Market Overview

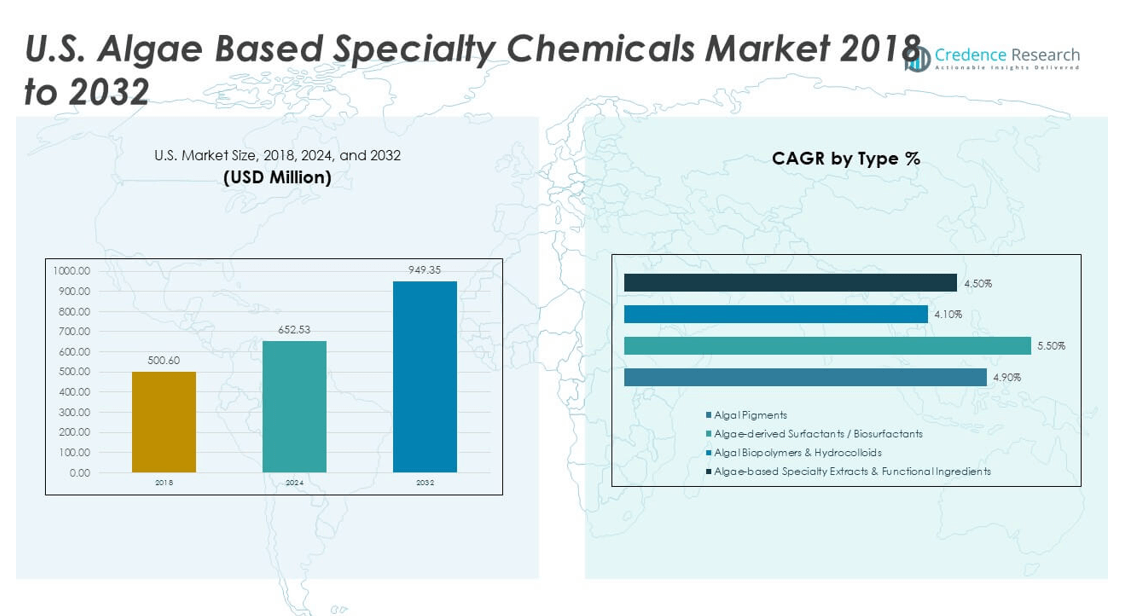

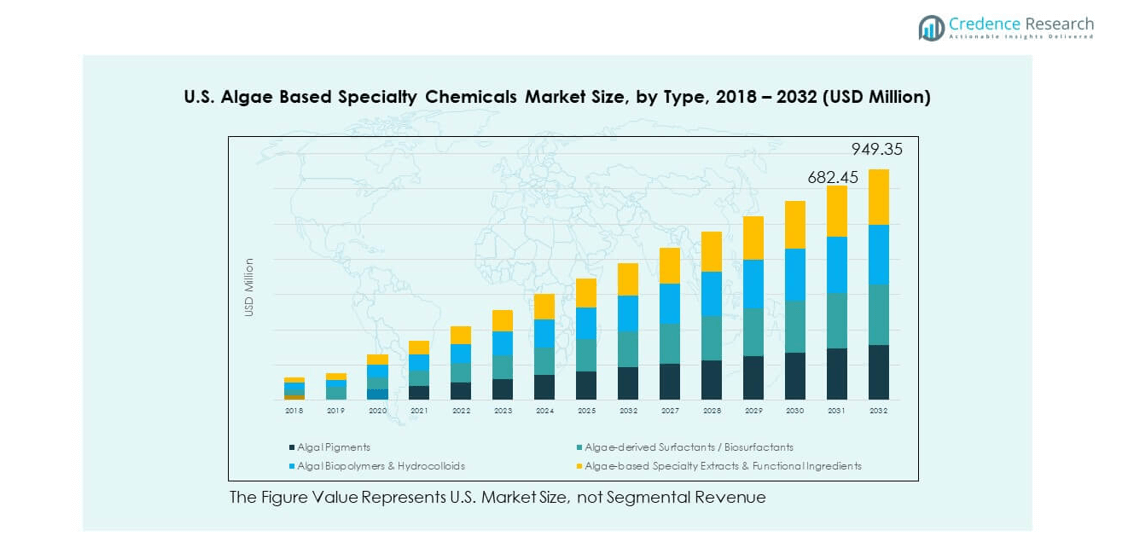

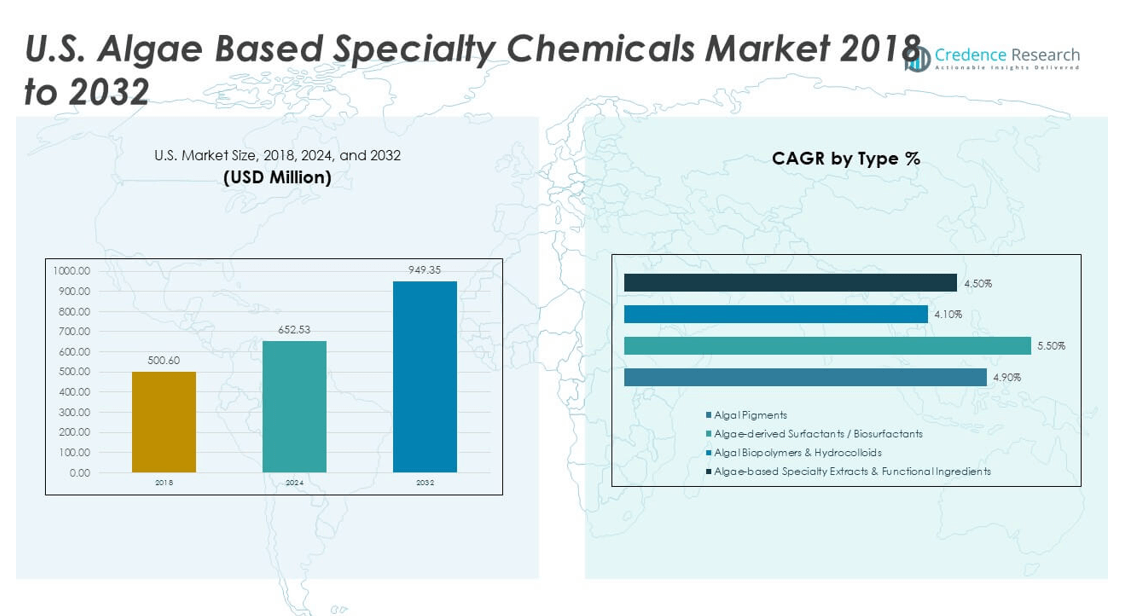

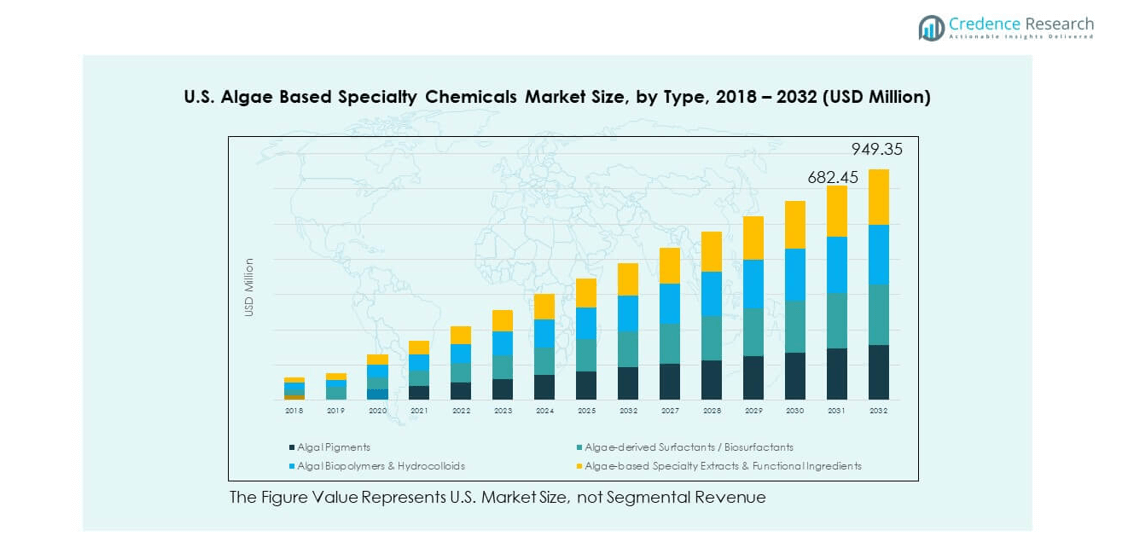

The U.S. Algae Based Specialty Chemicals Market size was valued at USD 500.6 million in 2018 to USD 652.53 million in 2024 and is anticipated to reach USD 949.35 million by 2032, at a CAGR of 4.88% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Algae Based Specialty Chemicals Market Size 2024 |

USD 79.91 million |

| U.S. Algae Based Specialty Chemicals Market, CAGR |

4.88% |

| U.S. Algae Based Specialty Chemicals Market Size 2032 |

USD 114.04 million |

The market is driven by rising demand for sustainable and bio-based solutions across food, nutraceutical, pharmaceutical, and cosmetic industries. Manufacturers are adopting algae-derived specialty chemicals due to their functional benefits, biodegradability, and ability to replace synthetic inputs. It gains momentum from government initiatives promoting green chemistry and carbon reduction goals. Innovations in cultivation and processing technologies strengthen supply consistency and reduce costs, enhancing adoption in mainstream applications. Increasing consumer preference for natural, safe, and clean-label products further supports expansion in multiple end-use industries.

Regionally, the Northeast leads due to strong pharmaceutical and nutraceutical clusters supported by advanced R&D infrastructure. The Midwest shows steady growth with applications in agriculture and bio-based manufacturing, driven by extensive farming activity and sustainability initiatives. It records significant growth in the West and South, supported by biotechnology hubs in California and industrial activities in Texas. The West benefits from innovation in cosmetics and personal care, while the South builds strength in industrial cleaning and aquaculture. Collectively, these subregions provide a balanced market footprint, ensuring that growth opportunities remain diverse across the U.S.

Market Insights

- The U.S. Algae Based Specialty Chemicals Market was valued at USD 500.6 million in 2018, reached USD 652.53 million in 2024, and is projected to touch USD 949.35 million by 2032, growing at a CAGR of 4.88%.

- The Northeast held 34% share, supported by strong pharmaceutical and nutraceutical clusters, while the Midwest accounted for 29% with agricultural and bio-based manufacturing, and the West & South collectively captured 37% with leadership in biotechnology and industrial applications.

- The fastest-growing subregion is the West, driven by California’s biotechnology ecosystem and high consumer demand for algae-based cosmetics and personal care products.

- Algal pigments represented 36% of the market in 2024, driven by demand in food, cosmetics, and nutraceuticals for natural colorants.

- Algae-based specialty extracts and functional ingredients held 28% share, supported by rising adoption in nutraceuticals, pharmaceuticals, and wellness-oriented product lines.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Sustainable and Eco-Friendly Alternatives

The U.S. Algae Based Specialty Chemicals Market benefits from a strong demand for bio-based alternatives that replace petroleum-derived inputs. Industries across food, cosmetics, pharmaceuticals, and agriculture increasingly adopt algae-derived solutions to align with sustainability goals. Algae-based chemicals offer biodegradability, low environmental impact, and versatile functionality, which improve their adoption across industrial applications. Strong consumer preference for natural and safe products drives significant use in nutraceuticals and personal care. Government policies encouraging green chemistry further support expansion. Manufacturers focus on scaling production capacities to meet industry requirements. Rising corporate commitments to carbon neutrality accelerate algae-based chemical adoption. It positions the market as a key contributor to sustainable innovation.

- For instance, by late 2019, BioMar had produced over 500,000 tonnes of salmon feed containing Corbion’s AlgaPrime™ DHA in Norway. This algae-based omega-3 ingredient enhances fish omega-3 content while reducing dependence on wild-caught fish oil, directly supporting sustainable aquaculture practices.

Growing Pharmaceutical and Nutraceutical Applications Boosting Market Penetration

The pharmaceutical and nutraceutical sectors are key drivers of algae-based specialty chemical demand. Algal compounds offer functional bioactive properties that support drug formulations, dietary supplements, and advanced health products. It provides antioxidants, proteins, and essential fatty acids suitable for clinical and consumer applications. Healthcare trends emphasizing preventive care push growth in functional ingredients sourced from algae. High bioavailability and clean-label appeal make algae-based inputs highly competitive. Strategic collaborations between biotech firms and pharmaceutical companies increase investments in algae-focused R&D. These collaborations enhance innovation and improve supply chain integration. The U.S. Algae Based Specialty Chemicals Market strengthens its position with rising penetration into medical and wellness products.

Advancements in Large-Scale Cultivation and Processing Technologies

Technological innovation in cultivation and processing significantly improves production efficiency for algae-based specialty chemicals. Improved photobioreactors, open pond systems, and hybrid cultivation models allow consistent quality output. Automation in harvesting and extraction reduces operational costs, driving large-scale production capabilities. Enhanced technologies increase yield predictability, which helps manufacturers maintain stable supply chains. It enables production at competitive costs, improving commercial viability. The integration of renewable energy in algae farms supports sustainable scaling of operations. Industry stakeholders invest in infrastructure that minimizes energy consumption and maximizes extraction efficiency. Advanced processing technologies position algae-based products as reliable alternatives in multiple industries.

Supportive Regulatory Environment and Policy Frameworks

Government regulations promoting bio-based products strengthen the foundation of this market. Policies supporting green chemistry encourage manufacturers to transition from synthetic inputs to natural substitutes. Funding for research programs helps advance algae-focused technologies and applications. The U.S. Department of Energy and related institutions support initiatives to scale algae-based production. It provides a regulatory environment that ensures long-term sustainability for companies investing in algae-based chemicals. Stringent environmental standards create demand for alternatives with lower carbon footprints. Businesses receive benefits for complying with sustainable practices, further encouraging adoption. The U.S. Algae Based Specialty Chemicals Market gains resilience through alignment with evolving environmental and regulatory mandates.

- For example, in November 2024, the U.S. Department of Energy announced $20.2 million in new project grants to 10 university and industry teams to advance mixed algae development for low-carbon biofuels and bioproducts. These projects aim to convert algae, seaweeds, and wet waste feedstocks into sustainable fuels, chemicals, and agricultural bioproducts, helping decarbonize U.S. transportation and industry.

Market Trends

Expansion of Algae-Derived Ingredients in Personal Care and Cosmetics

The U.S. Algae Based Specialty Chemicals Market experiences strong adoption across skincare, haircare, and cosmetic applications. Algae-derived pigments, antioxidants, and moisturizing agents appeal to consumers seeking natural and effective formulations. High demand for premium beauty products boosts research into algae-based actives. Brands highlight algae as a sustainable and innovative ingredient, enhancing consumer trust. It contributes to product differentiation in a competitive personal care market. Marketing campaigns emphasize eco-friendly sourcing and multifunctional properties of algae. Cosmetic companies increasingly partner with biotech firms for algae-based formulations. This trend reinforces algae-based chemicals as a mainstream component in beauty innovation.

Integration of Algae-Based Solutions in Agriculture and Crop Protection

Agricultural applications emerge as a growing trend within this market. Algae-based specialty chemicals provide bio-stimulants that improve soil health and crop productivity. Farmers adopt algae-derived formulations to enhance yields while reducing reliance on synthetic fertilizers. It helps achieve sustainable farming practices aligned with global environmental goals. Algae extracts also demonstrate benefits in pest and disease resistance. Rising concerns over soil degradation encourage broader use in regenerative farming. Industry players develop customized algae-based solutions tailored for diverse crops. The U.S. Algae Based Specialty Chemicals Market advances by addressing agricultural sustainability and productivity challenges.

Adoption of Algae-Based Inputs in Industrial and Energy Applications

Algae-based specialty chemicals find new relevance in lubricants, coatings, and energy-related products. Manufacturers incorporate algae oils and extracts in formulations designed for performance and eco-safety. It offers thermal stability, biodegradability, and renewable sourcing advantages. Industrial users explore algae-based inputs to meet regulatory compliance and sustainability standards. Research institutions test algae derivatives for renewable fuel blends and chemical substitutes. This adoption broadens applications beyond traditional food and healthcare markets. Strategic partnerships between energy firms and biotech players accelerate commercialization. Algae-based chemicals strengthen their role in industrial sustainability strategies.

- For instance, in April 2024, DIC Corporation began customer testing of its algae-oil-based EP additive DAILUBE™ KS-519, developed with Checkerspot Inc. The additive demonstrated strong lubricity, high oxidation stability, and sustainability advantages over conventional vegetable and lard-oil types.

Rising Focus on Algae Pigments and Natural Colorants

The market witnesses a growing trend toward algae-derived pigments and natural dyes. Food and beverage manufacturers seek clean-label alternatives to synthetic colorants. Algae pigments such as phycocyanin and astaxanthin deliver vibrant and stable natural coloring options. It meets consumer demand for safer, naturally sourced food additives. Growing scrutiny of artificial additives drives rapid adoption of algae pigments. Innovations improve pigment stability in varying processing conditions. Cosmetic and textile industries also expand use of algae-based colorants. The U.S. Algae Based Specialty Chemicals Market gains momentum through innovation in natural pigment solutions.

- For instance, in March 2024, Sun Chemical launched SACRANEX™, a skincare ingredient from Suizenji Nori algae with strong moisturizing benefits. In December 2023, it also introduced SunPURO™ Natural Carotene O N70-2317, an orange-red colorant from Dunaliella salina algae, highlighting its commitment to sustainable algae-based solutions in cosmetics and personal care.

Market Challenges Analysis

High Production Costs and Commercialization Barriers

The U.S. Algae Based Specialty Chemicals Market faces high costs associated with cultivation, harvesting, and processing. Advanced cultivation systems require significant investment in infrastructure, limiting scalability for small firms. Energy-intensive harvesting and drying processes raise operational expenses. It creates challenges in maintaining competitive pricing against synthetic chemicals. Market penetration is restricted due to cost barriers in large-volume industries such as agriculture. Limited access to low-cost feedstock and uneven supply chains further complicate growth. High upfront capital investment discourages new entrants, slowing competitive diversification. Long payback periods challenge commercial feasibility and hinder rapid adoption.

Limited Awareness and Technical Knowledge Among End Users

A major challenge lies in limited awareness of algae-based specialty chemical benefits among industrial users. Many industries remain hesitant due to knowledge gaps in application versatility. It restricts adoption in sectors where algae-based solutions could replace synthetic inputs. Technical expertise in handling algae-derived materials is still under development. Inconsistent quality standards raise concerns over performance reliability across industries. The absence of standardized guidelines complicates cross-industry integration. Education and outreach programs remain limited, slowing consumer and corporate acceptance. The U.S. Algae Based Specialty Chemicals Market must address these gaps to achieve broader mainstream adoption.

Market Opportunities

Expanding Scope in Functional Foods and Dietary Supplements

The U.S. Algae Based Specialty Chemicals Market holds strong opportunities in the functional food and supplement sector. Rising consumer focus on health and wellness creates demand for algae-based proteins, antioxidants, and essential fatty acids. It provides manufacturers with natural, nutrient-rich options to fortify food and beverage formulations. Growth in vegan and plant-based diets further supports algae-based innovation. Strategic alliances between nutraceutical companies and biotech firms strengthen product pipelines. Increasing investment in algae cultivation ensures consistent supply for the supplement industry. Market players can expand offerings by targeting consumer segments seeking holistic nutrition. This opportunity cements algae as a high-value functional ingredient source.

Emerging Role in Advanced Bioplastics and Sustainable Materials

Algae-based specialty chemicals demonstrate strong potential in bioplastics, coatings, and packaging materials. It offers renewable alternatives to petroleum-based plastics, supporting circular economy goals. Growing regulations restricting single-use plastics accelerate adoption of algae-derived biopolymer solutions. Manufacturers explore applications in biodegradable packaging, films, and coatings. Strategic R&D investments enhance durability and processability of algae-based materials. Global brands seek eco-friendly packaging to meet corporate sustainability commitments. The U.S. Algae Based Specialty Chemicals Market can leverage this trend to expand into advanced materials. These opportunities create new growth pathways and long-term competitive advantages for industry players.

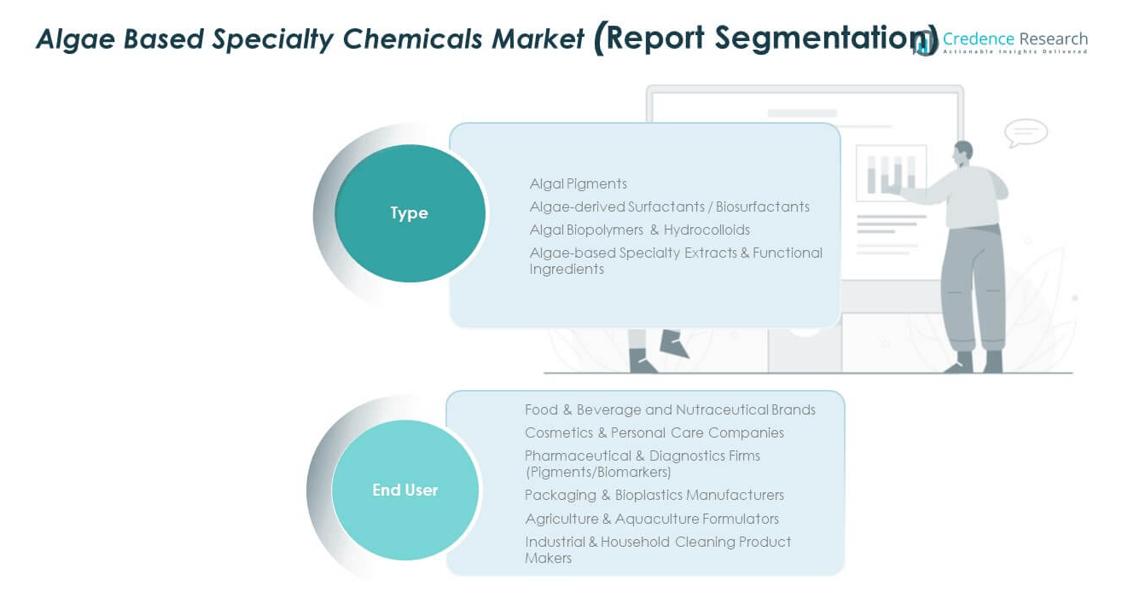

Market Segmentation Analysis

By type, the U.S. Algae Based Specialty Chemicals Market is segmented into algal pigments, algae-derived surfactants, algal biopolymers and hydrocolloids, and algae-based specialty extracts. Algal pigments dominate due to strong demand in food, beverage, and cosmetic industries for natural colorants. Algae-derived surfactants gain adoption in personal care and cleaning applications for their biodegradability and mild properties. Biopolymers and hydrocolloids expand through packaging, food texturizers, and pharmaceutical stabilizers. Specialty extracts and functional ingredients see rising use in nutraceuticals and wellness-focused formulations. It creates a balanced portfolio of offerings across diverse industries.

- For instance, Algatech Ltd. offers AstaPure® natural astaxanthin from Haematococcus pluvialis, including microencapsulated formats designed for use in functional foods, beverages, and dietary supplements. These innovations improve stability and solubility, supporting wider adoption of algae-based pigments in health and nutrition markets.

By end user, the U.S. Algae Based Specialty Chemicals Market is segmented into food and beverage, cosmetics and personal care, pharmaceutical and diagnostics, packaging and bioplastics, agriculture and aquaculture, and industrial and household cleaning. Food and beverage, along with nutraceutical brands, lead due to demand for natural proteins, pigments, and functional compounds. Cosmetics and personal care companies integrate algae ingredients for skin health and eco-friendly positioning. Pharmaceutical firms adopt algal pigments and biomarkers for advanced formulations. Packaging and bioplastics manufacturers use algae-based biopolymers to meet sustainability goals. Agriculture and aquaculture adopt bio-stimulants for productivity, while cleaning product makers focus on algae-derived surfactants for safer alternatives. It strengthens overall market diversity and ensures growth across multiple verticals.

- For instance, Corbion’s AlgaPrime™ DHA has been incorporated into Atlantic salmon feed through the Millennial Salmon Project, involving partners such as Cargill and MOWI. Trials reported in 2024 confirmed stable feed performance, good digestibility, and improved omega-3 profiles, supporting sustainability in aquaculture.

Segmentation

By Type

- Algal Pigments

- Algae-derived Surfactants / Biosurfactants

- Algal Biopolymers & Hydrocolloids

- Algae-based Specialty Extracts & Functional Ingredients

By End User

- Food & Beverage and Nutraceutical Brands

- Cosmetics & Personal Care Companies

- Pharmaceutical & Diagnostics Firms (Pigments / Biomarkers)

- Packaging & Bioplastics Manufacturers

- Agriculture & Aquaculture Formulators

- Industrial & Household Cleaning Product Makers

Regional Analysis

Northeast Region

The Northeast holds a market share of 34% in the U.S. Algae Based Specialty Chemicals Market, driven by strong demand from pharmaceuticals and nutraceutical sectors. Leading biotech hubs in Massachusetts and New Jersey support advanced algae research and commercialization. High consumer preference for natural products fuels adoption in cosmetics and personal care. It benefits from well-established academic collaborations that strengthen innovation pipelines. Companies in the region invest in algae-based solutions for dietary supplements and medical applications. Regulatory support for bio-based industries also drives sustained growth in the Northeast subregion.

Midwest Region

The Midwest accounts for 29% of the U.S. Algae Based Specialty Chemicals Market, largely supported by agriculture and bio-based manufacturing. States such as Iowa and Illinois lead in algae cultivation projects tied to sustainable farming. It supports growth through demand for algae-based fertilizers and crop-enhancing formulations. The strong agricultural base ensures integration of algae inputs into farming practices. Regional universities contribute to research on large-scale cultivation technologies. Bioplastics and packaging applications also expand due to regional demand for sustainable industrial products. Market expansion is reinforced by investment in renewable chemical production.

West and South Regions

The West and South collectively capture 37% of the U.S. Algae Based Specialty Chemicals Market, with California and Texas as primary growth hubs. California’s biotechnology ecosystem and strong personal care industry drive algae-based innovation. Texas leverages energy research to explore algae-derived industrial chemicals and lubricants. It benefits from growing investment in food, beverage, and aquaculture industries. Rising consumer interest in vegan and clean-label products supports algae adoption in the West. The South expands through collaborations with industrial cleaning and specialty chemical manufacturers. These regions demonstrate strong potential for long-term growth supported by research and industrial demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- CABB Chemicals

- BASF SE

- I.D. Parry (Parry Nutraceuticals)

- Cyanotech Corporation

- Earthrise Nutritionals

- Algatechnologies (Algatech)

- CP Kelco

- Cargill

- AlgaEnergy

- Other Key Players

Competitive Analysis

The U.S. Algae Based Specialty Chemicals Market is characterized by intense competition among multinational corporations and specialized biotech firms. Key players such as BASF SE, Cargill, and CP Kelco dominate through diversified portfolios and global supply networks. Smaller players like Cyanotech Corporation, Earthrise Nutritionals, and Algatechnologies focus on niche segments such as pigments and nutraceutical ingredients. It experiences steady consolidation with acquisitions and partnerships aimed at scaling production and enhancing product pipelines. Companies invest heavily in R&D to improve cultivation efficiency and expand end-use applications across cosmetics, pharmaceuticals, and agriculture. Strategic expansions in the U.S. highlight a clear shift toward sustainable, high-value algae-derived solutions that strengthen competitive positioning in this emerging market.

Recent Developments

- In July 2025, CABB Group entered a partnership with the green chemicals company Origin by Ocean to launch what they called the world’s first algae-derived specialty chemical produced at an industrial scale. This initiative is targeted at expanding algae-based chemical adoption in the North American market, including the United States, leveraging the partnership’s combined bioprocessing expertise to create more sustainable solutions for food, cosmetics, and pharmaceuticals.

- In March 2025, Earthrise Nutritionals, a subsidiary of DIC Corporation, completed the launch of a new edible algae cultivation facility in California, implementing sustainable smart farming practices to boost production of Spirulina and other specialty algae ingredients. This move reflects strategic expansion by a leading U.S. microalgae player focused on meeting the rising demand for algae-based chemicals in wellness, supplement, and nutraceutical applications.

- In February 2025, GC Rieber VivoMega introduced a new product called Algae 1060 TG Premium, a specialty algae-based DHA and EPA supplement designed for easy integration into various dietary supplement and functional food formulations within the U.S. market. The launch aimed to address growing demand for plant-based omega-3s among consumers seeking sustainable alternatives to traditional fish oils.

Report Coverage

The research report offers an in-depth analysis based on Type and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The U.S. Algae Based Specialty Chemicals Market will expand steadily as industries transition toward sustainable alternatives.

- Innovation in cultivation and processing will reduce production costs and support broader commercialization.

- Rising applications in nutraceuticals and pharmaceuticals will strengthen growth in health-focused product segments.

- Demand from cosmetics and personal care will intensify with consumer preference for natural and eco-friendly ingredients.

- Agricultural and aquaculture applications will gain traction as algae-based inputs enhance soil and crop performance.

- Industrial adoption will rise in bioplastics, coatings, and lubricants, creating new commercial opportunities.

- Expanding R&D investments will generate advanced formulations with higher efficiency and functionality.

- Strategic partnerships and acquisitions will accelerate market penetration and strengthen competitive positioning.

- Regional ecosystems in the Northeast and West will continue to drive innovation and market leadership.

- Supportive regulations and policies will reinforce long-term growth and increase investor confidence.