Market Overview

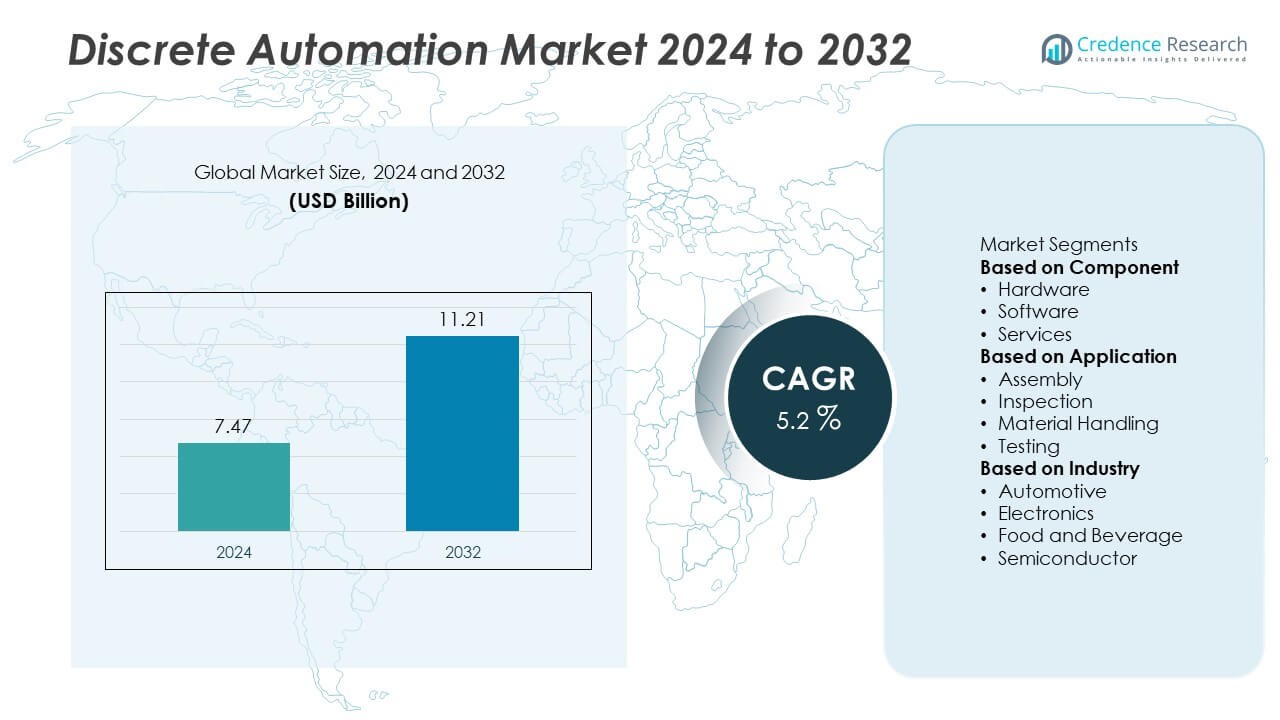

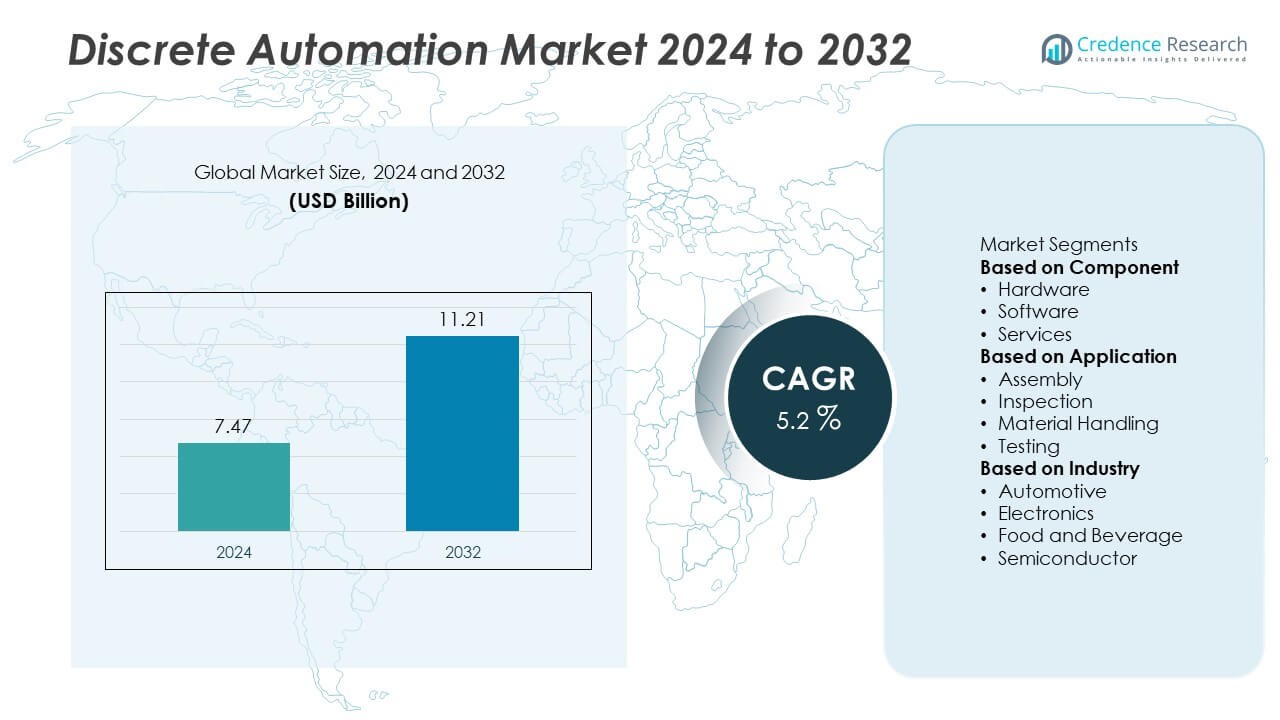

The Discrete Automation Market was valued at USD 7.47 billion in 2024 and is projected to reach USD 11.21 billion by 2032, growing at a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Discrete Automation Market Size 2024 |

USD 7.47 Billion |

| Discrete Automation Market, CAGR |

5.2% |

| Discrete Automation Market Size 2032 |

USD 11.21 Billion |

The Discrete Automation Market grows with rising adoption of Industry 4.0, demand for smart factories, and increasing need for operational efficiency. Manufacturers invest in robotics, PLCs, and advanced control systems to improve productivity and reduce errors.

Asia-Pacific leads the Discrete Automation Market with strong growth driven by rapid industrialization, smart factory initiatives, and large-scale investments in robotics and control systems. China, Japan, and South Korea dominate adoption with advanced manufacturing facilities focusing on efficiency and precision. North America follows with robust demand from automotive, aerospace, and electronics sectors, supported by Industry 4.0 implementation and strong R&D capabilities. Europe shows steady growth driven by Germany, Italy, and France, where manufacturers focus on digital transformation and energy-efficient production systems. Latin America and Middle East & Africa are gradually adopting automation solutions as industrial modernization projects expand. Key players in the market include Siemens, Mitsubishi Electric, Rockwell Automation, and Schneider Electric, which focus on developing innovative hardware, IoT-enabled control platforms, and integrated automation solutions. These companies invest in R&D, partnerships, and global distribution networks to meet rising demand for flexible, scalable, and sustainable automation systems worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Discrete Automation Market was valued at USD 7.47 billion in 2024 and is projected to reach USD 11.21 billion by 2032, growing at a CAGR of 5.2% during the forecast period.

- Growth is driven by rising adoption of Industry 4.0 technologies, smart factory initiatives, and increasing demand for operational efficiency and high-quality production output.

- Trends show strong adoption of collaborative robots, IoT-enabled devices, and digital twin solutions that support predictive maintenance, process optimization, and real-time monitoring.

- Competitive landscape includes key players such as Siemens, Mitsubishi Electric, Rockwell Automation, Schneider Electric, and Honeywell, focusing on innovation, automation hardware, and IoT-integrated control platforms.

- Market restraints include high implementation costs, integration challenges with legacy systems, and shortage of skilled professionals to manage and maintain automation systems.

- Asia-Pacific leads demand due to rapid industrialization and investment in smart manufacturing, while North America and Europe see steady growth through digital transformation and Industry 4.0 adoption.

- Latin America and Middle East & Africa are emerging regions where automation adoption is growing, supported by government initiatives and modernization of manufacturing sectors to improve productivity and global competitiveness.

Market Drivers

Rising Demand for Industry 4.0 and Smart Manufacturing

The Discrete Automation Market grows with the global shift toward Industry 4.0 and digital transformation. Manufacturers adopt automation to improve production accuracy, reduce downtime, and enhance traceability. It enables real-time monitoring of equipment and seamless integration with enterprise systems. Demand for smart factories fuels adoption of PLCs, robotics, and industrial IoT platforms. Automation supports predictive maintenance and minimizes operational losses. It strengthens competitiveness for manufacturers facing global supply chain pressures.

- For instance, at its Regensburg plant, BMW deployed an in-house AI-supported smart maintenance system, using data from conveyor controls to predict faults and cut vehicle assembly disruptions by an average of around 500 minutes annually.

Increasing Need for Higher Productivity and Efficiency

Industries focus on automation to improve throughput and maintain consistent product quality. The Discrete Automation Market benefits from solutions that optimize assembly lines and reduce human error. It supports faster cycle times and high-volume production with minimal resource waste. Automation ensures compliance with strict quality standards in automotive, electronics, and aerospace sectors. Growing labor costs encourage manufacturers to invest in robotics and advanced motion control systems. It drives continuous upgrades in automation infrastructure to meet rising productivity targets.

- For instance, a case study showed that an OEM used Rockwell Automation’s iTRAK intelligent track system to slash changeover times by up to 50%, helping them to increase overall equipment effectiveness (OEE) and achieve higher throughput.

Growing Adoption in Automotive and Electronics Manufacturing

Automotive and electronics sectors represent key end-users with high automation intensity. The Discrete Automation Market gains traction as these industries demand scalable, flexible, and precise production systems. It supports tasks like welding, pick-and-place, and testing with high repeatability. Electric vehicle production and miniaturization of electronics boost demand for advanced robotics and control systems. Automation helps maintain competitiveness in markets with short product lifecycles. It ensures rapid reconfiguration of production lines to meet changing consumer demand.

Focus on Energy Efficiency and Sustainability

Manufacturers adopt discrete automation to lower energy consumption and optimize resource use. The Discrete Automation Market benefits from solutions that monitor energy usage and control machine operations efficiently. It enables integration of renewable energy systems and reduces environmental footprint. Energy-efficient drives, sensors, and controllers help companies meet regulatory requirements and sustainability targets. Green manufacturing initiatives accelerate investment in smart automation systems. It positions automation as a critical tool for balancing productivity with environmental responsibility.

Market Trends

Integration of Industrial IoT and Smart Sensors

The Discrete Automation Market sees a strong shift toward IoT-enabled systems and connected devices. Smart sensors collect real-time data on machine performance and production status. It enables predictive maintenance and helps prevent costly unplanned downtime. Cloud-based platforms support remote monitoring and analytics for multi-site operations. Data-driven insights allow faster decision-making and process optimization. It enhances transparency and supports full digitalization of manufacturing workflows.

- For instance, Schneider Electric’s Lexington Smart Factory in Kentucky connected over 500,000 sq ft of operations through its EcoStruxure IoT platform, eliminating 90 % of paperwork, cutting mean time to repair by 20 %, and reducing unplanned downtime by nearly 6 %.

Rising Use of Collaborative and Autonomous Robots

Manufacturers deploy collaborative robots (cobots) to work safely alongside human operators. The Discrete Automation Market benefits from cobots’ flexibility and ease of programming for diverse tasks. It reduces the need for extensive safety barriers and speeds up deployment. Autonomous mobile robots gain traction for intralogistics and material handling. Adoption grows in small and mid-sized enterprises seeking cost-effective automation. It drives demand for modular robotics that can scale with production requirements.

- For instance, Yaskawa Electric has numerous installations of its HC-series cobots, which are designed to increase assembly efficiency and work safely alongside human operators in confined spaces. The use of these collaborative robots in manufacturing can help reduce labor shortages and improve productivity.

Adoption of Digital Twins and Simulation Tools

Digital twins allow manufacturers to simulate and optimize production processes before implementation. The Discrete Automation Market leverages virtual modeling to test new layouts and improve line efficiency. It reduces commissioning time and minimizes implementation risks. Simulation tools also support operator training and maintenance planning. Integration with PLCs and control systems provides real-time updates for process adjustments. It accelerates innovation cycles and supports agile manufacturing strategies.

Focus on Cybersecurity and System Integration

As automation systems become more connected, cybersecurity gains importance for manufacturers. The Discrete Automation Market responds with secure communication protocols and advanced network protection. It ensures protection of production data and minimizes vulnerability to cyber threats. Seamless integration of legacy equipment with new automation platforms is another key trend. Interoperability standards help manufacturers build scalable and future-ready systems. It supports continuous modernization without disrupting ongoing operations.

Market Challenges Analysis

High Implementation Costs and Skilled Workforce Shortage

The Discrete Automation Market faces challenges due to high upfront investment in hardware, software, and integration services. Small and medium enterprises often delay automation adoption because of budget constraints. It also requires skilled professionals to install, program, and maintain automation systems. Shortage of trained engineers and technicians slows deployment and limits system efficiency. Training costs add to overall project expenses for manufacturers. It pushes companies to seek cost-effective solutions or phased implementation plans to manage financial pressure.

Complexity of System Integration and Cybersecurity Risks

Integrating new automation systems with existing infrastructure can be complex and time-consuming. The Discrete Automation Market must address compatibility issues between legacy equipment and modern control systems. It can cause delays in project execution and disrupt production schedules. Growing connectivity also increases exposure to cyber threats, putting sensitive production data at risk. Manufacturers face rising costs to implement robust security measures and compliance protocols. It drives demand for standardized platforms and secure networks that simplify integration and protect operations.

Market Opportunities

Growing Adoption of Smart Manufacturing in Emerging Economies

The Discrete Automation Market holds strong potential in rapidly industrializing regions such as Asia-Pacific and Latin America. Governments support digital transformation through incentives and policies promoting smart factory adoption. It creates opportunities for automation suppliers to deliver scalable solutions tailored to local manufacturing needs. Expanding automotive, electronics, and consumer goods production drives demand for flexible and cost-efficient automation systems. Manufacturers invest in advanced robotics, motion control, and PLCs to enhance productivity. It allows them to compete globally while meeting rising quality and efficiency standards.

Expansion of Industry 4.0 and Energy-Efficient Solutions

Global focus on Industry 4.0 initiatives encourages companies to modernize production with connected systems. The Discrete Automation Market benefits from rising demand for energy-efficient drives, controllers, and monitoring solutions. It supports sustainability goals while lowering operating costs. Integration of AI, machine learning, and digital twins creates opportunities for predictive maintenance and process optimization. Growth of e-commerce and customized manufacturing increases need for agile production lines. It positions automation providers to deliver innovative technologies that improve responsiveness and scalability.

Market Segmentation Analysis:

By Component

The Discrete Automation Market is segmented by component into hardware, software, and services. Hardware dominates with strong demand for PLCs, sensors, drives, and robotics that form the backbone of automated systems. It ensures precise control and high reliability for production lines. Software solutions, including SCADA, HMI, and analytics platforms, are growing in demand to enable real-time monitoring and process optimization. Services such as installation, maintenance, and system integration play a key role in ensuring smooth operation and maximum return on investment. It allows manufacturers to upgrade legacy systems while minimizing downtime and production losses.

- For instance, Siemens provided automation technology, including SIMATIC controllers, to Volkswagen’s Zwickau plant to support the conversion for electric vehicle production. The project aimed to increase the degree of automation in specific areas, such as the body shop and final assembly, to boost productivity and efficiency.

By Application

Applications of discrete automation include assembly, material handling, quality control, and packaging. The Discrete Automation Market records highest adoption in assembly and production lines where accuracy and repeatability are critical. It supports automated welding, inspection, and machine tending in high-volume manufacturing environments. Material handling applications use robotics and motion control systems to streamline warehouse operations and reduce labor dependency. Automated quality control ensures compliance with stringent industry standards and reduces rework costs. It boosts operational efficiency and product consistency across manufacturing sites.

- For instance, Krones provides robotic packaging solutions, such as its Robogrip systems, that enable high-throughput beverage bottling operations and significantly reduce the need for manual labor.

By Industry

Industries using discrete automation include automotive, electronics, aerospace, food and beverage, and machinery manufacturing. The Discrete Automation Market sees maximum demand from the automotive sector for applications such as robotic welding, painting, and assembly. It also plays a critical role in electronics manufacturing, where precision and speed are essential for circuit board production. Aerospace companies invest in automation to improve component traceability and meet strict safety standards. Food and beverage producers adopt automation to enhance throughput and maintain hygiene compliance. It drives industry-wide adoption as manufacturers seek scalability, cost savings, and higher operational efficiency.

Segments:

Based on Component

- Hardware

- Software

- Services

Based on Application

- Assembly

- Inspection

- Material Handling

- Testing

Based on Industry

- Automotive

- Electronics

- Food and Beverage

- Semiconductor

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds 27% market share in the Discrete Automation Market, driven by strong adoption of advanced manufacturing technologies and Industry 4.0 initiatives. The U.S. leads the region with significant investments in robotics, PLCs, and digital control systems across automotive and aerospace sectors. It benefits from a well-established manufacturing base and early adoption of IoT-enabled automation solutions. Canada supports growth with initiatives to modernize production and enhance energy efficiency in key industries. Rising labor costs encourage companies to implement collaborative robots and automated assembly lines to maintain competitiveness. It positions North America as a key hub for high-value, technology-driven manufacturing.

Europe

Europe accounts for 29% market share and remains a leading region for automation adoption, supported by advanced manufacturing infrastructure. Germany, Italy, and France lead with strong demand from automotive, machinery, and electronics sectors. The Discrete Automation Market benefits from EU initiatives that promote smart factories, energy-efficient systems, and digital transformation. It records growing deployment of industrial robotics and motion control systems to support high-precision manufacturing. Strict regulatory requirements encourage use of automation for quality control and compliance monitoring. It ensures Europe continues to play a major role in global automation innovation and deployment.

Asia-Pacific

Asia-Pacific holds the largest share at 33%, making it the fastest-growing region in the Discrete Automation Market. China dominates with aggressive investment in robotics, smart factories, and digital manufacturing technologies to boost productivity. It benefits from government programs encouraging industrial automation and local production of automation equipment. Japan and South Korea focus on advanced robotics and precision control solutions for electronics and automotive manufacturing. India shows rapid adoption with growth in automotive, electronics, and consumer goods sectors seeking cost-effective automation. It drives significant demand for scalable and flexible systems suited to both large-scale and mid-sized manufacturers.

Latin America

Latin America represents 6% market share, led by Brazil and Mexico, where industrial modernization projects are underway. The Discrete Automation Market grows as manufacturers in automotive and food processing sectors invest in PLCs and robotics to meet international quality standards. It benefits from growing foreign direct investment and expansion of global supply chains into the region. Rising need for productivity improvements pushes adoption of automated assembly and material handling systems. Government initiatives to promote industrial digitalization create new opportunities for suppliers. It supports gradual market growth despite economic volatility in some countries.

Middle East & Africa

Middle East & Africa hold 5% market share, supported by increasing automation in oil & gas, mining, and manufacturing sectors. The Discrete Automation Market gains traction in Gulf countries investing in diversification projects and industrial modernization. It records growing adoption of SCADA systems, drives, and control solutions in infrastructure and utility projects. South Africa leads regional demand with upgrades in automotive and food production facilities. Limited skilled labor encourages investment in automation to maintain efficiency and output quality. It is expected to see steady growth as governments push for industrial development and smart manufacturing adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- GEA Group

- Rockwell Automation

- Siemens

- Mitsubishi Electric

- Yokogawa Electric Corporation

- Honeywell

- Yaskawa Electric Corporation

- Schneider Electric

- Endress+Hauser

- Krones

Competitive Analysis

Competitive landscape of the Discrete Automation Market features leading players such as Siemens, Mitsubishi Electric, Rockwell Automation, Schneider Electric, Honeywell, Yaskawa Electric Corporation, Yokogawa Electric Corporation, GEA Group, Endress+Hauser, and Krones. These companies focus on delivering advanced automation hardware, software, and integrated solutions that enhance productivity, efficiency, and quality control in manufacturing. They invest heavily in R&D to develop IoT-enabled platforms, robotics, motion control systems, and predictive maintenance solutions that support Industry 4.0 transformation. Strategic collaborations with technology providers and system integrators strengthen their market presence and allow seamless deployment of automation projects across industries. Many players expand their global footprint by establishing manufacturing and service facilities in emerging economies to meet rising demand for smart manufacturing solutions. Their efforts to provide scalable, energy-efficient, and cybersecurity-ready systems ensure competitiveness and long-term customer partnerships in a rapidly evolving automation landscape.

Recent Developments

- In July 2025, Mitsubishi Electric’s ME Innovation Fund invested in the startup Things, Inc., which provides AI-assisted PLM (Product Lifecycle Management) systems. Mitsubishi aims to merge its control/automation expertise with generative AI capabilities.

- In June 2025, Rockwell Automation introduced PointMax I/O, a flexible remote input/output system. It supports modular, scalable I/O deployments and integrates with Logix 5000 controllers.

- In May 2025, Rockwell Automation launched FactoryTalk PharmaSuite 12.00, a MES (Manufacturing Execution System) release aimed at pharmaceutical and biopharmaceutical manufacturers. It features cloud-based deployment (Kubernetes, Linux containers), a tool to automate validation (MICKA), modular design, built-in monitoring, stronger cybersecurity.

- In March 2025, GEA launched an AI-powered application for its engineer-to-order (ETO) processes. Developed in partnership with NTT DATA and Microsoft, it automates handling of complex technical quotes by analyzing requirements, assigning tasks to departments. Initially rolled out in GEA’s Separation & Flow Technologies BU.

Report Coverage

The research report offers an in-depth analysis based on Component, Application, Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for discrete automation will grow with rapid adoption of Industry 4.0 and smart manufacturing.

- Collaborative and autonomous robots will see higher deployment in assembly and material handling tasks.

- IoT-enabled devices and cloud platforms will drive real-time monitoring and predictive maintenance.

- Digital twin technology will be widely used to simulate and optimize production processes.

- Energy-efficient drives and controllers will gain popularity to meet sustainability goals.

- Cybersecurity solutions will become essential to protect connected automation systems.

- Flexible and modular automation systems will support mass customization in manufacturing.

- Emerging economies will increase investments in automation to boost productivity and competitiveness.

- Integration of AI and machine learning will enhance decision-making and process efficiency.

- Strategic partnerships between automation providers and software companies will accelerate digital transformation initiatives.