Market Overview

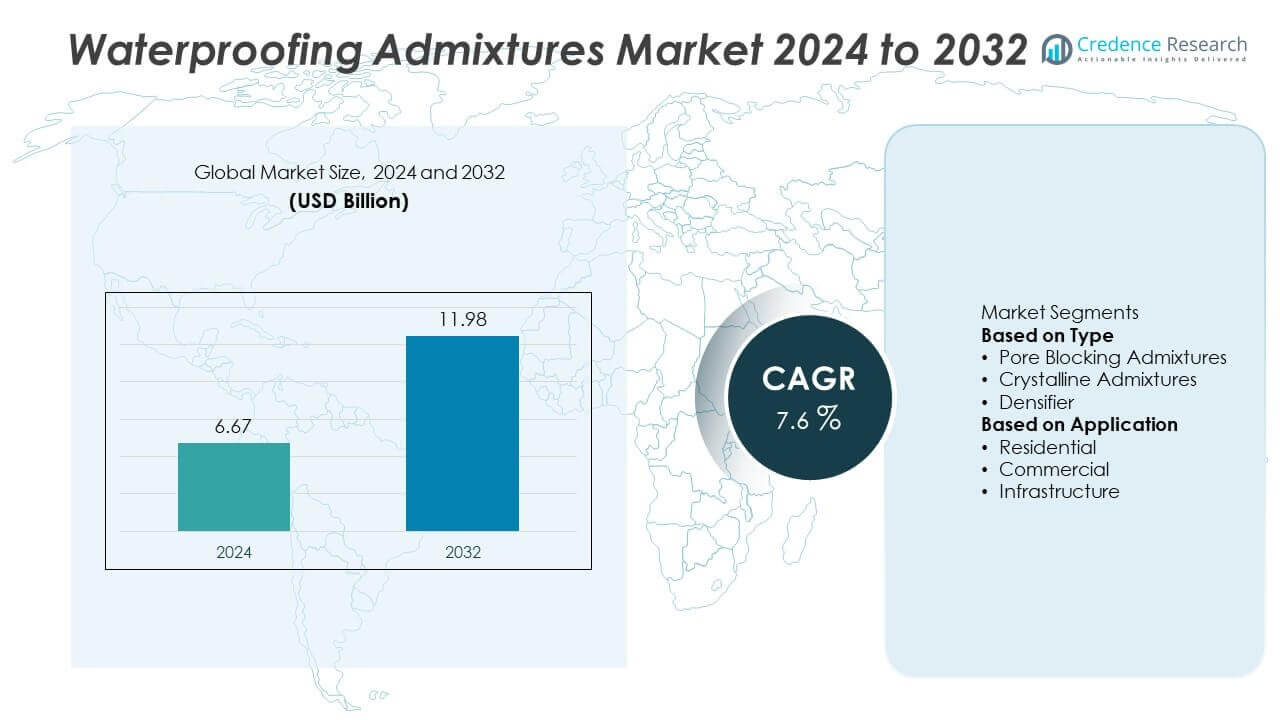

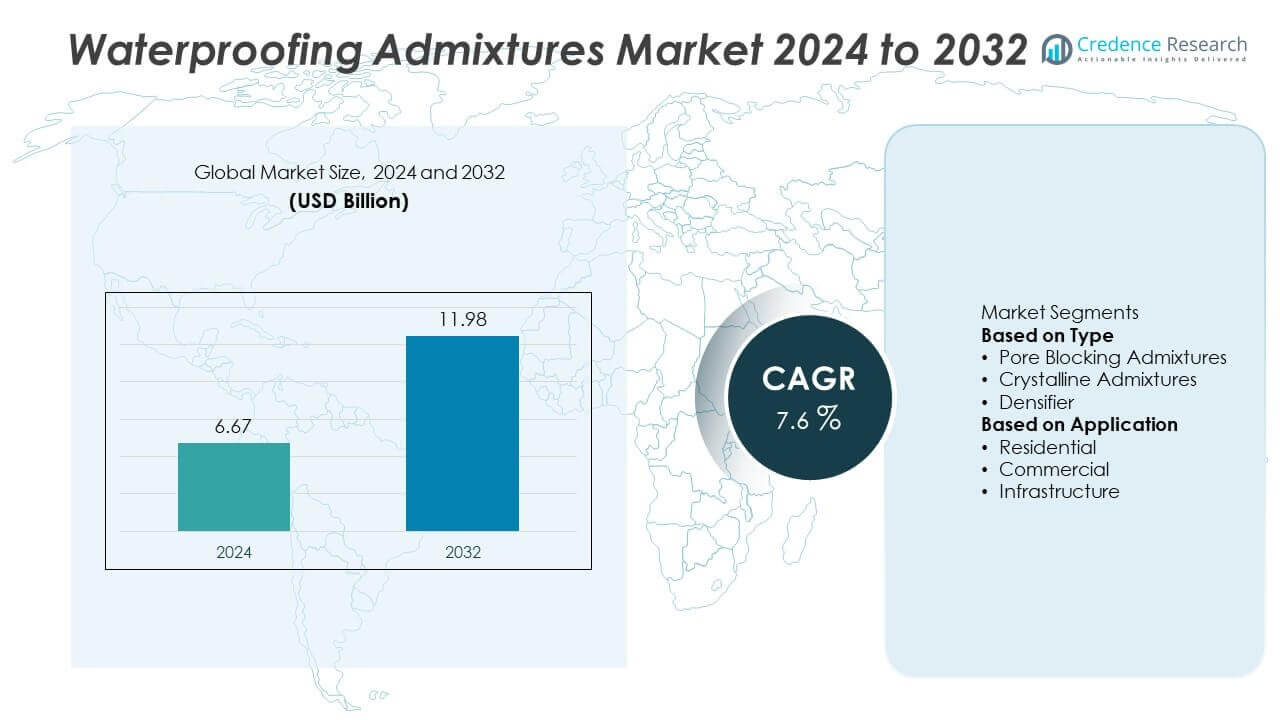

The waterproofing admixtures market was valued at USD 6.67 billion in 2024 and is projected to reach USD 11.98 billion by 2032, growing at a CAGR of 7.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Waterproofing Admixtures Market Size 2024 |

USD 6.67 Billion |

| Waterproofing Admixtures Market, CAGR |

7.6% |

| Waterproofing Admixtures Market Size 2032 |

USD 11.98 Billion |

The waterproofing admixtures market is led by key players including Penetron, BASF SE, Sika AG, Dow Inc, Mapei S.p.A, Fosroc Inc., Evonik A G, RPM International Inc, Kryton International Inc, and Alchemco. These companies dominate the market through innovations in crystalline admixtures, pore-blocking solutions, and densifiers that enhance concrete durability and reduce water ingress. North America held the largest share with 34% in 2024, supported by strong infrastructure spending and stringent building codes. Europe followed with 30% share, driven by sustainable construction initiatives and renovation projects, while Asia-Pacific captured 28% share, fueled by rapid urbanization, government-backed infrastructure programs, and growing demand for durable, low-maintenance concrete solutions.

Market Insights

Market Insights

- The waterproofing admixtures market was valued at USD 6.67 billion in 2024 and is projected to reach USD 11.98 billion by 2032, growing at a CAGR of 7.6% during the forecast period.

- Rising demand for durable and low-maintenance concrete structures is a major driver, supported by growing infrastructure investments and stringent waterproofing standards in residential, commercial, and public projects.

- Key trends include adoption of crystalline admixtures for self-healing concrete, development of eco-friendly formulations, and integration of admixtures in high-performance concrete for sustainability compliance.

- The market is competitive, with players like Penetron, BASF SE, Sika AG, Dow Inc, and Mapei focusing on innovation, partnerships with construction firms, and capacity expansion to strengthen their global presence.

- North America led with 34% share, followed by Europe at 30% and Asia-Pacific at 28%; by type, pore-blocking admixtures dominated with over 40% share, driven by demand in large-scale infrastructure and urban development projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Pore blocking admixtures dominated the waterproofing admixtures market in 2024, capturing over 50% share due to their cost-effectiveness and wide usage in general concrete applications. These admixtures work by blocking capillary pores, reducing permeability, and extending the service life of structures. Crystalline admixtures are witnessing rapid adoption, supported by their self-sealing properties and ability to withstand high hydrostatic pressure, making them ideal for basements and water tanks. Densifiers cater to niche applications requiring enhanced surface hardness, particularly in industrial flooring and high-wear areas.

- For instance, Sika began supplying pore-blocking admixtures rebranded as Sika products in 2024, continuing the legacy of formulations from the acquired MBCC Group that reduce concrete permeability and enhance durability.

By Application

Infrastructure projects accounted for more than 45% share of the market in 2024, driven by rising investments in roads, bridges, tunnels, and water-retaining structures. Waterproofing admixtures are preferred in infrastructure due to their ability to ensure durability and reduce maintenance costs under harsh environmental conditions. The residential sector follows closely, supported by growth in housing projects, especially in urban areas. Commercial construction, including offices and retail complexes, is also a key contributor as developers focus on long-term structural integrity and moisture protection.

- For instance, FCSC’s AQUAPROOF Crystalline admixture has demonstrated the capability to reduce water permeability in tunnel concrete by forming non-soluble crystalline structures within pores, significantly enhancing concrete lifespan by preventing moisture ingress

Key Growth Drivers

Rising Infrastructure Development

The surge in infrastructure projects, including bridges, tunnels, and water-retaining structures, is driving demand for waterproofing admixtures. Governments are investing in urban development, smart cities, and public utilities, which require durable concrete solutions to prevent water ingress and reduce long-term repair costs. The growing need for reliable, maintenance-free structures supports the use of pore blocking and crystalline admixtures, which improve concrete life cycle performance and ensure compliance with stringent quality standards, making them a preferred choice in infrastructure construction.

- For instance, the Thames Tideway Tunnel project in London utilized Xypex Admix C-Series crystalline waterproofing admixture, with 100,000 kg supplied for the west section. The original design for the Hammersmith connection tunnel included a waterproofing membrane between the primary and secondary liners.

Growing Residential and Commercial Construction

Rapid urbanization and population growth are boosting residential housing and commercial building projects worldwide. Waterproofing admixtures are increasingly used in basements, foundations, and rooftops to prevent leakage and dampness. Builders and developers are prioritizing moisture resistance to improve building durability and reduce warranty claims. Affordable housing initiatives, especially in developing nations, are further fueling adoption as admixtures enhance structural performance without significantly raising construction costs, driving steady growth in the residential and commercial sectors.

- For instance, the Kochi Metro project incorporated various strategies to protect reinforced concrete structures from corrosion, particularly due to the potential exposure to a marine environment. Among these strategies, specialized admixtures, like corrosion-inhibiting admixtures, were utilized to enhance the durability of the concrete. These admixtures are added to the concrete mix during preparation, ensuring uniform distribution throughout the material.

Regulatory Push for Durable Concrete Solutions

Stringent building codes and environmental standards are pushing construction companies to use materials that enhance durability and minimize maintenance. Waterproofing admixtures play a key role in achieving compliance by reducing concrete permeability and protecting reinforcement against corrosion. Their use aligns with sustainability goals, as longer-lasting structures reduce resource consumption and carbon footprint. This regulatory push, combined with increasing awareness about life-cycle costs, is creating strong market demand for advanced admixture solutions across multiple construction sectors.

Key Trends & Opportunities

Adoption of Crystalline Admixtures

Crystalline admixtures are gaining traction due to their self-healing properties and ability to seal cracks up to 0.4 mm, even after construction. This feature significantly reduces maintenance costs and enhances service life in water-retaining and below-grade structures. Demand is particularly strong in wastewater treatment plants, reservoirs, and tunnels where high hydrostatic pressure is common. Manufacturers are focusing on innovation in crystalline technology to meet the growing demand for high-performance, sustainable concrete solutions, presenting a key opportunity for product differentiation.

- For instance, in a concrete mix study using a crystalline admixture at 0.8% by cement weight, crack closures higher than 70% were achieved after three months of curing, with the admixture effectively sealing cracks up to 0.4 mm, significantly improving permeability resistance compared to mixes without the admixture.

Integration with Green Building Practices

The rise of green construction and LEED-certified projects is creating opportunities for eco-friendly admixtures with low VOC content and sustainable formulations. Builders are seeking solutions that contribute to energy efficiency and moisture protection without harmful environmental impact. Waterproofing admixtures that enhance durability and reduce repair frequency are being marketed as sustainable options, aligning with global ESG goals. This trend is encouraging manufacturers to develop admixtures with recycled content and improved compatibility with supplementary cementitious materials.

- For instance, certain crystalline admixtures used in green building projects have been formulated to incorporate recycled industrial by-products and demonstrate consistent compressive strength values exceeding 38 MPa at 28 days, ensuring both sustainability and performance criteria are met.

Key Challenges

High Product Cost and Awareness Gap

The relatively higher cost of advanced waterproofing admixtures can be a barrier for small contractors and projects with tight budgets. In many developing regions, there is limited awareness of the long-term benefits of admixtures, leading to preference for cheaper, short-term solutions. This challenge can slow adoption rates and limit market penetration. Addressing this issue requires educational initiatives and demonstration projects that highlight the cost savings achieved through reduced maintenance and longer structural life.

Compatibility and Performance Variability

Performance of waterproofing admixtures can vary depending on mix design, cement type, and jobsite conditions, leading to inconsistent results if not properly specified. Compatibility issues with other admixtures or construction chemicals can also affect concrete setting and strength. These challenges raise concerns among contractors and engineers, making technical support and proper guidance critical. Manufacturers need to focus on training applicators and offering testing services to ensure reliable performance and build trust in admixture solutions.

Regional Analysis

North America

North America held 32% share of the waterproofing admixtures market in 2024, driven by robust construction activity in residential, commercial, and infrastructure sectors. The U.S. leads demand with significant investments in smart city projects, bridge rehabilitation, and water treatment facilities that require durable concrete solutions. Increasing adoption of crystalline admixtures for underground structures and basements is fueling growth. Stringent building codes and emphasis on long-term sustainability are encouraging contractors to use advanced admixtures. Canada is also contributing steadily, supported by green building initiatives and infrastructure upgrades across urban centers and industrial developments.

Europe

Europe accounted for 28% share in 2024, supported by strict regulations for building durability, water conservation, and sustainability. Countries such as Germany, France, and the UK are key markets, driven by renovation of aging infrastructure and focus on energy-efficient construction. Demand for waterproofing admixtures is strong in tunnel projects, wastewater treatment facilities, and green-certified residential developments. EU directives promoting sustainable construction practices are accelerating the use of low-VOC admixtures. The region is witnessing high adoption of crystalline and pore-blocking solutions that enhance concrete longevity and align with circular economy goals.

Asia-Pacific

Asia-Pacific captured 30% share of the waterproofing admixtures market in 2024, emerging as the fastest-growing region. China and India lead demand, fueled by rapid urbanization, smart city development, and large-scale infrastructure investments, including metro projects and highways. Rising residential construction and government-backed affordable housing schemes are boosting consumption of admixtures. Japan and Southeast Asia are also contributing, supported by stringent quality standards and flood-resilient construction initiatives. Growing industrialization and demand for water-retaining structures further support market expansion, while increasing awareness of life-cycle cost savings is driving adoption among contractors and developers.

Latin America

Latin America held 6% share in 2024, led by Brazil and Mexico with growing demand from residential housing projects, industrial parks, and transport infrastructure development. The region is witnessing rising adoption of waterproofing admixtures in commercial buildings, shopping centers, and hotels to improve durability and reduce leakage-related maintenance. Mining and oil projects in Chile and Argentina are also driving demand for durable concrete structures. Limited awareness and budget constraints remain challenges, but government initiatives to modernize public infrastructure are expected to stimulate steady market growth over the forecast period.

Middle East & Africa

The Middle East & Africa region accounted for 4% share in 2024, supported by investments in desalination plants, airports, and high-rise building projects. The UAE and Saudi Arabia are leading adopters with significant demand from megaprojects under Vision 2030 and urban development programs. Waterproofing admixtures are increasingly used in concrete for water-retaining structures and underground car parks. In Africa, growth is led by South Africa and Nigeria, where infrastructure upgrades and housing projects are expanding. Harsh climatic conditions are creating demand for admixtures that improve concrete durability and prevent water ingress under extreme temperatures.

Market Segmentations:

By Type

- Pore Blocking Admixtures

- Crystalline Admixtures

- Densifier

By Application

- Residential

- Commercial

- Infrastructure

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape of the waterproofing admixtures market is shaped by leading players such as Penetron, Evonik A G, Mapei S.p.A, Alchemco, RPM International Inc, BASF SE, Fosroc Inc., Sika AG, Dow Inc, and Kryton International Inc. These companies focus on developing advanced admixtures that improve concrete durability, reduce permeability, and enhance resistance to harsh environmental conditions. Strategic initiatives include expanding production capacities, investing in R&D for crystalline and pore-blocking technologies, and launching eco-friendly formulations to meet green building standards. Partnerships with construction firms and infrastructure developers strengthen market reach, while digital tools for mix design optimization support better product performance. Global players are emphasizing training and technical support to educate contractors and engineers, ensuring proper product application and improved project outcomes. The competitive environment remains innovation-driven, with companies leveraging sustainability, performance differentiation, and compliance with international construction standards to gain market share and long-term contracts.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, Evonik AG transitioned its epoxy curing agent production (Crosslinkers business line) to run on 100% renewable electricity.

- In May 2025, BASF introduced Pluriol® A 2400 I, a reactive PEG (polyethylene glycol) to make next-gen superplasticizers for concrete. These help concrete flow and can reduce water usage.

- In April 2025, Sika AG opened a new plant in Ust-Kamenogorsk, Kazakhstan, for concrete admixtures and mortars (including waterproofing admixtures).

- In February 2025, Saint-Gobain completed its acquisition of Fosroc Inc., enhancing its waterproofing and repair-chemicals capabilities internationally

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for waterproofing admixtures will grow with rising global construction and infrastructure projects.

- Crystalline admixtures will gain popularity for self-healing and long-lasting concrete protection.

- Residential and commercial construction will continue driving adoption of pore-blocking admixtures.

- Innovation in eco-friendly and VOC-free admixtures will meet green building standards.

- Integration of admixtures in high-performance concrete will enhance durability and lifecycle performance.

- Asia-Pacific will remain the fastest-growing region with rapid urbanization and infrastructure expansion.

- Digital construction practices will boost demand for quality-controlled admixture solutions.

- Strategic partnerships between manufacturers and contractors will improve market penetration.

- R&D investments will focus on enhancing compatibility with various cement types.

- Rising focus on reducing maintenance costs will push adoption across water treatment and tunneling projects.

Market Insights

Market Insights