Market Overview

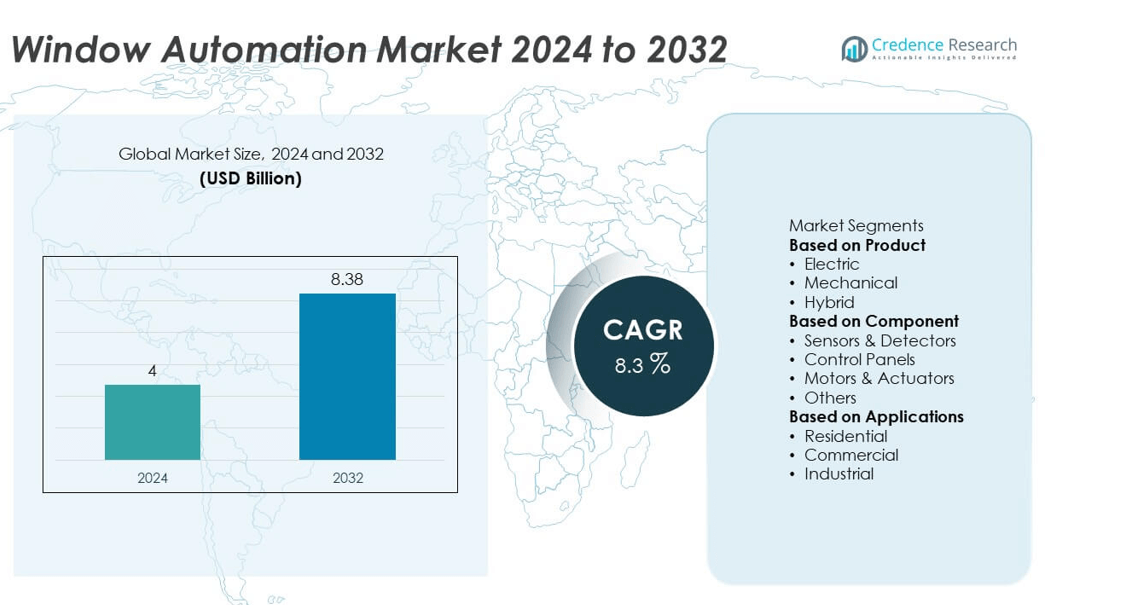

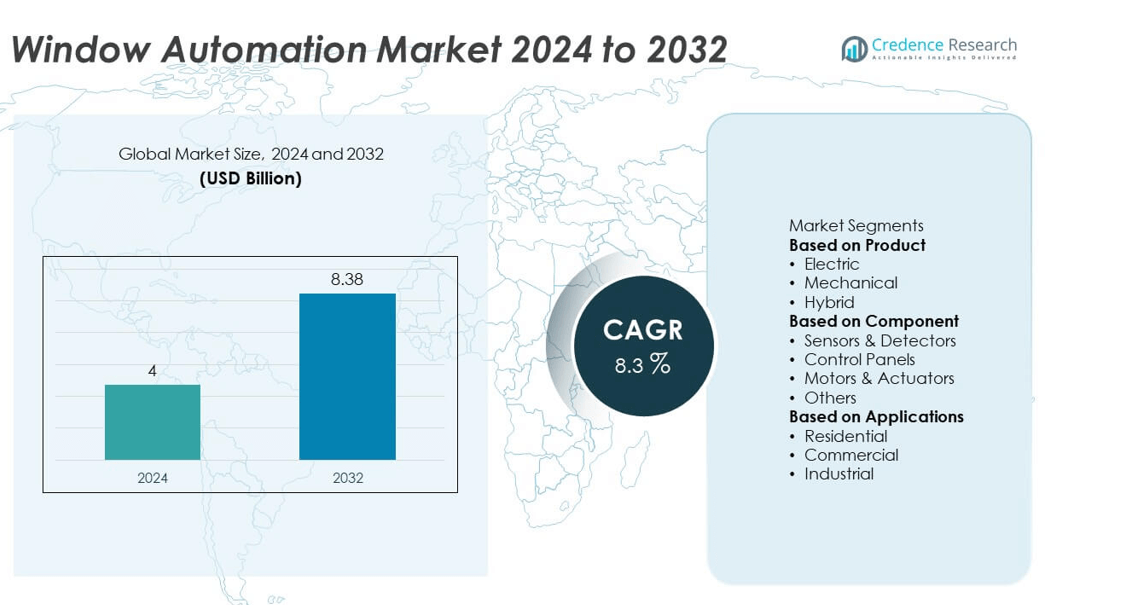

The global window automation market was valued at USD 4 billion in 2024 and is projected to reach USD 8.38 billion by 2032, growing at a CAGR of 8.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Window Automation Market Size 2024 |

USD 4 billion |

| Window Automation Market, CAGR |

8.3% |

| Window Automation Market Size 2032 |

USD 8.38 billion |

The window automation market is led by key players including GEZE GmbH, JLC Automation Services, SE Controls, Kintrol, EBSA, Pella Corporation, Aumuller Aumatic GmbH, Colt International Pty Limited, D+H Mechatronic AG, and WindowMaster International. These companies focus on delivering electric and hybrid window automation solutions integrated with smart building and energy management systems. North America held the largest share with 33% in 2024, driven by high adoption in commercial and institutional buildings. Europe followed with 30% share, supported by strict energy efficiency regulations and retrofitting projects, while Asia-Pacific captured 25% share, fueled by rapid urbanization and government-backed smart city initiatives.

Market Insights

- The window automation market was valued at USD 4 billion in 2024 and is projected to reach USD 8.38 billion by 2032, growing at a CAGR of 8.3%.

- Rising demand for smart building solutions, natural ventilation, and energy efficiency compliance is driving adoption of electric and hybrid window automation systems across residential, commercial, and industrial spaces.

- Key trends include integration with IoT platforms, use of AI-driven sensors for real-time control, and growth of retrofitting projects supporting sustainability and green building certifications.

- The market is competitive with GEZE GmbH, JLC Automation Services, SE Controls, Kintrol, Pella Corporation, and WindowMaster International focusing on advanced actuators, wireless control panels, and partnerships with construction and smart building solution providers.

- North America led with 33% share in 2024, followed by Europe at 30% and Asia-Pacific at 25%, while commercial applications dominated with over 50% share due to strong demand in offices, schools, and healthcare facilities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Electric window automation systems dominated the market with over 60% share in 2024, driven by their ease of integration with building management systems and compatibility with smart home technologies. These systems are widely adopted in commercial buildings, schools, and modern residential projects for automated natural ventilation and improved energy efficiency. Growing demand for touchless and remote-controlled solutions further boosts adoption. Electric systems also support integration with IoT-enabled devices and sensors, allowing real-time adjustments based on indoor air quality and weather conditions, which makes them a preferred choice for sustainable building projects.

- For instance, WindowMaster International won a contract on May 5, 2025, for a new and refurbished school in Bern, Switzerland. The company will deliver actuators and controls for 50 zones, enabling demand-controlled natural ventilation based on CO₂ levels and temperature sensors. The project is expected to be completed in the spring of 2026.

By Component

Motors and actuators held the largest share, accounting for over 40% of the market in 2024, as they are the core components enabling window movement and automation. Their demand is rising due to the need for reliable, quiet, and efficient operation in residential and commercial applications. Innovations in compact and energy-efficient actuators are driving adoption across retrofitting projects and new construction. Integration of actuators with smart sensors allows for precise control of ventilation and natural light, enhancing occupant comfort while reducing energy consumption. This makes them essential in smart building infrastructure.

- For instance, GEZE GmbH offers a wide range of electric window automation systems for commercial and institutional buildings across Europe, with modern products supporting IoT integration and remote monitoring via platforms like myGEZE Control.

By Applications

The commercial segment led the market with over 50% share in 2024, supported by widespread use of automated windows in offices, educational facilities, and healthcare buildings. Rising focus on indoor air quality, energy management, and compliance with green building standards such as LEED and BREEAM drives demand. Commercial users prefer automated systems for their ability to improve ventilation, reduce HVAC load, and enhance occupant productivity. The growing construction of smart buildings and retrofitting of existing infrastructure with automated solutions continues to fuel growth in this segment globally.

Market Overview

Rising Demand for Smart Building Solutions

The growing adoption of smart buildings is a major driver for the window automation market. Building owners are integrating automated windows with building management systems to improve energy efficiency, ventilation, and occupant comfort. Automated systems allow for precise control of natural light and air flow, reducing dependence on HVAC systems and lowering energy costs. Government initiatives promoting green building certifications such as LEED and BREEAM are encouraging installation of smart window solutions, especially in commercial and institutional buildings, boosting demand across new construction and retrofit projects.

- For instance, SE Controls equipped Loughborough University’s East Park Design School building with an integrated natural ventilation system, ensuring that indoor air quality and CO2 levels were maintained.

Focus on Indoor Air Quality and Energy Efficiency

Heightened awareness of indoor air quality and its impact on health is driving the use of automated natural ventilation systems. Window automation supports controlled airflow, reduces CO₂ levels, and improves occupant well-being in residential and commercial spaces. Simultaneously, energy efficiency regulations encourage the adoption of systems that optimize natural ventilation and daylight use, lowering energy consumption. These factors make window automation a key component in sustainable building design, aligning with global decarbonization and energy-saving goals.

- For instance, SE Controls specializes in designing and delivering smart automated ventilation window systems for commercial buildings, contributing to improved indoor air quality and reduced reliance on mechanical ventilation.

Growth in Urban Infrastructure Development

Rapid urbanization and increasing construction of commercial complexes, residential apartments, and institutional buildings are fueling demand for automated window solutions. Modern infrastructure projects prioritize energy efficiency, automation, and occupant convenience, making window automation a preferred choice. Infrastructure spending by governments and private players is supporting adoption in smart city projects, airports, schools, and hospitals. The rising trend of integrating IoT-based devices in building automation systems further strengthens the use of automated windows, driving consistent market growth in both developed and emerging economies.

Key Trends & Opportunities

Integration with IoT and Cloud-Based Systems

Window automation systems are increasingly being connected to IoT platforms, enabling remote monitoring and control through smartphones and cloud-based dashboards. This integration allows building managers to automate ventilation schedules, receive maintenance alerts, and adjust operations based on weather data or occupancy levels. The trend creates opportunities for solution providers to deliver AI-driven automation that optimizes energy consumption and enhances user experience. The shift toward connected buildings is accelerating adoption across commercial and residential sectors.

- For instance, major building technology companies like Honeywell and Siemens have integrated cloud-based, AI-driven platforms into their building management systems (BMS), enabling remote diagnostics, predictive maintenance, and optimized energy usage for numerous commercial properties.

Expansion of Retrofits and Energy Renovation Projects

The growing demand for retrofitting existing buildings with energy-efficient solutions presents a significant opportunity. Automated windows are increasingly being installed as part of energy renovation projects to meet stricter building codes and reduce carbon emissions. Governments and organizations are offering incentives for energy-efficient upgrades, encouraging property owners to adopt automation. This trend supports steady growth for motorized actuators and smart control systems that can be easily integrated into existing infrastructure without major structural changes.

- For instance, JLC Group supplies and installs specialized security and access control systems for industries such as aviation, including blast-enhanced doors and automated gates. For the aviation sector, the company provides ground power solutions and cable carriers to major airports.

Key Challenges

High Initial Installation Costs

The cost of installing automated window systems, including actuators, control panels, and smart sensors, can be high, particularly for large buildings or retrofitting projects. This upfront investment can deter adoption among small-scale property owners and budget-constrained sectors. Manufacturers must focus on offering scalable and modular solutions that balance cost-efficiency with performance to increase accessibility for a wider customer base.

Complexity of Integration and Maintenance

Integrating automated windows with building management systems and ensuring compatibility with existing infrastructure can be complex and time-consuming. Maintenance requirements, including calibration of sensors and periodic servicing of actuators, add to operational costs. Lack of technical expertise for proper installation and maintenance may result in underperformance, leading to user dissatisfaction and slower adoption rates in certain markets.

Regional Analysis

North America

North America held the largest share of the window automation market with 33% share in 2024, driven by strong adoption of smart building technologies and green construction standards. The U.S. leads demand with widespread integration of automated windows in commercial buildings, schools, and healthcare facilities to improve energy efficiency and indoor air quality. Supportive regulations such as ASHRAE standards and incentives for energy-efficient upgrades encourage market growth. Canada is also witnessing increased adoption in residential and public infrastructure projects. The presence of major automation solution providers and advanced IoT infrastructure further supports steady market expansion.

Europe

Europe accounted for 30% share in 2024, supported by stringent energy efficiency regulations and growing emphasis on sustainable construction practices. Countries like Germany, the U.K., and France are leading adoption due to initiatives like the EU Green Deal and compliance with EN standards. Demand is strong across commercial and institutional buildings, where automated windows help achieve natural ventilation targets and reduce carbon emissions. Retrofitting of older buildings with automated solutions is a key growth driver. The region’s mature construction industry and focus on occupant well-being continue to support consistent market penetration.

Asia-Pacific

Asia-Pacific represented 25% share in 2024 and is the fastest-growing region, driven by rapid urbanization and infrastructure development in China, India, and Southeast Asia. Rising construction of residential complexes, commercial offices, and educational institutions is fueling demand for energy-efficient and automated ventilation systems. Government-backed smart city initiatives and stricter building codes are accelerating adoption. Domestic manufacturers are launching cost-effective electric actuators and smart sensors to cater to local demand. Growing middle-class housing projects and increased awareness about indoor air quality are further boosting the uptake of window automation systems in the region.

Middle East & Africa

The Middle East & Africa captured 7% share in 2024, with demand driven by rising investments in modern infrastructure and commercial projects. Countries like UAE, Saudi Arabia, and Qatar are incorporating automated ventilation systems in airports, hospitality complexes, and high-end residential developments to meet sustainability goals. The region’s hot climate increases demand for systems that support optimal airflow and reduce energy consumption for cooling. Africa is gradually adopting these solutions in premium residential and commercial projects, with South Africa leading uptake. Growing focus on energy conservation and luxury construction continues to fuel steady market growth.

Latin America

Latin America accounted for 5% share in 2024, with Brazil and Mexico leading adoption of automated window solutions in commercial and residential sectors. The market is supported by rising urbanization, investments in office spaces, and modernization of educational and healthcare infrastructure. Government initiatives promoting energy efficiency and ventilation standards encourage installation of smart window systems. The aftermarket segment is growing as building owners increasingly retrofit older structures with motorized actuators and control panels. Despite economic fluctuations, demand is expected to grow steadily as sustainability and indoor air quality become top priorities for building operators.

Market Segmentations:

By Product

- Electric

- Mechanical

- Hybrid

By Component

- Sensors & Detectors

- Control Panels

- Motors & Actuators

- Others

By Applications

- Residential

- Commercial

- Industrial

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the window automation market is defined by leading players such as GEZE GmbH, JLC Automation Services, SE Controls, Kintrol, EBSA, Pella Corporation, Aumuller Aumatic GmbH, Colt International Pty Limited, D+H Mechatronic AG, and WindowMaster International. These companies focus on developing advanced electric and hybrid window automation solutions integrated with smart building systems. Strategic initiatives include partnerships with construction firms, collaborations with IoT technology providers, and expansion into emerging markets to cater to rising demand for energy-efficient ventilation solutions. Key players invest heavily in R&D to develop compact actuators, wireless control panels, and sensor-driven automation that support green building certifications. Competitive intensity is fueled by the increasing need for retrofit solutions and compliance with energy efficiency standards, driving continuous product innovation and pricing strategies to meet diverse commercial, residential, and industrial requirements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- GEZE GmbH

- JLC Automation Services

- SE Controls

- Kintrol

- EBSA

- Pella Corporation

- Aumuller Aumatic GmbH

- Colt International Pty Limited

- D+H Mechatronic AG

- WindowMaster International

Recent Developments

- In August 2025, WindowMaster International A/S announced a collaboration with UPVC supplier VEKA to certify smoke-ventilation windows under EN 12101-2, enabling those windows to meet UK smoke-evacuation legal requirements.

- In August 2025, WindowMaster released firmware version 2.03 for WSC 5xx panels. This update allows the NV Embedded™ system to run on its FlexiSmoke™ panels.

- In May 2025, WindowMaster won a contract for a new build school and kindergarten in Dulliken, Switzerland. The project involves offering natural air supplementation and controlling 45 different zones via its NV Advance® solution.

- In November 2024, GEZE GmbH unveiled via its BAU 2025 preview the myGEZE Control building automation platform. This system enables networking of door, window, and safety systems and integrates façades and door systems into building control units

Report Coverage

The research report offers an in-depth analysis based on Product, Component, Applications and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of IoT-enabled window automation systems will expand to support remote monitoring and control.

- Demand for energy-efficient ventilation solutions will rise with stricter green building regulations.

- Commercial buildings will continue to dominate as smart offices and institutions integrate automated systems.

- Retrofitting of existing buildings will grow as property owners focus on energy upgrades and compliance.

- Integration with AI and predictive controls will optimize natural ventilation and energy management.

- Wireless and battery-powered actuators will gain popularity for easy installation and maintenance.

- Partnerships between automation providers and construction firms will increase to deliver turnkey solutions.

- Asia-Pacific will witness the fastest growth driven by urbanization and smart city development.

- Product innovation will focus on compact, quiet, and durable actuators for diverse applications.

- Rising awareness of indoor air quality will drive adoption in residential and healthcare facilities.