Market Overview

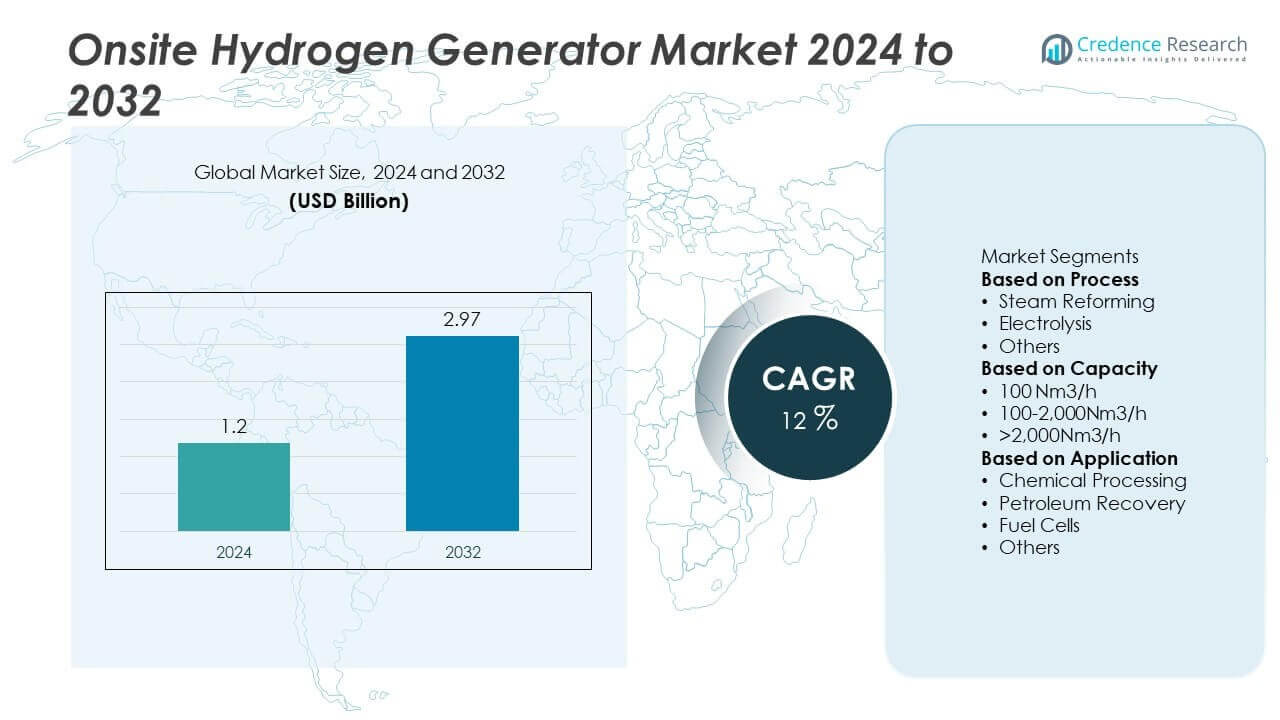

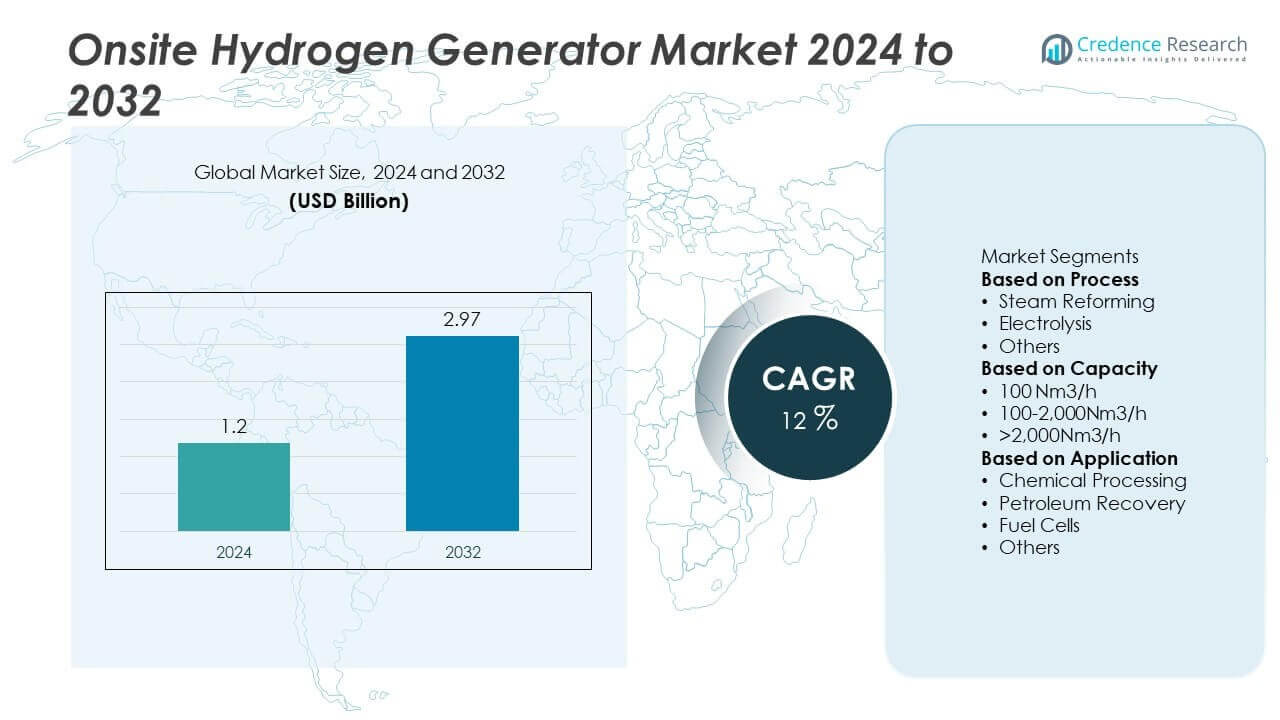

Onsite Hydrogen Generator Market size was valued at USD 1.2 billion in 2024 and is anticipated to reach USD 2.97 billion by 2032, growing at a CAGR of 12% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Onsite Hydrogen Generator Market Size 2024 |

USD 1.2 Billion |

| Onsite Hydrogen Generator Market, CAGR |

12% |

| Onsite Hydrogen Generator Market Size 2032 |

USD 2.97 Billion |

The onsite hydrogen generator market is driven by key players including Idroenergy, Mahler AGS, Hitachi Zosen Corporation, EPOCH Energy Technology Corp, Teledyne Technologies Incorporated, MVS Engineering Pvt. Ltd., LNI Swissgas Srl, Cockerill Jingli Hydrogen, Air Products & Chemicals, Inc., and Element 1. These companies focus on advancing steam reforming and electrolysis technologies to meet rising hydrogen demand in industrial and clean energy applications. Regionally, Asia-Pacific led the market with 34% share in 2024, supported by rapid industrialization and hydrogen infrastructure investments. North America followed with 32% share, driven by strong adoption in refining and fuel cells, while Europe accounted for 28% share, supported by green hydrogen initiatives and strict carbon reduction policies.

Market Insights

Market Insights

- The onsite hydrogen generator market was valued at USD 1.2 billion in 2024 and is projected to reach USD 2.97 billion by 2032, growing at a CAGR of 12% during the forecast period.

- Steam reforming dominated the market with over 55% share in 2024, driven by cost efficiency and strong use in chemical and refining industries, while electrolysis is expanding rapidly with rising green hydrogen adoption.

- A key trend is the growing integration of renewable energy with electrolysis-based generators, supported by government incentives and decarbonization targets across major economies.

- The market is highly competitive with players such as Air Products & Chemicals, Inc., Teledyne Technologies, Mahler AGS, Cockerill Jingli Hydrogen, and Element 1 focusing on scalable systems, strategic partnerships, and technological advancements.

- Asia-Pacific led with 34% share, followed by North America at 32% and Europe at 28%, while the 100–2,000 Nm³/h capacity segment held more than 50% share in 2024.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Process

Steam reforming dominated the onsite hydrogen generator market in 2024, accounting for more than 55% share. Its leadership is driven by cost efficiency, established infrastructure, and ability to generate hydrogen at scale for industrial applications. This process remains widely adopted in refineries and chemical plants where natural gas availability is strong. Electrolysis follows as a fast-growing segment, supported by rising demand for green hydrogen and integration with renewable energy. While steam reforming holds the largest base, electrolysis is projected to gain share due to global decarbonization efforts and increasing government incentives for clean hydrogen production.

- For instance, Mahler AGS offers its HYDROFORM-M steam reforming systems with capacities between 200 and 5,000 Nm³/h, achieving hydrogen purity levels up to 99.9999 vol% after PSA purification, making them suitable for refineries and chemical plants.

By Capacity

The 100–2,000 Nm³/h capacity range led the market with over 50% share in 2024, supported by its suitability for mid-scale industrial and energy applications. This range provides flexibility, balancing cost efficiency with adequate output for sectors such as chemicals, petroleum, and power generation. Smaller units of 100 Nm³/h remain in demand among research facilities and distributed energy projects but serve niche requirements. Large-scale systems above 2,000 Nm³/h are steadily gaining traction as hydrogen demand rises for grid-scale power, steelmaking, and clean fuel production, though adoption is currently limited to advanced economies and large industrial users.

- For instance, MVS Engineering Pvt. Ltd. has deployed on-site hydrogen plants for steel and chemical clients, delivering a continuous supply of hydrogen with purities of up to 99.9998% and at operating pressures of 15 bar.

By Application

Chemical processing held the dominant position in 2024, capturing over 40% share of the onsite hydrogen generator market. Its leadership stems from widespread hydrogen use in ammonia production, methanol synthesis, and other key industrial processes. Petroleum recovery follows as another major application, driven by the demand for hydrogen in refining and desulfurization. The fuel cell segment is expanding rapidly, supported by growth in clean mobility solutions and stationary power systems. While “others” include diverse sectors such as food processing and electronics, large-scale demand from chemical processing ensures it remains the leading application for onsite hydrogen generation.

Key Growth Drivers

Rising Demand for Clean Hydrogen in Industrial Applications

The increasing shift toward clean energy solutions is driving demand for onsite hydrogen generators in industries such as chemicals, refining, and fertilizers. These generators enable efficient and continuous hydrogen supply while reducing dependence on external logistics and large-scale distribution networks. With industries under pressure to cut emissions and adopt sustainable practices, onsite generation offers cost-effective and reliable production. The strong role of hydrogen in ammonia, methanol, and desulfurization processes ensures consistent adoption, strengthening the market outlook across major industrial hubs worldwide.

- For instance, Air Products & Chemicals, Inc. operates onsite hydrogen plants delivering over 3,000 Nm³/h with 99.999% purity to refineries in North America, supporting hydrocracking and desulfurization units that process more than 150,000 barrels per day of crude oil.

Government Incentives and Decarbonization Initiatives

Supportive government policies promoting hydrogen as a clean energy carrier are fueling onsite hydrogen generator adoption. Incentives for green hydrogen production through electrolysis, particularly in Europe, North America, and Asia-Pacific, are accelerating deployment. Carbon reduction targets and renewable integration goals are also encouraging industries to invest in onsite hydrogen solutions. These initiatives not only support technological advancements but also reduce financial barriers for end-users. As global economies pursue net-zero commitments, the availability of favorable regulations and subsidies will remain a critical driver of market growth.

- For instance, Teledyne Energy Systems has deployed electrolysis units producing 5 to 50 Nm³/h of hydrogen at >99.999% purity, supported by U.S. Department of Energy funding programs, enabling industrial users to align with decarbonization and renewable integration targets.

Growth of Hydrogen Fuel Cell Applications

The rapid expansion of hydrogen fuel cell technology in transportation and stationary power generation is creating strong demand for onsite hydrogen generators. Fuel cells require a reliable and high-purity hydrogen supply, which is efficiently supported by localized generation systems. Applications in electric vehicles, buses, forklifts, and backup power are expanding across developed and emerging regions. Onsite generators offer scalability and operational flexibility, aligning with the growing deployment of hydrogen infrastructure. This rising use of fuel cells in clean mobility and distributed energy sectors is expected to accelerate market penetration in the coming years.

Key Trends & Opportunities

Adoption of Green Hydrogen through Electrolysis

Electrolysis-based onsite hydrogen generation is emerging as a key opportunity, supported by the integration of renewable energy sources such as solar and wind. Unlike steam reforming, electrolysis provides zero-carbon hydrogen production, making it central to decarbonization strategies. Falling renewable energy costs and technological improvements in electrolyzers are enhancing efficiency and affordability. Governments and industries investing in green hydrogen corridors and pilot projects are driving early adoption. This trend positions electrolysis as one of the fastest-growing segments in the onsite hydrogen generator market.

- For instance, Cockerill Jingli Hydrogen produces pressurized alkaline electrolyzer systems with single-stack capacities of 5 MW. These electrolyzers are capable of producing over 1,000 Nm³/h of hydrogen and can be integrated with purification systems to achieve 99.999% purity.

Integration into Distributed Energy and Microgrids

The growing demand for decentralized energy solutions is creating opportunities for onsite hydrogen generators in distributed energy and microgrid systems. Hydrogen can act as both a fuel and energy storage medium, ensuring reliable power supply in regions with intermittent renewable resources. Onsite generation reduces transmission losses and supports energy independence for industrial facilities, remote locations, and commercial establishments. With increasing emphasis on energy security and resilience, the integration of hydrogen generators into hybrid renewable systems is becoming a strategic opportunity for both energy providers and end-users.

- For instance, Element 1 Corp. manufactures the L18-PSA methanol-to-hydrogen generator, which is designed to be paired with a third-party pressure-swing absorption (PSA) unit to produce high-purity, fuel cell-grade hydrogen.

Key Challenges

High Capital and Operational Costs

Onsite hydrogen generators require significant initial investment, particularly for electrolysis systems designed for green hydrogen production. The costs of electrolyzers, compressors, and storage infrastructure remain high compared to conventional hydrogen sourcing. Operational expenses, including energy requirements, further add to the financial burden. This makes adoption challenging for small and medium-scale industries in cost-sensitive regions. Without further cost reductions and financial support mechanisms, high capital intensity will continue to hinder wider market penetration.

Infrastructure and Supply Chain Limitations

Despite rising interest in hydrogen, the lack of supporting infrastructure poses a major challenge to market growth. Many regions still lack the distribution networks, refueling stations, and storage facilities needed to integrate onsite hydrogen generators into broader energy ecosystems. Limited supply chains for advanced components such as membranes and catalysts also affect deployment timelines. These gaps restrict scalability and discourage investment, particularly in emerging economies. Expanding infrastructure and securing robust supply chains will be critical for unlocking the full potential of onsite hydrogen generation.

Regional Analysis

North America

North America accounted for over 32% share of the onsite hydrogen generator market in 2024, driven by strong adoption across refining, chemical processing, and fuel cell applications. The United States leads regional growth with government-backed initiatives supporting hydrogen infrastructure and decarbonization goals. Demand is also reinforced by investments in clean mobility, where onsite hydrogen generation supports refueling stations for fuel cell vehicles. Canada contributes with large-scale projects integrating renewable energy into electrolysis-based hydrogen production. Favorable policies, combined with strong industrial demand and expanding hydrogen fuel applications, ensure North America maintains a leading role in the global market.

Europe

Europe captured more than 28% share of the onsite hydrogen generator market in 2024, supported by ambitious carbon reduction targets and rapid adoption of green hydrogen initiatives. Countries such as Germany, France, and the UK are leading investments in electrolysis-based hydrogen production, aligning with the European Union’s hydrogen strategy. The chemical and refining industries continue to be major consumers, while expanding hydrogen mobility projects further drive demand. With strong regulatory frameworks and funding for renewable integration, Europe is accelerating its transition toward sustainable hydrogen generation, positioning itself as a key hub for clean energy adoption.

Asia-Pacific

Asia-Pacific dominated the onsite hydrogen generator market in 2024 with over 34% share, making it the largest regional contributor. Rapid industrialization, particularly in China, Japan, and South Korea, drives hydrogen demand for chemicals, refining, and fuel cells. Governments across the region are investing heavily in hydrogen infrastructure to reduce carbon emissions and strengthen energy security. Japan and South Korea are advancing hydrogen-powered transportation, while China leads in large-scale projects integrating hydrogen into its energy mix. The region’s strong manufacturing base and growing focus on renewable-powered electrolysis ensure Asia-Pacific’s continued leadership in market expansion.

Latin America

Latin America accounted for more than 4% share of the onsite hydrogen generator market in 2024, supported by growing investments in clean energy and industrial modernization. Brazil and Mexico are leading adopters, with hydrogen generation increasingly used in refining and fertilizer production. Government-backed renewable energy programs provide opportunities for electrolysis-based solutions, though high capital costs limit widespread adoption. Expanding oil and gas industries in the region also support hydrogen demand for desulfurization processes. While still a developing market, Latin America shows strong potential for growth as energy transition initiatives gain momentum.

Middle East & Africa

The Middle East & Africa region held around 2% share of the onsite hydrogen generator market in 2024. Growth is primarily driven by rising demand in petroleum refining and energy diversification projects in Gulf countries. Saudi Arabia and the UAE are spearheading investments in large-scale green hydrogen projects, positioning the region as a future exporter. In Africa, hydrogen adoption is limited but gaining attention through pilot projects linked to renewable energy. Despite challenges in infrastructure and high upfront costs, the region’s abundant solar and wind resources create long-term opportunities for green hydrogen production and onsite generation solutions.

Market Segmentations:

By Process

- Steam Reforming

- Electrolysis

- Others

By Capacity

- 100 Nm3/h

- 100-2,000Nm3/h

- >2,000Nm3/h

By Application

- Chemical Processing

- Petroleum Recovery

- Fuel Cells

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the onsite hydrogen generator market features major players such as Idroenergy, Mahler AGS, Hitachi Zosen Corporation, EPOCH Energy Technology Corp, Teledyne Technologies Incorporated, MVS Engineering Pvt. Ltd., LNI Swissgas Srl, Cockerill Jingli Hydrogen, Air Products & Chemicals, Inc., and Element 1. These companies compete by focusing on technological innovation, efficiency improvements, and expanding their global presence. Leading players such as Air Products & Chemicals and Teledyne Technologies emphasize large-scale solutions for refining and chemical industries, while firms like Mahler AGS and MVS Engineering cater to mid-scale and modular onsite systems. Element 1 and LNI Swissgas Srl specialize in compact hydrogen generators, addressing distributed energy and fuel cell applications. Strategic partnerships, renewable-powered electrolysis projects, and government-backed hydrogen initiatives are central to competition. With rising demand for green hydrogen, companies are accelerating investments in electrolysis technologies, positioning themselves to capture long-term opportunities in the global energy transition.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, Teledyne Technologies showcased its hydrogen-tech capabilities with a Teledyne fuel-cell payload launched on Blue Origin’s New Shepard, complementing Teledyne Energy Systems’ on-site H₂/O₂ generators portfolio.

- In July 2025, Cockerill Jingli Hydrogen (John Cockerill Hydrogen) acquired key McPhy assets to accelerate its next-gen pressurized alkaline electrolyzers, strengthening on-site hydrogen offerings.

- In March 2025, Element 1 secured a five-year, US$5.3 million multi-unit order and an exclusive distribution deal for its L18-PSA methanol-to-hydrogen generators across North America and the UK.

- In October 2024, LNI Swissgas Srl announced the HG PRO M hydrogen-generator series for labs and small on-site supply. The release highlights PEM units with flows up to 20 L/min and high-purity output.

Report Coverage

The research report offers an in-depth analysis based on Process, Capacity, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising demand for clean hydrogen in industrial applications.

- Steam reforming will maintain dominance, but electrolysis will gain faster growth with green hydrogen initiatives.

- Mid-scale generators in the 100–2,000 Nm³/h range will remain the most adopted capacity segment.

- Chemical processing will continue as the leading application, supported by ammonia and methanol production.

- Fuel cell adoption will accelerate demand for compact and high-purity onsite hydrogen generators.

- Asia-Pacific will sustain leadership, driven by industrialization and hydrogen infrastructure projects.

- North America will strengthen its position with decarbonization policies and mobility applications.

- Europe will expand rapidly through strict carbon reduction targets and green hydrogen funding.

- Manufacturers will invest in renewable-powered electrolysis and modular generation systems.

- Competition will intensify as global players form partnerships to expand into emerging markets.

Market Insights

Market Insights