Market Overview

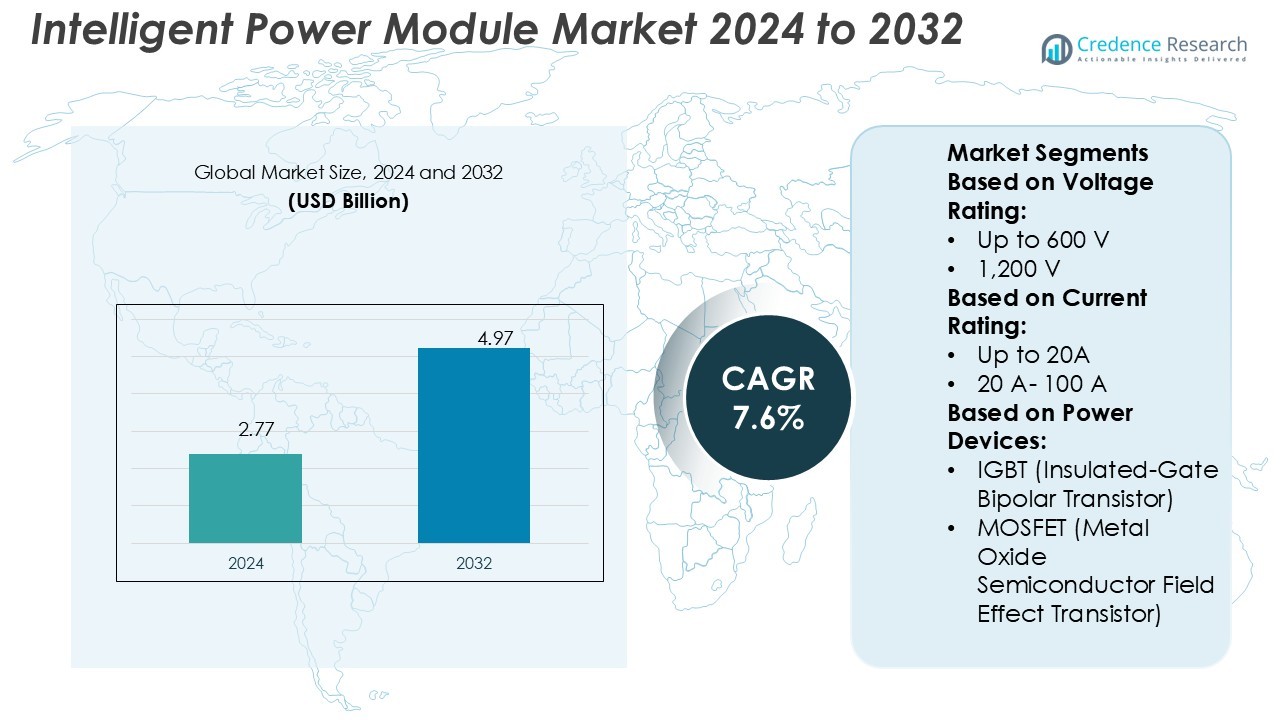

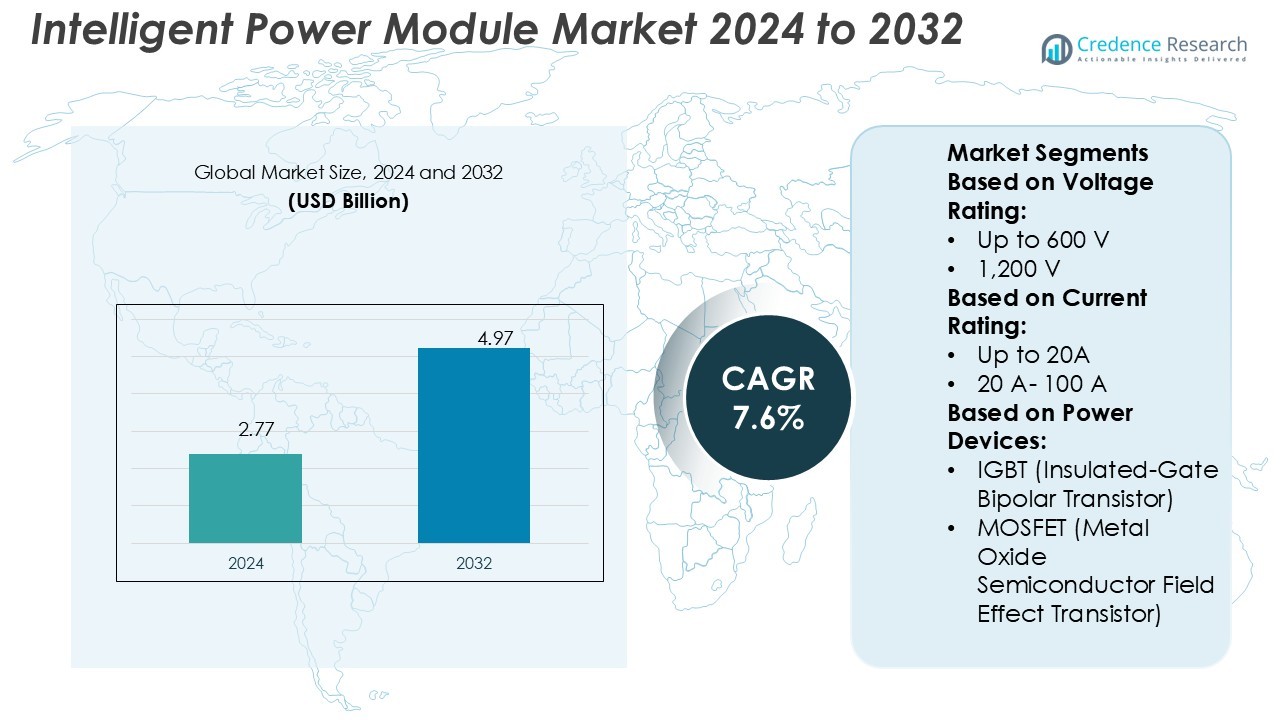

Intelligent Power Module Market size was valued USD 2.77 billion in 2024 and is anticipated to reach USD 4.97 billion by 2032, at a CAGR of 7.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Intelligent Power Module Market Size 2024 |

USD 2.77 Billion |

| Intelligent Power Module Market, CAGR |

7.6% |

| Intelligent Power Module Market Size 2032 |

USD 4.97 Billion |

The intelligent power module market is driven by top players such as Rohm Semiconductor, Mitsubishi Electric, Hangzhou Silan Microelectronics, On Semiconductor, STMicroelectronics, Sino Microelectronics, Infineon Technologies, Fuji Electric, Semikron, and Sanken Electric. These companies compete through advancements in IGBT- and MOSFET-based modules, focusing on efficiency, compact designs, and integration of wide-bandgap materials like SiC and GaN. Strategic collaborations with automotive, renewable, and industrial sectors strengthen their market positions. Asia-Pacific leads the global market with a 41% share, supported by robust manufacturing ecosystems, strong demand in consumer electronics, rapid EV adoption, and government-backed renewable energy initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The intelligent power module market size was USD 2.77 billion in 2024 and is expected to reach USD 4.97 billion by 2032, growing at a CAGR of 7.6%.

- Key drivers include rising demand from electric vehicles, renewable energy integration, and industrial automation, with the 600 V voltage rating and 20 A–100 A current range emerging as the dominant segments.

- Market trends highlight increasing use of wide-bandgap semiconductors such as SiC and GaN, along with miniaturization and high-power density designs, enhancing performance across consumer electronics and automotive systems.

- Competitive intensity is high as leading players focus on innovation, compact form factors, and collaborations across automotive, energy, and industrial sectors, though high development costs and thermal management challenges act as restraints.

- Asia-Pacific leads with 41% share, supported by strong EV production and appliance demand, followed by North America at 26% and Europe at 22%, reflecting balanced global adoption patterns.

Market Segmentation Analysis:

By Voltage Rating

The up to 600 V segment dominates the intelligent power module market with a significant share, driven by its extensive use in consumer electronics, home appliances, and small motor drives. This voltage range offers a balance between performance and cost efficiency, making it ideal for mass adoption. Rising demand for compact, energy-efficient appliances and the surge in renewable energy systems further support its growth. Manufacturers increasingly integrate advanced control features and improved thermal management within this range, enhancing reliability and extending operating life, which strengthens its market leadership.

- For instance, Rohm Semiconductor introduced its BM6437x series IPMs rated at 600 V, integrating a low-loss IGBT with optimized gate driver circuits. These modules deliver switching frequencies up to 20 kHz while reducing power loss by a notable percentage compared to previous models.

By Current Rating

The 20 A–100 A segment holds the largest share due to its wide applicability across industrial automation, automotive, and renewable energy sectors. These modules are preferred for applications requiring higher power handling without compromising efficiency. The increasing adoption of electric vehicles (EVs) and industrial motor drives is boosting demand in this range. Improved switching performance, reduced power losses, and better heat dissipation are key drivers supporting its growth. Vendors are focusing on compact designs and integration with advanced power devices to meet rising demand for reliable medium-current solutions.

- For instance, Mitsubishi Electric’s PSS20S92F6-AG intelligent power module supports a ±20 A rating per transistor, features junction-to-case thermal resistance of about 3.0 K/W for IGBT chips, and integrates built-in short circuit and under-voltage protection circuits within the same module.

By Power Devices

IGBT-based modules dominate the market, capturing the largest share due to their superior performance in medium to high-power applications. IGBTs offer low conduction losses and efficient switching, making them suitable for EVs, industrial motor drives, and renewable power generation. Their ability to handle higher voltages and currents compared to MOSFETs further strengthens adoption. The ongoing global shift toward energy-efficient solutions and electrification of transport continues to drive IGBT demand. Meanwhile, MOSFET-based modules are gaining traction in low-voltage, high-frequency applications, but IGBTs remain the leading segment due to broader industrial applicability.

Key Growth Drivers

Rising Adoption of Electric Vehicles

The growing penetration of electric and hybrid vehicles significantly drives demand for intelligent power modules. These modules ensure efficient power conversion, lower switching losses, and enhance thermal performance in EV applications. Automakers rely on IGBT-based and MOSFET-based modules to improve battery efficiency and extend vehicle range. Government incentives and stricter emission norms are accelerating EV production globally. As EV sales rise, particularly in Asia-Pacific and Europe, intelligent power modules are becoming critical for vehicle electrification, reinforcing their role as a central growth driver.

- For instance, Hangzhou Silan Microelectronics has developed a series of SiC MOSFET modules, including 650 V models, which offer significant performance improvements over its earlier 650 V silicon IGBT modules.

Expansion of Renewable Energy Integration

The increasing focus on renewable energy integration strengthens demand for intelligent power modules across solar and wind energy systems. These modules improve inverter efficiency, reduce energy losses, and support stable grid operations. Rising global investment in clean energy infrastructure, combined with declining renewable generation costs, expands deployment opportunities. Intelligent power modules are vital in optimizing energy conversion, supporting smart grid development, and enabling sustainable power generation. Their scalability and efficiency make them indispensable for driving renewable energy adoption, fueling long-term market expansion.

- For instance, onsemi’s recently introduced EliteSiC SPM 31 modules enable 1200 V operation with current ratings from 40 A to 70 A, and deliver higher power density and lower losses compared to Field Stop 7 IGBT modules.

Advancements in Industrial Automation

The shift toward Industry 4.0 and widespread industrial automation boosts demand for intelligent power modules. Factories increasingly deploy motor drives, robotics, and automation equipment requiring efficient, compact, and thermally stable power solutions. Intelligent power modules provide integrated protection, enhanced performance, and reduced downtime in these systems. Rising investments in smart manufacturing, particularly in Asia-Pacific, amplify demand. Modules with higher current ratings and advanced heat management capabilities are becoming essential. Industrial digitization and automation trends thus play a critical role in accelerating adoption and driving consistent market growth.

Key Trends & Opportunities

Miniaturization and High-Power Density Designs

Manufacturers are focusing on developing compact modules with higher power density to meet modern application needs. Advances in packaging technologies and integration of wide-bandgap semiconductors like SiC and GaN enable smaller footprints with improved efficiency. Miniaturization allows deployment in space-constrained systems, including portable electronics and next-generation EVs. The trend also supports cost savings by reducing system complexity and improving reliability. Companies leveraging innovative module designs with high thermal conductivity and compact form factors stand to capture strong market opportunities.

- For instance, ST introduced its SLLIMM High Power 650 V / 50 A IPM in a compact dual-in-line mold package, achieving a maximum junction temperature of 175 °C and using a DBC substrate to improve thermal performance.

Integration of Wide-Bandgap Semiconductors

The adoption of silicon carbide (SiC) and gallium nitride (GaN) devices within intelligent power modules presents a major growth opportunity. These semiconductors deliver superior efficiency, faster switching, and higher temperature tolerance compared to conventional silicon. They are increasingly used in EV fast chargers, renewable energy inverters, and high-frequency applications. As demand for energy efficiency rises, wide-bandgap integration enhances performance while lowering total system cost. Market players investing in SiC- and GaN-based module development gain a competitive edge in high-growth industries.

- For instance, Sino Microelectronics has developed 1200 V SiC MOSFET modules that offer significant performance improvements over its silicon IGBT counterparts. These SiC modules, which enable higher current density and operate at high frequencies, are known to achieve lower switching losses.

Growing Demand in Consumer Electronics

Consumer electronics, including air conditioners, washing machines, and refrigerators, are increasingly adopting intelligent power modules to improve energy efficiency. Governments worldwide are enforcing stricter efficiency standards, prompting manufacturers to adopt advanced modules. Compact designs and cost-effective solutions make these modules attractive for appliance manufacturers. Rising disposable incomes and demand for smart appliances, particularly in Asia-Pacific, expand market opportunities. Integration of intelligent power modules in everyday electronics enhances performance and reduces energy consumption, strengthening growth prospects in this segment.

Key Challenges

High Development and Implementation Costs

The design and production of intelligent power modules involve high costs due to advanced semiconductor materials, packaging technologies, and integration of thermal management systems. These costs increase the final product price, limiting adoption in price-sensitive markets. Small and medium manufacturers face challenges in competing with larger players due to capital-intensive R&D requirements. Additionally, end-users often hesitate to switch from conventional power solutions due to cost barriers. Overcoming price sensitivity remains a significant challenge for widespread adoption across emerging economies.

Thermal Management and Reliability Issues

Despite advancements, maintaining consistent thermal performance and reliability under high-power operation remains a challenge. Intelligent power modules often face issues related to heat dissipation, long-term stability, and device failure under demanding conditions. Applications in EVs, industrial automation, and renewable systems require modules to operate continuously in harsh environments. Any reliability concerns can increase downtime and maintenance costs, reducing customer trust. Addressing thermal limitations through advanced materials, cooling techniques, and robust packaging is essential to ensure consistent long-term adoption.

Regional Analysis

North America

North America holds a 26% share of the intelligent power module market, supported by strong adoption in electric vehicles, renewable energy, and industrial automation. The U.S. leads demand, driven by government initiatives promoting EV adoption and clean energy infrastructure. Growing investments in automation across automotive and aerospace sectors further accelerate market penetration. Key players in the region focus on integrating wide-bandgap semiconductors, enhancing energy efficiency and reliability. The presence of leading semiconductor companies and robust R&D infrastructure strengthens technological innovation. Favorable policies and rising consumer demand for energy-efficient solutions reinforce North America’s position in the global landscape.

Europe

Europe accounts for 22% of the intelligent power module market, fueled by strict energy efficiency regulations and the region’s leadership in EV adoption. Germany, France, and the UK dominate demand due to strong automotive and industrial bases. Rapid growth in renewable energy projects, particularly wind and solar, drives the use of high-efficiency modules in inverters and grid systems. European manufacturers emphasize sustainability, compact designs, and integration of SiC-based devices. Supportive government policies and rising demand for smart appliances enhance adoption. The region’s focus on carbon neutrality by 2050 further boosts intelligent power module applications across industries.

Asia-Pacific

Asia-Pacific leads the intelligent power module market with a dominant 41% share, driven by robust manufacturing ecosystems in China, Japan, and South Korea. High-volume production of consumer electronics, home appliances, and vehicles significantly fuels demand. The region also benefits from rising EV adoption, government-backed renewable energy expansion, and rapid industrialization. Local players invest heavily in R&D, focusing on compact designs and advanced thermal management. Strong supply chains and cost-effective production strengthen regional dominance. Asia-Pacific’s growing urbanization and adoption of smart technologies reinforce its position as the largest and fastest-growing market for intelligent power modules globally.

Latin America

Latin America holds a 6% share of the intelligent power module market, with Brazil and Mexico as leading contributors. Rising investments in renewable energy projects, particularly solar and wind, drive adoption. Increasing automotive production and industrial automation further support growth. The region’s demand for energy-efficient appliances and systems is expanding as urbanization and disposable incomes rise. Limited local manufacturing capacity, however, results in reliance on imports from Asia-Pacific and North America. Government energy efficiency programs and renewable integration initiatives create opportunities for intelligent power module suppliers to expand their footprint in Latin America.

Middle East & Africa

The Middle East & Africa region represents 5% of the intelligent power module market, driven by infrastructure modernization and rising renewable energy initiatives. Countries like the UAE, Saudi Arabia, and South Africa are investing in solar power projects, increasing the use of power modules in inverters and grid systems. Industrial automation and electrification of transport are also gaining momentum, though adoption remains slower compared to other regions. Limited local manufacturing capacity poses challenges, but partnerships with global suppliers are helping bridge the gap. Growing demand for energy-efficient systems offers long-term opportunities in this region.

Market Segmentations:

By Voltage Rating:

By Current Rating:

By Power Devices:

- IGBT (Insulated-Gate Bipolar Transistor)

- MOSFET (Metal Oxide Semiconductor Field Effect Transistor)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the intelligent power module market is shaped by key players including Rohm Semiconductor, Mitsubishi Electric, Hangzhou Silan Microelectronics, On Semiconductor, STMicroelectronics, Sino Microelectronics, Infineon Technologies, Fuji Electric, Semikron, and Sanken Electric. The intelligent power module market is defined by continuous innovation, strategic partnerships, and increasing investments in advanced semiconductor technologies. Companies are focusing on integrating wide-bandgap materials such as silicon carbide (SiC) and gallium nitride (GaN) to enhance energy efficiency, reduce switching losses, and improve thermal performance. Growing demand from sectors like electric vehicles, renewable energy, and industrial automation has intensified competition, pushing firms to optimize module designs with higher power density and compact form factors. Additionally, collaborations with automotive OEMs and renewable energy providers are expanding product applications, while regional manufacturers emphasize cost-effective solutions to strengthen global market reach.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Rohm Semiconductor

- Mitsubishi Electric

- Hangzhou Silan Microelectronics

- On Semiconductor

- STMicroelectronics

- Sino Microelectronics

- Infineon Technologies

- Fuji Electric

- Semikron

- Sanken Electric

Recent Developments

- In April 2025, Alpha and Omega Semiconductor introduced its Mega IPM-7 series intelligent power modules engineered to improve application performance and deliver increased power density.

- In March 2025, Onsemi introduced the first generation of its 1200V SiC MOSFET-based SPM 31 intelligent power modules (IPMs). These EliteSiC SPM 31 IPMs are said to deliver the highest energy efficiency and power density in the smallest form factor compared to using Field Stop 7 IGBT technology, resulting in lower total system cost than any other leading solution on the market.

- In August 2024, Infineon Technologies AG added the CIPOS Maxi Intelligent Power Module (IPM) series for low-power motor drives to its 7th generation TRENCHSTOP IGBT7 product family.

- In July 2024, MediaTek and JioThings launched the ‘Made in India’ Smart Digital Cluster and Smart Module for the 2-wheeler market, combining advanced chipsets and innovative IoT solutions. This collaboration aims to enhance digital experiences, speed market entry for OEMs, and cater to the growing EV segment.

Report Coverage

The research report offers an in-depth analysis based on Voltage Rating, Current Rating, Power Devices and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising adoption of electric and hybrid vehicles.

- Demand will grow as renewable energy projects integrate intelligent power modules.

- Industrial automation and smart factories will drive increased usage of power modules.

- Wide-bandgap semiconductors like SiC and GaN will enhance performance and efficiency.

- Miniaturization and high-power density designs will support compact electronic applications.

- Consumer electronics and home appliances will continue adopting energy-efficient modules.

- Strategic partnerships will strengthen innovation and global market reach.

- Government policies promoting clean energy and efficiency will boost adoption.

- Reliability and thermal management improvements will increase long-term system stability.

- Emerging markets will create new growth opportunities through rapid electrification and urbanization.