Market Overview:

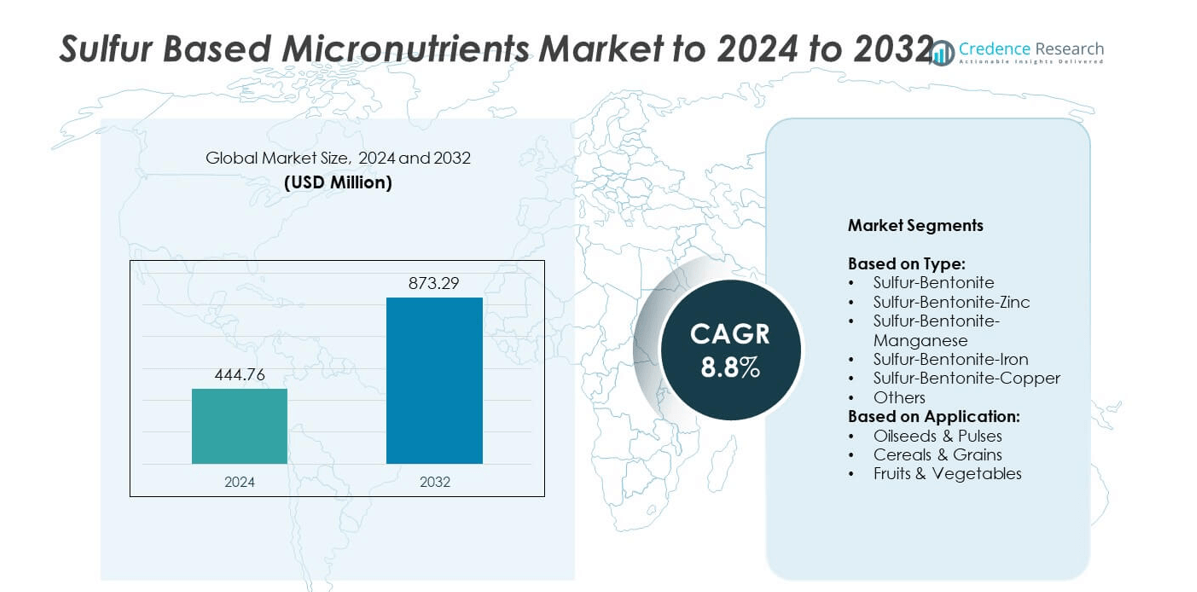

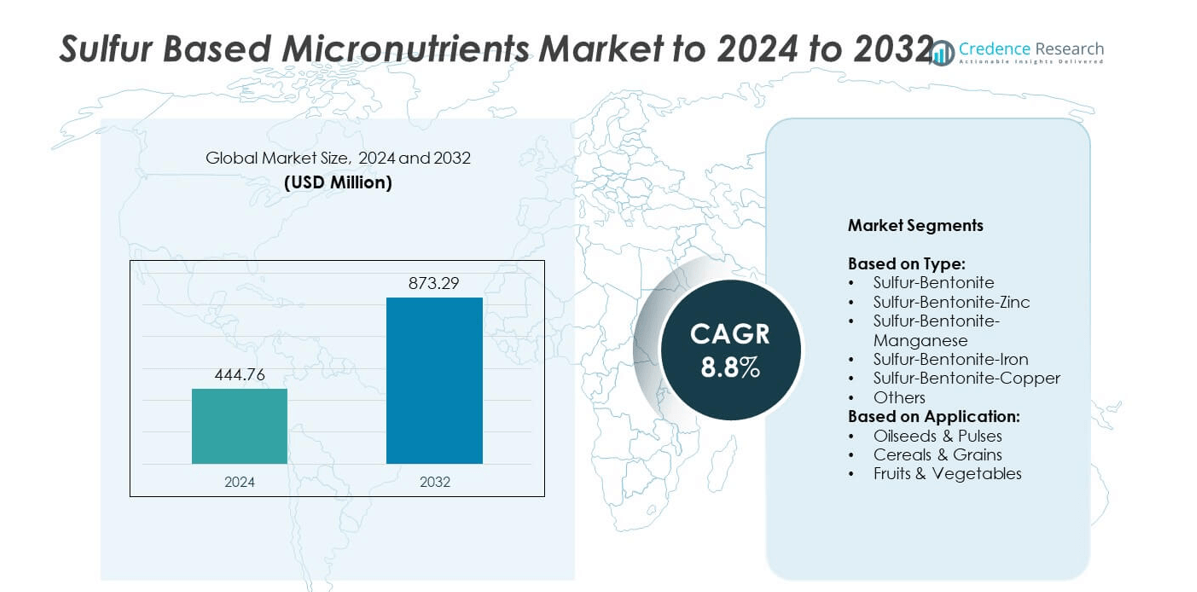

The sulfur based micronutrients market size was valued at USD 444.76 million in 2024 and is anticipated to reach USD 873.29 million by 2032, at a CAGR of 8.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sulfur Based Micronutrients Market Size 2024 |

USD 444.76 million |

| Sulfur Based Micronutrients Market, CAGR |

8.8% |

| Sulfur Based Micronutrients Market Size 2032 |

USD 873.29 million |

The sulfur based micronutrients market is driven by leading players such as Nutrien, Tiger-Sul Products LLC, Yara International, CF Industries, Coromandel, IFFCO, Aries Agro Limited, DFPCL, HBT India, Agroasia, Sohar Sulphur Fertilizers LLC, and Mirabelle Agro Manufacturing Pvt Ltd. These companies focus on expanding production capacity, offering fortified blends, and strengthening global distribution to meet rising agricultural demand. North America emerged as the leading region in 2024, commanding around 35% share, supported by advanced farming practices, government-backed initiatives, and strong adoption of micronutrient-enriched fertilizers. Europe followed with nearly 25%, driven by sustainability policies, while Asia Pacific accounted for over 28% share, fueled by population growth, sulfur-deficient soils, and government support for balanced fertilization practices.

Market Insights

- The sulfur based micronutrients market was valued at USD 444.76 million in 2024 and is projected to reach USD 873.29 million by 2032, growing at a CAGR of 8.8%.

- Rising global food demand and soil nutrient depletion are key drivers, as farmers increasingly adopt fortified fertilizers to improve crop yield and quality.

- A major trend is the growing use of sulfur-based blends in high-value crops like fruits, vegetables, and oilseeds, alongside precision farming practices that enhance fertilizer efficiency.

- The competitive landscape features global leaders and regional specialists focusing on cost-effective formulations, expanded production capacity, and collaborations with local agricultural bodies to strengthen farmer adoption.

- North America led the market with 35% share in 2024, followed by Europe at 25% and Asia Pacific at 28%, while the sulfur-bentonite segment dominated by type with over 40% share, driven by its efficiency and affordability in large-scale farming.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The sulfur-bentonite segment dominated the market in 2024, accounting for over 40% share. Its popularity comes from cost-effectiveness, high soil compatibility, and ease of use in large-scale farming. Sulfur-bentonite enhances nutrient absorption and corrects sulfur deficiencies in crops, making it a preferred choice among growers. Blended variants like sulfur-bentonite-zinc and sulfur-bentonite-manganese are gaining traction as they address multiple micronutrient shortages simultaneously. The rising demand for fortified fertilizers and balanced crop nutrition is fueling adoption, while sulfur-bentonite’s proven agronomic efficiency keeps it the leading sub-segment across global agricultural markets.

- For instance, Coromandel International commissioned a new sulfur-bentonite plant at its Visakhapatnam facility in Andhra Pradesh in March 2025, which doubled its total sulphur bentonite production capacity to 50,000 metric tons per year. The company had also commissioned a new sulphuric acid plant at the same site in October 2023.

By Application

Cereals and grains emerged as the largest application segment, capturing more than 45% share in 2024. This dominance is driven by extensive global cultivation of wheat, rice, and maize, which are staple crops requiring balanced micronutrient support. Sulfur-based micronutrients play a crucial role in improving protein synthesis, enhancing yield, and maintaining grain quality. Farmers increasingly adopt these solutions to combat sulfur depletion in soils caused by intensive farming. Demand is further supported by government initiatives promoting sulfur-based fertilizers to ensure food security and improve nutritional value in large-scale grain production.

- For instance, Haifa Group upgraded its Controlled Release Fertilizer (CRF) production in Lunel, France, to 24,000 metric tons per annum (MTPA) of its Multicote product range.

Market Overview

Rising Global Food Demand

The increasing need to feed a growing global population is a key growth driver. Expanding agricultural output requires balanced crop nutrition, and sulfur-based micronutrients address soil deficiencies effectively. Their role in enhancing protein synthesis, chlorophyll formation, and nutrient uptake makes them critical for yield improvement. Governments and industry players promote sulfur-fortified fertilizers to ensure higher productivity in staple crops like rice, wheat, and maize. With declining soil fertility from intensive farming, demand for sulfur-based solutions continues to rise, strengthening the segment’s contribution to sustainable food security.

- For instance, in 2024 Nutrien supplied 27 million tonnes of essential fertilizer products to customers in more than 50 countries.

Shift Toward Micronutrient-Enriched Fertilizers

A key driver is the shift toward fortified fertilizers that combine sulfur with micronutrients such as zinc, iron, and manganese. Farmers seek solutions that improve overall soil health while addressing multiple deficiencies simultaneously. These blends reduce input costs, improve efficiency, and ensure better crop resilience against nutrient-related disorders. The rising adoption of integrated plant nutrition management practices further accelerates uptake. Sulfur-bentonite blends are particularly favored due to their versatility and soil adaptability, making them a cornerstone in sustainable farming and boosting long-term market growth.

- For instance, Yara will supply 165,000 tons per year of fertilizers (mainly low-carbon or renewable ammonia-based) to PepsiCo Europe by 2030.

Supportive Government Policies

Government initiatives promoting sulfur-based fertilizers act as a key driver for market expansion. Subsidy programs and agricultural extension activities encourage farmers to adopt nutrient-balanced solutions. Regulatory emphasis on improving crop quality and meeting food security goals adds momentum. In regions like Asia-Pacific and North America, authorities actively support micronutrient use to address sulfur-deficient soils. Policies focusing on sustainable farming practices, alongside rising investment in fertilizer production infrastructure, further enhance accessibility. Such initiatives create a favorable ecosystem, ensuring stable demand growth for sulfur-based micronutrients across both developed and emerging economies.

Key Trends & Opportunities

Growing Adoption in High-Value Crops

A key trend is the growing use of sulfur-based micronutrients in high-value crops such as fruits, vegetables, and oilseeds. Farmers increasingly recognize their role in enhancing flavor, shelf life, and nutritional content. Rising consumer preference for premium produce with improved quality standards drives this adoption. This creates opportunities for companies offering specialized formulations tailored to crop-specific requirements. The expansion of horticulture and export-driven agriculture further supports demand, as maintaining product quality becomes a key priority in both domestic and international food markets.

- For instance, in the U.S., over 50% of corn, cotton, rice, sorghum, soybeans, and winter wheat acreage now use automated guidance systems.

Sustainable and Precision Farming Practices

The adoption of sustainable farming and precision agriculture represents a major opportunity for market players. Sulfur-based micronutrients align with the push for eco-friendly inputs that optimize resource use and reduce soil degradation. Precision application technologies, such as controlled-release fertilizers and digital soil monitoring, enhance efficiency and minimize waste. Farmers benefit from higher yields and reduced environmental impact, making these solutions attractive in regions adopting advanced agricultural practices. This trend is particularly strong in developed economies, where digital agriculture investments drive adoption of nutrient-balanced products.

- For instance, Rantizo flew over 200,000 acres in the U.S. in 2023 using its drone-spraying services across 30 states.

Key Challenges

High Production and Application Costs

A key challenge for the market is the relatively high production and application cost of sulfur-based micronutrients. Farmers with limited budgets often hesitate to adopt these products compared to conventional fertilizers. Transportation and processing expenses further increase retail prices, especially in developing economies. This cost barrier restricts large-scale adoption despite proven agronomic benefits. To overcome this challenge, companies are focusing on cost-effective manufacturing processes and innovative formulations that enhance affordability while maintaining efficiency in diverse soil and crop conditions.

Limited Awareness Among Farmers

Another major challenge is the limited awareness of sulfur deficiency and the benefits of sulfur-based micronutrients among small and medium-scale farmers. Many continue to rely on traditional fertilizers, overlooking the importance of balanced nutrient management. Inadequate extension services and lack of education on advanced soil health practices hinder adoption. This gap is more evident in emerging economies, where extension networks are underdeveloped. Bridging this knowledge divide through awareness campaigns, demonstrations, and farmer training programs is crucial to unlock the full potential of the market.

Regional Analysis

North America

North America held the largest share of the sulfur based micronutrients market in 2024, accounting for around 35%. The region’s dominance is supported by advanced farming practices, high adoption of fortified fertilizers, and strong government initiatives promoting balanced nutrient application. The United States and Canada lead demand due to large-scale cultivation of cereals and oilseeds, which require sulfur inputs for higher yields. Precision agriculture technologies and awareness programs drive farmer adoption. Growing demand for nutrient-rich crops to meet food security and export goals further sustains market growth across the region, ensuring continued leadership during the forecast period.

Europe

Europe accounted for nearly 25% of the sulfur based micronutrients market share in 2024. The region benefits from stringent regulations on soil fertility management and widespread adoption of sustainable farming practices. Countries such as Germany, France, and the United Kingdom lead consumption, with a strong focus on crop quality and environmental compliance. Rising awareness of sulfur depletion in soils and the need for balanced fertilization strategies support demand. Ongoing investments in eco-friendly fertilizers and increasing cultivation of high-value crops like fruits and vegetables add further growth potential for sulfur based micronutrients across the European agricultural sector.

Asia Pacific

Asia Pacific represented over 28% share of the sulfur based micronutrients market in 2024, driven by vast agricultural lands and increasing population-driven food demand. Major countries including China, India, and Japan significantly contribute to the region’s dominance. Rising incidences of sulfur-deficient soils and government-led initiatives promoting micronutrient usage encourage adoption. Growing cultivation of cereals, oilseeds, and vegetables further supports market expansion. Smallholder farmers are gradually shifting toward balanced fertilizers to enhance productivity. With increasing investment in modern farming techniques and rapid growth in fertilizer manufacturing, the region is expected to witness the fastest growth during the forecast period.

Latin America

Latin America accounted for nearly 7% of the sulfur based micronutrients market in 2024. Brazil and Argentina are the major contributors, supported by large-scale production of soybeans, maize, and other oilseeds. Farmers in the region are adopting sulfur-based blends to address soil deficiencies and increase yields for export-oriented crops. The growing demand for sustainable agricultural practices and awareness of nutrient-balanced solutions are driving adoption. Government policies promoting efficient fertilizer use and the presence of global agribusinesses investing in the region further enhance growth prospects. The region offers untapped opportunities, particularly in high-value crop segments.

Middle East and Africa

The Middle East and Africa held around 5% share of the sulfur based micronutrients market in 2024. The region faces challenges from arid climates and low soil fertility, driving demand for nutrient-enhancing solutions. Countries such as South Africa and Saudi Arabia are key adopters, focusing on improving food security and agricultural productivity. Investments in advanced farming techniques and government-backed initiatives to enhance soil health support growth. Rising demand for fruits, vegetables, and cereals further boosts adoption. Although the market remains smaller compared to other regions, its growth potential is strong due to increasing agricultural modernization efforts.

Market Segmentations:

By Type:

- Sulfur-Bentonite

- Sulfur-Bentonite-Zinc

- Sulfur-Bentonite-Manganese

- Sulfur-Bentonite-Iron

- Sulfur-Bentonite-Copper

- Others

By Application:

- Oilseeds & Pulses

- Cereals & Grains

- Fruits & Vegetables

By Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The sulfur based micronutrients market is shaped by leading players such as Nutrien, Tiger-Sul Products LLC, Mirabelle Agro Manufacturing Pvt Ltd, CF Industries, Aries Agro Limited, Agroasia, Yara International, HBT India, Coromandel, Sohar Sulphur Fertilizers LLC, DFPCL, and IFFCO. These companies compete through a mix of innovation, regional expansion, and strategic partnerships, focusing heavily on enhancing product portfolios with fortified blends that address multiple nutrient deficiencies. Market participants emphasize cost-effective formulations and advanced processing technologies to improve crop yield efficiency while ensuring sustainability. Expansion into high-growth regions with sulfur-deficient soils remains a priority, supported by targeted distribution networks and collaborations with local agricultural bodies. Companies are also aligning strategies with government policies and farmer training initiatives to strengthen adoption. The landscape reflects a balance between global giants with large-scale production capacity and regional specialists delivering tailored solutions, ensuring strong competition and steady advancements across the sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nutrien

- Tiger-Sul Products LLC

- Mirabelle Agro Manufacturing Pvt Ltd

- CF Industries

- Aries Agro Limited

- Agroasia

- Yara International

- HBT India

- Coromandel

- Sohar Sulphur Fertilizers LLC

- DFPCL

- IFFCO

Recent Developments

- In 2025, CF Industries reported that positive global demand and constrained nitrogen supply were influencing the market. As a major producer, CF’s stability is crucial for the broader fertilizer market, including sulfur-integrated offerings.

- In 2023, Yara acquired the organic-based fertilizer business of Agribios Italiana to support its organic strategy in Europe.

- In 2022, Nutrien announced plans to upgrade its fertilizer manufacturing capacity, with the goal of increasing potash production to 18 million tons by 2025.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with rising demand for balanced crop nutrition.

- Adoption of sulfur-bentonite blends will increase due to multi-nutrient benefits.

- Precision farming practices will boost targeted use of sulfur-based micronutrients.

- Governments will expand subsidy programs to encourage micronutrient adoption.

- Demand from high-value crops such as fruits and vegetables will rise.

- Emerging economies will see faster adoption driven by soil deficiency awareness.

- Sustainable and eco-friendly fertilizer formulations will gain stronger traction.

- Strategic partnerships among agribusinesses will enhance market penetration.

- Advanced manufacturing processes will reduce costs and improve accessibility.

- Global food security needs will ensure long-term demand for sulfur micronutrients.