Market Overview

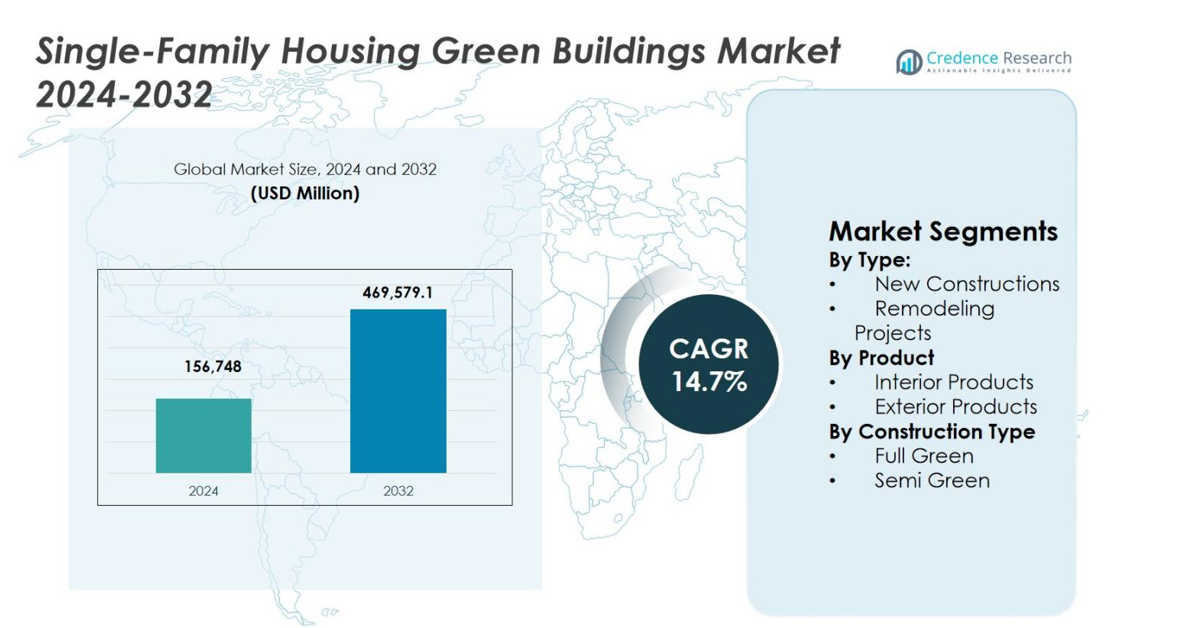

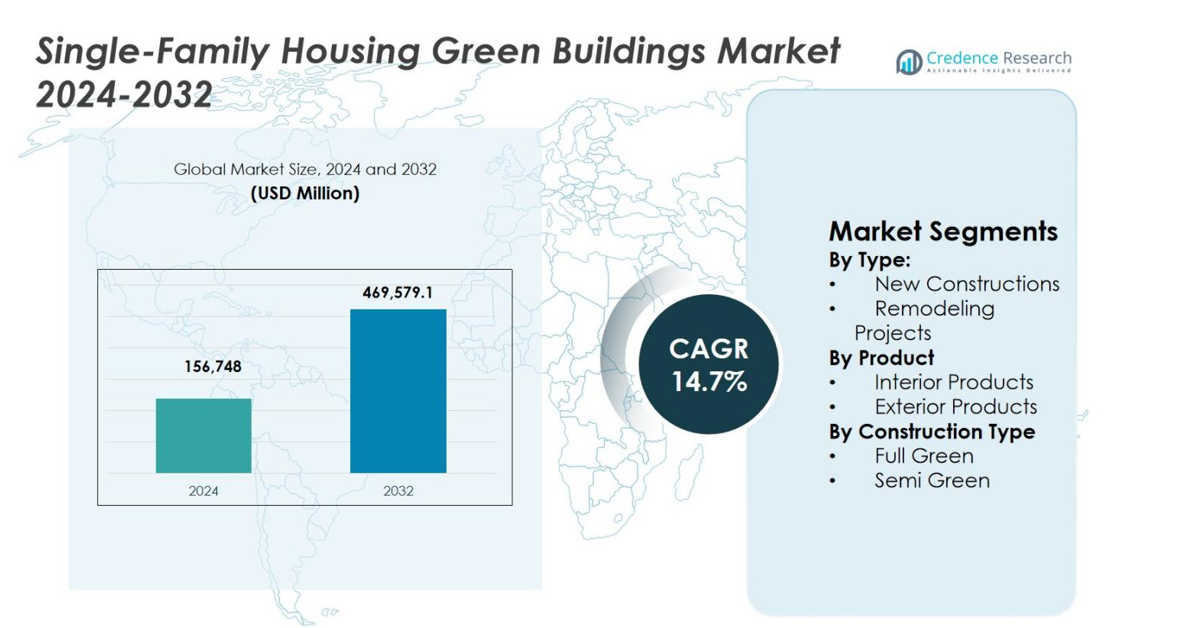

The Single-Family Housing Green Buildings Market size was valued at USD 156,748 million in 2024 and is anticipated to reach USD 469,579.1 million by 2032, growing at a CAGR of 14.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Single-Family Housing Green Buildings Market Size 2024 |

USD 156,748 million |

| Single-Family Housing Green Buildings Market, CAGR |

14.7% |

| Single-Family Housing Green Buildings Market Size 2032 |

USD 469,579.1 million |

Single-Family Housing Green Buildings Market is shaped by the strong presence of established construction and engineering firms such as Turner Construction Co., Skanska USA, AECOM, The Gilbane Building Co., Clark Group, Hensel Phelps, Whiting-Turner Contracting Co., Holder Construction, Webcor Builders, and Structure Tone. These companies focus on energy-efficient residential designs, green certification expertise, and integration of smart and sustainable building technologies to support single-family housing developments. North America leads the market with a 34.6% share, driven by stringent energy regulations, high consumer awareness, and advanced green construction practices. Europe follows with a 29.8% share, supported by climate-focused policies and mandatory sustainability standards, while Asia-Pacific accounts for a 24.1% share, reflecting accelerating adoption of green single-family housing across emerging and developed economies.

Market Insights

- Single-Family Housing Green Buildings Market was valued at USD 156,748 million in 2024 and is projected to reach USD 469,579.1 million by 2032, growing at a CAGR of 14.7% during the forecast period.

- Market growth is driven by strict energy-efficiency regulations, government incentives, rising energy costs, and increasing preference for sustainable and low-carbon single-family homes.

- Key market trends include higher adoption of smart energy management systems, green-certified materials, and integrated sustainable design, with New Constructions leading at 64.2% segment share in 2024.

- The market features strong participation from large construction firms focusing on green certifications, smart technologies, and lifecycle efficiency, while high initial costs and skilled labor gaps act as restraints.

- Regionally, North America leads with 34.6% market share, followed by Europe at 29.8% and Asia-Pacific at 24.1%, reflecting strong regulatory support and expanding green housing adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type:

The Single-Family Housing Green Buildings Market shows clear dominance of New Constructions, which accounted for 64.2% market share in 2024, driven by rising adoption of energy-efficient designs at the planning stage. New green homes integrate solar panels, advanced insulation, smart HVAC systems, and sustainable materials more effectively than retrofits, ensuring compliance with green building codes and certifications. Government incentives, tax benefits, and stricter energy-efficiency regulations further support new green residential developments. In contrast, Remodeling Projects remain important but are limited by higher retrofit costs and structural constraints compared to purpose-built green homes.

- For instance, Nathan Good Architects designed the Cannon Beach Home in Oregon with a 5.9kW photovoltaic solar system, high insulation, sustainable salvaged materials, and a rooftop garden for rainwater filtration, prioritizing environmental impact reduction from the outset.

By Product:

Within the Single-Family Housing Green Buildings Market, Interior Products dominated with a 58.6% market share in 2024, supported by strong demand for energy-efficient lighting, insulation, flooring, low-VOC paints, and smart home systems. Homeowners prioritize interior upgrades that directly reduce energy consumption, improve indoor air quality, and enhance living comfort. Growing awareness of health benefits and long-term operational cost savings continues to drive interior product adoption. Exterior Products, including green roofing and sustainable cladding, maintain steady growth but contribute a smaller share due to higher upfront installation costs.

- For instance, Benjamin Moore’s Eco Spec interior paint features a zero-VOC formula with less than 5g of volatile organic compounds per liter, certified Green Seal and asthma/allergy friendly to minimize emissions and improve indoor air quality.

By Construction Type:

The Full Green segment led the Single-Family Housing Green Buildings Market with a 61.8% market share in 2024, driven by comprehensive sustainability integration across energy, water, materials, and waste management systems. Full green homes achieve higher certification levels and deliver superior lifecycle cost savings, making them attractive to environmentally conscious buyers. Increasing availability of green financing and supportive policy frameworks accelerates adoption. Meanwhile, Semi Green constructions remain relevant for cost-sensitive buyers but offer limited performance benefits compared to fully integrated green residential structures.

Major Key Growth Drivers

Government Regulations and Incentive Programs

The Single-Family Housing Green Buildings Market benefits strongly from supportive government regulations and financial incentive programs promoting sustainable residential construction. Policies mandating higher energy-efficiency standards, carbon reduction targets, and green building certifications encourage developers to adopt environmentally responsible designs. Tax credits, subsidies, and low-interest green mortgages reduce upfront costs for homeowners and builders, improving affordability. Public sector initiatives focused on net-zero housing and climate resilience further accelerate adoption, creating a favorable regulatory environment that consistently stimulates demand for green single-family homes across developed and emerging markets.

- For instance, Ashok B Lall Architects developed the Net Zero Carbon Homes pilot with five 2BHK single-family units achieving an Energy Performance Intensity of 32 kWh/m²/year through low-carbon materials and smart technologies.

Rising Energy Costs and Long-Term Cost Savings

Escalating energy prices significantly drive growth in the Single-Family Housing Green Buildings Market by increasing the economic appeal of energy-efficient homes. Green buildings reduce electricity and water consumption through high-performance insulation, solar integration, efficient HVAC systems, and smart energy management. These features lower long-term utility expenses and protect homeowners from energy price volatility. Growing awareness of lifecycle cost benefits strengthens buyer preference for sustainable housing, encouraging developers to incorporate green technologies as standard features rather than optional upgrades.

- For instance, Chinburg Properties built high-performance green homes in New Hampshire seacoast developments using advanced insulation and energy-efficient systems.

Growing Consumer Awareness and Sustainability Preferences

Increasing consumer awareness regarding environmental impact and health benefits strongly supports expansion of the Single-Family Housing Green Buildings Market. Homebuyers increasingly prioritize indoor air quality, natural lighting, non-toxic materials, and reduced carbon footprints. Sustainability has become a key purchasing criterion, particularly among younger homeowners and environmentally conscious families. This shift in buyer behavior motivates builders to differentiate projects through green certifications and eco-friendly features, reinforcing demand and encouraging wider adoption of sustainable construction practices in the single-family housing sector.

Key Trends & Opportunities

Integration of Smart Home and Energy Management Technologies

The Single-Family Housing Green Buildings Market is witnessing a strong trend toward integrating smart home technologies with green construction. Advanced energy management systems, smart thermostats, automated lighting, and real-time energy monitoring optimize resource consumption and enhance user convenience. These technologies improve energy efficiency while enabling homeowners to track and control usage patterns. The convergence of digitalization and sustainability creates opportunities for technology providers and builders to offer value-added, future-ready green homes that align with evolving consumer expectations.

- For instance, Google’s Nest Learning Thermostat achieved 12% average electricity savings for heating in 174 Oregon homes equipped with heat pumps, by learning occupancy patterns and adjusting temperatures automatically.

Expansion of Green Financing and Mortgage Solutions

The growing availability of green financing solutions presents a major opportunity within the Single-Family Housing Green Buildings Market. Financial institutions increasingly offer preferential mortgage rates, extended loan tenures, and sustainability-linked financing for certified green homes. These instruments lower ownership costs and expand accessibility for middle-income buyers. As lenders integrate environmental criteria into risk assessment models, green homes gain financial advantages over conventional housing, encouraging broader market adoption and supporting long-term growth.

- For instance, Union Bank of India’s Union Green Home loan provides a 10 basis point interest rate concession for IGBC- or other certified green homes, with no regulatory cap on loan amount and eligibility extending to both new construction and purchase of certified residential properties.

Key Challenges

High Initial Construction and Material Costs

High upfront costs remain a significant challenge in the Single-Family Housing Green Buildings Market. Sustainable materials, energy-efficient systems, and certification processes often increase initial construction expenses compared to conventional homes. These costs can deter price-sensitive buyers and small-scale developers, particularly in emerging markets. Although long-term savings offset initial investments, limited awareness and financing gaps restrict widespread adoption, slowing market penetration in cost-conscious regions.

Limited Skilled Workforce and Standardization Gaps

The Single-Family Housing Green Buildings Market faces challenges related to shortages of skilled labor and inconsistent construction standards. Green building practices require specialized expertise in energy modeling, sustainable materials, and integrated system design. Insufficient training and certification programs limit workforce readiness, increasing project timelines and costs. Additionally, varying regional standards and certification frameworks create complexity for developers operating across multiple markets, hindering scalability and uniform implementation of green housing solutions.

Regional Analysis

North America

The Single-Family Housing Green Buildings Market in North America accounted for 34.6% market share in 2024, supported by strong regulatory enforcement and high sustainability awareness. The region has demonstrated steady expansion since 2018, driven by strict energy-efficiency building codes and widespread adoption of certified green homes. The United States leads regional demand due to favorable incentives, advanced construction practices, and increasing development of net-zero single-family housing. High penetration of smart energy systems and long-term decarbonization goals continue to reinforce market growth.

Europe

Europe held a 29.8% share of the Single-Family Housing Green Buildings Market in 2024, underpinned by stringent climate policies and mandatory green construction standards. The market has expanded consistently since 2018, led by Germany, the UK, and France. Strong emphasis on low-emission housing, sustainable materials, and energy-efficient renovation programs supports adoption. Alignment with ESG objectives and regulatory compliance requirements continues to position Europe as a mature and stable regional market for green single-family housing.

Asia-Pacific

Asia-Pacific captured a 24.1% market share in 2024, emerging as a key growth region in the Single-Family Housing Green Buildings Market. The region has experienced rapid expansion since 2018, driven by urbanization, rising household incomes, and government-led green housing initiatives. China, India, Japan, and Australia play central roles in advancing sustainable residential development. Increasing awareness of energy efficiency and expanding investments in eco-friendly housing infrastructure continue to strengthen regional adoption.

Latin America

Latin America accounted for 6.8% market share in 2024, reflecting steady progress in sustainable single-family housing adoption since 2018. Brazil, Mexico, and Chile lead regional activity through urban sustainability programs and improving access to green financing. Rising energy costs and alignment with international green building standards encourage developers to incorporate energy-efficient designs. Despite slower adoption compared to developed regions, the market shows consistent momentum supported by policy and infrastructure improvements.

Middle East & Africa

The Middle East & Africa held a 4.7% share of the Single-Family Housing Green Buildings Market in 2024, with gradual expansion since 2018. Growth is concentrated in Gulf countries where sustainability-driven housing policies and energy-efficiency initiatives are gaining importance. Increasing investment in green infrastructure and climate-resilient residential projects supports market development, while broader regional adoption remains influenced by cost sensitivity and varying regulatory maturity.

Market Segmentations:

By Type:

- New Constructions

- Remodeling Projects

By Product

- Interior Products

- Exterior Products

By Construction Type

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape analysis of the Single-Family Housing Green Buildings Market includes major participants such as Turner Construction Co., Skanska USA, AECOM, The Gilbane Building Co., Clark Group, Hensel Phelps, Whiting-Turner Contracting Co., Holder Construction, Webcor Builders, and Structure Tone. The market features a mix of large integrated construction firms and specialized green building contractors focusing on energy-efficient residential development. Companies compete through sustainable design expertise, green certification capabilities, and adoption of advanced construction technologies. Strategic partnerships with material suppliers, technology providers, and local developers strengthen project execution and scalability. Investment in smart energy systems, prefabrication, and low-carbon construction materials enhances differentiation. Firms increasingly emphasize compliance with regional green standards and lifecycle cost efficiency to attract environmentally conscious homeowners. Continuous innovation, portfolio diversification, and expansion into emerging sustainable housing markets remain central to maintaining long-term competitive positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Webcor Builders

- Skanska USA

- Holder Construction

- Turner Construction Co.

- Structure Tone

- Whiting-Turner Contracting Co.

- Hensel Phelps

- Clark Group

- The Gilbane Building Co.

- AECOM

Recent Developments

- In April 2025, the U.S. Green Building Council launched LEED v5, an updated green building rating system that strengthens performance and technology criteria for residential projects, including single-family green homes.

- In October 2025, Turner Construction Company was ranked the #1 Green Builder in the United States by Engineering News-Record for the 18th consecutive year, reinforcing its leadership in sustainable building practices.

- In August 2025, International Finance Corporation (IFC) and HDFC Capital partnered to boost green affordable housing finance in India through a dedicated sustainable housing fund, advancing green residential development.

Report Coverage

The research report offers an in-depth analysis based on Type, Product, Construction Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Single-Family Housing Green Buildings Market will continue expanding as sustainability becomes a standard requirement in residential construction.

- Energy-efficient design and low-carbon materials will gain wider adoption across new single-family housing projects.

- Government policies and building codes will increasingly mandate green compliance, supporting long-term market stability.

- Smart home and energy management technologies will become integral components of green residential developments.

- Demand for net-zero and climate-resilient single-family homes will strengthen across both developed and emerging regions.

- Green financing and preferential mortgage schemes will improve affordability and broaden buyer participation.

- Builders will focus on integrated design approaches to optimize lifecycle performance and operational efficiency.

- Prefabrication and modular construction methods will support faster and more sustainable project delivery.

- Consumer preference for healthier indoor environments will drive adoption of non-toxic and low-emission materials.

- Collaboration between developers, technology providers, and policymakers will accelerate innovation and market maturity.