Market Overview

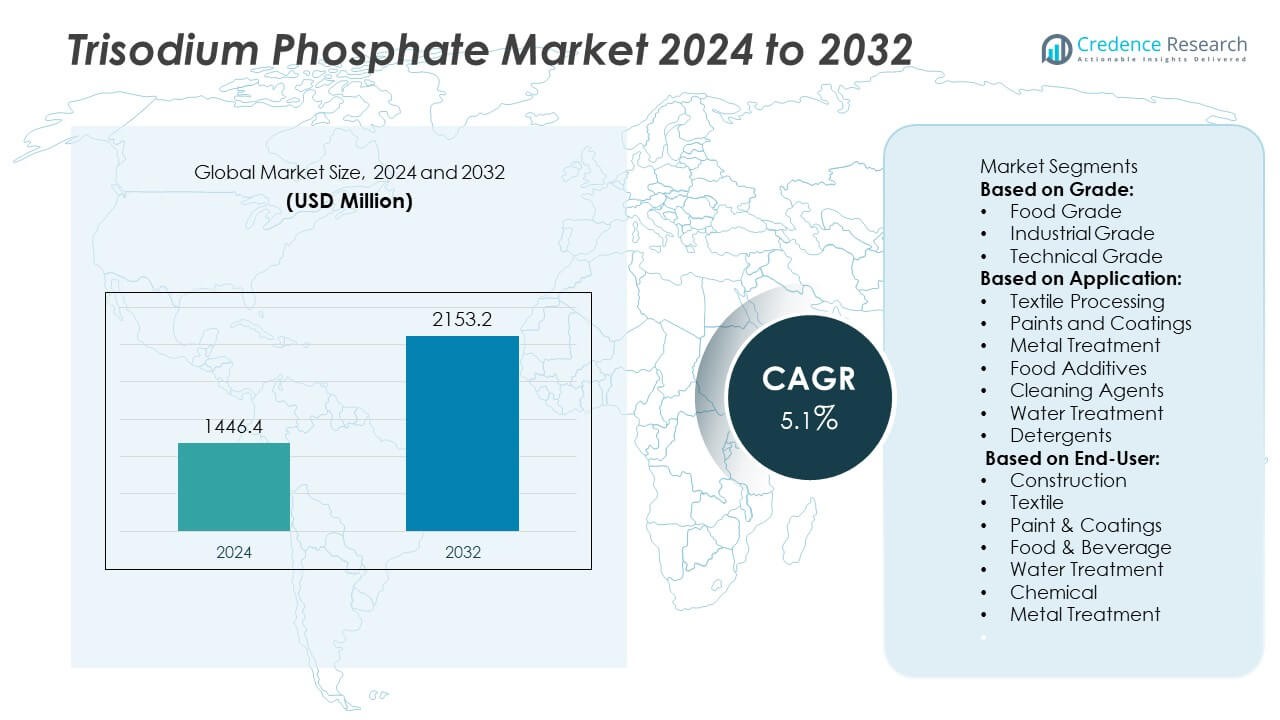

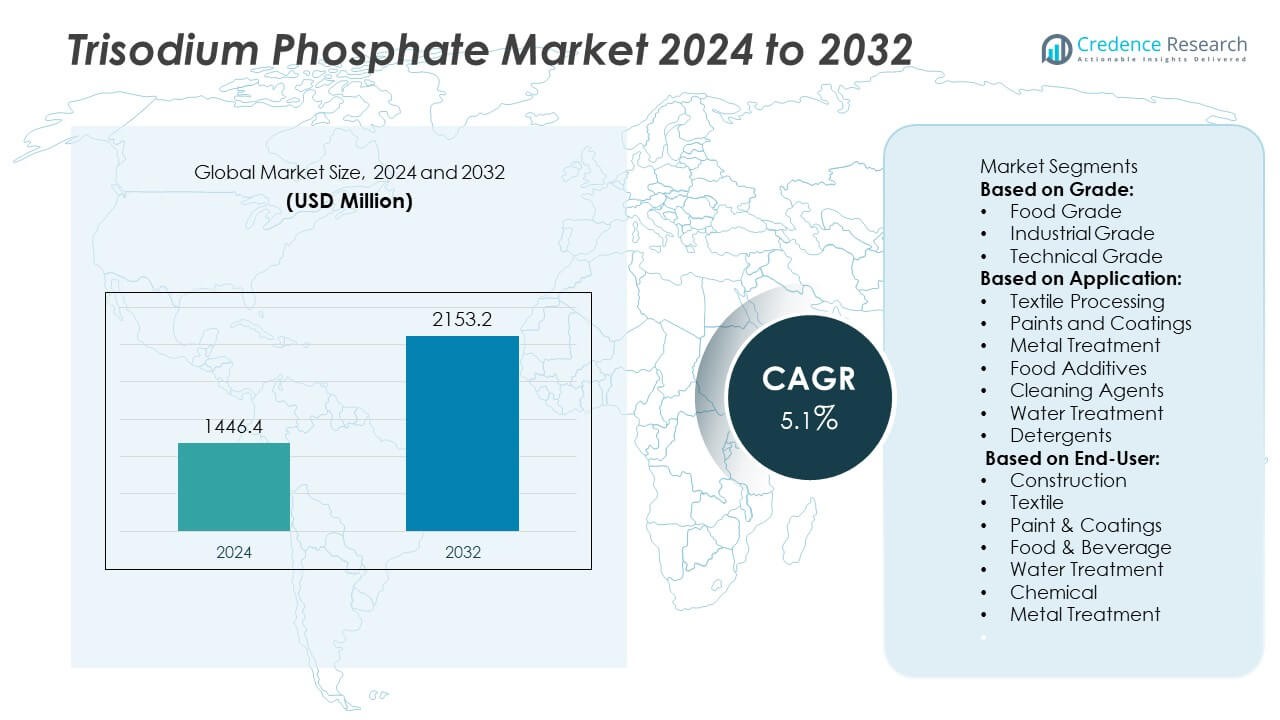

The Trisodium Phosphate market was valued at USD 1,446.4 million in 2024 and is projected to reach USD 2,153.2 million by 2032, growing at a CAGR of 5.1% over 2024–2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

|

|

USD 1,446.4 Million |

|

|

5.1% |

|

|

USD 2,153.2 Million |

The Trisodium Phosphate Market advances on strict food-safety protocols, heavy-duty cleaning needs, and reliable surface preparation in construction and coatings. Processors adopt food-grade inputs for precise pH control and sanitation outcomes, while utilities value stable alkalinity for water treatment. Contractors use TSP to improve paint adhesion and cut rework.

The Trisodium Phosphate market shows broad regional demand anchored by distinct use cases and regulatory contexts. Asia–Pacific leads consumption through expanding food processing, detergents, textiles, and construction workflows, with buyers emphasizing consistent assay and moisture-controlled packaging. North America sustains steady pull from stringent sanitation programs in meat and poultry, water treatment utilities, and repaint cycles in infrastructure. Europe prioritizes REACH-compliant, high-purity grades and documented traceability for food, coatings, and metal prep lines. Latin America grows with modernization of beverages, household cleaners, and industrial maintenance, while the Middle East & Africa see rising use in hospitality, utilities, and hot-climate surface preparation. Key players include Aditya Birla Chemicals, Merck KGaA, Ixom, and Recochem Corporation, each strengthening reach through multi-grade portfolios, audit-ready documentation, and distribution close to industrial clusters.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Trisodium Phosphate market was valued at USD 1,446.4 million in 2024 and is projected to reach USD 2,153.2 million by 2032, at a CAGR of 5.1%.

- Demand rises with stricter food-safety protocols, heavy-duty sanitation needs, and reliable surface preparation in coatings and construction; buyers value stable alkalinity, predictable pH control, and easy handling that shortens setup and reduces rework.

- Product trends center on tighter impurity windows, dust-reduced granules, fast-dissolve crystals, and pre-measured packs that cut mix error; digital CoAs, lot traceability, and moisture-barrier liners protect quality from plant to field.

- Competition pivots on multi-grade portfolios, audit-ready documentation, and multi-plant sourcing; leaders widen service moats through on-site trials, SOP development, dosing guides, and quick technical response while managing raw-material and energy cost volatility.

- Constraints include nutrient-discharge limits, REACH and local compliance demands, and substitution pressure from phosphate-free chemistries in detergents and metal prep; caking risk, rinse-water control, and hazmat handling rules add operating steps.

- Regional dynamics show Asia–Pacific as the volume hub across food processing, detergents, textiles, and infrastructure work; North America emphasizes sanitation, utilities, and repaint cycles; Europe prioritizes high-purity, compliance-verified grades; Latin America and Middle East & Africa expand with modernization of processing and utilities.

- Growth opportunities favor high-purity food grades, service-bundled industrial programs, and automation with inline sensors and closed-loop dosing; vendor-managed inventory near clusters, flexible pack sizes, and localized training strengthen resilience and customer retention.

Market Drivers

Expanding Food-Grade Applications Under Stricter Safety and Quality Protocols

The Trisodium Phosphate Market gains momentum from rising processed food output. Manufacturers use TSP for pH control and texture optimization. It supports microbial load reduction on poultry and seafood lines. Compliance teams prefer well-characterized, food-grade inputs with stable supply. Label and audit requirements push consistent specifications and traceability. Demand grows where food safety systems tighten oversight.

- For instance, a major poultry processor implemented an 8% TSP dip (15 min) on chicken breasts and achieved a reduction in aerobic plate counts from 8.2 to 5.69 log CFU/g—and Staphylococcus counts dropped from 4.30 to 3.32 log CFU/g.

Rising Demand for High-Performance Cleaning and Sanitization Chemicals

Industrial users favor TSP for heavy-duty degreasing and residue removal. It delivers reliable performance in CIP and open-plant cleaning. It helps reduce rewash rates and labor time in hygiene programs. Facilities adopt standardized TSP blends for predictable results. Multi-site operators value simple dilution control and wide material compatibility. Growth follows investments in hygiene-critical sectors.

- For instance, statistics from the U.S. Department of Agriculture’s Food Safety and Inspection Service baseline surveys in poultry plants document that TSP interventions produced statistically significant reductions in microbial contamination across multiple processing steps, supporting standardized use under audited HACCP programs.

Growth in Construction, Paint Pretreatment, and Surface Preparation Workflows

Contractors use TSP to etch glossy surfaces before repainting. The compound improves adhesion by removing oils and chalking. It reduces callbacks linked to premature coating failure. It fits into simple, field-ready preparation kits and SOPs. Retail channels support demand through DIY and professional assortments. Building renovation cycles further lift consumption.

Process Efficiency Gains in Water Treatment and Pulp & Paper Operations

Utilities apply TSP for scale control and alkalinity adjustment. It stabilizes process conditions across variable feedwater quality. It supports consistent output in pulp washing and bleaching steps. Mill operators value easy handling and predictable dosing behavior. It integrates with automated feeders and routine lab checks. Efficiency goals and uptime targets reinforce recurring use.

Market Trends

Tighter Food Regulations, Reformulation Momentum, and Traceable Ingredient Systems

The Trisodium Phosphate Market tracks stricter audits that push precise dosing, purity control, and full batch traceability. Brands phase in low-sodium recipes while retaining texture and pH targets. Suppliers offer food-grade lots with narrower impurity limits and robust certificates of analysis. Clean-label scrutiny raises demand for documented sourcing and allergen controls. Retailers ask for supplier scorecards and digital specs. R&D shifts toward multifunctional blends that maintain yield and line throughput.

- For instance, data from the USDA Food Safety and Inspection Service shows that integrating a TSP rinse at 10 g/L in poultry processing maintained consistent product pH within ±0.05 units across multiple monitored shifts, while microbial surface swab counts on processing equipment remained below 2.5 log CFU/cm² over a 30-day audit period, demonstrating compliance with Hazard Analysis and Critical Control Point (HACCP) verification standards

Supply Chain Resilience, Regional Sourcing, and Lower-Footprint Logistics

The Trisodium Phosphate Market expands regional production to hedge freight disruptions and lead-time swings. Producers secure upstream phosphoric acid and build buffer stocks near demand hubs. Distributors deploy vendor-managed inventory and EDI links to stabilize plant supply. Packaging shifts to heavier-duty liners that reduce moisture ingress and product loss. Fleet routing tools trim empty miles and depot dwell time. Buyers prefer multi-plant suppliers with validated alternates for critical SKUs.

- For instance, at Jorf Lasfar, OCP commissioned a new fertilizer unit in July 2024 adding 1,000,000 metric tons (DAP-equivalent) capacity, alongside two sulfuric-acid lines, each 5,000 metric wet tons per day; Phase I of a TSP Hub (planned 1,000,000 metric tons) is also on track, expanding on an integrated 187 km mine-to-plant slurry pipeline that continuously feeds the complex.

Higher-Performance Cleaning Grades, Pack Formats, and Application Tooling

The Trisodium Phosphate Market moves toward dust-reduced granules, fast-dissolving crystals, and residue-low grades for CIP and surface prep. Contractors prefer pre-measured sachets that cut waste and mix errors. Paint professionals adopt etch-assist kits that pair TSP with rinse aids for smoother adhesion. Industrial users specify corrosion-aware formulations for sensitive alloys. Facilities standardize SOPs that tie TSP strength to soil load classes. Training modules and QR-coded instructions lift first-pass cleaning rates.

Process Automation, Dosing Control, and Cross-Industry Integration

The Trisodium Phosphate Market aligns with inline sensors, closed-loop dosing pumps, and PLC tie-ins that keep alkalinity on target. Water utilities script set-points by feedwater variability to stabilize operations. Pulp and paper mills link TSP charge to washer differentials and brightness goals. Food plants fold TSP checks into hazard plans to lock consistency. Maintenance teams track scale control through scheduled titrations. Equipment vendors bundle TSP programs with service dashboards and KPI reporting.

Market Challenges Analysis

Environmental Compliance Pressures, Discharge Limits, and Regulatory Uncertainty

The Trisodium Phosphate Market faces scrutiny from nutrient discharge rules that target phosphate load in wastewater. Municipal permits tighten thresholds, which raises the cost of effluent treatment for food plants and mills. Coatings and cleaning contractors must manage rinse-water capture to avoid penalties. Formulators face label and audit demands that require tight impurity control and full batch traceability. It must also address worker safety due to high alkalinity that can irritate skin and eyes. Variations in local rules across states and countries complicate specification, documentation, and cross-border approvals. Frequent rule updates add risk to long-term contracts and inventory plans.

Supply Risk, Cost Volatility, and Performance Substitution Pressures

Global availability depends on phosphate rock and purified phosphoric acid, which exposes buyers to mining constraints, export policies, and freight shocks. Energy price swings influence upstream conversion costs and raise delivered prices for packaged TSP. Buyers seek dual sourcing and higher on-site buffer stocks, which ties up working capital. It competes with phosphates alternatives in detergents, metal prep, and water treatment, which can erode share when budgets tighten. Surface sensitivity on aluminum and some coatings can limit use without strict rinse protocols. Moisture uptake leads to caking, so packaging, handling, and storage controls add operating steps. Inventory age control and QA testing become mandatory to protect consistent field performance.

Market Opportunities

Expansion in High-Purity Grades, Digital Traceability, and Food Safety Programs

The Trisodium Phosphate Market can capture demand from processors that require verified, low-impurity food-grade inputs. Brands seek suppliers that deliver narrow spec windows, robust CoAs, and rapid lot release. Integrated track-and-trace, allergen controls, and audit-ready documentation raise purchase confidence. Halal and kosher certifications open access to multi-regional product lines. Poultry and seafood plants value predictable pH control and residue removal that protect yield and shelf life. Vendors that bundle application support, on-site trials, and sanitation SOPs win multi-site standardization. Growth follows investments in compliance labs, packaging integrity, and recall-ready data systems.

Process Optimization, Retrofit Potential, and Service-Led Contracts in Non-Food Verticals

Industrial users prioritize proven alkalinity control in paint prep, metal treatment, and water utilities. Retrofit kits that pair TSP with closed-loop dosing pumps reduce mix errors and downtime. High-solubility, dust-reduced grades improve handling and housekeeping metrics on busy lines. Contractors prefer pre-measured sachets that speed job turnaround and cut waste. E-commerce and distributor portals expand access to small and mid-size buyers that require fast replenishment. The market rewards vendors that package training, safety materials, and performance dashboards with supply contracts. Pack size variety and moisture-barrier liners support reliable storage across varied climates.

Market Segmentation Analysis:

By Grade

The Trisodium Phosphate Market segments into food grade, technical grade, and reagent grade. Food grade meets strict impurity limits and supports pH control and microbial load reduction in processing lines. Technical grade serves heavy-duty cleaning, paint prep, and water treatment where consistent alkalinity and solubility matter. Reagent grade targets labs and specialty processes that require high assay and tight metal limits. Buyers evaluate certificates of analysis, moisture control, and packaging integrity to protect shelf life. It rewards suppliers that standardize specifications across plants and maintain audit-ready documentation for multi-site customers.

- For instance, Chemfax’s technical-grade TSP SDS (Version 5, effective 25 Jan 2021) specifies a 10% solution pH of 13–14, relative density 1.62, decomposition temperature 75 °C, and composition 95–100% trisodium phosphate dodecahydrate (CAS 10101-89-0), supporting consistent alkalinity in cleaning blends.

By Application

The Trisodium Phosphate Market spans cleaning agents, food additives, water treatment, paints and coatings, detergents, textile processing, and metal treatment. Cleaning programs use TSP to lift oils and baked-on soils while keeping rinse steps predictable. Food processors apply controlled doses for pH adjustment and surface preparation under validated protocols. Water utilities use TSP for alkalinity adjustment and scale control. Paint and coatings teams rely on TSP surface prep to improve adhesion and cut callbacks. Textile and metal treatment lines use precise charge to stabilize upstream baths and improve finish quality. It advances where operators link dosing to SOPs and in-line checks.

- For instance, Trisodium phosphate (TSP) is a common food additive that helps to regulate pH, emulsify ingredients, and stabilize food products. It is a white, crystalline powder that is highly soluble in water. It can also be called trisodium orthophosphate or simply sodium phosphate.

By End User

End-user coverage in the Trisodium Phosphate Market includes food and beverage, chemicals, textiles, water treatment utilities, paints and coatings, construction, and metal finishing. Food plants seek verified food-grade supply and rapid lot release to support audits. Chemical manufacturers value reliable alkalinity and consistent reaction behavior. Utilities prioritize steady feed quality that aligns with dosing pumps and lab titrations. Coating contractors and builders choose TSP kits that improve surface readiness and reduce site returns. Metal finishing facilities specify stable solubility and impurity control to protect part quality. It gains traction with vendors that pair product with training, safety sheets, and field technical support.

Segments:

Based on Grade:

- Food Grade

- Industrial Grade

- Technical Grade

Based on Application:

- Textile Processing

- Paints and Coatings

- Metal Treatment

- Food Additives

- Cleaning Agents

- Water Treatment

- Detergents

Based on End-User:

- Construction

- Textile

- Paint & Coatings

- Food & Beverage

- Water Treatment

- Chemical

- Metal Treatment

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

Asia-Pacific

The Trisodium Phosphate Market holds its largest footprint in Asia-Pacific on the back of expansive food processing, detergents, textile, and construction ecosystems. China and India anchor consumption with dense manufacturing clusters and steady public works that require reliable surface prep and cleaning chemistries. Regional converters prefer consistent assay, low heavy-metal content, and moisture-controlled packaging to protect shelf life in humid climates. Governments continue to upgrade food-safety and hygiene codes, which raises demand for documented, food-grade lots and traceable supply. Distributors expand vendor-managed inventory programs near industrial parks to stabilize lead times. Producers invest in bulk handling, dust-reduced granules, and stronger liners to reduce material loss during monsoon seasons.

North America

The Trisodium Phosphate Market in North America benefits from stringent sanitation protocols across meat, poultry, and ready-to-eat facilities, as well as established paint and coatings maintenance cycles. End users value tight impurity limits, repeatable alkalinity, and clear certificates of analysis that accelerate lot release under third-party audits. Building renovation and infrastructure maintenance sustain steady pull in surface preparation, where contractors adopt pre-measured packets to cut mix errors. Utilities and paper mills prioritize dosing reliability and integration with automated feeders. Buyers demand multi-plant sourcing and contingency stock to mitigate freight or weather disruptions. Sustainability teams evaluate closed-loop rinse practices and improved effluent management to meet evolving discharge requirements.

Europe

The Trisodium Phosphate Market in Europe reflects rigorous environmental and product-safety regulations, which encourages high-purity grades and robust documentation. Food processors emphasize validated pH control and allergen-aware handling, while metal and coating shops apply standard operating procedures that link TSP charge to surface readiness metrics. Buyers seek REACH-compliant inputs, tamper-evident packaging, and palletization that withstands cross-border logistics. Regional distributors strengthen just-in-time models with electronic data interchange to align plant consumption and replenishment. Construction refurbishment—especially exterior cleaning and repaint cycles—supports recurring demand. Vendors that pair training, safety data, and application audits with supply contracts gain preferred status across multinational accounts.

Latin America

The Trisodium Phosphate Market in Latin America advances with modernization of food processing, beverages, and household cleaning products. Brazil and Mexico lead usage where producers standardize on predictable alkalinity and straightforward dilution control. Paint and coatings maintenance for industrial facilities and transport fleets adds steady volume, particularly in hot, high-soil environments. Buyers prioritize rugged packaging, moisture protection, and clear shelf-life labeling for regional climates. Distributors develop hybrid channels—direct to large plants and e-commerce for SMEs—to broaden access. Training modules in Spanish and Portuguese support safe handling, dosage accuracy, and improved first-pass cleaning rates on busy production lines.

Middle East & Africa

The Trisodium Phosphate Market in the Middle East & Africa grows with investment in food processing, hospitality, and utilities across Gulf states and key African economies. Hot-water cleaning, desalination-adjacent maintenance, and infrastructure repaint cycles sustain demand for stable solubility and residue-low performance. Buyers request corrosion-aware protocols for aluminum and coated surfaces, supported by rinse verification and field titration kits. Suppliers position high-integrity liners and weather-resistant pallets to protect quality through long haul routes. Local warehousing near ports reduces lead-time volatility and supports project-based orders. Technical service that aligns dosing with water quality and operating temperature helps end users meet hygiene targets and reduce rework.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

Leading players in the Trisodium Phosphate market include Aditya Birla Chemicals, Merck KGaA, Recochem Corporation, Chem One Ltd., Ixom, Chemfax, Albright & Wilson, Bangye Inc., Sundia, and Shifang Juyuan Chemical, all competing through multi-grade portfolios, process consistency, and regional distribution depth. These companies focus on high-purity food, technical, and reagent grades with tight impurity control, moisture-stable packaging, and audit-ready documentation to meet regulated use cases. Aditya Birla Chemicals leverages integrated phosphate assets and large-scale production to support consistent assay and dependable global supply, while Merck KGaA prioritizes high-assay reagents and robust QA systems for validated lab and pharma workflows. Recochem Corporation and Chem One Ltd. strengthen reach with diversified sourcing, private-label options, and just-in-time stocking for industrial and sanitation customers, and Ixom with Chemfax emphasize local manufacturing, hazardous-goods handling, and flexible pack sizes across ANZ and North America. Albright & Wilson, Bangye Inc., Sundia, and Shifang Juyuan Chemical focus on core phosphate chemistry and cost-efficient bulk supply for coatings, water treatment, and textile operations. Continuous investment in compliance capability, packaging integrity, and technical service—SOP design, dosing guidance, and on-site trials—reinforces competitive positioning and long-term customer retention across regulated end markets.

Recent Developments

- In Aug 2025, Chem One Ltd. (catalog status): US distributor catalog page shows Trisodium Phosphate (anhydrous & dodecahydrate; PRC/India origin) with SDS available to logged-in users. No dated change log or press note beyond the live product listing.

- In May 2025, Ixom began a proposed upgrade to its Botany Chlor Alkali Plant, supporting its production capabilities relevant to phosphates including TSP.

- In January 2024, Aditya Birla Chemicals invested $50million in a new US manufacturing and R&D facility focused on phosphates, enhancing its production capacity and global footprint.

- In March 2023, Airedale Group, a UK-based industrial chemicals company and supplier of high-quality food preservatives, acquired McCann Chemicals, a specialty chemicals manufacturer. The acquisition is part of Airedale’s growth strategy to expand its product portfolio and geographic reach. The combined company will benefit from synergies in manufacturing, distribution, and research and development, allowing it to better serve its customers across various industries.

Market Concentration & Characteristics

The Trisodium Phosphate Market shows moderate concentration, anchored by integrated phosphate producers with secure access to phosphoric acid and supported by regional formulators and distributors. Buyers prioritize tight impurity limits, consistent assay, and audit-ready documentation, which favors suppliers with robust QA systems and multi-plant redundancy. Pricing tracks upstream rock, acid, and energy costs, while freight and port conditions influence delivered reliability. Product variety spans food, technical, and reagent grades, with demand for dust-reduced granules, fast-dissolve crystals, and moisture-barrier packaging to protect shelf life across climates. End users seek clear SOPs, dosing calculators, and on-site trials that link chemical charge to measurable KPIs in sanitation, surface prep, and utilities. Regulatory scrutiny over nutrient discharge and workplace safety shapes specifications and drives investment in effluent control playbooks. It rewards vendors that pair stable supply with application support, electronic certificates of analysis, and responsive service, creating sticky relationships across multi-site industrial accounts.

Report Coverage

The research report offers an in-depth analysis based on Grade, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will shift toward high-purity, low-impurity grades supported by tighter audit requirements.

- Producers will invest in moisture-barrier packaging, dust-reduced granules, and fast-dissolve crystals to improve handling.

- Automation will expand with closed-loop dosing, inline sensors, and PLC integration to keep set points stable.

- Suppliers will strengthen multi-plant sourcing and regional stocking to reduce lead-time and freight risk.

- Digital traceability will grow through electronic CoAs, batch IDs, and EDI links across enterprise buyers.

- Regulatory scrutiny on nutrient discharge will spur effluent-management playbooks and application guidance.

- Service bundles will matter more, including SOP design, on-site trials, and dosing calculators tied to KPIs.

- Renovation and maintenance cycles in coatings and construction will sustain steady surface-prep demand.

- Utilities and process industries will favor standardized TSP programs aligned with corrosion and scale control targets.

- The Trisodium Phosphate market will reward suppliers that combine consistent assay, reliable logistics, and responsive technical support.