Market Overview

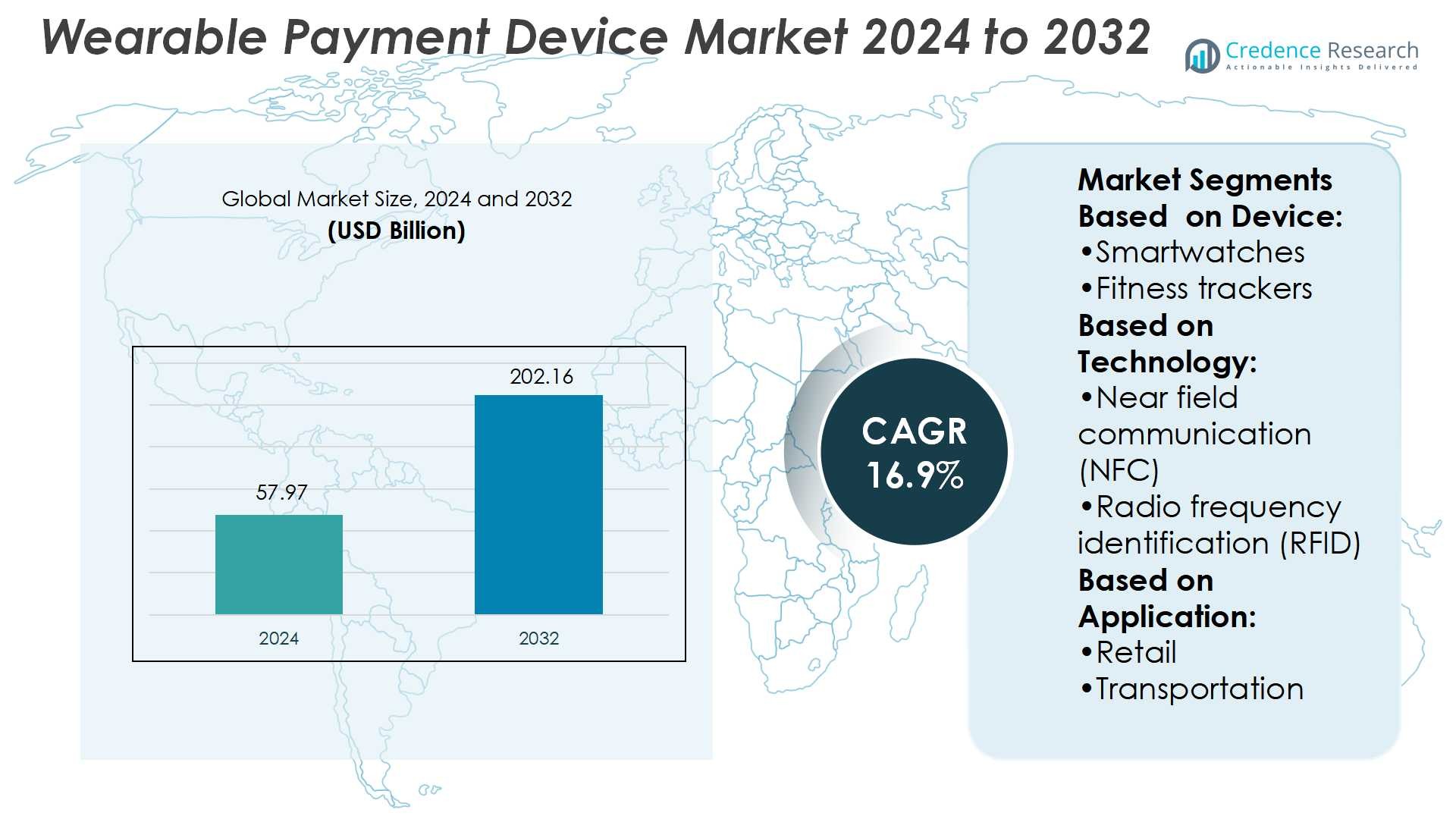

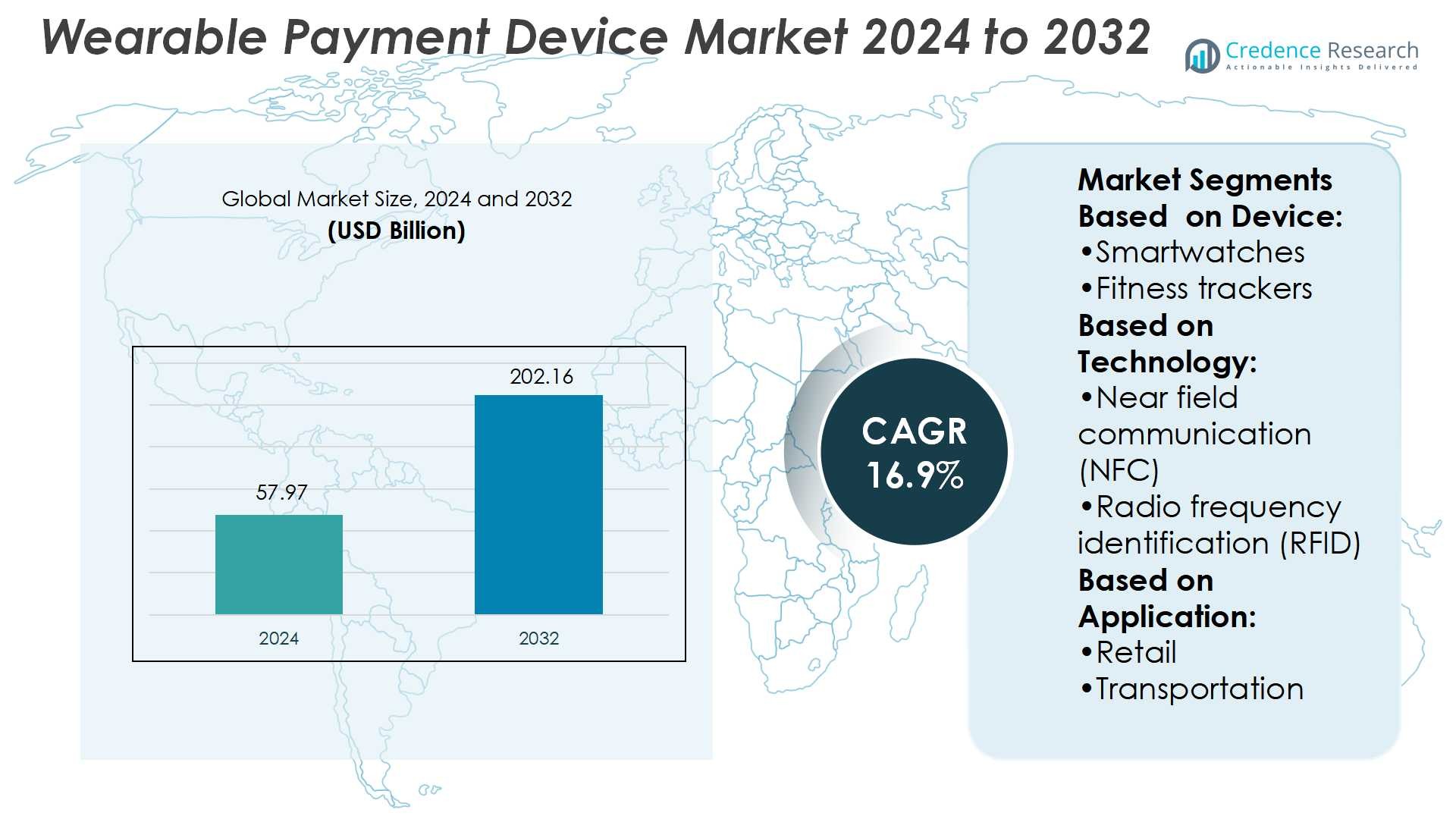

Wearable Payment Device Market size was valued USD 57.97 billion in 2024 and is anticipated to reach USD 202.16 billion by 2032, at a CAGR of 16.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wearable Payment Device Market Size 2024 |

USD 57.97 Billion |

| Wearable Payment Device Market, CAGR |

16.9% |

| Wearable Payment Device Market Size 2032 |

USD 202.16 Billion |

The wearable payment device market is shaped by top players including Apple Inc., Samsung Electronics Co., Ltd., Google LLC, Huawei Technologies Co., Ltd., Xiaomi Corporation, Garmin Ltd., PayPal Holding Inc., Mastercard, Inc., VISA Inc., and Thales SA. These companies drive growth through ecosystem integration, secure transaction platforms, and innovative wearable designs that enhance user convenience. Apple, Samsung, and Google dominate the smartwatch-based payment segment, while VISA and Mastercard provide the backbone for global acceptance networks. Regionally, North America leads the market with a 34% share, supported by advanced payment infrastructure, high consumer adoption of smart devices, and strong presence of global technology leaders.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The wearable payment device market was valued at USD 57.97 billion in 2024 and will reach USD 202.16 billion by 2032, growing at a CAGR of 16.9%.

- Increasing demand for contactless transactions and integration of secure payment technologies are key drivers supporting rapid adoption across consumer segments.

- The market shows strong trends toward biometric authentication, fashion-tech collaborations, and ecosystem-based offerings that combine payments with health, communication, and fitness features.

- Competition is shaped by players such as Apple, Samsung, Google, Huawei, Xiaomi, Garmin, PayPal, VISA, Mastercard, and Thales, with smartwatch-based payment devices holding the largest share.

- North America leads with 34% share due to advanced infrastructure and strong consumer adoption, followed by Europe with 28% share, while Asia-Pacific holds 25% and remains the fastest-growing region with increasing penetration of digital wallets and affordable wearable devices.

Market Segmentation Analysis:

By Device

Smartwatches dominate the wearable payment device market, holding the largest share due to their multifunctionality. They integrate payment solutions with health tracking, messaging, and navigation, making them highly versatile. Consumer preference for all-in-one devices, coupled with strong brand adoption by Apple and Samsung, drives this dominance. Fitness trackers also hold significant adoption in the low-cost segment, while smart rings and payment wristbands cater to niche users focused on convenience and fashion. The expanding use of contactless payments continues to strengthen smartwatch-led growth.

- For instance, Garmin Pay allows a single smartwatch to have up to 10 credit or debit cards stored in its wallet. Garmin devices require entering a four-digit passcode to unlock payment and suspend payments if incorrect passcode entered three times.

By Technology

Near Field Communication (NFC) leads the market with the highest share, supported by its reliability and global acceptance across retail and transit. NFC-based payments enable quick, secure, and tap-to-pay transactions, fueling adoption in developed economies. Major payment platforms like Apple Pay, Google Pay, and Samsung Pay rely heavily on NFC infrastructure. RFID and Bluetooth Low Energy (BLE) support specialized applications in access control and wearable connectivity. Meanwhile, QR codes and barcodes remain popular in emerging markets due to lower infrastructure costs.

- For instance, Visa Tap to Phone has seen 200% growth globally in usage by sellers, allowing small and midsize businesses to accept NFC contactless payments using only their smartphones.

By Application

Retail represents the dominant application segment, accounting for the largest market share, as contactless transactions accelerate in supermarkets, convenience stores, and e-commerce. Retailers invest in compatible terminals, boosting consumer adoption of wearable payments. Transportation follows as another critical segment, where wearable payments streamline ticketing in metro systems, buses, and ride-sharing services. Healthcare is an emerging application, where wearable payments support hospital cafeterias, pharmacies, and staff convenience. The increasing adoption of digital payment ecosystems ensures retail maintains leadership, while transportation shows strong growth potential.

Key Growth Drivers

Rising Adoption of Contactless Payments

The growing consumer preference for fast, secure, and convenient transactions drives demand for wearable payment devices. Contactless solutions align with rising hygiene concerns and the shift toward cashless economies. Financial institutions and retailers are expanding NFC-enabled infrastructure, which supports widespread use. Governments in regions like Europe and Asia-Pacific actively promote digital payments, accelerating adoption. This trend benefits wearable device makers, who integrate secure payment features into smartwatches and fitness trackers, reinforcing their role in everyday consumer transactions.

- For instance, Apple recently expanded in-app NFC transaction support through its Secure Element technology across 7 countries, enabling developers to integrate NFC features directly within apps.

Integration of Wearables with Digital Ecosystems

Wearable payment devices increasingly function as part of broader digital ecosystems, enhancing their value. Brands like Apple, Samsung, and Garmin integrate payment, fitness, communication, and IoT features into unified platforms. This convergence increases user stickiness and boosts demand for multifunctional devices. Partnerships with banks and fintech providers strengthen device compatibility with global payment networks. The ecosystem-driven model encourages recurring engagement, enabling vendors to capture long-term revenue from services, upgrades, and data-driven offerings, thus driving sustained market expansion.

- For instance, Xiaomi Pay is supported by devices like the Xiaomi Watch S1 Pro, Xiaomi Smart Band 7 NFC, and Xiaomi Smart Band 6 NFC. It enables cashless payments with bank cards and is supported in over 34 countries and territories, though the exact availability can vary by product and region.

Expanding Penetration in Emerging Economies

Emerging markets present strong growth opportunities for wearable payment devices, driven by rising smartphone penetration and financial inclusion initiatives. Affordable product lines from Chinese brands and increased QR-based payment adoption widen accessibility. Governments in India, Brazil, and Southeast Asia promote cashless initiatives, encouraging acceptance of digital wallets and wearable transactions. As retail, transportation, and small merchants adopt low-cost payment terminals, consumer confidence in wearables grows. Expanding middle-class populations further support volume growth, positioning emerging economies as future demand hotspots.

Key Trends & Opportunities

Advancements in Biometric Authentication

The integration of biometric authentication, such as fingerprint and heart-rate pattern recognition, is gaining momentum in wearable payments. This trend enhances transaction security and reduces reliance on PINs or passwords. Companies explore advanced sensors that secure payments against fraud, increasing consumer trust. The combination of biometrics with NFC technology positions wearables as a safer alternative to cards or cash. Vendors leveraging biometric innovation strengthen market differentiation and open opportunities in high-security industries like healthcare and corporate access control.

- For instance, Mastercard Biometric Card is available in over 70 markets, enabling fingerprint templates stored securely on-card (not shared with merchant), compatible with EMV chip-enabled POS terminals.

Growth of Fashion-Tech Collaborations

Wearable payment devices increasingly focus on design appeal, fueling collaborations between technology providers and fashion brands. Smart rings, luxury wristbands, and designer smartwatches highlight this convergence. Consumers demand devices that combine functionality with aesthetics, especially in premium markets. Fashion-tech partnerships attract new customer segments and enhance brand visibility. This trend creates opportunities for companies to expand into lifestyle markets, where differentiation is based not only on payment features but also on style, personalization, and exclusivity.

- For instance, The Samsung Galaxy Watch8 offers a “Dynamic Lug System” that enables single-click band adjustment for a snug fit and a premium look. The case is available in two sizes—40 mm and 44 mm.

Expansion into Transportation Systems

Urban mobility solutions increasingly adopt wearable payments for seamless ticketing and fare collection. Metro, bus, and ride-hailing operators integrate NFC and QR-based payments into contactless infrastructure. This trend improves commuter convenience and reduces transaction bottlenecks in high-traffic systems. Government investments in smart city initiatives strengthen opportunities for wearable adoption. Transportation as an application area grows rapidly, enabling providers to capture large-scale, recurring transactions and demonstrating the scalability of wearable payments in public infrastructure ecosystems.

Key Challenges

Data Security and Privacy Concerns

Wearable payment devices face scrutiny regarding data security, as they store sensitive financial information. Cyberattacks, fraud risks, and data breaches can undermine consumer trust and slow adoption. Compliance with strict regulations such as GDPR and PCI DSS raises development costs for manufacturers. Ensuring end-to-end encryption and secure authentication is critical but resource-intensive. Companies that fail to address these challenges risk reputational damage and customer attrition, making cybersecurity investment a non-negotiable factor in sustaining market growth.

High Cost and Limited Awareness in Developing Markets

Despite expanding opportunities, high device costs and limited consumer awareness hinder adoption in developing economies. Premium smartwatches and branded devices remain unaffordable for large populations, restricting penetration to urban elites. Lack of education on payment features further limits uptake. Small merchants may resist upgrading infrastructure due to cost concerns, slowing ecosystem growth. Companies must address affordability and conduct awareness campaigns to unlock these markets. Without such initiatives, wearable payment adoption will remain uneven across global regions.

Regional Analysis

North America

North America leads the wearable payment device market with a 34% share, driven by strong adoption of digital payment ecosystems and advanced infrastructure. The presence of global technology leaders such as Apple, Garmin, and Fitbit enhances innovation and consumer trust. High disposable incomes, strong retail acceptance of NFC-enabled terminals, and partnerships with major banks support growth. The U.S. dominates regional revenue due to widespread smartwatch adoption and integration with platforms like Apple Pay and Google Pay. Canada contributes steadily, supported by cashless initiatives and favorable regulations promoting secure, contactless transactions across retail and transportation sectors.

Europe

Europe holds a 28% share of the wearable payment device market, supported by early adoption of contactless payment solutions and strict regulatory frameworks that ensure security. The U.K., Germany, and France lead in adoption, driven by strong financial networks and consumer preference for cashless payments. European banks actively collaborate with technology firms to expand wearable integration with digital wallets. Smartwatches dominate sales, while growing use of payment wristbands in transit and events highlights diversity. Government-led digital economy initiatives, coupled with the growing demand for convenience, sustain Europe’s market expansion across retail, healthcare, and public transportation.

Asia-Pacific

Asia-Pacific accounts for 25% of the wearable payment device market and is the fastest-growing region, fueled by rapid smartphone penetration and digital wallet adoption. Countries such as China, India, and Japan lead growth through expanding e-commerce, government cashless initiatives, and urban transit digitalization. QR code and NFC technologies dominate, supported by platforms like Alipay, WeChat Pay, and Paytm. Affordable wearables from brands such as Xiaomi and Huawei increase accessibility for mass consumers. The rising middle-class population, coupled with heavy investment in digital infrastructure, positions Asia-Pacific as a critical growth hub with significant long-term expansion potential.

Latin America

Latin America represents a 7% share of the wearable payment device market, with Brazil and Mexico driving adoption through fintech expansion and rising smartphone use. Government-backed financial inclusion initiatives and cashless payment campaigns encourage greater acceptance of wearable transactions. Retailers and transport operators increasingly invest in contactless infrastructure, particularly in urban centers. Affordable smartwatches and wristbands are gaining traction, while partnerships between local fintechs and global payment providers expand availability. Despite economic disparities and uneven infrastructure, the region shows strong potential for future growth as consumer awareness and payment acceptance increase steadily.

Middle East & Africa

The Middle East & Africa region holds a 6% share of the wearable payment device market, with growth driven by rising digital banking adoption and smart city projects. The UAE and Saudi Arabia lead adoption through strong government-led cashless initiatives and retail digitization. Increasing use of wearables for transit payments in metro and bus systems supports growth. Africa, led by South Africa and Nigeria, shows potential as mobile money adoption expands, though infrastructure gaps remain. With growing fintech penetration and rising consumer preference for convenience, the region is poised for gradual but steady adoption of wearable payments.

Market Segmentations:

By Device:

- Smartwatches

- Fitness trackers

By Technology:

- Near field communication (NFC)

- Radio frequency identification (RFID)

By Application:

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The wearable payment device market is highly competitive, shaped by leading players such as PayPal Holding Inc., Huawei Technologies Co., Ltd., Garmin Ltd., VISA Inc., Apple Inc., Xiaomi Corporation, Mastercard, Inc., Samsung Electronics Co., Ltd., Google LLC, and Thales SA. The wearable payment device market is characterized by intense competition, rapid technological innovation, and strong ecosystem integration. Companies compete by enhancing device functionality, improving transaction security, and expanding compatibility with global payment networks. Growth is fueled by the convergence of health monitoring, communication, and contactless payment features in multifunctional wearables. Strategic collaborations with financial institutions and retailers support wider adoption, while affordable product lines expand reach in emerging markets. The industry also emphasizes design appeal and biometric authentication to strengthen consumer trust. Continuous investment in R&D, security solutions, and user experience remains central to sustaining competitive advantage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- PayPal Holding Inc.

- Huawei Technologies Co., Ltd.

- Garmin Ltd.

- VISA Inc.

- Apple Inc.

- Xiaomi Corporation

- Mastercard, Inc.

- Samsung Electronics Co., Ltd.

- Google LLC

- Thales SA

Recent Developments

- In August 2024, Mastercard announced its collaboration with the Indian consumer electronics firm boAt to enable the tap-and-pay feature on the latter’s smartwatch offerings. As per the deal, Mastercard cardholders utilizing boAt’s payment-enabled smartwatches can leverage this contactless payment feature via boAt’s Crest Pay application.

- In June 2024, MuchBetter launched a free contactless ceramic payment ring in Italy, aiming to provide consumers with a stylish and convenient way to make payments. This innovative offering allows users to obtain the ring at no initial cost, provided they load it with through the MuchBetter digital wallet app.

- In April 2024, Garmin Vietnam announced that it had expanded its partnership with five leading national banks, namely MB, ACB, Techcombank, Vietcombank, and Sacombank. This cooperation allowed Garmin to offer more options for secure and convenient one-touch payment through its application Garmin Pay on a number of its smartwatch offerings.

- In September 2023, Eastern Bank Limited (EBL) officially launched WEARABLE, Bangladesh’s first range of wearable payment devices, in collaboration with Mastercard and Visa. The launch event took place at ERB’s head office in Gulshan, where customers received their pre-booked devices.

Report Coverage

The research report offers an in-depth analysis based on Device, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as consumers shift further toward cashless and contactless payments.

- Smartwatches will continue leading adoption due to multifunctional capabilities and ecosystem integration.

- Emerging economies will drive strong growth through digital wallet adoption and financial inclusion programs.

- Retail will remain the dominant application, supported by increasing merchant adoption of NFC terminals.

- Transportation systems will see rising integration of wearable payments for seamless commuter experiences.

- Biometric authentication will become a standard feature to enhance transaction security and consumer trust.

- Fashion-tech collaborations will increase demand for stylish, customizable payment wearables.

- Affordable devices will capture mass-market demand, especially in Asia-Pacific and Latin America.

- Strategic partnerships between technology providers and financial institutions will strengthen market penetration.

- Continuous innovation in connectivity and security will shape the long-term competitiveness of wearable payments.