Market Overview

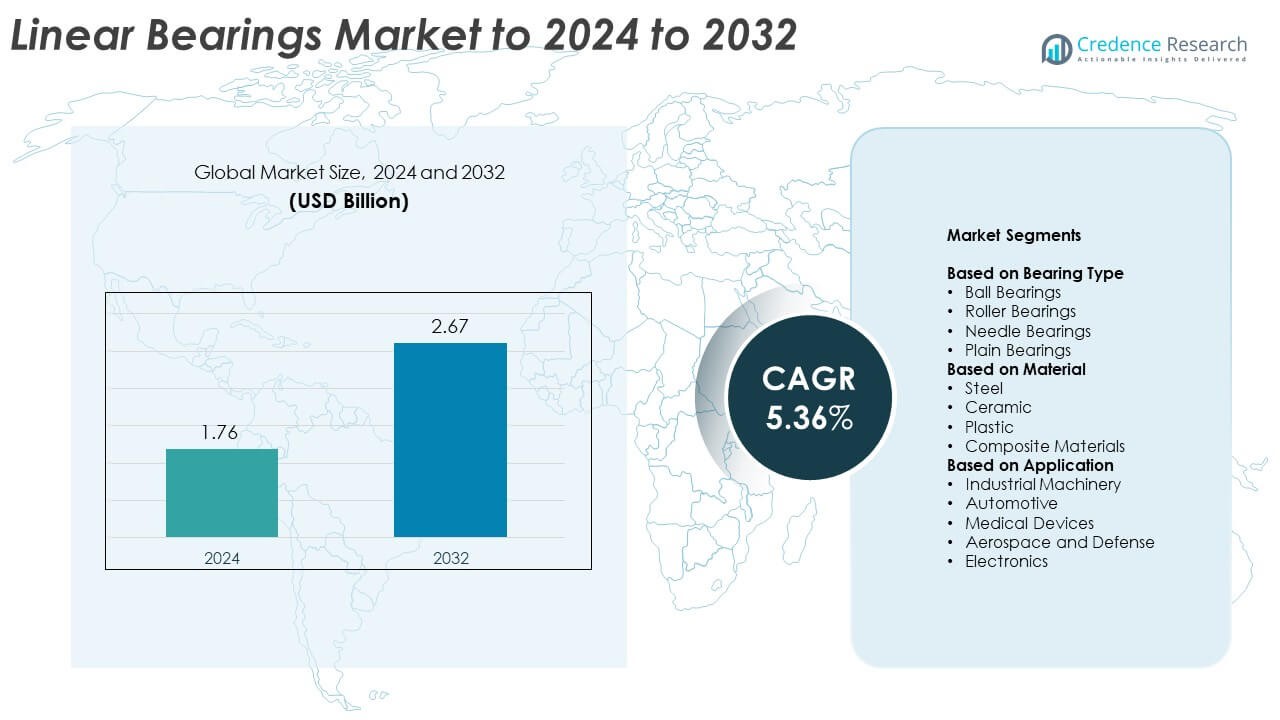

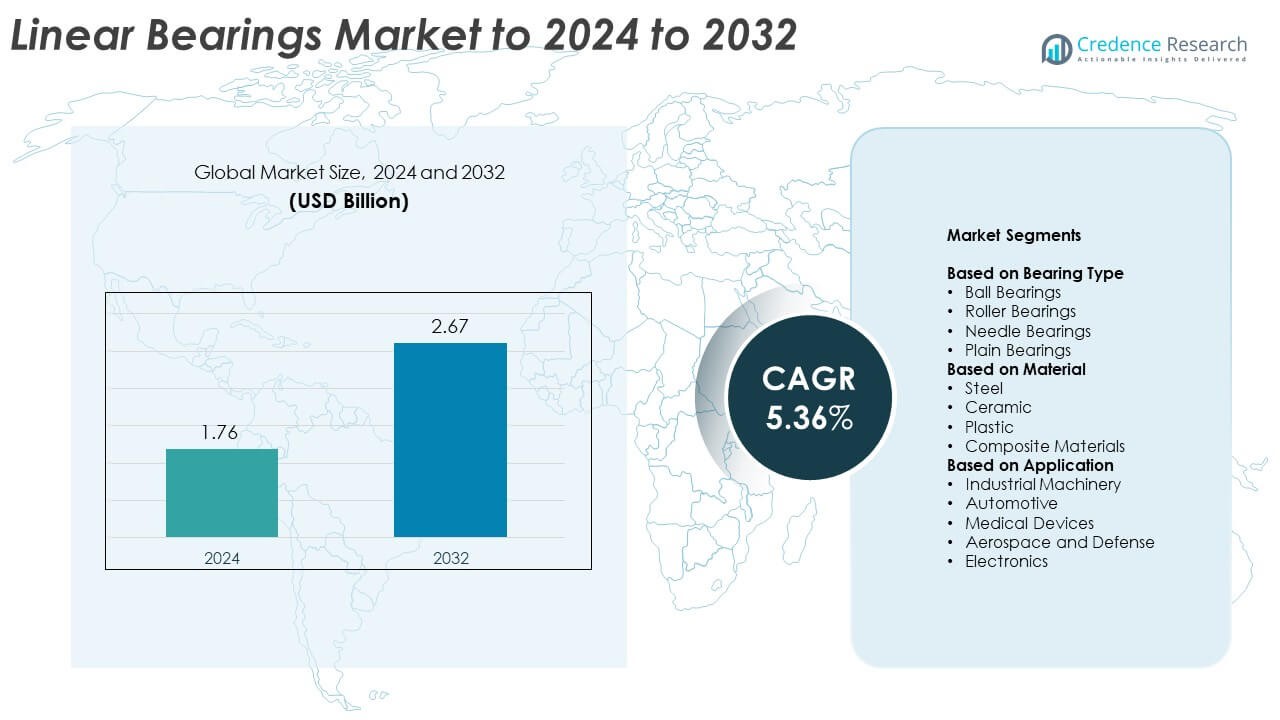

Linear Bearings market size was valued USD 1.76 billion in 2024 and is anticipated to reach USD 2.67 billion by 2032, at a CAGR of 5.36% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Linear Bearings Market Size 2024 |

USD 1.76 Billion |

| Linear Bearings Market, CAGR |

5.36% |

| Linear Bearings Market Size 2032 |

USD 2.67 Billion |

The linear bearings market is led by prominent players including THK Co. Ltd., SKF, NTN Bearing, Schaeffler Technologies, JTEKT Corporation, The Timken Company, Norgren Inc, and NBI Bearings Europe. These companies dominate through strong product portfolios, advanced manufacturing technologies, and global distribution networks. Asia-Pacific emerged as the leading region with a 33.6% market share in 2024, driven by rapid industrial automation and expanding electronics and automotive production in China, Japan, and South Korea. Europe followed with 28.7%, supported by precision engineering and sustainability-focused industries, while North America accounted for 31.4% due to robust investments in smart manufacturing and robotics integration across industrial sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The linear bearings market was valued at USD 1.76 billion in 2024 and is projected to reach USD 2.67 billion by 2032, expanding at a CAGR of 5.36% during the forecast period.

- Growing automation in manufacturing, robotics, and precision engineering is driving market growth as industries seek improved accuracy and operational efficiency.

- The trend toward smart bearings with self-lubricating and sensor-based technologies is reshaping industrial applications and enabling predictive maintenance.

- Competition remains intense, with leading companies focusing on material innovation, product customization, and expanding presence across emerging economies.

- Asia-Pacific led the market with a 33.6% share, followed by North America at 31.4% and Europe at 28.7%, while the ball bearings segment dominated with 46.3% share due to its superior performance and reliability in automated equipment.

Market Segmentation Analysis:

By Bearing Type

The ball bearings segment dominated the linear bearings market in 2024 with a 46.3% share. This dominance is driven by their high precision, low friction, and smooth linear motion, making them essential in industrial automation and robotics. Ball bearings are preferred for applications requiring reduced maintenance and long operational life. Roller bearings follow due to their superior load-carrying capacity, particularly in heavy machinery and rail systems. Growing adoption of precision automation equipment across manufacturing and packaging industries continues to propel the demand for advanced ball bearing systems.

- For instance, Schaeffler’s KLLT linear recirculating ball guides support speeds up to 5 m/s and accelerations to 75 m/s², suiting fast automation moves.

By Material

The steel segment held the largest share of 54.7% in 2024, driven by its durability, strength, and cost efficiency. Steel bearings are widely used in heavy industrial and automotive applications where high load resistance is required. Ceramic bearings are gaining traction for their lightweight and corrosion-resistant properties, especially in high-speed and cleanroom environments. Plastic and composite materials are expanding steadily due to their low noise and chemical resistance, supporting applications in medical and food processing equipment where hygiene and smooth operation are critical.

- For instance, SKF INSOCOAT hybrid bearings provide electrical resistance of ≥ 50 MΩ and withstand 1 000 V DC operating voltage, limiting stray-current damage.

By Application

The industrial machinery segment led the market with a 39.2% share in 2024. Linear bearings are extensively used in CNC machines, packaging lines, and material handling systems to ensure precise linear movement and minimal wear. The automotive sector also contributes significantly, driven by increased use in electric vehicle manufacturing and automated assembly lines. Rising demand for compact and efficient linear motion components in medical devices, aerospace, and electronics further boosts the market, as manufacturers seek higher accuracy, longer lifespan, and reduced maintenance costs across diverse applications.

Key Growth Drivers

Rising Industrial Automation and Robotics Adoption

The growing integration of robotics and automation in manufacturing is a major driver for the linear bearings market. Industries such as automotive, packaging, and electronics rely on high-precision movement for assembly and inspection tasks. Linear bearings enable accurate positioning and reduced vibration in robotic arms and CNC systems. Increasing investments in smart factories and Industry 4.0 initiatives are accelerating the adoption of automated motion systems, boosting the demand for durable and low-friction linear bearing solutions globally.

- For instance, IKO C-Lube linear roller guides run maintenance-free for 20 000 km or 5 years, reducing planned downtime on robots and gantries.

Expanding Automotive and Electric Vehicle Production

The rapid rise in global automobile and EV manufacturing significantly drives linear bearing demand. These bearings support assembly lines, robotic welding, and battery module installations where precision and efficiency are essential. Electric vehicles, in particular, require high-performance motion systems in production equipment for enhanced accuracy. Growing focus on lightweight and energy-efficient vehicles encourages adoption of advanced linear motion components, fostering sustained market growth across major automotive hubs such as China, Germany, Japan, and the United States.

- For instance, NSK’s K1-L lubrication unit enables linear guides to run up to 50 000 km using the unit alone (or well over 100 000 km with an initial grease fill) before maintenance, supporting EV assembly precision equipment.

Growth in Medical and Semiconductor Equipment

The rising use of precision instruments in medical devices and semiconductor manufacturing contributes strongly to market expansion. Linear bearings play a vital role in diagnostic systems, surgical robots, and wafer handling units requiring high stability and minimal contamination. The growing demand for compact, vibration-free, and long-life bearings in these sectors supports higher production efficiency. With ongoing miniaturization trends and the need for sterile, high-accuracy equipment, linear bearings are becoming increasingly critical to maintaining precision in technologically advanced environments.

Key Trends and Opportunities

Adoption of Smart and Self-Lubricating Bearings

Manufacturers are focusing on developing self-lubricating and smart linear bearings integrated with sensors to monitor load, temperature, and vibration. These innovations enhance reliability and reduce maintenance downtime in industrial automation. The shift toward predictive maintenance aligns with Industry 4.0 frameworks, offering real-time data for performance optimization. The adoption of smart bearings provides opportunities for reducing energy use and improving operational safety, making them ideal for demanding applications in automotive, aerospace, and high-speed manufacturing environments.

- For instance, Bosch Rexroth’s IMScompact integrated measuring system offers ± 20 µm/m accuracy and ± 1 µm repeatability, enabling precise condition feedback.

Rising Preference for Lightweight and Eco-Friendly Materials

The trend toward sustainability is promoting the use of lightweight and eco-friendly materials such as engineered plastics and hybrid composites. These materials reduce friction and noise while maintaining performance in sensitive environments. Plastic and composite linear bearings are particularly favored in medical, food, and packaging sectors where corrosion resistance and clean operation are crucial. The growing demand for sustainable design and recyclable components presents an opportunity for manufacturers to align with environmental regulations and gain competitive advantage.

- For instance, igus xiros® A500 polymer ball bearings operate from –100 °C to +150 °C with ceramic balls, enabling lubrication-free, low-mass designs.

Key Challenges

High Cost of Advanced Precision Bearings

The production of high-precision linear bearings involves advanced materials, tight tolerances, and complex manufacturing processes, leading to elevated costs. This restricts adoption among small and medium enterprises that operate on limited budgets. Additionally, replacement and maintenance costs can be high, especially for applications demanding continuous operation under harsh conditions. Manufacturers face the challenge of balancing cost efficiency with performance while maintaining quality standards, particularly as automation expands into cost-sensitive industries.

Availability of Low-Cost Substitutes and Counterfeit Products

The presence of inexpensive and low-quality bearing alternatives in developing markets poses a significant challenge to leading manufacturers. Counterfeit bearings often fail to meet durability and precision requirements, leading to premature failures and reduced operational reliability. These issues undermine consumer confidence and erode brand reputation. To counter this, key players are focusing on stricter supply chain controls, authentication technologies, and partnerships with authorized distributors to ensure the availability of genuine, high-performance linear bearing products.

Regional Analysis

North America

North America held a 31.4% share of the linear bearings market in 2024, driven by the strong presence of automation and industrial equipment manufacturers. The United States leads regional demand due to widespread adoption of robotics, precision machinery, and aerospace manufacturing. Expanding electric vehicle production and high investment in smart factories are fueling growth. Canada’s growing medical device sector and Mexico’s emerging automotive assembly hubs also contribute significantly. The region benefits from advanced R&D capabilities and established distribution networks, ensuring steady adoption of high-performance linear bearing systems across industries.

Europe

Europe accounted for a 28.7% share in 2024, supported by robust manufacturing bases in Germany, Italy, and France. The region’s focus on precision engineering, renewable energy projects, and sustainable automation solutions drives steady demand. Germany dominates with strong applications in automotive, machine tools, and robotics. The European Union’s emphasis on energy efficiency and reduced friction components encourages innovations in lightweight bearings. Expanding aerospace and semiconductor sectors further boost the market, as manufacturers adopt advanced linear motion technologies to enhance equipment reliability and production accuracy across industrial operations.

Asia-Pacific

Asia-Pacific led the global market with a 33.6% share in 2024, emerging as the fastest-growing region. China, Japan, and South Korea dominate due to their leadership in electronics, automotive, and semiconductor manufacturing. The region’s rapid industrial automation, coupled with growing demand for high-precision equipment, drives large-scale adoption of linear bearings. India and Southeast Asia are witnessing strong investments in industrial and medical production facilities. Cost-effective manufacturing, technological innovation, and expanding export capacity position Asia-Pacific as a global hub for linear bearing production and application expansion across diverse end-use sectors.

Latin America

Latin America captured a 3.4% share of the linear bearings market in 2024, supported by growing industrial modernization across Brazil and Mexico. Rising automation in automotive assembly, packaging, and mining equipment manufacturing is fueling market expansion. Brazil’s increasing adoption of precision machinery and robotics in production plants enhances regional demand. Additionally, government initiatives encouraging domestic manufacturing and infrastructure projects contribute to market growth. However, slower technological adoption and limited access to advanced materials moderately restrain development, presenting opportunities for international bearing manufacturers to expand their footprint in the region.

Middle East & Africa

The Middle East & Africa region accounted for a 2.9% share in 2024, primarily driven by industrial growth in the UAE, Saudi Arabia, and South Africa. Rising investments in oil and gas, mining, and logistics industries are supporting the use of linear bearings in automated machinery. Ongoing diversification efforts in the Gulf countries toward manufacturing and renewable energy further stimulate demand. The region’s gradual adoption of precision engineering technologies and infrastructure modernization programs is expanding opportunities, although high import dependency and limited local production remain key challenges for market penetration.

Market Segmentations:

By Bearing Type

- Ball Bearings

- Roller Bearings

- Needle Bearings

- Plain Bearings

By Material

- Steel

- Ceramic

- Plastic

- Composite Materials

By Application

- Industrial Machinery

- Automotive

- Medical Devices

- Aerospace and Defense

- Electronics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The linear bearings market is characterized by the presence of major global players such as THK Co. Ltd., NTN Bearing, Schaeffler Technologies, SKF, JTEKT Corporation, The Timken Company, Norgren Inc, NBI Bearings Europe, Samick, Ningbo Yinzhou Weixing Bearing, MPS Microsystem, RBC, NBB-Bearing, and Nippon Bearing. The market remains highly competitive, driven by product innovation, precision engineering, and technological integration. Companies are focusing on advanced materials, smart sensing capabilities, and self-lubricating mechanisms to enhance performance and reduce maintenance costs. Strategic mergers, partnerships, and global expansion into emerging markets are common to strengthen distribution and customer reach. Continuous investments in automation, R&D, and sustainability are shaping the competition, as manufacturers strive to meet growing demand for high-accuracy and durable linear motion systems. Moreover, strong after-sales service and customization capabilities are becoming key differentiators among leading suppliers aiming to capture a larger share of the industrial automation segment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- THK Co. Ltd.

- NTN Bearing

- Schaeffler Technologies

- SKF

- JTEKT Corporation

- The Timken Company

- Norgren Inc

- NBI Bearings Europe

- Samick

- Ningbo Yinzhou Weixing Bearing

- MPS Microsystem

- RBC

- NBB-Bearing

- Nippon Bearing

Recent Developments

- In 2024, Schaeffler Group Completed the acquisition of Vitesco Technologies, significantly extending its product offering in power electronics and sensors to become a leading motion technology company.

- In 2023, SKF Expanded its manufacturing facility in Changshan, China, with an investment to meet growing demand for industrial and automotive bearings in the Asia-Pacific region.

- In 2023, RBC Bearings Introduced the acquisition of Specline, Inc., a manufacturer of engineered precision bearings and components for commercial and defense aerospace markets.

Report Coverage

The research report offers an in-depth analysis based on Bearing Type, Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The linear bearings market will continue growing with rising industrial automation across manufacturing sectors.

- Increasing demand for robotics and precision machinery will drive advanced bearing adoption.

- Asia-Pacific will remain the fastest-growing region, supported by expanding production and exports.

- Europe will focus on energy-efficient and lightweight bearing designs for sustainability.

- Smart and sensor-based linear bearings will gain traction in predictive maintenance applications.

- The automotive industry will boost demand through electric vehicle manufacturing and assembly automation.

- Growth in medical devices and semiconductor industries will create new high-precision opportunities.

- Manufacturers will invest in hybrid materials to reduce noise and enhance durability.

- Strategic collaborations and product innovation will strengthen competition among key global players.

- Digital manufacturing and Industry 4.0 integration will shape long-term market expansion.