Market Overview

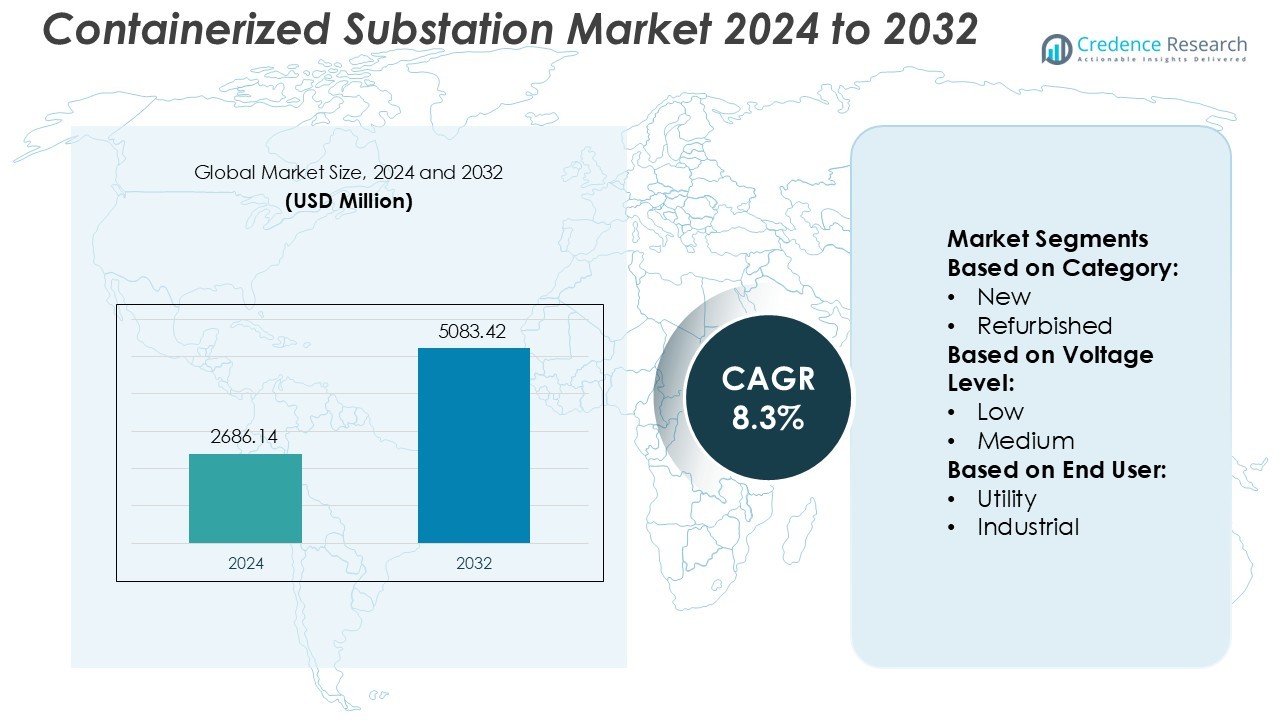

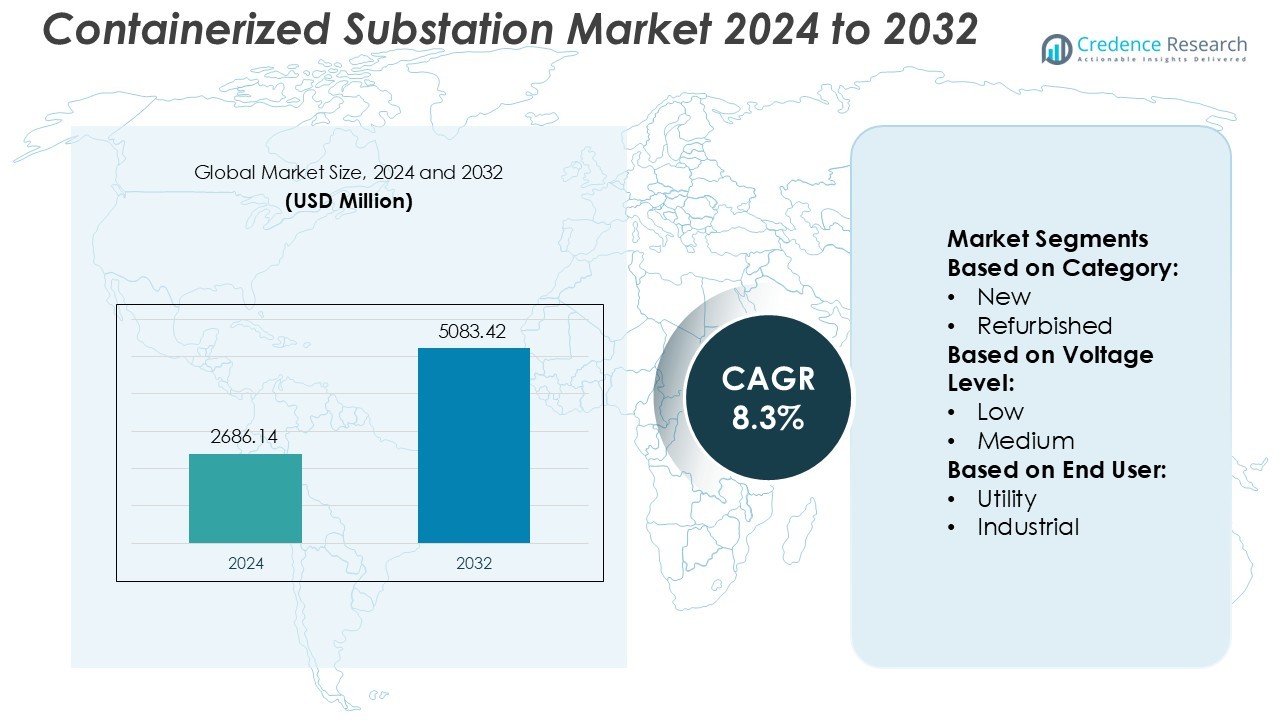

Containerized Substation Market size was valued USD 2686.14 million in 2024 and is anticipated to reach USD 5083.42 million by 2032, at a CAGR of 8.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Containerized Substation Market Size 2024 |

USD 2686.14 Million |

| Containerized Substation Market, CAGR |

8.3% |

| Containerized Substation Market Size 2032 |

USD 5083.42 Million |

The containerized substation market ABB Ltd., Siemens AG, Eaton Corporation, General Electric, Toshiba Corporation, Larsen & Toubro, Crompton Greaves, Elsewedy Electric Co S.A.E., IMESA S.p.A., and Kirloskar Electric. These companies compete through modular engineering, smart monitoring systems, and fast-deployment designs suited for renewable plants, industrial sites, and emergency grid restoration. North America remains the leading region with 32% market share, driven by strong investment in grid modernization, renewable integration, and disaster-resilient power infrastructure. Rising adoption of digital control systems and remote diagnostics continues to strengthen regional demand and supports long-term market growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Containerized Substation Market size was valued at USD 2,686.14 million in 2024 and is expected to reach USD 5,083.42 million by 2032, registering a CAGR of 8.3% through the forecast period.

- Growth is driven by rapid renewable energy deployment, fast-installation needs, and reduced civil work, with medium-voltage units holding nearly 58% share due to strong adoption in solar and wind projects.

- Major players such as ABB Ltd., Siemens AG, Eaton Corporation, General Electric, and Toshiba Corporation focus on modular engineering, IoT-based monitoring, and compact gas-insulated systems to gain competitive advantage.

- High initial investment and logistics barriers for large containerized units act as market restraints, especially in cost-sensitive and remote regions that face transport limitations.

- North America leads with 32% market share, supported by grid modernization spending and disaster-resilient power needs, while the utility segment dominates with nearly 62% share as power distributors integrate digital substations and remote diagnostics for reliable grid expansion.Top of Form

Market Segmentation Analysis:

By Category

New containerized substations hold the dominant share at nearly 73% of the market. Industries and utilities continue to prefer newly manufactured units due to better reliability, warranty coverage, and lower operational risks. New systems integrate digital monitoring, smart protection relays, and advanced fire-safe enclosures, making them suitable for renewable plants, mining sites, and grid modernization. Refurbished units address cost-sensitive buyers in developing regions, but their adoption remains limited due to shorter lifecycle and restricted customization options. Growing investment in compact power solutions supports stronger sales of new units worldwide.

- For instance, CG Power and Industrial Solutions (formerly Crompton Greaves) supplies containerized substations built with medium-voltage switchgear (such as 33 kV class) and appropriately sized transformers, which can be coupled with IEC 61850-based protection relays.

By Voltage Level

Medium-voltage containerized substations lead the market with close to 58% share. These units support rapid grid expansion for renewable projects, urban construction, and industrial loads. Medium-voltage systems offer balanced performance, optimized footprint, and fast deployment without extensive civil work. High-voltage solutions gain traction in transmission upgrades and offshore energy, while low-voltage units serve commercial complexes and remote small-scale needs. Rising integration of medium-voltage substations in solar and wind farms continues to drive segment growth across Europe, Asia-Pacific, and the Middle East.

- For instance, Siemens’ container substation solution uses its 8DJH switchgear rated for up to 24 kV and 20 kA and a busbar of 630 A. High-voltage solutions gain traction in transmission upgrades and offshore energy.

By End User

Utilities account for nearly 62% share, making them the leading end-user segment. Power distribution companies deploy containerized substations to enhance grid reliability, reduce outage time, and support emergency standby operations. The plug-and-play design allows faster installation in disaster zones, rural electrification, and temporary grid extensions. Industrial customers use these substations to power mining sites, manufacturing plants, and oil and gas fields where permanent infrastructure is costly. However, utilities remain dominant due to rising spending on smart grid upgrades and renewable capacity integration.

Key Growth Drivers

Rapid Renewable Energy Expansion

Utility-scale solar and wind projects rely on compact power distribution units that can be installed quickly with minimal civil work. Containerized substations reduce commissioning time, support modular expansion, and integrate smart protection systems for remote environments. Developers prefer these units to avoid delays and reduce grid connection costs. With global renewable capacity rising, especially in Asia-Pacific, Europe, and the Middle East, demand continues to grow. The shift toward decentralized power generation strengthens adoption, as containerized units enable fast grid synchronization and stable voltage management in large renewable farms.

- For instance, IMESA S.p.A. manufactures containerized substations with the IMESA MSA series medium-voltage switchgear, rated up to 24 kV with a short-circuit withstand capacity of 20 kA and an internal arc classification IAC AFL 20 kA for one second.

Grid Modernization and Replacement Demand

Aging grid infrastructure drives utilities to replace traditional brick-and-mortar substations with modular and digital alternatives. Containerized substations offer higher operational safety, remote diagnostics, and reduced downtime. Their standardized design simplifies maintenance and improves reliability during peak load transfer. Governments allocate capital towards smart grid projects, disaster-resilient distribution, and remote electrification, pushing adoption higher. The ability to retrofit existing networks without land acquisition hurdles provides a strong advantage. This modernization trend supports steady growth across developed and developing markets.

- For instance, Elsewedy Electric supplies containerized substations equipped with 24 kV GIS switchgear rated at 1250 A and a short-circuit withstand capacity of 25 kA for one second, combined with digital protection relays that support IEC 61850 communication and remote breaker control.

Growing Deployment in Remote and Harsh Environments

Industrial operators in mining, oil and gas, and heavy construction prefer containerized substations due to their durability and mobility. These units withstand extreme climates, vibration, and dust while ensuring stable power supply for field operations. The plug-and-play format eliminates long construction timelines, enabling fast deployment in deserts, mountains, offshore rigs, and conflict zones. Emergency response teams and military bases also use mobile substations for temporary grid restoration. Rising global focus on operational continuity and temporary power needs continues to fuel the market.

Key Trends & Opportunities

Integration of Smart Monitoring and Digital Control

Manufacturers add IoT sensors, advanced SCADA systems, and predictive analytics to containerized substations. These technologies enable real-time fault detection, load optimization, and remote control, reducing downtime and maintenance costs. Utilities view digital substations as a step toward fully automated grids. The trend opens opportunities for software vendors, cyber-secured platforms, and AI-based monitoring services. Smart-ready substations also support renewable intermittency and peak load management, making them attractive to power distributors and industrial users.

- For instance, General Electric integrates its Multilin G650 protection relay in containerized units, which processes up to 32 analog channels and reports breaker status and fault records in less than 1 millisecond through IEC 61850 GOOSE messaging.

Rising Adoption in Developing Economies

Developing regions in Africa, Southeast Asia, and South America invest in quick-to-deploy power infrastructure for rural electrification and industrial growth. Traditional substations require land, labor, and time, whereas containerized units offer rapid delivery and minimal site preparation. Governments seeking reliable electricity for new manufacturing zones, mining projects, and disaster recovery generate new demand. Low maintenance needs and modular scalability create attractive opportunities for vendors offering cost-efficient solutions.

- For instance, Pasternack offers the PE2082 2-way divider, which operates from DC to 6 GHz, supports 2 W input power, and maintains a typical insertion loss of 6 dB across the band (which includes the 3 dB power split loss), as specified in its datasheet.

Key Challenges

High Initial Investment Compared to Conventional Solutions

Despite faster deployment and lower civil work needs, containerized substations require higher upfront payment due to integrated systems, factory-built enclosures, and advanced monitoring equipment. Budget-constrained utilities in developing countries often delay procurement or choose refurbished units. This cost barrier limits adoption in markets where power projects depend on public funding or foreign investment. Vendors must offer leasing models, financing support, and lifecycle cost savings to accelerate market penetration.

Logistics and Transport Limitations

Large, high-voltage containerized substations face transport challenges due to size, weight, and customs restrictions. Remote regions with weak road infrastructure struggle to receive oversized units. Damage risk during transit increases insurance and handling costs. In countries with strict import duties or complex regulations, shipment delays affect project timelines. These constraints compel manufacturers to explore regional assembly hubs, lightweight enclosure materials, and modular split-container designs to simplify logistics.

Regional Analysis

North America

North America holds nearly 32% of the market share due to strong investments in grid modernization, renewable integration, and disaster-resilient infrastructure. Utilities in the United States deploy containerized substations to shorten outage restoration time and support rapid grid expansion for solar and wind facilities. Canada adopts modular substations for remote mining and northern communities where harsh climates complicate traditional construction. Strong presence of global and regional manufacturers, reliable funding mechanisms, and favorable regulatory policies support continued growth. Rising focus on digital substations and smart monitoring also strengthens long-term adoption across the region.

Europe

Europe accounts for roughly 25% share, supported by renewable development, offshore wind projects, and energy transition goals. Countries such as Germany, the United Kingdom, and France install containerized substations to optimize voltage control, reduce land use, and accelerate power distribution for distributed energy systems. Urban infrastructure upgrades and electric mobility expansion further drive demand. The region benefits from advanced manufacturing capabilities, strong environmental standards, and increasing preference for compact, low-emission substation designs. Growing emphasis on grid stability amid rising renewable penetration keeps Europe an attractive market for suppliers and technology partners.

Asia-Pacific

Asia-Pacific commands the largest share at nearly 35%, driven by high electricity demand, industrialization, and large-scale renewable deployment. China, India, Japan, and Southeast Asian countries prefer modular substations for fast rural electrification, factory expansion, and solar and wind integration. Governments focus on expanding transmission and distribution infrastructure and reducing power losses, which supports market penetration. Containerized units also gain traction in mining, railways, and remote construction sites. Rapid urbanization and escalating power consumption ensure sustained demand across the region, making Asia-Pacific a key growth hub for global manufacturers.

Latin America

Latin America captures nearly 3% of the market, with adoption led by Brazil, Chile, and Mexico. The region leverages containerized substations for mining, renewable energy, and quick grid restoration in storm-affected zones. Tight project timelines and budget constraints encourage use of cost-efficient modular solutions over traditional builds. Growing wind and solar capacity, especially in remote areas, strengthens the need for compact and transportable power systems. While economic instability restricts large-scale procurement, international financing and private sector investments help expand deployment across industrial and utility applications.

Middle East & Africa

The Middle East & Africa region holds close to 5% share but shows strong growth potential due to increasing power requirements in industrial zones, oil and gas fields, and remote desert operations. Countries such as Saudi Arabia, the UAE, and South Africa adopt containerized substations to improve power reliability and accelerate grid build-out. Harsh climate conditions favor compact, sealed designs with low maintenance needs. Emerging rural electrification programs and renewable projects in Africa also open new opportunities. Although adoption is currently moderate, capacity additions and infrastructure spending support gradual market expansion.

Market Segmentations:

By Category:

By Voltage Level:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the containerized substation market players such as Crompton Greaves, Siemens AG, IMESA S.p.A., Larsen & Toubro, Elsewedy Electric Co S.A.E., General Electric, Kirloskar Electric, Toshiba Corporation, Eaton Corporation, and ABB Ltd. The containerized substation market focuses on advanced engineering, digital control, and modular power delivery. Leading manufacturers prioritize compact designs that reduce civil work, shorten installation time, and improve grid reliability. Vendors integrate smart monitoring, SCADA systems, and IoT-based diagnostics to support remote operation and predictive maintenance. Many companies target renewable projects, mining sites, and temporary grid expansions where mobility and fast deployment offer strong advantages. The market also shows rising demand for gas-insulated switchgear, low-loss transformers, and fire-safe enclosures that improve safety and efficiency. Strategic partnerships with utilities, EPC contractors, and energy developers help expand project pipelines across emerging and developed regions. To strengthen competitiveness, manufacturers invest in sustainable materials, voltage optimization, and cyber-secure communication systems, positioning containerized solutions as a modern alternative to traditional substations.

Key Player Analysis

- Crompton Greaves

- Siemens AG

- IMESA S.p.A.

- Larsen & Toubro

- Elsewedy Electric Co S.A.E.

- General Electric

- Kirloskar Electric

- Toshiba Corporation

- Eaton Corporation

- ABB Ltd.

Recent Developments

- In October 2025, Hitachi Energy was selected to deliver 1100 KV gas insulated switchgear for the 1000 KV Nanchang ultra-high-voltage substation in Jiangxi province, China. This project supports the expansion of the Nanchang site as a part of the country’s border UHV grid development initiative.

- In March 2025, Schneider Electric fortified its presence in Tanzania by setting up a full-fledged team, a new office in Dar es Salaam, and a cutting edge fabrication yard capable of assembling containerized substation solutions. The strategic decision is to cater to the region’s growing infrastructure and energy needs. Schneider Electric, as part of its growth, will partner with regional partners to design and supply containerized substations.

- In June 2024, ABB launched ABB Ability™ OPTIMAX® 6.4, a software solution that is a key component of their digital energy infrastructure. This system mainly focuses on improving energy efficiency and accelerating decarbonization efforts for industrial users.

- In August 2023, Hartek Power Pvt Ltd won a contract from TP Western Odisha Distribution Ltd, a Tata Power group, for the development of two containerized substations. The 25 crore turnkey project involves the construction of two new 3/11kV E-House (container-type) power substations in western Odisha.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Category, Voltage Level, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as renewable projects require fast grid connection and compact power systems.

- Utilities will adopt more digital and automated containerized substations for remote monitoring.

- Modular plug-and-play designs will support disaster recovery and emergency power restoration.

- Growing industrialization in Asia-Pacific and Africa will increase deployment in mining and manufacturing.

- More vendors will integrate IoT sensors, smart relays, and predictive maintenance features.

- Hybrid substations using gas-insulated switchgear will gain preference in space-constrained locations.

- Financing models and leasing options will expand adoption in cost-sensitive markets.

- Offshore wind and remote solar plants will drive demand for high-durability enclosures.

- Regional assembly hubs will reduce logistics barriers and shorten delivery timelines.

- Cyber-secure control systems will become standard as utilities move toward fully digital grids.