Market Overview

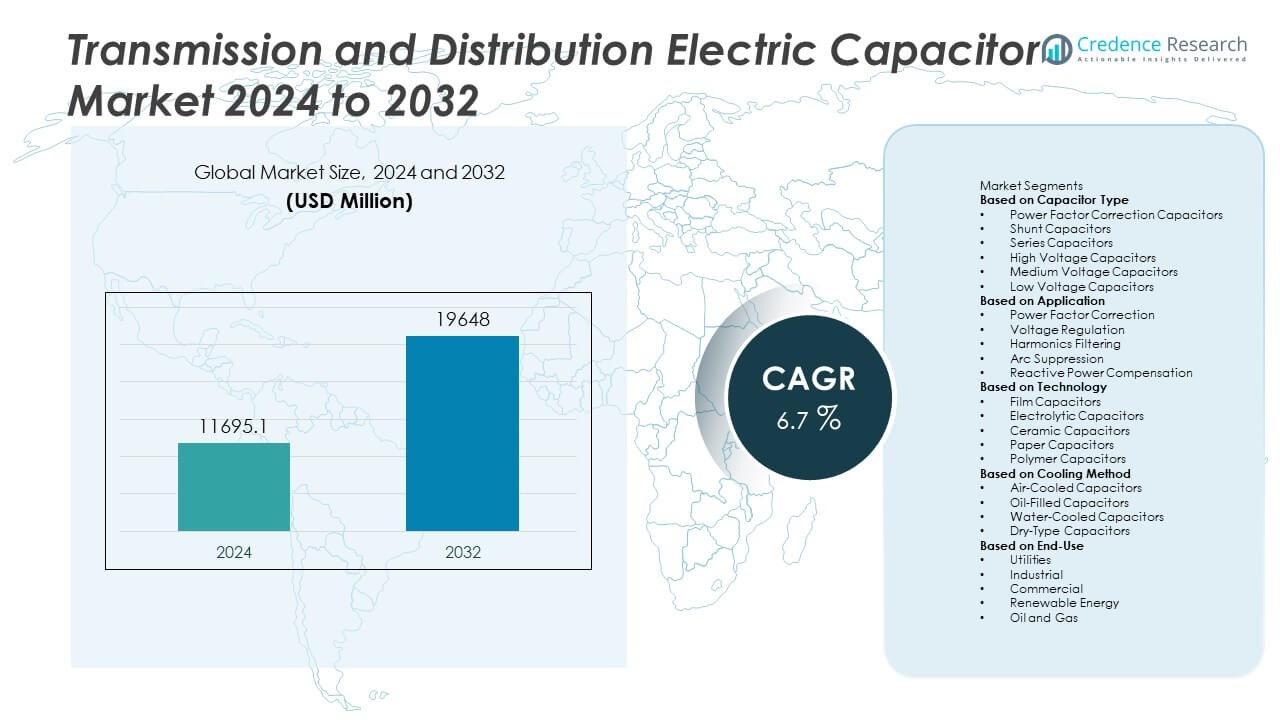

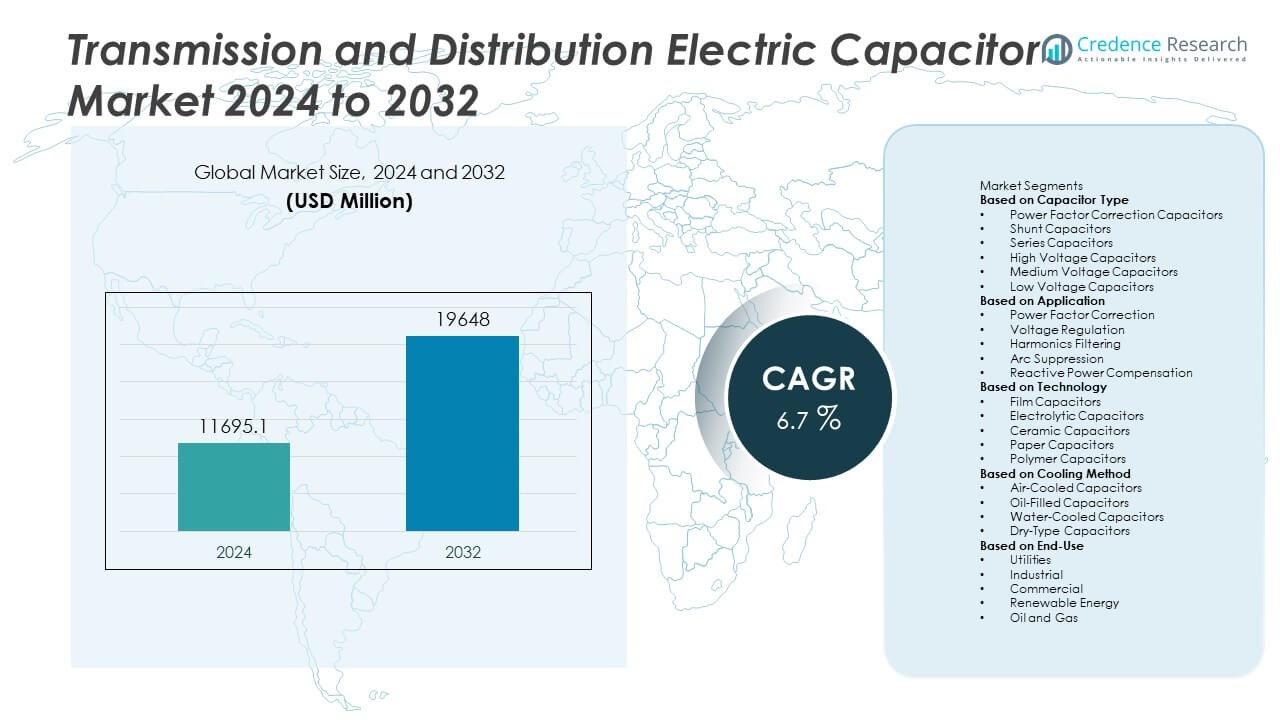

The Transmission and Distribution Electric Capacitor Market was valued at USD 11,695.1 million in 2024 and is projected to reach USD 19,648 million by 2032, expanding at a CAGR of 6.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Transmission and Distribution Electric Capacitor Market Size 2024 |

USD 11,695.1 Million |

| Transmission and Distribution Electric Capacitor Market, CAGR |

6.7% |

| Transmission and Distribution Electric Capacitor Market Size 2032 |

USD 19,648 Million |

The Transmission and Distribution Electric Capacitor Market grows on the strength of rising electricity demand, rapid industrialization, and increasing need for efficient grid management. Utilities adopt capacitors to reduce power losses, improve voltage stability, and enhance energy efficiency across expanding networks.

The Transmission and Distribution Electric Capacitor Market demonstrates strong growth across regions, supported by infrastructure modernization, renewable integration, and rising energy consumption. North America emphasizes advanced capacitor deployment in smart grids, while Europe focuses on stability and efficiency in renewable-dense networks. Asia-Pacific leads adoption with rapid urbanization, industrialization, and large-scale transmission projects, while Latin America and the Middle East & Africa witness steady demand from expanding electrification initiatives. Key players actively shaping the competitive landscape include ABB Ltd., Eaton Corporation, and General Electric Company, which provide innovative capacitor solutions for global utility projects. EPCOS AG and Vishay Intertechnology strengthen their presence with advanced dielectric materials and compact capacitor designs, enhancing durability and performance. Cornell Dubilier Electronics and Kemet contribute with tailored solutions for diverse industrial and utility needs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Transmission and Distribution Electric Capacitor Market was valued at USD 11,695.1 million in 2024 and is expected to reach USD 19,648 million by 2032, growing at a CAGR of 6.7% during the forecast period.

- Rising electricity demand, grid modernization programs, and industrial expansion drive the adoption of capacitors, as they improve voltage stability and reduce power losses in transmission and distribution networks.

- A major trend shaping the market is the integration of renewable energy sources such as wind and solar, where capacitors ensure grid stability and support smooth integration of fluctuating power inputs.

- The competitive landscape features strong players like ABB Ltd., Eaton Corporation, and General Electric Company, along with EPCOS AG, Vishay Intertechnology, and Kemet, all of which focus on innovation, advanced materials, and energy-efficient designs to strengthen their global presence.

- Market restraints include high initial installation costs, technical limitations such as overheating and dielectric breakdown, and supply chain disruptions linked to raw material availability.

- Regionally, Asia-Pacific leads demand due to rapid industrialization, large infrastructure investments, and urban expansion, while North America and Europe emphasize modernization and renewable integration, and Latin America and the Middle East & Africa show steady growth through electrification projects.

- The overall market outlook remains positive as utilities and industries increasingly invest in advanced capacitor solutions to support sustainability, enhance power quality, and improve the reliability of evolving grid infrastructures worldwide.

Market Drivers

Rising Demand for Efficient Power Transmission

The Transmission and Distribution Electric Capacitor Market grows with the rising need for efficient power delivery across expanding grids. Utilities seek to minimize power losses and improve voltage stability, which increases reliance on advanced capacitor technologies. It supports reactive power compensation, reducing transmission inefficiencies and ensuring consistent energy flow. With global electricity demand surging, utilities prioritize solutions that extend infrastructure lifespan and enhance operational efficiency. Strong demand from both developed and emerging economies continues to accelerate adoption. It provides a crucial component for stabilizing networks under heavy loads.

- For instance, Hitachi ABB Power Grids has announced the successful commissioning on 31 March of a 500 kV, 1400 MVAr series capacitor bank, one of the largest in the world, for Minnesota Power’s Great Northern Transmission Line project.

Integration of Renewable Energy Sources

The rapid expansion of renewable energy integration acts as a major driver for this market. Grid operators require capacitors to handle intermittent generation from wind and solar power plants. It enhances grid flexibility by stabilizing voltage fluctuations and improving power quality. Capacitors enable seamless connection of renewable sources to distribution networks, ensuring smooth operation. The push for decarbonization and sustainable energy increases installations across utility projects worldwide. Governments and regulators encourage capacitor deployment to meet renewable energy targets. It plays a pivotal role in enabling long-term energy transitions.

- For instance, Eaton’s Cooper Power series power capacitor products are designed for worldwide utility and industrial applications for system voltages from 2.4 kV through EHV.

Expansion of Smart Grids and Modernization Initiatives

Smart grid development significantly supports the adoption of advanced capacitors. Governments and private utilities invest in modernizing outdated infrastructure to meet rising consumption needs. It contributes to grid resilience, enabling dynamic load management and improved system reliability. Smart grids require high-performance components that can operate efficiently under variable conditions. Transmission and distribution networks implement capacitor banks for real-time power factor correction. Continuous digital transformation fuels demand for energy-efficient capacitor systems. It ensures seamless operation of intelligent power infrastructure.

Growing Industrialization and Urban Energy Needs

Rising industrialization and rapid urbanization across Asia-Pacific, Latin America, and Africa create strong opportunities for capacitor deployment. Large-scale manufacturing hubs and urban centers demand stable, high-quality power for continuous operations. It addresses the challenge of fluctuating loads by providing improved voltage regulation. Capacitors reduce risks of equipment damage, thereby supporting industrial productivity. Urban expansion and infrastructure development accelerate grid reinforcement projects, further fueling growth. The Transmission and Distribution Electric Capacitor Market benefits directly from these large-scale investments. It remains a critical enabler of reliable electricity supply for both industries and cities.

Market Trends

Shift Toward Energy-Efficient Solutions

The Transmission and Distribution Electric Capacitor Market shows a strong trend toward energy-efficient technologies that reduce operational costs and improve reliability. Utilities focus on capacitors that enhance power factor correction while minimizing energy losses. It helps reduce carbon emissions and aligns with global sustainability targets. Manufacturers design advanced units with higher efficiency ratings to meet stricter regulatory requirements. Demand grows for capacitors that support long-term energy conservation goals. It positions energy-efficient capacitors as essential in modern grid infrastructure.

- For instance, Vishay Intertechnology introduced MKP1848C AC filtering film capacitors rated up to 75 µF and 1,250 V AC, designed for high-efficiency power conversion and meeting IEC 61071 standards for long service life exceeding 100,000 hours.

Rising Adoption of Advanced Materials and Designs

New materials and design innovations are shaping capacitor performance across global markets. The Transmission and Distribution Electric Capacitor Market benefits from improved dielectric materials that offer longer service life and enhanced thermal stability. It allows utilities to maintain grid reliability under heavy electrical loads. Advanced designs also reduce maintenance needs and operating costs for power distribution companies. Manufacturers expand R&D efforts to introduce compact and durable capacitor systems. It signals a broader shift toward innovation-led growth in power components.

- For instance, EPCOS (TDK) B3277 series MKP DC-link film capacitors offer a wide range of capacitance values from 0.68 µF to 170 µF. These capacitors are designed with polypropylene dielectric and are intended for compact form factors, long operational life, and use in demanding industrial, solar inverter, and frequency converter applications

Integration with Smart Grid Technologies

Smart grid development accelerates the adoption of digitally enabled capacitor systems. Utilities increasingly deploy monitoring and control features to ensure efficient grid operation. The Transmission and Distribution Electric Capacitor Market integrates with automated systems for real-time voltage regulation. It enhances system reliability by enabling dynamic load adjustments across networks. Capacitors equipped with IoT sensors provide predictive maintenance capabilities. It supports the broader move toward digital transformation in the energy sector.

Expanding Role in Renewable Energy Infrastructure

The growing focus on renewable energy integration highlights a critical role for capacitors in stabilizing power systems. Wind and solar power plants require support for voltage balancing and frequency regulation. The Transmission and Distribution Electric Capacitor Market expands as renewable projects increase worldwide. It ensures that fluctuating power inputs are managed effectively across grids. Capacitors enable utilities to maintain consistent power quality under variable conditions. It strengthens the role of capacitors as indispensable components in renewable energy infrastructure.

Market Challenges Analysis

High Costs and Technical Limitations

The Transmission and Distribution Electric Capacitor Market faces challenges related to high initial investment and maintenance costs. Advanced capacitor technologies require significant capital, which can discourage adoption in cost-sensitive regions. It demands continuous upgrades to match evolving grid standards, leading to financial strain for smaller utilities. Technical issues such as overheating, dielectric breakdown, and reduced lifespan under extreme conditions add complexity to deployment. Limited expertise in installation and monitoring further slows adoption in developing markets. It restricts the pace of modernization in certain regions where budgets remain constrained.

Supply Chain Disruptions and Regulatory Barriers

Global supply chain disruptions create hurdles for timely capacitor production and delivery. The Transmission and Distribution Electric Capacitor Market depends heavily on raw materials like aluminum and polypropylene, which face price volatility and availability risks. It exposes manufacturers to uncertainty in fulfilling large-scale utility contracts. Stringent regulatory frameworks around safety, quality, and environmental standards raise compliance costs for industry players. Regional variations in technical standards make it difficult for companies to standardize products across markets. It adds delays and increases the complexity of global expansion strategies.

Market Opportunities

Expansion of Renewable Energy Integration

The global transition toward renewable energy offers significant opportunities for the Transmission and Distribution Electric Capacitor Market. Solar and wind projects require advanced capacitor systems to manage voltage fluctuations and maintain power quality. It supports seamless integration of intermittent energy sources into existing grids. Governments continue to expand investments in clean energy infrastructure, creating steady demand for capacitor solutions. Utility providers adopt capacitor banks to ensure stability during peak renewable generation. It positions capacitors as a critical enabler of sustainable and resilient energy systems worldwide.

Growing Infrastructure Investments and Smart Grid Deployment

Large-scale investments in grid modernization create favorable prospects for capacitor adoption. The Transmission and Distribution Electric Capacitor Market benefits from government-backed programs focused on upgrading outdated transmission and distribution networks. It gains momentum from rising smart grid deployments that demand advanced reactive power management tools. Expanding urbanization and industrialization in emerging economies accelerate the need for reliable energy delivery. Capacitors provide cost-effective solutions for reducing transmission losses and improving operational efficiency. It strengthens the role of capacitors as a vital component in long-term infrastructure development.

Market Segmentation Analysis:

By Capacitor Type

The Transmission and Distribution Electric Capacitor Market segments by capacitor type into shunt capacitors, series capacitors, and others. Shunt capacitors dominate due to their widespread use in reactive power compensation and voltage regulation across distribution networks. It improves system efficiency by reducing line losses and stabilizing load performance. Series capacitors gain traction in transmission lines where they enhance power transfer capability and improve system stability under heavy loads. Other capacitor types, including harmonic filter capacitors, serve specialized applications in grid balancing. It reflects growing diversification of products to meet evolving grid demands.

- For instance, ABB installed more than 1,200 shunt capacitor units totaling 600 Mvar in India’s Power Grid Corporation projects, cutting transmission losses by over 35 MW.

By Application

Applications in the Transmission and Distribution Electric Capacitor Market span power factor correction, harmonic filtering, voltage regulation, and energy savings. Power factor correction leads demand, as utilities seek to reduce losses and enhance overall grid efficiency. It addresses fluctuating power conditions in industrial and urban load centers. Harmonic filtering applications expand due to rising non-linear loads from digital infrastructure and renewable power plants. Voltage regulation emerges as a critical application in stabilizing power quality for large-scale transmission networks. It positions capacitors as indispensable for modern grid operations.

- For instance, Eaton’s comprehensive line of Cooper Power series open air bank solutions are available in externally fused, fuseless or internally fused designs. Each design is custom-configured in a variety of parallel/series combinations to meet a full range of application needs based on kvar requirements, system voltage, protection strategy and system solutions.

By End-Use

End-use segmentation includes utilities, industries, and commercial sectors. The Transmission and Distribution Electric Capacitor Market finds its largest consumer base in utilities, which rely heavily on capacitors for grid reliability and loss reduction. It plays a vital role in ensuring stable electricity delivery across transmission and distribution systems. Industrial end users adopt capacitors to safeguard equipment from voltage fluctuations and reduce operational inefficiencies. The commercial sector, including large business complexes and data centers, increasingly integrates capacitor systems to ensure uninterrupted operations. It highlights broad adoption across diverse end-user categories.

Segments:

Based on Capacitor Type

- Power Factor Correction Capacitors

- Shunt Capacitors

- Series Capacitors

- High Voltage Capacitors

- Medium Voltage Capacitors

- Low Voltage Capacitors

Based on Application

- Power Factor Correction

- Voltage Regulation

- Harmonics Filtering

- Arc Suppression

- Reactive Power Compensation

Based on Technology

- Film Capacitors

- Electrolytic Capacitors

- Ceramic Capacitors

- Paper Capacitors

- Polymer Capacitors

Based on Cooling Method

- Air-Cooled Capacitors

- Oil-Filled Capacitors

- Water-Cooled Capacitors

- Dry-Type Capacitors

Based on End-Use

- Utilities

- Industrial

- Commercial

- Renewable Energy

- Oil and Gas

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds 27% of the Transmission and Distribution Electric Capacitor Market, driven by grid modernization programs and strong investments in renewable integration. Utilities in the United States and Canada deploy advanced capacitor banks to manage reactive power, reduce energy losses, and stabilize voltage in aging transmission lines. It supports the transition toward cleaner energy sources, particularly wind and solar, which require efficient grid balancing. The region also benefits from large-scale smart grid projects that integrate digital monitoring and IoT-enabled capacitor systems. Federal incentives and regulatory frameworks encourage consistent adoption across utility providers. It positions North America as a key market focused on efficiency, reliability, and sustainability in energy distribution.

Europe

Europe accounts for 23% of the Transmission and Distribution Electric Capacitor Market, supported by stringent environmental policies and the EU’s commitment to energy efficiency. Countries such as Germany, France, and the UK lead in capacitor adoption due to extensive renewable energy penetration. It addresses the challenge of managing intermittent power flows from wind and solar installations. The European market also emphasizes grid reliability and harmonics control, where capacitors play a crucial role. Ongoing investments in cross-border interconnection projects create additional opportunities for capacitor deployment. It reflects Europe’s focus on building resilient and interconnected power networks across the region.

Asia-Pacific

Asia-Pacific dominates the Transmission and Distribution Electric Capacitor Market with 35% share, fueled by rapid industrialization, urbanization, and massive infrastructure development. China leads adoption with large-scale grid expansion projects aimed at reducing transmission losses and integrating renewable energy. It benefits from India’s strong government-backed initiatives to modernize power networks and support industrial growth. Japan and South Korea emphasize advanced capacitor technologies to meet high energy efficiency standards. The region’s vast population and growing demand for electricity push utilities to expand transmission and distribution capacity. It reinforces Asia-Pacific’s position as the fastest-growing and most dynamic regional market.

Latin America

Latin America represents 8% of the Transmission and Distribution Electric Capacitor Market, with growth centered on expanding energy access and modernizing outdated infrastructure. Brazil and Mexico lead demand with large utility projects focused on loss reduction and improved grid stability. It supports rural electrification programs that require stable and reliable power delivery. The integration of renewable energy, particularly hydropower and solar, creates further opportunities for capacitor adoption. Governments in the region implement policies to attract foreign investments in energy infrastructure. It drives steady progress despite financial constraints in some countries.

Middle East & Africa

The Middle East & Africa account for 7% of the Transmission and Distribution Electric Capacitor Market, supported by rising electricity demand and rapid urban development. Countries such as Saudi Arabia, the UAE, and South Africa invest in modernizing their transmission and distribution networks. It addresses the challenge of high energy losses and frequent grid instabilities. Expansion of renewable projects, particularly solar power, creates new demand for advanced capacitors. Industrial growth and urban expansion require improved grid reliability across the region. It positions the Middle East & Africa as an emerging market with significant long-term growth potential.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- EPCOS AG

- Eaton Corporation

- Vishay Intertechnology

- Shanghai Keli Electric Device

- ABB Ltd.

- General Electric Company

- Cornell Dubilier Electronics

- Changan Electric

- Kemet

- Xian Keli Electric Device

Competitive Analysis

The competitive landscape of the Transmission and Distribution Electric Capacitor Market is characterized by the presence of global leaders such as ABB Ltd., Eaton Corporation, General Electric Company, EPCOS AG, Vishay Intertechnology, Cornell Dubilier Electronics, Kemet, Changan Electric, Xian Keli Electric Device, and Shanghai Keli Electric Device. These companies focus on delivering advanced capacitor technologies that enhance grid stability, reduce transmission losses, and support renewable energy integration. ABB Ltd. and Eaton Corporation lead with strong portfolios in utility-grade capacitor banks and smart grid solutions, while General Electric Company leverages its extensive power infrastructure expertise to expand product offerings across regions. EPCOS AG and Vishay Intertechnology emphasize innovation in dielectric materials and compact designs, ensuring durability and efficiency under demanding conditions. Cornell Dubilier Electronics and Kemet strengthen their positions with customized industrial and utility-focused solutions. Emerging players like Changan Electric, Xian Keli Electric Device, and Shanghai Keli Electric Device expand regional reach by catering to fast-growing markets in Asia-Pacific. Intense competition drives continuous product innovation, strategic collaborations, and capacity expansions, ensuring that market leaders maintain resilience while meeting the evolving needs of global transmission and distribution networks.

Recent Developments

- In June 2025, Eaton introduced its “Factories as a Grid” initiative. This strategy enhances energy resilience by allowing manufacturing facilities to intelligently manage power systems—integrating renewables and optimizing operations with smart grid concepts.

- In May 2025, At PCIM Europe, Vishay unveiled its comprehensive portfolio of power management innovations, targeting e-mobility, energy storage, and smart grid systems. The presentation emphasized rugged SiC components and low‑TCR shunts for solid-state power distribution units.

- In August 2023, ABB delivered high-voltage capacitors to a 500 kV transmission line project in China, improving power quality and cutting maintenance costs by approximately 15%.

Market Concentration & Characteristics

The Transmission and Distribution Electric Capacitor Market demonstrates a moderately consolidated structure, with global leaders and regional manufacturers competing through technology, reliability, and cost efficiency. A few multinational corporations such as ABB Ltd., Eaton Corporation, and General Electric Company dominate through broad portfolios and strong global distribution networks, while specialized players like EPCOS AG, Vishay Intertechnology, and Cornell Dubilier Electronics focus on advanced materials and application-specific designs. It exhibits high entry barriers due to capital-intensive production, strict quality standards, and reliance on advanced dielectric technologies. Regional companies from Asia, including Shanghai Keli Electric Device and Xian Keli Electric Device, strengthen competition by providing cost-effective solutions tailored to local grid modernization needs. Demand is shaped by infrastructure upgrades, renewable integration, and the transition to smart grids, which require capacitors that deliver efficiency and durability. It reflects a market where innovation, regulatory compliance, and long-term supply reliability define competitive advantage.

Report Coverage

The research report offers an in-depth analysis based on Capacitor Type, Application, Technology, Cooling Method, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising global electricity demand and grid modernization efforts.

- Renewable energy integration will drive strong demand for capacitors that stabilize variable inputs.

- Smart grid development will create opportunities for advanced digital and IoT-enabled capacitor systems.

- Asia-Pacific will continue to lead adoption due to rapid urbanization and industrial growth.

- Utilities will prioritize high-efficiency capacitors to reduce losses and improve voltage stability.

- Innovation in dielectric materials will enhance product lifespan and thermal performance.

- Regulatory frameworks will encourage adoption of energy-efficient and environmentally compliant designs.

- Industrial and commercial sectors will increase capacitor deployment to ensure operational reliability.

- Strategic collaborations and acquisitions will shape competition among global and regional players.

- The market will benefit from growing investments in infrastructure projects across emerging economies.