Market Overview

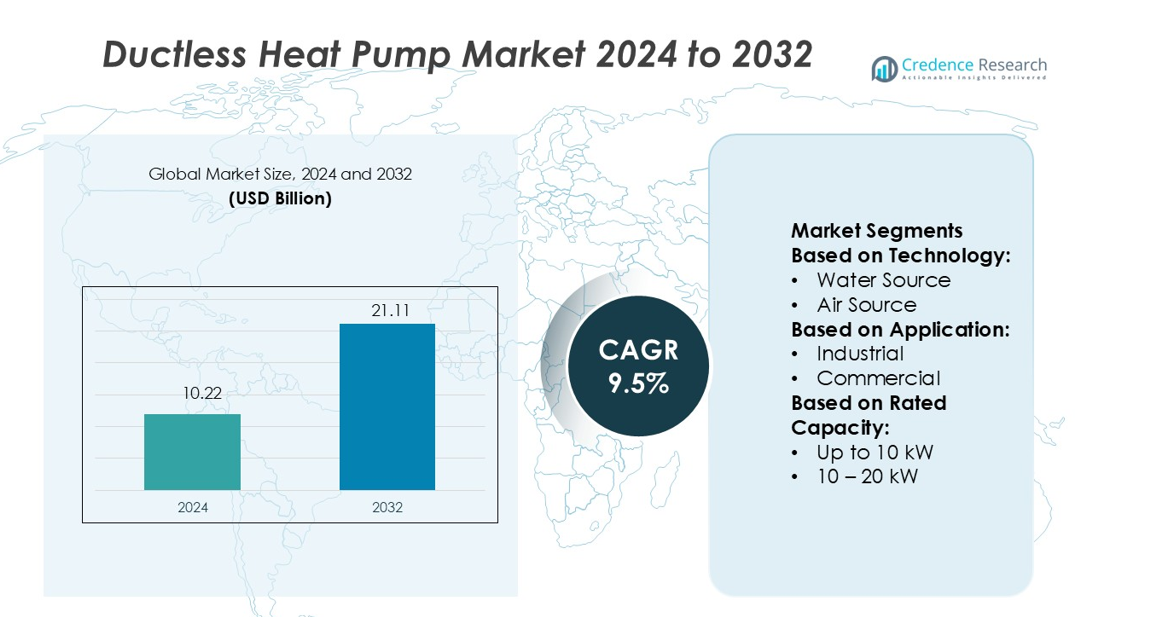

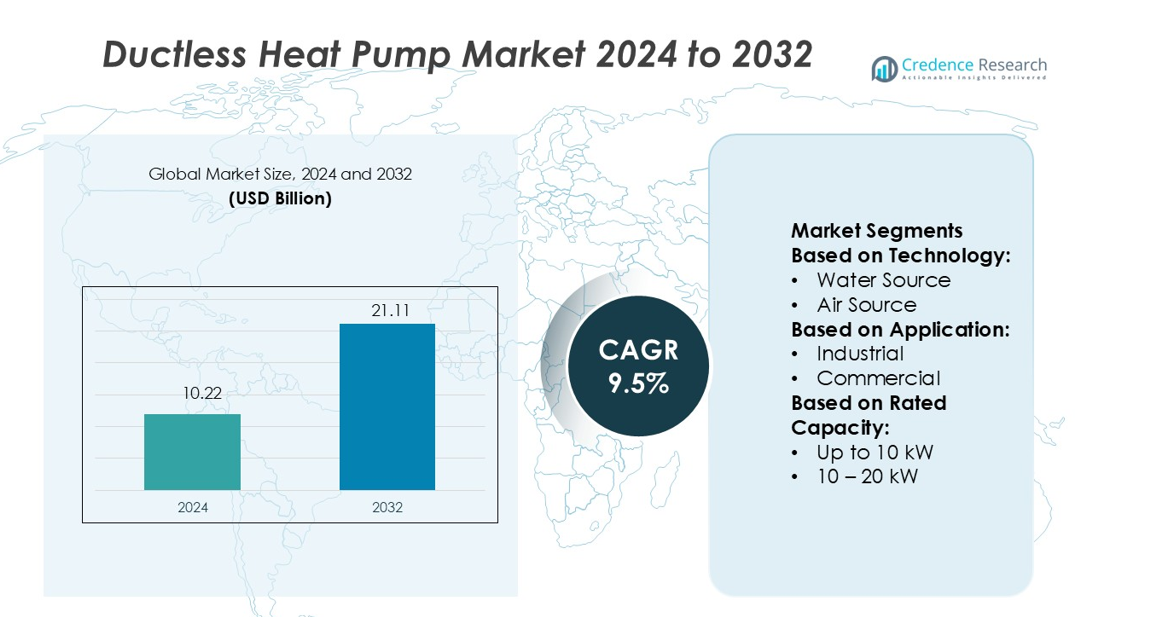

Ductless Heat Pump Market size was valued USD 10.22 billion in 2024 and is anticipated to reach USD 21.11 billion by 2032, at a CAGR of 9.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ductless Heat Pump Market Size 2024 |

USD 10.22 billion |

| Ductless Heat Pump Market, CAGR |

9.5% |

| Ductless Heat Pump Market Size 2032 |

USD 21.11 billion |

The Ductless Heat Pump Market is shaped by leading companies such as Fujitsu General, Johnson Controls, Argoclima, Bosch Thermotechnology, Blue Star, Carrier, Bryant Heating & Cooling, Gree Electric Appliances, Daikin, and Klimaire Products. These players focus on technological innovation, energy efficiency, and smart connectivity to strengthen their competitive positions. Their strategies include expanding product portfolios, optimizing inverter technology, and enhancing regional distribution networks. Asia Pacific leads the global market with a 34% market share, driven by rapid urbanization, strong residential demand, and government energy-efficiency programs. The region’s large-scale housing development and growing adoption of sustainable HVAC solutions further reinforce its dominant market position.

Market Insights

- The Ductless Heat Pump Market was valued at USD 10.22 billion in 2024 and is expected to reach USD 21.11 billion by 2032, growing at a CAGR of 9.5%.

- Rising demand for energy-efficient HVAC systems and strong government support drive market growth across residential and commercial applications.

- Asia Pacific leads the market with a 34% share, supported by rapid urbanization and large-scale housing development, followed by North America at 32% and Europe at 28%.

- Key players focus on inverter technology, smart connectivity, and expanded product portfolios to strengthen competitiveness.

- High initial installation costs and performance limitations in extreme climates remain key restraints, while air source technology holds the largest segment share due to its cost efficiency and flexibility.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology

Air source heat pumps dominate the Ductless Heat Pump Market with a strong market share. Their lower installation costs, flexible design, and compatibility with existing ductless systems drive widespread adoption. These units deliver efficient heating and cooling in varied climates, supporting rapid market penetration. Water source and ground source systems gain traction for high energy efficiency but face higher upfront costs. Hybrid heat pumps show increasing acceptance for their adaptive performance and cost savings. Growing demand for low-maintenance and energy-efficient HVAC solutions further strengthens air source heat pump adoption in both residential and commercial settings.

- For instance, Fujitsu General AIRSTAGE™ V-II system has an operating range that included -20°C for heating and 46°C for cooling, confirming that it was capable of performing in this range of temperatures.

By Application

Residential applications lead the market with the largest share, supported by rapid housing development and energy-efficient building standards. Single-family homes dominate this segment due to rising consumer preference for flexible temperature control and lower operating costs. Multi-family units also show steady growth as property developers adopt ductless solutions for reduced installation complexity. Commercial, hospitality, and healthcare sectors expand adoption to meet green building goals and improve indoor comfort. Educational institutes and logistics facilities add further demand, driven by energy savings and government incentives supporting clean heating and cooling technologies.

- For instance, Hitachi air365 Hybrid system, a residential dual-fuel system. The system pairs a Hitachi Mini VRF heat pump with an existing or new gas furnace, using a smart sensor to automatically select the most efficient heating source based on outdoor temperature to enable significant energy savings.

By Rated Capacity

Systems up to 10 kW hold the dominant market share due to their suitability for residential and small commercial spaces. These units offer cost-effective installation, low noise levels, and high operational efficiency, making them attractive for homeowners and small businesses. The 10–20 kW range gains traction in medium-sized buildings, including offices and retail spaces. Higher capacity segments above 20 kW serve industrial and large commercial facilities, focusing on performance and reliability. Strong adoption of smaller capacity systems reflects the growing demand for flexible and efficient temperature control in compact spaces

Key Growth Drivers

Rising Demand for Energy-Efficient Heating and Cooling Solutions

The increasing focus on energy efficiency is a major driver of the Ductless Heat Pump Market. Homeowners and businesses are shifting toward systems that reduce power consumption and carbon emissions. Ductless heat pumps offer superior efficiency compared to traditional HVAC systems, supporting lower utility costs and compliance with energy regulations. Government incentives and tax rebates further boost adoption. Growing environmental awareness among consumers accelerates the demand for eco-friendly temperature control solutions across residential and commercial spaces, positioning ductless systems as a preferred sustainable alternative.

- For instance, Argoclima developed the DELUXE 9000 inverter heat pump, which features a Seasonal Energy Efficiency Ratio (SEER) of 8.5 and a Seasonal Coefficient of Performance (SCOP) of 4.6 (for the average climate).

Supportive Government Policies and Incentives

Government programs promoting renewable energy and energy-efficient technologies strongly support market growth. Many countries offer rebates, subsidies, and low-interest financing to encourage ductless heat pump adoption. Policies promoting decarbonization and net-zero emission targets push industries and homeowners to upgrade their HVAC systems. Compliance with stricter building energy codes accelerates installation in new constructions and retrofits. This policy support not only reduces upfront costs for consumers but also stimulates steady market expansion across residential, commercial, and institutional applications.

- For instance, Bosch Thermotechnology introduced the IDS Premium Connected Heat Pump series. A 3-ton unit can have a heating capacity of approximately 10.5 kW and some models achieve an HSPF2 rating of up to 10.5.

Growing Construction and Retrofit Activities

Rapid urbanization and rising construction investments strengthen demand for ductless heat pumps. New residential and commercial developments increasingly adopt energy-efficient HVAC systems to meet green building standards. Retrofit activities in older structures also contribute to market expansion, as ductless systems allow quick installation without complex ductwork. Builders and property owners favor these solutions for their low maintenance, flexible zoning, and operational cost benefits. Rising investments in modernizing buildings and improving indoor comfort support long-term market growth across key regions.

Key Trends & Opportunities

Expansion of Smart and Connected HVAC Systems

The integration of smart controls and IoT technology is shaping the future of the Ductless Heat Pump Market. Modern units now feature remote monitoring, automated temperature control, and energy optimization through mobile apps. Consumers prefer connected systems that offer better comfort and real-time energy insights. Manufacturers are investing in advanced sensors and intelligent algorithms to improve performance. This digital shift presents strong opportunities for companies to enhance user experience, reduce operational costs, and align with smart building development trends.

- For instance, Blue Star launched the Smart Inverter Series equipped with Wi-Fi connectivity, supporting voice control through Google Assistant and Alexa, and enabling 24×7 remote monitoring through the Blue Star Smart App.

Growth in Renewable Energy Integration

Ductless heat pumps are increasingly paired with renewable energy systems like solar panels to boost energy efficiency. This integration supports net-zero energy goals and reduces dependency on traditional power sources. The trend is gaining traction in residential and commercial sectors, particularly in regions with strong sustainability targets. Advancements in inverter technology and compatibility with renewable energy sources offer manufacturers new growth avenues. This shift aligns with global efforts to lower carbon emissions and promote clean energy adoption in HVAC solutions.

- For instance, Bryant’s Evolution™ Extreme 24 cold-climate heat pump offers up to 22 SEER2 cooling and up to 10.5 HSPF2 heating. It is designed to maintain operation down to –15 °F (approximately –26 °C), though heating capacity decreases at the most extreme temperatures.

Rising Adoption in Commercial and Institutional Buildings

Commercial spaces and public buildings are adopting ductless systems to improve indoor air quality and reduce energy expenses. Offices, educational institutes, and healthcare facilities favor these solutions for flexible zoning and temperature control. Their quiet operation and easy installation make them ideal for retrofit projects. Growing interest in meeting environmental certifications such as LEED further boosts adoption. This trend creates expansion opportunities for manufacturers targeting large-scale infrastructure and public sector projects.

Key Challenges

High Initial Installation Costs

The upfront cost of ductless heat pumps remains a major barrier to market growth. Although these systems offer long-term energy savings, the initial investment is higher than traditional HVAC options. Consumers in price-sensitive markets often delay or avoid upgrades despite efficiency benefits. This cost factor impacts adoption rates, especially in small residential projects. Addressing pricing through financing programs, rebates, and cost-effective product innovations will be essential to overcome this challenge and drive broader market penetration.

Performance Limitations in Extreme Climates

Ductless heat pumps face operational challenges in very cold or hot climates. Their performance may decline at extreme temperatures, limiting heating or cooling output. This constraint reduces their suitability for certain regions without supplemental systems. Manufacturers are developing advanced models with improved compressor technology and defrost mechanisms to address these issues. However, climate-related limitations remain a key hurdle for achieving widespread adoption, particularly in regions with harsh weather conditions and high energy demands.

Regional Analysis

North America

North America holds a 32% market share in the Ductless Heat Pump Market, driven by increasing residential installations and strong energy-efficiency policies. The U.S. leads the region with rising adoption in single-family and multi-family homes, supported by federal and state incentives. Commercial sectors, including offices and healthcare facilities, are also shifting to ductless systems to meet green building standards. Advancements in cold-climate heat pump technology further expand applications across northern states and Canada. Growing awareness of cost savings and environmental benefits continues to support steady regional demand and infrastructure modernization efforts.

Europe

Europe accounts for a 28% market share, supported by strict energy efficiency regulations and climate goals. Countries like Germany, France, and the UK are accelerating adoption to reduce carbon emissions from buildings. Retrofit projects in older structures play a key role in market growth, supported by financial incentives and EU decarbonization initiatives. Demand from residential and public sector buildings continues to expand, especially in urban areas. Cold-weather performance improvements also encourage wider acceptance. Europe’s commitment to achieving net-zero targets strongly positions ductless heat pumps as a critical sustainable HVAC solution.

Asia Pacific

Asia Pacific leads the global market with a 34% market share, driven by rapid urbanization and strong residential demand. China, Japan, and South Korea dominate installations, supported by large-scale housing projects and government efficiency programs. Expanding construction in commercial and hospitality sectors adds further momentum. High population density and rising living standards increase demand for flexible temperature control solutions. Manufacturers focus on developing cost-effective, energy-efficient models to serve diverse climatic conditions. Ongoing policy support and rising awareness of energy savings make Asia Pacific the fastest-growing region in the ductless heat pump landscape.

Latin America

Latin America represents a 4% market share, with growing adoption in residential and light commercial sectors. Brazil and Mexico are the main contributors, driven by expanding urban housing and improved economic conditions. Rising energy costs push consumers toward energy-efficient HVAC solutions. However, limited consumer awareness and lower purchasing power challenge rapid growth. Government initiatives to promote renewable energy and efficient systems are gradually improving market penetration. Manufacturers are targeting this region with low-cost, adaptable systems designed for warm climates, supporting steady but moderate market expansion across key urban centers.

Middle East & Africa

The Middle East & Africa hold a 2% market share, with adoption focused mainly on the commercial and hospitality sectors. The hot climate in Gulf countries supports strong cooling demand, positioning ductless systems as cost-efficient alternatives to conventional air conditioning. Hotels, retail spaces, and offices lead installations, driven by energy savings and flexibility. Residential adoption remains limited due to pricing concerns and lack of awareness. However, growing smart city initiatives and increasing investment in energy-efficient infrastructure are expected to boost long-term demand. Market expansion remains gradual but promising in urbanized regions.

Market Segmentations:

By Technology:

By Application:

By Rated Capacity:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Ductless Heat Pump Market is highly competitive, with key players including Fujitsu General, Johnson Controls, Argoclima, Bosch Thermotechnology, Blue Star, Carrier, Bryant Heating & Cooling, Gree Electric Appliances, Daikin, and Klimaire Products. The Ductless Heat Pump Market is defined by strong competition, rapid technological advancements, and expanding global demand. Manufacturers are prioritizing innovation in inverter technology, energy efficiency, and smart control systems to strengthen their market position. Companies focus on developing flexible, cold-climate-compatible systems to address diverse regional needs. Strategic initiatives such as R&D investments, product diversification, and channel expansion drive their competitiveness. Growing emphasis on sustainability and regulatory compliance also influences product development strategies. The rising integration of IoT-enabled solutions enhances user control, energy management, and performance optimization, supporting long-term market growth and industry transformation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fujitsu General

- Johnson Controls

- Argoclima

- Bosch Thermotechnology

- Blue Star

- Carrier

- Bryant Heating & Cooling

- Gree Electric Appliances

- Daikin

- Klimaire Products

Recent Developments

- In September 2024, Samsung Electronics introduced the Bespoke AI Laundry Combo to the European market. The Bespoke AI Laundry Combo will be controlled by AI, heat pump technology, and a 7” display to deliver a convenient, entertaining laundry experience that is also energy efficient.

- In July 2024, Bosch is set to expand its HVAC portfolio through a significant acquisition. The company has agreed to purchase the residential and light commercial HVAC business from Johnson Controls and Hitachi.

- In May 2024, Samsung and Lennox have joined forces to establish Samsung Lennox HVAC North America, a new venture focused on distributing ductless air conditioning and heat pump systems in the U.S. and Canadian markets. The joint venture will offer a range of ductless products, including mini-split, multi-split, and VRF systems, aiming to deliver efficient heating and cooling solutions to customers across these regions.

- In May 2024, Daikin Comfort Technologies North America, Inc. has been awarded the 2024 Seal Sustainable Product Award for its ATMOSPHERA system. This innovative single-zone ductless heat pump is the first in North America to utilize R-32, a refrigerant with a reduced global warming impact.

Report Coverage

The research report offers an in-depth analysis based on Technology, Application, Rated Capacity and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with rising demand for energy-efficient HVAC solutions.

- Smart and connected ductless systems will gain wider adoption in residential and commercial buildings.

- Cold-climate compatible models will expand the market in regions with extreme weather.

- Government incentives and energy regulations will continue to drive installations.

- Retrofit projects in older buildings will contribute significantly to market expansion.

- Integration with renewable energy systems will enhance overall system efficiency.

- Manufacturers will focus on reducing upfront costs to increase affordability.

- Urbanization and new housing development will create strong demand opportunities.

- Technological advancements in inverter and sensor control will improve system performance.

- Global competition will push companies toward innovation and sustainable product strategies.