Market Overview

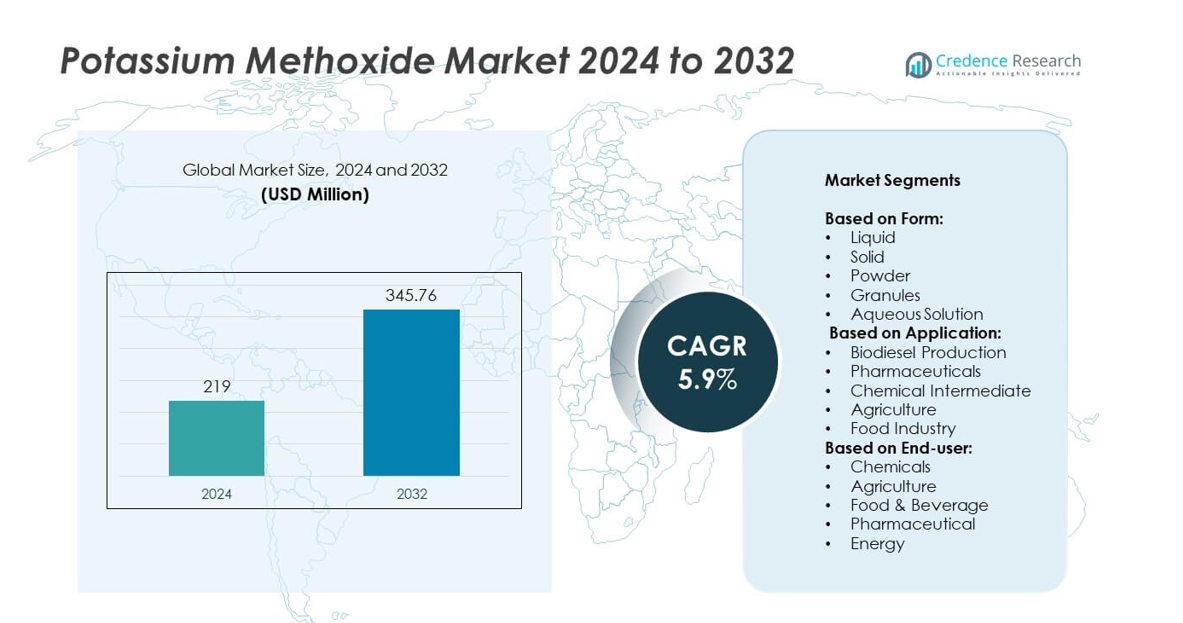

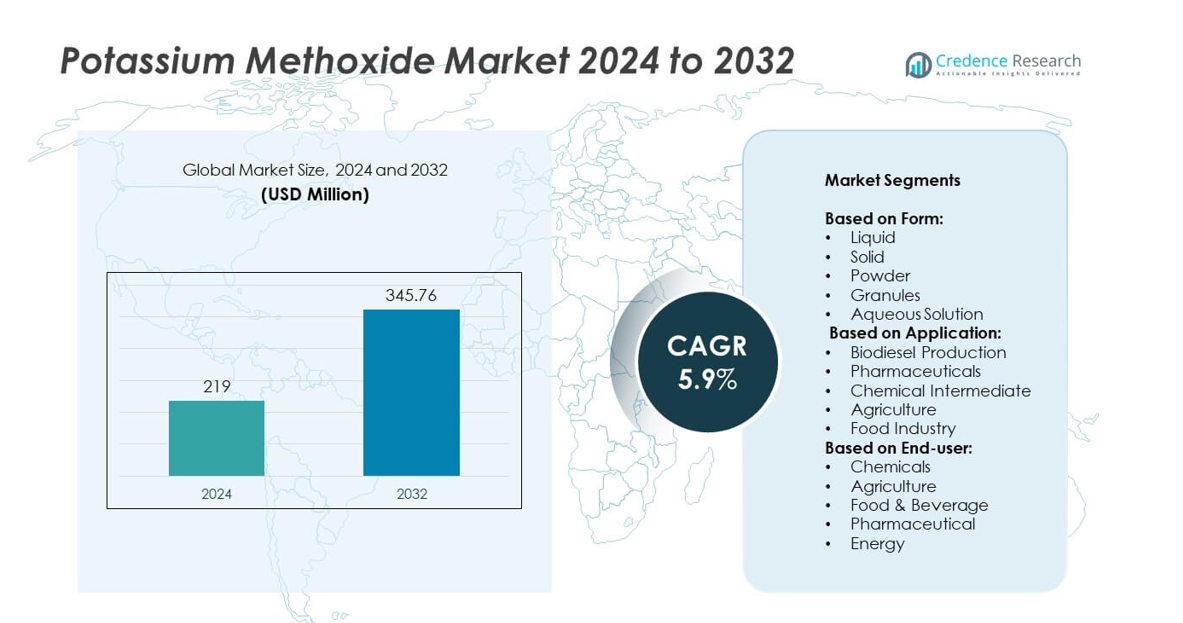

The potassium methoxide market size was valued at USD 219 million in 2024 and is anticipated to reach USD 345.76 million by 2032, growing at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Potassium Methoxide Market Size 2024 |

USD 219 million |

| Potassium Methoxide Market, CAGR |

5.9% |

| Potassium Methoxide Market Size 2032 |

USD 345.76 million |

The potassium methoxide market is driven by key players such as Evonik, Kraft Chemical Company, Huntsman Corporation, Albemarle Corporation, Solvay S.A., BASF SE, SABIC, Luxi Chemical, and FMC Corporation, who focus on capacity expansion, product innovation, and strategic collaborations to meet rising global demand. These companies prioritize partnerships with biodiesel producers and invest in advanced manufacturing processes to improve catalyst efficiency and safety. North America led the market in 2024 with around 32% share, supported by strong biodiesel mandates and a robust chemical manufacturing base. Asia-Pacific followed closely with 30% share, driven by rapid industrialization, expanding pharmaceutical production, and increasing renewable fuel initiatives.

Market Insights

- The potassium methoxide market was valued at USD 219 million in 2024 and is projected to reach USD 345.76 million by 2032, growing at a CAGR of 5.9% between 2025 and 2032.

- Rising biodiesel production remains the key driver, with the liquid form segment dominating over 45% share due to its high solubility and efficiency in transesterification processes.

- The market is witnessing a shift toward green chemistry solutions, supported by stricter environmental regulations and growing investment in sustainable catalysts.

- Competition is intense, with major players expanding capacity, forming supply agreements with biodiesel producers, and focusing on R&D for safer formulations to strengthen their market position.

- North America leads with 32% market share, followed by Asia-Pacific at 30% and Europe at 28%, with strong growth expected in Asia-Pacific due to expanding pharmaceutical and agrochemical industries and rising renewable energy initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Form

Liquid potassium methoxide dominated the market with over 45% share in 2024 due to its high solubility and ease of handling during large-scale biodiesel production. Its compatibility with continuous manufacturing processes drives adoption across chemical and energy sectors. The solid and powder forms follow, serving applications that demand extended shelf life and safer storage. Granules and aqueous solutions cater to niche requirements in laboratory research and specialty formulations. Growth in liquid form use is strongly driven by rising biodiesel mandates and growing demand for efficient transesterification catalysts in renewable fuel production.

- For instance, a study by Chanakaewsomboon et al. found that using 1.0 wt% potassium methoxide in liquid form with refined palm oil (0.49 wt% free fatty acids) produced ester content greater than 96.5 wt%.

By Application

Biodiesel production accounted for more than 50% of the market share in 2024, positioning it as the dominant application. This strong presence is driven by government incentives for renewable energy and the shift toward cleaner fuels. Pharmaceutical and chemical intermediate applications are growing steadily due to their role in drug synthesis and specialty chemical manufacturing. Agriculture benefits from potassium methoxide’s use in herbicide and pesticide production, while food industry adoption remains limited to niche processing. Expanding biodiesel plant capacities globally continues to be the key driver for application growth.

- For instance, in a 2024 study published in a journal affiliated with the National Institutes of Health, researchers optimized biodiesel production from waste cooking oil and sesame oil, achieving a highest yield of 94% under specific conditions.

By End-User

The chemicals sector led the market with over 40% share in 2024, supported by its extensive use in producing specialty chemicals and intermediates. The energy sector follows closely due to growing biodiesel production facilities across Asia-Pacific and Europe. Agriculture and pharmaceuticals are also key end-users, leveraging potassium methoxide for agrochemical formulations and drug synthesis. The food and beverage segment contributes a smaller share, focusing on additives and processing aids. Rising investments in green chemistry and sustainable fuel initiatives are major factors strengthening the dominance of the chemicals segment.

Market Overview

Rising Biodiesel Production

Growing demand for biodiesel is the most significant driver for the potassium methoxide market. Governments are implementing blending mandates and subsidies to cut carbon emissions, boosting biodiesel capacity. Potassium methoxide is preferred as a transesterification catalyst for its high efficiency and faster reaction time. Expanding biodiesel facilities in Asia-Pacific and Europe strengthen demand. This segment is the largest consumer, ensuring stable long-term growth and positioning biodiesel production as the primary driver for market expansion during the forecast period.

- For instance, in castor-oil transesterification experiments (industrial chemistry setup), Encinar et al. used potassium methoxide at 1.0 wt% at 65 °C with a 9:1 methanol/oil molar ratio to meet EN 14214 qualities.

Increasing Pharmaceutical Applications

Pharmaceutical manufacturers are increasingly using potassium methoxide in drug synthesis and fine chemical production. Its strong base properties support manufacturing of active pharmaceutical ingredients, including antihypertensive and anti-inflammatory drugs. Growth of the pharmaceutical sector in India and China is fueling consumption. Rising R&D investments and generic drug production expansion contribute to demand, making pharmaceuticals an important growth driver for the market.

- For instance, Evonik Operations GmbH offers a “Potassium Methylate Solution 32 %” product where the effective alkalinity lies between 31.5-33 wt %.

Expansion of Agrochemical Industry

Rising demand for herbicides and crop protection chemicals is driving potassium methoxide use in agriculture. It is used in synthesizing methylated herbicides and intermediates, supporting efficient farming solutions. Growing food demand and shrinking arable land push adoption of high-performance agrochemicals. Government programs to boost agricultural productivity and increased agri-chem R&D investments strengthen market growth. Agriculture is emerging as a major contributor to overall demand during the forecast period.

Key Trends & Opportunities

Shift Toward Green Chemistry

The market is shifting toward eco-friendly and sustainable chemical processes. Potassium methoxide supports biodiesel production, aligning with efforts to cut greenhouse gas emissions. The focus on green chemistry encourages adoption of cleaner catalysts with minimal waste. This creates opportunities for producers to offer sustainable grades and gain market share in regions with strict environmental rules, supporting long-term demand.

- For instance, in a study by D. Celante et al., published in Fuel in 2018, the transesterification of soybean oil with dimethyl carbonate (DMC) was explored using potassium methoxide prepared via a recrystallization process. At the optimal conditions—a reaction temperature of 80 °C, a catalyst concentration of 2.0 wt%, and a DMC-to-oil molar ratio of 6:1—a triglyceride conversion exceeding 99% was achieved.

Technological Advancements in Manufacturing

Advances in catalytic process technology are improving yield and production efficiency. Continuous process innovations reduce energy consumption and minimize by-products, making production more economical. Producers are investing in advanced packaging and safer handling systems to maintain purity and performance. These innovations create opportunities to meet growing demand from biodiesel and pharmaceutical sectors while remaining cost-competitive.

- For instance, Wako Pure Chemical Corporation supplies a 30 % potassium methoxide solution in methanol. The product has a concentration specification of 30.0 ± 1.0 %.

Key Challenges

Handling and Storage Concerns

Potassium methoxide is highly reactive and requires controlled storage to avoid moisture absorption and hazardous reactions. Specialized equipment and safety protocols increase costs for producers and users. Exposure to moisture reduces product effectiveness and raises accident risk, limiting adoption by smaller facilities. Development of safer formulations and improved handling solutions could help overcome this challenge.

Fluctuating Raw Material Prices

Production cost is affected by volatility in potassium hydroxide and methanol prices. Price swings can reduce margins and create supply instability. Global trade issues and energy cost increases add further pressure on production economics. Manufacturers are focusing on long-term sourcing contracts and vertical integration to stabilize costs and maintain consistent supply to end-users.

Regional Analysis

North America

North America held around 32% of the potassium methoxide market share in 2024, driven by the strong presence of biodiesel production facilities in the United States. Supportive government policies like renewable fuel standards and tax incentives have increased demand for transesterification catalysts. The region also benefits from advanced chemical manufacturing infrastructure and growing pharmaceutical production. Canada’s focus on sustainable fuel adoption adds to market expansion. Rising demand from agriculture and food processing sectors further supports growth, while ongoing investments in green chemistry and cleaner production technologies are expected to sustain steady demand through the forecast period.

Europe

Europe accounted for nearly 28% of the global market share, supported by stringent emission reduction targets and the EU’s biofuel blending mandates. Countries like Germany, France, and Italy lead biodiesel production, which drives potassium methoxide consumption. The region also has a strong pharmaceutical and chemical industry base, contributing to steady demand. Growth is further supported by increasing investments in sustainable chemical processes and government funding for renewable energy projects. Rising awareness of cleaner fuels and the adoption of high-efficiency catalysts are expected to keep Europe an attractive market throughout the forecast period, with consistent long-term demand.

Asia-Pacific

Asia-Pacific captured about 30% of the potassium methoxide market share in 2024, making it one of the fastest-growing regions. Rapid industrialization in China and India drives demand from biodiesel, pharmaceuticals, and agrochemical production. Government initiatives promoting renewable energy and domestic fuel security further boost market growth. The expanding pharmaceutical manufacturing sector, particularly in India, creates additional opportunities. Rising food demand and increasing adoption of high-performance agrochemicals also contribute to growth. Strong manufacturing capacity and low production costs position Asia-Pacific as a key hub for potassium methoxide production and export, with significant expansion expected during the forecast period.

Latin America

Latin America held approximately 6% of the global market share, led by Brazil’s robust biodiesel production capacity and government blending programs. Argentina also plays a key role in regional consumption, with growing agricultural and chemical manufacturing sectors. Rising demand for crop protection products supports potassium methoxide usage in agrochemical synthesis. The region benefits from abundant feedstock availability, supporting cost-effective biodiesel production and sustained demand for catalysts. Economic development and infrastructure expansion are expected to drive higher adoption across pharmaceutical and energy sectors, although growth may remain moderate compared to Asia-Pacific and North America due to slower industrial expansion.

Middle East & Africa

Middle East & Africa accounted for close to 4% of the global market share, with demand concentrated in chemical manufacturing hubs and emerging biodiesel initiatives. South Africa and GCC countries lead adoption, supported by investments in alternative fuel projects and chemical industries. Growth opportunities exist in agriculture, where demand for crop protection chemicals is rising. However, limited domestic production capacity and reliance on imports constrain rapid market expansion. Increasing focus on diversifying energy sources and growing investment in specialty chemicals are likely to drive steady but gradual demand for potassium methoxide across this region in coming years.

Market Segmentations:

By Form:

- Liquid

- Solid

- Powder

- Granules

- Aqueous Solution

By Application:

- Biodiesel Production

- Pharmaceuticals

- Chemical Intermediate

- Agriculture

- Food Industry

By End-user:

- Chemicals

- Agriculture

- Food & Beverage

- Pharmaceutical

- Energy

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The potassium methoxide market is characterized by the presence of leading players such as Evonik, Kraft Chemical Company, Huntsman Corporation, Tianjin Kankun Chemical Co. Ltd., Shanghai Huzheng Chemical Co. Ltd., Albemarle Corporation, Solvay S.A., BASF SE, Guangdong Kinte Chemical Co. Ltd., Luxi Chemical, FMC Corporation, SABIC, and Eastman Chemical Company. These companies focus on strengthening their production capacities, optimizing supply chains, and developing advanced formulations to meet growing demand from biodiesel, pharmaceuticals, and agrochemicals. Strategic initiatives include mergers, acquisitions, and long-term supply agreements with biodiesel manufacturers to secure consistent demand. Players are also investing in research to create safer and more efficient catalyst solutions, aligning with green chemistry trends. Expansion into emerging markets with rising renewable energy mandates is a key growth strategy. Strong distribution networks and competitive pricing further enable them to maintain market presence and meet the increasing requirements of end-user industries worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Evonik

- Kraft Chemical Company

- Huntsman Corporation

- Tianjin Kankun Chemical Co. Ltd.

- Shanghai Huzheng Chemical Co. Ltd.

- Albemarle Corporation

- Solvay S.A.

- BASF SE

- Guangdong Kinte Chemical Co. Ltd.

- Luxi Chemical

- FMC Corporation

- SABIC

- Eastman Chemical Company

Recent Developments

- In 2025, BASF confirmed investment in a new alcoholates plant at its Ludwigshafen site to produce both sodium methylate and potassium methylate, enhancing their supply for the pharmaceutical, agrochemical, and biodiesel sectors.

- In 2025, Dow announced its participation in the K 2025 trade fair in Dusseldorf, Germany, with the theme “Generation Transformation,” showcasing its materials science solutions for packaging, consumer goods, infrastructure, and mobility, with a focus on fostering collaboration for a sustainable future.

- In 2025, Evonik inaugurated a new world-scale alkoxides plant in Singapore to strengthen its presence in the Asia-Pacific market and meet rising demand for high-purity potassium methoxide

Report Coverage

The research report offers an in-depth analysis based on Form, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see steady growth driven by rising biodiesel production worldwide.

- Demand from pharmaceutical manufacturing will expand with increasing API production in Asia.

- Agrochemical synthesis will remain a key application, supporting long-term market stability.

- Technological advancements will improve catalyst efficiency and reduce production costs.

- Green chemistry adoption will boost usage in sustainable fuel and chemical processes.

- Emerging economies will witness higher consumption due to industrial expansion and energy projects.

- Strategic partnerships between producers and biodiesel plants will ensure stable supply.

- R&D investments will focus on safer formulations and improved handling systems.

- Regulatory support for renewable energy will create new opportunities for manufacturers.

- Competitive pricing and capacity expansions will shape market dynamics in coming years.