Market Overview

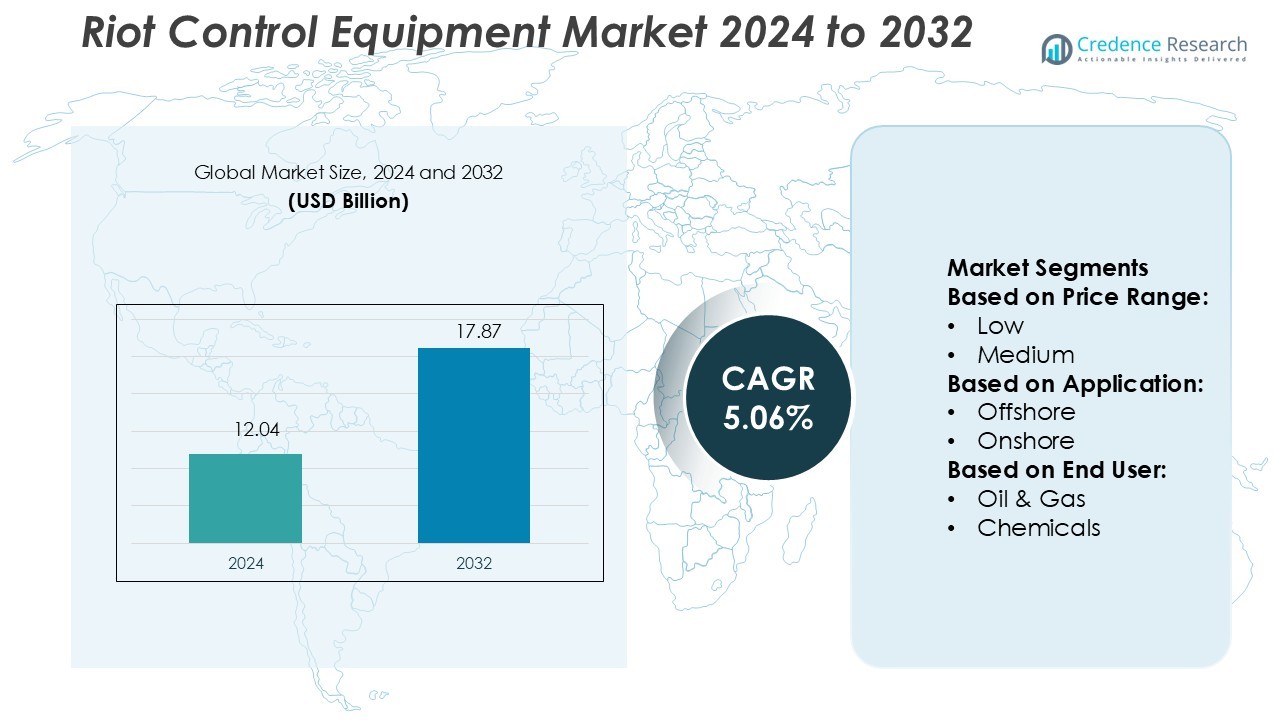

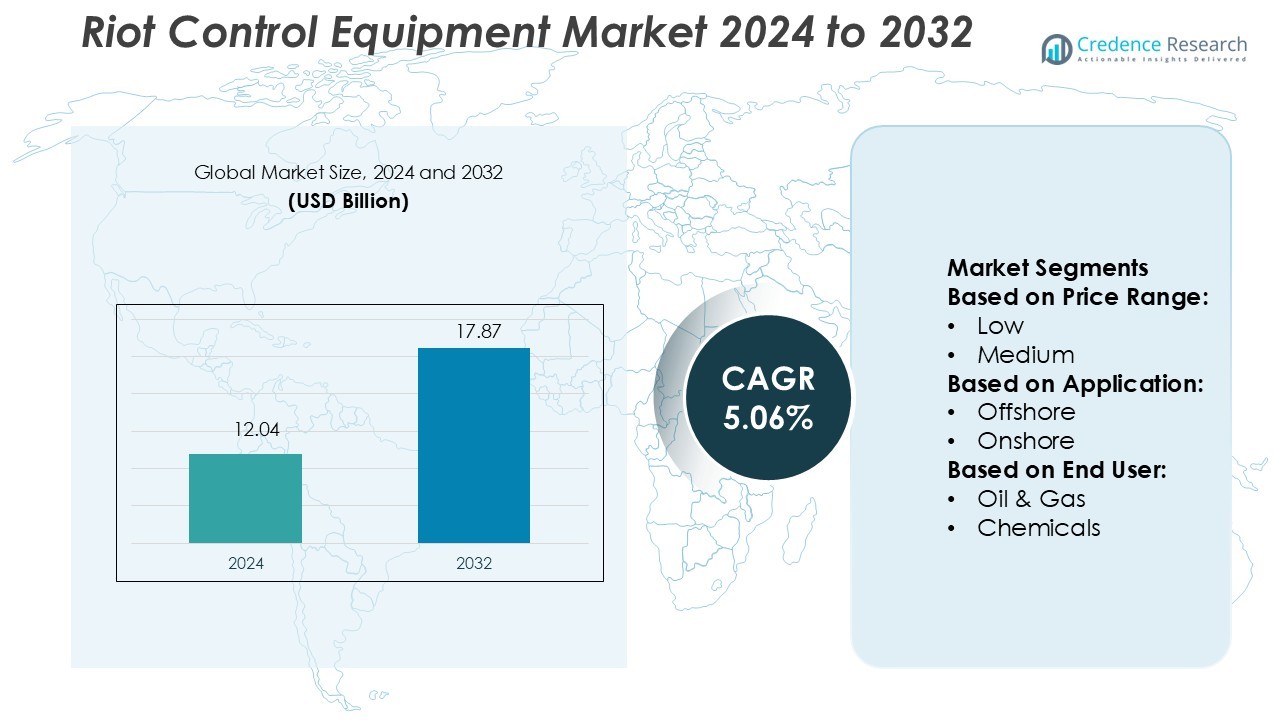

Riot Control Equipment Market size was valued USD 12.04 billion in 2024 and is anticipated to reach USD 17.87 billion by 2032, at a CAGR of 5.06% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Riot Control Equipment Market Size 2024 |

USD 12.04 Billion |

| Riot Control Equipment Market, CAGR |

5.06% |

| Riot Control Equipment Market Size 2032 |

USD 17.87 Billion |

The Riot Control Equipment Market is shaped by leading companies such as Emerson Electric Co., Baker Hughes Company, Dril-Quip, Inc., Honeywell International Inc., Halliburton Company, General Electric Company (GE Oil & Gas), Aker Solutions ASA, Curtiss-Wright Corporation, FMC Technologies, Inc., and Cameron International Corporation. These players focus on advanced non-lethal technologies, surveillance systems, and tactical protective gear to strengthen their global presence. Strategic collaborations and R&D investments drive product innovation and enhance operational effectiveness. North America leads the market with a 32% share, supported by strong defense spending, rapid technology adoption, and large-scale modernization of law enforcement infrastructure. This leadership is further reinforced by a robust supplier base and stringent security regulations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Riot Control Equipment Market size was valued at USD 12.04 billion in 2024 and is expected to reach USD 17.87 billion by 2032, at a CAGR of 5.06%.

- Rising civil unrest and increasing security threats are driving strong demand for non-lethal weapons, tactical gear, and advanced surveillance technologies.

- Integration of AI, IoT, and lightweight materials is shaping market trends, improving operational efficiency and response speed for law enforcement agencies.

- The competitive landscape is defined by global companies investing in product innovation, strategic partnerships, and regulatory compliance to strengthen their market position.

- North America leads the market with a 32% share, supported by high defense spending and rapid technology adoption, while protective gear holds the largest segment share due to rising modernization initiatives.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Price Range

The medium price range segment holds the dominant market share in the riot control equipment market. Medium-priced solutions offer a balance of performance, durability, and cost, making them suitable for large-scale procurement by law enforcement agencies. These products include protective gear, non-lethal launchers, and crowd dispersal systems with advanced safety features. The rising focus on cost optimization and operational efficiency drives this segment’s growth. Governments and security forces prefer medium-priced equipment to ensure effective crowd management while staying within budget, enhancing their rapid response capabilities during high-risk situations.

- For instance, Innovex International, Inc. (formerly Dril-Quip) offers the VXTe™ Vertical Subsea Tree System, which was launched in 2020. Compared to conventional systems, this technology eliminates approximately 40 tons of hardware and can reduce carbon emissions by up to 1,000 metric tonnes per tree.

By Application

Onshore applications dominate the market share due to extensive use of riot control equipment in urban areas, borders, and sensitive locations. These deployments cover crowd control, political protests, and security operations at critical infrastructure sites. Onshore settings allow for a wide range of equipment, including shields, body armor, tear gas, and batons, to manage both planned and unexpected disturbances. The increasing frequency of civil unrest, political demonstrations, and law enforcement modernization programs strengthens the demand for onshore riot control equipment across multiple regions.

- For instance, The Bobcat T7X all-electric compact track loader features a 72.6-kilowatt-hour lithium-ion battery and can run for up to six hours of continuous operation on a single charge.

By End-User

The oil and gas sector leads the end-user segment, holding the largest market share. Energy facilities often face security threats, including labor strikes, protests, and geopolitical tensions. Riot control equipment is critical to protect infrastructure, personnel, and supply chains in these high-risk environments. Companies in this sector deploy specialized equipment to secure refineries, pipelines, and offshore platforms. Growing investments in energy assets and rising security concerns in volatile regions further accelerate demand from the oil and gas sector, positioning it as the primary contributor to the market.

Key Growth Drivers

Rising Civil Unrest and Protests

Increasing incidents of political unrest, social movements, and demonstrations are driving the demand for riot control equipment. Governments and security agencies are prioritizing rapid response and crowd management capabilities to maintain order. Non-lethal tools such as shields, batons, and tear gas are essential for minimizing casualties while ensuring effective control. Law enforcement modernization programs further boost procurement of advanced equipment. This growing need for security preparedness across urban centers, borders, and critical infrastructure strengthens overall market expansion.

- For instance, Abbott’s HeartMate 3 heart pump demonstrated significantly improved five-year outcomes compared to its predecessor, the HeartMate II. The five-year data, presented in 2022, showed that the overall survival rate was 58.4% for patients with the HeartMate 3, compared to 43.7% for those with the HeartMate II.

Government Investments in Law Enforcement Modernization

Many countries are increasing defense and public safety budgets to equip police and paramilitary forces with modern riot control tools. Advanced protective gear, tactical vehicles, and less-lethal weapons support safer and more efficient operations. These investments aim to enhance operational readiness, minimize response time, and improve officer protection. Modernization initiatives also include training programs and technology upgrades to handle large-scale disturbances. This rising government spending fuels steady market growth, particularly in regions with high urbanization and geopolitical tensions.

- For instance, Henry Schein’s Blood Control IV Catheter 20-Gauge has a 1-inch beveled tip and comes 50 units per box, 4 boxes per case, ensuring standardization and ease of supply chain handling.

Technological Advancements in Non-Lethal Weapons

The development of precision non-lethal technologies is improving operational efficiency and public safety outcomes. Modern systems integrate features like adjustable impact energy, enhanced visibility, and improved dispersal accuracy. Smart tear gas launchers, electroshock devices, and protective armor with ergonomic designs are gaining traction. These advancements help security forces control crowds while reducing long-term injuries. Enhanced equipment reliability and modular designs also lower maintenance costs. The adoption of such technologies across military and police units supports sustained demand growth globally.

Key Trends & Opportunities

Adoption of Smart and Connected Equipment

The integration of IoT and sensor technologies is transforming traditional riot control gear into connected solutions. Smart helmets, body cameras, and location-tracking devices provide real-time situational awareness for command centers. These tools improve coordination and reduce operational risks during large-scale events. Data analytics and remote monitoring capabilities enable faster decision-making and more targeted crowd control strategies. This trend creates opportunities for manufacturers to offer advanced, data-driven solutions to security agencies worldwide.

- For instance, Terumo’s MEDISAFE WITH The main pump unit measures 77.9 mm x 40.1 mm x 18.9 mm and weighs 34 g (including the cartridge and holder but excluding insulin). The remote control measures 136.2 mm x 75.0 mm x 14.3 mm and weighs 152 g (including two AAA batteries).

Growing Demand for Protective Gear and Non-Lethal Systems

The shift toward minimizing civilian harm is increasing the adoption of non-lethal weapons and advanced protective equipment. Law enforcement agencies are prioritizing body armor, shields, and helmets designed to withstand high-impact situations. Manufacturers are focusing on lightweight, durable materials to enhance mobility and comfort. This trend aligns with global safety regulations and human rights standards. Expanding demand from both developed and developing countries presents growth opportunities for suppliers offering innovative, compliance-driven solutions.

- For instance, BD’s primary IV administration sets for pediatric use often feature microbore tubing under 2 mm internal diameter, which minimizes priming volume and suits low-volume infusions.

Expansion in Emerging Economies

Emerging economies are witnessing increased political activism, urban protests, and border tensions. These factors drive higher procurement of riot control systems by local security forces. Governments are focusing on strengthening internal security frameworks and modernizing equipment. Rising defense budgets in countries across Asia Pacific, the Middle East, and Latin America create significant opportunities for manufacturers. Market players can benefit by offering cost-effective solutions tailored to local operational needs and budget constraints.

Key Challenges

Regulatory and Human Rights Constraints

Stringent global regulations on the use of force and compliance with human rights norms pose a challenge for market growth. Governments and agencies must ensure that riot control equipment meets international safety and ethical standards. Restrictions on certain non-lethal weapons can limit deployment scope and delay procurement. Public scrutiny of law enforcement practices further increases accountability. These legal and ethical pressures push manufacturers to invest more in compliance and certifications, raising production costs and limiting product flexibility.

High Costs of Advanced Equipment

Advanced riot control systems, including smart helmets, body cameras, and precision launchers, involve significant investment. High acquisition and maintenance costs can limit adoption in budget-constrained regions. Smaller security forces often rely on basic equipment, slowing technological upgrades. This cost barrier creates a gap between demand and actual procurement. Manufacturers face challenges in balancing product innovation with affordability, particularly when competing in price-sensitive markets with limited government spending capacity.

Regional Analysis

North America

North America holds a 32% share of the global Riot Control Equipment Market. The demand is driven by increased public demonstrations, crowd management needs, and law enforcement modernization programs. The U.S. leads the region due to heavy investments in tactical gear, non-lethal weapons, and advanced surveillance systems. Government contracts and local manufacturing capabilities strengthen domestic supply chains. Canada focuses on integrating digital monitoring solutions to enhance response efficiency. The presence of leading equipment suppliers and a strong regulatory framework supports steady market growth. The region continues to adopt cutting-edge technology for effective and controlled riot management.

Europe

Europe accounts for a 27% share of the global Riot Control Equipment Market. The region emphasizes human rights compliance and non-lethal control technologies, driving the adoption of advanced protective gear and less-lethal weapons. Countries such as the U.K., France, and Germany are investing in crowd control vehicles, body armor, and communication systems. Strict regulatory standards guide procurement and operational deployment. The rising frequency of political protests and urban unrest increases demand for modern equipment. Collaborative security programs within the European Union further enhance cross-border coordination and equipment standardization, boosting market expansion.

Asia Pacific

Asia Pacific captures a 28% share of the global Riot Control Equipment Market. Rapid urbanization, political movements, and increasing public gatherings drive regional demand. China and India lead procurement through large-scale defense and police modernization projects. Governments are investing in shields, helmets, tear gas systems, and advanced non-lethal weapons to enhance operational efficiency. Growing defense budgets and domestic manufacturing capabilities support steady supply. The rising adoption of AI-based surveillance and crowd analytics strengthens regional response strategies. Expanding defense partnerships and rising security concerns make Asia Pacific one of the fastest-growing regions in the market.

Latin America

Latin America holds an 8% share of the global Riot Control Equipment Market. Demand is primarily driven by frequent civil unrest, protests, and political instability. Brazil and Mexico are the key markets, focusing on strengthening police forces with modern riot gear and vehicles. Government initiatives to improve law enforcement infrastructure support steady procurement. Budget constraints remain a challenge, but international partnerships help expand access to equipment. Local suppliers are emerging, offering cost-effective protective solutions. The increasing use of non-lethal weapons aligns with evolving public security strategies in the region, supporting gradual market growth.

Middle East & Africa

The Middle East & Africa account for a 5% share of the global Riot Control Equipment Market. Demand is supported by geopolitical tensions, public demonstrations, and security modernization initiatives. Gulf countries invest in high-performance tactical gear and surveillance systems to strengthen public security forces. African nations focus on affordable protective equipment, supported by foreign aid and defense partnerships. Political instability and limited budgets challenge market penetration in some areas. However, rising urbanization and cross-border security cooperation are driving gradual equipment adoption, supporting steady long-term growth in the region.

Market Segmentations:

By Price Range:

By Application:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Riot Control Equipment Market features major companies such as Emerson Electric Co., Baker Hughes Company, Dril-Quip, Inc., Honeywell International Inc., Halliburton Company, General Electric Company (GE Oil & Gas), Aker Solutions ASA, Curtiss-Wright Corporation, FMC Technologies, Inc., and Cameron International Corporation. The Riot Control Equipment Market is defined by strong technological innovation, strategic partnerships, and expanding product portfolios. Companies are focusing on developing advanced non-lethal weapons, protective gear, and digital surveillance systems to meet evolving security demands. Investments in AI-based monitoring, IoT integration, and lightweight materials are enhancing operational effectiveness and user safety. Strategic collaborations with defense and law enforcement agencies support large-scale deployments and strengthen market reach. Global manufacturers are also prioritizing regulatory compliance, cost optimization, and product customization to address regional security needs and maintain a competitive edge in the market.

Key Player Analysis

- Emerson Electric Co.

- Baker Hughes Company

- Dril-Quip, Inc.

- Honeywell International Inc.

- Halliburton Company

- General Electric Company (GE Oil & Gas)

- Aker Solutions ASA

- Curtiss-Wright Corporation

- FMC Technologies, Inc.

- Cameron International Corporation

Recent Developments

- In December 2024, Honeywell’s Phoenix Controls launched the Critical Spaces Control Platform, designed to enhance safety and operational efficiency in critical environments. This advanced platform utilizes automation to manage airflow through a specialized venturi valve, ensuring optimal ventilation in settings such as hospitals, laboratories, cleanrooms, and research facilities, where precise environmental control is essential.

- In May 2024, Emerson launched the AVENTICS™ Series 625 Sentronic Proportional Pressure Control Valves, marking a significant leap in precision pressure management. Boasting a control deviation of under 0.5%, these valves are crafted for superior electronic proportional pressure control. Such precision guarantees peak performance across diverse applications.

- In March 2024, Nederman’s newest innovation, which is the MCP Air Purification Tower was launched. The air filter is specially designed to provide constant duty filtration however, safeguarding fabrication workers against the working environment is prioritized for the device.

- In February 2024, Haryana Police became the first Indian police force to employ tear gas drones. These drones, crafted by Haryana’s Drone Imaging and Information Service, were instrumental in dispersing protesting farmers at the Shambhu Barrier on the Punjab-Haryana border.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Price Range, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising security concerns will increase demand for advanced riot control technologies.

- Governments will invest more in smart surveillance and rapid response equipment.

- Non-lethal weapon development will remain a core focus to ensure compliance with global standards.

- Digital integration using AI and IoT will strengthen operational efficiency in riot control.

- Strategic partnerships will expand product portfolios and global market reach.

- Lightweight and durable materials will improve comfort and protection for enforcement personnel.

- Increased funding for law enforcement modernization will support steady equipment upgrades.

- Regional production hubs will strengthen supply chains and reduce procurement delays.

- Training programs will expand, ensuring effective use of modern control systems.

- Regulatory standards will influence product innovation and international market expansion.

Market Segmentation Analysis:

Market Segmentation Analysis: