Market Overview:

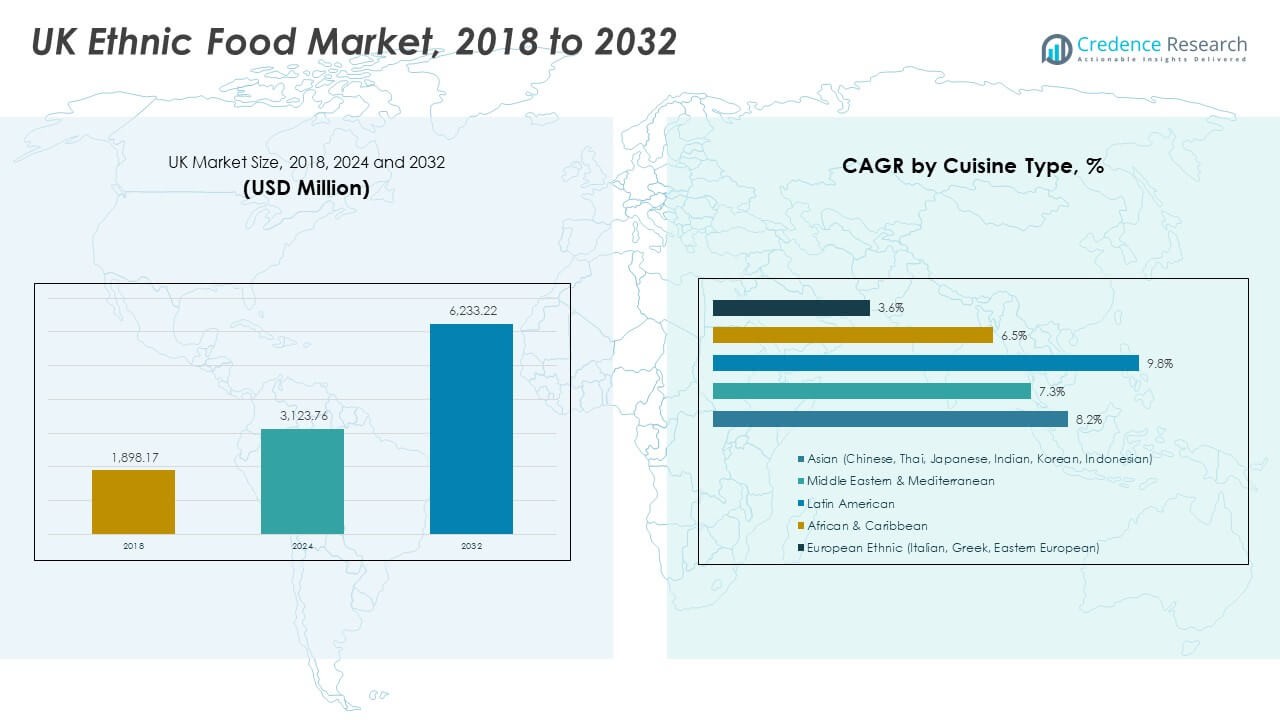

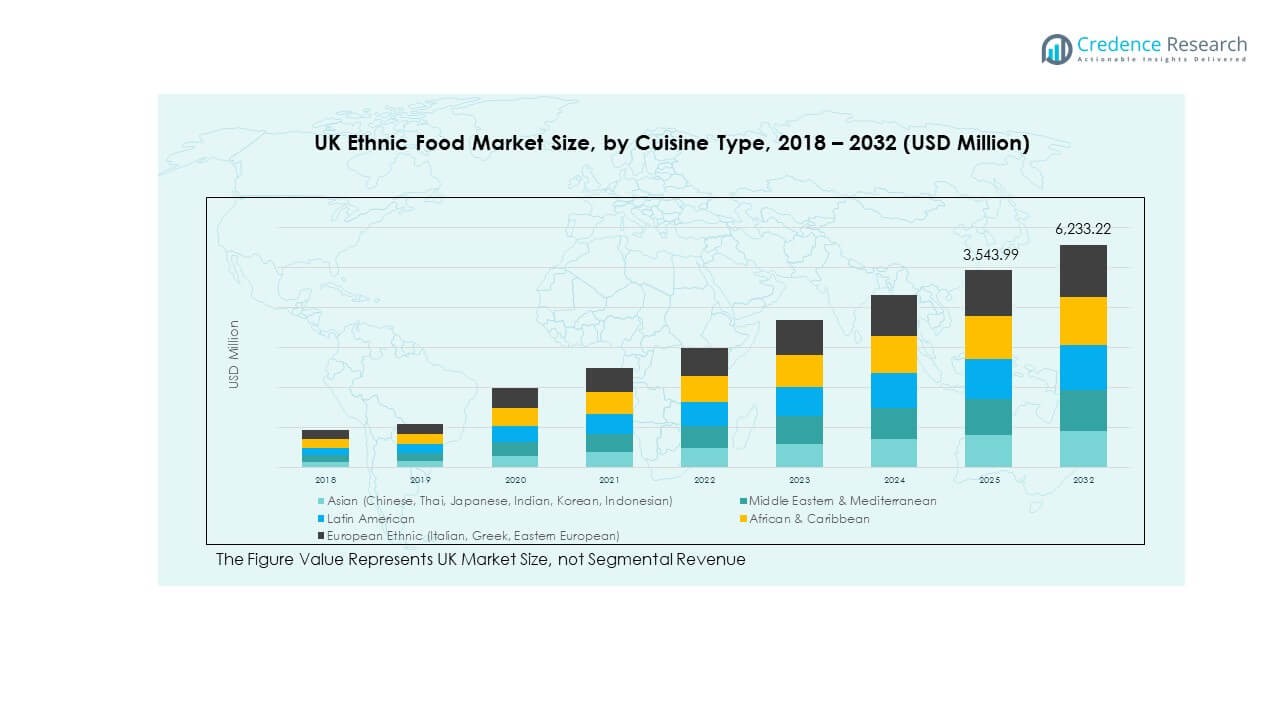

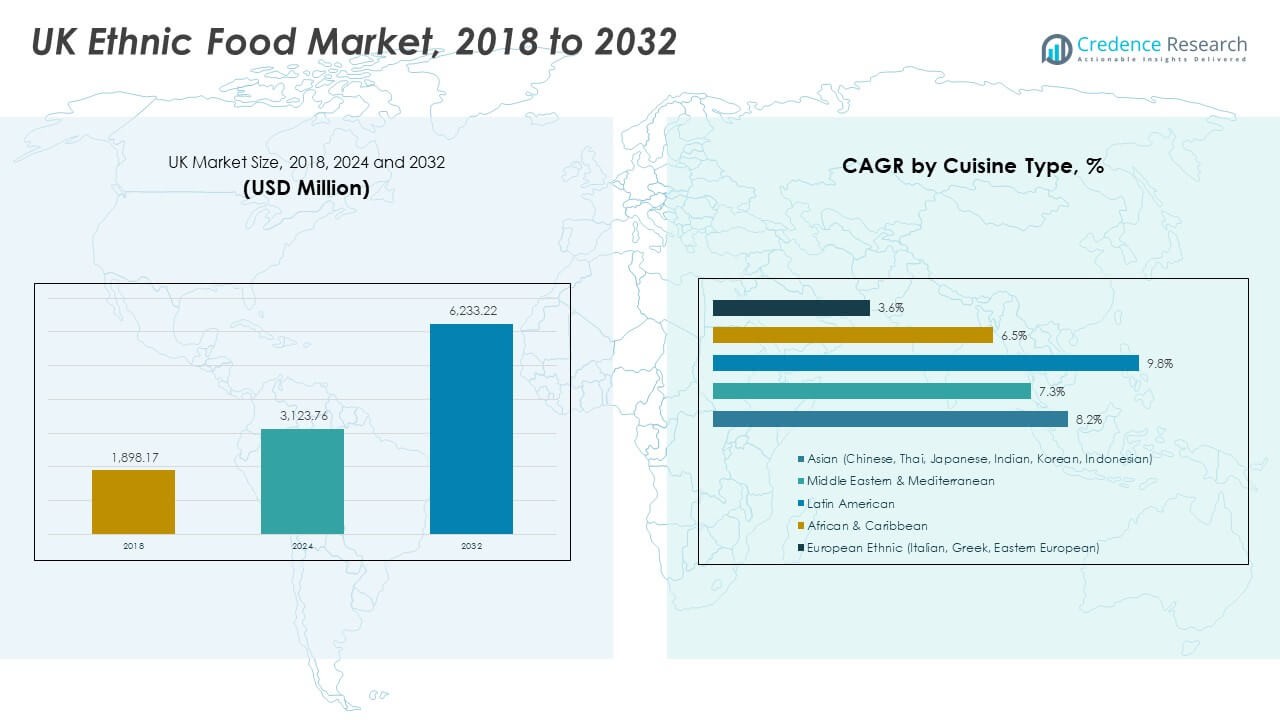

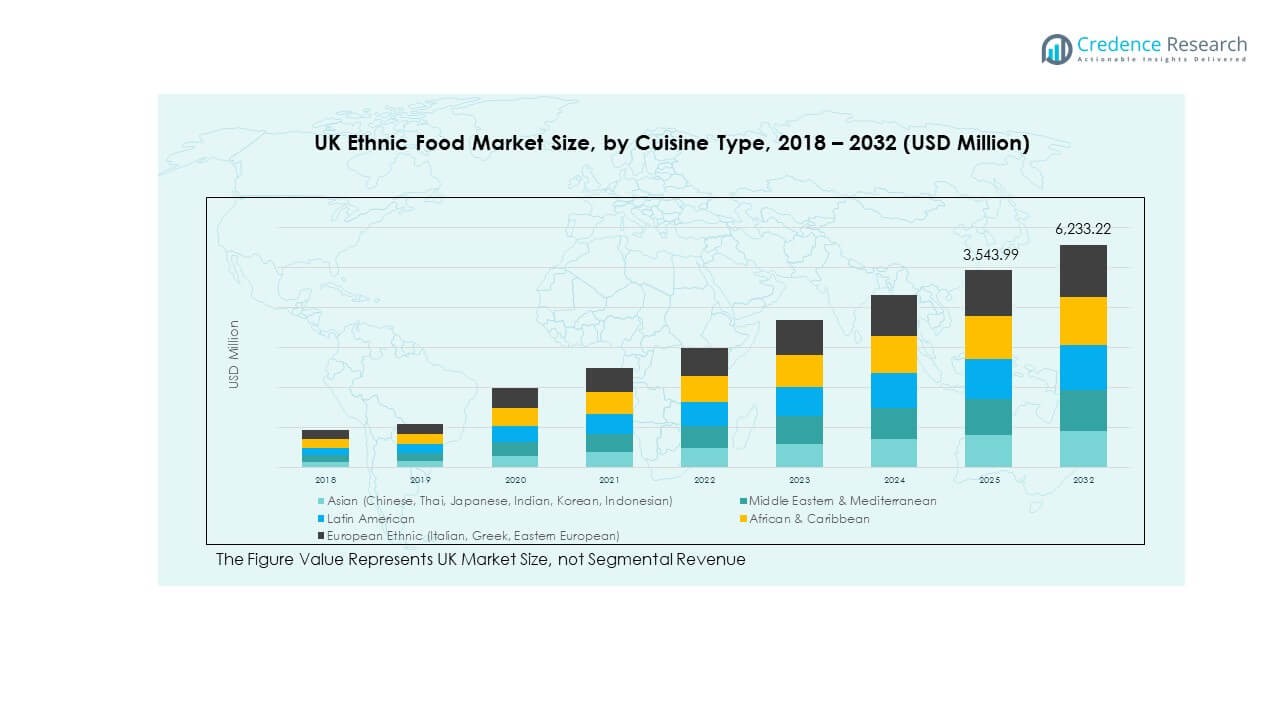

The UK Ethnic Food Market size was valued at USD 1,898.17 million in 2018 to USD 3,123.76 million in 2024 and is anticipated to reach USD 6,233.22 million by 2032, at a CAGR of 8.40% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Ethnic Food Market Size 2024 |

USD 3,123.76 Million |

| UK Ethnic Food Market, CAGR |

8.40% |

| UK Ethnic Food Market Size 2032 |

USD 6,233.22 Million |

The market grows steadily due to rising cultural diversity and consumer openness to global cuisines. Demand increases for authentic and fusion-based food options supported by strong retail expansion. Supermarkets, convenience stores, and online platforms expand ethnic food availability across categories. Rising disposable income and time constraints push consumers toward ready-to-eat meals and snacks. Restaurants and foodservice chains integrate ethnic dishes to attract younger demographics. Health awareness strengthens preference for natural and minimally processed ethnic products. Increasing innovation in packaging and product range continues to drive long-term growth.

England dominates the UK Ethnic Food Market, supported by its dense multicultural population and strong retail infrastructure. London remains a major hub for product launches, distribution, and diverse restaurant formats. Scotland shows consistent growth, fueled by expanding tourism and increasing urban exposure to international cuisines. Wales and Northern Ireland are emerging regions with rising consumer awareness and expanding ethnic restaurant chains. Regional food festivals and trade events promote cross-cultural culinary experiences. Broader product availability across these subregions enhances consumer reach and sustains market penetration.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The UK Ethnic Food Market was valued at USD 1,898.17 million in 2018, reached USD 3,123.76 million in 2024, and is projected to attain USD 6,233.22 million by 2032, growing at a CAGR of 8.40%.

- England leads with about 70% share, supported by a dense multicultural population and strong supermarket penetration across major cities.

- Wales and Northern Ireland collectively account for around 21% share, with Wales emerging fastest due to expanding ethnic restaurant chains and rising youth-driven demand.

- Asian cuisines hold roughly 45% segment share, dominating due to deep consumer familiarity with Indian, Chinese, and Thai dishes.

- Middle Eastern and Mediterranean cuisines follow with around 25% share, benefiting from growing preference for healthy and flavor-rich meal options.

Market Drivers

Growing Multicultural Population and Diverse Consumer Palates

The UK Ethnic Food Market expands with rising cultural diversity and migration trends. Urban centers such as London, Birmingham, and Manchester host large communities influencing food preferences nationwide. It benefits from younger demographics open to experimenting with global cuisines. Supermarkets and restaurants introduce broader menus to meet varied tastes. Food festivals and ethnic food fairs strengthen exposure to international flavors. Online delivery platforms make authentic ethnic meals more accessible. Millennials and Gen Z consumers seek adventurous dining experiences. Strong cultural exchange drives long-term demand growth across product categories.

Expansion of Retail Distribution and Supermarket Offerings

Major retailers broaden product portfolios to include ethnic sauces, snacks, and ready meals. It helps traditional ethnic brands enter mainstream retail shelves. Companies like Tesco and Sainsbury’s stock South Asian, Chinese, and African products under private labels. Visibility in premium stores promotes consumer trial. Discount chains such as Aldi and Lidl also widen ethnic assortments to attract diverse audiences. Growing investments in cold chain logistics ensure freshness and quality. Shelf placement optimization enhances awareness and brand penetration. Broader retail access stimulates frequent purchase and consumption cycles.

- Tesco, for example, stocking over 150 ethnic food SKUs including South Asian and African products in their diversified portfolio. Similarly, discount retailers such as Aldi and Lidl have increased ethnic assortment to attract multicultural consumers.

Rise of Ready-to-Eat and Convenience-Based Products

Busy lifestyles fuel demand for ethnic ready-to-eat, frozen, and meal-kit solutions. The UK Ethnic Food Market benefits from the popularity of microwaveable curries, noodles, and wraps. Manufacturers invest in packaging innovations to maintain authenticity and shelf life. Consumers favor convenient meal solutions replicating restaurant taste. Quick-service restaurants collaborate with suppliers to expand menu offerings. Frozen ethnic foods gain acceptance in households seeking time-efficient meals. Food delivery apps boost accessibility through curated ethnic meal options. The preference for convenience without compromising authenticity drives repeat consumption.

Health-Conscious Choices and Authentic Ingredient Sourcing

Consumers increasingly prefer natural and minimally processed ethnic foods. It encourages brands to use clean-label ingredients and transparent sourcing. Gluten-free, vegan, and low-sodium ethnic dishes find traction among health-conscious buyers. Producers highlight regional authenticity and traditional recipes. Food certification programs raise trust in imported products. Restaurants emphasize locally sourced ingredients for premium experiences. Manufacturers invest in traceability systems to assure origin integrity. The health and authenticity trend strengthens premium segment growth.

- For instance, Ainsley Foods by chef Ainsley Harriott markets Caribbean-inspired soups with plant-based ingredients, available across UK supermarkets to align with the growing healthy ethnic food trend.

Market Trends

Rising Influence of Social Media and Digital Culinary Engagement

Social media platforms amplify interest in ethnic cuisines through influencers and food bloggers. Visual storytelling encourages home cooking and experimentation. Consumers follow recipe creators to discover authentic dishes from global regions. The UK Ethnic Food Market gains visibility through viral cooking challenges. Restaurants engage audiences via online tasting events and live streaming. Short videos featuring Indian, Thai, and Middle Eastern cuisines attract large audiences. Digital platforms inspire cross-cultural food exploration. Online visibility accelerates awareness and product trial rates.

Innovation in Fusion Cuisine and Product Customization

Fusion cuisine trends merge global flavors with local British preferences. Restaurants blend Asian, African, and Latin elements into creative menus. It allows brands to introduce hybrid dishes such as tikka tacos or sushi burritos. Supermarkets offer ready-to-cook fusion kits appealing to younger customers. Food manufacturers develop sauces mixing traditional herbs with Western seasonings. The rise in cross-border culinary exposure supports product experimentation. Limited-edition launches attract attention from urban consumers. The fusion movement sustains market freshness and appeal.

- For instance, Itsu launched “Asian fusion meal kits” combining Japanese noodles with British-inspired sauces, reflecting the growing appeal of hybrid ethnic convenience foods.

E-Commerce Expansion and Direct-to-Consumer Sales Growth

Online grocery and food delivery services transform ethnic food accessibility. The UK Ethnic Food Market leverages e-commerce to reach multicultural households nationwide. Online platforms host regional products not stocked in local stores. Subscription boxes provide curated ethnic meals to home cooks. Delivery firms collaborate with ethnic restaurants to extend reach. AI-driven recommendations guide users toward culturally aligned options. Consumer reliance on doorstep delivery boosts digital sales volumes. Growing internet penetration and mobile apps support long-term channel expansion.

- For example, MOB Kitchen, a UK-based brand with 1.5 million TikTok followers and 189K YouTube subscribers. MOB Kitchen democratizes cooking by offering affordable, culturally diverse ready-to-cook meals highly popular among younger consumers, exemplifying the growth in direct-to-consumer ethnic food sales through digital platforms.

Sustainability and Eco-Friendly Packaging Practices

Sustainability shapes consumer purchase decisions in the ethnic food sector. Brands introduce recyclable and biodegradable packaging to meet green standards. Importers optimize logistics routes to cut carbon emissions. It strengthens brand image among eco-aware consumers. Restaurants implement reusable containers and paper-based packaging for takeaways. Retailers prefer suppliers with certified sustainable practices. Consumers value transparency in environmental responsibility. The sustainability trend aligns cultural authenticity with modern ethics.

Market Challenges Analysis

High Import Dependency and Supply Chain Volatility

The UK Ethnic Food Market faces instability due to reliance on imported raw materials. Supply disruptions affect ingredient availability and cost consistency. Fluctuations in trade tariffs and currency values complicate pricing structures. Seasonal shortages of spices, herbs, and condiments impact production schedules. Manufacturers struggle to maintain uniform taste profiles under volatile supply conditions. Customs delays affect perishable product quality and shelf life. Regulatory differences among exporting nations add compliance burdens. Companies must build local sourcing and storage capabilities to reduce risk exposure.

Balancing Authenticity with Mainstream Consumer Expectations

Brands face challenges aligning authentic ethnic flavors with mainstream preferences. Intense seasoning or unfamiliar ingredients may limit consumer acceptance. It requires recipe reformulation without losing cultural essence. Restaurants adapt traditional recipes to suit broader palates, impacting authenticity. Smaller ethnic brands struggle to scale without compromising quality. Competitive pressure from private labels intensifies price wars. Maintaining product differentiation in a crowded market becomes harder. Balancing authenticity and commercial viability remains a core strategic challenge.

Market Opportunities

Growing Demand from Expanding Multicultural Demographics

The UK Ethnic Food Market benefits from a steady rise in multicultural residents. Second-generation immigrants continue traditional consumption while influencing peers. It creates a large audience seeking both heritage and modern interpretations. Educational institutions and workplaces hosting diverse populations amplify exposure. Retailers use demographic insights to refine assortments and promotions. Expanding diversity supports year-round demand stability. Multicultural households drive continuous innovation and flavor variety. Rising inclusivity fosters a sustainable growth pathway.

Strategic Collaborations and Product Diversification Potential

Collaborations between ethnic food brands and mainstream retailers enhance visibility. Joint ventures enable better supply chain integration and brand localization. Celebrity chefs and influencers partner with producers to popularize authentic dishes. It drives consumer trust through brand association. Private labels expand into niche cuisines, creating new shelf categories. Product diversification across snacks, beverages, and frozen meals boosts overall portfolio reach. The growing collaboration trend enhances innovation and strengthens market competitiveness.

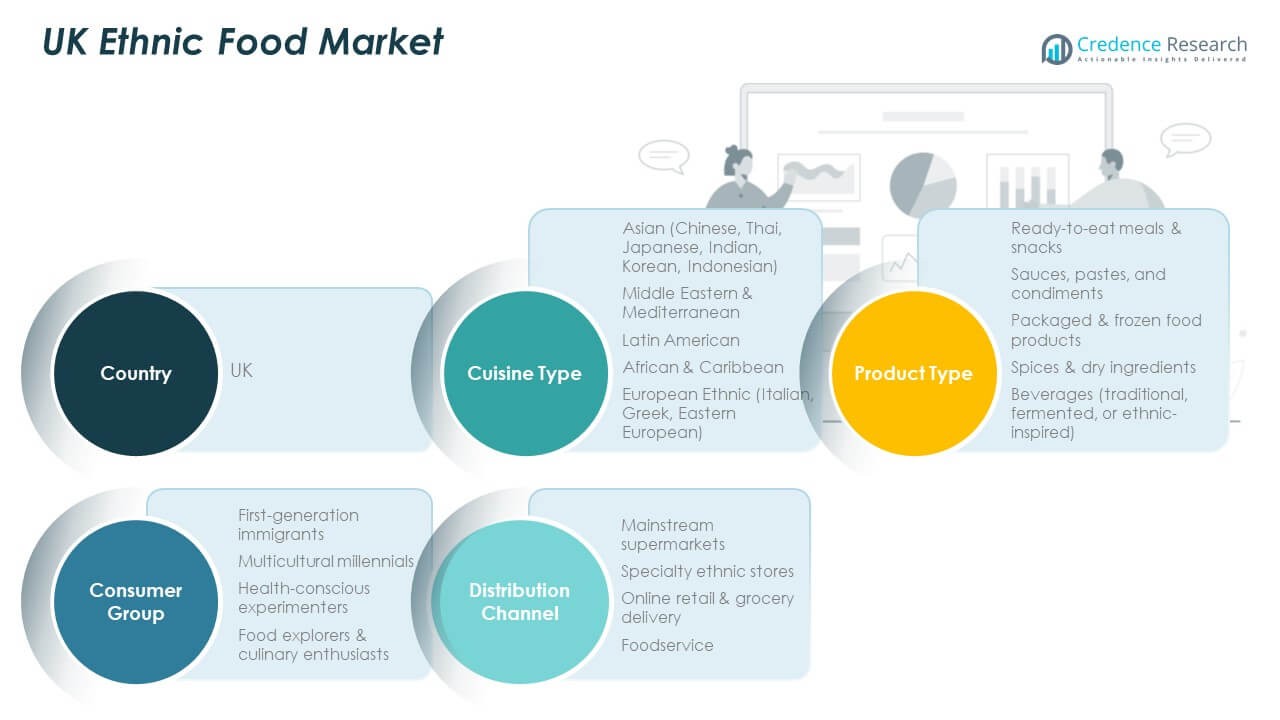

Market Segmentation Analysis

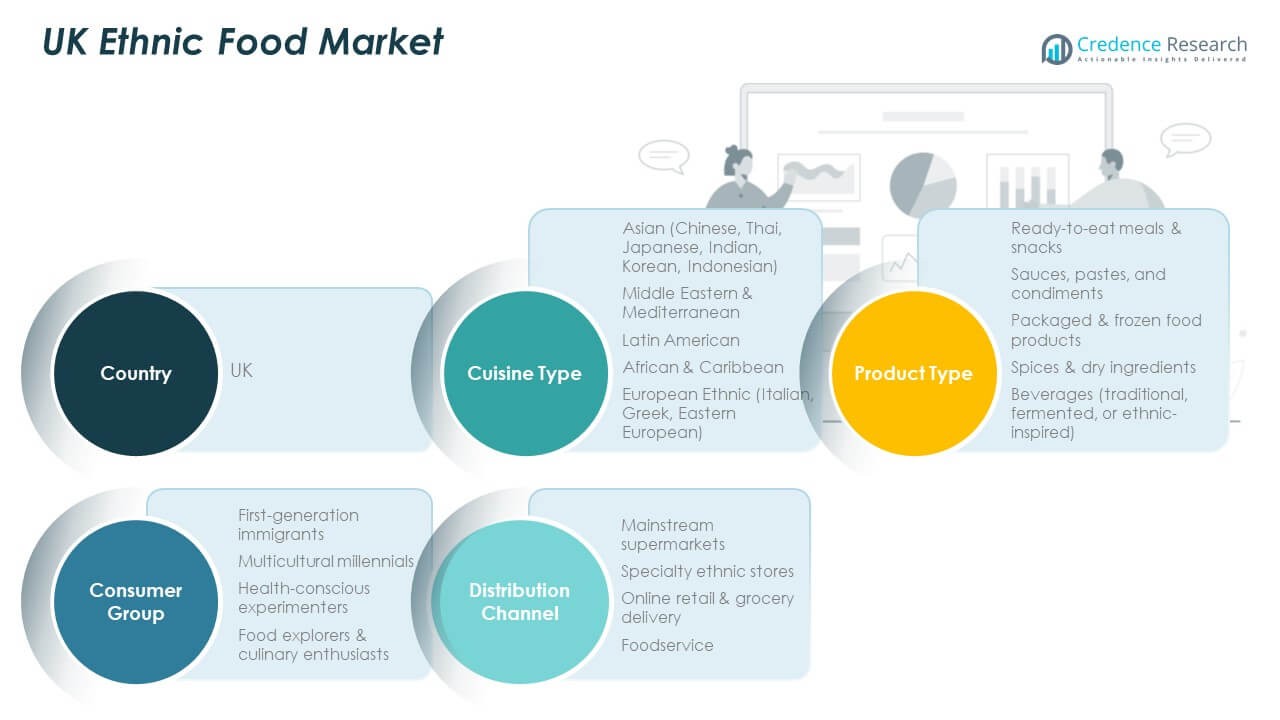

By Cuisine Type

The UK Ethnic Food Market records strong dominance from Asian cuisines such as Chinese, Indian, Thai, and Japanese. It benefits from their deep cultural presence and familiarity among UK consumers. Middle Eastern and Mediterranean dishes gain steady adoption for their healthy ingredients and versatile flavors. Latin American, African, and Caribbean cuisines attract growing interest from younger demographics exploring global foods. European ethnic varieties, including Italian and Greek, maintain consistent consumption across households. The diversity across these cuisines enhances the market’s resilience and culinary appeal.

By Product Type

Ready-to-eat meals and snacks lead demand due to convenience and wide retail availability. Sauces, pastes, and condiments secure strong sales through household cooking and restaurant use. Packaged and frozen ethnic food products grow in urban centers with fast-paced lifestyles. Spices and dry ingredients remain essential for authentic home preparation. Traditional and ethnic-inspired beverages expand through restaurants and specialty retailers. The product mix highlights rising preference for authenticity and quick meal solutions.

- For example, Capital Foods, maker of Ching’s Secret, is a leading Indian company known for sauces, noodles, and ready-to-eat products exported to markets including the UK. In early 2024, Tata Consumer Products acquired a majority stake in Capital Foods to strengthen its packaged-food portfolio and expand international reach.

By Consumer Group

First-generation immigrants remain key consumers sustaining cultural food traditions. Multicultural millennials contribute heavily by embracing diverse cuisines in daily diets. Health-conscious experimenters prefer ethnic meals made from clean-label and plant-based ingredients. Food explorers and culinary enthusiasts expand consumption through travel and global exposure. The UK Ethnic Food Market captures these evolving consumption habits to maintain consistent category growth.

By Distribution Channel

Mainstream supermarkets dominate with extended ethnic food aisles and private labels. Specialty ethnic stores continue to attract loyal community shoppers. Online retail and grocery delivery platforms rise rapidly through convenience and nationwide access. Foodservice outlets and restaurants expand ethnic menu offerings to meet growing demand. Each channel reinforces broader accessibility and strengthens product visibility across regions.

- For example, Tesco, one of the UK’s largest supermarket chains, continues to expand its ethnic food range through dedicated aisles and private-label offerings. Its 2024 annual report confirms ongoing investment in ethnic product categories, enhancing nationwide accessibility and supporting strong growth within the UK Ethnic Food Market.

Segmentation

By Cuisine Type

- Asian (Chinese, Thai, Japanese, Indian, Korean, Indonesian)

- Middle Eastern & Mediterranean

- Latin American

- African & Caribbean

- European Ethnic (Italian, Greek, Eastern European)

By Product Type

- Ready-to-eat meals & snacks

- Sauces, pastes, and condiments

- Packaged & frozen food products

- Spices & dry ingredients

- Beverages (traditional, fermented, or ethnic-inspired)

By Consumer Group

- First-generation immigrants

- Multicultural millennials

- Health-conscious experimenters

- Food explorers & culinary enthusiasts

By Distribution Channel

- Mainstream supermarkets

- Specialty ethnic stores

- Online retail & grocery delivery

- Foodservice

Regional Analysis

The UK Ethnic Food Market is heavily weighted in England, which commands approximately 70 % of total revenue. England’s dominance stems from dense urban centres with diverse populations and extensive retail networks. It draws strong demand from multicultural hubs such as London, the West Midlands and the North West. The concentration of supermarkets, foodservice outlets and online delivery platforms in these areas supports widespread access to ethnic food products. Investment in logistics and rapid distribution helps maintain supply across metropolitan and suburban zones. Retailers increasingly tailor assortments to local demographic profiles, reinforcing England’s leading position.

Scotland holds around 9 % share in the market, with Glasgow and Edinburgh acting as primary demand centres. It benefits from growth in tourism, international students and independent food-service businesses offering ethnic cuisine. It faces somewhat lower population density compared to England, but strong cultural food interest offsets this constraint. Regional retail chains and niche online platforms support ethnic food penetration beyond major cities. Food-service growth aligns with rising consumer willingness to try new global dishes. Local sourcing and promotional events further boost ethnic food adoption in Scotland.

Wales and Northern Ireland together contribute the remaining circa 21 % of market share, with Wales at roughly 15 % and Northern Ireland around 6 %. Wales sees gradual growth led by Cardiff, Swansea and Newport, where diverse communities and university populations support demand. Northern Ireland’s smaller size limits overall volume, but Belfast and other urban centres show rising interest in ethnic foods. Both regions show scope for expansion due to less saturation of ethnic-food offerings in retail and foodservice. Online delivery platforms bridge accessibility gaps in rural areas, enabling growth into less developed markets.

Key Player Analysis

- Euro Foods (UK) Ltd

- Patak’s

- Sharwood’s

- Ambala Foods (Ambala Sweets)

- Oseyo

- Flying Goose Brand

- Blue Dragon (AB World Foods)

- KTC Edibles Ltd

- Laila Foods

- TRS Wholesale Co. Ltd

Competitive Analysis

The market features a mix of large international food conglomerates and specialised regional players. Companies such as Associated British Foods PLC, General Mills, Inc., Ajinomoto Co., Inc. and McCormick & Company, Incorporated hold strong positions thanks to extensive product portfolios and broad retail distribution networks. These firms deploy strategies that emphasise brand recognition, retail shelf placement, and strategic partnerships with ethnic-food specialists. Small and mid-sized regional importers and manufacturers compete by focusing on authenticity, niche cuisines, and community-based supply chains. It intensifies competition because these niche players often respond faster to changing consumer preferences and regional demand patterns. Retailers push private-label ethnic food lines, which places pricing pressure on branded players and erodes margins. To maintain market share, leading companies invest in supply-chain optimisation, packaging innovation and digital commerce channels. The competitive environment remains moderately concentrated, yet dynamic, with new entrants and niche brands steadily increasing their presence in the market.

Recent Developments

- In May 2025, Greencore announced plans to purchase Bakkavor, a chilled food specialist, for £1.2 billion, creating a large UK food business with combined revenues of £4 billion. This acquisition is significant in the convenience food segment, which includes ethnic ready meals and snacks, reflecting ongoing consolidation and expansion in the UK ethnic food market.

- In March 2025, Cake Box Holdings plc agreed to acquire Ambala Foods Limited, an Asian sweet treat specialist, in a £22 million deal. This acquisition included £16 million for the Ambala brand and £6 million for its 42,000 sq ft production facility in Welwyn Garden City.

- In January 2025, Waitrose expanded its PlantLiving range with new and improved vegan ready meals and nutrient-dense products like Vegetable Tikka Masala & Rice and Creamy Spinach Ravioli, responding to growing consumer demand for plant-based convenience foods in the UK ethnic food market. This reflects a trend toward healthier, culturally diverse ready meals.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Cuisine Type, Product Type, Consumer Group and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for authentic global cuisines will strengthen as cultural diversity continues shaping consumer behavior.

- Product innovation in plant-based, gluten-free, and low-sodium ethnic foods will drive premium positioning.

- Retail expansion across both physical and digital platforms will improve product visibility and accessibility.

- Ready-to-eat and frozen ethnic meals will gain higher adoption from urban working households.

- Collaborations between ethnic brands and mainstream retailers will boost national reach and customer trust.

- Sustainable sourcing and eco-friendly packaging practices will grow in importance among conscious consumers.

- Foodservice operators will expand ethnic offerings in quick-service and casual dining formats.

- Social media engagement will influence taste exploration and recipe experimentation among younger demographics.

- Increased import diversification will stabilize ingredient supply chains and reduce cost fluctuations.

- The UK Ethnic Food Market will evolve toward broader inclusion of hybrid and fusion cuisines to sustain consumer excitement.