Market Overview

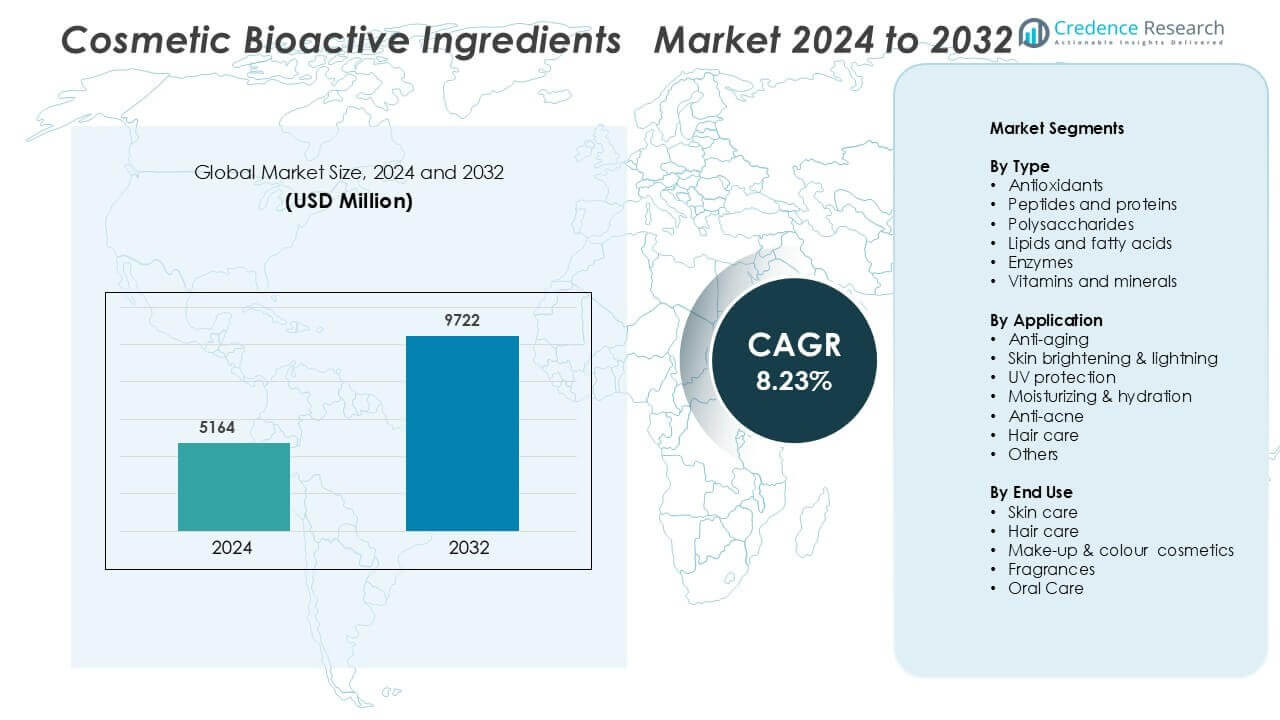

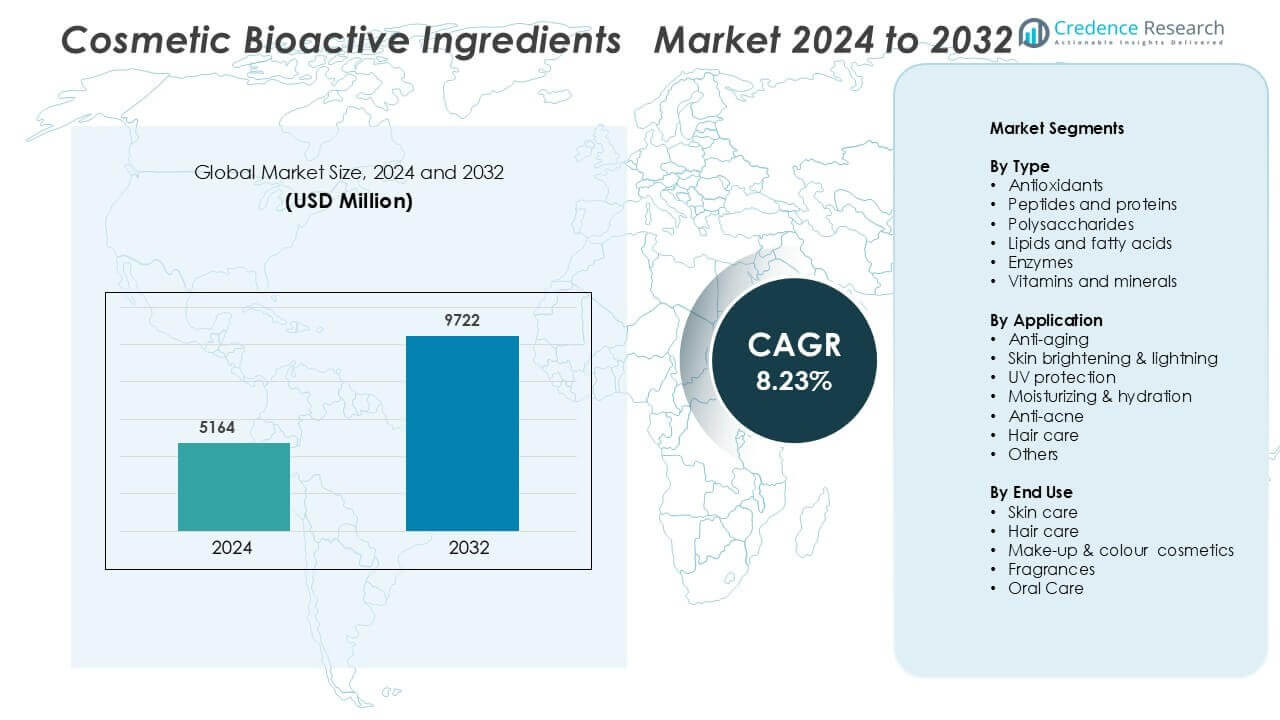

Cosmetic Bioactive Ingredients Market was valued at USD 5164 million in 2024 and is anticipated to reach USD 9722 million by 2032, growing at a CAGR of 8.23% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cosmetic Bioactive Ingredients Market Size 2024 |

USD 5164 Million |

| Cosmetic Bioactive Ingredients Market, CAGR |

8.23% |

| Cosmetic Bioactive Ingredients Market Size 2032 |

USD 9722 Million |

The cosmetic bioactive ingredients market is dominated by major players such as BASF SE, DuPont, Cargill, Archer Daniels Midland Company (ADM), Ajinomoto Co., Inc., Ingredion, Sabinsa, Nuritas, Mazza Innovation Ltd., and Owen Biosciences, Inc. These companies focus on sustainable ingredient development, biotechnology innovation, and strategic collaborations to enhance product efficacy and safety. BASF SE and DuPont lead in peptide and antioxidant-based actives, while Sabinsa and Nuritas specialize in plant-derived and peptide bioactives with clinically proven results. North America emerges as the leading region, holding a 37% market share, driven by strong consumer demand for premium, natural, and science-backed cosmetic formulations supported by robust R&D infrastructure and advanced manufacturing capabilities.

Market Insights

- The Cosmetic Bioactive Ingredients Market was valued at USD 5164 million in 2024 and is projected to grow at a CAGR of 8.23% through 2032.

- Growing consumer demand for natural, functional, and sustainable cosmetic formulations drives market expansion across skincare, hair care, and anti-aging segments.

- Increasing adoption of plant-based peptides, antioxidants, and polysaccharides highlights the trend toward clean beauty and personalized skincare solutions.

- Key players such as BASF SE, DuPont, Cargill, and Sabinsa lead the competitive landscape through innovation in bio-based actives and advanced delivery technologies.

- North America holds the largest regional share of 37%, followed by Europe at 30%, while the antioxidants segment leads by type with a 31% market share, driven by strong adoption in anti-aging and protective skincare formulations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Antioxidants dominate the cosmetic bioactive ingredients market with a 31% share, driven by their strong role in protecting skin from oxidative stress and environmental damage. These compounds, including vitamin C, coenzyme Q10, and polyphenols, help reduce free radical damage, supporting anti-aging and skin repair formulations. Peptides and proteins are gaining momentum for their collagen-boosting and firming effects, while polysaccharides are valued for hydration and barrier enhancement. The demand for natural and multifunctional bioactive ingredients continues to grow as consumers prioritize clean beauty and clinically proven efficacy.

- For instance, L’Oréal developed its patented Pro-Xylane molecule, derived from xylose sugar, which boosts skin density by stimulating glycosaminoglycan (GAG) synthesis. In vitro (lab) studies showed GAG synthesis increased by up to 48% in dermal cells; in clinical in vivo (human) studies, Pro-Xylane improved overall skin quality and structure (including increased dermal thickness and elasticity) by approximately 17%.

By Application

Anti-aging applications hold the largest market share of 35%, fueled by increasing consumer focus on wrinkle reduction and skin rejuvenation. Bioactive ingredients like retinol, ceramides, and peptides are widely used to enhance elasticity and smoothness. The skin-brightening and UV-protection segments are expanding rapidly due to rising sun exposure concerns and urban pollution. Moisturizing and anti-acne formulations also witness steady adoption, particularly among young consumers seeking natural, effective, and non-irritating skincare solutions. The trend toward multifunctional products strengthens this segment’s innovation pipeline.

- For instance, Estée Lauder’s Advanced Night Repair Synchronized Multi-Recovery Complex features Chronolux Power Signal Technology, which helps boost the skin’s natural ability for visible self-repair and promotes natural collagen production (with in vitro testing showing it helps increase collagen levels when the skin’s natural rhythm of repair is optimized).

By End Use

Skin care represents the leading end-use segment with a 47% market share, supported by strong demand for serums, creams, and lotions enriched with bioactive ingredients. Consumers increasingly prefer products with antioxidants, vitamins, and peptides that promote visible results. Hair care follows closely, with bioactive formulations targeting scalp health, follicle stimulation, and hair strength. Make-up and color cosmetics are adopting bioactive ingredients to blend skincare benefits with aesthetics, while fragrances and oral care are gradually integrating natural actives for enhanced sensory and health appeal.

Key Growth Drivers

Rising Demand for Natural and Functional Ingredients

The growing preference for natural, plant-derived, and clean-label cosmetic formulations is a major growth driver for the cosmetic bioactive ingredients market. Consumers are increasingly aware of the potential side effects of synthetic chemicals, leading brands to integrate ingredients such as botanical extracts, antioxidants, peptides, and enzymes that offer proven skin benefits. Manufacturers are investing heavily in R&D to improve ingredient stability, absorption, and bioavailability in topical applications. For instance, BASF has expanded its line of bioactive ingredients with plant-based antioxidants designed for anti-aging and protection from pollution. This shift toward sustainable sourcing, transparency, and eco-friendly formulations continues to enhance product credibility, attracting both premium and mass-market consumers across regions.

- For instance, BASF expanded its Plant Care Actives line with Dermagenist™, derived from Origanum majorana leaf extract, which is clinically proven to improve skin density and firmness by targeting the skin’s epigenetic patterns. It helps restore the fibroblasts’ natural ability to produce essential matrix proteins, resulting in a strengthened matrix and improved skin firmness.

Growing Popularity of Anti-Aging and Skin Health Products

The rising global aging population and increased consumer interest in preventive skincare have boosted demand for bioactive ingredients with anti-aging and rejuvenating properties. Ingredients such as collagen peptides, retinol derivatives, and coenzyme Q10 are widely used to promote elasticity, reduce wrinkles, and enhance cellular repair. The market benefits from strong demand across serums, moisturizers, and functional cosmetics designed to improve long-term skin health. Companies like Croda International and Givaudan have introduced biomimetic peptides that target skin renewal at the molecular level. This trend reflects a broader shift from cosmetic enhancement to dermal wellness, where consumers seek clinically validated, performance-driven ingredients supported by scientific research and proven efficacy claims.

- For instance, Skinnova SC Technology is described as an innovative principle of cell renewal that combines two components: active support for the skin’s own stem cells (the “SC” part, using a Stem Cell Peptide) and the provision of an ideal micro-environment for all skin cells (the “SkinNova” part).

Technological Advancements in Ingredient Formulation

Continuous innovation in biotechnology, nanotechnology, and encapsulation systems has significantly improved the performance and delivery of bioactive ingredients. Advanced encapsulation methods enhance the penetration and stability of sensitive compounds such as vitamins, enzymes, and essential oils. For instance, Evonik’s ROVISOME® delivery technology enables controlled release of actives for prolonged efficacy and reduced irritation. This technological evolution allows brands to offer multifunctional products addressing hydration, UV protection, and pigmentation simultaneously. Additionally, AI-driven formulation design and precision fermentation are enabling ingredient customization at a molecular level. These advancements are fostering the development of targeted solutions that align with specific skin and hair needs, improving overall user satisfaction and market competitiveness.

Key Trends & Opportunities

Integration of Biotechnology and Sustainable Production

Biotechnology-based ingredient production is emerging as a sustainable alternative to conventional extraction methods. Companies are adopting microbial fermentation, enzymatic synthesis, and cell culture techniques to create high-purity bioactive compounds with reduced environmental impact. For instance, DSM’s use of biotech processes in producing hyaluronic acid and peptides ensures consistent quality and eco-efficiency. This trend aligns with the clean beauty movement and supports circular economy initiatives in cosmetics manufacturing. The growing collaboration between cosmetic and biotech firms presents an opportunity to develop innovative, lab-grown actives that address ethical sourcing challenges while maintaining product performance and stability.

- For instance, DSM’s hyaluronic acid products, including Hyaluronic Acid BT and those in the HYA-ACT™ line, are indeed produced through microbial fermentation (biotechnologically manufactured).

Expanding Role of Personalized and Smart Skincare

The rise of personalized beauty is reshaping product development in the cosmetic bioactive ingredients market. Advances in skin diagnostics, genetic testing, and AI-driven analytics are allowing brands to create formulations tailored to individual skin types and environmental conditions. Companies like L’Oréal and Shiseido are integrating AI-powered tools to recommend products containing customized concentrations of bioactives such as niacinamide, peptides, and ceramides. This approach enhances user experience, loyalty, and perceived value. The combination of data-driven insights with precision-formulated actives represents a major opportunity for manufacturers to differentiate offerings in a crowded market and meet the growing demand for bespoke skincare solutions.

- For instance, the original Neutrogena Skin360 system, launched in 2018, included an optional hardware accessory called the “SkinScanner” which attached to a smartphone and featured a 30x magnification lens and 12 LED lights.

Rising Adoption in Men’s Grooming and Hair Care

The men’s grooming segment presents new growth avenues for bioactive ingredients, especially in anti-aging, moisturizing, and hair-strengthening formulations. Male consumers are increasingly adopting skincare routines focused on hydration, texture improvement, and anti-pollution protection. For instance, Unilever’s Dove Men+Care line integrates bioactive peptides and natural oils to improve skin resilience and smoothness. Similarly, hair care brands are incorporating botanical actives like caffeine and biotin to enhance scalp health and prevent hair thinning. This expansion beyond traditional female-focused products reflects a broader shift toward inclusivity and functional personal care solutions, supporting higher market penetration.

Key Challenges

High Cost and Complex Production Processes

Producing bioactive ingredients involves intricate extraction, purification, and stabilization steps that significantly increase production costs. The use of advanced biotechnological and encapsulation techniques adds further expense, often limiting large-scale adoption by small and mid-sized cosmetic brands. Ingredient degradation due to heat, pH, and light exposure during formulation also complicates processing. For instance, maintaining the bioavailability of vitamin C and retinol in emulsions remains technically demanding. These factors restrict accessibility, particularly in price-sensitive markets, and pose challenges for consistent product quality. Reducing production costs through scalable, sustainable technologies will be essential for broader industry adoption.

Regulatory and Safety Compliance Barriers

The cosmetic bioactive ingredients market faces strict regulatory frameworks governing ingredient safety, claims validation, and labeling transparency. Differences in standards between regions—such as FDA (U.S.), EMA (Europe), and CFDA (China)—create additional complexities for global manufacturers. Extensive testing is required to confirm the efficacy and non-toxicity of new bioactive compounds before commercialization. Instances of allergens or irritation linked to natural extracts can also lead to consumer skepticism and product recalls. For example, certain botanical actives require specific allergen disclosures under EU REACH regulations. Ensuring full compliance while maintaining innovation speed remains a major challenge for manufacturers aiming to enter new markets efficiently.

Regional Analysis

North America

North America holds a 37% share of the cosmetic bioactive ingredients market, driven by high consumer demand for premium skincare and anti-aging products. The region benefits from a strong presence of established cosmetic manufacturers such as Estée Lauder and Procter & Gamble, which invest heavily in advanced formulations. Increasing awareness of clean beauty, coupled with a growing preference for natural and sustainable ingredients, supports steady market growth. The U.S. dominates regional sales due to technological innovation, regulatory support for safe ingredients, and high spending on dermatological and cosmeceutical products.

Europe

Europe accounts for 30% of the global market share, supported by strong regulatory frameworks emphasizing ingredient transparency and safety. The region’s leading cosmetics hubs France, Germany, and Italy promote innovation through eco-friendly formulations and biotechnological advancements. European consumers favor vegan, organic, and cruelty-free products, boosting demand for bioactive ingredients such as antioxidants and peptides. Companies like BASF SE and Givaudan are spearheading sustainable ingredient production using fermentation technologies. The shift toward circular beauty and sustainable packaging further strengthens Europe’s market position in premium skincare and hair care formulations.

Asia-Pacific

Asia-Pacific holds a 25% market share and exhibits the fastest growth, driven by rising disposable incomes and increasing beauty consciousness among younger demographics. Countries such as Japan, South Korea, and China are leading innovation in cosmeceuticals, particularly in anti-aging and skin-brightening applications. The region’s manufacturers leverage plant-based and marine-derived actives to cater to natural skincare preferences. South Korea’s K-beauty trend and Japan’s J-beauty influence global product formulations. Rapid urbanization, e-commerce expansion, and domestic R&D investments are expected to position Asia-Pacific as a key hub for bioactive ingredient development.

Latin America

Latin America captures an 5% share of the cosmetic bioactive ingredients market, driven by increasing adoption of natural and herbal cosmetic products. Brazil and Mexico dominate regional demand due to their strong beauty and personal care industries. Local brands are incorporating botanical extracts, vitamins, and essential oils into skincare and hair care lines to meet growing consumer interest in sustainability. Supportive regulatory policies and rising awareness of dermatological health are further encouraging innovation. Expanding retail distribution networks and digital beauty platforms are helping global players strengthen their presence across the region.

Middle East & Africa

The Middle East & Africa account for a 3% share of the global market, supported by growing consumer interest in luxury and wellness-based cosmetics. The UAE and Saudi Arabia are key contributors, with rising demand for anti-aging, UV-protection, and hydration-focused skincare. Increasing tourism and a surge in premium beauty retail chains support the region’s expansion. Global companies are partnering with regional distributors to introduce bioactive-enriched products suited for hot, arid climates. Government initiatives promoting local manufacturing and halal-certified cosmetics are also fostering the adoption of bioactive ingredients in high-end formulations.

Market Segmentations

By Type

- Antioxidants

- Peptides and proteins

- Polysaccharides

- Lipids and fatty acids

- Enzymes

- Vitamins and minerals

By Application

- Anti-aging

- Skin brightening & lightning

- UV protection

- Moisturizing & hydration

- Anti-acne

- Hair care

- Others

By End Use

- Skin care

- Hair care

- Make-up & color cosmetics

- Fragrances

- Oral Care

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The cosmetic bioactive ingredients market is highly competitive, featuring a mix of global chemical giants, biotechnology innovators, and specialized ingredient developers. Leading players such as BASF SE, DuPont, Cargill, Archer Daniels Midland Company (ADM), and Ajinomoto Co., Inc. focus on expanding their bioactive portfolios through advanced biotechnological and sustainable production methods. Companies like Sabinsa and Nuritas emphasize plant-based and peptide-based actives supported by clinical efficacy studies. Ingredion and Mazza Innovation Ltd. are strengthening their market presence through natural extraction and clean-label solutions. Owen Biosciences, Inc. concentrates on biotechnology-driven ingredient innovations targeting dermal rejuvenation and repair. Strategic collaborations, product launches, and R&D investments are central to maintaining competitiveness. For instance, BASF’s Care Creations division continues to introduce bioactives with scientifically proven skin benefits, while ADM leverages its fermentation expertise for functional cosmetic ingredients. This combination of scientific innovation and sustainable sourcing defines the industry’s evolving competitive environment.

Key Player Analysis

- BASF SE

- DuPont

- Cargill

- Archer Daniels Midland Company (ADM)

- Ajinomoto Co., Inc.

- Ingredion

- Sabinsa

- Nuritas

- Mazza Innovation Ltd.

- Owen Biosciences, Inc.

Recent Developments

- In March 2023, Lucas Meyer Cosmetics, a division of IFF, unveiled two new releases at in-cos global in Barcelona. These products focus on night time skin ingredients that aid in skin regeneration and relaxation. The active components work in tandem, employing a dual mechanism to enhance sleep quality and directly impact skin rejuvenation, leading to improved nighttime skin recovery.

- In March 2023, Symrise introduces a new range of skincare bioactive. With the emergence of these differentiated and innovative nutritional ingredients, the company will be able to expand its product range. A comprehensive range of skin care solutions that include conditioning and preventing aging, brightening the skin as well as hair and nail treatments is available. The launch is a complement to Symrise’s long history in the cosmetics sector, with its offering of ingredients for skin care.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for natural and plant-derived bioactive ingredients will continue to rise in premium skincare.

- Biotechnology and fermentation-based production methods will improve ingredient purity and sustainability.

- Personalized skincare formulations using AI-driven diagnostics will shape product innovation.

- Peptides and antioxidants will remain the most preferred ingredients for anti-aging applications.

- Advanced encapsulation technologies will enhance bioavailability and stability of active compounds.

- Clean beauty and eco-certified ingredients will gain more regulatory and consumer support.

- Strategic collaborations between cosmetic and biotech firms will expand product development pipelines.

- Emerging markets in Asia-Pacific will drive future growth through rising beauty awareness.

- Men’s grooming and hair care products will increasingly incorporate bioactive formulations.

- Ongoing R&D investment will lead to multifunctional ingredients addressing hydration, repair, and protection.