Market Overview

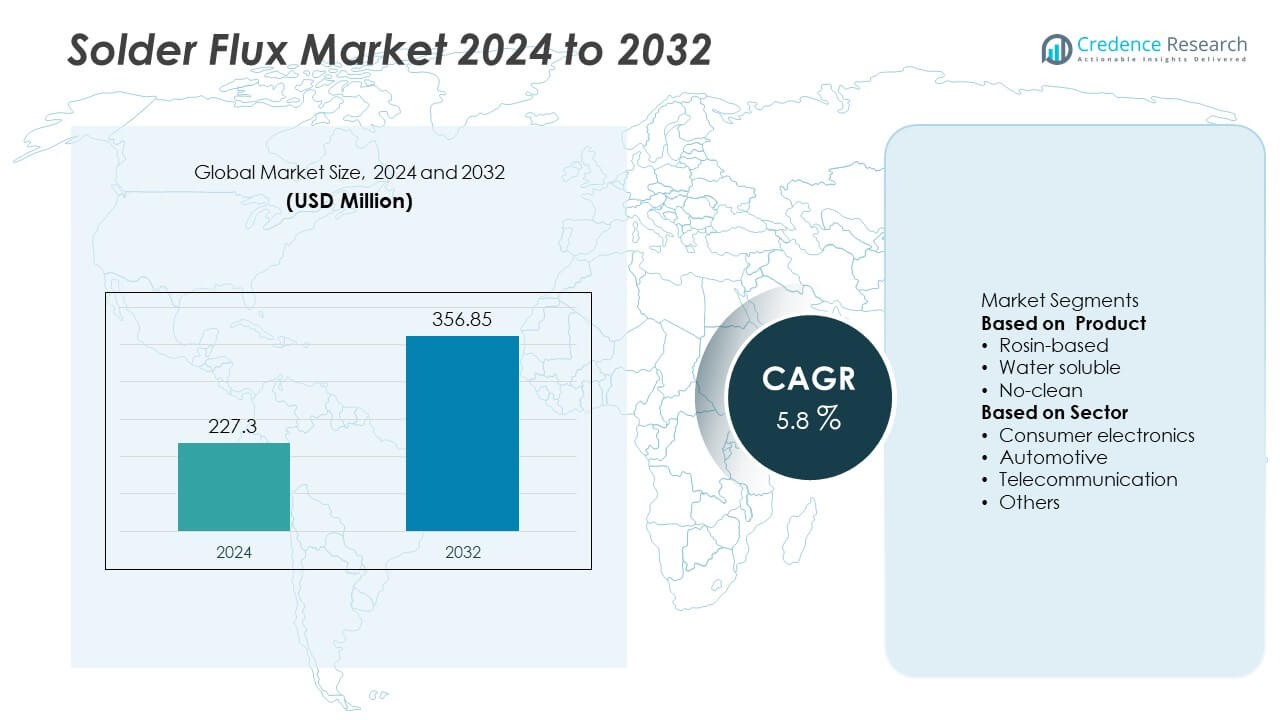

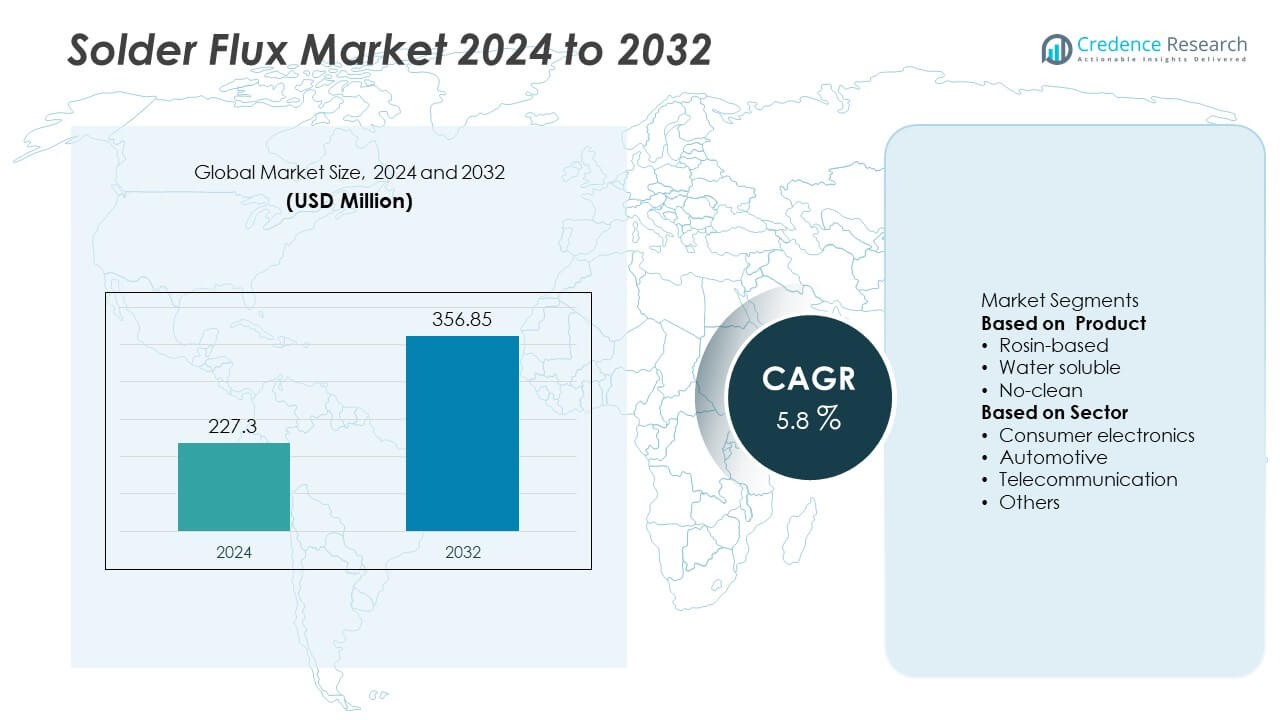

The Solder Flux market was valued at USD 227.3 million in 2024 and is projected to reach USD 356.85 million by 2032, expanding at a CAGR of 5.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Solder Flux Market Size 2024 |

USD 227.3 Million |

| Solder Flux Market, CAGR |

5.8% |

| Solder Flux Market Size 2032 |

USD 356.85 Million |

The solder flux market is led by key players including INVENTEC Performance Chemicals, Johnson Matthey, KOKI Company Ltd, FCT Solder, Henkel, Shenzhen Tong Fang Electronic New Material Co., Ltd., La-Co Industries Inc, Indium Corporation, PREMIER INDUSTRIES, and MacDermid Alpha Electronics Solutions. These companies focus on no-clean, lead-free, and eco-friendly flux solutions to meet the demands of advanced electronics, automotive, and telecommunication sectors. In 2024, North America held 34% share, driven by strong consumer electronics and EV adoption, while Europe accounted for 27%, supported by stringent RoHS and REACH regulations. Asia-Pacific captured 29%, emerging as the fastest-growing region due to large-scale electronics manufacturing, with Latin America and the Middle East & Africa holding 6% and 4% respectively.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The solder flux market was valued at USD 227.3 million in 2024 and is projected to reach USD 356.85 million by 2032, growing at a CAGR of 5.8% during the forecast period.

- Growth is driven by rising demand from consumer electronics, which held 52% share in 2024, supported by increasing production of smartphones, laptops, and wearables requiring advanced soldering solutions.

- Key trends include growing adoption of no-clean flux, which led with 48% share in 2024, along with rising demand for eco-friendly, lead-free formulations aligned with global sustainability standards.

- The competitive landscape features major players such as INVENTEC Performance Chemicals, Johnson Matthey, KOKI Company Ltd, FCT Solder, Henkel, Indium Corporation, Shenzhen Tong Fang Electronic New Material Co., Ltd., PREMIER INDUSTRIES, La-Co Industries Inc, and MacDermid Alpha Electronics Solutions, focusing on innovation and compliance with RoHS and REACH.

- Regionally, North America led with 34% share, followed by Asia-Pacific at 29%, Europe at 27%, and Latin America and Middle East & Africa with 6% and 4% respectively.

Market Segmentation Analysis:

By Product

The no-clean solder flux segment dominated the market in 2024 with a 48% share. Its leadership is driven by increasing demand in consumer electronics and telecommunication sectors where minimal post-solder cleaning reduces production time and cost. No-clean fluxes provide strong solder joint reliability while minimizing residue, which is critical in miniaturized circuits and advanced PCB designs. Rosin-based and water-soluble fluxes continue to serve niche applications, with rosin preferred in traditional soldering and water-soluble valued for high-reliability assemblies, but the low-maintenance benefits of no-clean variants sustain their dominance across global manufacturing facilities.

- For instance, Indium Corporation manufactures a range of advanced halogen-free, no-clean SnAgCu solder pastes, such as the Indium8.9HF series, engineered for high reliability in demanding and miniaturized assembly contexts.

By Sector

Consumer electronics accounted for the largest share of the solder flux market in 2024 with 52%. The sector’s dominance is supported by rising global demand for smartphones, tablets, laptops, and wearables that require precise soldering solutions. Increasing complexity of printed circuit boards and miniaturized components drives the adoption of high-performance flux formulations. The automotive sector also shows strong growth, particularly in electric vehicles where advanced soldering materials ensure durability and heat resistance. Telecommunication and other industrial applications add steady demand, but consumer electronics remains the leading driver of global flux consumption.

- For instance, a 2014 study published by Indium Corporation’s Eric Bastow demonstrated that no-clean solder pastes, when reflowed at a peak temperature as low as 225°C, could achieve very good (high) Surface Insulation Resistance (SIR) values, suggesting advancements in flux technology that can enhance reliability for electronics assembly.

Key Growth Drivers

Rising Demand from Consumer Electronics

The consumer electronics sector, which held 52% share in 2024, remains the largest growth driver for the solder flux market. Rising production of smartphones, laptops, tablets, and wearables boosts demand for reliable soldering solutions. Increasing miniaturization of circuit boards requires advanced flux formulations that ensure strong joints and minimal residue. Manufacturers are investing in no-clean flux products to meet high-volume assembly needs and reduce cleaning costs. Rapid product innovation and growing global electronics consumption continue to sustain strong demand for solder flux in this sector.

- For instance, Henkel supplies advanced no-clean flux formulations used in high-speed smartphone manufacturing, which support demanding production line speeds and ensure uniform wetting and residue control on complex, high-density PCBs.

Growth in Automotive Electronics

The expansion of automotive electronics, especially with electric vehicles and ADAS systems, is a key driver of solder flux demand. In 2024, automotive applications represented 23% share, highlighting their growing role in market growth. Solder flux is critical for ensuring durability, heat resistance, and reliability of electronic components in harsh automotive environments. Increasing investments in EV battery management systems and in-vehicle infotainment systems further support adoption. The automotive industry’s shift toward electronic integration positions solder flux as a critical enabler of long-term growth.

- For instance, MacDermid Alpha Electronics Solutions offers various halogen-free, no-clean fluxes, like the ALPHA EF-6808HF, which are designed to meet stringent electrical reliability requirements, such as those governed by IPC J-STD-004B. These products are engineered for use in demanding automotive applications, including EV powertrain and ADAS electronic modules, where they demonstrate high reliability and durability under thermal stress, contributing to consistent performance and improved solder joint cosmetics.

Advancements in Telecommunication Infrastructure

The roll-out of 5G networks and growing demand for high-frequency devices is fueling demand for solder flux in the telecommunication sector. With telecommunication applications holding 17% share in 2024, the need for precise soldering solutions for compact, high-performance devices continues to rise. Flux formulations that ensure minimal signal interference and improved conductivity are increasingly preferred. Investments in global 5G infrastructure and IoT device production further expand opportunities. This trend makes telecommunication a key growth driver, complementing demand from electronics and automotive sectors.

Key Trends & Opportunities

Adoption of No-Clean Flux Solutions

The no-clean solder flux segment led the market with 48% share in 2024, and its adoption continues to rise. The reduced need for post-solder cleaning lowers operational costs and speeds up production cycles, especially in high-volume electronics manufacturing. With growing complexity of PCBs, no-clean formulations also provide stronger joints and long-term reliability. Manufacturers see opportunities to expand environmentally friendly no-clean fluxes tailored for miniaturized circuits and advanced semiconductor devices, ensuring continued leadership of this product type in global markets.

- For instance, AIM Solder highlighted its NC259FPA ultrafine no-clean solder paste in 2024, which offers excellent stencil print transfer efficiency with a volume transfer rate exceeding 95%, optimized for high-precision electronic assemblies.

Shift Toward Eco-Friendly and Lead-Free Fluxes

Sustainability regulations and environmental standards are driving opportunities for eco-friendly solder flux formulations. Manufacturers are developing lead-free and halogen-free fluxes to comply with global regulations such as RoHS and REACH. These eco-friendly options also align with industry efforts to reduce harmful residues and emissions. As electronics production expands worldwide, demand for fluxes that balance environmental compliance with high soldering efficiency will increase. This shift positions sustainable flux solutions as a long-term growth opportunity in developed and emerging markets alike.

- For instance, Indium Corporation’s Indium8.9HFRV no-clean solder paste, launched in 2024, features low voiding characteristics and provides exceptional solder joint quality with air reflow capabilities, supporting greener manufacturing processes with halogen-free certification.

Key Challenges

Volatility in Raw Material Prices

The solder flux market faces challenges due to fluctuations in raw material costs, including rosin, solvents, and activators. Price volatility impacts manufacturing margins and creates uncertainty for producers dependent on stable supply chains. Smaller manufacturers are particularly affected, as they lack scale to absorb cost swings. This challenge can hinder consistent product pricing and limit competitiveness in highly cost-sensitive markets, especially across Asia-Pacific and Latin America.

Stringent Environmental and Safety Regulations

While eco-friendly formulations present opportunities, compliance with strict environmental and workplace safety regulations remains a challenge. Regulations restricting volatile organic compounds (VOCs) and lead-based materials force manufacturers to invest heavily in R&D for alternative formulations. Transitioning to compliant products increases production costs and may slow adoption in price-sensitive regions. Failure to meet global compliance standards could limit access to key markets such as Europe and North America, creating additional barriers for growth.

Regional Analysis

North America

North America held the largest share of the solder flux market in 2024 with 34%. Strong demand from the consumer electronics sector, driven by advanced manufacturing in the United States, supports regional dominance. The automotive industry also contributes significantly, particularly with growing adoption of electric vehicles requiring reliable soldering solutions for battery systems and power electronics. Rising R&D investment and strict environmental standards encourage the adoption of eco-friendly, no-clean, and lead-free fluxes. The presence of established electronics and automotive OEMs, coupled with regulatory emphasis on quality and sustainability, ensures North America remains a leading region for solder flux.

Europe

Europe accounted for 27% share of the solder flux market in 2024, supported by strong automotive and industrial electronics demand. Countries such as Germany, France, and the UK drive consumption with a focus on advanced vehicle electronics and renewable energy applications. Strict EU regulations like RoHS and REACH accelerate the transition toward lead-free and environmentally compliant fluxes. The region’s commitment to sustainability boosts innovation in halogen-free and low-residue flux solutions. With high penetration of premium electronic devices and robust manufacturing bases, Europe remains a critical market for technologically advanced and eco-friendly solder flux products.

Asia-Pacific

Asia-Pacific represented 29% share of the solder flux market in 2024, making it the fastest-growing region. China, Japan, South Korea, and India are key contributors, driven by large-scale electronics manufacturing and expanding telecommunication infrastructure. The region benefits from a strong presence of semiconductor and PCB assembly industries, where demand for no-clean flux is highest. Rapid industrialization, urbanization, and rising disposable incomes further boost electronics consumption. Increasing automotive production, especially in EVs, adds significant opportunities. Asia-Pacific’s cost-efficient manufacturing and growing focus on high-performance, environmentally compliant fluxes ensure its position as a growth engine for the global market.

Latin America

Latin America held 6% share of the solder flux market in 2024, with growth mainly concentrated in Brazil and Mexico. Expanding consumer electronics manufacturing and rising automotive assembly operations contribute to regional demand. Cost sensitivity favors affordable rosin-based and water-soluble fluxes, though demand for no-clean fluxes is gradually increasing as manufacturing sophistication improves. Government initiatives to strengthen industrial production and attract foreign investments support growth. Despite challenges such as economic fluctuations and limited advanced R&D, Latin America shows potential for steady expansion in solder flux consumption, especially in automotive electronics and household appliance manufacturing.

Middle East & Africa

The Middle East & Africa accounted for 4% share of the solder flux market in 2024. Demand is driven by growing investments in telecommunication infrastructure, electronics assembly, and industrial applications in countries like the UAE, Saudi Arabia, and South Africa. The consumer electronics market is gradually expanding, supported by increasing urbanization and rising demand for imported and locally assembled devices. While adoption of advanced flux solutions is limited due to cost constraints, the region is witnessing rising interest in eco-friendly, lead-free formulations. Ongoing diversification of economies and focus on high-tech industries create opportunities for gradual market growth.

Market Segmentations:

By Product

- Rosin-based

- Water soluble

- No-clean

By Sector

- Consumer electronics

- Automotive

- Telecommunication

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the solder flux market features key players such as INVENTEC Performance Chemicals, Johnson Matthey, KOKI Company Ltd, FCT Solder, Henkel, Shenzhen Tong Fang Electronic New Material Co., Ltd., La-Co Industries Inc, Indium Corporation, PREMIER INDUSTRIES, and MacDermid Alpha Electronics Solutions. These companies compete by offering advanced flux formulations designed for miniaturized circuits, high-reliability soldering, and compliance with global environmental standards. No-clean and lead-free fluxes are the main focus, aligning with growing demand for eco-friendly and cost-efficient solutions in electronics, automotive, and telecommunication industries. Leading players invest heavily in R&D to enhance performance, reduce residue, and improve compatibility with automated soldering processes. Strategic initiatives include partnerships with electronics manufacturers, expansion into emerging Asia-Pacific markets, and diversification of product portfolios to meet sector-specific requirements. With stricter regulations and rapid advancements in consumer electronics, competition is intensifying, driving innovation and shaping the market’s evolution toward sustainable and high-performance soldering solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- INVENTEC PERFORMANCE CHEMICALS

- Johnson Matthey

- KOKI Company Ltd

- FCT Solder

- Henkel

- Shenzhen Tong fang Electronic New Material Co., Ltd.

- La-Co Industries Inc

- Indium Corporation

- PREMIER INDUSTRIES

- MacDermid Alpha Electronics Solutions

Recent Developments

- In July 2025, Indium Corporation announced the global availability of WS-910 Flip-Chip Flux, a new water-soluble flux for semiconductor devices.

- In 2025, Henkel sustained its leadership in the solder flux market with a wide range of no-clean, water-soluble, and rosin-based flux solutions tailored for high-reliability electronics manufacturing, focusing on halogen-free and lead-free fluxes to meet environmental regulations and expanding its presence in Asia-Pacific markets.

- In 2025, La-Co Industries Inc concentrated on no-clean and rosin-based flux products with development aimed at enhancing flux performance for SMT processes and meeting stricter environmental standards, particularly in North America and Asia.

Report Coverage

The research report offers an in-depth analysis based on Product, Sector and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The solder flux market will expand steadily with rising demand from electronics manufacturing.

- No-clean flux will continue to dominate due to reduced cleaning needs and lower costs.

- Lead-free and eco-friendly formulations will gain traction under stricter global regulations.

- Consumer electronics will remain the largest sector, driving high-volume flux consumption.

- Automotive electronics, especially in EVs, will create strong growth opportunities for advanced fluxes.

- Telecommunication infrastructure, including 5G networks, will boost demand for high-reliability flux.

- Asia-Pacific will remain the fastest-growing region with large-scale electronics production.

- North America and Europe will lead in adopting sustainable and high-performance formulations.

- Competition among global players will intensify as they expand into emerging markets.

- Ongoing R&D investment will drive innovation in residue-free, high-temperature, and automated soldering solutions.