Market Overview

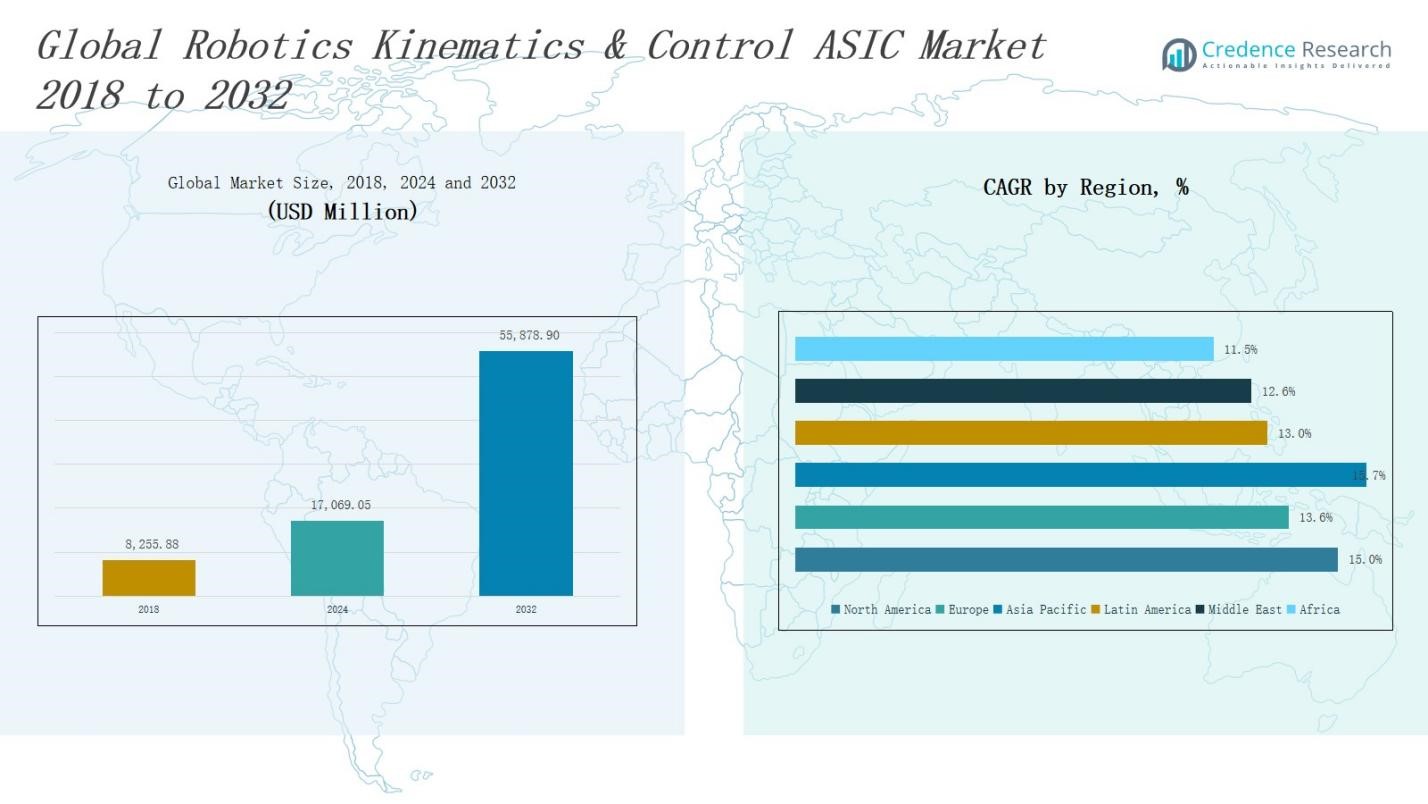

The Robotics Kinematics & Control ASIC Market size was valued at USD 8,255.88 million in 2018 to USD 17,069.05 million in 2024 and is anticipated to reach USD 55,878.90 million by 2032, at a CAGR of 14.90% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Robotics Kinematics & Control ASIC Market Size 2024 |

USD 17,069.05 Million |

| Robotics Kinematics & Control ASIC Market, CAGR |

14.90% |

| Robotics Kinematics & Control ASIC Market Size 2032 |

USD 55,878.90 Million |

The Robotics Kinematics & Control ASIC Market is driven by growing demand for high-precision motion control in industrial automation, surgical robotics, and autonomous systems. Increased adoption of collaborative robots and real-time adaptive control mechanisms accelerates the need for application-specific integrated circuits (ASICs) optimized for low latency and energy efficiency. Rising integration of AI and edge computing enhances the performance of robotic systems, supporting faster kinematic calculations and improved sensor fusion. Trends include the development of compact, power-efficient ASICs and increasing collaboration between semiconductor firms and robotics OEMs to deliver customized control architectures for complex robotic applications.

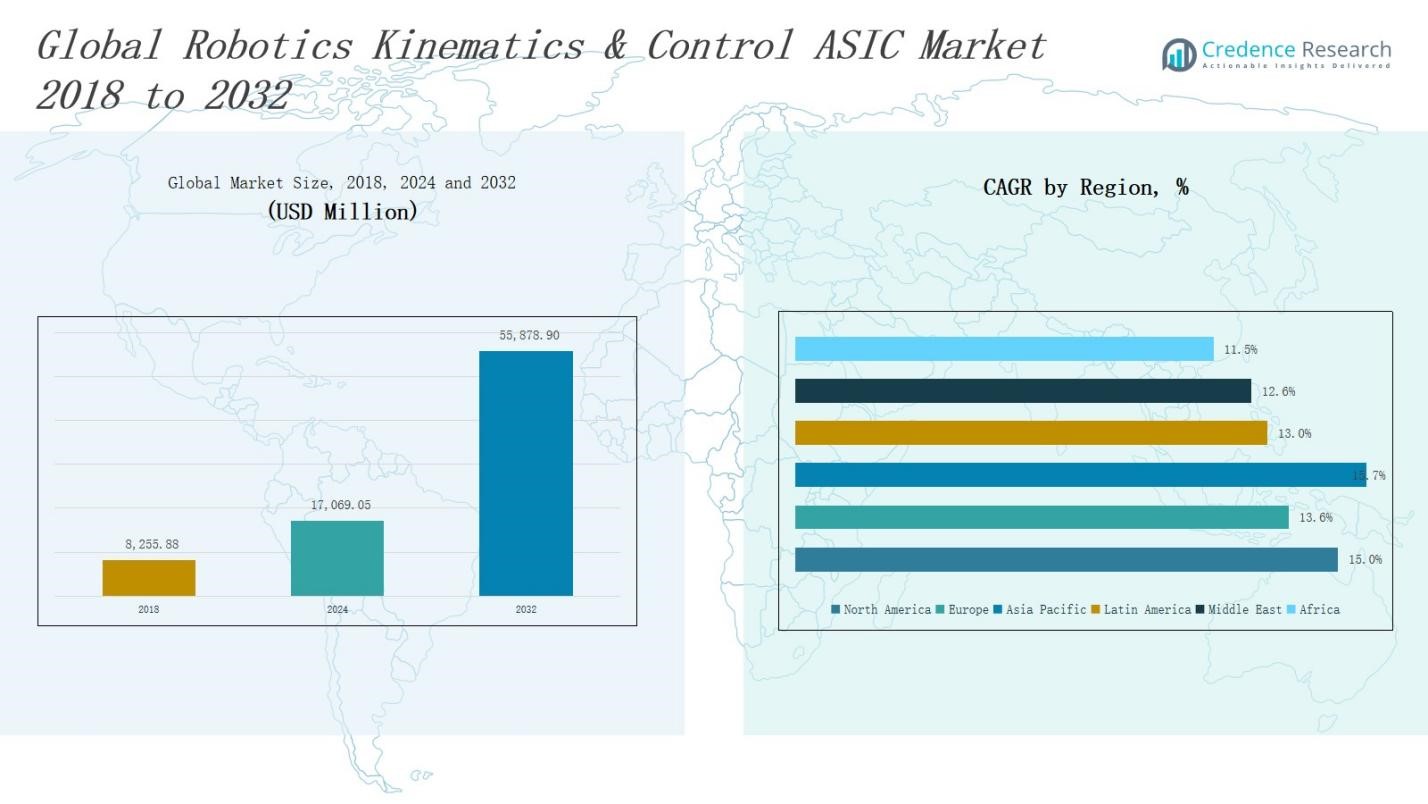

The Robotics Kinematics & Control ASIC Market spans North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa. Asia Pacific leads the market due to rapid industrialization and strong semiconductor manufacturing. North America and Europe follow, driven by advanced automation and innovation ecosystems. Latin America, the Middle East, and Africa show emerging potential through sector-specific robotics adoption. Key players include NVIDIA, Intel, AMD, Hailo Technologies, Tenstorrent, GreenWaves Technologies, Ambarella, SiFive, Ceva Inc., Kalray, Synaptics, Cambricon Technologies, Flex Logix, MediaTek, and Rockchip Electronics.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Robotics Kinematics & Control ASIC Market was valued at USD 17,069.05 million in 2024 and is projected to reach USD 55,878.90 million by 2032, growing at a CAGR of 14.90%.

- Industrial automation, surgical robotics, and autonomous systems are driving demand for low-latency, high-precision ASICs tailored for real-time motion control.

- Integration of AI and edge computing into ASICs enhances kinematic calculations, sensor fusion, and autonomous decision-making.

- North America and Europe hold strong market shares due to innovation ecosystems, while Asia Pacific leads with over USD 27 billion projected by 2032.

- Key trends include miniaturized, power-efficient chipsets and collaborations between chipmakers and robotics OEMs for customized control architectures.

- Major challenges include high ASIC development costs and limited upgradability compared to programmable alternatives like FPGAs.

- Key players include NVIDIA, Intel, AMD, Hailo, GreenWaves Technologies, Ambarella, Synaptics, SiFive, and Cambricon Technologies.

Market Drivers

Surging Demand for High-Precision Industrial Automation

The Robotics Kinematics & Control ASIC Market is primarily driven by the growing need for precision and speed in industrial automation. Manufacturers are deploying robots for tasks requiring exact positioning and real-time motion control, such as welding, packaging, and material handling. These operations demand ASICs capable of processing complex kinematic equations with minimal latency. It enables seamless integration of sensors, actuators, and processors, improving robotic efficiency. Automation in automotive, electronics, and logistics industries accelerates demand for tailored ASIC solutions.

- For instance, NVIDIA developed a robotics-focused ASIC that delivers high-performance processing and AI acceleration, specifically enhancing real-time control and sensor integration in robotic arms used for manufacturing automation.

Expansion of Autonomous and Collaborative Robotic Systems

The rise of autonomous mobile robots (AMRs) and collaborative robots (cobots) significantly influences the Robotics Kinematics & Control ASIC Market. These robots rely on real-time sensor data and complex kinematic modeling for safe human interaction and navigation. ASICs provide the computational capability to support such functions with low power consumption and high reliability. It supports safety compliance and high-speed processing required in dynamic environments. Market growth reflects broader robotics adoption in smart factories and service sectors.

- For instance, cobots deployed in manufacturing environments adjust their speed and movement in real-time based on proximity sensors to ensure safe collaboration with human workers, leveraging ASICs for fast and reliable sensor data processing.

Advancements in Edge AI and Embedded Processing

The integration of AI and machine learning algorithms at the edge drives innovation in the Robotics Kinematics & Control ASIC Market. Robotics systems are increasingly performing complex tasks independently, requiring embedded intelligence directly on the chip. ASICs designed for these applications deliver enhanced performance in kinematic calculations, motion planning, and environmental adaptation. It reduces dependence on external computing and improves response time. These developments enhance robotic versatility across industries including healthcare, agriculture, and defense.

Miniaturization and Power Efficiency of ASIC Designs

Shrinking form factors and energy constraints in robotics fuel the need for compact, power-efficient ASICs. Developers are designing custom ASICs with low power profiles and high integration to support lightweight robotic platforms. It allows for longer battery life and better heat management in mobile and wearable robotic systems. The Robotics Kinematics & Control ASIC Market benefits from this trend as demand rises for agile, lightweight robots. Integration of multifunctional capabilities within single ASICs optimizes design and cost.

Market Trends

Integration of AI and Machine Learning into ASIC Architectures

One of the key trends in the Robotics Kinematics & Control ASIC Market is the integration of AI and machine learning capabilities into ASIC architectures. These enhancements allow robots to perform real-time kinematic adaptations and decision-making without relying on cloud processing. It enables robots to function autonomously in unstructured environments with improved precision and response time. Developers are embedding neural processing units (NPUs) and tensor accelerators within ASICs. This integration boosts localized computation, enhancing safety and intelligence across use cases. Demand for smarter robotics drives this ongoing trend.

- For instance, tesla’s development of custom ASICs for its autonomous vehicles, which combine AI-driven kinematics to adapt dynamically to road conditions and ensure high-precision control with minimal latency.

Shift Toward Edge Computing for Low-Latency Robotic Control

The growing emphasis on edge computing is reshaping design strategies in the Robotics Kinematics & Control ASIC Market. Robotics applications demand ultra-low latency for time-critical motion control tasks. ASICs optimized for edge execution reduce data transmission delays and increase autonomy in field operations. It supports applications such as automated guided vehicles (AGVs), surgical robots, and pick-and-place systems. Manufacturers are incorporating advanced memory controllers and optimized instruction sets into ASICs. The edge-centric approach is gaining traction in factories, hospitals, and defense scenarios.

- For instance, NVIDIA’s Jetson AGX Xavier platform enables autonomous robots and AGVs to process sensor data locally, delivering real-time decision-making with latency as low as a few milliseconds, crucial for precise motion control in manufacturing.

Rising Adoption of Modular and Scalable Chip Designs

Modularity and scalability in ASIC design have become prominent trends across the Robotics Kinematics & Control ASIC Market. Companies are building flexible ASIC platforms that can be tailored for various robot types, from micro-robots to industrial arms. It enables faster product development cycles and reduced hardware customization costs. Scalable designs support varied kinematic workloads and future software updates. This trend reflects growing demand for adaptive robotic solutions across multiple verticals. Market players are prioritizing reusable IP blocks and configurable cores in new chipsets.

Emphasis on Low-Power Consumption and Thermal Efficiency

Energy efficiency remains a critical design goal in the Robotics Kinematics & Control ASIC Market, driven by mobile and compact robotic systems. Power-efficient ASICs extend operational time and reduce thermal stress, enabling robotics to operate reliably in space-constrained or battery-powered environments. It encourages innovation in ultra-low-power logic and dynamic voltage scaling techniques. Demand is high from sectors deploying drones, medical robotics, and inspection bots. Thermal-aware chip packaging and efficient heat dissipation techniques are shaping future ASIC releases. This trend aligns with green robotics and sustainability goals.

Market Challenges Analysis

High Development Costs and Design Complexity of Custom ASICs

The Robotics Kinematics & Control ASIC Market faces a significant challenge in the high cost and complexity of designing custom ASICs. Developing chips tailored for robotic control involves specialized engineering, long design cycles, and extensive validation processes. It limits market entry for startups and smaller robotics firms with constrained budgets. Evolving robotic applications require frequent updates to hardware, further increasing the cost burden. Custom ASICs also demand advanced fabrication technologies, which can restrict production scalability and accessibility.

Limited Flexibility and Upgradability in Application-Specific Hardware

ASICs designed for robotics offer optimized performance but often lack the flexibility of programmable alternatives like FPGAs. This rigidity poses a challenge in adapting to new control algorithms, sensor inputs, or evolving safety standards. The Robotics Kinematics & Control ASIC Market must address these concerns to remain competitive in fast-moving innovation cycles. It may struggle to support rapid iterations in robotic system design. Limited reconfigurability reduces long-term hardware utility and increases the total cost of ownership for end users.

Market Opportunities

Rising Demand Across Service Robotics and Emerging Sectors

Expanding use of service robots in healthcare, agriculture, hospitality, and retail presents new opportunities for the Robotics Kinematics & Control ASIC Market. These sectors require compact, energy-efficient chips with real-time control capabilities tailored to diverse operational environments. It opens the door for specialized ASIC solutions that deliver optimized performance while maintaining safety and reliability. Aging populations, labor shortages, and demand for automation in non-industrial settings drive this opportunity. Custom ASICs can support differentiated features for robotic assistants, delivery bots, and precision farming equipment.

Growth Potential in AI-Driven and Human-Robot Interaction Systems

Increasing emphasis on intelligent motion planning and seamless human-robot interaction creates demand for ASICs with integrated AI accelerators and sensory fusion capabilities. The Robotics Kinematics & Control ASIC Market can expand by delivering chips that support adaptive learning, gesture recognition, and environment-aware decision-making. It offers opportunities for companies developing autonomous navigation, vision-guided systems, and voice-responsive robotics. Markets such as smart homes, rehabilitation robotics, and educational robots are evolving quickly. Tailored ASICs can enable next-generation experiences through faster processing and enhanced responsiveness.

Market Segmentation Analysis:

By Type

The Robotics Kinematics & Control ASIC Market includes fixed-function, full-custom, and semi-custom ASICs. Fixed-function ASICs dominate legacy applications where repeatable and stable control logic is required. Full-custom ASICs gain traction in high-performance robotics, offering optimized latency, size, and energy consumption. Semi-custom ASICs, including standard cell-based and gate array-based designs, offer a cost-effective balance between performance and flexibility. It supports design reuse and faster time-to-market for various robotics applications across sectors.

- For instance, Elmo Motion Control developed ultra-small, powerful EtherCAT servo drives integrated directly onto the joints of a 7-joint collaborative robot built by Siasun Robotics.

By Application

The market spans industrial, service, consumer, defense, and autonomous robotic applications. Industrial robotics leads demand with widespread use in manufacturing, particularly in welding, assembly, and material handling. Service robotics grows rapidly in healthcare, agriculture, and hospitality, driving demand for compact, energy-efficient ASICs. Consumer robotics focuses on home assistants and entertainment robots. Defense and autonomous vehicles require high-speed processing and secure path control, pushing advanced ASIC integration. The Robotics Kinematics & Control ASIC Market supports diverse application-specific needs across all categories.

- For instance, FANUC’s industrial robots are extensively used for arc welding and material handling in automotive manufacturing, achieving precise and consistent welds while improving worker safety.

By Function

Functionally, ASICs in this market handle motion control, sensor integration, kinematic modeling, path planning, and safety mechanisms. Motion control remains the core function across all robot types. Kinematic modeling and path planning are essential for autonomous navigation and precision task execution. Sensor integration enhances real-time feedback, while safety and collision avoidance are critical for human-robot interaction. It enables performance optimization by embedding these functions directly into the hardware for faster and more reliable operation.

Segments:

Based on Type:

- Fixed-function ASICs

- Full-custom ASICs

- Semi-custom ASICs (Standard Cell-Based and Gate Array-Based)

Based on Application:

- Industrial Robotics (Assembly, Welding, Material Handling)

- Service Robotics (Medical, Delivery, Cleaning, Agriculture)

- Consumer Robotics (Home Assistants, Entertainment)

- Defense and Security Robotics

- Autonomous Vehicles and Drones

Based on Function:

- Motion Control

- Sensor Integration

- Kinematic Modeling

- Path Planning

- Safety & Collision Avoidance

Based on End-User Industry:

- Manufacturing

- Healthcare

- Agriculture

- Automotive

- Logistics and Warehousing

- Aerospace and Defense

Based on Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

The North America Robotics Kinematics & Control ASIC Market size was valued at USD 2,272.30 million in 2018 to USD 4,620.57 million in 2024 and is anticipated to reach USD 15,193.42 million by 2032, at a CAGR of 15.0% during the forecast period. North America holds the second-largest market share driven by advanced robotics adoption in manufacturing, defense, and healthcare. The region benefits from a strong semiconductor ecosystem and high R&D spending by leading companies. It supports the integration of AI and edge computing in robotic control systems. The U.S. leads the regional growth with strategic investments in automation and autonomous mobility. Robotics OEMs in this region increasingly deploy custom ASICs to optimize robotic intelligence and motion control.

Europe

The Europe Robotics Kinematics & Control ASIC Market size was valued at USD 1,611.55 million in 2018 to USD 3,157.31 million in 2024 and is anticipated to reach USD 9,442.01 million by 2032, at a CAGR of 13.6% during the forecast period. Europe maintains a significant market share, driven by strong industrial automation, precision engineering, and regulatory focus on robotic safety. Germany, France, and the UK lead in robotics innovation and system integration. It fosters demand for custom ASICs supporting sensor fusion and real-time path planning. Growth is reinforced by Europe’s focus on sustainable and collaborative robotics. Automotive and pharmaceutical sectors play a central role in technology deployment.

Asia Pacific

The Asia Pacific Robotics Kinematics & Control ASIC Market size was valued at USD 3,643.65 million in 2018 to USD 7,808.66 million in 2024 and is anticipated to reach USD 27,107.69 million by 2032, at a CAGR of 15.7% during the forecast period. Asia Pacific holds the largest market share due to rapid industrialization and the presence of leading semiconductor manufacturers. China, Japan, and South Korea dominate the demand for ASICs in industrial and service robotics. It supports mass deployment of robots in electronics, logistics, and smart factories. Regional governments promote robotics through favorable policies and funding. Demand for high-performance, low-cost ASICs continues to grow with AI integration.

Latin America

The Latin America Robotics Kinematics & Control ASIC Market size was valued at USD 364.25 million in 2018 to USD 743.06 million in 2024 and is anticipated to reach USD 2,133.05 million by 2032, at a CAGR of 13.0% during the forecast period. Latin America shows moderate growth, driven by increasing use of automation in mining, agriculture, and food processing. Brazil and Mexico lead regional adoption supported by industrial upgrades and government-backed technology programs. It creates opportunities for low-power, application-specific ASICs tailored to regional needs. Robotics startups and academic institutions support innovation through collaborations. The market reflects growing demand for smart robotics with efficient control systems.

Middle East

The Middle East Robotics Kinematics & Control ASIC Market size was valued at USD 240.41 million in 2018 to USD 455.97 million in 2024 and is anticipated to reach USD 1,269.21 million by 2032, at a CAGR of 12.6% during the forecast period. The region experiences rising adoption of robotics in oil & gas, construction, and healthcare sectors. It benefits from smart city initiatives and national digital transformation strategies. UAE and Saudi Arabia lead ASIC demand for advanced robotic applications. Focus on sustainability and operational efficiency drives integration of custom ASICs. Regional companies invest in AI-driven robotics for infrastructure maintenance and service automation.

Africa

The Africa Robotics Kinematics & Control ASIC Market size was valued at USD 123.72 million in 2018 to USD 283.47 million in 2024 and is anticipated to reach USD 733.53 million by 2032, at a CAGR of 11.5% during the forecast period. Africa holds the smallest market share but shows emerging potential through robotics in agriculture, security, and telemedicine. Countries such as South Africa, Nigeria, and Kenya explore automation to address labor shortages and infrastructure challenges. It encourages interest in cost-effective ASIC solutions with scalable control functions. The market is supported by growing educational initiatives and international collaborations. Demand is likely to rise with greater access to local fabrication and design services.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Ceva Inc.

- Tenstorrent Inc.

- GreenWaves Technologies

- Cambricon Technologies

- Intel Corporation

- Synaptics Incorporated

- Kalray S.A.

- Rockchip Electronics Co., Ltd.

- NVIDIA Corporation

- Flex Logix Technologies, Inc.

- MediaTek Inc.

- SiFive, Inc.

- Hailo Technologies Ltd.

- Advanced Micro Devices, Inc. (AMD)

- Ambarella, Inc.

Competitive Analysis

The Robotics Kinematics & Control ASIC Market features strong competition among global semiconductor leaders and specialized AI chip manufacturers. Companies such as NVIDIA, Intel, and AMD focus on high-performance computing for robotics, integrating AI accelerators and advanced kinematics processing into their ASIC solutions. Startups like Hailo, Tenstorrent, and GreenWaves Technologies target niche applications with low-power, edge-optimized chips. It sees strategic partnerships between robotics OEMs and chip designers to develop application-specific architectures. Players compete on power efficiency, real-time processing, customization, and integration capabilities. Investments in AI, edge computing, and neuromorphic design strengthen product differentiation. The market continues to evolve as firms innovate to meet complex robotics control demands.

Recent Developments

- In March 2025, NVIDIA introduced Isaac GR00T N1, the first open humanoid robot foundation model, during its GTC event.

- In January 2025, NVIDIA announced a partnership with Toyota at CES to integrate DriveOS into upcoming autonomous vehicle platforms.

- In January 2025, Ambarella launched the N1‑655 edge GenAI SoC at CES, designed for low-power multi-camera processing in autonomous robots and smart-city systems.

- In April 2025, Hailo appointed Avnet ASIC as its silicon partner to support the production of next-generation edge AI processors for robotics and vision use cases.

Market Concentration & Characteristics

The Robotics Kinematics & Control ASIC Market shows moderate-to-high concentration, with a mix of established semiconductor giants and agile AI-focused startups. It is characterized by rapid innovation cycles, high entry barriers due to fabrication costs, and strong demand for application-specific performance. Leading players such as NVIDIA, Intel, and AMD dominate in high-performance segments, while companies like Hailo, GreenWaves, and Tenstorrent target edge computing and low-power solutions. The market favors firms that can deliver high-speed, energy-efficient, and compact ASICs tailored to diverse robotic applications. It remains highly competitive, with players investing in proprietary IP, co-design with robotics OEMs, and integration of AI accelerators. Technological differentiation, vertical specialization, and design scalability are key success factors. Demand concentration is highest in Asia Pacific, followed by North America and Europe, driven by advanced manufacturing, government support, and adoption of smart automation technologies. The market evolves quickly in response to shifting performance requirements and robotic form factor constraints.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Function, End-User Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for custom ASICs will increase with the expansion of collaborative and service robotics across industries.

- AI integration on-chip will enhance real-time kinematic modeling and autonomous decision-making.

- Edge computing adoption will drive development of low-latency, power-efficient ASIC architectures.

- Miniaturization of robotics will create opportunities for compact and thermally optimized ASIC solutions.

- Robotics OEMs will collaborate more with semiconductor firms to co-develop application-specific control chips.

- Adoption of ASICs in healthcare robotics will grow due to need for precision and reliability.

- Autonomous vehicles and drones will demand high-performance ASICs for path planning and sensor fusion.

- Advancements in design tools will reduce time-to-market for next-generation robotics ASICs.

- Regional manufacturing initiatives will boost local ASIC production in Asia Pacific and North America.

- Sustainable robotics development will prioritize energy-efficient ASICs to meet environmental standards.