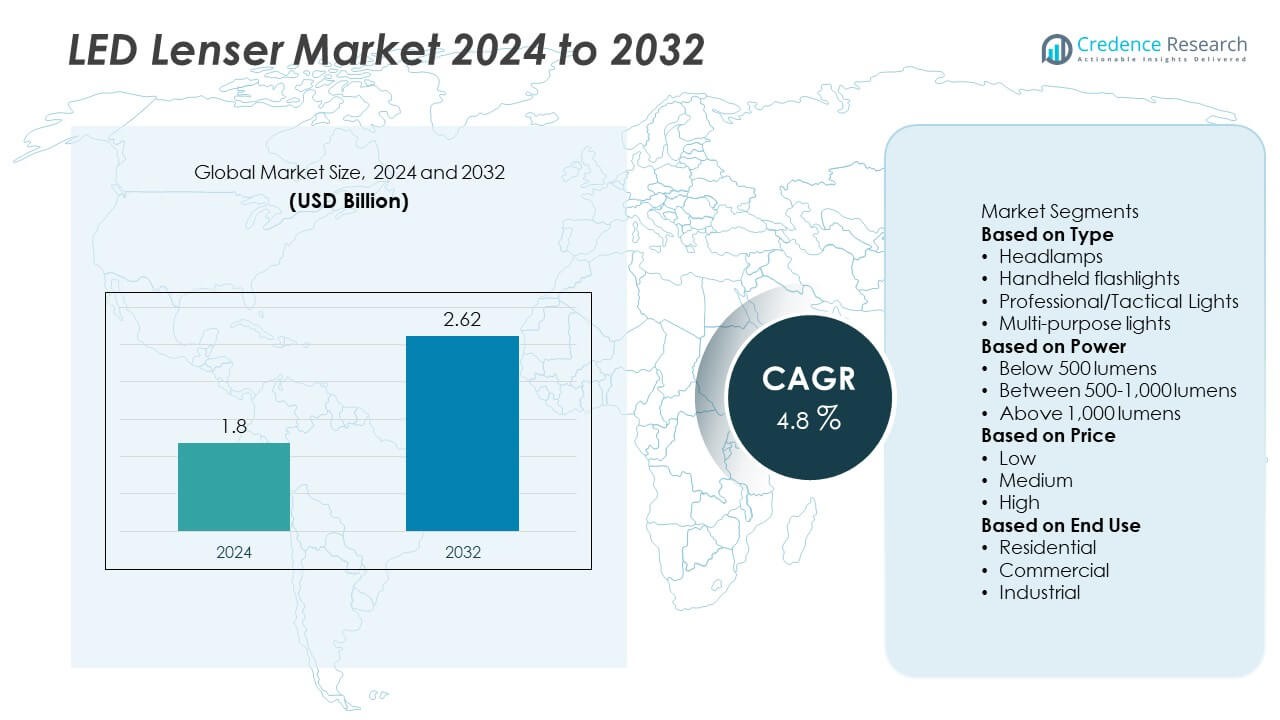

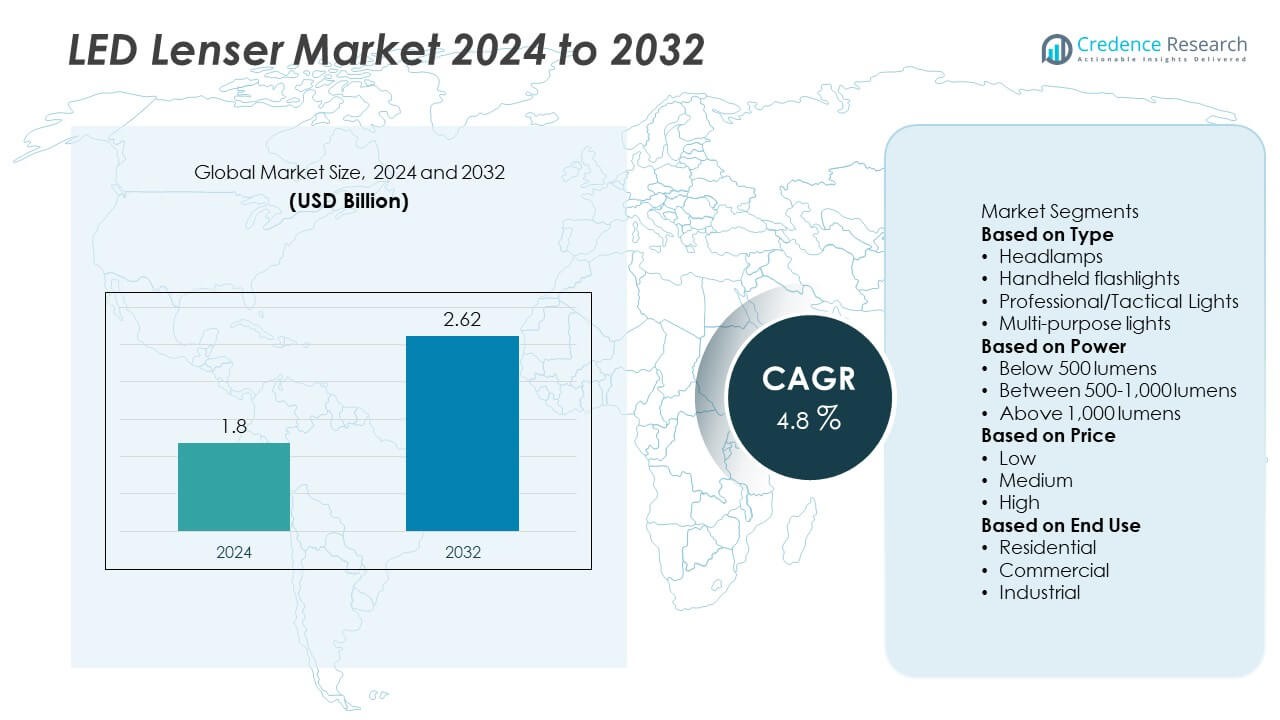

The LED Lenser market was valued at USD 1.8 billion in 2024 and is projected to reach USD 2.62 billion by 2032, expanding at a CAGR of 4.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| LED Lenser Market Size 2024 |

USD 1.8 Billion |

| LED Lenser Market, CAGR |

4.8% |

| LED Lenser Market Size 2032 |

USD 2.62 Billion |

The LED Lenser market is driven by prominent players including Klarus Lighting Technology, Maglite, Olight, Nitecore, Energizer, Ledlenser, Black Diamond Equipment, Nebo Tools, Coast Products, and Fenix Lighting. These companies focus on innovation in lumen efficiency, rechargeable battery technology, and rugged designs to meet the needs of outdoor, professional, and tactical users. Asia-Pacific led the market with 34% share in 2024, supported by strong manufacturing and rising consumer adoption, while Europe followed with 28% share, driven by regulatory standards and high outdoor activity levels. North America accounted for 26%, reinforced by widespread recreational and professional use.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The LED Lenser market was valued at USD 1.8 billion in 2024 and is projected to reach USD 2.62 billion by 2032, growing at a CAGR of 4.8% during the forecast period.

- Strong demand from handheld flashlights, holding 42% share in 2024, drives growth, supported by versatile use in households, outdoor recreation, and emergency applications.

- A major trend is the rising adoption of rechargeable models, aligning with eco-friendly preferences and reducing dependency on disposable batteries, while smart features expand opportunities.

- Key players such as Klarus Lighting Technology, Maglite, Olight, Nitecore, Energizer, Ledlenser, Black Diamond Equipment, Nebo Tools, Coast Products, and Fenix Lighting focus on innovation, tactical-grade designs, and expansion through e-commerce channels to strengthen competitiveness.

- Asia-Pacific led with 34% share in 2024, followed by Europe at 28% and North America at 26%, while Latin America held 7% and Middle East & Africa accounted for 5%, reflecting balanced global demand.

Market Segmentation Analysis:

By Type

Handheld flashlights dominated the LED Lenser market in 2024, capturing nearly 42% share. Their popularity is driven by wide adoption across residential, outdoor, and professional uses due to portability and reliability. Handheld models are preferred for everyday activities, camping, and emergency preparedness, supported by strong product availability across retail and e-commerce channels. Headlamps followed with significant uptake in sports and industrial work, while professional/tactical lights gained traction in defense and law enforcement. Multi-purpose lights held smaller shares, serving niche requirements. The dominance of handheld flashlights reflects their versatility and strong consumer base.

- For instance, the 4-cell D version of Maglite’s ML300L handheld flashlight delivers up to 1,002 lumens with a beam distance of up to 511 meters, offering a runtime of up to 434 hours in eco mode. Maglite flashlights, including the ML300L model, are widely used in law enforcement and outdoor sectors.

By Power

The 500–1,000 lumens category led the LED Lenser market in 2024 with about 48% share. This dominance comes from its balance of brightness, energy efficiency, and suitability for everyday use. Products in this range are widely used in outdoor recreation, household activities, and professional tasks. Below 500 lumens, holding 32% share, remain popular in budget-friendly and compact devices, while above 1,000 lumens accounted for 20% share, appealing to tactical, industrial, and search operations requiring higher brightness. The 500–1,000 lumen range is expected to remain the mainstream segment due to its practicality and cost-effectiveness.

- For instance, Fenix Lighting’s PD36R Pro flashlight outputs 2,800 lumens at maximum with a 380-meter beam distance, but also features a regulated 1,000-lumen high mode with a 225-meter beam distance, providing nearly 4 hours of runtime. This aligns with the high-demand 500–1,000 lumen category for multi-environment use.

By Price

The medium-price segment led the LED Lenser market in 2024, securing around 51% share. Consumers favor mid-range products that provide reliable brightness, durability, and advanced features without premium costs. This segment appeals strongly to outdoor enthusiasts, households, and professionals who value performance at a balanced price. The low-price category accounted for 28% share, driven by mass adoption in emerging markets. The high-price segment held 21% share, fueled by demand from tactical users, premium outdoor gear buyers, and professional industries. The medium-price segment continues to lead due to affordability and widespread product availability.

Key Growth Drivers

Increasing Demand for Outdoor and Recreational Activities

The rising popularity of hiking, camping, and adventure tourism has significantly increased demand for LED Lenser products. Handheld flashlights and headlamps are especially preferred for their durability, brightness, and portability in outdoor conditions. Growing consumer awareness of safety during night activities strengthens this demand. Retail and e-commerce channels are expanding product reach, further boosting sales. This shift toward outdoor lifestyles positions LED Lenser devices as essential tools for recreational users and supports consistent market growth across both developed and emerging economies.

- For instance, Black Diamond’s Icon 700 headlamp delivers 700 lumens with a maximum beam distance of 140 meters and a runtime of 7 hours at full power, making it a widely used choice for trekking and alpine expeditions.

Rising Adoption in Professional and Industrial Applications

LED Lenser lights are increasingly used in construction, mining, and emergency services where reliable illumination is critical. Professional and tactical lights meet stringent brightness and durability requirements, supporting demand from law enforcement, military, and industrial workers. With workplace safety regulations emphasizing efficient and safe lighting, adoption continues to expand. The growth of industrial activities in Asia-Pacific and infrastructure projects globally further fuels this demand. These factors establish professional applications as a strong driver of sustained market growth for LED Lenser products.

- For instance, Nitecore’s TM20K tactical flashlight outputs 20,000 lumens with a beam throw of 290 meters, powered by dual 21700 batteries, and is widely deployed in industrial inspections and emergency response operations.

Advancements in LED Technology and Battery Efficiency

Continuous improvements in LED efficiency and rechargeable battery technology have enhanced the performance of LED Lenser products. Higher lumen output, longer runtimes, and compact designs provide better user experiences, attracting both consumer and professional buyers. Rechargeable options also align with sustainability goals, reducing reliance on disposable batteries. This technological progress improves product affordability and accessibility, driving replacement demand in households and industries alike. The integration of advanced features such as adjustable focus and smart lighting further reinforces growth in the LED Lenser market.

Key Trends & Opportunities

Shift Toward Rechargeable and Eco-Friendly Products

A clear trend in the LED Lenser market is the shift toward rechargeable models that minimize environmental impact. Consumers increasingly prefer eco-friendly devices with USB charging, longer lifespans, and reduced battery waste. Governments and organizations promoting sustainability also encourage this transition. Manufacturers are capitalizing on this trend by expanding rechargeable product lines, making them more affordable and widely available. The growing focus on green products presents significant opportunities for companies to capture environmentally conscious consumers and strengthen their competitive edge in the market.

- For instance, Olight’s Seeker 4 Pro is equipped with a 5,000 mAh rechargeable battery, providing a maximum output of 4,600 lumens with a beam distance of 260 meters and up to 15 days runtime on low mode, significantly reducing the reliance on disposable batteries.

Expansion in Smart and Connected Lighting Solutions

Smart LED Lenser devices are emerging as an opportunity, particularly with the integration of Bluetooth and mobile app controls. Features such as adjustable brightness modes, battery monitoring, and location tracking enhance user convenience and safety. These innovations appeal to tech-savvy consumers and professional users seeking efficiency and control. As IoT adoption rises, demand for connected lighting systems in outdoor, industrial, and defense applications will expand. This trend opens new revenue streams for manufacturers while positioning LED Lenser as part of the broader smart device ecosystem.

- For instance, Ledlenser’s MH11 headlamp connects via Bluetooth to a smartphone app, enabling customized light settings up to 1,000 lumens, with a maximum beam distance of 320 meters and runtime of 100 hours on low mode, showcasing advanced smart control integration.

Key Challenges

Price Sensitivity in Emerging Markets

While demand is growing, price sensitivity remains a major barrier in emerging regions. Low-cost alternatives and counterfeit products often undercut established brands, limiting penetration of premium LED Lenser models. Consumers in cost-conscious markets prioritize affordability over advanced features, slowing adoption of mid- to high-range products. This challenge forces manufacturers to balance between quality and cost efficiency to remain competitive. Without effective strategies to address price concerns, growth potential in developing economies may remain constrained despite rising demand.

Competition from Alternative Lighting Solutions

The LED Lenser market faces strong competition from alternative lighting solutions such as generic LED flashlights, solar-powered lights, and multi-functional devices integrated into smartphones. These substitutes provide cheaper or more versatile options for consumers, especially in casual or low-demand use cases. Professional buyers may also consider specialized industrial lighting systems over handheld solutions. This competitive pressure challenges established players to differentiate through superior quality, durability, and brand reputation. Sustaining growth will require continuous innovation and emphasis on high-performance applications where substitutes cannot compete effectively.

Regional Analysis

North America

North America accounted for 26% share of the LED Lenser market in 2024, driven by strong consumer demand for outdoor gear and professional lighting. The U.S. led the region due to widespread adoption of handheld flashlights and headlamps across recreational, household, and tactical uses. Industrial applications in construction and emergency services further reinforced growth. Canada contributed through demand for eco-friendly rechargeable models, while Mexico supported market expansion via automotive and industrial usage. Growing interest in energy-efficient lighting and advanced tactical solutions positions North America as a consistent growth hub during the forecast period.

Europe

Europe held 28% share of the LED Lenser market in 2024, supported by high adoption in professional, industrial, and consumer applications. Germany, the U.K., and France drove demand through strong outdoor activity culture and strict safety standards in workplaces. Tactical and professional lights gained popularity among law enforcement and defense agencies. The region’s emphasis on sustainable, rechargeable devices aligned with EU environmental goals, encouraging rapid adoption. Eastern European countries added growth through rising construction and infrastructure projects. Europe’s combination of regulatory support and consumer preference for premium lighting reinforces its role as a leading regional market.

Asia-Pacific

Asia-Pacific led the LED Lenser market in 2024 with 34% share, supported by expanding urbanization, outdoor activities, and industrialization. China dominated demand due to large-scale manufacturing, outdoor consumer markets, and growing tactical applications. India and Southeast Asia contributed through strong adoption in household lighting, construction, and recreational uses. Rising disposable incomes and growing e-commerce platforms accelerated product accessibility across the region. Additionally, renewable energy and smart infrastructure projects supported demand for eco-friendly and rechargeable solutions. Asia-Pacific’s cost-efficient production and fast-growing consumer base position it as the largest and most dynamic regional market through 2032.

Latin America

Latin America represented 7% share of the LED Lenser market in 2024, with Brazil and Mexico leading demand. Growth was supported by increasing consumer interest in affordable handheld flashlights and headlamps for residential and outdoor use. Expanding middle-class households and rising adoption in automotive and construction applications further contributed to market expansion. However, price sensitivity and competition from low-cost imports limited premium product penetration. Manufacturers are focusing on expanding mid-range rechargeable models to capture untapped opportunities. With growing awareness of safety and energy efficiency, Latin America is expected to steadily strengthen its role in the global market.

Middle East & Africa

The Middle East & Africa accounted for 5% share of the LED Lenser market in 2024, driven by infrastructure projects, defense demand, and outdoor activities. Gulf nations such as Saudi Arabia and the UAE fueled adoption through investments in tactical and professional lighting for construction, defense, and industrial sectors. South Africa contributed through consumer adoption of handheld lights for residential and outdoor purposes. Limited local production created reliance on imports, offering opportunities for global suppliers. Growing awareness of fire safety and interest in rechargeable, eco-friendly lighting solutions will support gradual market growth across the region.

Market Segmentations:

By Type

- Headlamps

- Handheld flashlights

- Professional/Tactical Lights

- Multi-purpose lights

By Power

- Below 500 lumens

- Between 500-1,000 lumens

- Above 1,000 lumens

By Price

By End Use

- Residential

- Commercial

- Industrial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the LED Lenser market is shaped by leading players such as Klarus Lighting Technology, Maglite, Olight, Nitecore, Energizer, Ledlenser, Black Diamond Equipment, Nebo Tools, Coast Products, and Fenix Lighting. These companies compete through continuous innovation, focusing on product durability, higher lumen output, rechargeable battery technology, and smart features to enhance user convenience. Strong demand from outdoor enthusiasts, professionals, and tactical users has pushed players to diversify portfolios and strengthen distribution networks across retail and e-commerce. Many companies emphasize sustainability by introducing eco-friendly, rechargeable solutions aligned with global environmental standards. Strategic partnerships with defense, construction, and industrial sectors further expand their market presence. Competition is also defined by pricing strategies, as established brands balance premium offerings with mid-range products to capture wider audiences. Overall, differentiation through technology, reliability, and brand reputation remains central to maintaining competitiveness in the LED Lenser market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Olight used CES 2025 as a platform to debut the Ostation X and expanded its trade show presence globally.

- In 2024, Olight listed new products on its official “New Products” page, including tactical, EDC, and outdoor flashlights with latest features.

- In 2023, Ledlenser introduced the P5R CORE, a compact rechargeable flashlight designed for everyday carry and professional use. This product launch demonstrated the company’s commitment to innovation in the LED flashlight market.

Report Coverage

The research report offers an in-depth analysis based on Type, Power, Price, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for handheld flashlights will remain strong due to versatile household and outdoor use.

- Headlamps will gain traction as outdoor and industrial safety applications expand globally.

- Rechargeable LED Lenser products will grow in adoption with rising eco-friendly preferences.

- Smart and connected lighting solutions will create new opportunities for premium market segments.

- Professional and tactical lights will see steady demand from defense, law enforcement, and emergency services.

- Mid-priced products will dominate sales as consumers seek performance with affordability.

- Asia-Pacific will continue leading the market, supported by manufacturing strength and rising consumption.

- Europe will grow steadily due to regulatory standards and strong outdoor activity culture.

- North America will maintain stable growth, driven by recreational and professional lighting needs.

- Competition from low-cost alternatives will push brands to differentiate through durability and advanced features.