Market Overview

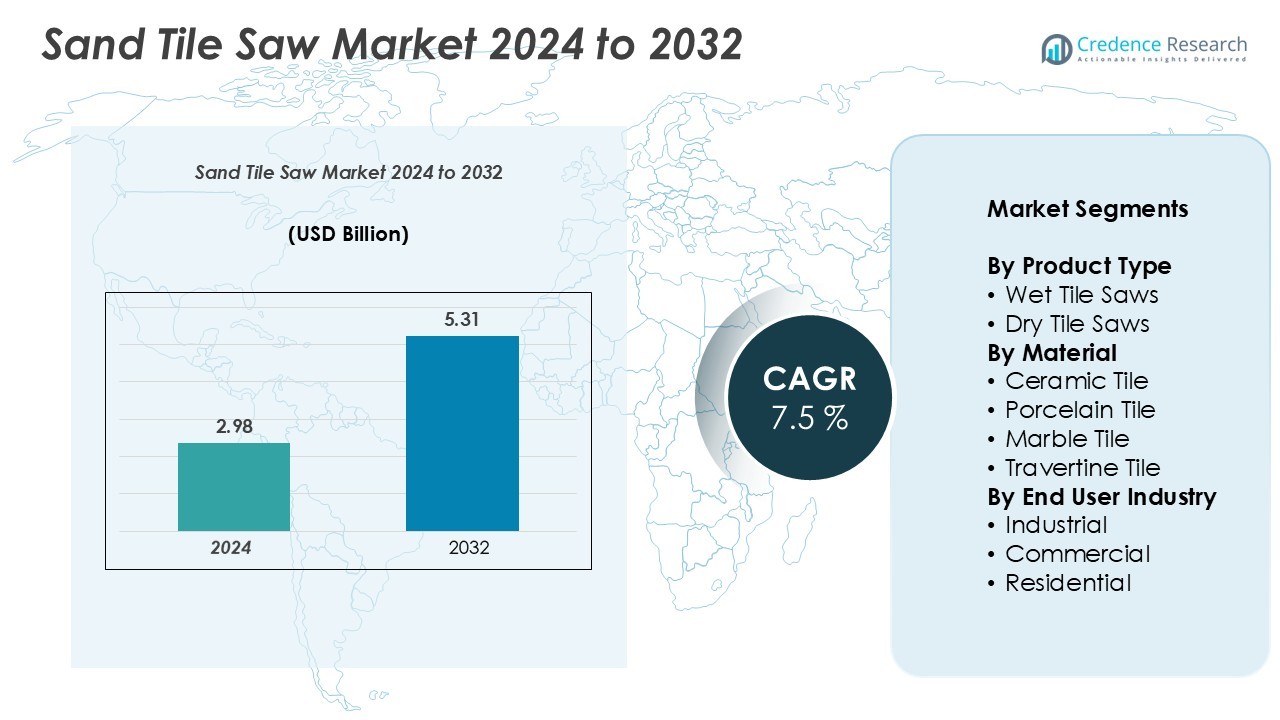

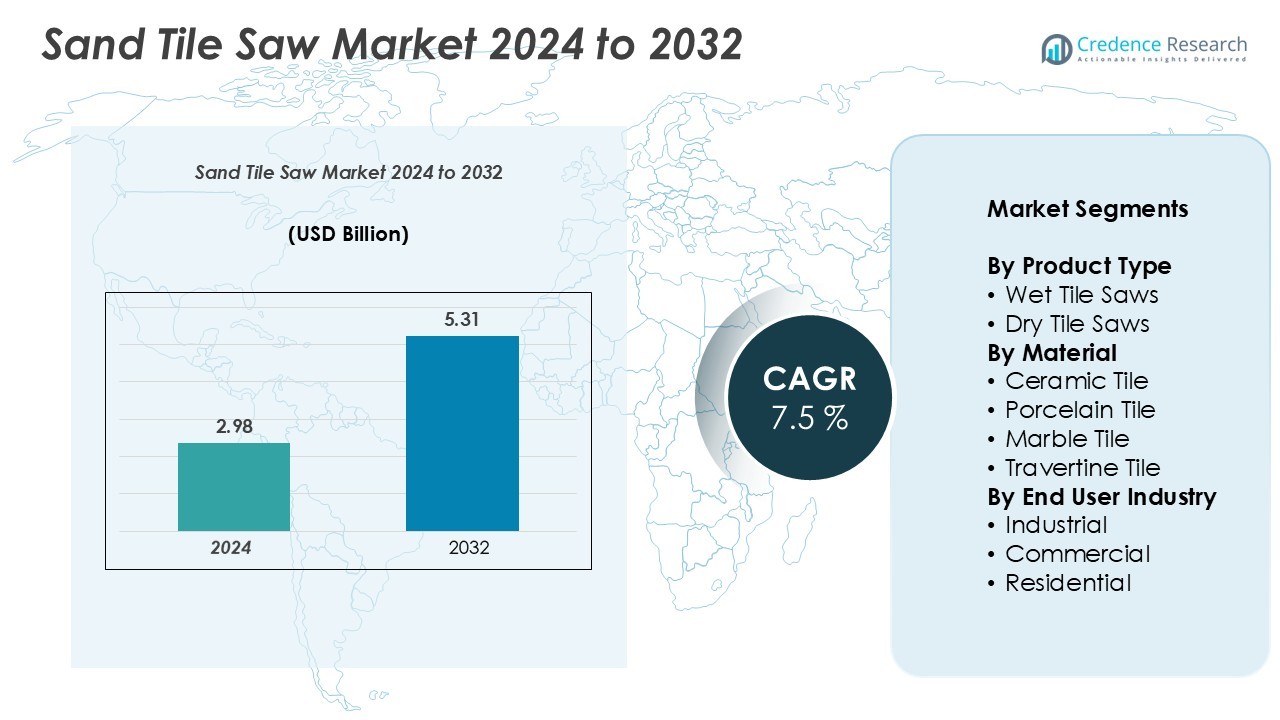

The Sand Tile Saw Market size was valued at USD 2.98 billion in 2024 and is anticipated to reach USD 5.31 billion by 2032, growing at a CAGR of 7.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sand Tile Saw Market Size 2024 |

USD 2.98 Billion |

| Sand Tile Saw Market, CAGR |

7.5% |

| Sand Tile Saw Market Size 2032 |

USD 5.31 Billion |

The sand tile saw market is driven by leading companies such as Makita, Stihl, QEP, Bosch, WEN, Husqvarna, Stanley Black & Decker, Delta, Rubi Tools, Metabo, Dremel, MK Diamond, RIDGID, Genesis, and Skil. These players focus on developing precision-engineered, durable, and user-friendly tools to meet both professional and DIY demands. Advanced features like laser guidance, water-cooling systems, and cordless mobility enhance competitiveness. Asia-Pacific leads the global market with a 33.8% share, followed by North America at 31.6% and Europe at 27.4%. Strong construction activity, expanding home renovation projects, and the presence of established manufacturers continue to fuel regional growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The sand tile saw market was valued at USD 2.98 billion in 2024 and is projected to reach USD 5.31 billion by 2032, growing at a CAGR of 7.5%.

- Rising construction and home renovation projects drive market growth, with strong demand from residential users holding a 52.8% share.

- Technological trends such as cordless mobility, laser-guided precision, and water-efficient systems enhance efficiency and safety across applications.

- Key players including Makita, Bosch, Husqvarna, and Stanley Black & Decker focus on innovation, compact designs, and sustainability to strengthen market presence.

- Asia-Pacific leads with a 33.8% share, followed by North America at 31.6% and Europe at 27.4%, while wet tile saws dominate the product segment with 61.3% share.

Market Segmentation Analysis:

By Product Type

The wet tile saw segment dominated the market with a 61.3% share in 2024. Wet saws are preferred for their precision and ability to reduce dust during cutting, making them ideal for professional and large-scale projects. Their integrated water-cooling system enhances blade life and ensures smooth cutting of hard tiles like porcelain and marble. Growing demand from the construction and remodeling sectors supports this dominance. In contrast, dry tile saws cater to small-scale or on-site operations, offering portability and ease of setup for quick cutting tasks.

- For instance, DeWalt’s D36000 wet tile saw features a 15-amp motor and delivers a 37-inch rip capacity, enabling efficient cutting of large-format tiles with high accuracy.

By Material

The ceramic tile segment held the largest share of 44.7% in 2024, driven by its widespread use in flooring and wall applications. Ceramic tiles are affordable, durable, and easy to cut, making them suitable for both residential and commercial projects. Wet saws are extensively used for achieving smooth edges in ceramic and porcelain tiles. Increasing urban housing projects and renovation activities continue to fuel demand. Marble and travertine tiles, though premium materials, are gaining traction in luxury interior designs, supporting the high-end segment of the market.

- For instance, The MK Diamond MK-212-4 wet saw features a 2-horsepower motor and a 10-inch blade capacity. It is capable of cutting ceramic and stone tiles up to 2 inches thick while maintaining precision and edge smoothness.

By End User Industry

The residential segment accounted for 52.8% of the market in 2024, leading due to rising home renovation and interior improvement projects. Consumers increasingly prefer personalized tile designs in kitchens, bathrooms, and outdoor spaces, driving demand for efficient tile cutting equipment. The commercial segment also shows steady growth, supported by expanding infrastructure projects in offices, hotels, and retail establishments. Industrial use remains smaller but consistent, with applications in large-scale manufacturing and construction operations requiring heavy-duty tile cutting systems.

Key Growth Drivers

Rising Construction and Renovation Activities

The increasing rate of residential and commercial construction projects drives the demand for sand tile saws globally. Rapid urbanization and home remodeling trends in developed and developing countries are expanding tile installation works. Consumers prefer aesthetic flooring and wall designs using ceramic, porcelain, and marble tiles, creating consistent equipment needs. Governments’ infrastructure initiatives, such as smart city and affordable housing programs, further boost the market. The demand for precise, dust-free, and efficient cutting tools is growing as contractors prioritize quality and speed. This ongoing expansion in the construction sector remains a major growth catalyst.

- For instance, Bosch’s TC10 wet tile saw is equipped with a 10-inch diamond blade and a 1.4 HP, 15-amp motor that delivers up to 4,200 RPM, enabling clean and fast cutting for large porcelain tiles used in modern housing projects.

Technological Advancements in Tile Cutting Equipment

Advancements in motor efficiency, blade design, and water-cooling systems have improved the performance and lifespan of sand tile saws. Manufacturers are integrating automation, noise reduction, and laser-guided precision technologies to enhance usability. Compact and lightweight designs are also gaining attention, especially for small-scale and residential use. These innovations reduce manual effort and material waste, making cutting operations more efficient. The adoption of smart control systems and eco-friendly materials strengthens product reliability. Such continuous improvements in functionality and ergonomics are helping manufacturers meet professional and DIY user requirements, stimulating market expansion.

- For instance, The RUBI Tools’ DC-250-1200 tile sawis equipped with a 1.5-horsepower direct-drive motor and a cutting head that runs on bearings, offering a maximum straight cutting length of approximately 48 inches (120 cm).

Expanding Demand from the Home Improvement Sector

Rising disposable incomes and consumer inclination toward home renovation projects significantly drive market growth. Homeowners increasingly invest in modern interior designs featuring decorative tiles for kitchens, bathrooms, and patios. This surge in do-it-yourself (DIY) tile installation activities increases the demand for easy-to-use sand tile saws. Retail and e-commerce channels offering compact, affordable models further support adoption. The growing availability of instructional content on digital platforms encourages non-professional users to perform tile work themselves. This trend, combined with lifestyle-driven renovation spending, continues to strengthen the market for residential-grade sand tile saws worldwide.

Key Trends & Opportunities

Growing Shift Toward Sustainable Manufacturing

Manufacturers are adopting sustainable production practices and materials to reduce environmental impact. The integration of recyclable components, energy-efficient motors, and water-saving systems aligns with global sustainability goals. Government initiatives promoting green building materials further drive this shift. Demand for eco-labeled construction tools is increasing among environmentally conscious consumers and contractors. Companies investing in low-emission production technologies and green certifications gain a competitive advantage. This trend not only enhances brand reputation but also creates opportunities for premium, eco-friendly product lines in the sand tile saw market.

- For instance, Indian manufacturer Bharat Bijlee’s SynchroVERT® series IE4 class motors demonstrated reduced energy consumption when used in cement and textile applications.

Rising Adoption of Cordless and Portable Saws

Portable and cordless tile saws are gaining traction due to their convenience and flexibility. Professionals prefer battery-operated models for on-site work where power access is limited. Lightweight designs and improved lithium-ion battery technology provide longer runtime and faster charging capabilities. Manufacturers are focusing on ergonomic handles, dust control systems, and quick blade-change mechanisms to improve user experience. The increasing trend of mobile and compact construction equipment supports this demand. As end-users prioritize portability and efficiency, cordless saws are emerging as a lucrative segment for market players.

- For instance, Makita’s 18 V LXT® Lithium-Ion 6.0 Ah battery reaches full charge in 55 minutes and delivers 108 Wh of energy (18 V × 6.0 Ah) for improved runtime.

Key Challenges

High Maintenance and Operational Costs

Despite their advantages, sand tile saws require regular maintenance to ensure performance and safety. The cost of replacing blades, maintaining water systems, and repairing motor components can be high, especially for frequent industrial use. These expenses deter small contractors and DIY users from investing in premium models. In addition, improper maintenance often leads to operational inefficiencies, reducing equipment life span. Addressing this challenge requires manufacturers to focus on cost-effective designs and offer reliable after-sales service. Lowering maintenance burdens can help boost adoption across price-sensitive markets.

Safety Concerns and Skill Requirements

Operating sand tile saws involves potential risks such as blade injuries, dust exposure, and electrical hazards. Skilled handling and adherence to safety standards are essential for effective operation. However, many residential users and inexperienced workers lack the technical knowledge required to operate the equipment safely. This limits the widespread adoption of professional-grade models in the DIY segment. Manufacturers are increasingly incorporating safety shields, automatic shut-off systems, and user-friendly designs to mitigate risks. Yet, the need for operator training and safety awareness remains a critical barrier to market expansion.

Regional Analysis

North America

North America held a 31.6% share of the sand tile saw market in 2024, driven by strong construction and home renovation activities across the United States and Canada. The region’s growing trend toward luxury housing and kitchen remodeling supports the demand for high-performance tile saws. Professional contractors increasingly adopt wet saws for precision cutting of porcelain and marble tiles. The presence of established manufacturers and advanced distribution networks enhances product accessibility. Rising DIY culture, supported by online retail expansion and training resources, continues to fuel market growth across residential and small-scale commercial segments.

Europe

Europe accounted for 27.4% of the market in 2024, supported by rapid urban redevelopment and energy-efficient construction projects. Countries such as Germany, France, and the United Kingdom witness strong demand for ceramic and marble tile installations. Stringent regulations promoting sustainable construction tools have accelerated the adoption of water-efficient and low-emission saws. Consumers prefer compact and automated equipment for professional finishing in both commercial and residential spaces. The region’s renovation-focused market, coupled with advanced product innovation from key players, positions Europe as a mature yet steadily expanding hub for sand tile saw manufacturers.

Asia-Pacific

Asia-Pacific dominated the global market with a 33.8% share in 2024, driven by rapid urbanization and large-scale infrastructure development in China, India, and Southeast Asia. Expanding residential construction, growing disposable incomes, and demand for decorative tile installations are key growth enablers. The region’s cost-effective manufacturing base supports large-scale production of wet and dry saws. Increasing adoption of advanced cutting tools by local contractors further drives demand. Government investments in smart city projects and modern housing initiatives continue to strengthen regional growth, making Asia-Pacific the most promising market for long-term expansion.

Latin America

Latin America captured a 4.3% share in 2024, with Brazil and Mexico leading regional demand. Growth is fueled by expanding residential construction, rising disposable incomes, and modernization of commercial infrastructure. The shift toward improved interior aesthetics in urban households promotes the use of tile cutting tools. However, limited access to high-end models and fluctuating economic conditions restrain wider adoption. Local distributors and international brands are increasingly collaborating to introduce affordable, durable equipment. The region’s gradual shift toward mid-range, portable sand tile saws highlights its emerging market potential in the coming years.

Middle East & Africa

The Middle East & Africa accounted for 2.9% of the global sand tile saw market in 2024. The region’s growth is driven by construction booms in the UAE, Saudi Arabia, and South Africa, supported by large-scale infrastructure and tourism projects. Increasing investments in luxury residential complexes and commercial spaces create opportunities for high-precision tile cutting equipment. Government efforts to diversify economies beyond oil are further boosting the construction tools sector. However, market expansion remains gradual due to price sensitivity and limited local manufacturing capabilities, prompting reliance on imported machinery from global brands.

Market Segmentations:

By Product Type

- Wet Tile Saws

- Dry Tile Saws

By Material

- Ceramic Tile

- Porcelain Tile

- Marble Tile

- Travertine Tile

By End User Industry

- Industrial

- Commercial

- Residential

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the sand tile saw market is characterized by the presence of established global manufacturers and emerging regional players focusing on innovation and product differentiation. Key companies include Makita, Stihl, QEP, Bosch, WEN, Husqvarna, Stanley Black & Decker, Delta, Rubi Tools, Metabo, Dremel, MK Diamond, RIDGID, Genesis, and Skil. These players compete on parameters such as precision, durability, energy efficiency, and user safety. Leading firms are integrating laser-guided cutting, water-cooling mechanisms, and lightweight designs to enhance performance and ease of use. For instance, Bosch and Makita have expanded cordless and portable product lines to meet on-site application demands. Meanwhile, Husqvarna and MK Diamond focus on high-end, professional-grade models for industrial users. Strategic partnerships, digital marketing, and e-commerce distribution have also become crucial for brand visibility. Continuous R&D investment and eco-friendly manufacturing practices further strengthen competitiveness and support long-term market leadership across diverse end-user segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Makita

- Stihl

- QEP

- Bosch

- WEN

- Husqvarna

- Stanley Black & Decker

- Delta

- Rubi Tools

- Metabo

- Dremel

- MK Diamond

- RIDGID

- Genesis

- Skil

Recent Developments

- In 2024, SKIL has unveiled its newest 7-inch Wet Tile Saw which makes completing tile projects easier year-round with its unique HydroLock System that effectively cuts tile with little mess. The 7-inch Wet Tile Saw’s innovative HydroLock System keeps water splash to a minimum so tiles can be cut in the room where they’re being installed. The 7-inch Wet Tile Saw is unique, stable and perfect for the intermediate to advanced home improvement enthusiast.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, End-User Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for sand tile saws will continue rising with global growth in residential construction.

- Technological advancements will lead to more efficient, low-noise, and dust-free cutting tools.

- Cordless and portable models will gain higher adoption among professionals and DIY users.

- Manufacturers will focus on developing eco-friendly designs with reduced water and energy consumption.

- Automation and digital control features will improve precision and ease of operation.

- Asia-Pacific will remain the leading regional market due to rapid urbanization and infrastructure projects.

- North America and Europe will see steady growth driven by home renovation trends.

- Strategic partnerships and online sales expansion will strengthen brand competitiveness.

- Training and safety awareness programs will promote responsible equipment use across industries.

- Innovation in blade materials and cooling systems will enhance performance and extend product lifespan.