Market Overview

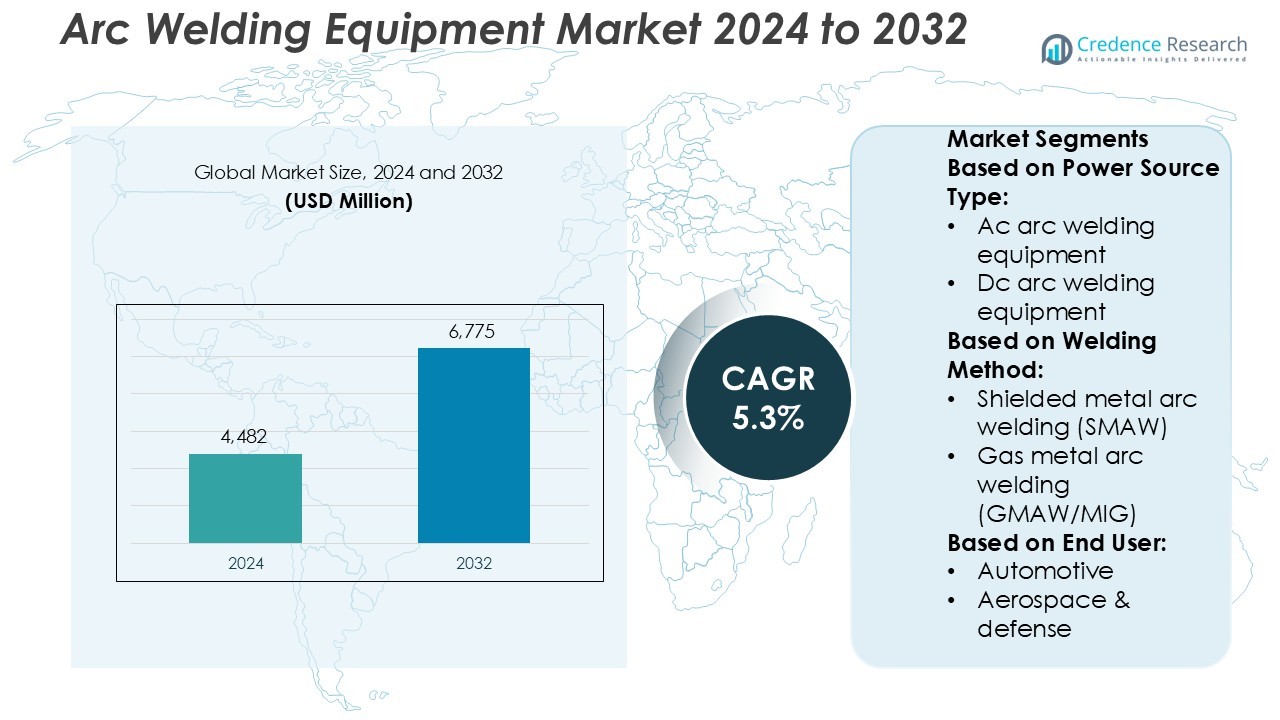

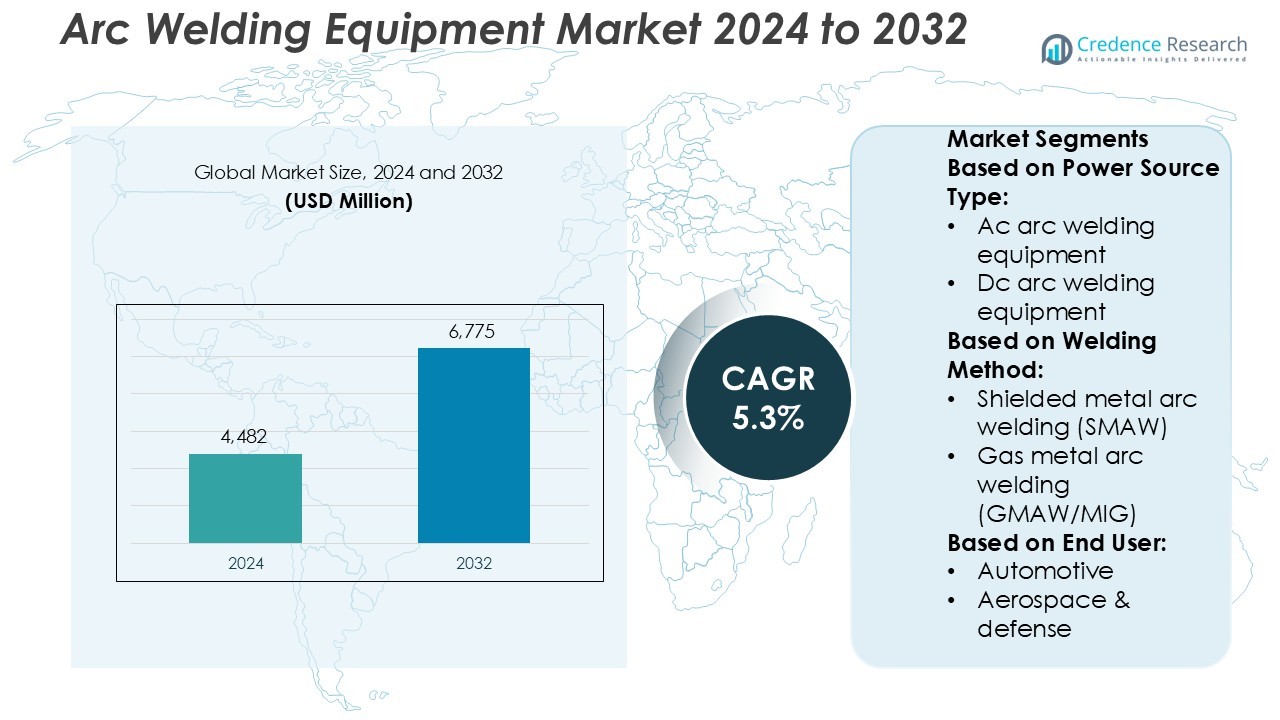

Arc Welding Equipment Market size was valued USD 4,482 million in 2024 and is anticipated to reach USD 6,775 million by 2032, at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Arc Welding Equipment Market Size 2024 |

USD 4,482 Million |

| Arc Welding Equipment Market, CAGR |

5.3% |

| Arc Welding Equipment Market Size 2032 |

USD 6,775 Million |

The Arc Welding Equipment Market is led by prominent players including Kemppi Oy, Atlas Copco, Air Liquide Welding, Panasonic Welding Systems Co., Ltd., Emerson Electric, Fronius International GmbH, Obara Corporation, Colfax Corporation, Robert Bosch, and Stanley Decker. These companies focus on automation, digital integration, and energy-efficient technologies to enhance welding performance and reliability. Product innovation, strategic partnerships, and expansion into emerging markets remain key competitive strategies. Asia-Pacific dominates the global market with a 37% share, driven by rapid industrialization, large-scale infrastructure development, and strong manufacturing growth in countries such as China, India, Japan, and South Korea.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Arc Welding Equipment Market was valued at USD 4,482 million in 2024 and is projected to reach USD 6,775 million by 2032, growing at a CAGR of 5.3%.

- Rising demand from manufacturing, construction, and automotive sectors drives the adoption of advanced welding systems.

- Automation, digital integration, and energy-efficient inverter technologies are shaping market trends toward high-performance welding solutions.

- The competitive landscape features strong innovation and global expansion efforts by leading players, though high equipment costs and skilled labor shortages remain challenges.

- Asia-Pacific holds a dominant 37% regional share, supported by rapid industrialization and infrastructure growth, while DC arc welding equipment leads by power source type due to its precision and consistent output.

Market Segmentation Analysis:

By Power Source Type

DC arc welding equipment holds the dominant share of the Arc Welding Equipment Market. Its popularity stems from superior control, stable arcs, and deeper weld penetration compared to AC systems. DC power sources are preferred in industries such as automotive and heavy manufacturing, where precision and consistent quality are crucial. AC welding equipment remains in demand for aluminum and repair work due to its lower cost and versatility. The “others” category includes hybrid and inverter-based sources gaining adoption for energy efficiency and portability in small-scale and field operations.

- For instance, Kemppi’s Minarc T 223 DC portable TIG machine outputs up to 220 amps and weighs only 9.6 kg. DC power sources are preferred in industries such as automotive and heavy manufacturing, where precision and consistent quality are crucial.

By Welding Method

Gas metal arc welding (GMAW/MIG) leads the market with the largest share among welding methods. The process offers high deposition rates, ease of automation, and suitability for a range of metals, making it a standard in automotive and fabrication industries. Shielded metal arc welding (SMAW) continues to be used for its simplicity and low equipment cost, particularly in construction and repair applications. Flux-cored arc welding (FCAW) finds growing use in structural steelwork due to its high productivity in outdoor conditions, while other methods serve niche and specialized welding needs.

- For instance, Atlas Copco’s Industrial Technique division integrated a robotic welding cell in a vehicle chassis line that achieved a wire-feed rate of 12 m/min and a deposition current of 350 A using a GMAW system in 2023 (internal case study).

By End User

The manufacturing sector dominates the market, accounting for the largest end-user share. Rising automation and demand for durable, high-quality joints in machinery and equipment production drive adoption. Automotive and construction industries also represent significant consumers, leveraging welding systems for body frames, infrastructure, and pipelines. The aerospace and defense sector demands advanced, precision-controlled welding systems for lightweight alloys. Oil and gas industries invest in robust systems for high-pressure pipeline welding, while others include small fabrication workshops and custom component producers contributing to overall market growth.

Key Growth Drivers

- Rising Industrial Automation and Manufacturing Expansion

The increasing adoption of automated welding systems across manufacturing facilities drives market growth. Automation enhances weld precision, productivity, and consistency while minimizing material waste and labor dependency. Expanding automotive, construction, and heavy machinery sectors further strengthen equipment demand. Growing investments in smart factories and Industry 4.0 integration promote the use of advanced robotic and inverter-based arc welding systems for high-speed, multi-axis operations across global production environments.

- For instance, Air Liquide’s subsidiary Airgas offers the BotX™ Cobot Welding System which clients report achieved a 2 × to 3 × increase in productivity compared with manual welding.

- Increasing Infrastructure and Construction Activities

Rapid urbanization and infrastructure development across emerging economies boost demand for arc welding equipment. Large-scale projects in transportation, energy, and commercial construction require reliable welding tools for structural integrity and long-term performance. Governments are investing heavily in bridges, pipelines, and industrial facilities, creating a robust need for efficient, portable welding systems. Additionally, the focus on sustainable and modular construction techniques supports the adoption of energy-efficient arc welding equipment in both on-site and off-site applications.

- For instance, Panasonic’s Indian arm launched the IGBT-controlled DC TIG welding power source model YD-400AT3DJU at its Jhajjar, Haryana facility that supports weld currents as low as 4 amps and is built in a hermetically sealed, dust-proof and waterproof structure.

- Technological Advancements in Welding Equipment

The introduction of inverter technology, digital control interfaces, and energy-efficient systems has transformed welding operations. These innovations provide enhanced arc stability, reduced power consumption, and higher operational flexibility. Manufacturers are integrating IoT-enabled monitoring, adaptive controls, and predictive maintenance features to improve productivity and reduce downtime. Such technological progress encourages industries to upgrade legacy systems, leading to sustained equipment demand and increased penetration of advanced arc welding solutions across industrial applications.

Key Trends & Opportunities

- Growing Shift Toward Energy-Efficient and Portable Systems

Manufacturers are focusing on developing lightweight, portable arc welding systems that consume less energy without compromising performance. Compact inverter-based machines are becoming popular for remote and on-site applications. These systems meet sustainability targets and reduce carbon footprints. The growing preference for mobility and eco-friendly solutions among contractors and fabrication units creates lucrative opportunities for equipment suppliers emphasizing low-energy, high-efficiency technologies.

- For instance, Emerson launched the “Energy Manager” plug-and-play solution that monitors up to 10 endpoints (expandable to 50) in real-time, helping manufacturers reduce idle-machine energy by up to 30 %.

- Rising Demand for Automated and Robotic Welding Solutions

The integration of robotics with arc welding processes is reshaping modern production lines. Automated welding offers precision, repeatability, and reduced cycle times in high-volume manufacturing environments. Automotive and aerospace industries are adopting robotic systems to meet tight tolerances and quality standards. This trend opens opportunities for vendors to provide integrated robotic-welding packages and AI-based process control tools that ensure consistent weld quality under varying material and environmental conditions.

- For instance, Fronius’s robotic welding power-source platform “TPS/i Robotics” supports welding currents up to 600 A, enabling simultaneous use of standard, pulse, and CMT processes in robot-mounted systems.

- Expansion in Renewable Energy and Offshore Projects

Growing investments in wind, solar, and offshore energy infrastructure present emerging opportunities for arc welding manufacturers. The need for durable welds in turbine towers, offshore platforms, and energy storage structures drives specialized equipment demand. The development of corrosion-resistant materials and advanced welding consumables further supports these projects. This transition toward renewable energy infrastructure fuels market expansion across both developed and developing economies.

Key Challenges

- Shortage of Skilled Welding Workforce

A global shortage of skilled welders poses a major challenge to the arc welding equipment market. Operating advanced systems requires technical proficiency, yet many regions face declining enrollment in vocational welding programs. The widening skills gap restricts productivity and limits the adoption of automated systems. Manufacturers and training institutes are addressing this by developing simulation-based training and remote learning modules to upskill technicians and support industry modernization.

- High Initial Cost and Maintenance RequirementsThe high cost of advanced arc welding systems, particularly automated and robotic setups, acts as a restraint for small and medium enterprises. Initial investment, combined with ongoing maintenance and consumable costs, can hinder adoption. Additionally, downtime due to component wear or software calibration increases operational expenses. Manufacturers are responding with modular systems, leasing options, and service-based models to make advanced equipment more accessible and cost-effective for smaller production units.

Regional Analysis

North America

North America holds a market share of 28% in the Arc Welding Equipment Market. The region’s strong industrial base, especially in automotive, aerospace, and energy sectors, drives consistent demand for advanced welding systems. The United States leads adoption due to high automation levels and technological innovation in manufacturing. Growth in oil and gas pipeline projects further boosts demand for portable and high-performance arc welders. Government investments in infrastructure rehabilitation and renewable energy expansion support market stability, while the presence of major manufacturers fosters ongoing product advancements across the region.

Europe

Europe accounts for 24% of the global arc welding equipment market, driven by its robust automotive and industrial machinery sectors. Germany, Italy, and France dominate with advanced production capabilities and emphasis on energy-efficient welding technologies. The European Union’s stringent safety and emission standards encourage manufacturers to adopt eco-friendly, low-emission welding systems. Automation and robotic welding are gaining traction in automotive and shipbuilding industries. Ongoing infrastructure renewal projects, coupled with steady demand from renewable energy equipment manufacturing, further enhance regional market performance and technology adoption across industrial segments.

Asia-Pacific

Asia-Pacific leads the Arc Welding Equipment Market with a 37% market share, making it the dominant regional segment. Rapid industrialization, strong construction activity, and large-scale manufacturing expansion in China, India, Japan, and South Korea drive growth. The region benefits from low production costs, growing foreign investments, and rising demand for consumer goods and vehicles. Local manufacturers are increasingly adopting automated and inverter-based welding systems for enhanced productivity. Government initiatives promoting industrial modernization and infrastructure development continue to boost demand, making Asia-Pacific a global manufacturing and welding technology hub.

Latin America

America captures 6% of the global market share, supported by expanding construction, oil and gas, and automotive industries. Brazil and Mexico are key contributors, driven by growing industrial production and infrastructure projects. The rising adoption of energy-efficient and portable arc welding systems is enhancing operational efficiency in manufacturing and repair sectors. Government-led development in renewable energy and transportation networks is expected to accelerate market growth. However, limited technological integration and high import dependency may restrain adoption compared to more industrialized regions.

Middle East & Africa

The Middle East & Africa region holds a 5% share in the global Arc Welding Equipment Market. Growth is primarily driven by oil and gas pipeline projects, infrastructure development, and the establishment of new industrial zones. Countries such as Saudi Arabia, the UAE, and South Africa are witnessing increased use of automated welding systems to improve efficiency and quality in energy and construction sectors. Investments in renewable energy and industrial diversification are strengthening regional demand. However, slower technological adoption and limited local manufacturing capabilities pose mild growth constraints.

Market Segmentations:

By Power Source Type:

- Ac arc welding equipment

- Dc arc welding equipment

By Welding Method:

- Shielded metal arc welding (SMAW)

- Gas metal arc welding (GMAW/MIG)

By End User:

- Automotive

- Aerospace & defense

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Arc Welding Equipment Market features strong competition among key players such as Kemppi Oy, Atlas Copco, Air Liquide Welding, Panasonic Welding Systems Co., Ltd., Emerson Electric, Fronius International GmbH, Obara Corporation, Colfax Corporation, Robert Bosch, and Stanley Decker. The Arc Welding Equipment Market is highly competitive, driven by rapid technological advancements and growing demand for automation. Manufacturers are investing in research and development to create energy-efficient, portable, and digitally integrated welding systems. The market is witnessing a strong shift toward inverter-based and robotic welding technologies that enhance productivity and precision in industrial applications. Strategic collaborations, mergers, and product innovations remain key strategies to strengthen global presence. Companies are also expanding their service networks and adopting smart monitoring systems to improve operational efficiency and meet evolving customer requirements across industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kemppi Oy

- Atlas Copco

- Air Liquide Welding

- Panasonic Welding Systems Co., Ltd.

- Emerson Electric

- Fronius International GmbH

- Obara Corporation

- Colfax Corporation

- Robert Bosch

- Stanley Decker

Recent Developments

- In April 2025, TRUMPF and SCHMID Group partnered to co-develop laser-plus-wet-chemistry processes for glass interposers used in advanced semiconductor packages, broadening TRUMPF’s photonics exposure beyond metal welding.

- In June 2024, Burnsview Secondary School in North Delta received a $3,500 grant from the CWB Welding Foundation to support its welding education program. The funds will be used to purchase a TIG welder, offering students hands-on experience with industry-standard equipment and materials.

- In March 2023, voestalpine Böhler Welding Group GmbH launched Böhler Welding`s Crane & Lifting Full Welding Solution. The product helped the company to achieve 50% faster welding speed.

- In February 2023, Miller Electric Mfg. LLC launched the Copilot Collaborative Welding System in February 2023. It is a cobot with advanced capabilities intended for welders and shops new to robotic welding who are looking for solutions to keep up with demand.

Report Coverage

The research report offers an in-depth analysis based on Power Source Type, Welding Method, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow with rising adoption of automated and robotic welding systems.

- Demand for energy-efficient and inverter-based welding equipment will increase across industries.

- Integration of IoT and AI technologies will enhance real-time monitoring and process control.

- Infrastructure expansion and industrialization in emerging economies will boost equipment sales.

- Portable and lightweight welding machines will gain popularity in construction and repair sectors.

- Manufacturers will focus on digital welding solutions to improve precision and productivity.

- Training programs and simulation tools will address the shortage of skilled welders.

- Strategic collaborations and mergers will strengthen global supply and innovation capacity.

- Growth in renewable energy and transportation sectors will create new application opportunities.

- Sustainability goals will drive the development of low-emission and eco-friendly welding systems.