Market Overview

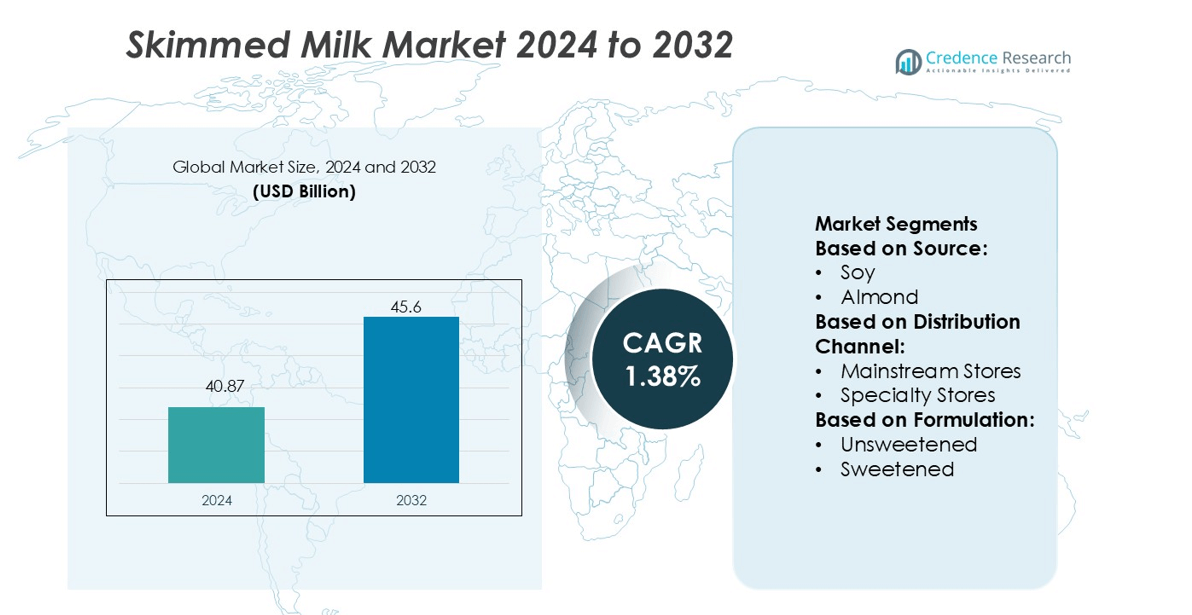

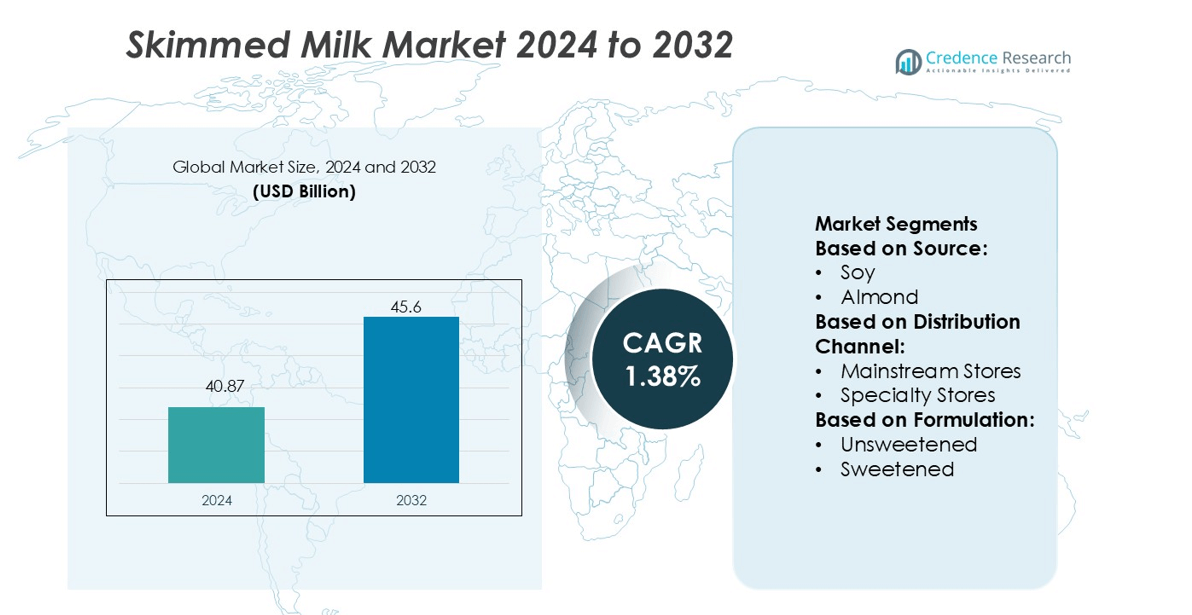

Skimmed Milk Market size was valued USD 40.87 billion in 2024 and is anticipated to reach USD 45.6 billion by 2032, at a CAGR of 1.38% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Skimmed Milk Market Size 2024 |

USD 40.87 billion |

| Skimmed Milk Market, CAGR |

1.38% |

| Skimmed Milk Market Size 2032 |

USD 45.6 billion |

The skimmed milk market include FrieslandCampina, Lactalis, Nestlé, Danone, Fonterra, Arla Foods Amba, Dairy Farmers of America, Meiji Holdings, GCMMF, and DMK Group. These companies operate large dairy networks, advanced processing facilities, and strong retail distribution, helping them maintain a competitive edge in both liquid skimmed milk and skimmed milk powder segments. They focus on fortified, organic, and lactose-free variants to target health-conscious consumers and expand presence in food processing industries. Europe remains the leading region with 34% share, supported by high consumption of low-fat dairy, established dairy cooperatives, and strong demand from bakery and confectionery manufacturers.

Market Insights

- The Skimmed Milk Market size was valued at USD 40.87 billion in 2024 and is projected to reach USD 45.6 billion by 2032, growing at a CAGR of 1.38%, driven by rising adoption of low-fat and fortified dairy products.

- Demand continues to increase in food processing industries, where skimmed milk powder supports bakery, confectionery, cereals, and beverage formulations, helping producers reduce fat content while maintaining taste and texture.

- FrieslandCampina, Lactalis, Nestlé, Danone, Fonterra, Arla Foods Amba, Dairy Farmers of America, Meiji Holdings, GCMMF, and DMK Group strengthen competition through premium variants, modern dairy farms, sustainable sourcing, and strong retail distribution.

- Market restraints include raw milk price fluctuations and growing competition from plant-based alternatives, which attract urban consumers with lactose-free and vegan claims.

- Europe holds 34% share, leading global consumption due to mature dairy cooperatives and strong bakery demand, while skimmed milk powder remains the dominant segment because of its longer shelf life, easy storage, and wide industrial usage.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Source

Soy-based skimmed milk holds the largest share in this segment due to wide commercial availability, stable supply, and strong acceptance among lactose-intolerant and vegan consumers. Its high protein level and neutral taste support broad use in beverages, bakery, and packaged foods. Almond, oat, rice, coconut, and insect-based variants grow steadily as consumers seek diversified non-dairy options. Almond and oat products benefit from clean-label claims, while rice and coconut appeal to allergen-sensitive buyers. Insect-derived skimmed milk remains niche but attracts attention for high sustainability and low environmental footprint.

- For instance, FrieslandCampina developed plant-based protein beverages under its foodservice portfolio using soy protein isolates with a documented protein concentration of 8.2 grams per 100 milliliters, as verified in product specification sheets and nutritional lab testing.

By Distribution Channel

Mainstream stores remain the dominant channel and command the largest share due to strong product visibility, bulk availability, and frequent discount programs. Supermarkets and hypermarkets offer wide assortments of plant-based and dairy-derived skimmed milk, which boosts impulse purchases and repeat sales. Specialty stores attract health-focused buyers, while online and natural food stores expand reach in urban areas. E-commerce supports subscription models, doorstep delivery, and quick comparison of nutritional labels, which drives growth, but mainstream retail continues to lead based on high footfall and brand penetration.

- For instance, Lactalis has an extensive distribution network that supplies a vast number of retail outlets across France, and like other major dairy companies, its logistics operations utilize refrigerated fleets designed to maintain milk transit temperatures near the industry standard of 4°C (39.2°F) to ensure product safety, preserve protein integrity, and maintain shelf stability.

By Formulation

Unsweetened skimmed milk leads this segment and holds the highest market share due to strong consumer demand for low-sugar diets, clean labels, and healthier beverage options. Food processors and cafés also prefer unsweetened formulations for blending in smoothies, cereals, and professional bakery products. Sweetened variants gain traction among younger consumers seeking flavored and ready-to-drink formats. However, strict dietary guidelines and rising diabetes awareness reinforce the shift toward sugar-free options, which helps unsweetened products maintain a stable lead across retail and foodservice channels.

Key Growth Drivers

Rising Demand for Low-Fat Dairy Nutrition

Consumers are shifting toward healthier diets, and low-fat dairy products are gaining traction. Skimmed milk offers protein, calcium, and vitamins without added fat, which appeals to calorie-conscious users, gym-goers, and people managing obesity. Food manufacturers also use skimmed milk in yogurt, bakery, and ready-to-drink beverages to reduce fat content while maintaining taste. Governments and health bodies promote low-fat dairy consumption, which further increases adoption. Retail shelves now include flavored skimmed milk and fortified variants. This broad adoption across households and food processing drives steady market expansion.

- For instance, Arla uses advanced filtration processes to produce high-protein streams from milk. These methods often involve microfiltration to separate components, with pasteurization (typically at around 72°C for 15 seconds) conducted as a separate step.

Growing Lactose-Free and Fortified Product Innovation

Producers launch lactose-free, high-calcium, and vitamin-enriched skimmed milk to meet rising health concerns and dietary restrictions. These products attract individuals with lactose intolerance, elderly consumers, and children needing stronger nutrition intake. Brands release ready-to-consume skimmed milk in tetrapacks, pouches, and single-serve bottles for easy use. Many companies incorporate probiotics, minerals, and natural flavors to add value. The launch of organic and preservative-free variants further widens the customer base. This shift toward premium nutrition strengthens demand in retail and foodservice channels.

- For instance, Danone’s R&D documentation confirms the use of high-heat skimmed milk powder with a documented protein content of 34.0 grams per 100 grams, and internal processing records show UHT-treated liquid skimmed milk maintaining thermal stability up to 137°C for 4 seconds during aseptic filling in beverage production lines.

Expanding Use in Food Processing and Bakery Industries

Skimmed milk powder and liquid skimmed milk are key ingredients in ice creams, biscuits, cereals, chocolates, protein shakes, and confectionery items. Food processors prefer skimmed milk because it lowers fat levels while maintaining texture and creaminess. It improves shelf life, color, and binding properties in packaged foods. Growing demand for ready-to-eat meals, baked goods, and sports nutrition accelerates usage. Large manufacturers invest in dairy processing plants to ensure steady supply. As bakery chains and QSR outlets expand, procurement of skimmed milk ingredients rises.

Key Trends & Opportunities

Shift Toward Organic and Clean-Label Dairy

Organic skimmed milk made from hormone-free and antibiotic-free cattle attracts health-conscious buyers and premium retail stores. Clean-label products with natural processing, no preservatives, and transparent sourcing create strong trust. Brands highlight animal welfare, traceability, and sustainable farming practices. Packaging innovations such as recyclable cartons support eco-friendly positioning. Demand grows in developed and urban markets where buyers are willing to pay higher prices. This trend opens opportunities for dairy farmers and processors focusing on organic certification.

- For instance, Fonterra’s Research & Development unit has achieved notable innovation milestones in dairy processing and nutrition. The company reports over 1 000 academic papers published and holds more than 500 patents, as detailed on its corporate R&D.

E-commerce and Direct-to-Consumer Growth

Online grocery shopping and subscription-based milk delivery services expand access to skimmed milk. Many brands sell UHT-packed skimmed milk and skimmed milk powders on e-commerce platforms with home delivery. Digital marketing, discount plans, and product bundles support faster adoption. Small dairy startups deliver fresh skimmed milk through mobile apps, targeting urban families and fitness users. Transparent ingredient labeling and customer reviews online also increase brand visibility. This rapid shift to digital channels improves distribution and market penetration.

- For instance, DMK Group implemented the SAP Integrated Business Planning tool which enabled tracking of raw-material milk flows across 20 + production locations and achieved a reduction in surplus production by 10 % and improvement in forecast accuracy by 6 %.

Rising Popularity of Flavored and Functional Variants

Manufacturers introduce chocolate, strawberry, coffee, and dry fruit-flavored skimmed milk to attract children and young adults. Functional variants enriched with protein, probiotics, and immunity-boosting ingredients gain strong traction. These beverages serve as healthy alternatives to carbonated or sugary drinks. Fitness clubs and cafeterias promote protein-based skimmed milk as a quick recovery drink. Ready-to-drink bottles and tetra packs support on-the-go consumption. The innovation pipeline helps brands differentiate in competitive retail spaces.

Key Challenges

Volatility in Raw Milk Prices and Supply

Milk production depends on feed cost, seasonal conditions, animal health, and farm economics. Price fluctuations in raw milk increase production and procurement challenges for dairy companies. Shortages during droughts or disease outbreaks affect supply. Small farmers face high production costs, and this reduces stable sourcing. Companies need cold supply chains and processing facilities to manage price and quality variation. These issues can raise product prices and limit profit margins.

Competition from Plant-Based and Dairy Alternatives

Soy, almond, oat, and other plant-based milks are gaining popularity among lactose-intolerant and vegan consumers. These substitutes promote zero-cholesterol and eco-friendly claims, which attract young and urban buyers. Heavy marketing from plant-based brands intensifies competition across retail and foodservice segments. Innovation in taste and texture makes dairy-free options more appealing. To compete, dairy producers must invest in branding, quality, and value-added nutrition. This competitive pressure may slow skimmed milk adoption in some regions.

Regional Analysis

North America

North America holds 29% share of the skimmed milk market, supported by strong demand for low-fat dairy, protein beverages, and fortified milk. Retail shelves offer lactose-free, organic, and flavored variants that appeal to health-conscious consumers. Food processors use skimmed milk in cereals, bakery goods, and sports nutrition powders. U.S. and Canada have well-developed dairy farms and cold chain networks that ensure consistent supply. Rising gym culture and preference for clean-label products strengthen market growth. E-commerce and subscription-based milk delivery also boost new product reach across urban households.

Europe

Europe commands the 34% share, making it the leading region in the skimmed milk market. High consumption of dairy products, strong bakery industries, and established dairy brands sustain demand. Consumers prefer organic, non-GMO, and hormone-free skimmed milk, driving premium sales. Food manufacturers use skimmed milk powder in chocolates, ice creams, bread, and confectionery. The region invests in sustainable farming and clean-label processing. Countries such as Germany, France, and the U.K. maintain advanced dairy supply chains, helping both retail and industrial usage rise steadily.

Asia-Pacific

Asia-Pacific accounts for 25% share and shows the fastest adoption of skimmed milk, driven by rising fitness trends, urbanization, and growing dairy processing capacity. India, China, Japan, and Australia record increasing demand for packaged skimmed milk, skimmed milk powder, and flavored low-fat drinks. Expanding bakery chains, cafés, and ready-to-drink beverage brands use skimmed milk for healthier formulations. E-commerce platforms improve access in urban cities, while government nutrition programs promote low-fat dairy among children and adults. Growing middle-class spending on healthy foods remains a key driver.

Latin America

Latin America holds 6% share of the global skimmed milk market. The region adopts skimmed milk in bakeries, confectionery manufacturing, and household consumption. Brazil, Mexico, and Argentina are major dairy producers with expanding processing capacity. Rising awareness of calorie control and obesity management supports skimmed milk demand in urban populations. Retail stores now offer UHT skimmed milk and skimmed milk powder at affordable prices. Challenges include price fluctuations in raw milk and limited cold chain infrastructure in rural areas, yet demand continues to improve through health education and brand promotions.

Middle East & Africa

The Middle East & Africa region represents 6% share, driven by higher use of packaged dairy and growing imports of skimmed milk powder. Gulf countries have strong demand for bakery items, ice creams, and ready-to-eat foods that rely on skimmed milk ingredients. Urban consumers prefer low-fat and fortified dairy options sold through supermarkets and hypermarkets. Local dairy processing is improving in the UAE, Saudi Arabia, and South Africa. However, dependence on imports and unstable milk supply in several nations limit faster growth. Increasing adoption of UHT milk and e-commerce deliveries supports gradual market expansion.

Market Segmentations:

By Source:

By Distribution Channel:

- Mainstream Stores

- Specialty Stores

By Formulation:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the skimmed milk market players such as FrieslandCampina, Lactalis, Meiji Holdings Co. Ltd., Arla Foods Amba, Danone, Dairy Farmers of America, Inc., Fonterra, GCMMF, DMK Group, and Nestlé. The skimmed milk market features strong activity from global dairy processors, regional cooperatives, and specialized nutrition brands. Companies focus on large-scale milk collection, advanced processing, and efficient cold-chain distribution to maintain consistent product quality. Many producers invest in organic, lactose-free, and fortified formulations to target health-conscious consumers and premium retail segments. Skimmed milk powders receive high demand from bakeries, confectionery makers, beverage companies, and sports nutrition brands, driving long-term supply contracts and industrial partnerships. E-commerce and subscription-based home delivery services improve brand reach, while ready-to-drink low-fat beverages gain popularity among young consumers. Firms also strengthen sustainability practices through traceable sourcing, eco-friendly packaging, and reduced carbon footprints. Product innovation, clean-label ingredients, and marketing focused on nutrition benefits create strong brand differentiation, driving intense competition across retail and food processing channels.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- FrieslandCampina

- Lactalis

- Meiji Holdings Co. Ltd.

- Arla Foods Amba

- Danone

- Dairy Farmers of America, Inc.

- Fonterra

- GCMMF

- DMK Group

- Nestlé

Recent Developments

- In August 2025, Breast Milk scoop that is freshly expressed and oddly familiar sweet, salty, and smooth with hints of honey and many of the nutrients included in breast milk, like colostrum, the company Frida teamed with OddFellows.

- In July 2025, Amit Shah dairy launched by cooperative projects worth over Rs. 400 Crore in Gujarat, which urge transparency and technology adoption. Amit Shah virtually inaugurated the expansion of Amul’s Rs. 105 crore chocolate plant at Tribhuvandas Food Complex, Mogar, and the Rs. 260 crore Dr. Verghese Kurien Cheese Plant in Khatraj.

- In June 2025, Darigold, Inc. has commenced operations at its newly established dairy processing facility in Pasco, Washington. The facility aims to process daily up of milk sourced from over 100 regional farms.

- In May 2025, Asahi Group Japan introduced Like Milk, a yeast extract powder-based milk alternative free from 28 major allergens, marking the company’s first venture into dairy alternatives as part of diversification strategy to increase non-alcoholic beverage.

Report Coverage

The research report offers an in-depth analysis based on Source, Distribution Channel, Formulation and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of fortified, lactose-free, and organic skimmed milk will continue to rise.

- Growth in bakery, confectionery, and ready-to-drink beverages will increase industrial demand.

- E-commerce, app-based delivery, and subscription models will expand product reach.

- Flavored and functional skimmed milk will gain stronger traction among young consumers.

- Clean-label and sustainable packaging will influence purchasing decisions.

- Investments in modern dairy farms and cold-chain systems will improve supply stability.

- Rising fitness and weight-management trends will support everyday consumption.

- Dairy cooperatives and large processors will expand into new emerging markets.

- Digital marketing and brand transparency will boost consumer trust and loyalty.

- Competition from plant-based alternatives will drive more innovation in taste and nutrition.