| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2019-2022 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| White Cement Market Size 2024 |

USD 9,827.80 million |

| White Cement Market, CAGR |

5% |

| White Cement Market Size 2032 |

USD 14,476.74 million |

Market Overview:

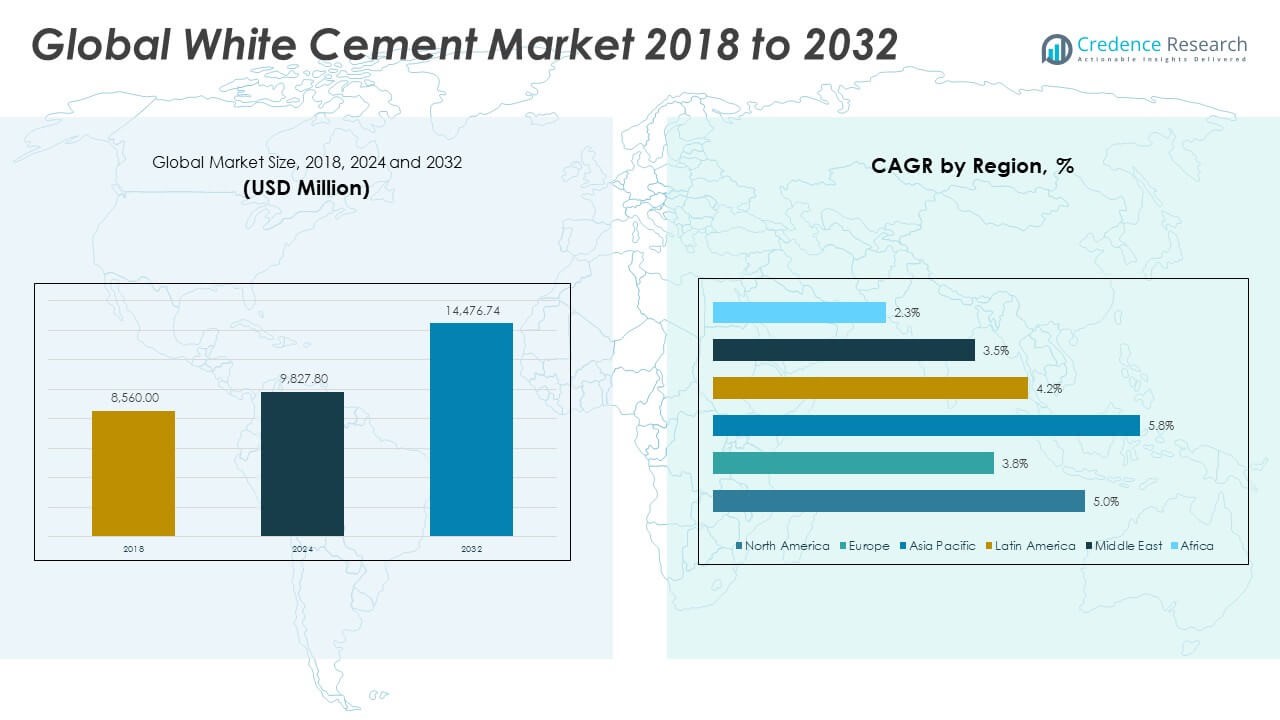

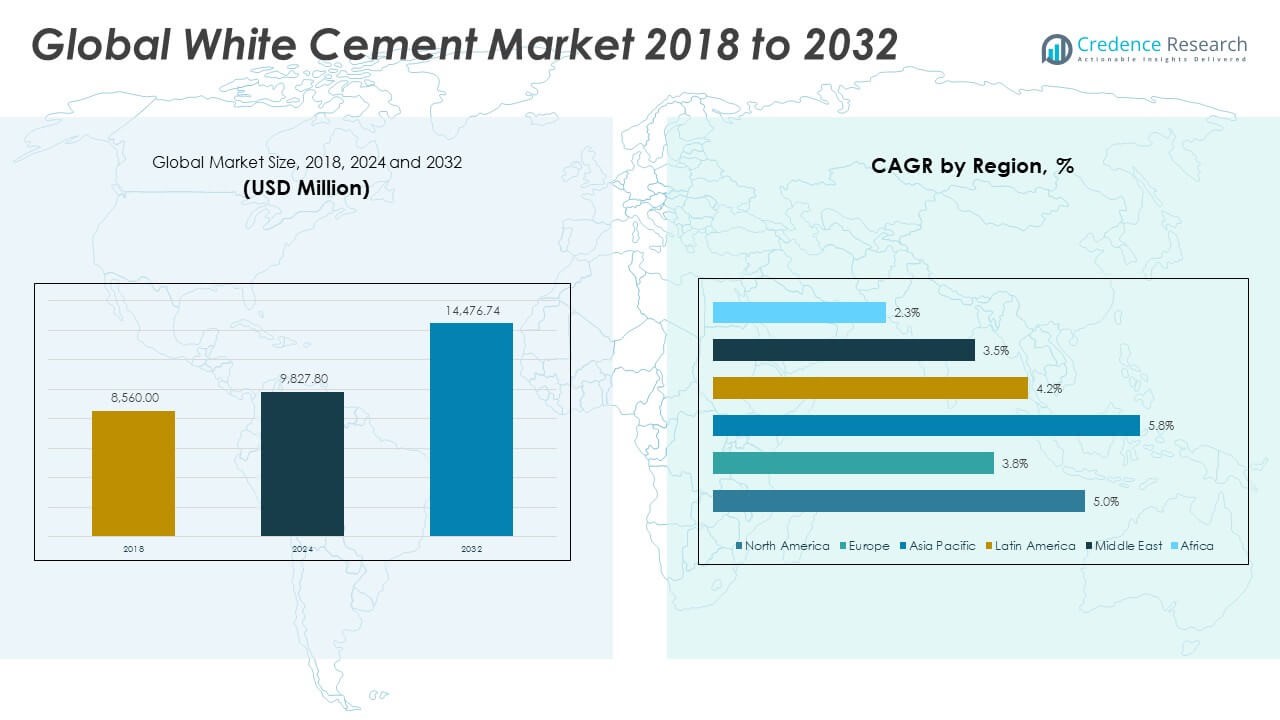

The Global White Cement Market size was valued at USD 8,560.00 million in 2018 to USD 9,827.80 million in 2024 and is anticipated to reach USD 14,476.74 million by 2032, at a CAGR of 5% during the forecast period.

Several major drivers are propelling the growth of the white cement market. First, global infrastructure development, especially in Asia and the Middle East, has significantly increased the demand for high-quality construction materials with enhanced aesthetic appeal. Urbanization and smart city projects across regions are accelerating this trend. White cement’s distinct visual appeal and superior reflective properties make it ideal for facades, decorative finishes, terrazzo flooring, precast elements, and artistic concrete works. Second, its application in energy-efficient buildings is gaining momentum, particularly because white surfaces reflect sunlight better than traditional gray concrete, contributing to lower indoor temperatures and energy savings. This aligns with the global shift toward green buildings and sustainable construction practices. Third, rapid technological advancements in production processes are enhancing product consistency, reducing energy consumption, and lowering the environmental footprint of cement manufacturing. The incorporation of cleaner fuels, waste-heat recovery systems, and digital process control has improved the operational efficiency and competitiveness of white cement producers. Lastly, increasing consumer preference for premium home décor and high-end commercial interiors is stimulating demand across residential and non-residential construction segments. In response, manufacturers are expanding their white cement portfolios with value-added products, including wall putty, tile adhesives, and architectural mortars.

Regionally, the Asia-Pacific region dominates the global white cement market, accounting for the largest share. Countries such as China, India, Vietnam, and Indonesia are the primary contributors due to high levels of urbanization, population growth, and major infrastructure investments. China continues to lead in production and consumption, while Vietnam is emerging as a fast-growing market. India is witnessing increased use of white cement in residential and commercial building aesthetics, particularly in Tier 1 and Tier 2 cities. The region’s growth is supported by ongoing housing development, infrastructure modernization, and rising use of white cement in decorative and energy-efficient applications. In Europe, white cement demand is driven by its extensive use in heritage building restoration, high-end architectural projects, and energy-conscious design. Western Europe, particularly Spain, Germany, and France, shows consistent demand, while Eastern Europe adds to regional volume growth. The Middle East and Africa are also emerging as important markets, with Saudi Arabia, the UAE, and Egypt investing heavily in smart cities, tourism infrastructure, and large-scale commercial developments. The Vision 2030 initiative in Saudi Arabia is expected to generate long-term demand for premium construction materials, including white cement. Latin America shows moderate growth, particularly in Brazil and Mexico, where infrastructure and commercial construction sectors are gradually recovering. Meanwhile, North Africa is expanding its white cement production capabilities to cater to both domestic needs and exports across Africa and Southern Europe.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global White Cement Market was valued at USD 8,560.00 million in 2018 and reached USD 9,827.80 million in 2024. It is projected to reach USD 14,476.74 million by 2032, growing at a CAGR of 5% during the forecast period. This steady expansion reflects sustained demand across multiple construction segments, particularly in regions prioritizing aesthetic and performance-driven materials.

- Ongoing infrastructure development and urbanization, especially in Asia and the Middle East, are key contributors to market growth. Countries such as China, India, and Saudi Arabia are investing in smart cities, transport infrastructure, and commercial real estate, where white cement plays a critical role due to its strength and clean appearance. Its visual appeal and surface uniformity continue to influence purchasing decisions in modern architectural projects.

- White cement is increasingly being used in decorative and high-end design applications. Its ability to produce bright, vibrant surfaces and compatibility with pigments make it a preferred choice for terrazzo flooring, wall finishes, and precast elements. Consumers and developers are opting for premium construction materials to elevate the visual quality of both residential and commercial spaces.

- Sustainability efforts are driving demand for white cement in energy-efficient building solutions. Its high solar reflectance supports temperature control and reduces cooling needs, contributing to green building standards. Its application in reflective surfaces and urban heat mitigation initiatives is growing in cities facing climate-related challenges.

- Technological advancements in white cement production are improving quality, lowering energy consumption, and expanding use cases. Producers are optimizing raw material sourcing, integrating cleaner fuels, and adopting automated process controls. These innovations support consistent product performance and help manufacturers comply with increasingly strict environmental regulations.

- Despite its benefits, white cement remains expensive to produce and energy-intensive, which limits its affordability in cost-sensitive markets. Fluctuating energy prices and the need for precision manufacturing raise operational costs. Regulatory pressure to reduce carbon emissions adds another layer of complexity for producers seeking long-term compliance and competitiveness.

- Asia-Pacific dominates the Global White Cement Market, led by China, India, and Vietnam, where infrastructure growth and aesthetic construction drive demand. Europe shows stable demand through heritage restoration and green building trends, while the Middle East continues to expand usage in large commercial and cultural projects. Latin America and North Africa are showing gradual progress with increased production capacity and regional consumption.

Market Drivers:

Urbanization and Infrastructure Development Boost Demand for Durable and Aesthetic Materials:

The Global White Cement Market benefits significantly from rapid urbanization and extensive infrastructure development across emerging and developed regions. Governments are investing in large-scale projects such as smart cities, transportation networks, commercial hubs, and public spaces, which require high-performance and visually appealing construction materials. White cement is widely used in architectural structures due to its brightness, color uniformity, and ability to enhance design aesthetics. Infrastructure programs in countries like India, China, Saudi Arabia, and the United States are accelerating the consumption of white cement in roads, bridges, and facades. It supports both structural strength and design versatility, which are increasingly prioritized in modern building strategies. The material’s premium positioning in construction aligns well with the demand from urban development and national modernization plans.

- For instance, JK Cement’s white cement plant in Gotan, India, has an installed capacity of 610,000 tonnes per annum, supporting major infrastructure and urban development projects across the country with consistent supply and high-quality output.

Rising Demand for Decorative and Value-Added Architectural Applications:

Aesthetic appeal is becoming a crucial factor in both residential and commercial construction, driving the demand for white cement-based products. It is widely used in decorative concrete, terrazzo flooring, sculptures, wall finishes, and precast elements. Architects and designers prefer white cement for its compatibility with pigments and its ability to produce clean, vibrant surfaces. The growing popularity of high-end interiors, luxury exteriors, and visually distinctive buildings is contributing to market expansion. Consumers are also shifting toward premium-grade cement solutions that combine both durability and decorative potential. The Global White Cement Market continues to capitalize on these trends by positioning white cement as a key enabler of modern design.

- For instance, Cementir Holding Aalborg White brand is a global leader, present in over 70 countries. Aalborg White cement has been specified in numerous high-profile architectural projects, such as the Sky Park in Bratislava, which features more than 20,000 square meters of public park and 55,000 square meters of office and retail space, utilizing Aalborg White for its color consistency and durability.

Sustainability Goals and Energy Efficiency Trends Favor High-Reflectance Cement:

Sustainability initiatives in construction are influencing the choice of materials, with white cement gaining traction for its high solar reflectance and energy-efficient properties. Its use in reflective pavements, roofing systems, and external walls helps reduce heat absorption and improve building energy performance. Regulatory standards and green building certifications are encouraging developers to adopt materials that support thermal regulation and lower energy consumption. The Global White Cement Market is responding to this demand with products tailored for eco-conscious applications. White cement also contributes to urban heat island mitigation efforts in dense city environments. It aligns with global efforts to reduce carbon footprints and increase environmental resilience in urban planning.

Technological Advancements and Product Innovation Drive Market Growth:

Manufacturers are investing in advanced production technologies that improve white cement quality, reduce energy usage, and optimize operational efficiency. Developments in kiln design, process automation, and raw material optimization are helping reduce emissions and costs. These innovations are expanding the applicability of white cement into new segments such as lightweight concrete, specialty mortars, and prefabricated systems. It allows producers to meet increasingly stringent environmental regulations while maintaining competitive performance characteristics. The Global White Cement Market is benefiting from this wave of innovation by offering differentiated products that cater to evolving construction requirements. Technological leadership is becoming a key competitive advantage in this sector.

Market Trends:

Strategic Expansion of Production Facilities in Emerging and Export-Driven Economies:

Major manufacturers are expanding white cement production facilities in cost-efficient regions to meet rising domestic and export demand. Countries like India, Vietnam, Egypt, and the UAE are witnessing increased capacity additions to support both regional construction booms and global distribution strategies. These locations offer advantages in terms of raw material availability, labor cost, and logistical access to high-demand markets in Asia, Africa, and Europe. The Global White Cement Market is witnessing a geographic shift in supply chains, with a growing focus on balancing local presence and international reach. This trend is enabling producers to respond faster to regional consumption spikes and reduce freight costs. It is also intensifying competition among suppliers in key export hubs.

- For instance, Ras Al Khaimah Co. for White Cement and Construction Materials in the UAE has expanded its annual white cement production capacity to 900,000 tonnes, making it one of the largest producers in the Middle East and a key exporter to more than 45 countries.

Integration of White Cement into Sustainable Urban Design and Smart City Concepts:

Urban planners are incorporating white cement into smart city infrastructure to improve thermal performance and aesthetic cohesion. Its application in reflective pavements, energy-efficient rooftops, and urban landscaping aligns well with sustainability-driven city models. Governments and municipal authorities are prioritizing materials that enhance livability while contributing to lower energy consumption and environmental impact. The Global White Cement Market is seeing increasing collaboration between urban development agencies and cement producers to develop customized formulations for climate-responsive infrastructure. White cement is also being evaluated for use in permeable surfaces and light-colored transport corridors to support sustainable drainage and mobility goals. This trend reflects its growing role in multifunctional and performance-based urban planning.

- For instance, CEMEX supplied over 27,000 cubic meters of special concrete for the renovation of 15 streets in Mexico City’s Zona Rosa, including the iconic Paseo de la Reforma. The project used architectural concrete pavements with high reflectivity, improving pedestrian safety and reducing surface temperatures in high-traffic urban areas.

Rising Adoption of Precast and Modular Construction Systems Using White Cement:

The construction industry is shifting toward precast and modular systems to accelerate project timelines and reduce labor dependency. White cement is gaining popularity in this context due to its superior finish and compatibility with factory-produced architectural components. It enables consistent quality, reduced onsite finishing work, and improved aesthetics in prefabricated structures. The Global White Cement Market is benefiting from this transition as builders and contractors seek reliable materials for offsite production. White cement-based precast elements are increasingly used in building facades, cladding, wall panels, and decorative features. This trend is expected to strengthen with the growth of affordable housing and industrialized construction practices globally.

Growth in Customized and Pigmented White Cement Solutions for Niche Applications:

The market is witnessing a shift toward customization, with architects and developers demanding colored and textured white cement for specialty applications. Manufacturers are introducing a wider range of pigment-compatible white cement products that offer design flexibility without compromising performance. These solutions are finding demand in landscaping, high-end interiors, branded retail outlets, and cultural heritage restoration. The Global White Cement Market is adapting to this trend by offering tailored blends and surface treatments that meet both visual and structural requirements. Innovation in color retention, surface smoothness, and environmental resistance is shaping product development. This customization trend reflects a broader movement toward differentiated construction materials that align with project-specific themes and branding.

Market Challenges Analysis:

High Production Costs and Energy Intensity Limit Market Penetration:

White cement requires a more refined production process than ordinary Portland cement, involving higher-grade raw materials and elevated kiln temperatures. This leads to significantly higher energy consumption and operating costs, which restrict its use to premium applications. Manufacturers often face cost pressures due to fluctuating energy prices and the need to maintain strict color consistency across batches. The Global White Cement Market contends with lower profit margins in price-sensitive regions where construction budgets are limited. It remains less accessible in developing economies where affordability drives material choices. These production challenges continue to hinder the market’s ability to scale across mass-construction sectors.

Stringent Environmental Regulations and Carbon Emission Targets Pose Compliance Risks:

White cement manufacturing contributes to substantial carbon emissions, making it a focus area in global efforts to decarbonize the construction sector. Regulatory frameworks in Europe, North America, and parts of Asia are imposing stricter emission limits, placing pressure on producers to adopt cleaner technologies and carbon mitigation strategies. The capital investment required to upgrade plants with carbon capture, waste heat recovery, and alternative fuels is high, especially for small and mid-sized manufacturers. The Global White Cement Market must also navigate increasing scrutiny from sustainability-conscious stakeholders, including investors, architects, and public sector buyers. Delays in regulatory adaptation or failure to meet environmental benchmarks can lead to reputational risks and market access limitations. These compliance requirements add complexity and cost to long-term strategic planning.

Market Opportunities:

Rising Demand from Heritage Restoration and Cultural Architecture Projects:

White cement is increasingly preferred in the restoration of historic monuments, religious structures, and heritage buildings due to its ability to deliver high aesthetic precision and long-term durability. Governments and cultural preservation agencies are investing in projects that require materials with color consistency, low shrinkage, and compatibility with lime-based systems. The Global White Cement Market stands to benefit from this trend, particularly in regions like Europe, the Middle East, and South Asia where architectural heritage remains a national priority. It enables restorers to match original finishes while meeting modern strength and weather-resistance standards. This specialized demand offers a high-margin opportunity for manufacturers capable of delivering customized formulations. Expanding partnerships with conservation bodies and architects can strengthen market presence in this niche segment.

Growing Application in Designer Interiors and Luxury Real Estate Developments:

The upscale construction sector is adopting white cement for its ability to support minimalist design, smooth textures, and seamless integration with luxury finishes. Designers are using it in polished floors, feature walls, countertops, and bespoke furniture elements. The Global White Cement Market can capitalize on this growing trend by offering premium blends tailored to aesthetic and performance demands. High-income consumers and luxury real estate developers are prioritizing distinctive materials that elevate visual impact and design flexibility. This shift opens new avenues for product differentiation and brand positioning. Targeted marketing and distribution through premium construction channels can unlock substantial growth potential.

Market Segmentation Analysis:

By Product

The Global White Cement Market is segmented into White Portland Cement, White Masonry Cement, and Others. White Portland Cement holds the largest share due to its broad utility in architectural and structural applications that demand strength, brightness, and surface uniformity. It is commonly used in facades, precast panels, and decorative concrete finishes. White Masonry Cement, though smaller in volume, is essential in mortar and plaster work, especially in residential buildings. Its smooth texture and consistent color make it ideal for interior and exterior finishes. The Others segment comprises specialty formulations designed for restoration, artistic designs, and niche construction requirements where high visual impact is necessary.

- For instance, Federal White Cement in North America produces over 250,000 tonnes of White Portland Cement annually, supplying major precast and decorative concrete manufacturers across the United States and Canada.

By Application

By application, the market is divided into Residential, Commercial, and Other Applications. The residential segment leads the Global White Cement Market, driven by increased demand for premium, aesthetically pleasing construction in housing developments. White cement is used in decorative floors, walls, pavements, and landscape features. The commercial segment includes hotels, shopping complexes, educational institutions, and office buildings, where white cement enhances architectural value and project branding. Other Applications consist of cultural monuments, religious buildings, and public installations that require color permanence and visual clarity. These segments collectively highlight the material’s versatility and its alignment with both functional and aesthetic construction demands.

- For instance, UltraTech Cement supplied over 10,000 tonnes of white cement for the Akshardham Temple in New Delhi, ensuring long-term color retention and structural integrity for one of the world’s largest Hindu temple complexes.

Segmentation:

By Product

- White Portland Cement

- White Masonry Cement

- Others

By Application

- Residential

- Commercial

- Other Applications

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America White Cement Market size was valued at USD 2,011.60 million in 2018 to USD 2,266.23 million in 2024 and is anticipated to reach USD 3,331.12 million by 2032, at a CAGR of 5.0% during the forecast period. The Global White Cement Market in North America benefits from steady residential and commercial construction activity, particularly in the United States and Mexico. Demand for high-performance and visually appealing construction materials supports market growth. White cement is widely used in urban housing, decorative finishes, and public infrastructure. The U.S. leads in consumption due to rising investments in premium housing and urban renewal projects. Mexico contributes significantly with its expanding cement exports and infrastructure modernization.

Europe

The Europe White Cement Market size was valued at USD 1,415.82 million in 2018 to USD 1,525.01 million in 2024 and is anticipated to reach USD 2,043.43 million by 2032, at a CAGR of 3.8% during the forecast period. The Global White Cement Market in Europe is driven by demand for restoration materials, energy-efficient construction, and architectural design. Western Europe, led by Spain, Germany, and France, shows consistent use in cultural preservation and public buildings. Eastern European countries are witnessing moderate growth with increased infrastructure upgrades. White cement’s aesthetic versatility aligns with the region’s strict environmental and quality standards. Government initiatives promoting low-carbon materials are also influencing product preferences.

Asia Pacific

The Asia Pacific White Cement Market size was valued at USD 3,946.16 million in 2018 to USD 4,637.20 million in 2024 and is anticipated to reach USD 7,230.93 million by 2032, at a CAGR of 5.8% during the forecast period. The Global White Cement Market in Asia Pacific holds the largest share due to rapid urbanization and large-scale infrastructure development. China, India, and Vietnam are key contributors to regional demand. Increased spending on residential projects, smart cities, and industrial construction supports consumption. India shows strong growth in decorative and energy-efficient applications. Vietnam is emerging as a major exporter, while Southeast Asia is investing in capacity expansion to meet growing regional demand.

Latin America

The Latin America White Cement Market size was valued at USD 671.10 million in 2018 to USD 764.50 million in 2024 and is anticipated to reach USD 1,060.71 million by 2032, at a CAGR of 4.2% during the forecast period. The Global White Cement Market in Latin America is influenced by economic recovery, government infrastructure projects, and rising demand for affordable housing. Brazil and Mexico are leading markets in the region. Decorative applications in public buildings and urban spaces are gaining traction. Manufacturers are strengthening local production to reduce reliance on imports. Market growth remains moderate but stable, supported by demand for aesthetic and durable construction materials.

Middle East

The Middle East White Cement Market size was valued at USD 295.32 million in 2018 to USD 315.41 million in 2024 and is anticipated to reach USD 414.11 million by 2032, at a CAGR of 3.5% during the forecast period. The Global White Cement Market in the Middle East is driven by high-value construction projects, luxury real estate developments, and national transformation plans. Saudi Arabia, the UAE, and Qatar are investing in tourism, hospitality, and mixed-use infrastructure. White cement is used in facades, monuments, and climate-responsive architecture. The Vision 2030 initiative in Saudi Arabia provides a long-term growth platform. Regional demand is supported by a strong preference for premium, visually appealing materials.

Africa

The Africa White Cement Market size was valued at USD 219.99 million in 2018 to USD 319.44 million in 2024 and is anticipated to reach USD 396.43 million by 2032, at a CAGR of 2.3% during the forecast period. The Global White Cement Market in Africa is expanding gradually, driven by urbanization, population growth, and infrastructure needs. Egypt and South Africa lead regional consumption with investments in housing, transport, and public works. Local production is increasing to meet domestic and export demand. Use in decorative and functional applications is rising in urban centers. Affordability constraints and access to consistent supply remain key challenges for broader market penetration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Cementir Holding N.V.

- Çimsa Çimento Sanayi ve Ticaret A.Ş.

- Royal White Cement

- LafargeHolcim

- Aditya Birla (Grasim Industries Limited)

- Cimsa

- Dyckerhoff GMBH

- Federal White Cement

- India Cements Ltd

- K. Cement Company

- Ultratech Cement Ltd

- Saudi White Cement Company

- Suez Group (France)

Competitive Analysis:

The Global White Cement Market features a concentrated competitive landscape dominated by a mix of multinational corporations and regionally strong players. Key companies such as Cementir Holding, Çimsa Çimento, LafargeHolcim, JK Cement, and UltraTech Cement hold significant market share through extensive distribution networks, advanced production technologies, and diverse product portfolios. It is characterized by high entry barriers due to capital-intensive manufacturing, stringent quality standards, and the need for consistent raw material sourcing. Market participants focus on expanding production capacity, enhancing product customization, and adopting energy-efficient technologies to maintain a competitive edge. Strategic mergers, acquisitions, and joint ventures are common among leading firms seeking to strengthen their geographic presence and supply capabilities. Innovation in pigment compatibility, strength development, and sustainability is also shaping competition. The Global White Cement Market remains highly sensitive to pricing, energy costs, and regulatory compliance, compelling players to balance operational efficiency with product differentiation.

Recent Developments:

- In June 2025, Çimsa Cementos España, a subsidiary of Çimsa, announced a €12.55 million investment in its Buñol white cement plant in Spain. The investment focuses on developing alternative fuels, energy efficiency, and new business lines, following the launch of a photovoltaic installation in 2024 that now supplies 18% of the plant’s energy needs.Additionally, in August 2024, Çimsa completed the acquisition of a majority stake in Ireland-based Mannok, integrating premium white cement products into the Mannok brand for the UK and Ireland markets.

- In June 2025, Holcim completed the 100% spin-off of its North American business, Amrize, with trading beginning on June 23, 2025, on the New York Stock Exchange and SIX Swiss Exchange. This strategic move allows Holcim to streamline global operations and enables Amrize to focus on North America’s infrastructure and construction market.

- In June 2025, India Cements Ltd announced the sale of its subsidiary, Industrial Chemicals and Monomers, to Mirai Sensing for Rs 97.68 crore. This divestment follows UltraTech Cement’s acquisition of a controlling stake in India Cements in December 2024, further consolidating UltraTech’s leadership in the Indian cement sector.

- In May 2025, UltraTech Cement, part of the Aditya Birla Group, expanded its total domestic cement production capacity by 1.4 million tonnes per annum through efficiency enhancements and debottlenecking at its Nagpur, Panipat, and Jhajjar units. This expansion supports UltraTech’s position as India’s largest cement producer, with a total capacity of 190.16 MTPA as of May 2025.

- In February 2025, Mannok, now associated with Çimsa, introduced Ultra White Cement to its bagged cement range in the UK and Ireland. The product is manufactured at Çimsa’s Mersin plant in Turkey and is recognized for its exceptional whiteness and strength, marking the first of several Çimsa products to be integrated into Mannok’s portfolio.

Market Concentration & Characteristics:

The Global White Cement Market is moderately concentrated, with a handful of established players controlling a significant portion of global production and supply. It exhibits characteristics of a capital-intensive industry with high operational costs, limited raw material sources, and stringent production requirements. The market favors companies with strong vertical integration, technical expertise, and access to consistent limestone and kaolin reserves. It operates under high quality and performance standards, especially in architectural and decorative applications. Regional demand patterns vary widely, influenced by construction practices, climate, and aesthetic preferences. The Global White Cement Market also shows limited price elasticity, with demand driven more by application-specific requirements than by cost. Players compete on product quality, whiteness index, consistency, and supply reliability, while maintaining compliance with environmental and energy regulations.

Report Coverage:

The research report offers an in-depth analysis based on product and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for white cement will grow steadily, driven by increasing adoption in decorative and high-end architectural applications.

- Asia Pacific will continue to dominate global consumption, supported by infrastructure expansion and urban development.

- Energy-efficient and reflective building materials will boost white cement use in sustainable construction.

- Technological advancements will enhance product quality, reduce emissions, and optimize manufacturing efficiency.

- Premium residential and commercial real estate developments will fuel demand for aesthetic cement finishes.

- Emerging economies in Africa and Southeast Asia will see rising usage, supported by domestic production investments.

- Regulatory emphasis on low-carbon materials will push producers to adopt greener production processes.

- Precast and modular construction trends will create new opportunities for consistent, high-performance white cement products.

- Customization and pigmentation capabilities will gain traction in luxury design and niche applications.

- Strategic mergers and capacity expansions will reshape global supply dynamics and intensify competition.