Market Overview:

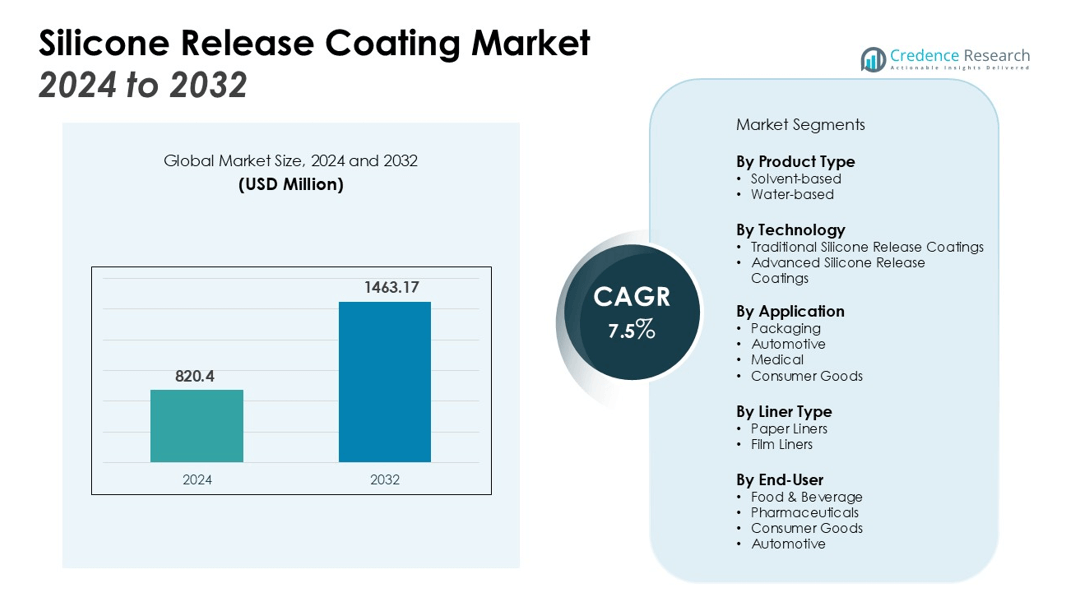

The Silicone Release Coating Market size was valued at USD 820.4 million in 2024 and is anticipated to reach USD 1463.17 million by 2032, at a CAGR of 7.5% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Silicone Release Coating Market Size 2024 |

USD 820.4 million |

| Silicone Release Coating Market, CAGR |

7.5% |

| Silicone Release Coating Market Size 2032 |

USD 1463.17 million |

Key drivers of market growth include the rising demand for sustainable packaging solutions, as silicone release coatings are considered an eco-friendly alternative to traditional release agents. Additionally, advancements in coating technologies and the growing need for high-performance materials in end-use industries are further boosting market expansion. The shift toward e-commerce, with its demand for efficient packaging and labeling solutions, is also contributing to the increased adoption of silicone release coatings.

Regionally, North America dominates the market, accounting for the largest share due to the high demand for silicone release coatings in packaging and automotive sectors. Europe follows closely, supported by stringent regulations on food packaging safety and sustainable materials. The Asia Pacific region is expected to witness the highest growth, driven by rapid industrialization and the expanding packaging and consumer goods industries.

Market Insights:

- The Silicone Release Coating Market was valued at USD 820.4 million in 2024 and is projected to reach USD 1463.17 million by 2032, growing at a CAGR of 7.5%.

- The demand for sustainable packaging solutions is increasing, with silicone coatings offering eco-friendly alternatives to traditional release agents.

- Technological advancements improve silicone coatings’ chemical resistance, durability, and performance, driving demand in automotive and medical packaging.

- The growing adoption of adhesive tapes and labels across industries boosts the need for silicone release coatings for reliable performance.

- E-commerce growth accelerates demand for efficient packaging solutions, creating opportunities for silicone release coatings in packaging and label applications.

- North America dominates the market with a 40% share, driven by demand from packaging, automotive, and consumer goods industries.

- The Asia Pacific region, with a 25% market share, is experiencing rapid growth due to industrialization and increased demand for packaging solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand for Sustainable Packaging Solutions

The increasing emphasis on eco-friendly materials is one of the primary drivers for the Silicone Release Coating Market. Industries are moving toward sustainable packaging solutions to meet consumer demand for environmentally responsible products. Silicone release coatings offer an attractive alternative due to their ability to reduce waste and improve recyclability, making them ideal for use in food packaging, labels, and adhesive applications. The market is benefitting from this shift, as manufacturers focus on reducing the environmental impact of packaging.

Advancements in Silicone Release Coating Technologies

Technological innovations in silicone release coatings contribute significantly to market growth. Enhanced coating formulations now offer improved performance characteristics, such as superior chemical resistance, higher durability, and better release properties. These advancements allow manufacturers to meet the rising demand for high-performance materials, especially in demanding applications such as automotive and medical packaging. The Silicone Release Coating Market is expanding due to these ongoing innovations, providing greater versatility and efficiency.

- For example, Dow’s SYL-OFF™ SL 184 Coating is designed for fast curing with minimized mist at production line speeds above 1000 meters per minute, offering highly stable release and optimized processing efficiency for industrial applications.

Increasing Adoption of Adhesive Tapes and Labels

The growing use of adhesive tapes and labels across various industries further drives the Silicone Release Coating Market. These coatings are essential in the production of high-quality, reliable adhesive products used in packaging, automotive, and consumer goods. As demand for effective and durable labeling and packaging solutions continues to rise, manufacturers increasingly rely on silicone release coatings for their excellent release properties and performance consistency.

- For instance, 3M’s Silicone Laminating Adhesive Tapes can bond strongly to tough surfaces like silicone rubbers and foams with an adhesive thickness of 0.002 inches (0.05 mm), providing high shear strength and solvent resistance in industrial applications.

Growth of E-Commerce and Packaging Solutions

The rise of e-commerce has accelerated the demand for efficient and high-quality packaging solutions. Silicone release coatings play a crucial role in streamlining packaging processes by enhancing the efficiency of adhesive materials used in product packaging. The increased focus on packaging design, label accuracy, and ease of handling is further pushing the need for advanced silicone release coatings, creating more opportunities for market growth.

Market Trends:

Shift Toward Eco-Friendly and Biodegradable Coatings

The Silicone Release Coating Market is witnessing a growing trend toward the adoption of eco-friendly and biodegradable coatings. With rising environmental concerns and regulations around packaging waste, industries are increasingly seeking sustainable alternatives. Silicone coatings, known for their recyclability and minimal environmental impact, are gaining traction as they provide an effective solution for reducing the carbon footprint. Manufacturers are now focusing on developing formulations that not only enhance performance but also align with the global push for green packaging solutions. This shift toward sustainability is helping to expand the market’s reach across various industries, including food packaging and consumer goods.

- For instance, WACKER’s ELASTOSIL® eco silicone sealant products contain 100 percent silicone and are produced using bio-based methanol sourced from certified sustainable materials, with raw material volumes audited annually to ensure fossil-based components are fully replaced in manufacturing.

Integration of Advanced Technologies for Improved Performance

Another notable trend in the Silicone Release Coating Market is the integration of advanced technologies to improve coating performance. Innovations in silicone formulations are enhancing durability, resistance to extreme temperatures, and chemical stability. These improvements allow the coatings to perform better in specialized applications, such as automotive parts and medical packaging, where higher precision and performance are required. The ability to customize coatings for specific applications is becoming a key selling point, driving demand in niche markets. Additionally, technological advancements are allowing for more efficient production processes, reducing costs and increasing scalability, which is attracting more manufacturers to adopt silicone release coatings.

- For instance, Shin-Etsu Chemical’s automotive silicone materials maintain stability at temperatures up to 250 degrees Celsius, protecting engine components and boosting vehicle performance.

Market Challenges Analysis:

High Raw Material Costs and Supply Chain Instabilities

One of the significant challenges facing the Silicone Release Coating Market is the rising cost of raw materials. Silicone-based materials and specialized additives often come at a higher price compared to conventional coatings, impacting production costs. This has become more pronounced with ongoing supply chain disruptions, which affect the availability and cost of essential components. Manufacturers are under pressure to balance cost-efficiency with maintaining the high-quality performance characteristics that silicone release coatings are known for. These factors present a barrier for smaller manufacturers, potentially limiting their ability to compete in the market.

Regulatory Challenges and Compliance Requirements

The Silicone Release Coating Market faces increasing scrutiny regarding regulatory compliance, particularly in packaging applications. With tightening environmental regulations and sustainability standards, manufacturers must ensure that their products meet stringent guidelines for safety and environmental impact. Meeting these regulations often requires significant investment in research, testing, and the adaptation of existing formulations. For companies operating in multiple regions, navigating the complex and varied regulatory landscapes becomes an added challenge, especially as countries continue to implement more stringent packaging waste and sustainability laws. These compliance challenges can lead to delays in product development and increased costs.

Market Opportunities:

Expanding Demand for Sustainable Packaging Solutions

The increasing shift toward sustainable packaging presents significant opportunities for the Silicone Release Coating Market. With growing consumer and regulatory demand for eco-friendly products, silicone coatings are becoming an attractive solution due to their recyclability and reduced environmental impact. Industries such as food and beverage, pharmaceuticals, and consumer goods are seeking sustainable packaging options, and silicone release coatings play a key role in providing effective and environmentally friendly alternatives. This trend is expected to drive market expansion, offering manufacturers an opportunity to innovate and meet the growing need for green solutions.

Technological Innovations and Customization Capabilities

There is an opportunity in the Silicone Release Coating Market to capitalize on technological advancements that enhance performance and customization. The development of specialized coatings for applications in automotive, medical, and high-performance packaging is a growing trend. Silicone coatings’ ability to adapt to specific needs, such as higher temperature resistance and durability, opens new market segments. Manufacturers can expand their product portfolios by offering customized solutions that meet unique customer requirements, thus gaining a competitive edge. This focus on innovation and customization is expected to further fuel market growth and attract new customers.

Market Segmentation Analysis:

By Product Type

The Silicone Release Coating Market is segmented into solvent-based and water-based coatings. Solvent-based coatings dominate the market due to their superior performance in demanding applications, such as automotive and medical packaging. These coatings offer enhanced chemical resistance and durability. However, water-based coatings are gaining traction due to their environmentally friendly characteristics and regulatory support for sustainable solutions. These coatings are preferred in industries seeking eco-friendly alternatives for packaging and labeling applications.

By Technology

The market is divided into traditional and advanced silicone release coatings. Traditional coatings are widely used in general applications due to their cost-effectiveness and consistent performance. However, advanced silicone release coatings, incorporating cutting-edge technologies, are gaining popularity. These coatings provide superior release properties, better durability, and resistance to extreme conditions, making them ideal for high-performance industries, such as aerospace and medical. Manufacturers are increasingly shifting to advanced coatings to meet growing demands for specialized applications and sustainability.

- For instance, Momentive’s advanced RTV silicone adhesives, used in the aerospace sector, retain their essential elastomeric properties at temperatures as high as 205°C (400°F), ensuring reliability in extreme environments.

By Application

The Silicone Release Coating Market serves various applications, including packaging, automotive, medical, and consumer goods. The packaging segment holds the largest share, driven by the increasing demand for efficient and sustainable packaging solutions. Silicone release coatings are used in labels, tapes, and food packaging due to their excellent release properties and eco-friendliness. The automotive sector is another key application, where silicone release coatings are used in automotive parts and components to enhance performance. The medical industry also drives demand for high-performance silicone coatings in medical devices and packaging solutions.

- For instance, Shin-Etsu Chemical has achieved a significant technological advancement for the packaging industry with a new method that reduces the required amount of platinum in its silicone release coatings by one-half, a key component for release liners.

Segmentations:

By Product Type

- Solvent-based

- Water-based

By Technology

- Traditional Silicone Release Coatings

- Advanced Silicone Release Coatings

By Application

- Packaging

- Automotive

- Medical

- Consumer Goods

By Liner Type

By End-User

- Food & Beverage

- Pharmaceuticals

- Consumer Goods

- Automotive

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis:

North America: Leading the Market

North America accounts for 40% of the Silicone Release Coating Market share, driven by strong demand from packaging, automotive, and consumer goods industries. The region excels in adopting advanced silicone coatings, with manufacturers focusing on high-performance solutions that meet strict environmental and safety standards. The presence of major players in the U.S. and Canada, coupled with significant investments in research and development, strengthens the market position. The growing emphasis on sustainable packaging solutions and high rates of e-commerce further fuel the need for efficient release coatings in North America.

Europe: Robust Growth Supported by Regulations

Europe holds a 30% share of the Silicone Release Coating Market, driven by stringent regulations and the increasing demand for eco-friendly products. The region is focused on sustainable packaging, driving the adoption of silicone release coatings in industries like food packaging and personal care. With a well-established automotive and pharmaceutical industry, the need for high-performance coatings is growing, as manufacturers seek solutions that meet both regulatory and operational requirements. As European nations continue to implement stricter sustainability and waste reduction regulations, market growth in the region is expected to strengthen.

Asia Pacific: Rapid Growth and Industrialization

Asia Pacific holds a 25% share of the Silicone Release Coating Market, witnessing the highest growth rate due to rapid industrialization and urbanization. The growing consumer base in countries like China, India, and Japan, along with a booming e-commerce sector, boosts the demand for high-quality packaging and labeling solutions. The expansion of the automotive and electronics industries in the region further contributes to the increased demand for silicone release coatings. With ongoing economic development, the market in Asia Pacific offers significant growth opportunities for industry players.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- 3M Company

- Dow Inc.

- Wacker Chemie AG

- Huntsman Corporation

- Momentive Performance Materials Inc.

- B. Fuller

- BASF SE

- Sika AG

- Shin-Etsu Chemical Co., Ltd.

- Elkem ASA

- Arkema S.A.

- Siltech Corporation

Competitive Analysis:

The Silicone Release Coating Market is highly competitive, with key players like Dow Inc., Wacker Chemie AG, Momentive Performance Materials Inc., and Shin-Etsu Chemical Co., Ltd. leading the market. These companies focus on innovation through research and development, enhancing product performance and environmental compliance. Regional players, including Elkem ASA and Siltech Corporation, are also expanding their global presence by offering tailored solutions for high-growth sectors such as packaging and medical devices. The market is shaped by technological advancements, such as solventless and UV-curable coatings, which help meet sustainability regulations. Competitive dynamics are further influenced by raw material costs, regulatory challenges, and the need for eco-friendly solutions, with companies focusing on high-performance coatings to maintain a strong market position.

Recent Developments:

- In March 2025, 3M and Sumitomo Electric Industries signed an agreement to collaborate on expanded beam optical interconnect technology for data centers.

- In May 2025, Dow Inc. launched a broader portfolio of skin, hair, and color cosmetics, introducing low carbon silicone elastomer blends under the Decarbia™ reduced carbon platform.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Technology, Application, Liner Type, End-User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Silicone Release Coating Market will continue to expand due to increasing demand for sustainable packaging solutions.

- Technological advancements in coating formulations will lead to improved performance and durability, driving innovation in various industries.

- The automotive sector’s growth will contribute to the demand for high-performance silicone release coatings in automotive parts and components.

- The medical device industry will see a rising need for silicone coatings in packaging, driven by the demand for advanced, high-quality medical solutions.

- The expansion of the e-commerce sector will further accelerate the adoption of silicone coatings in packaging and labeling applications.

- Regulatory pressure on environmental sustainability will encourage the development of eco-friendly and biodegradable silicone coatings.

- Increased industrialization in emerging economies, especially in Asia Pacific, will offer new growth opportunities for the silicone release coating market.

- Customization of silicone coatings for niche applications, including high-temperature resistance and chemical stability, will open up new market segments.

- Demand for adhesive tapes and labels in various industries will continue to grow, boosting the silicone release coatings market.

- Competitive pressure will drive companies to focus on improving their R&D capabilities, exploring novel formulations, and enhancing product efficiency to maintain market leadership.