Market Overview:

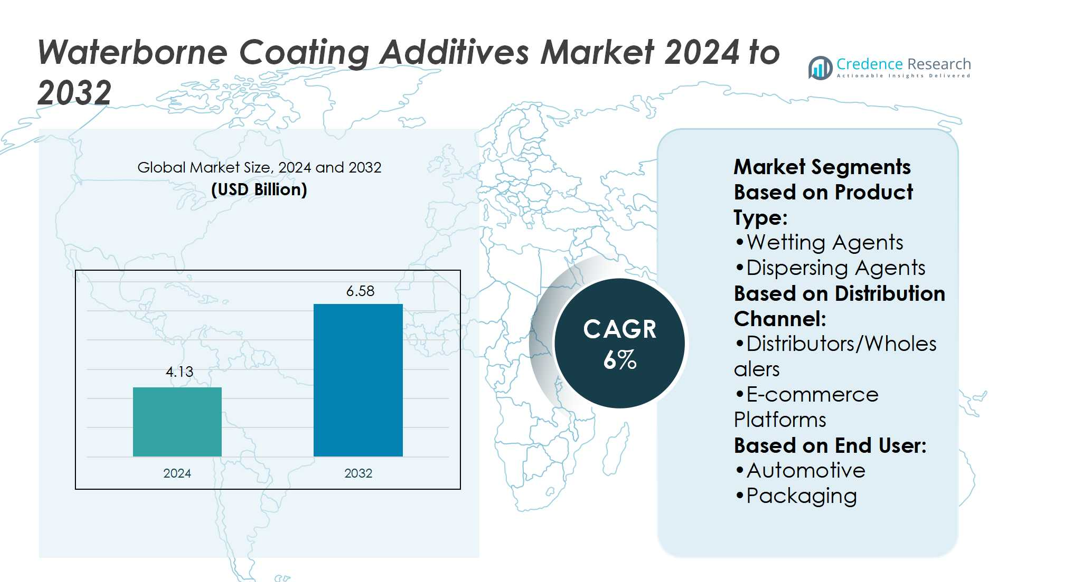

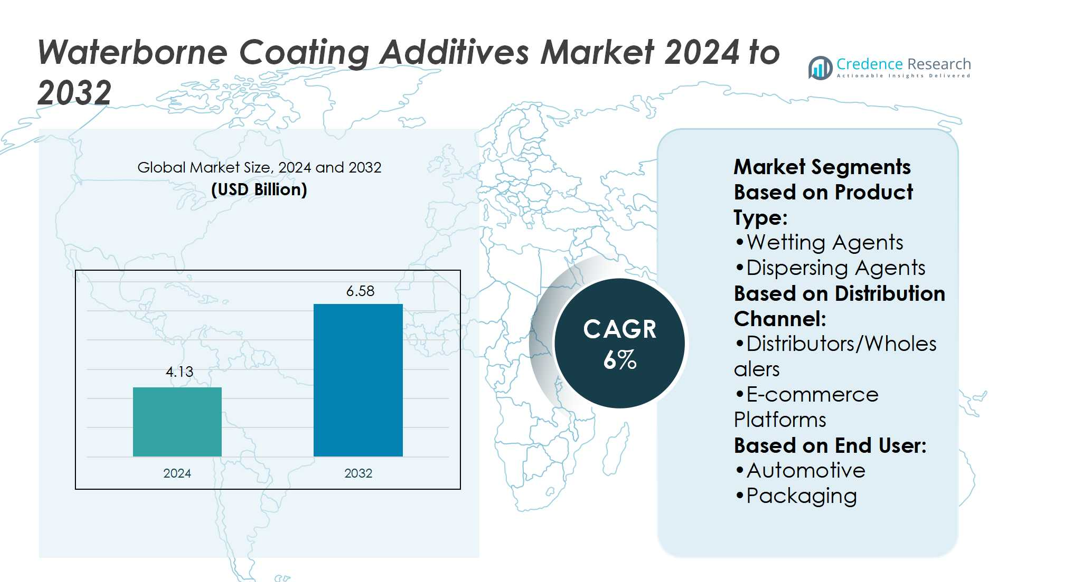

Waterborne Coating Additives Market size was valued USD 4.13 billion in 2024 and is anticipated to reach USD 6.58 billion by 2032, at a CAGR of 6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Waterborne Coating Additives Market Size 2024 |

USD 4.13 billion |

| Waterborne Coating Additives Market, CAGR |

6% |

| Waterborne Coating Additives Market Size 2032 |

USD 6.58 billion |

The waterborne coating additives market is shaped by key players such as Troy Corporation, BASF SE, Harmony Additive Pvt. Ltd., KaMin LLC. / CADAM, Evonik Industries AG, ALTANA, Dow, BELAMI FINE CHEMICALS PVT. LTD., ALLNEX NETHERLANDS B.V., and Akzo Nobel NV. These companies focus on sustainable formulations, advanced chemistries, and strategic partnerships to expand global reach and strengthen competitiveness. North America emerges as the leading region, holding a 34% market share in 2024, driven by strict environmental regulations, strong construction demand, and a well-established automotive sector adopting low-VOC and eco-friendly coating solutions.

Market Insights

- The waterborne coating additives market size was USD 4.13 billion in 2024 and is projected to reach USD 6.58 billion by 2032, registering a CAGR of 6% during the forecast period.

- Market growth is driven by rising demand for eco-friendly and low-VOC coatings, with building and construction leading end-use adoption, holding 38% share in 2024.

- Key trends include the shift toward bio-based raw materials, digital sales expansion, and advanced rheology modifiers that enhance coating performance across construction, automotive, and packaging sectors.

- The competitive landscape features global players such as BASF SE, Dow, Evonik, and Akzo Nobel NV, alongside regional firms like Harmony Additive Pvt. Ltd. and BELAMI Fine Chemicals, focusing on sustainable innovation and strategic partnerships.

- Regionally, North America dominates with 34% share in 2024, followed by Europe at 28% and Asia-Pacific at 27%, with the latter showing the fastest growth due to rapid industrialization and infrastructure development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

In the waterborne coating additives market, rheology modifiers hold the dominant share of 32% in 2024. Their importance lies in controlling viscosity, ensuring uniform film formation, and enhancing application properties. The demand is driven by the growing use of high-performance coatings in automotive and construction sectors. Wetting agents and dispersing agents also see steady growth, supported by the rising need for improved surface coverage and pigment stability. Defoamers and wax additives remain niche, primarily used to eliminate foam or improve scratch resistance in premium applications.

- For instance, Troy’s Troythix® 200X & 220B rheology modifiers provide anti-settling and sag resistance in pigmented systems, while activating at 45 °C to maintain application performance. The demand is driven by the growing use of high-performance coatings in automotive and construction sectors.

By Distribution Channel

Direct sales lead this segment with a 41% share in 2024, supported by long-term contracts between manufacturers and large end users in construction and automotive. Manufacturers prefer this channel for better cost control and closer customer relationships. Distributors and wholesalers follow closely, ensuring supply to small and medium buyers. E-commerce platforms are gaining momentum, especially in packaging and smaller construction projects, due to easy access and cost benefits. Other channels, including local suppliers, maintain relevance in developing markets where digital penetration is lower.

- For instance, BASF’s digital ordering platform in Greater China allows smaller buyers to purchase biomass-balanced Polyamide 6 modules in batch sizes as small as 1 metric ton.

By End User

Building and construction dominates with a 38% market share in 2024, driven by the rapid adoption of eco-friendly, durable coatings in residential and commercial infrastructure. The shift toward waterborne formulations in green building projects further strengthens this demand. Automotive coatings represent the second-largest share, supported by the push for low-VOC and high-performance surface treatments. Packaging applications are expanding as food-grade and protective coatings see wider adoption. Other sectors, such as industrial and marine, contribute smaller shares but show steady demand for specialized waterborne additives.

Market Overview

Rising Demand for Eco-Friendly Coatings

The shift toward sustainable solutions is a major growth driver for the waterborne coating additives market. Increasing regulatory pressure on volatile organic compounds (VOCs) is pushing manufacturers to adopt waterborne formulations. These coatings offer lower emissions, reduced health risks, and compliance with strict environmental standards. Industries such as construction, automotive, and packaging prefer eco-friendly additives to align with green building certifications and sustainability goals. This trend significantly boosts demand for advanced additives that enhance performance without compromising environmental benefits.

- For instance, Harmony Additives offers a dispersant product with this name. The technical data sheet for Additive 5235 specifies an active ingredient content of 45%.

Rapid Expansion in Construction and Infrastructure

Growing construction activity across emerging and developed regions strongly supports the market. Waterborne coating additives improve durability, adhesion, and surface finish, making them ideal for residential, commercial, and industrial projects. Government-led infrastructure investments and urbanization projects fuel steady demand for protective and decorative coatings. In particular, Asia-Pacific’s rapid urban growth creates significant opportunities for additive manufacturers. The focus on sustainable and high-performance building materials ensures consistent uptake of these solutions, reinforcing their role in construction-driven market growth.

- For instance, KaMin’s Polyfil 90B water-washed kaolin grade offers a median particle size of 1.5 µm, which improves film smoothness and reduces visible surface defects in architectural coatings.

Technological Advancements in Additives

Continuous innovation in additive formulations enhances the performance of waterborne coatings. Advanced rheology modifiers, dispersants, and flow agents improve film stability, color uniformity, and application efficiency. R&D investments by key companies focus on tailoring additives for diverse end uses such as automotive, packaging, and construction. The integration of nanotechnology and bio-based raw materials further elevates product efficiency and eco-compatibility. These innovations provide manufacturers with opportunities to differentiate their offerings, reduce costs, and meet evolving customer demands for high-quality, sustainable coatings.

Key Trends & Opportunities

Shift Toward Bio-Based Raw Materials

One key trend is the rising use of bio-based and renewable raw materials in waterborne additives. Growing environmental awareness and resource efficiency goals encourage companies to explore plant-derived or biodegradable inputs. This transition creates opportunities for suppliers to strengthen their eco-friendly portfolios and cater to industries prioritizing sustainable materials. The use of bio-based rheology modifiers and dispersants is expected to expand, providing cost-effective and performance-driven solutions. This shift also helps manufacturers align with circular economy initiatives.

- For instance, Evonik’s TEGO® Foamex 812 eCO defoamer delivers more than 60 g of bio-carbon per 100 g additive, yet maintains performance in both micro-foam and macro-foam suppression in pigmented coatings.

Growth of E-Commerce Distribution Channels

The expansion of e-commerce platforms presents a strong opportunity for the market. Online sales enable manufacturers and distributors to reach a wider customer base, including small contractors and individual buyers. Digital platforms also provide competitive pricing, customer reviews, and direct-to-consumer engagement. With increasing internet penetration and adoption of digital solutions in construction and industrial procurement, e-commerce channels will gain higher significance. This opportunity allows smaller players to compete with established brands while enhancing market accessibility and efficiency.

- For instance, Altana’s Atlas platform holds more than 2.8 billion shipment-level records enabling enterprises to trace flow of goods from individual facilities to buyers via digital dashboards.

Key Challenges

High Cost of Advanced Additives

The development of high-performance waterborne coating additives involves significant R&D investment and specialized raw materials. These factors increase production costs compared to conventional additives. For cost-sensitive markets such as emerging economies, higher prices limit large-scale adoption. Small and medium enterprises often face budget constraints that restrict their ability to shift toward advanced waterborne solutions. Balancing cost competitiveness while maintaining performance and sustainability standards remains a major challenge for manufacturers.

Performance Limitations in Extreme Conditions

Although waterborne additives offer strong eco-friendly benefits, their performance can be limited under extreme conditions. High humidity, low temperatures, or heavy-duty applications sometimes reduce drying efficiency, adhesion, and durability. This restricts their use in specific automotive, marine, or industrial environments where solvent-based alternatives perform better. Manufacturers must overcome these limitations by improving formulations to ensure broader applicability. Achieving consistent performance across varied environmental conditions is essential to expanding the market’s reach and long-term adoption.

Regional Analysis

North America

North America leads the waterborne coating additives market with a 34% share in 2024, supported by strict environmental regulations and advanced industrial practices. The U.S. dominates regional demand, driven by the construction, automotive, and packaging sectors adopting low-VOC coatings. Government-backed green building initiatives further promote waterborne solutions. Canada contributes with rising infrastructure investments, while Mexico’s growing automotive industry adds to demand. Strong R&D capabilities and the presence of global additive manufacturers reinforce North America’s leadership, ensuring continued adoption of eco-friendly and high-performance additives across diverse end-use industries.

Europe

Europe holds a 28% market share in 2024, supported by stringent EU regulations on emissions and sustainability. Germany, France, and the UK are key markets, driven by strong automotive and construction activities. The demand for energy-efficient and eco-friendly coatings aligns with the region’s carbon neutrality goals. European manufacturers are actively investing in bio-based raw materials and advanced formulations to meet rising demand for green products. Continuous innovation, combined with high consumer preference for sustainable solutions, ensures steady market growth, making Europe a significant hub for waterborne coating additive development and adoption.

Asia-Pacific

Asia-Pacific accounts for 27% of the market share in 2024, fueled by rapid urbanization, industrialization, and infrastructure projects. China leads regional demand, followed by India, Japan, and South Korea, with construction and automotive sectors driving adoption. The region benefits from cost-effective raw materials and expanding manufacturing capabilities. Rising environmental awareness and government-led sustainability initiatives are encouraging industries to shift toward waterborne technologies. With ongoing investment in infrastructure and growing middle-class consumption, Asia-Pacific presents the fastest-growing market, offering strong opportunities for additive suppliers to capture demand in both developed and emerging economies.

Latin America

Latin America captures a 6% share of the global waterborne coating additives market in 2024, supported by expanding construction activities and a rising automotive sector. Brazil and Mexico are the dominant contributors, with increasing infrastructure investments fueling demand for high-performance coatings. The gradual adoption of eco-friendly solutions is encouraged by evolving regulations, though cost sensitivity limits widespread use of advanced additives. Growing e-commerce channels and local distributors play a key role in market expansion. Despite challenges, rising urbanization and industrial growth create opportunities for regional adoption of waterborne additive technologies.

Middle East & Africa

The Middle East & Africa holds a 5% market share in 2024, with growth driven by construction megaprojects in the UAE and Saudi Arabia. Demand is supported by infrastructure expansion, commercial real estate developments, and government-backed smart city initiatives. Automotive and packaging sectors also contribute, though on a smaller scale compared to construction. The region faces cost-related adoption challenges, as advanced additives are priced higher than traditional alternatives. However, rising interest in eco-friendly materials and long-term durability requirements in harsh climates are gradually driving the shift toward waterborne coating additives.

Market Segmentations:

By Product Type:

- Wetting Agents

- Dispersing Agents

By Distribution Channel:

- Distributors/Wholesalers

- E-commerce Platforms

By End User:

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the waterborne coating additives market players such as Troy Corporation, BASF SE, Harmony Additive Pvt. Ltd., KaMin LLC. / CADAM, Evonik Industries AG, ALTANA, Dow, BELAMI FINE CHEMICALS PVT. LTD., ALLNEX NETHERLANDS B.V., and Akzo Nobel NV. The waterborne coating additives market is characterized by intense innovation and strategic growth initiatives. Companies are investing heavily in research and development to enhance additive performance, focusing on rheology control, dispersing efficiency, and improved surface properties. Sustainability remains a core driver, with manufacturers prioritizing eco-friendly, low-VOC, and bio-based formulations to comply with global environmental regulations. Partnerships, mergers, and acquisitions are common strategies to expand geographic reach and diversify product portfolios. Additionally, firms are leveraging digital sales platforms and strengthening distribution networks to capture demand across construction, automotive, and packaging industries, ensuring long-term competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Troy Corporation

- BASF SE

- Harmony Additive Pvt. Ltd.

- KaMin LLC. / CADAM

- Evonik Industries AG

- ALTANA

- Dow

- BELAMI FINE CHEMICALS PVT. LTD.

- ALLNEX NETHERLANDS B.V.

- Akzo Nobel NV

Recent Developments

- In March 2025, Anochrome Group introduced a PFAS-free coating solution for the wind energy industry, which helps companies in the sector meet stringent environmental specifications.

- In January 2025, Axalta Coating Systems, a leading player in the global coatings market, announced the launch of a new waterborne automotive refinish coating under its Cromax Pro range. The product aims to reduce drying time and energy consumption, aligning with sustainable auto body shop practices.

- In April 2024, Westlake Corporation announced that Westlake Epoxy launched various new deep pour lower yellowing epoxy resin products to be held in the USA. These new products provide easier use for 4-inch pours in a single application.

- In February 2024, Arkema, a world leader in specialty materials, highlighted new technologies and advancements aimed at increasing circularity, energy efficiency, decarbonization, and living comfort through more sustainable paint and coating solutions at Paint India

Report Coverage

The research report offers an in-depth analysis based on Product Type, Distribution Channel, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness steady growth driven by rising demand for eco-friendly solutions.

- Construction and infrastructure projects will continue to generate significant demand for advanced additives.

- Automotive coatings will adopt waterborne formulations to meet sustainability and performance standards.

- Bio-based and renewable raw materials will gain wider acceptance in additive production.

- Technological innovations will enhance rheology control, dispersing efficiency, and film stability.

- E-commerce platforms will expand as an important distribution channel for coating additives.

- Asia-Pacific will remain the fastest-growing region due to rapid industrialization and urbanization.

- Strategic collaborations and mergers will strengthen global market reach and competitiveness.

- Regulatory compliance will drive adoption of low-VOC and high-performance coating additives.

- Continuous R&D investment will support development of specialized additives for diverse end uses.