Market Overview

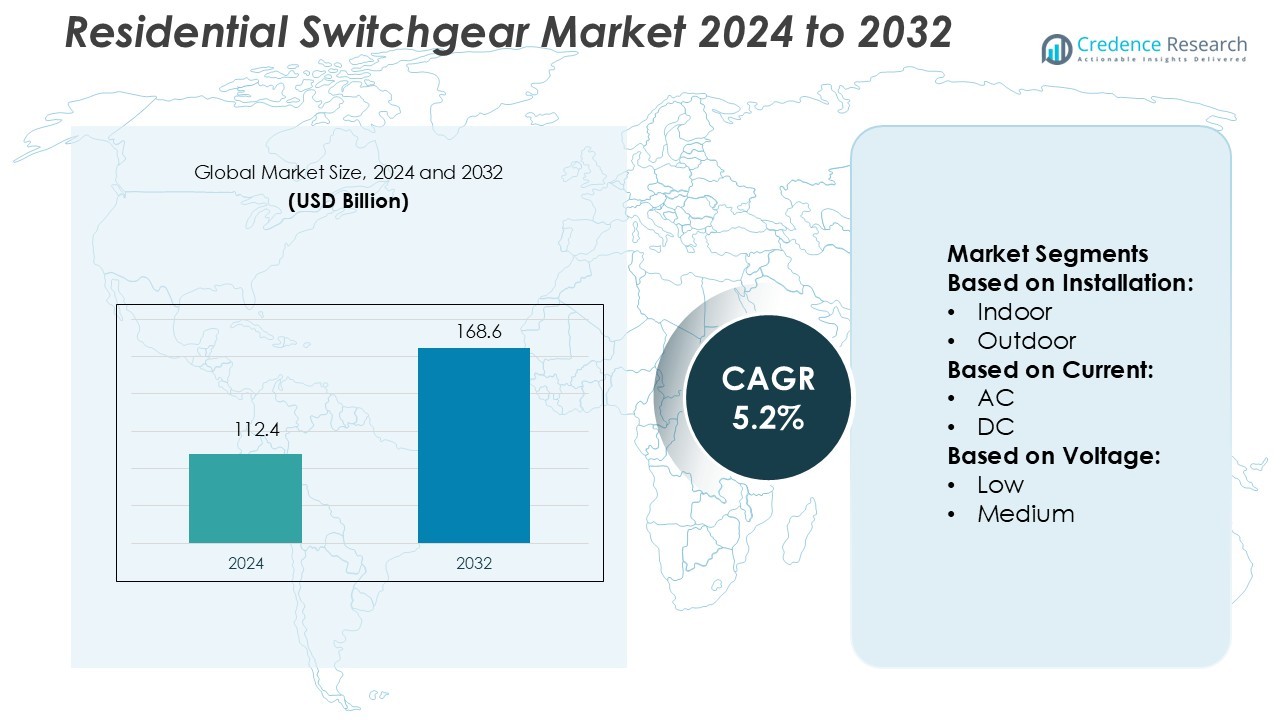

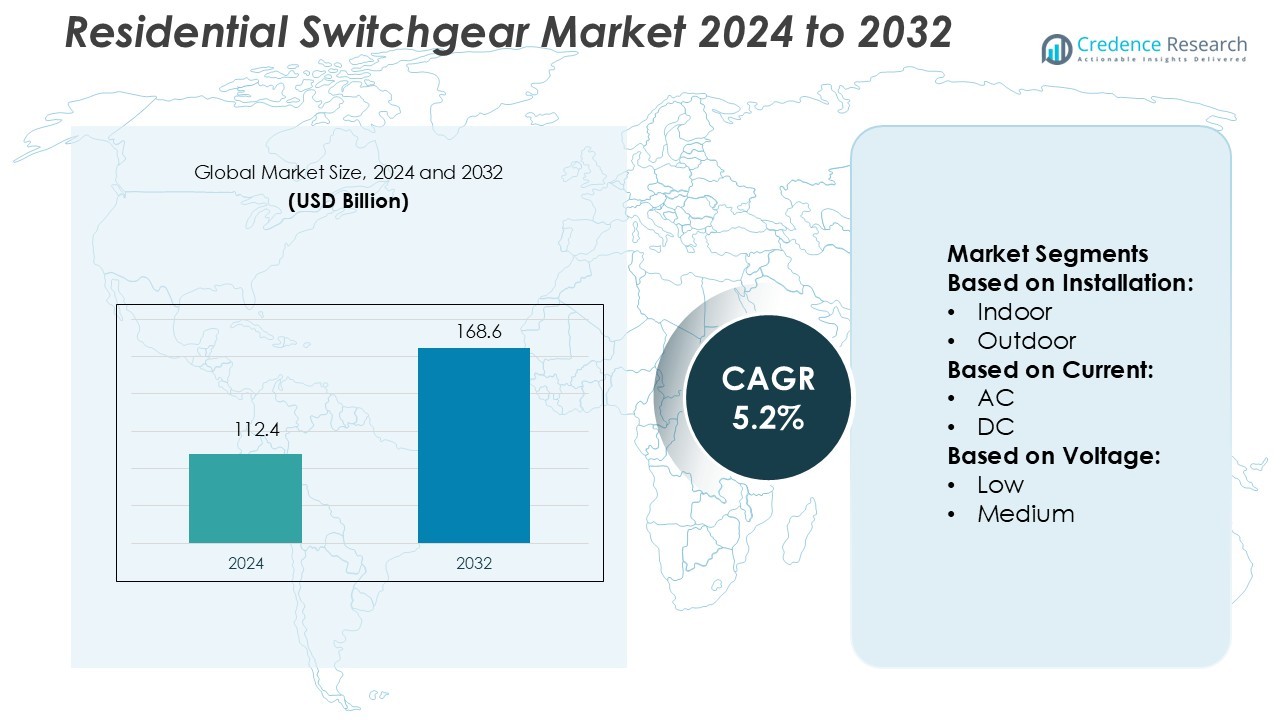

Residential Switchgear Market size was valued USD 112.4 billion in 2024 and is anticipated to reach USD 168.6 billion by 2032, at a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Residential Switchgear Market Size 2024 |

USD 112.4 Billion |

| Residential Switchgear Market, CAGR |

5.2% |

| Residential Switchgear Market Size 2032 |

USD 168.6 Billion |

The residential switchgear market is driven by strong competition among major players such as CG Power and Industrial Solutions, Fuji Electric, Eaton, E + I Engineering, ABB, HD Hyundai Electric, Hyosung Heavy Industries, Hitachi, General Electric, and Bharat Heavy Electricals. These companies focus on developing smart and energy-efficient switchgear solutions that meet modern housing demands. Their strategies include expanding digital product lines, enhancing safety features, and integrating IoT-enabled monitoring systems. Strategic collaborations with utility providers and real estate developers are helping them strengthen market presence. Europe leads the global residential switchgear market with a 36% share, supported by widespread adoption of smart grid technologies, strict energy regulations, and government incentives for sustainable residential infrastructure. North America and Asia Pacific follow closely, driven by increasing electrification and smart home adoption. This competitive environment is pushing companies to accelerate innovation and strengthen their regional distribution networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Residential Switchgear Market size was valued at USD 112.4 billion in 2024 and is projected to reach USD 168.6 billion by 2032, growing at a CAGR of 5.2%.

- Rising demand for energy-efficient infrastructure and smart home adoption is driving market expansion. Increasing electrification in urban and rural areas is also fueling switchgear installations.

- Smart and digital switchgear systems with IoT-enabled monitoring are becoming a key trend, improving energy management and system safety. Compact modular designs are gaining traction in residential buildings.

- Strong competition among major players is shaping the market through innovation, safety enhancements, and strategic collaborations with utility providers and real estate developers.

- Europe leads the market with a 36% share, supported by strict energy regulations and smart grid integration, while North America and Asia Pacific follow closely with strong residential electrification and smart home adoption across key segments.

Market Segmentation Analysis:

By Installation

Indoor switchgear holds the largest share of the Residential Switchgear Market. This dominance is driven by growing adoption in urban residential complexes and smart homes. Indoor systems offer compact design, easy maintenance, and improved safety for enclosed environments. Their integration with digital monitoring and automation supports efficient power management in high-density buildings. Rapid construction of multi-family housing units further fuels this segment’s growth. In contrast, outdoor switchgear is gaining traction in suburban and rural areas with expanding residential infrastructure and distributed energy systems.

- For instance, Fuji Electric’s HS series vacuum circuit breakers deliver breaking currents up to 63 kiloamperes (kA), at rated voltages between 3.6 kilovolts (kV) and 36 kV, enhancing fault interruption in high-load networks.

By Current

AC switchgear represents the dominant segment in the Residential Switchgear Market. The widespread use of alternating current in residential power distribution systems drives its high adoption. AC switchgear ensures efficient fault protection, stable load management, and easy integration with existing grid networks. Increasing deployment of HVAC systems, lighting, and electric vehicle charging stations further strengthens demand for AC configurations. While DC switchgear adoption remains limited, growing interest in solar-based home power systems is slowly increasing its relevance in modern residential applications.

- For instance, Eaton’s low-voltage metal-enclosed switchgear “Magnum” series supports service voltages up to 600 V, continuous main bus ratings up to 10,000 A and short-circuit withstand ratings up to 200 kA.

By Voltage

Low voltage switchgear dominates the Residential Switchgear Market with the highest share. Its popularity stems from its suitability for household electrical systems, offering reliable circuit protection and easy installation. Rising use of smart meters, energy-efficient appliances, and home automation supports strong demand for low voltage setups. These systems also provide enhanced operational safety and cost-effectiveness, making them ideal for residential construction projects. Medium voltage switchgear is used in larger residential estates and gated communities where higher load capacities and distribution efficiency are required.

Key Growth Drivers

Rising Urban Electrification

The rapid pace of residential infrastructure expansion is driving strong demand for switchgear installations. Urbanization has increased the need for reliable and efficient power distribution in modern housing. Governments and utilities are investing heavily in grid upgrades to meet growing electricity demand. Indoor low-voltage switchgear is widely used to ensure stable and safe power flow in high-density residential zones. This growth is further supported by the deployment of smart grids and automated distribution systems, ensuring improved system reliability and operational flexibility.

- For instance, E+I Engineering’s low-voltage modular switchgear line carries continuous currents up to 4,000 A and is fully type-tested in accordance with IEC 61439 standards.

Expansion of Smart Homes

The increasing adoption of smart homes is a major catalyst for residential switchgear demand. Smart meters, automated load management, and connected protection devices require advanced switchgear systems to function efficiently. Consumers are prioritizing safety, energy efficiency, and convenience, which drives the integration of intelligent switchgear solutions. Home automation platforms enable real-time monitoring and remote control, increasing system reliability. Manufacturers are developing compact, IoT-enabled switchgear to meet these evolving consumer preferences and support the modernization of power networks.

- For instance, ABB’s smart switchgear offers up to 66% fewer cable runs and 10% fewer connectivity components, enabling reduced installation time and improved flexibility.

Government Energy Efficiency Initiatives

Government programs promoting energy efficiency and renewable integration are accelerating switchgear adoption. Many residential projects are required to meet strict energy codes and safety standards. Incentives for solar rooftop systems and decentralized energy generation are increasing the need for reliable protection equipment. Low-voltage switchgear ensures smooth integration of renewable sources into residential power systems. These initiatives are not only improving energy security but also fostering the deployment of advanced, automated distribution infrastructure in residential areas.

Key Trends & Opportunities

Adoption of Smart Grid Technology

The integration of smart grid technology in residential areas is creating strong growth opportunities. Digital switchgear supports real-time monitoring, predictive maintenance, and seamless connectivity with automated home systems. Advanced control capabilities help improve energy efficiency and minimize outages. Utilities are adopting these technologies to enable demand response and improve grid stability. This shift is driving increased investment in intelligent switchgear that supports interoperability with modern energy management platforms.

- For instance, Hyundai Electric’s MV switchgear model HMGS-G81 is rated for up to 4,000 A at 36 kV with a breaking capacity of 40 kA/3 s. Digital MV switchgear supports real-time monitoring and predictive maintenance, and can connect to industrial automation systems (SCADA), not automated home systems.

Rising Solar Integration in Homes

The growing shift toward rooftop solar and distributed energy systems is driving new opportunities in the residential switchgear market. Homeowners require protection devices that can handle bidirectional power flow and ensure stable grid connectivity. DC switchgear, though less dominant, is gaining traction in solar-powered households. Smart protective equipment is crucial to maintain grid safety and operational efficiency. This trend aligns with net-zero energy targets and enhances the overall resilience of residential energy networks.

- For instance, Hyosung’s “Pro MV SWGR” medium-voltage unit delivers up to 40 kA short-time current rating at 24 kV with a compact footprint reducing installation area by more than 40%.

Increased Emphasis on Safety Standards

Stricter building and electrical safety regulations are increasing the use of certified residential switchgear systems. Governments and utilities are enforcing upgraded protection standards to reduce risks associated with overloads, short circuits, and grid faults. Advanced circuit breakers and surge protection devices offer improved fault detection and response times. Manufacturers are capitalizing on this opportunity by developing compact, modular systems that comply with global safety norms, ensuring better performance and market expansion.

Key Challenges

High Initial Installation Costs

The high upfront cost of advanced switchgear systems remains a major barrier, especially in low- and middle-income housing. Smart and automated solutions require expensive components, specialized installation, and integration with existing power networks. For many residential developers, cost remains a deciding factor, leading to slower adoption. Smaller projects often choose basic protection systems, delaying widespread modernization. This cost challenge can limit market penetration in price-sensitive regions and delay infrastructure upgrades.

Complex Integration with Legacy Systems

Integrating modern switchgear solutions with existing residential power infrastructure can be technically challenging. Many older buildings lack compatibility with digital or IoT-enabled equipment, requiring significant retrofitting. This increases project complexity, cost, and installation time. Utility companies and contractors face operational disruptions during upgrades, further slowing deployment. These integration challenges highlight the need for modular and retrofit-friendly switchgear designs to support large-scale adoption in aging residential grids.

Regional Analysis

North America

North America holds a 31% share of the Residential Switchgear Market. The region’s growth is fueled by rapid adoption of smart grid technologies and increasing electrification of residential buildings. Strong investments in modernizing distribution networks and integrating renewable energy sources drive demand for advanced low-voltage switchgear. The U.S. leads due to strict safety standards and wide deployment of energy-efficient systems. Rising adoption of smart homes, electric vehicle infrastructure, and energy storage solutions further boosts switchgear installations across both urban and suburban housing projects, strengthening the region’s dominant position in technological innovation and utility modernization.

Europe

Europe accounts for a 28% share of the Residential Switchgear Market. The region benefits from stringent energy efficiency regulations, green building standards, and large-scale renewable integration. Countries such as Germany, France, and the U.K. are accelerating the deployment of low-voltage and smart switchgear in residential construction projects. Retrofitting of old electrical infrastructure supports steady market growth. The widespread use of solar rooftop systems and smart meters also strengthens the region’s demand. Government decarbonization goals and strong grid reliability requirements continue to shape Europe’s leadership in advanced residential electrical protection technologies.

Asia Pacific

Asia Pacific leads with a 33% share of the Residential Switchgear Market. The region’s dominance is driven by rapid urbanization, large-scale housing developments, and grid expansion projects. China, India, and Japan represent the largest demand centers, supported by strong government initiatives for electrification and smart infrastructure. Rising adoption of energy-efficient solutions and solar-based residential systems accelerates switchgear deployment. High investments in modern grid infrastructure and rising living standards further strengthen regional growth. Expanding middle-class populations and increasing use of automated home systems also boost market penetration across both urban and semi-urban residential areas.

Latin America

Latin America captures a 5% share of the Residential Switchgear Market. The market is expanding due to grid modernization programs and growing access to electricity in rural and semi-urban regions. Brazil and Mexico lead with strong investments in residential infrastructure and renewable energy integration. Low-voltage switchgear dominates installations, supporting electrification in both new and existing housing projects. Government initiatives to promote energy-efficient and safe power systems are further strengthening adoption. Rising urban population and improving distribution network reliability are expected to accelerate future market penetration across the region.

Middle East & Africa

The Middle East & Africa region holds a 3% share of the Residential Switchgear Market. Growth is supported by rapid urban development, infrastructure modernization, and increasing demand for reliable power supply. The UAE, Saudi Arabia, and South Africa lead installations, driven by large-scale residential construction and renewable integration. Low-voltage switchgear adoption is growing in both urban smart housing projects and rural electrification programs. However, limited grid infrastructure in some areas slows widespread deployment. Ongoing government initiatives to strengthen power reliability and expand access to electricity create steady opportunities for market expansion.

Market Segmentations:

By Installation:

By Current:

By Voltage:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The residential switchgear market is characterized by strong competition among key players including CG Power and Industrial Solutions, Fuji Electric, Eaton, E + I Engineering, ABB, HD Hyundai Electric, Hyosung Heavy Industries, Hitachi, General Electric, and Bharat Heavy Electricals. The residential switchgear market is witnessing intense competition driven by rapid technological advancements and evolving energy standards. Companies are focusing on product differentiation through innovation, improved safety features, and advanced digital control systems. Smart switchgear with IoT integration is enabling real-time monitoring, fault detection, and predictive maintenance, improving operational efficiency in residential applications. Strong emphasis on sustainability is pushing manufacturers to develop energy-efficient products that support renewable integration. Strategic moves such as capacity expansion, regional distribution strengthening, and R&D investments are reshaping market dynamics. Partnerships with utility providers, housing developers, and energy management firms are also boosting market penetration. As electrification continues to accelerate, the competitive environment is expected to intensify further with stronger focus on automation, smart home integration, and compliance with global safety standards.

Key Player Analysis

- CG Power and Industrial Solutions

- Fuji Electric

- Eaton

- E + I Engineering

- ABB

- HD Hyundai Electric

- Hyosung Heavy Industries

- Hitachi

- General Electric

- Bharat Heavy Electricals

Recent Developments

- In August 2025, Powell Industries has introduced a new modular switchgear solution tailored for hyperscale data centers, marking a significant advancement in power distribution technology.

- In October 2024, Schneider Electric, a prominent company in the digital transformation of energy management and automation, announced the launch of its Ringmaster AirSeT in the UK. This next-generation medium-voltage switchgear is free of sulfur hexafluoride (SF₆) and plays a vital role in advancing smarter and more sustainable electrical grid infrastructure.

- In August 2024, Hitachi Energy Ltd. introduced a switchgear technology aimed at reducing sulfur hexafluoride (SF₆) emissions, which account for 80% of such emissions in the power sector. In response, the company has unveiled the world’s highest-voltage SF₆-free solutions.

- In July 2024, CG Power and Industrial Solutions, part of the Murugappa Group, has unveiled plans for a capacity expansion worth INR 662 crore. The engineering firm aims to wrap up these projects within the next 18 months, relying solely on internal accruals for funding.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Installation, Current, Voltage and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Smart and digital switchgear adoption will increase due to rising demand for home automation.

- Energy-efficient solutions will gain traction with growing focus on sustainable housing.

- IoT integration will enhance monitoring, fault detection, and predictive maintenance capabilities.

- Regulatory standards will push manufacturers to adopt advanced safety technologies.

- Compact and modular switchgear designs will see wider use in modern residential buildings.

- Renewable energy integration will drive demand for compatible low-voltage switchgear systems.

- Advanced protection systems will improve grid stability and household electrical safety.

- Regional manufacturers will expand capacity to meet growing urban and rural electrification needs.

- Strategic partnerships with construction firms and utility providers will increase market penetration.

- Continuous R&D investment will accelerate innovation in intelligent and connected switchgear solutions.