| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Automotive Bulb Market Size 2024 |

USD 465.39 Million |

| UK Automotive Bulb Market, CAGR |

3.42% |

| UK Automotive Bulb Market Size 2032 |

USD 609.05 Million |

Market Overview:

The UK Automotive Bulb Market is projected to grow from USD 465.39 million in 2024 to an estimated USD 609.05 million by 2032, with a compound annual growth rate (CAGR) of 3.42% from 2024 to 2032.

Several key factors are propelling this market expansion. The enforcement of stringent road safety regulations has necessitated the adoption of high-performance lighting systems to enhance vehicle visibility and reduce accidents. This regulatory shift has spurred investments in new lighting technologies, leading to the proliferation of advanced automotive bulbs. Concurrently, there is a growing consumer preference for energy-efficient and aesthetically pleasing lighting options, such as LED and HID bulbs, which offer superior illumination and longevity compared to traditional halogen bulbs. The increasing awareness of environmental sustainability has further accelerated this shift towards energy-efficient solutions. Additionally, the rising production and sales of vehicles, particularly electric vehicles (EVs), have further amplified the demand for specialized automotive bulbs tailored to meet the unique requirements of modern automobiles. These factors have fostered a thriving market environment for innovation in automotive lighting.

Regionally, urban areas like London, Southeast England, and the Midlands emerge as significant contributors to the UK’s automotive bulb market. These regions exhibit high vehicle ownership rates and a pronounced inclination towards advanced automotive technologies, positioning them as focal points for market growth. The presence of a mature automotive industry, coupled with a robust emphasis on vehicle safety standards, provides a conducive environment for market expansion. In particular, government-led initiatives aimed at promoting vehicle safety and reducing road accidents are further supporting demand for high-quality lighting solutions. Leading industry players, including Osram GmbH, Philips Lighting, Valeo SA, and General Electric, continue to drive innovation and maintain strong market positions, further bolstering the market’s expansion. Their ongoing research and development efforts are expected to solidify their leadership in the market while setting new benchmarks in automotive lighting.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The UK Automotive Bulb Market is projected to expand from USD 465.39 million in 2024 to USD 609.05 million by 2032, reflecting a CAGR of 3.42%.

- Stringent road safety regulations are driving the adoption of high-performance lighting systems to enhance vehicle visibility and reduce accidents.

- There is a growing consumer preference for energy-efficient and aesthetically pleasing lighting options, such as LED and HID bulbs, due to their superior illumination and longevity compared to traditional halogen bulbs.

- The increasing production and sales of vehicles, particularly electric vehicles (EVs), are amplifying the demand for specialized automotive bulbs tailored to modern automobiles’ unique requirements.

- Urban areas like London, Southeast England, and the Midlands are significant contributors to the market, exhibiting high vehicle ownership rates and a preference for advanced automotive technologies.

- Leading industry players, including Osram GmbH, Philips Lighting, Valeo SA, and General Electric, continue to drive innovation and maintain strong market positions, setting new benchmarks in automotive lighting.

- The rise in EV production is creating significant demand for energy-efficient and customized automotive lighting technologies, further propelling market growth.

Market Drivers:

Government Regulations and Road Safety Standards

One of the key drivers of the UK automotive bulb market is the stringent government regulations and road safety standards aimed at improving vehicle safety. The UK government has enforced laws that mandate the use of high-performance lighting systems in vehicles to ensure optimal visibility, thereby reducing accidents. These regulations require vehicles to be equipped with advanced lighting solutions that enhance road safety, which in turn drives the demand for better automotive bulbs. As consumers and manufacturers increasingly recognize the importance of visibility for accident prevention, the adoption of quality lighting solutions, such as LEDs and HIDs, becomes essential for compliance with safety standards.

Consumer Demand for Energy Efficiency and Aesthetics

The growing consumer preference for energy-efficient and aesthetically pleasing automotive lighting solutions is another important driver in the market. For example, Tesla’s Model 3 features advanced LED lighting systems that are both energy-efficient and visually striking, enhancing the vehicle’s modern design while reducing power consumption. With rising environmental awareness, consumers are shifting towards lighting options that offer superior energy efficiency without compromising on performance. LED and HID automotive bulbs, which provide longer lifespan and lower power consumption compared to traditional halogen bulbs, have become the preferred choice for many vehicle owners. Furthermore, consumers are increasingly seeking lighting solutions that complement the modern design of their vehicles. The demand for energy-efficient lighting that also enhances vehicle aesthetics has contributed significantly to the growth of the UK automotive bulb market.

Technological Advancements in Lighting Systems

Technological advancements in automotive lighting systems have played a pivotal role in driving the growth of the automotive bulb market in the UK. Innovations such as adaptive lighting systems, smart lighting, and customizable LED configurations have enhanced the functionality and appeal of automotive bulbs. For instance, Rolls-Royce’s Spectre, which incorporates 22 LEDs in its illuminated grille design and features an advanced split headlamp configuration with ultra-slim LED DRLs. These advancements not only improve the visual aesthetics of vehicles but also offer practical benefits such as better road illumination, energy savings, and increased safety. The integration of cutting-edge technology in automotive bulbs is a major factor behind the rising demand for more sophisticated lighting solutions, further fueling market growth.

Increasing Vehicle Production and Sales

The increasing production and sales of vehicles, particularly electric vehicles (EVs), have contributed significantly to the expansion of the UK automotive bulb market. As the automotive industry in the UK continues to grow, the demand for vehicle components such as automotive bulbs also increases. EVs, in particular, are driving the need for specialized lighting solutions that cater to their unique requirements. With more vehicles on the road and a growing focus on eco-friendly technologies, the demand for energy-efficient, durable, and high-performance automotive bulbs continues to rise. This surge in vehicle production and sales directly impacts the demand for automotive lighting, pushing the market to new heights.

Market Trends:

Shift Towards LED and HID Lighting Solutions

A prominent trend in the UK automotive bulb market is the increasing adoption of LED and HID lighting solutions. These advanced lighting technologies have gained significant traction due to their superior efficiency, longer lifespan, and enhanced performance compared to traditional halogen bulbs. For instance, manufacturers like Range Rover have integrated sophisticated LED technology into their vehicles, such as configurable cabin lighting with 30 interior color options and ambient lighting solutions. According to recent market reports, the LED segment is projected to dominate the market, accounting for more than 60% of the total automotive lighting revenue in the coming years. The growing preference for LED and HID bulbs is driven by their ability to provide bright, clear illumination while consuming less power, making them an ideal choice for eco-conscious consumers and vehicle manufacturers seeking to reduce carbon footprints. The shift towards these lighting technologies reflects the broader trend of modernizing automotive lighting systems for better energy efficiency and performance.

Integration of Smart Lighting Systems

The integration of smart lighting systems is another notable trend in the UK automotive bulb market. As vehicles become more technologically advanced, lighting systems are evolving to offer increased functionality, such as adaptive headlights and dynamic lighting patterns. Smart lighting systems, which adjust automatically based on road conditions, weather, or driving speed, are gaining popularity for their ability to enhance driver safety and improve road visibility. For instance, Marelli developed Full-LED Adaptive Matrix Headlights for Alfa Romeo Tonale, incorporating Adaptive Low Beam and Adaptive Driving Beam technologies. Additionally, the use of sensors and camera-based technologies allows for more precise lighting control. As these systems continue to improve, their adoption in new vehicles is expected to grow, further driving the demand for innovative automotive bulbs. This trend highlights the increasing consumer interest in integrating convenience and safety features into their vehicles.

Focus on Customization and Aesthetics

Another emerging trend in the UK automotive bulb market is the growing focus on customization and aesthetics. Vehicle owners are increasingly looking for personalized lighting solutions that match their unique preferences and the design of their cars. Automotive lighting manufacturers are responding to this demand by offering customizable color options and design configurations for interior and exterior lights. These personalized lighting solutions allow consumers to create a more distinct and visually appealing look for their vehicles. As the trend towards vehicle personalization continues to grow, demand for automotive bulbs that cater to aesthetic preferences is likely to increase, further diversifying the product offerings in the market.

Sustainability and Eco-friendly Solutions

Sustainability has become a central theme in the automotive industry, and the lighting sector is no exception. Consumers are increasingly prioritizing eco-friendly solutions in their purchasing decisions, leading to a rise in the demand for energy-efficient lighting technologies, particularly LEDs. The UK automotive bulb market is aligning with this shift by offering bulbs that not only use less energy but also have a longer lifespan, thereby reducing waste. Additionally, manufacturers are focusing on reducing the environmental impact of the production and disposal of automotive bulbs. As environmental concerns continue to shape consumer preferences, the demand for sustainable and eco-friendly lighting solutions is expected to grow, driving further innovation and market growth in the UK automotive bulb industry.

Market Challenges Analysis:

High Cost of Advanced Lighting Technologies

One of the key restraints in the UK automotive bulb market is the high cost of advanced lighting technologies such as LED and HID bulbs. Although these lighting solutions offer numerous benefits, including superior efficiency, longer lifespan, and improved performance, they often come at a significantly higher price point compared to traditional halogen bulbs. This cost disparity can be a barrier for some consumers, particularly in the budget-conscious segments of the automotive market. The initial investment required for upgrading to advanced lighting technologies may deter price-sensitive customers, limiting the widespread adoption of these bulbs.

Compatibility Issues with Older Vehicle Models

Another challenge facing the UK automotive bulb market is the compatibility of advanced lighting technologies with older vehicle models. Many older vehicles, particularly those manufactured before the widespread adoption of LED and HID lighting, are not equipped to support these newer technologies without significant modifications. For instance, retrofitting halogen-based headlight units with LED or HID bulbs often fails MOT tests due to incompatibility with beam patterns and focal dimensions. This issue can create additional costs and inconvenience for vehicle owners seeking to upgrade their lighting systems. The need for specialized components or retrofitting can also slow down the market’s growth, as some vehicle owners may choose to delay or avoid upgrading their automotive bulbs due to these compatibility concerns.

Regulatory Compliance and Standards

The stringent regulatory requirements and safety standards for automotive lighting in the UK can also pose a challenge for market players. Manufacturers must adhere to rigorous testing and certification processes to ensure their products meet safety and performance standards set by local authorities. While these regulations are essential for vehicle safety, they can increase production costs and lead to longer product development cycles. Additionally, as regulations evolve, manufacturers must constantly innovate to meet new standards, which can strain resources and affect the overall market dynamics.

Intense Market Competition

The highly competitive nature of the UK automotive bulb market presents another challenge. With numerous players, including global giants like Osram, Philips, and Valeo, the market is crowded, making it difficult for new entrants to secure a foothold. Price competition, coupled with the need for continuous innovation, can put pressure on profit margins. For smaller manufacturers, competing with well-established brands that have significant market share and financial resources can be an ongoing challenge.

Market Opportunities:

One of the most significant opportunities in the UK automotive bulb market lies in the rapid growth of the electric vehicle (EV) sector. As more consumers and businesses embrace electric vehicles due to their eco-friendly nature and government incentives, there is a growing demand for specialized automotive lighting solutions tailored to EVs. EVs require energy-efficient and durable lighting systems to maximize their range and performance, presenting a unique opportunity for manufacturers to develop innovative lighting solutions specifically designed for these vehicles. The increase in EV production and sales is expected to drive the demand for advanced lighting technologies such as LEDs and HIDs, which align with the sustainable nature of electric vehicles. This growing shift towards EVs presents manufacturers with the chance to expand their product offerings and cater to this emerging segment.

The continuous technological advancements in automotive lighting systems present another opportunity for growth in the UK automotive bulb market. Innovations such as adaptive headlights, smart lighting systems, and customizable color options are becoming more popular, particularly among consumers seeking personalized vehicle features. Manufacturers who can integrate advanced technology into their automotive lighting products will have a competitive edge in the market. Furthermore, as consumers increasingly value vehicle aesthetics and functionality, the demand for customizable lighting solutions that allow for unique visual effects and better road illumination will continue to rise. By focusing on innovation and customization, market players can tap into new consumer segments and enhance their market positioning in the competitive landscape.

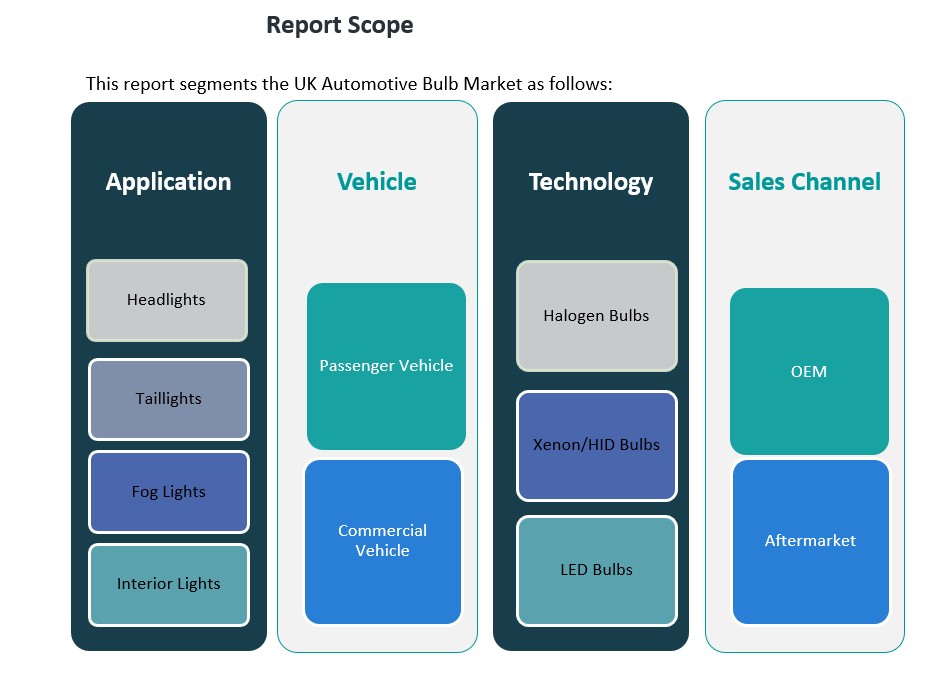

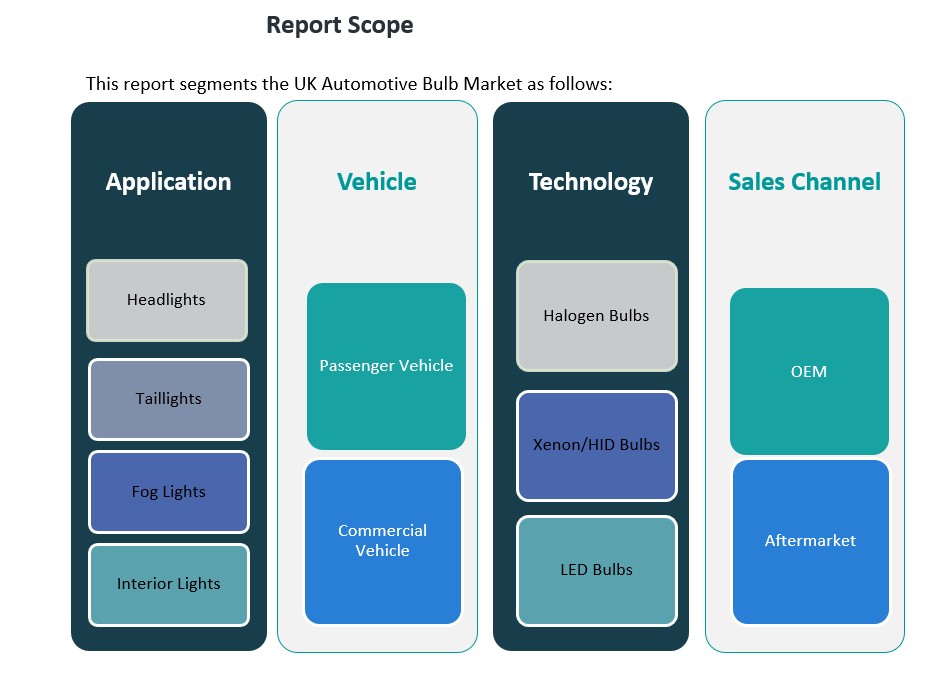

Market Segmentation Analysis:

The UK Automotive Bulb Market is segmented across various categories, each contributing to its overall growth and dynamics.

By Vehicle Segment, the market is primarily driven by Passenger Vehicles, which account for the largest share due to the high demand for advanced lighting systems in personal vehicles. The Commercial Vehicle segment is also growing, driven by increased demand for robust and long-lasting lighting solutions that meet the specific needs of heavy-duty vehicles.

By Application Segment, the market is divided into Headlights, Taillights, Fog Lights, and Interior Lights. Headlights dominate the market, driven by increasing safety standards and consumer preference for high-performance lighting. Taillights and Fog Lights are gaining traction as well, as they play a critical role in enhancing vehicle visibility, particularly in adverse weather conditions. The demand for Interior Lights is also growing due to increasing consumer preference for aesthetic and functional lighting solutions inside vehicles.

By Technology Segment, LED Bulbs are the dominant technology, driven by their energy efficiency, longer lifespan, and superior performance compared to traditional lighting options. Halogen Bulbs remain popular in certain vehicle segments, but Xenon/HID Bulbs are increasingly adopted due to their advanced lighting capabilities and improved safety features.

By Sales Channel Segment, the market is split between OEM (Original Equipment Manufacturer) and Aftermarket channels. The OEM segment holds a significant share, driven by the demand from automotive manufacturers for high-quality, integrated lighting solutions. The Aftermarket segment is also growing as consumers seek to replace or upgrade their vehicle lighting for better performance and aesthetics.

Segmentation:

By Vehicle Segment:

- Passenger Vehicle

- Commercial Vehicle

By Application Segment:

- Headlights

- Taillights

- Fog Lights

- Interior Lights

By Technology Segment:

- Halogen Bulbs

- Xenon/HID Bulbs

- LED Bulbs

By Sales Channel Segment:

- OEM (Original Equipment Manufacturer)

- Aftermarket

Regional Analysis:

The United Kingdom’s automotive bulb market exhibits notable regional variations, influenced by factors such as vehicle ownership density, regional economic activity, and the prevalence of automotive manufacturing hubs. While comprehensive market share data for each UK region is limited, available insights highlight key areas contributing to the market’s dynamics.

London and Southeast England

London, along with Southeast England, stands out as a significant contributor to the automotive bulb market. These regions benefit from high vehicle ownership rates, a dense population, and a concentration of commercial activities, leading to increased demand for both original equipment manufacturer (OEM) and aftermarket lighting solutions. The emphasis on vehicle safety and aesthetics in urban areas further drives the adoption of advanced automotive lighting technologies, including LEDs and HIDs.

Midlands

The Midlands region, historically known as the heart of the UK’s automotive industry, continues to play a crucial role in the automotive bulb market. The presence of numerous automotive manufacturers and suppliers in this area fosters a steady demand for automotive lighting solutions. Both OEM requirements and aftermarket preferences contribute to the market’s growth, with a focus on innovative lighting technologies that enhance vehicle safety and performance.

Other Regions

While specific market share data for regions such as Northwest England, Northeast England, Yorkshire and the Humber, Southwest England, and Wales is limited, these areas contribute to the overall market through a combination of residential vehicle ownership and regional automotive activities. The demand for automotive bulbs in these regions is influenced by factors such as local economic conditions, transportation infrastructure, and consumer preferences for vehicle customization and safety enhancements.

Key Player Analysis:

- Magneti Marelli S.p.A.

- GE Lighting

- Valeo

- OSRAM United Kingdom

- Philips Electronics United Kingdom Limited

Competitive Analysis:

The UK automotive bulb market is characterized by the presence of several prominent players, including Osram, Philips, Hella, and Koito. These companies offer a diverse range of lighting solutions, encompassing halogen, LED, and xenon HID bulbs, catering to both OEM and aftermarket segments. The market is witnessing a shift towards energy-efficient lighting technologies, with LEDs gaining significant traction due to their longer lifespan and reduced energy consumption. This transition aligns with global trends towards sustainability and is supported by stringent government regulations promoting advanced lighting systems. The competitive landscape is further influenced by continuous technological advancements, with companies investing in smart lighting solutions and adaptive systems to enhance vehicle safety and driver experience. Additionally, the growing adoption of electric vehicles presents new opportunities and challenges for automotive lighting manufacturers, necessitating innovations tailored to the unique requirements of EVs.

Recent Developments:

- In March 2023, HELLA expanded its Black Magic auxiliary headlamp series by introducing 32 new lightbars. This range includes 14 lightbars with ECE approval for on-road use and 18 designed for off-road applications. Additionally, the company launched the New Generation of NARVA Range Performance Signaling Bulbs, offering crisp and vibrant positioning and interior lighting solutions.

- In March 2025, Valeowon the Road Safety Innovation Award for its EvenLED technology. This innovation enhances vehicle visibility with ultra-homogeneous light diffusion and is designed for both front and rear signaling systems. EvenLED technology complies with international regulations and offers versatile applications for light and heavy vehicles.

- In March 2025, Valeo announced a collaboration with TactoTek to integrate In-Mold Structural Electronics (IMSE®) technology into its lighting solutions. This partnership aims to deliver advanced safety features and customizable lighting designs for next-generation vehicles.

Market Concentration & Characteristics:

The UK automotive bulb market is moderately concentrated, dominated by key players such as Osram GmbH, Philips Lighting, Valeo SA, and General Electric. These companies offer a diverse range of lighting solutions, including halogen, LED, and HID bulbs, catering to both OEM and aftermarket segments. The market is characterized by a shift towards energy-efficient technologies, with LEDs gaining prominence due to their longer lifespan and reduced energy consumption compared to traditional halogen bulbs. This transition aligns with global sustainability trends and is supported by stringent government regulations promoting advanced lighting systems. Continuous technological advancements, such as the development of adaptive lighting and smart lighting solutions, further enhance vehicle safety and driver experience, contributing to the competitive dynamics of the market. The competitive landscape is further shaped by ongoing product innovations and strategic partnerships, with companies continuously enhancing their offerings to meet evolving consumer preferences and regulatory standards.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Vehicle Segment, Application Segment, Technology Segment and Sales Channel Segment. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The UK automotive bulb market is expected to grow steadily due to rising demand for advanced lighting solutions, driven by vehicle safety regulations and consumer preferences.

- LED and HID bulbs will continue to dominate the market, with LEDs showing the most significant growth due to energy efficiency and long lifespan.

- Increasing electric vehicle (EV) adoption will create new opportunities for specialized automotive bulbs, tailored to the unique requirements of EVs.

- Smart lighting systems, including adaptive headlights, are set to gain traction, improving driver safety and enhancing user experience.

- Growing interest in vehicle aesthetics will fuel demand for customizable lighting options, allowing for personalized interior and exterior features.

- Technological advancements in automotive lighting, such as dynamic lighting and intelligent systems, will drive innovation in the market.

- Stringent government regulations promoting road safety will push for further adoption of high-performance lighting solutions.

- The shift towards sustainability and eco-friendly solutions will accelerate demand for energy-efficient lighting systems, especially among environmentally conscious consumers.

- Intense competition from both established players and emerging startups will foster continuous innovation in product offerings.

- Increased vehicle production and sales, particularly of higher-end and luxury vehicles, will expand the market for premium lighting systems.