Market Overview

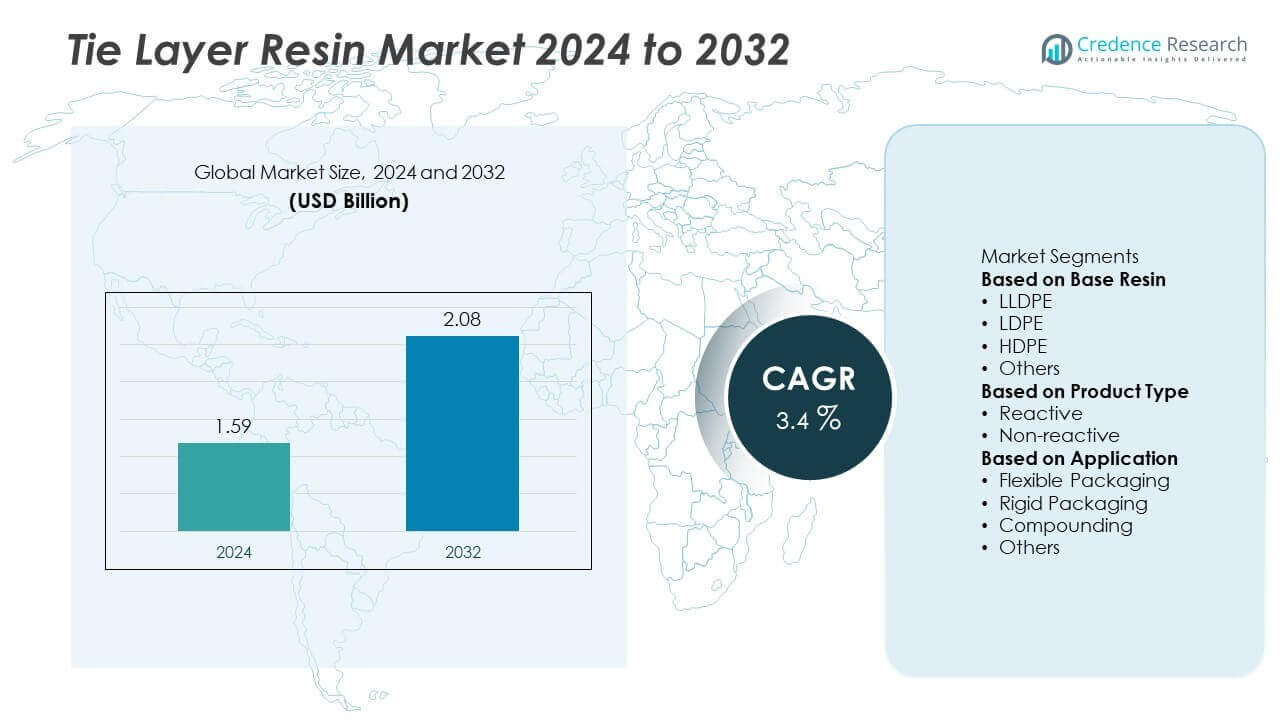

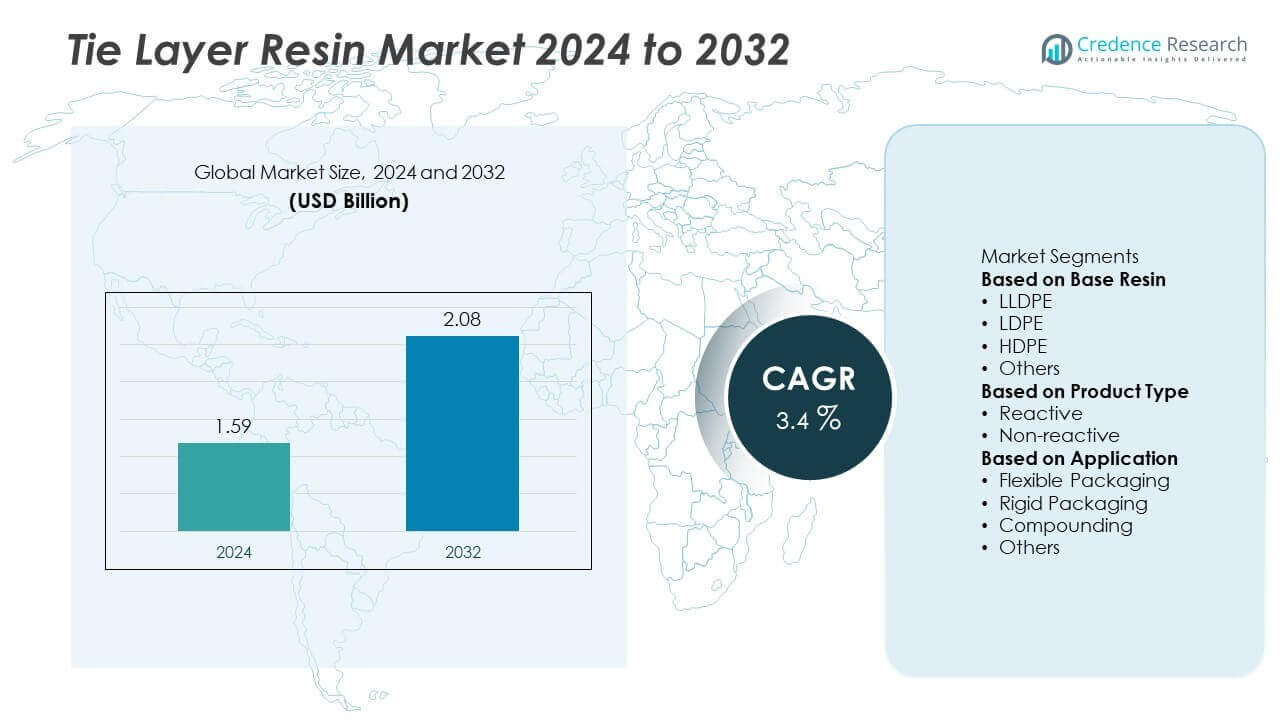

The tie layer resin market was valued at USD 1.59 billion in 2024 and is projected to reach USD 2.08 billion by 2032, growing at a CAGR of 3.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Tie Layer Resin Market Size 2024 |

USD 1.59 Billion |

| Tie Layer Resin Market, CAGR |

3.4% |

| Tie Layer Resin Market Size 2032 |

USD 2.08 Billion |

The tie layer resin market is driven by key players including Mitsubishi Chemical, DuPont, Westlake Chemicals, Arkema, Addivant, LyondellBasell, Exxon Mobil, Eastman Chemical, The Dow Chemical Company, and Mitsui Chemicals. These companies focus on developing high-performance reactive resins, expanding production capacity, and introducing recyclable grades to meet sustainability targets. Asia-Pacific led the market with 41% share in 2024, supported by rising demand for multilayer flexible packaging in food and pharmaceutical sectors. North America held 27% share, driven by adoption of monomaterial solutions and strong healthcare packaging demand, while Europe accounted for 22% share, influenced by strict regulatory requirements and circular economy initiatives.

Market Insights

Market Insights

- The tie layer resin market was valued at USD 1.59 billion in 2024 and is projected to reach USD 2.08 billion by 2032, growing at a CAGR of 3.4% during the forecast period.

- Rising demand for multilayer packaging in food, beverage, and pharmaceutical sectors drives market growth, with LLDPE-based resins holding over 40% share due to their flexibility and strong adhesion.

- Technological advancements in reactive tie layer resins and development of recyclable, PE-rich monomaterial structures are major trends supporting sustainability goals and regulatory compliance.

- Key players such as Mitsubishi Chemical, DuPont, Westlake Chemicals, Arkema, LyondellBasell, Exxon Mobil, and Mitsui Chemicals invest in R&D and capacity expansions to strengthen market presence and address evolving converter needs.

- Asia-Pacific led with 41% share, followed by North America at 27% and Europe at 22%, while flexible packaging accounted for over 55% share, dominating applications across all regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Base Resin

LLDPE dominated the tie layer resin market by base resin, capturing over 40% share in 2024. Its dominance is attributed to excellent flexibility, puncture resistance, and strong adhesion to barrier layers, making it ideal for multilayer films and packaging. LDPE followed with significant use in low-temperature sealing applications, while HDPE gained traction for rigid packaging structures requiring stiffness and durability. The “Others” category, including EVA and PP-based resins, is expanding in niche barrier applications. Rising demand for food and pharmaceutical packaging drives adoption of LLDPE-based tie layers due to their performance and processability.

- For instance, Dow Chemical Company is a significant producer of LLDPE and recently brought a new 600,000 metric tons/year capacity LLDPE/HDPE swing unit online in Texas in 2025. LLDPE is extensively used for flexible packaging applications, including food and medical packaging, with high-performance films exhibiting tensile strength and elongation properties ideal for stretch and shrink films.

By Product Type

Reactive tie layer resins led the market with around 65% share in 2024, supported by their superior chemical bonding with polar substrates such as EVOH, PA, and PET. This ensures excellent layer adhesion, critical for high-barrier packaging films. Non-reactive resins accounted for the remaining share, primarily used in applications where physical adhesion is sufficient. The growing focus on improving packaging durability, reducing delamination, and extending shelf life continues to favor reactive resin demand, especially in food, beverage, and industrial packaging segments.

- For instance, Arkema produces a range of reactive tie layer resins, such as the Orevac brand, using functionalization technology to achieve strong adhesion between incompatible layers in multilayer films. This provides durability and resistance to delamination for various industrial and packaging applications.

By Application

Flexible packaging emerged as the largest application segment, holding over 55% share in 2024. Its growth is driven by surging demand for multilayer pouches, films, and bags used across food, personal care, and pharmaceutical sectors. Rigid packaging follows, leveraging tie layers in bottles, containers, and thermoformed trays to improve barrier properties. Compounding applications utilize tie layer resins to modify material properties, while “Others” include niche uses in adhesives and coatings. Rapid growth in e-commerce packaging and consumer preference for lightweight, high-barrier solutions are boosting the flexible packaging segment’s dominance.

Key Growth Drivers

Rising Demand for Multilayer Packaging

The increasing adoption of multilayer flexible packaging is a major growth driver, accounting for strong demand across food, beverages, and pharmaceutical sectors. Tie layer resins enhance adhesion between dissimilar materials like EVOH, PA, and PE, improving barrier properties and shelf life. Growing consumption of ready-to-eat meals and convenience foods further boosts demand. Packaging converters prefer tie layers that enable lightweight designs without compromising performance, aligning with sustainability initiatives and reducing overall material use, which supports steady market expansion globally.

- For instance, Dow offers BYNEL tie-layer resins used in multilayer films to bond incompatible materials like polyethylene and EVOH. These resins enable multilayer packaging with high barrier properties and extended shelf life for demanding applications, such as food and pharmaceutical products.

Expanding Food and Pharmaceutical Applications

Food and pharmaceutical packaging collectively contribute to over 50% of tie layer resin consumption. These industries demand high-barrier solutions to protect products from moisture, oxygen, and contaminants. The surge in packaged food consumption, driven by urbanization and busy lifestyles, accelerates the need for high-performance tie layers. Similarly, pharmaceutical packaging requires reliable, tamper-evident multilayer films to ensure drug safety and compliance with regulatory standards. This steady growth in critical end-use industries continues to strengthen market revenues and encourage development of advanced resin grades.

- For instance, Arkema manufactures reactive tie layer resins, like its Orevac® and Platamid® brands, which are used to improve adhesion in multilayer films for packaging. These formulations are part of its larger portfolio of specialty polymers designed to enhance the barrier properties and overall performance of films used in sensitive applications, such as for food and potentially pharmaceuticals. The company actively invests in new technologies to meet growing demand in high-performance markets.

Shift Toward Sustainable Packaging Solutions

Sustainability initiatives are driving innovation in recyclable and bio-based tie layer resins. Brand owners and packaging companies increasingly seek materials compatible with monomaterial recycling streams to meet circular economy targets. Reactive tie layers that bond with polyethylene-based structures are gaining traction for their recyclability benefits. Regulatory frameworks such as the EU Packaging and Packaging Waste Directive further push demand for eco-friendly solutions. This shift encourages resin manufacturers to develop low-VOC, halogen-free, and recyclable options, providing long-term growth opportunities and competitive differentiation in the market.

Key Trends & Opportunities

Technological Advancements in Reactive Resins

Continuous innovation in reactive tie layer resin formulations is improving adhesion strength, thermal stability, and process efficiency. New grades offer better compatibility with high-performance barrier materials like EVOH and PA while reducing resin usage per layer. These advancements support lightweighting trends and cost optimization for converters. The opportunity lies in expanding adoption across demanding applications such as retort packaging, industrial laminates, and high-barrier films, where performance consistency and durability are critical to maintain product quality over extended storage periods.

- For instance, Arkema completed a 40% global expansion of its Pebax® elastomers production capacity at its Serquigny, France plant in February 2024, to meet growing demand in the sports and consumer goods markets.

Growth of E-Commerce and Flexible Packaging Formats

The rapid growth of e-commerce is fueling demand for durable, puncture-resistant, and tamper-proof packaging. Flexible packaging formats such as stand-up pouches and vacuum-sealed bags are increasingly favored for shipping food, pet products, and household goods. Tie layer resins enable multilayer structures with superior barrier properties and sealing strength, ensuring safe product delivery. This trend presents opportunities for resin suppliers to develop solutions tailored for heavy-duty e-commerce packaging and customizable structures that balance performance with cost-effectiveness in a highly competitive market.

- For instance, Dow Chemical is a significant supplier of tie-layer resins, which are essential for manufacturing robust, multi-layer packaging such as flexible stand-up pouches. These resins enable durable seal strength, supporting packaging widely used in e-commerce logistics and distribution.

Key Challenges

Volatility in Raw Material Prices

Tie layer resins are primarily derived from petrochemical feedstocks such as ethylene, and their prices are sensitive to crude oil fluctuations. Price volatility impacts production costs and margins for resin manufacturers and packaging converters. Frequent cost adjustments strain supply contracts and create uncertainty for end-users. Companies are adopting long-term procurement strategies and exploring bio-based feedstocks to mitigate these risks, but short-term volatility remains a challenge that affects market stability and investment planning across the value chain.

Stringent Environmental Regulations

Evolving global regulations on plastic waste management and recycling place pressure on resin manufacturers to reformulate products. Non-recyclable multilayer structures face increasing restrictions, pushing converters to shift toward monomaterial solutions. Compliance with standards such as REACH and the EU Green Deal requires significant R&D investment, raising production costs. Smaller players often struggle to meet these requirements, creating a competitive disadvantage. Regulatory uncertainty and frequent policy changes add complexity, potentially slowing innovation and adoption rates in some regions.

Regional Analysis

Asia-Pacific

Asia-Pacific led the market with 41% share in 2024. Growth stems from soaring flexible packaging demand. China and India drive food and pharma laminates. Regional converters favor LLDPE-based reactive grades for EVOH bonding. Local resin supply supports stable pricing and short lead times. E-commerce packaging accelerates multilayer film adoption. Retort pouches and liquid packaging board expand usage. Regulatory pushes for recyclability back PE-rich structures. Brand owners request downgauging without barrier loss. Investments in blown film lines strengthen capacity across Southeast Asia. The region remains the key engine for volume growth through 2032.

North America

North America held 27% share in 2024. High hygiene standards support barrier packaging adoption. Grocery and meal-kit channels favor puncture-resistant multilayers. Converters specify reactive tie layers for EVOH and PA. PE-rich monomaterial designs gain traction for recyclability. Downgauging targets reduce resin intensity per pack. Healthcare and nutraceuticals require long shelf life. Cold-chain expansion boosts high-seal strength films. Resin producers emphasize FDA compliance and consistency. Capital upgrades focus on multilayer blown and cast film lines. Sustainability mandates and retailer scorecards sustain strong procurement pipelines.

Europe

Europe captured 22% share in 2024. The region advances circular packaging goals. EU rules favor recyclable monomaterial PE structures. Reactive tie layers enable strong bonding to EVOH barriers. Premium foods and pet care need odor and oxygen control. Private labels push downgauged, high-integrity pouches. Pharma compliance sustains medical laminate demand. Energy costs drive process efficiency and waste reduction. Local producers invest in bio-based chemistries. Supply chains prioritize REACH-conforming formulations. Retailers expand refill and lightweight formats, supporting innovative tie layer grades.

Latin America

Latin America accounted for 6% share in 2024. Packaged foods and beverages expand rapidly. Dairy and snacks drive multilayer film demand. Converters deploy cost-effective LLDPE tie layers. Regional bottlers require strong seal and barrier performance. Pet food exports encourage high-puncture pouches. Investments modernize film lines in Mexico and Brazil. Retail growth favors stand-up pouches over rigid formats. Agricultural films add selective opportunities. Currency swings challenge imported specialty grades. Localization efforts and technical service improve adoption of reactive systems.

Middle East & Africa

Middle East and Africa held 4% share in 2024. Urbanization increases packaged food penetration. Water and beverage sectors drive rigid and flexible demand. Reactive tie layers support multilayer bottles and caps. GCC investments expand regional polymer capacity. Retail modernization favors lightweight pouches and sachets. Pharma packaging grows in select hubs. Supply reliability and training remain priorities. Converters seek adhesion with reduced resin usage. Recycling initiatives encourage PE-rich structures. Gradual capacity additions and standards adoption will lift volumes.

Market Segmentations:

By Base Resin

By Product Type

By Application

- Flexible Packaging

- Rigid Packaging

- Compounding

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the tie layer resin market is shaped by major players such as Mitsubishi Chemical, DuPont, Westlake Chemicals, Arkema, Addivant, LyondellBasell, Exxon Mobil, Eastman Chemical, The Dow Chemical Company, and Mitsui Chemicals. These companies compete on product innovation, cost efficiency, and global distribution reach. Leading producers focus on developing reactive tie layer resins that enhance adhesion to barrier materials like EVOH and PA while supporting recyclable monomaterial structures. Strategic initiatives include capacity expansions in Asia and North America, partnerships with packaging converters, and R&D investment in bio-based and low-VOC formulations. Key players also emphasize compliance with evolving regulations such as the EU Packaging Waste Directive and FDA standards. Regional players target niche applications with cost-effective solutions, while global leaders strengthen their supply chain resilience to meet rising demand from food, beverage, and pharmaceutical packaging industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2025, The Dow Chemical Company launched INNATE™ TF 220 Precision Packaging Resin. This resin is for high-performance biaxially oriented polyethylene (BOPE) films, designed for recyclability and uses tie-layer type functionality.

- In April 2025, Mitsubishi Chemical Group received recyclability certification for a food-packaging multilayer film using their gas barrier resin SoarnoL together with a recycling aid Soaresin. This development points to sustainable multi-layer / tie layer film systems.

- In 2024, Mitsubishi Chemical Group offers a range of functional polyolefins and materials like OLEFISTA™ and BioPTMG

Report Coverage

The research report offers an in-depth analysis based on Base Resin, Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily as demand for multilayer packaging continues to rise.

- Reactive tie layer resins will see higher adoption for high-barrier film applications.

- Growth will be supported by increasing use of recyclable monomaterial packaging solutions.

- Food and pharmaceutical sectors will remain the largest end-use industries.

- Innovation in bio-based and low-VOC tie layer resins will gain momentum.

- Flexible packaging will continue to dominate, driven by e-commerce and retail demand.

- Asia-Pacific will remain the fastest-growing region with strong production and consumption.

- Capacity expansions and strategic collaborations will strengthen supply chains.

- Regulations promoting sustainability will accelerate adoption of PE-rich structures.

- Advanced processing technologies will improve efficiency and reduce material usage.

Market Insights

Market Insights