Market Overview

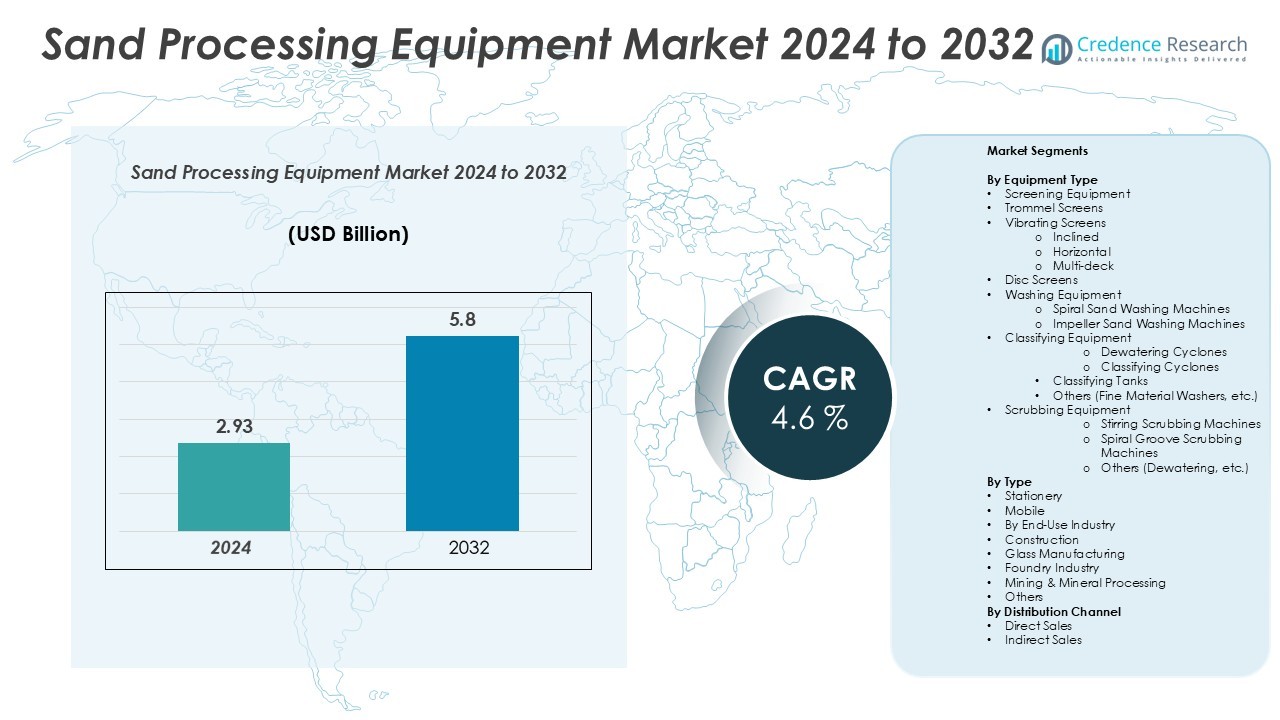

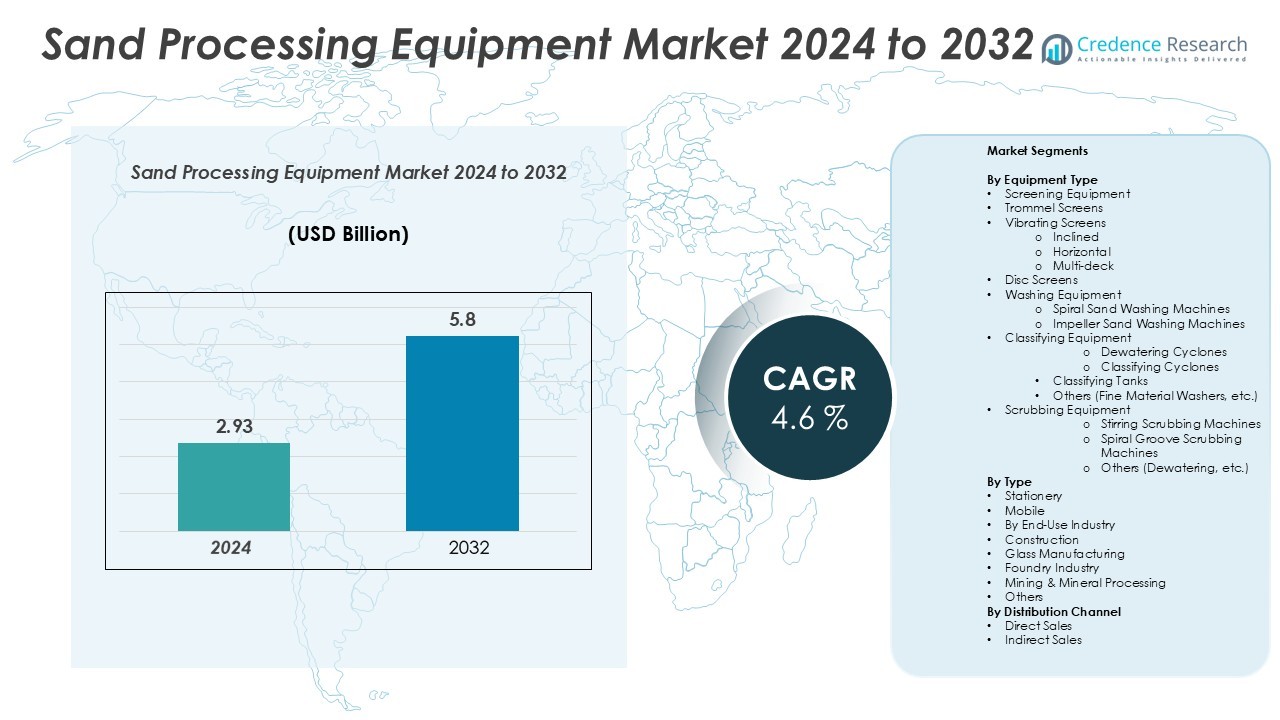

The Sand Processing Equipment Market size was valued at USD 2.93 billion in 2024 and is anticipated to reach USD 5.8 billion by 2032, growing at a CAGR of 4.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sand Processing Equipment Market Size 2024 |

USD 2.93 Billion |

| Sand Processing Equipment Market, CAGR |

4.6% |

| Sand Processing Equipment Market Size 2032 |

USD 5.8 Billion |

The sand processing equipment market is characterized by strong competition among global and regional manufacturers focused on innovation and performance efficiency. Leading players include Metso, Titan Crushing Equipment, CDE Group, LZZG, Superior Industries, Palmer, Astec, Weir, Sinto, McLanahan, D&G Machinery, FSP, Sinonine, and Mogensen. These companies prioritize the development of advanced washing, screening, and classifying systems to meet rising industrial and construction needs. Asia-Pacific leads the global market with a 36.9% share, driven by rapid infrastructure growth and large-scale mining operations. North America follows with 28.6%, supported by high adoption of automation and sustainability-driven upgrades. Competitive differentiation relies heavily on technological innovation, aftersales services, and global distribution networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Sand Processing Equipment Market was valued at USD 2.93 billion in 2024 and is projected to reach USD 5.8 billion by 2032, growing at a CAGR of 4.6%.

- Growing construction and mining activities drive demand for efficient screening, washing, and classifying equipment globally.

- Automation, IoT integration, and energy-efficient systems are key trends shaping product innovation and operational efficiency.

- The market is moderately consolidated, with key players such as Metso, CDE Group, LZZG, and Weir focusing on sustainable solutions and global expansion.

- Asia-Pacific leads with a 36.9% share, followed by North America at 28.6% and Europe at 22.4%, while screening equipment dominates with 34.7% of the total market share.

Market Segmentation Analysis:

By Equipment Type

The sand processing equipment market is segmented into screening, washing, classifying, and scrubbing equipment. Among these, screening equipment dominates the market with a 34.7% share in 2024. Trommel and vibrating screens lead due to their efficiency in separating fine and coarse materials. The demand for multi-deck vibrating screens is rising in mining and construction for high-capacity material handling. Technological advancements, such as automated feed control and energy-efficient motors, further drive adoption. Manufacturers emphasize low-maintenance and high-throughput designs, enhancing operational efficiency and process precision across end-use industries.

- For instance, Metso’s UltraFine Screen (UFS) series uses a modular design with up to 10 high-frequency screen decks nested together, providing fine wet separation for particle sizes as fine as 0.075 mm (75 microns).

By Type

The market is categorized into stationery and mobile equipment. The stationery segment holds the largest market share at 57.3% in 2024, driven by its wide use in large-scale mining and mineral processing operations. Stationery systems offer greater durability and processing capacity compared to mobile units. However, mobile sand processing units are gaining traction in remote construction projects and temporary setups. Growth in on-site sand washing and screening applications supports mobile equipment demand. Improved transportability and compact design also enhance the flexibility of mobile processing solutions.

- For instance, Terex’s AggreSand 206 modular wash plant integrates a 20-foot triple-deck screen and a 200-ton-per-hour sand recovery system, improving efficiency in aggregate production.

By End-Use Industry

Based on end-use industry, the market is divided into construction, glass manufacturing, foundry, mining & mineral processing, and others. The construction segment dominates with a 41.8% share in 2024, fueled by rising infrastructure and urban development projects. The demand for processed sand in concrete, asphalt, and road building continues to increase globally. The glass manufacturing segment also shows steady growth due to consistent demand for silica sand of high purity. The expansion of mining operations in Asia-Pacific and Latin America further strengthens market demand across industrial sectors.

Key Growth Drivers

Expanding Construction and Infrastructure Projects

The rapid growth of global construction and infrastructure development is a major driver for the sand processing equipment market. Increased urbanization and investments in roads, bridges, and smart cities have heightened the demand for high-quality processed sand. Equipment such as vibrating screens and spiral sand washing machines are widely adopted to ensure consistent sand grading and purity. The rise of government-funded housing and renewable energy projects further fuels the need for efficient sand handling systems. Manufacturers are focusing on automation and high-capacity processing technologies to meet large-scale construction demands while improving energy efficiency and production output.

- For instance, CDE Global’s Combo X900 integrates a patented Hydrocyclone system capable of processing 500 tons of sand per hour with 95% water recovery efficiency.

Rising Adoption of Energy-Efficient and Automated Equipment

Automation and energy efficiency have become key priorities for end-users across industries. Advanced sand processing systems equipped with real-time monitoring sensors and variable frequency drives reduce power consumption and enhance operational control. Automated classifiers and dewatering systems help optimize moisture content and product consistency. The integration of IoT-enabled diagnostics allows predictive maintenance and minimizes equipment downtime. Manufacturers are investing in AI-based optimization systems to enhance performance and extend component lifespan. This technological shift aligns with global sustainability goals, driving strong adoption of automated and energy-efficient sand processing solutions across mining, construction, and glass manufacturing sectors.

- For instance, The Weir Minerals Warman WGR pump series is a second-generation medium-duty slurry pump designed for sand and aggregate applications, featuring Linatex® premium rubber wear components for superior performance and longevity. It has a capacity of up to 1,200 cubic meters per hour (for the largest 250mm model) and offers enhanced efficiency and reduced energy consumption through an improved hydraulic design.

Growing Demand from the Mining and Mineral Processing Industry

The expansion of mining operations worldwide significantly boosts the demand for sand processing equipment. Mining and mineral processing facilities require efficient screening, washing, and classification systems to handle high material volumes. Rising demand for silica and industrial sand used in glass and foundry applications supports equipment installation across developing economies. Advancements in scrubbing and cyclone-based classification systems enable better impurity removal and recovery rates. Mining operators are increasingly adopting mobile and modular units for flexible deployment in remote locations. The global focus on resource efficiency and the use of advanced filtration systems further reinforce this growth trend.

Key Trends & Opportunities

Integration of Smart Technologies and Predictive Maintenance

The market is witnessing a clear trend toward digital transformation through smart sand processing systems. Equipment manufacturers are integrating IoT sensors, cloud-based analytics, and remote control systems to enhance real-time performance monitoring. Predictive maintenance using machine learning algorithms helps reduce unplanned downtime and maintenance costs. Companies are also investing in digital twins to simulate and optimize production flows. This shift toward connected operations enhances reliability and cost efficiency, making smart sand processing solutions a key opportunity for future investments, especially in large-scale mining and construction projects.

- For instance, The Siemens SIMATIC PCS 7 platform includes a Maintenance Station that provides asset management and offers predictive diagnostics, helping operators detect component degradation before a potential failure occurs.

Increasing Shift Toward Sustainable and Modular Equipment Design

Sustainability and modularity are becoming core priorities in equipment design. End-users are seeking machines with low water usage, energy efficiency, and recyclable components. Manufacturers are responding by developing eco-friendly washing systems with advanced water recovery and zero-waste discharge capabilities. Modular plant designs offer scalability and ease of transportation, catering to temporary or small-scale projects. The rising adoption of green construction practices and stricter environmental standards creates strong opportunities for sustainable sand processing equipment, positioning modular solutions as a preferred choice for environmentally conscious operators.

- For instance, CDE Global’s AquaCycle thickenerrecycled up to 90% of process water, significantly reducing freshwater dependency. Manufacturers are responding by developing eco-friendly washing systems with advanced water recovery and zero waste discharge capabilities.

Key Challenges

High Equipment and Maintenance Costs

The significant capital investment required for advanced sand processing systems poses a major challenge for small and medium enterprises. High-quality vibrating screens, classifiers, and washing machines involve substantial setup and maintenance costs. Frequent component wear due to abrasive materials increases operational expenses and downtime. Although automation reduces manual labor, it requires skilled technicians and regular software upgrades. Limited access to affordable financing further restricts adoption in emerging markets. These cost-related barriers often lead end-users to rely on traditional, low-efficiency processing methods, slowing overall market penetration for advanced solutions.

Environmental Regulations and Resource Limitations

Stringent environmental regulations related to sand mining and processing limit market expansion. Excessive water usage, dust emissions, and waste generation create compliance challenges for operators. Governments across regions are imposing strict controls on sand extraction to curb ecosystem damage and groundwater depletion. Companies must adopt advanced water recycling and dust suppression technologies to meet these standards, increasing costs and operational complexity. Additionally, the declining availability of natural sand in several regions pressures manufacturers to innovate in alternative material processing, such as manufactured or recycled sand, which requires further R&D investments.

Regional Analysis

North America

North America holds a 28.6% share of the sand processing equipment market in 2024. The region benefits from strong construction and mining activity, particularly in the U.S. and Canada. Demand for advanced screening and washing equipment is driven by large-scale infrastructure projects and shale mining operations. Companies invest heavily in energy-efficient and automated systems to reduce operational costs. The presence of leading manufacturers and stringent environmental standards further encourages the use of sustainable sand processing technologies, strengthening North America’s position as a key revenue contributor in the global market.

Europe

Europe accounts for a 22.4% market share, supported by established construction and glass manufacturing industries. Countries like Germany, France, and the U.K. drive equipment demand through modernization of processing facilities and adoption of eco-friendly systems. The European Union’s emphasis on circular economy practices accelerates the shift toward water-efficient washing and classification machines. High-quality standards in industrial sand processing promote the use of precision screening technologies. Growing adoption of modular and automated plants across Europe enhances productivity and compliance with emission norms, sustaining steady regional growth.

Asia-Pacific

Asia-Pacific dominates the sand processing equipment market with a 36.9% share in 2024, driven by rapid urbanization and infrastructure development across China, India, and Southeast Asia. Expanding mining operations and growing demand for manufactured sand in construction fuel equipment installations. The region’s focus on cost-efficient and high-capacity systems supports widespread adoption of vibrating screens and spiral sand washers. Government initiatives promoting smart cities and sustainable resource use further accelerate growth. Local manufacturers are strengthening capabilities through automation and technological upgrades, making Asia-Pacific the fastest-growing regional market globally.

Latin America

Latin America holds a 7.8% share of the sand processing equipment market, supported by rising investments in construction and mining sectors. Brazil, Mexico, and Chile lead regional demand due to ongoing infrastructure upgrades and mining exploration. The need for reliable and durable equipment drives imports of high-performance screening and washing systems. Growing emphasis on local sand production to reduce transportation costs enhances market penetration. However, fluctuating raw material prices and limited financing options constrain large-scale adoption. Despite these challenges, increasing industrialization positions Latin America for gradual growth in the forecast period.

Middle East & Africa

The Middle East & Africa region accounts for a 4.3% share in 2024, supported by robust construction activities and expanding mineral extraction operations. The Gulf Cooperation Council (GCC) countries drive equipment demand for large-scale infrastructure and urban projects. In Africa, growing mining projects in South Africa and Nigeria contribute to equipment adoption. Manufacturers focus on mobile and modular units to serve remote locations effectively. Rising investments in smart and sustainable sand processing solutions are expected to improve operational efficiency, positioning the region as an emerging growth frontier in the global market.

Market Segmentations:

By Equipment Type

- Screening Equipment

- Trommel Screens

- Vibrating Screens

- Inclined

- Horizontal

- Multi-deck

- Disc Screens

- Washing Equipment

- Spiral Sand Washing Machines

- Impeller Sand Washing Machines

- Classifying Equipment

- Dewatering Cyclones

- Classifying Cyclones

- Classifying Tanks

- Others (Fine Material Washers, etc.)

- Scrubbing Equipment

- Stirring Scrubbing Machines

- Spiral Groove Scrubbing Machines

- Others (Dewatering, etc.)

By Type

By End-Use Industry

- Construction

- Glass Manufacturing

- Foundry Industry

- Mining & Mineral Processing

- Others

By Distribution Channel

- Direct Sales

- Indirect Sales

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The sand processing equipment market features a competitive landscape driven by innovation, technology integration, and global expansion strategies. Key players include Metso, Titan Crushing Equipment, CDE Group, LZZG, Superior Industries, Palmer, Astec, Weir, Sinto, McLanahan, D&G Machinery, FSP, Sinonine, and Mogensen. These companies focus on developing high-efficiency screening, washing, and classifying systems to meet rising demand across construction, mining, and glass manufacturing industries. For instance, Metso emphasizes sustainable solutions with its modular washing plants designed for water conservation and low energy use. CDE Group invests in circular economy technologies for recycled aggregates, while LZZG enhances sand recovery through advanced dewatering cyclones. Weir and McLanahan strengthen market presence through automation and global service networks. Continuous R&D, strategic partnerships, and aftersales support remain central to maintaining competitiveness, as manufacturers aim to provide cost-effective, durable, and eco-friendly equipment aligned with evolving environmental regulations and customer performance expectations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Metso

- Titan Crushing Equipment

- CDE Group

- LZZG

- Superior Industries

- Palmer

- Astec

- Weir

- Sinto

- McLanahan

- D&G Machinery

- FSP

- Sinonine

- Mogensen

Recent Developments

- In May 2025, Astec Industries announce the expansion of its partnership with Mineral Processing Solutions (MPS), part of the OPS Group, to strengthen support for quarrying and mining customers across Australia. Under the expanded agreement, MPS will distribute and support Astec’s complete line of fixed and modular crushing, screening, washing, material handling, and breaker technology equipment across all Australian states and territories.

- In March 2024, in response to the growing demand for sustainability, process flexibility and higher capacity, Metso’s Nordwheeler NW Rapid range expands with the new NW8HRC that is the first portable HRC 8 crushers for manufactured sand. HRC 8 is a part of Metso’s Planet Positive offering. It consumes up to 50% less power than any other technology in the same application to obtain the same volume as the same net product.

- In July 2022, Allup Silica Ltd. enhanced its resources for a silica sand project based in Western Australia. The initiative is called “Sparkler A Silica Sands Exploration Project”.

- In July 2022, Finnish Vatajankoski and Polar Night Energy presented the first fully functional “sand battery” capable of storing green electricity, which provides a low-emission and low-cost way to store renewable energy.

- In July 2022, Perpetual Resources shared plans to commence exploratory drilling at the Beharra Quartz Sand Project.

Report Coverage

The research report offers an in-depth analysis based on Equipment Type, Type, Distribution Channel, End-User Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for automated and energy-efficient sand processing systems will continue to increase.

- Manufacturers will focus on developing modular and mobile equipment for flexible operations.

- Integration of IoT and AI technologies will enhance monitoring and predictive maintenance.

- The construction sector will remain the leading end-use industry driving market growth.

- Rising adoption of water recycling systems will support sustainable processing practices.

- Asia-Pacific will maintain dominance due to strong infrastructure and mining investments.

- Technological partnerships will expand product innovation and global competitiveness.

- Equipment upgrades will prioritize reduced downtime and higher material recovery rates.

- Stringent environmental regulations will accelerate the shift toward eco-friendly machinery.

- Expansion of renewable energy and smart city projects will boost long-term equipment demand.