Market Overview

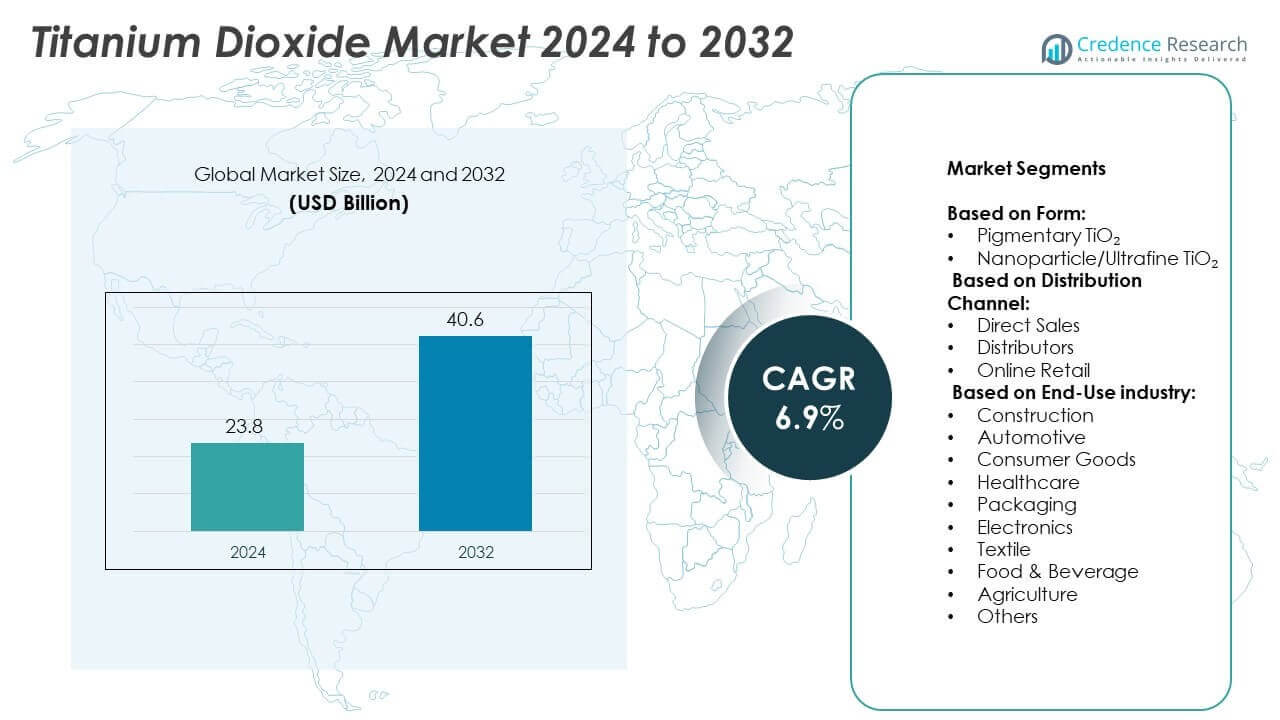

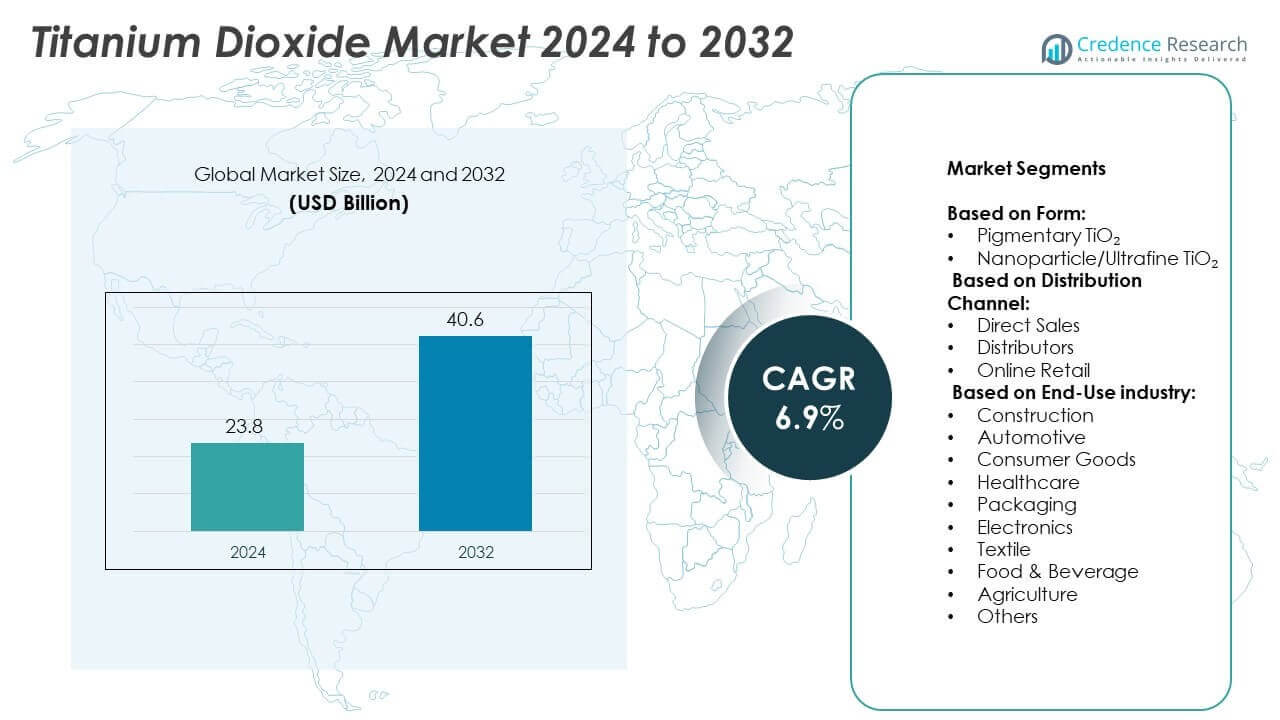

The Titanium Dioxide Market size was valued at USD 23.8 billion in 2024 and is anticipated to reach USD 40.6 billion by 2032, growing at a CAGR of 6.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Titanium Dioxide Market Size 2024 |

USD 23.8 Billion |

| Titanium Dioxide Market, CAGR |

6.9% |

| Titanium Dioxide Market Size 2032 |

USD 40.6 Billion |

The Titanium Dioxide market grows with rising demand from paints, coatings, plastics, and packaging industries. Expanding construction and automotive sectors drive consumption for durability, opacity, and UV resistance. Healthcare and personal care applications add momentum through use in sunscreens, cosmetics, and pharmaceuticals. Nanotechnology adoption supports advanced applications in solar panels, self-cleaning surfaces, and water treatment. Producers invest in sustainable chloride-based processes to meet stricter environmental standards. Growing urbanization in emerging economies further accelerates demand across diverse industrial and consumer applications.

North America demonstrates steady demand for Titanium Dioxide, driven by construction, automotive, and healthcare industries. Europe emphasizes sustainable production practices supported by strict environmental regulations. Asia-Pacific remains the fastest-growing region with strong consumption from China, India, Japan, and South Korea. Latin America and the Middle East & Africa show gradual expansion through construction, packaging, and consumer goods sectors. Key players shaping this landscape include The Chemours Company, Tronox Holdings PLC, Kronos Worldwide Inc., and Lomon Billions Group Co., Ltd.

Market Insights

- The Titanium Dioxide market was valued at USD 23.8 billion in 2024 and is expected to reach USD 40.6 billion by 2032, growing at a CAGR of 6.9%.

- Rising demand from paints, coatings, and plastics industries drives growth supported by construction and automotive expansion.

- Nanotechnology adoption opens opportunities in solar panels, water purification, and self-cleaning materials across advanced applications.

- The market remains competitive with global leaders investing in chloride processes, sustainable production, and innovation in specialty grades.

- Environmental regulations, raw material price volatility, and waste management challenges act as restraints for producers.

- Asia-Pacific leads growth driven by industrial expansion, urbanization, and strong consumer demand, while North America and Europe focus on sustainable practices and advanced applications.

- Latin America and the Middle East & Africa experience steady demand supported by infrastructure development, packaging growth, and consumer goods expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand from Paints and Coatings Industry

The Titanium Dioxide market expands strongly with its use in paints and coatings. It provides brightness, opacity, and durability, which drive demand in construction and automotive industries. Growing infrastructure development and renovation activities increase the consumption of architectural coatings. The automotive sector requires advanced coatings for improved aesthetics and protection against corrosion. Paint manufacturers adopt it for high-performance solutions, including weather resistance and color stability. Rapid urbanization in emerging markets further accelerates its adoption across building materials and decorative finishes.

- For instance, Venator Materials’ business has undergone significant transformation, including the sale of its 50% stake in the Louisiana Pigment Company to Kronos in July 2024 and the shutdown of production at its Duisburg, Germany facility in 2024

Growing Adoption in Plastics and Packaging Applications

Plastics and packaging industries represent a major growth driver for the Titanium Dioxide market. It enhances whiteness, opacity, and UV resistance in polymers used for packaging. Rising demand for consumer goods, e-commerce packaging, and lightweight automotive plastics supports its adoption. The food industry uses it to maintain product safety through UV protection and extended shelf life. Packaging companies prefer it for cost efficiency and performance advantages over alternative additives. The push toward recyclable plastics also strengthens the role of Titanium Dioxide in sustainable packaging.

- For instance, CNNC Hua Yuan Titanium Dioxide Co. company has since significantly expanded its capacity, with an update in March 2025 indicating an existing capacity of nearly 550,000 metric tonnes per year.

Expansion in Healthcare and Personal Care Applications

Healthcare and personal care segments support growth in the Titanium Dioxide market. It is widely used in sunscreens, cosmetics, and pharmaceuticals for UV blocking and whitening properties. Rising consumer awareness of skin protection drives sunscreen demand globally. The pharmaceutical sector uses it in tablet coatings to ensure stability and controlled release. Personal care brands incorporate it into daily-use products such as lotions and creams. Strict safety standards encourage manufacturers to refine formulations and maintain compliance. Expanding healthcare access in developing regions further stimulates product consumption.

Technological Advancements and Sustainability Initiatives

Innovation drives new opportunities in the Titanium Dioxide market. Producers invest in advanced production methods to reduce energy consumption and environmental footprint. Chloride process adoption grows due to higher purity and reduced waste compared to sulfate methods. Nanotechnology applications improve photocatalytic performance in environmental and energy solutions. Demand for eco-friendly coatings and sustainable plastics increases the focus on cleaner production. Companies expand research into bio-based packaging and green building materials that integrate Titanium Dioxide. Regulatory pressure and consumer preference for sustainable products strengthen market expansion.

Market Trends

Shift Toward High-Purity and Specialty Grades

The Titanium Dioxide market shows a clear shift toward high-purity and specialty grades. Industries demand advanced materials for coatings, plastics, and electronics where performance is critical. High-purity grades ensure improved opacity, UV resistance, and stability in end-use applications. Specialty forms, such as surface-treated or ultra-fine grades, cater to niche requirements in cosmetics and energy. Manufacturers focus on product differentiation to serve specialized applications effectively. Growing customer preference for tailored solutions strengthens the role of specialty Titanium Dioxide across industries.

- For instance, Exmar’s Tango FLNG, with a reported liquefaction capacity of 0.5 to 0.6 million tonnes per annum (mtpa), was deployed in Argentina under a contract with YPF starting in 2019.

Rising Role of Nanotechnology Applications

Nanotechnology plays an important role in reshaping the Titanium Dioxide market. It enables enhanced photocatalytic activity used in water treatment, air purification, and renewable energy. Nanoparticles improve efficiency in solar cells and environmental cleanup systems. Demand for self-cleaning surfaces in construction and automotive industries drives wider adoption. Cosmetic brands favor nanoscale formulations for superior transparency in sunscreens. Expanding nanotechnology research encourages companies to invest in new production capabilities and advanced application areas.

- For instance, Sakai Chemical Industry Co., Ltd. manufactures specialty titanium dioxide (\(TiO_{2}\)) products, including ultrafine anatase and rutile grades for applications such as cosmetics and photocatalysis. However, the company has announced a strategic shift and will end the production of pigment-grade titanium dioxide in fiscal year 2025. This decision, along with an approximately 24,000-tonne annual production volume reported for some mainstay products in recent years, indicates a focus away from large-scale pigment manufacturing towards higher-value specialty materials.

Increased Focus on Sustainability and Green Production

Sustainability trends are redefining growth patterns in the Titanium Dioxide market. Producers adopt eco-friendly production methods to meet regulatory standards and consumer expectations. Chloride-based processing gains traction due to lower emissions and reduced waste. Companies aim to integrate renewable energy sources and circular practices in manufacturing. Growing demand for sustainable paints, coatings, and packaging supports this transition. Environmental certifications and compliance with stricter policies further shape production choices globally.

Integration of Digital Technologies and Advanced Research

Digitalization influences operations and product development in the Titanium Dioxide market. Artificial intelligence and data analytics improve efficiency in process control and quality monitoring. Advanced research explores bio-based coatings and smart materials that integrate Titanium Dioxide. Collaborations between producers and universities accelerate material innovations. Digital tools help streamline supply chains and forecast demand more accurately. Integration of Industry 4.0 solutions enhances competitiveness and ensures long-term efficiency in production environments.

Market Challenges Analysis

Environmental Concerns and Regulatory Pressures

The Titanium Dioxide market faces strong challenges from environmental concerns and strict regulations. Production generates significant waste and emissions, creating compliance risks for producers. Governments enforce tighter standards on air quality, waste disposal, and energy efficiency. Companies must invest in cleaner technologies, which increases operational costs. Stricter rules on nanoparticle usage in cosmetics and food products also impact adoption. It drives manufacturers to balance performance needs with regulatory requirements, slowing growth in sensitive applications.

Raw Material Volatility and Supply Chain Disruptions

Volatility in raw material prices creates uncertainty for the Titanium Dioxide market. Producers rely on ilmenite, rutile, and titanium slag, which face supply fluctuations. Mining restrictions and geopolitical factors often disrupt availability and raise costs. Global supply chains remain vulnerable to transportation delays and trade policy changes. It forces companies to secure diversified sourcing strategies to maintain production stability. Small and mid-sized firms face greater risks, limiting their ability to compete with larger players.

Market Opportunities

Expansion in Emerging Economies and Infrastructure Growth

The Titanium Dioxide market benefits from rising demand in emerging economies. Rapid urbanization and large-scale infrastructure projects boost consumption of paints, coatings, and plastics. Construction activity in Asia-Pacific, Latin America, and the Middle East drives strong adoption. Expanding automotive production also increases the need for high-performance coatings. It creates opportunities for global and regional producers to scale operations in these fast-growing markets. Government initiatives to modernize infrastructure further strengthen long-term growth prospects.

Innovation in Advanced Applications and Sustainable Solutions

Innovation unlocks new opportunities for the Titanium Dioxide market across industries. Nanotechnology integration supports advanced uses in solar panels, water treatment, and self-cleaning materials. Demand for eco-friendly coatings and recyclable packaging creates a strong pull for sustainable grades. Healthcare and personal care industries expand product usage in sunscreens, cosmetics, and pharmaceuticals. It encourages producers to invest in R&D and sustainable manufacturing practices. Strategic collaborations with technology firms and research institutions accelerate the adoption of advanced Titanium Dioxide solutions.

Market Segmentation Analysis:

By Form:

The Titanium Dioxide market by form is dominated by pigmentary TiO₂ due to its strong opacity, brightness, and durability. It is widely used in paints, coatings, plastics, and paper, where high coverage and whiteness are critical. Pigmentary grades remain the preferred choice in large-scale applications requiring cost efficiency and proven performance. Nanoparticle or ultrafine TiO₂ gains traction in cosmetics, healthcare, and energy-related industries. Its superior photocatalytic activity supports demand in solar panels, water purification, and self-cleaning materials. It enables high-value innovation across specialty markets.

- For instance, LB Group (China) is a major global titanium dioxide ((TiO_{2})) producer, supplying both pigmentary and specialty grades to manufacturers of coatings, plastics, and other materials. In 2022, the company’s annual TiO₂ production was approximately 1 million tonnes, based on company reports. The company has since significantly expanded its capacity, with announcements in early 2024 indicating a total capacity of approximately 1.51 million tonnes per year, a mix of chloride and sulfate process production.

By Distribution Channel:

Distribution channels play a vital role in shaping the Titanium Dioxide market supply structure. Direct sales dominate, with producers catering to large industrial buyers such as coatings and plastics manufacturers. This approach ensures cost efficiency and closer collaboration for tailored solutions. Distributors hold significant share by serving medium and small-scale buyers across diverse industries. Online retail emerges as a growing channel, supported by the rise of e-commerce platforms. It improves accessibility for smaller businesses seeking quick procurement and competitive pricing. Channel diversity ensures flexibility across regional and sectoral demands.

- For instance, Before divesting its pigments division in 2017 to form Venator Materials, Huntsman Corporation’s titanium dioxide (\(TiO_{2}\)) nameplate production capacity was approximately 782,000 metric tons per year.

By End-Use Industry:

End-use segmentation highlights construction as the largest consumer of Titanium Dioxide, driven by paints, coatings, and building materials. The automotive industry requires it for coatings that improve durability, aesthetics, and corrosion resistance. Consumer goods, including household products and appliances, strengthen adoption due to its whitening and brightening properties. Healthcare industries integrate it into sunscreens, cosmetics, and pharmaceutical formulations for UV protection and stability. Packaging relies on its opacity and UV resistance to extend product shelf life. Electronics use it in specialized coatings and optical devices. Textile, food and beverage, and agriculture industries create additional demand, with applications in fibers, food coloring, and agricultural films. It supports a broad range of industries, making the material essential to modern production systems.

Segments:

Based on Form:

- Pigmentary TiO₂

- Nanoparticle/Ultrafine TiO₂

Based on Distribution Channel:

- Direct Sales

- Distributors

- Online Retail

Based on End-Use industry:

- Construction

- Automotive

- Consumer Goods

- Healthcare

- Packaging

- Electronics

- Textile

- Food & Beverage

- Agriculture

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 28% share of the Titanium Dioxide market, supported by strong demand across paints, coatings, and plastics industries. The region benefits from advanced infrastructure, large-scale construction projects, and steady automotive production that require high-performance coatings. Stringent regulatory standards encourage manufacturers to adopt eco-friendly and high-purity grades, strengthening demand for chloride-process TiO₂. The healthcare and personal care industries also contribute through extensive use in sunscreens, cosmetics, and pharmaceuticals, driven by consumer focus on safety and UV protection. Packaging applications gain momentum due to a thriving e-commerce sector and strong retail activity. It also finds use in electronics, where high-purity and ultrafine grades are required for specialty applications. Strategic investments in research and development sustain North America’s competitive position while ensuring compliance with evolving sustainability targets.

Europe

Europe holds 24% share of the Titanium Dioxide market, with strong adoption driven by paints, coatings, and packaging sectors. The construction industry in countries such as Germany, France, and the UK drives consistent demand for architectural coatings and building materials. Automotive production across Germany and Italy further supports usage in high-performance paints with strict environmental compliance. The region places emphasis on eco-friendly and sustainable production, pushing companies to adopt chloride processes and advanced waste treatment methods. Cosmetics and personal care industries use Titanium Dioxide widely in sunscreens, creams, and other formulations, supported by strict product safety regulations. Packaging demand grows with rising consumer awareness of sustainable solutions and recyclability standards. It is also integrated into specialty applications across textiles, electronics, and healthcare, making Europe a diverse yet sustainability-driven market for Titanium Dioxide.

Asia-Pacific

Asia-Pacific leads with 36% share of the Titanium Dioxide market, representing the largest and fastest-growing regional segment. China remains a key contributor with strong industrial bases in construction, automotive, and packaging. India follows with rapid urbanization and infrastructure growth, expanding the demand for paints, coatings, and plastics. Japan and South Korea play a crucial role in technological advancements, particularly in electronics, nanotechnology, and specialty applications. Rising consumer demand for cosmetics, personal care products, and healthcare goods adds momentum to the region’s growth. Packaging adoption accelerates due to population expansion, rising disposable incomes, and thriving e-commerce networks. It continues to benefit from cost-effective manufacturing capabilities, high demand from industrial sectors, and supportive government initiatives for infrastructure and industrialization. Asia-Pacific remains central to global Titanium Dioxide production and consumption trends.

Latin America

Latin America represents 7% share of the Titanium Dioxide market, supported by steady growth in construction, packaging, and consumer goods sectors. Countries such as Brazil and Mexico are leading contributors, with rising urbanization and housing developments creating demand for coatings and building materials. The food and beverage industry strengthens usage in packaging solutions, while automotive production supports adoption in paints. Demand for healthcare and personal care products increases, driven by expanding middle-class populations and higher spending power. Textile industries also incorporate Titanium Dioxide for fibers and fabrics. It benefits from the gradual industrial expansion and improving access to international supply chains. The region continues to gain momentum despite challenges such as uneven economic conditions and raw material price fluctuations.

Middle East & Africa

The Middle East & Africa holds 5% share of the Titanium Dioxide market, driven by construction, petrochemicals, and packaging industries. Infrastructure development projects, including large-scale residential and commercial buildings, create consistent demand for paints and coatings. The packaging sector benefits from the growing food and beverage industry, particularly in Gulf Cooperation Council (GCC) nations. Automotive demand in South Africa and emerging industrial bases across the region provide additional growth opportunities. Healthcare adoption strengthens due to expanding pharmaceutical and cosmetics markets. It is also applied in agriculture through films and protective coatings that support crop growth. The region’s demand is supported by population growth, rising urbanization, and government initiatives aimed at diversifying economies beyond oil dependence.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Tronox Holdings PLC

- INEOS Pigments (acquired by Venator)

- Grupa Azoty Zakłady Chemiczne “Police” S.A.

- Shandong Doguide Group Co., Ltd.

- Cinkarna Celje d.d.

- CNNC Lanzhou Titanium Industry Co., Ltd.

- Lomon Billions Group Co., Ltd.

- Taizhou Sunny Chemical Co., Ltd.

- Venator Materials PLC

- Cristal (acquired by Tronox)

- Precheza a.s.

- Titanos Group

- Tayca Corporation

- LB Group Co., Ltd. (formerly Henan Billions)

- Ishihara Sangyo Kaisha, Ltd.

- CNNC Huayuan Titanium Dioxide Co., Ltd.

- Henan Yuxing Sino-German Titanium Industry Co., Ltd.

- Evonik Industries AG

- Kronos Worldwide, Inc.

- The Chemours Company

Competitive Analysis

The leading players in the Titanium Dioxide market include The Chemours Company, Venator Materials PLC, Kronos Worldwide, Inc., Tronox Holdings PLC, Lomon Billions Group Co., Ltd., LB Group Co., Ltd. (formerly Henan Billions), Ishihara Sangyo Kaisha, Ltd., Tayca Corporation, Cinkarna Celje d.d., INEOS Pigments, Evonik Industries AG, Grupa Azoty Zakłady Chemiczne “Police” S.A., Precheza a.s., CNNC Huayuan Titanium Dioxide Co., Ltd., Shandong Doguide Group Co., Ltd., Henan Yuxing Sino-German Titanium Industry Co., Ltd., Cristal, CNNC Lanzhou Titanium Industry Co., Ltd., Taizhou Sunny Chemical Co., Ltd., and Titanos Group. The market is highly competitive, shaped by innovation, sustainability, and global supply capabilities. Established multinational companies focus on advanced production technologies, including chloride-based processes, to ensure high purity and lower environmental impact. Regional producers strengthen their position by catering to domestic demand and maintaining cost advantages in emerging markets. Competition intensifies as producers expand capacities to meet rising demand in construction, automotive, packaging, and healthcare. Investments in nanotechnology and sustainable product development create differentiation in high-value applications such as solar panels, cosmetics, and environmental solutions. Strategic mergers and acquisitions consolidate market positions and enhance global reach. Players also emphasize long-term supply contracts, research collaborations, and digital solutions to improve operational efficiency. The balance between cost control, regulatory compliance, and innovation defines the competitiveness of this market.

Recent Developments

- In July 2024, Venator completed the sale of its 50% share in the Louisiana Pigment Company TiO2 facility to Kronos Worldwide Inc. in a further step of business consolidation.

- In July 2024, Kronos Worldwide Inc. acquired Venator’s 50% interest in the Louisiana Pigment Company TiO2 manufacturing joint venture, strengthening its US pigment operations

- In June 2024, Chemours resumed production at its Titanium Dioxide site in Altamira, Mexico, after a temporary shutdown, aiming to stabilize supply chains for the Ti-Pure brand.

Report Coverage

The research report offers an in-depth analysis based on Form, Distribution Channel, End-Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Titanium Dioxide market will expand with rising demand in construction and automotive coatings.

- It will benefit from growing adoption in plastics and packaging industries worldwide.

- Nanotechnology integration will create opportunities in solar panels, water treatment, and self-cleaning materials.

- Regulatory focus on eco-friendly processes will drive adoption of chloride-based production methods.

- Healthcare and personal care industries will boost demand for sunscreens, cosmetics, and pharmaceuticals.

- Rising e-commerce activity will support packaging applications that require UV resistance and opacity.

- Producers will invest in sustainable solutions to meet environmental and consumer expectations.

- Technological innovation will improve product performance in electronics, fibers, and specialty coatings.

- Emerging economies will strengthen market growth through urbanization and infrastructure development.

- Strategic collaborations will expand research and development in advanced Titanium Dioxide applications.