Market Overview

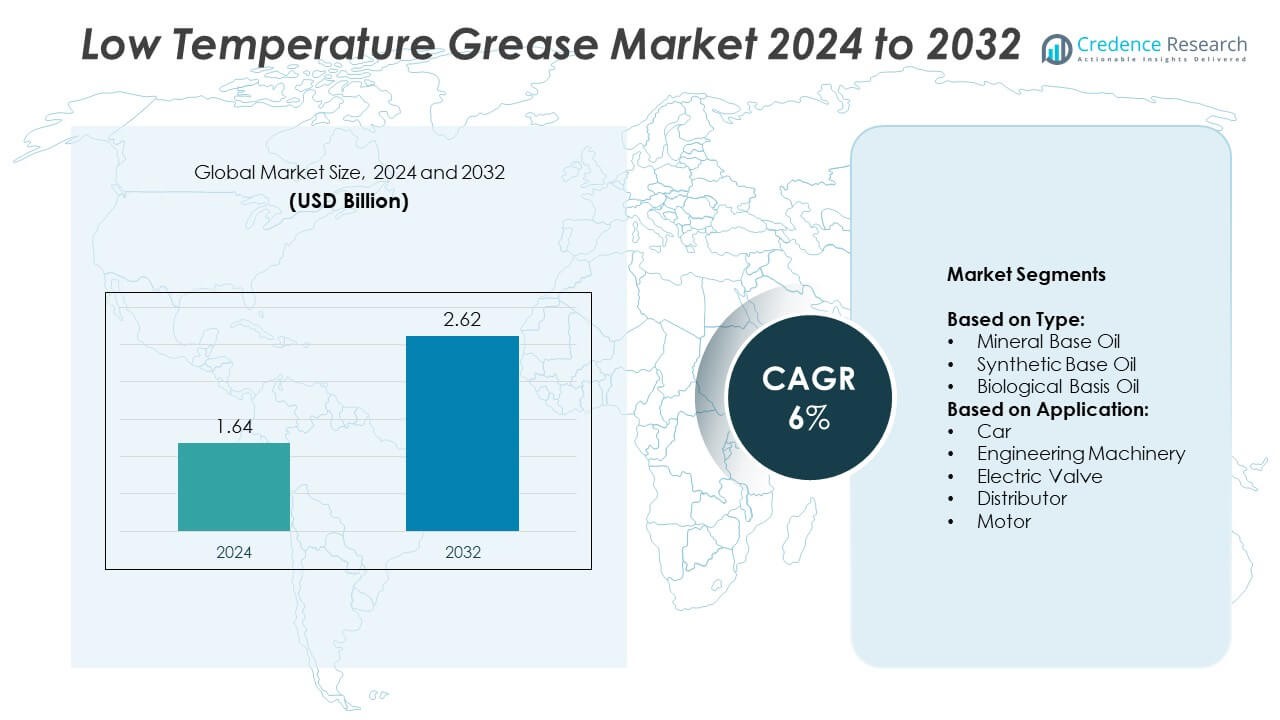

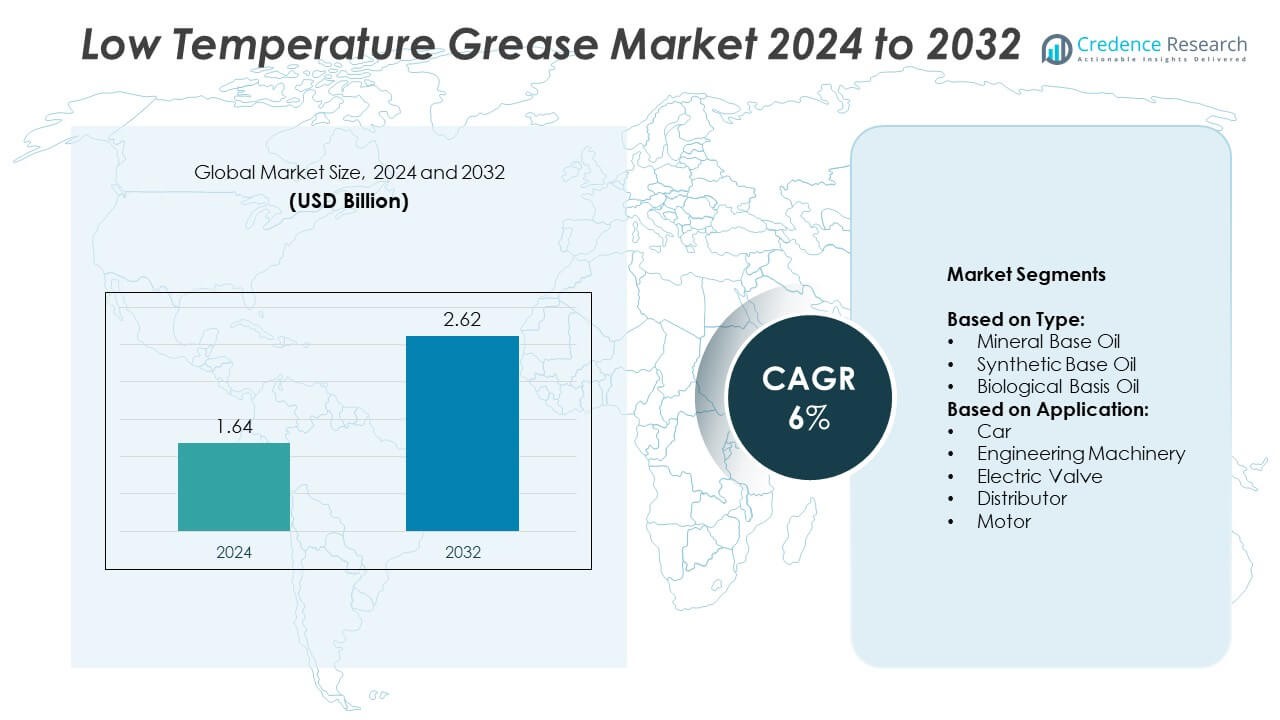

The low-temperature grease market size was valued at USD 1.64 billion in 2024 and is projected to reach USD 2.62 billion by 2032, growing at a CAGR of 6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Low-Temperature Grease Market Size 2024 |

USD 1.64 Billion |

| Low-Temperature Grease Market, CAGR |

6% |

| Low-Temperature Grease Market Size 2032 |

USD 2.62 Billion |

The low-temperature grease market is shaped by leading players such as Klaber Lubrication, UNTIL LUBRICANTS, ADDINOL Lube Oil, ROCOL, Euro, Central Chemie GmbH, DowDuPont, and Total Lubricants USA. These companies compete through advanced formulations, R&D investments, and partnerships with OEMs to enhance product performance in extreme cold conditions. North America leads the market with a 35% share, driven by strong automotive, aerospace, and heavy equipment demand. Europe follows with nearly 30% share, supported by strict environmental regulations and growing EV production, while Asia Pacific emerges as the fastest-growing region with expanding industrial and automotive output.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The low-temperature grease market was valued at USD 1.64 billion in 2024 and is projected to reach USD 2.62 billion by 2032, growing at a CAGR of 6%.

- Rising automotive production, growth of heavy machinery, and focus on energy-efficient lubrication are key drivers boosting demand across industries.

- The market is witnessing a shift toward synthetic base oil, which held over 55% share in 2024, supported by its superior low-temperature performance and longer service life.

- Competition is moderate, with players investing in R&D for bio-based greases and forming OEM collaborations to expand market penetration and meet regulatory requirements.

- North America leads with 35% share, followed by Europe with nearly 30%, while Asia Pacific is the fastest-growing region driven by industrialization, manufacturing growth, and increasing automotive output, contributing significantly to global market expansion.

Market Segmentation Analysis:

By Type

Synthetic base oil dominates the low-temperature grease market with over 55% share in 2024. Its superior thermal stability, low volatility, and excellent lubrication performance in extreme cold make it a preferred choice across industries. Demand is driven by rising use in automotive and aerospace applications, where consistent performance at sub-zero temperatures is critical. Mineral base oil remains relevant in cost-sensitive applications, supported by its easy availability and lower price. Biological base oil is gaining traction due to sustainability trends and regulatory push for biodegradable lubricants, though its adoption is still at a nascent stage compared to synthetic variants.

- For instance, Klüber Lubrication introduced Klübertemp GR AR 555, a high-temperature grease with a service temperature range from -30 °C to +250 °C. This long-term lubricant is used in various industrial applications, including in equipment exposed to high temperatures and aggressive media, such as corrugated roll bearings, seals, and conveyors

By Application

Cars hold the largest share of the market, accounting for more than 40% in 2024. Growth is supported by increasing vehicle production and the need for reliable greases for wheel bearings, steering systems, and chassis components in cold climates. Engineering machinery is another key segment, with strong demand from construction and mining sectors operating in sub-zero regions. Electric valves and distributors benefit from the need for consistent actuation in industrial automation systems, while motors require low-temperature grease to ensure reduced friction losses and improved energy efficiency in harsh operating conditions.

- For instance, SKF’s LGLT 2 grease is rated for low-temperature use down to −50 °C.

Key Growth Drivers

Rising Demand from Automotive Industry

The automotive sector is a major growth driver for the low-temperature grease market, contributing significantly to overall demand. Greases are essential for wheel bearings, steering systems, and chassis components in vehicles operating in cold climates. Rising vehicle production in North America, Europe, and Asia boosts consumption of synthetic and specialty greases that maintain performance in sub-zero conditions. The shift toward electric vehicles further supports market growth, as EV drivetrains and motors require high-performance lubricants to minimize energy loss and extend component life in extreme temperatures.

- For instance, NTN’s latest Low Friction Hub Bearing uses a new low-torque grease and cuts friction by up to 64% versus the conventional design.

Expansion of Heavy Equipment and Machinery Sector

Growing use of heavy equipment in construction, mining, and agriculture drives demand for low-temperature grease. Machines operating in harsh outdoor environments require greases that prevent wear and ensure smooth functioning in freezing conditions. Infrastructure investments in cold regions, such as Canada and Northern Europe, create consistent consumption. Industrial manufacturers favor synthetic greases for their long service life and ability to handle heavy loads. This reduces maintenance frequency and downtime, helping operators improve productivity and control operational costs while maintaining reliable equipment performance.

- For instance, Komatsu’s PC7000-11 excavator ships with automatic centralized lubrication and two refillable grease containers of ~600 L and ~300 L.

Focus on Equipment Efficiency and Sustainability

Rising emphasis on energy efficiency and environmental responsibility acts as a strong market driver. Manufacturers develop bio-based and low-toxicity greases to comply with regulatory requirements and meet sustainability goals. These products appeal to industries seeking to reduce their environmental footprint while maintaining equipment reliability. Advanced formulations lower friction losses, improve energy use, and extend component life. Increasing adoption of smart monitoring systems in industrial equipment also supports demand, as operators seek lubricants compatible with predictive maintenance strategies for better asset management and reduced downtime.

Key Trends & Opportunities

Shift Toward Synthetic and Specialty Greases

The market is witnessing a strong trend toward synthetic greases due to their superior performance in extreme conditions. Industries prefer these products for their excellent thermal stability, low volatility, and ability to function across wide temperature ranges. OEMs are integrating synthetic lubricants in new equipment to enhance reliability and reduce warranty claims. Specialty greases designed for specific applications, such as electric motors or aerospace components, are gaining popularity. This trend is also supported by R&D investment in advanced additive technology to enhance performance characteristics.

- For instance, ExxonMobil’s Mobiltemp SHC 32 recommends an operating range of −50 °C to 180 °C for extreme-temperature applications.

Growth of Bio-Based and Eco-Friendly Lubricants

Sustainability trends create opportunities for bio-based low-temperature greases that are biodegradable and safe for the environment. Growing regulations, including REACH and EPA standards, push manufacturers to adopt greener solutions. Industries operating in environmentally sensitive areas, such as marine and forestry, are early adopters of these products. Companies are focusing on developing high-performance bio-based formulations that match or exceed conventional greases. This offers a competitive advantage while supporting corporate ESG initiatives. The rising demand for green lubricants is expected to accelerate innovation and product diversification in this segment.

- For instance, TotalEnergies’ BioLife renewable isoalkanes are produced from 100% certified vegetable-origin feedstocks for lubricant formulations.

Key Challenges

High Cost of Synthetic Greases

The relatively high cost of synthetic and specialty greases remains a significant barrier to wider adoption. Price-sensitive markets, particularly in developing countries, continue to rely on cheaper mineral-based products despite their limited temperature performance. High production costs of advanced formulations and additives increase the overall product price, restricting market penetration in cost-driven sectors. End users may hesitate to switch unless clear cost-benefit advantages are demonstrated through reduced maintenance needs and longer service intervals, making education and value communication critical for suppliers.

Limited Awareness and Technical Expertise

Many end-users in emerging markets lack awareness about the benefits of low-temperature greases. This leads to the use of suboptimal lubricants that fail under extreme conditions, resulting in higher maintenance costs and equipment downtime. Limited technical expertise in selecting the right product for specific applications further restricts adoption. Manufacturers must invest in training programs, technical support, and targeted marketing to educate customers on the long-term benefits. Building trust and offering tailored solutions are key strategies to overcome this challenge and grow market penetration.

Regional Analysis

North America

North America holds around 35% share of the low-temperature grease market, driven by strong automotive and industrial demand. The United States leads the region, supported by high vehicle production, aerospace applications, and advanced manufacturing facilities. Growth is also fueled by the need for reliable lubrication in construction and mining equipment operating in cold climates. Stringent regulations on energy efficiency and emissions encourage the adoption of synthetic and bio-based greases. Canada contributes significantly due to its extreme weather conditions, where low-temperature greases are essential for transportation, power generation, and heavy machinery operations, ensuring steady market expansion across industries.

Europe

Europe accounts for nearly 30% of the market, supported by its strong automotive, aerospace, and industrial base. Germany, France, and the Nordic countries drive consumption, particularly for synthetic greases used in extreme cold applications. The European Union’s strict environmental regulations push demand for bio-based and eco-friendly formulations. Growth in electric vehicle production further boosts lubricant consumption, as EVs require advanced greases for motors and drivetrains. Cold weather regions such as Scandinavia rely heavily on low-temperature greases to maintain equipment reliability. Continuous R&D investments by European manufacturers enhance product innovation, strengthening the region’s competitive position in the global market.

Asia Pacific

Asia Pacific holds about 25% market share and is the fastest-growing region, led by China, Japan, and India. Rapid industrialization and high vehicle production rates drive strong demand for low-temperature greases, particularly synthetic variants. Cold regions in China, Japan, and South Korea create significant opportunities for applications in automotive, construction, and industrial machinery. Expanding manufacturing bases and rising infrastructure projects boost consumption across multiple sectors. Growing adoption of advanced equipment and electric vehicles further accelerates demand. Increasing awareness about preventive maintenance and energy-efficient lubricants supports steady growth, making Asia Pacific a key contributor to the global market’s expansion.

Latin America

Latin America contributes a smaller share, close to 6%, but shows steady growth prospects. Brazil and Mexico are the leading markets, driven by automotive manufacturing and mining activities. The region’s demand is gradually shifting from mineral-based to synthetic greases due to better performance in temperature-sensitive applications. Expanding construction projects in cooler southern regions create additional opportunities for suppliers. Economic recovery and growing investment in industrial automation are likely to improve market adoption. However, price sensitivity remains a challenge, requiring suppliers to offer cost-effective solutions while educating end-users on the long-term benefits of using premium low-temperature lubricants.

Middle East & Africa

The Middle East & Africa region accounts for nearly 4% of the global market, with demand concentrated in mining, oil and gas, and power generation sectors. Although extreme cold conditions are limited to select areas, applications in industrial equipment and critical infrastructure still drive consumption. South Africa and GCC countries lead demand, supported by ongoing investments in energy projects and heavy machinery operations. Import dependency for advanced greases remains high, presenting opportunities for international manufacturers. Growing focus on equipment reliability and reduced downtime in harsh operating environments is expected to support moderate market growth over the forecast period.

Market Segmentations:

By Type:

- Mineral Base Oil

- Synthetic Base Oil

- Biological Basis Oil

By Application:

- Car

- Engineering Machinery

- Electric Valve

- Distributor

- Motor

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The low-temperature grease market is driven by key players such as Klaber Lubrication, UNTIL LUBRICANTS, ADDINOL Lube Oil, ROCOL, Euro, Central Chemie GmbH, DowDuPont, and Total Lubricants USA. The market features a mix of global and regional companies competing through advanced product formulations and strong distribution networks. Players focus on developing high-performance synthetic and bio-based greases to meet the demand for superior low-temperature performance and compliance with environmental regulations. Investment in R&D remains a priority to improve energy efficiency, extend service life, and support equipment reliability in extreme conditions. Strategic collaborations with OEMs and expansion into emerging markets help strengthen customer reach and increase market penetration. Manufacturers also prioritize offering customized solutions for automotive, industrial, and heavy equipment applications, aligning with the rising trend of predictive maintenance and automation. Competitive intensity is expected to rise as companies innovate to cater to growing demand in cold climate operations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2024, ROCOL launched PFAS-free FOODLUBE formulations at the Anuga FoodTec event.

- In 2024, TotalEnergies launched its new eco-friendly EV lubricant ranges, “Quartz EV3R” for cars and “Rubia EV3R” for trucks. These are made with recycled base oils, showcasing innovation focused on sustainability in the EV market.

- In 2023, ADDINOL introduced ADDISIL FG 3, a synthetic grease based on silicone oil and PTFE thickener, offering high thermal and chemical resistance, especially for valves and fittings.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily, driven by demand for high-performance synthetic greases.

- Automotive and EV production will continue to be major contributors to market expansion.

- Heavy equipment and mining sectors will boost consumption in cold climate regions.

- Bio-based and eco-friendly grease formulations will see faster adoption due to regulations.

- Technological advancements will improve energy efficiency and extend grease service life.

- Asia Pacific will remain the fastest-growing region with strong industrial and automotive output.

- OEM collaborations will rise to integrate advanced lubricants in new machinery designs.

- Increased focus on predictive maintenance will drive demand for premium grease solutions.

- Price-sensitive markets may slow adoption of synthetic products, creating opportunities for cost optimization.

- Competition will intensify as players invest in R&D and expand into emerging markets.