Market Overview:

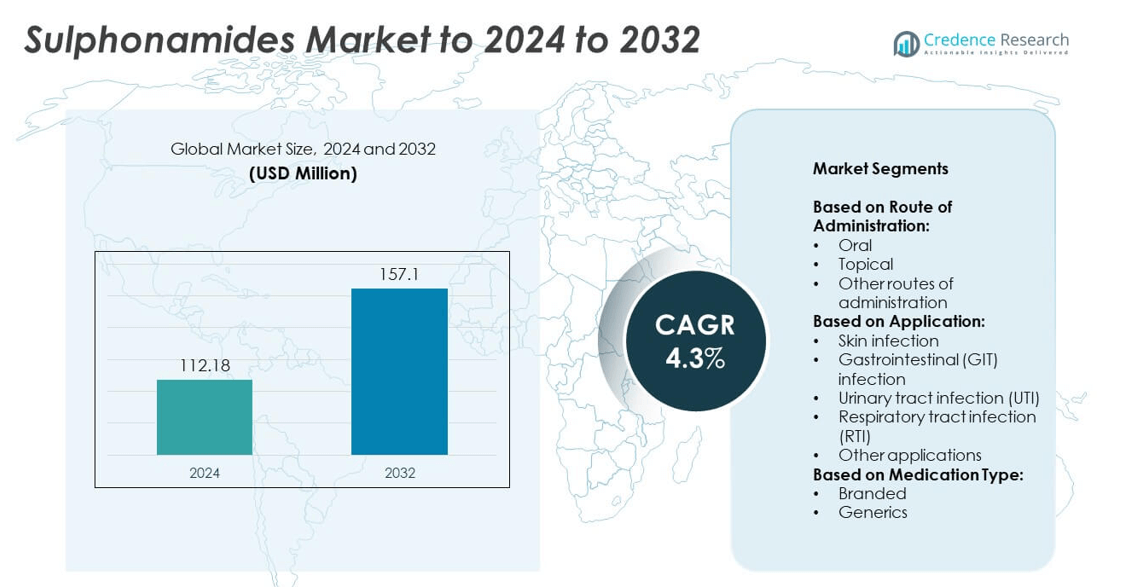

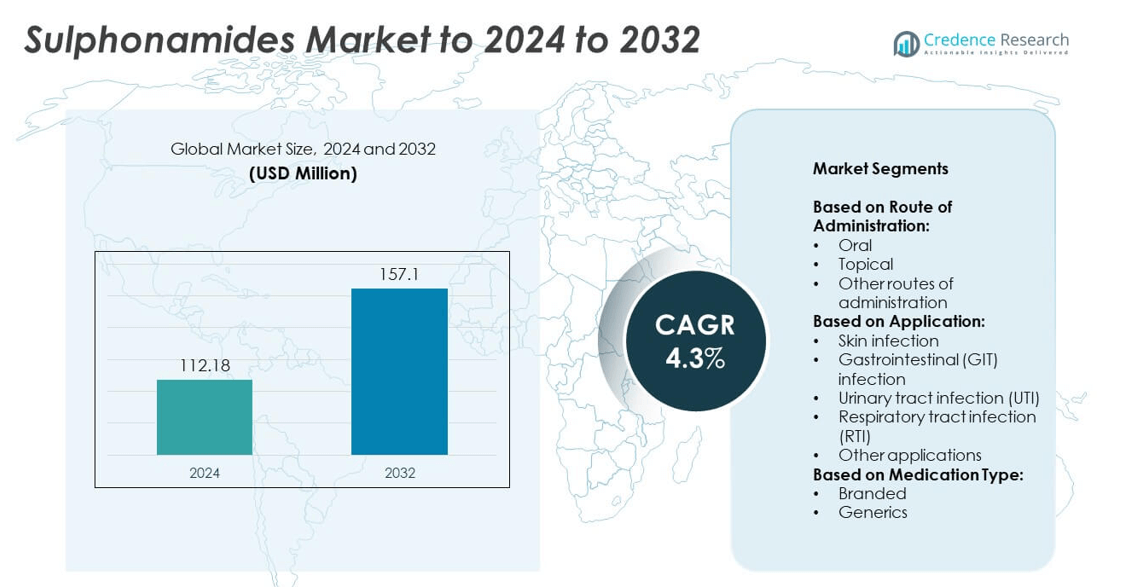

The Sulphonamides Market size was valued at USD 112.18 million in 2024 and is anticipated to reach USD 157.1 million by 2032, at a CAGR of 4.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sulphonamides Market Size 2024 |

USD 112.18 million |

| Sulphonamides Market, CAGR |

4.3% |

| Sulphonamides Market Size 2032 |

USD 157.1 million |

The sulphonamides market is shaped by the presence of leading companies such as Cipla Ltd., Pfizer Inc., Teva Pharmaceutical Industries Ltd., Sun Pharmaceutical Industries Ltd., GSK PLC, Dr. Reddy’s Laboratories, Aurobindo Pharma, and Cadila Pharmaceuticals Ltd. These players emphasize cost-effective generic production, robust distribution networks, and expansion into emerging economies to strengthen their positions. North America emerged as the leading region in 2024, commanding a 35% market share, supported by advanced healthcare systems and strong generic adoption. Europe followed with 28%, while Asia Pacific accounted for 25%, driven by a large patient base and rising healthcare investments, ensuring strong global competition.

Market Insights

- The sulphonamides market was valued at USD 112.18 million in 2024 and is projected to reach USD 157.1 million by 2032, growing at a CAGR of 4.3%.

- Rising prevalence of urinary tract and respiratory infections, along with strong adoption of generics, is driving steady market growth globally.

- Increasing focus on topical formulations for skin infections and combination therapies to address antibiotic resistance are shaping key market trends.

- The market is highly competitive, with players strengthening supply chains, expanding generic portfolios, and investing in cost-efficient manufacturing to maintain market share.

- North America led the market with 35% share in 2024, followed by Europe at 28% and Asia Pacific at 25%, while Latin America and the Middle East & Africa accounted for 7% and 5% respectively; by segment, the oral route dominated with over 65% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Route of Administration

The oral route dominated the sulphonamides market in 2024, accounting for over 65% share. Oral formulations remain preferred due to their ease of administration, better patient compliance, and suitability for long-term treatment of infections such as urinary tract and respiratory tract. The demand is further supported by wide availability of cost-effective generic options in oral dosage forms. While topical applications are gaining traction for treating localized skin infections, their overall share remains smaller. Other routes of administration, such as injectables, are limited to specific clinical settings, reducing their market contribution.

- For instance, Pharmaceutical Associates’ SULFATRIM oral suspension contains 200 mg sulfamethoxazole + 40 mg trimethoprim per 5 mL, supplied in 473 mL bottles.

By Application

Urinary tract infection (UTI) held the largest share in 2024, contributing over 40% of the sulphonamides market. This dominance is driven by the high prevalence of UTIs worldwide, particularly among women and the elderly. Rising antibiotic resistance has reinforced the continued use of sulphonamides as effective alternatives in UTI treatment. Respiratory tract infections also represent a significant segment, boosted by seasonal flu and bacterial complications. Skin and gastrointestinal infections contribute moderately, while other applications, such as prophylaxis in specific cases, have limited but steady demand.

- For instance, Aspen’s Septrin 80 mg/400 mg tablets are packed in blisters of 50 or 100 tablets, used for infections including UTIs.

By Medication Type

Generics accounted for more than 70% share of the sulphonamides market in 2024, making them the dominant segment. Their affordability, patent expirations of leading branded drugs, and inclusion in essential medicines lists drive strong adoption. Generics are especially favored in emerging economies where cost-sensitive healthcare systems prioritize accessible treatments. Branded sulphonamides maintain relevance in developed markets where premium formulations and strong brand recognition influence prescribing trends. However, rising healthcare cost pressures and broader acceptance of generic efficacy are expected to further strengthen the generics segment during the forecast period.

Market Overview

Rising Prevalence of Infections

The increasing global incidence of urinary tract, respiratory tract, and skin infections is a key growth driver for the sulphonamides market. With UTIs alone affecting millions of patients annually, the need for effective and affordable antibiotic therapy is expanding. Sulphonamides remain an accessible treatment option, especially in regions with limited healthcare budgets. Their continued relevance in treating resistant bacterial strains supports steady demand. The rising infection burden across developed and developing nations ensures a consistent growth trajectory for the market during the forecast period.

- For instance, Mylan Laboratories (Viatris) holds WHO prequalification for 400 mg/80 mg co-trimoxazole tablets, listed on 5 Apr 2019, supporting broad infectious-disease use.

High Adoption of Generics

The dominance of generic sulphonamides acts as a major market driver, fueled by their affordability and accessibility. Generics account for a significant share due to patent expirations of branded formulations and their proven clinical efficacy. Governments and healthcare systems, particularly in emerging economies, strongly encourage generic usage to lower treatment costs. This shift also increases market penetration across lower-income populations. With healthcare cost pressures growing worldwide, the adoption of generics will remain a powerful driver for overall market expansion in the coming years.

- For instance, Ipca Laboratories has a WHO-prequalified 400 mg/80 mg co-trimoxazole tablet, listed on 17 Feb 2021, evidencing generic availability.

Expanding Use in Developing Economies

The growing demand for sulphonamides in developing regions is another important growth driver. Limited access to advanced antibiotics and cost-effective treatment priorities make sulphonamides a widely prescribed option in Asia-Pacific, Latin America, and parts of Africa. Government-led public health programs and essential drug lists continue to reinforce their usage in primary care. Rising healthcare investments in these economies further boost market presence. The expanding patient base and accessibility focus ensure sulphonamides maintain strong relevance in treating infections across underserved regions.

Key Trends & Opportunities

Shift Toward Topical Applications

One of the emerging trends is the rising adoption of topical sulphonamides for treating localized skin infections and wound care. These formulations offer targeted therapy, fewer systemic side effects, and improved patient outcomes. Advancements in drug delivery technologies are further expanding their potential in dermatology. This trend presents a growth opportunity as demand for topical antimicrobial treatments increases in both developed and developing healthcare systems. The wider use of topical sulphonamides highlights a niche but promising pathway for market expansion.

- For instance, Flamazine (Smith & Nephew) is 1% silver sulfadiazine; packs include 50 g tubes and 500 g jars, used for infected wounds and burns.

Combination Therapies for Resistance Management

The growing focus on combination therapies is a key opportunity in the sulphonamides market. Combining sulphonamides with other antibiotics improves effectiveness and helps manage rising bacterial resistance. These therapies are increasingly being investigated for use in complex infections such as respiratory and gastrointestinal cases. Pharmaceutical companies are investing in R&D to explore new formulations and dosing strategies. This trend not only extends the clinical utility of sulphonamides but also strengthens their role in modern antibiotic stewardship programs worldwide.

- For instance, Accord-UK Ltd markets co-trimoxazole tablets at a fixed 80 mg/400 mg dose (trimethoprim/sulfamethoxazole), documenting the fixed-dose combination in product records.

Key Challenges

Antibiotic Resistance Concerns

The growing challenge of antibiotic resistance poses a major barrier to sulphonamide market growth. Overuse and misuse of antibiotics have reduced their effectiveness against certain bacterial strains, limiting their role in first-line therapies. This trend has led to a decline in prescribing in some developed markets. Regulatory authorities and clinicians are increasingly cautious about antibiotic use, which may restrict demand. Addressing resistance requires stricter stewardship programs, improved diagnostics, and continued research, making it a critical obstacle for sustainable market growth.

Competition from Advanced Antibiotics

The availability of newer and more advanced antibiotic classes creates significant competitive pressure for sulphonamides. Physicians often prefer prescribing broad-spectrum or next-generation antibiotics with higher efficacy and fewer side effects. This preference is especially strong in developed markets with advanced healthcare infrastructure. The competition limits sulphonamides’ use to specific cases or resource-constrained settings. Unless manufacturers innovate with novel formulations or combination therapies, sulphonamides may face reduced adoption in higher-income regions, presenting a long-term challenge to their market expansion.

Regional Analysis

North America

North America held the largest share of the sulphonamides market in 2024, accounting for nearly 35%. The region benefits from advanced healthcare infrastructure, high awareness of antibiotic treatments, and the continued use of sulphonamides for urinary tract and respiratory infections. Strong adoption of generics further strengthens growth, supported by favorable reimbursement policies in the United States and Canada. Rising antibiotic resistance challenges are encouraging selective prescribing, but demand remains steady. The region’s established pharmaceutical industry and ongoing research into combination therapies also support market stability, ensuring North America maintains its leading position through the forecast period.

Europe

Europe represented about 28% of the sulphonamides market in 2024, driven by a strong generic presence and widespread treatment for urinary and respiratory tract infections. Countries like Germany, France, and the United Kingdom prioritize cost-effective therapies, boosting adoption. Strict antibiotic stewardship policies influence prescribing patterns but ensure sulphonamides remain a reliable option for specific infections. Continued investments in healthcare services and the presence of key pharmaceutical players support market growth. Increasing interest in topical formulations for skin infections provides new opportunities, while regulatory scrutiny on antibiotic resistance remains a key factor shaping the European market outlook.

Asia Pacific

Asia Pacific captured around 25% of the sulphonamides market in 2024, supported by a large patient base and rising healthcare investments. High infection prevalence in countries such as China, India, and Japan drives significant demand for cost-effective antibiotics. Governments across the region actively promote generic medicines, making sulphonamides a preferred choice in primary healthcare. Expanding pharmaceutical manufacturing capabilities also strengthen supply and affordability. Although competition from advanced antibiotics is emerging in developed economies like Japan and South Korea, demand across low- and middle-income nations ensures Asia Pacific remains one of the fastest-growing regions during the forecast period.

Latin America

Latin America accounted for approximately 7% of the sulphonamides market in 2024, with Brazil and Mexico leading regional adoption. The rising burden of urinary tract and respiratory infections supports strong demand for affordable treatment options. Generic penetration is particularly high in the region, as healthcare systems prioritize cost-effective drugs to expand access. Limited availability of advanced antibiotics in rural areas reinforces reliance on sulphonamides. While economic disparities and weaker healthcare infrastructure pose challenges, growing government investments in public health programs are expected to drive moderate but consistent market growth across Latin America during the forecast period.

Middle East and Africa

The Middle East and Africa region held a 5% share of the sulphonamides market in 2024, driven by high infection prevalence and limited access to newer antibiotics. Countries in sub-Saharan Africa and parts of the Middle East continue to rely heavily on sulphonamides as part of essential medicine programs. Affordability and availability of generic formulations play a critical role in adoption. However, weaker healthcare infrastructure and inconsistent supply chains remain barriers to growth. Expanding international aid and local government initiatives aimed at improving healthcare delivery are expected to gradually increase market penetration in the region.

Market Segmentations:

By Route of Administration:

- Oral

- Topical

- Other routes of administration

By Application:

- Skin infection

- Gastrointestinal (GIT) infection

- Urinary tract infection (UTI)

- Respiratory tract infection (RTI)

- Other applications

By Medication Type:

By Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the sulphonamides market includes leading pharmaceutical companies such as Cipla Ltd., Monarch Pharmaceuticals, Sun Pharmaceutical Industries Ltd., Bausch & Lomb Incorporated, Glenmark Pharma Ltd., Teva Pharmaceutical Industries Ltd., F. Hoffmann-La Roche Ltd., Allergan, Amneal Pharmaceuticals LLC, Lexine Technochem Pvt. Ltd., Dr. Reddy’s Laboratories, Sandoz, Pfizer Inc., GSK PLC, Aurobindo Pharma, and Cadila Pharmaceuticals Ltd. These players compete on factors such as pricing, product quality, generic availability, and distribution networks. Market growth is strongly influenced by the dominance of generics, patent expirations, and affordability-focused strategies, especially in developing economies. Companies are actively strengthening their supply chains to ensure wider accessibility in emerging regions. Expanding research into topical formulations and combination therapies highlights a shift toward addressing antibiotic resistance and localized treatments. With increasing healthcare cost pressures, competition is expected to intensify as players invest in cost-efficient manufacturing, broader market penetration, and regulatory compliance to capture higher market share during the forecast period.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cipla Ltd.

- Monarch Pharmaceuticals

- Sun Pharmaceutical Industries Ltd.

- Bausch & Lomb Incorporated

- Glenmark Pharma Ltd.

- Teva Pharmaceutical Industries Ltd.

- Hoffmann-La Roche Ltd.

- Allergan

- Amneal Pharmaceuticals LLC

- Lexine Technochem Pvt. Ltd.

- Reddy’s Laboratories

- Sandoz

- Pfizer Inc.

- GSK PLC

- Aurobindo Pharma

- Cadila Pharmaceuticals Ltd.

Recent Developments

- In 2025, Amneal recalled several lots of Sulfamethoxazole/Trimethoprim tablets due to microbial contamination. This highlights the ongoing industry challenge of maintaining strict quality control and ensuring product safety in the manufacturing of generic drugs.

- In 2025, Aurobindo consistently launched new generic products, which bolstered its market presence, its product portfolio had grown significantly and included a variety of antibiotics.

- In 2024, Sandoz unveiled a new production facility in Kundl, Austria, to increase capacity by an estimated 20% compared to its previous operations.

Report Coverage

The research report offers an in-depth analysis based on Route of Administration, Application, Medication Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The sulphonamides market will continue to grow steadily with moderate demand across healthcare systems.

- Rising prevalence of urinary tract and respiratory infections will sustain market adoption.

- Generics will dominate the market due to affordability and wider patient accessibility.

- North America and Europe will maintain strong positions supported by advanced healthcare infrastructure.

- Asia Pacific will emerge as the fastest-growing region with high infection burden and cost-sensitive demand.

- Topical sulphonamide formulations will gain momentum in treating localized skin infections.

- Combination therapies will expand use by addressing growing antibiotic resistance challenges.

- Regulatory emphasis on antibiotic stewardship will shape prescribing practices and market direction.

- Competition from newer antibiotics will limit adoption in developed markets but strengthen use in emerging ones.

- Expanding healthcare investments in developing economies will provide long-term growth opportunities.