Market Overview

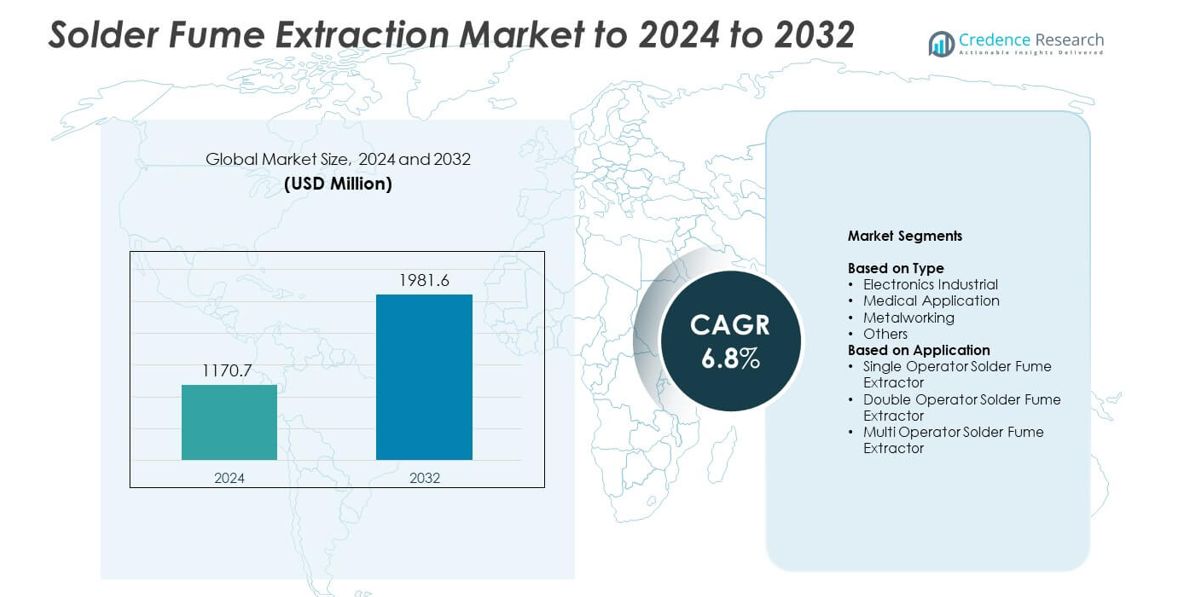

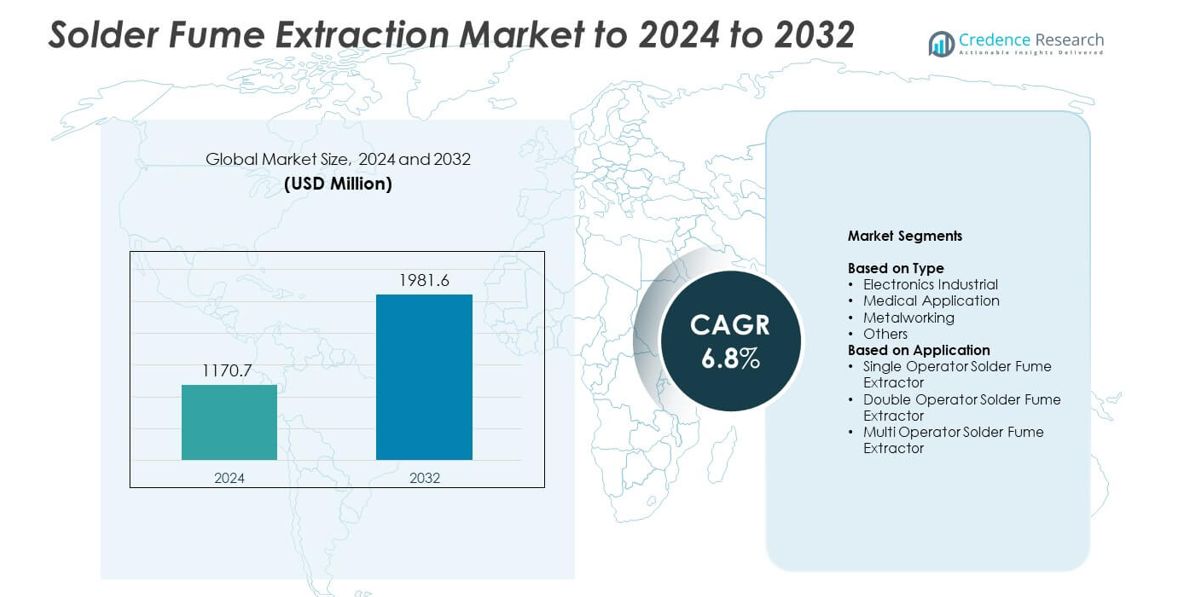

Solder Fume Extraction Market size was valued at USD 1170.7 million in 2024 and is anticipated to reach USD 1981.6 million by 2032, at a CAGR of 6.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Solder Fume Extraction Market Size 2024 |

USD 1170.7 million |

| Solder Fume Extraction Market, CAGR |

6.8% |

| Solder Fume Extraction Market Size 2032 |

USD 1981.6 million |

The Solder Fume Extraction Market is influenced by major players including Hakko, EUROVAC, BOFA, Quatro-air, Metcal, Sentry Air Systems, FUMEX, Weller, Nederman, and CLARCOR. These companies support global demand through advanced filtration systems, smart airflow control, and durable workstation extractors suited for electronics manufacturing and industrial environments. North America remained the leading region in 2024 with about 34% share, driven by strict occupational safety rules and high adoption in automated assembly lines. Europe followed with nearly 29% share due to strong regulatory compliance, while Asia Pacific accounted for about 27% as electronics and semiconductor production expanded across major manufacturing hubs.

Market Insights

- The Solder Fume Extraction Market reached USD 1170.7 million in 2024 and is projected to hit USD 1981.6 million by 2032 at a 6.8% CAGR.

- Strong market drivers include rising electronics manufacturing, tighter workplace safety rules, and wider use of automated soldering lines that increase demand for high-efficiency extraction systems.

- Key trends show growing adoption of smart, energy-efficient extractors and rising demand for portable units; the electronics industrial segment led the market with about 52% share in 2024.

- Competitive activity focuses on advanced multi-stage filtration, improved airflow control, and expansion of global service networks to support long-term compliance and operational reliability.

- North America held about 34% share in 2024, followed by Europe at nearly 29% and Asia Pacific at around 27%, while Latin America and the Middle East & Africa accounted for smaller but steadily growing regional shares.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Electronics industrial applications held the dominant share in 2024 with about 52% of the Solder Fume Extraction Market. Growth came from tighter workplace safety rules and wider use of automated soldering lines in PCB assembly. Electronics manufacturers adopted high-efficiency extractors to control airborne particulate levels and protect workers from long exposure to rosin-based fumes. Medical applications expanded due to cleanroom compliance needs, while metalworking demand rose as welding and brazing stations added localized extraction units. Other end users showed steady adoption as small workshops upgraded ventilation systems to meet safety standards.

- For instance, Bakon’s BK261 soldering fume extractor is rated at 150 W input power on 220 V AC and is designed for continuous PCB rework use.

By Application

Single operator solder fume extractors led the market in 2024 with nearly 46% share. Small and mid-sized electronics assembly units favored these systems because they offer flexible placement, low maintenance, and precise filtration at individual workbenches. Demand increased as manufacturers shifted toward workstation-level extraction to meet occupational exposure limits. Double-operator units gained traction in medium facilities seeking cost-optimized shared extraction. Multi-operator systems expanded in high-volume assembly lines where centralized fume control improves efficiency and reduces long-term operating costs.

- For instance, BOFA’s V200 solder fume extractor for individual benches provides a maximum airflow of 90 cubic metres per hour (\(\mathbf{90\ }\text{m}^{\mathbf{3}}\mathbf{/}\text{h}\)) with a 90 W motor. However, the compact cabinet has dimensions of 380 x 260 x 260 millimeters and weighs only 7 kilograms (\(\mathbf{7\ }\text{kg}\)).

Key Growth Drivers

Rising Compliance with Occupational Safety Regulations

Stricter global safety standards pushed factories to adopt certified fume extraction systems. Governments tightened limits on airborne particulate and toxic gases, especially in electronics assembly where soldering is continuous. Companies upgraded extraction units to protect workers from long-term respiratory risks. This regulatory push raised installation rates in both small workshops and large production plants. Higher inspections and mandatory ventilation rules strengthened steady demand across regions.

- For instance, a Donaldson single-phase weld and fume collector specified for one workstation delivers about 780 CFM airflow at 115 V supply and uses a MERV 15 filter rating to capture fine particulates in regulated production cells.

Expansion of Electronics Manufacturing Capacity

Electronics production grew due to rising output of consumer devices, automotive electronics, and industrial automation systems. PCB assembly units increased their soldering lines, which raised the need for efficient fume extraction near workstations. Manufacturers preferred high-efficiency filters to support stable throughput and maintain clean environments. Growth in semiconductor packaging and LED assembly also boosted equipment use. This expansion created sustained demand from large factories and contract manufacturers.

- For instance, Pure-Air’s PA-300TD-IQ soldering fume extractor is listed with about 300 m³/h airflow and two freestanding capture arms, enabling simultaneous extraction from multiple solder points on dense electronics assembly lines.

Shift Toward Automated and High-Precision Soldering

Automated soldering technologies, including reflow and selective soldering, expanded across electronics plants. These systems require reliable fume extraction to maintain air quality around sensitive components. Companies invested in advanced extractors with stronger airflow control and multi-stage filtration. Growth in high-precision assembly increased the need for consistent air handling to protect both workers and delicate electronic parts. This shift supported steady upgrades to modern extraction solutions.

Key Trends & Opportunities

Adoption of Smart and Energy-Efficient Extraction Systems

Producers introduced systems with smart sensors, variable-speed control, and automated air-quality monitoring. These solutions optimize airflow and reduce power use, which helps facilities cut operating costs. The rise of connected factories increased demand for units that integrate with digital dashboards. Better filter-life prediction tools also lowered maintenance downtime. These advancements created strong opportunities for suppliers offering intelligent and efficient designs.

- For instance, Plymovent’s MobilePro mobile filter unit combines a 1.1 kW fan with a maximum extraction capacity of 1,200 cubic metres per hour

Rising Use in Medical and Laboratory Environments

Cleanrooms, diagnostic labs, and medical device assembly units expanded adoption of compact extraction systems. Healthcare facilities preferred units that ensure low particulate levels and limit chemical exposure during delicate manufacturing tasks. Demand grew as medical device production scaled, especially for imaging components and surgical tools. This shift opened new opportunities in highly regulated and hygiene-focused applications.

- For instance, Sentry Air Systems’ SS-400 Portable Floor Sentry offers variable air volume from 50 CFM to 700 CFM high through a 6-inch diameter, 72-inch long self-supporting arm, which suits point-of-use extraction in labs and clean manufacturing cells

Growing Preference for Portable and Modular Extractors

Small and mid-sized enterprises increased the use of movable and modular extraction solutions. These units support flexible workstation layouts and quick reconfiguration during production changes. Growth in repair and rework centers also elevated demand for portable extractors. Manufacturers offering compact, low-noise systems saw rising interest across emerging markets. This trend supported wider accessibility and easier installation.

Key Challenges

High Installation and Maintenance Costs

Advanced extraction systems require significant upfront investment, which limits adoption among small manufacturers. Multi-stage filters, high-power motors, and airflow controls add to long-term operational costs. Facilities also face recurring expenses for filter replacement and periodic system upkeep. These financial barriers slow adoption in cost-sensitive regions. Price pressure remains a major challenge for wider deployment.

Limited Awareness in Small Workshops and Informal Sectors

Many small workshops still rely on basic ventilation and lack understanding of long-term health risks linked to solder fumes. Limited training and weak enforcement of safety rules reduce adoption of certified extractors. Informal electronics repair units often delay upgrades due to low budgets and minimal regulatory pressure. This gap restricts market penetration in developing regions and slows overall industry growth.

Regional Analysis

North America

North America held about 34% share of the Solder Fume Extraction Market in 2024. Demand stayed strong due to strict workplace safety rules and high adoption across electronics assembly plants. Manufacturers in the United States and Canada invested in advanced extraction systems to protect workers from hazardous fumes and maintain clean production spaces. Growth in semiconductor packaging and medical device manufacturing supported wider use of high-efficiency filtration units. Rising automation in electronics assembly also boosted upgrades to smart and energy-efficient extraction equipment across factories.

Europe

Europe accounted for nearly 29% share in 2024, driven by strong regulatory enforcement and a mature electronics manufacturing base. Countries such as Germany, France, and the United Kingdom adopted high-performance fume extraction systems to meet strict worker-protection standards. Automotive electronics production and industrial automation created steady demand for advanced extraction solutions. The region also saw rising adoption of energy-efficient and low-noise units in precision assembly environments. Ongoing expansion in medical technology manufacturing further supported consistent system installations.

Asia Pacific

Asia Pacific dominated growth momentum with around 27% share of the global market in 2024. Expanding PCB manufacturing, rising consumer electronics production, and strong investment in semiconductor facilities drove high demand for extraction equipment. China, Japan, South Korea, and India increased adoption across automated assembly lines to ensure compliance with worker-safety guidelines. Growing adoption of portable and modular extractors among small and mid-sized manufacturers also supported regional expansion. Rapid industrialization and large-scale electronics exports strengthened long-term demand.

Latin America

Latin America held about 6% share in 2024, supported by growing electronics assembly and rising awareness of workplace safety. Countries such as Mexico and Brazil expanded adoption of localized extraction systems in repair centers and mid-scale manufacturing units. Regulatory frameworks improved gradually, encouraging industries to replace outdated ventilation setups with certified fume extraction solutions. Demand also increased within metalworking and small workshop environments. Continued industrial expansion and training initiatives strengthened prospects for steady growth.

Middle East and Africa

The Middle East and Africa accounted for nearly 4% share in 2024. Adoption grew in electronics servicing hubs, industrial workshops, and emerging manufacturing zones. Countries in the Gulf region increased investments in safety-compliant production environments, leading to modest but steady uptake of advanced extraction systems. Growth in medical device assembly and laboratory environments supported additional installations. Limited awareness in smaller workshops remained a challenge, but expanding industrial activity and gradual regulatory improvements supported future demand.

Market Segmentations:

By Type

- Electronics Industrial

- Medical Application

- Metalworking

- Others

By Application

- Single Operator Solder Fume Extractor

- Double Operator Solder Fume Extractor

- Multi Operator Solder Fume Extractor

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Solder Fume Extraction Market is shaped by leading companies such as Hakko, EUROVAC, BOFA, Quatro-air, Metcal, Sentry Air Systems, FUMEX, Weller, Nederman, and CLARCOR. These firms strengthened their positions by expanding product ranges that target electronics assembly, medical environments, and industrial workstations. Major suppliers focused on high-efficiency filtration systems with multi-stage filters designed to capture fine particulate and chemical vapors. Manufacturers invested in smart airflow controls that support stable extraction during continuous soldering operations. Energy-efficient designs, reduced noise levels, and long-life filtration technologies helped attract larger production facilities. Companies also improved distribution networks and aftermarket service to support global customers seeking reliable compliance with evolving workplace air-quality standards.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hakko

- EUROVAC

- BOFA

- Quatro-air

- Metcal

- Sentry Air Systems

- FUMEX

- Weller

- Nederman

- CLARCOR

Recent Developments

- In 2025, Fumex introduced a new LED lamp option for three extraction-arm models, improving visibility and ergonomics at fume capture points while highlighting ongoing upgrades to its arm-based extraction portfolio.

- In 2024, BOFA (Donaldson Company, Inc.) continued to offer its existing product line of portable extraction systems for automated soldering processes, such as the V 2000 iQ, while also making strategic announcements.

- In 2023, Metcal released the BVX-250 fume extraction system, designed for efficient benchtop use in soldering environments.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as global factories tighten workplace air-quality standards.

- Electronics manufacturing growth will continue to drive new installations.

- Smart fume extraction systems with sensors will gain stronger adoption.

- Energy-efficient units will become a major buying focus across industries.

- Portable and modular extractors will see higher demand in small facilities.

- Medical and laboratory applications will expand due to strict hygiene needs.

- Multi-operator systems will grow as large assembly lines scale production.

- Manufacturers will invest more in long-life filters and low-maintenance designs.

- Emerging markets will adopt extraction systems as regulations strengthen.

- Integration of extraction units into automated soldering lines will accelerate.