Market Overview

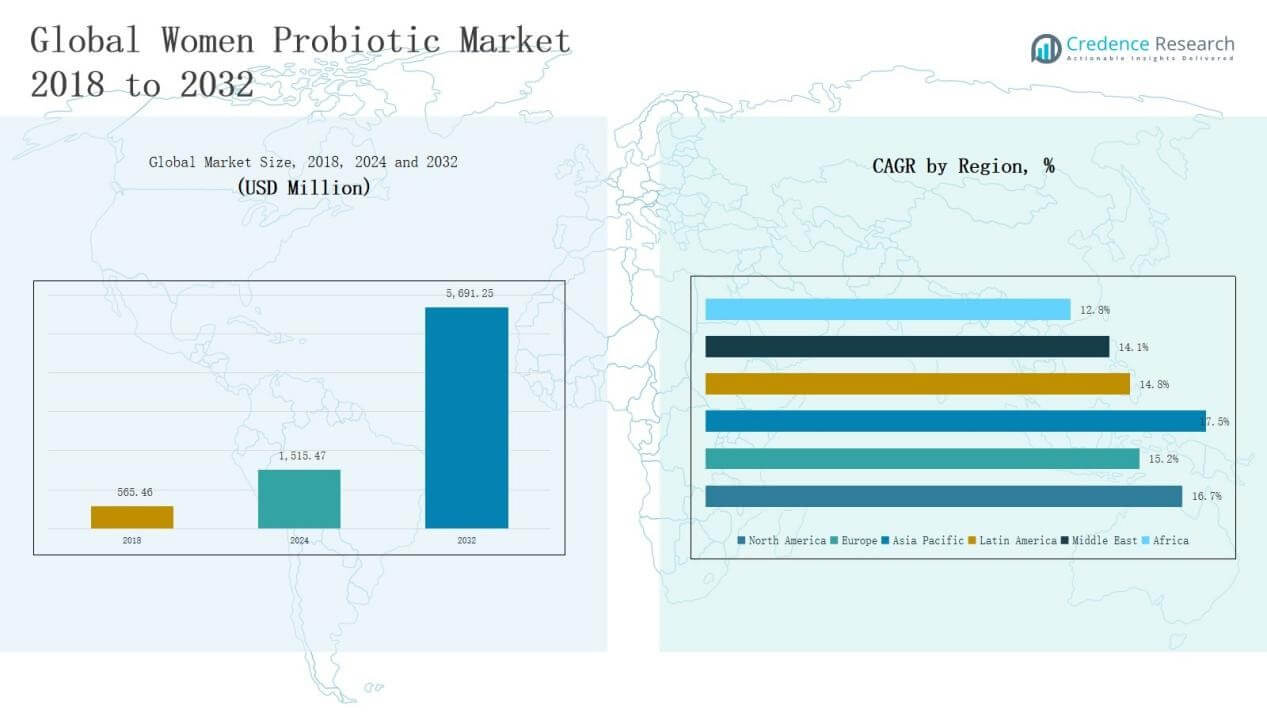

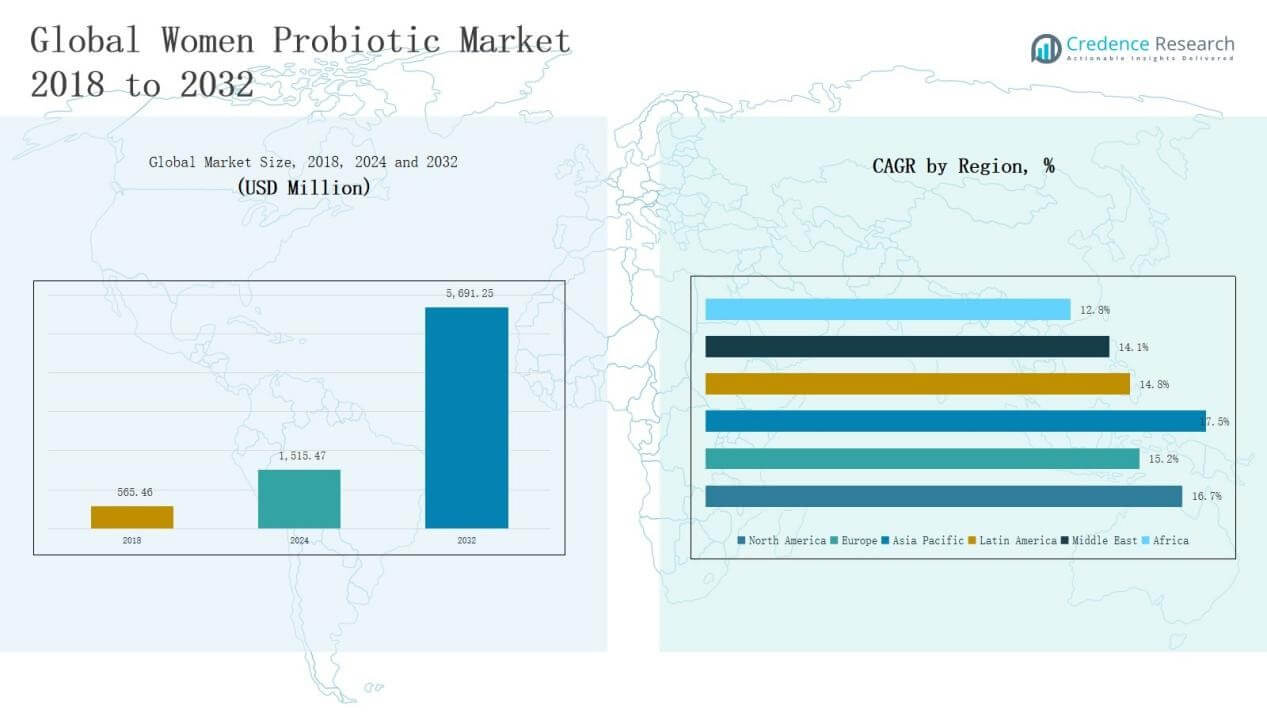

Global Women Probiotic Market size was valued at USD 565.46 million in 2018, reaching USD 1,515.47 million in 2024, and is anticipated to reach USD 5,691.25 million by 2032, at a CAGR of 16.77% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Women Probiotic Market Size 2024 |

USD 1,515.47 Million |

| Women Probiotic Market, CAGR |

16.77% |

| Women Probiotic Market Size 2032 |

USD 5,691.25 Million |

The Global Women Probiotic Market is shaped by strong competition among multinational leaders and specialized health-focused firms. Key players include Nestlé, Bayer, Unilever, Procter & Gamble (P&G), NOW Health Group, Amerifit Brands, and Reckitt, all of which invest in innovation, clinical validation, and diverse product formats such as powders, gummies, and liquids to capture broad consumer segments. These companies strengthen their market presence through acquisitions, e-commerce strategies, and partnerships targeting preventive women’s health solutions. Regionally, North America leads the market with a 42.3% share in 2024, supported by advanced healthcare awareness, retail infrastructure, and strong adoption of premium probiotic formulations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Global Women Probiotic Market grew from USD 565.46 million in 2018 to USD 1,515.47 million in 2024 and is projected to reach USD 5,691.25 million by 2032.

- North America led with 42.3% share in 2024, driven by strong health awareness, advanced distribution channels, and rapid e-commerce adoption across the U.S., Canada, and Mexico.

- By product, Powder dominated with 35–45% share due to affordability, stability, and wide consumer acceptance, while gummies and chewable tablets gained momentum through convenience and taste appeal.

- By strain type, Lactobacillus held the leading 30–40% share, supported by extensive clinical validation for digestive, urinary, and vaginal health, with Bifidobacterium ranking as the next major segment.

- Drug stores & pharmacies accounted for around 30–35% share in 2024, while e-commerce followed at 25–30%, supported by ease of access, privacy, and growing global reach.

Market Segment Insights

Market Segment Insights

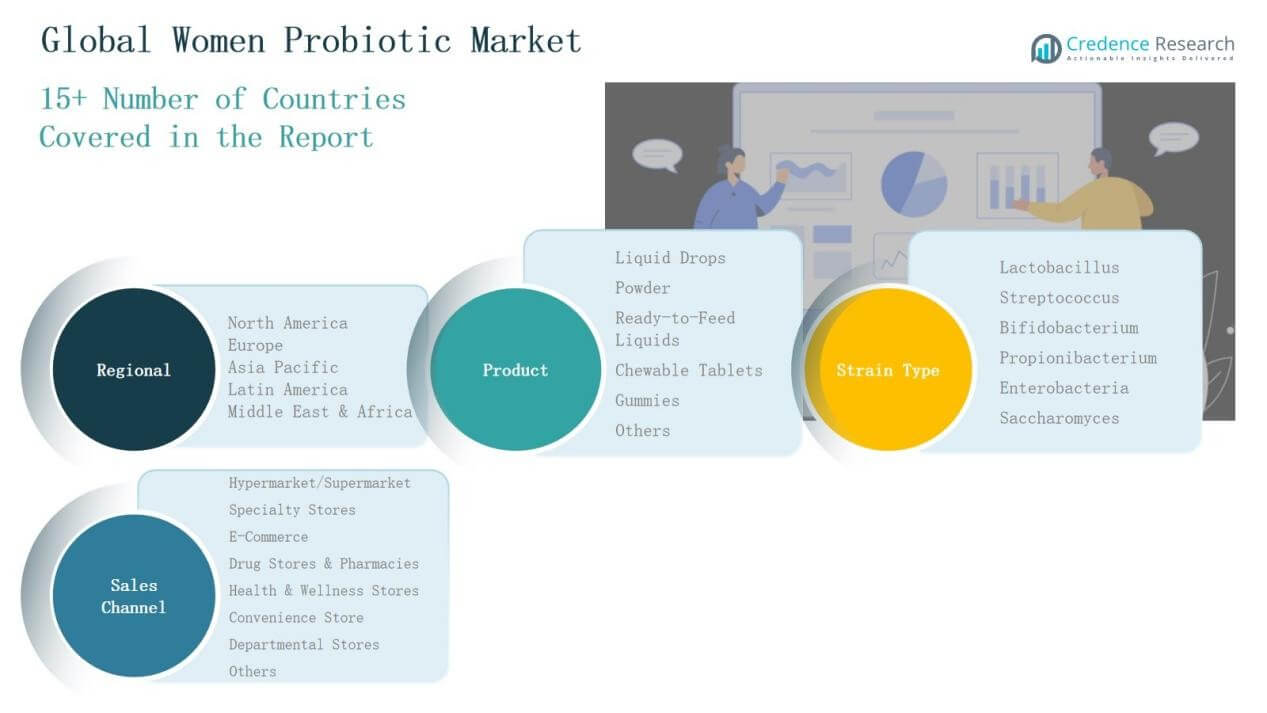

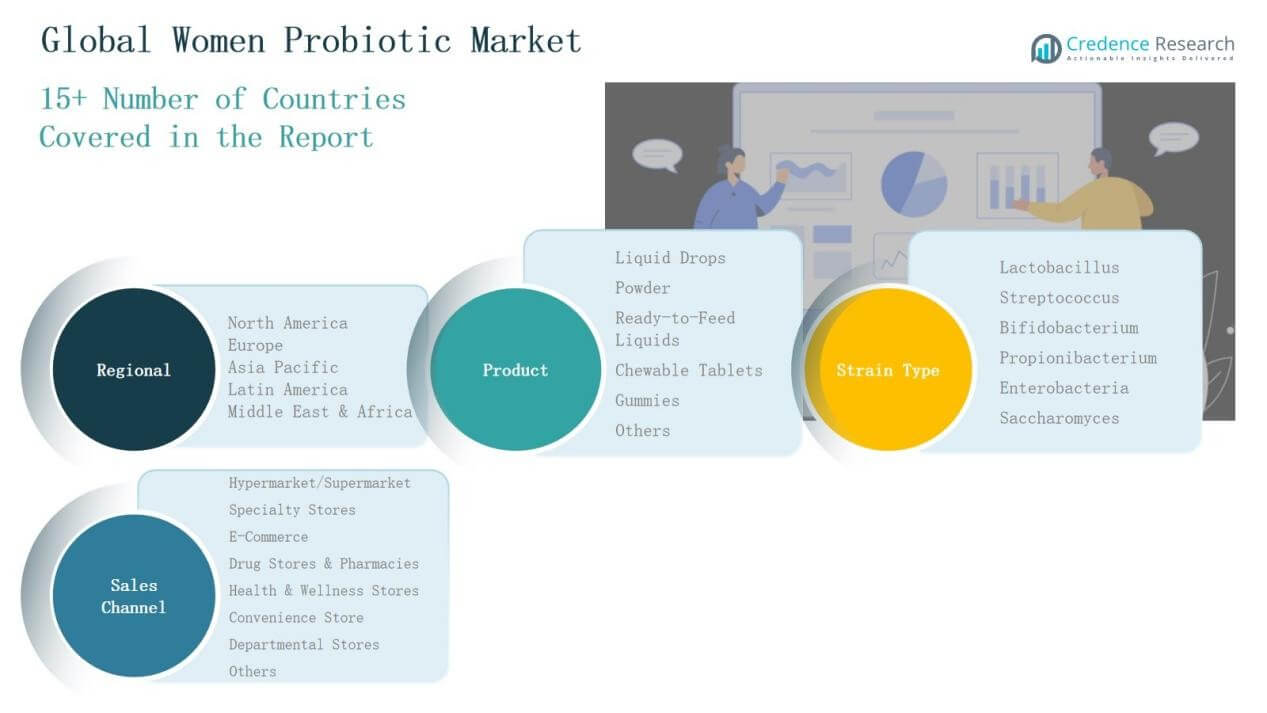

By Product

Liquid drops, powders, ready-to-feed liquids, chewable tablets, gummies, and others drive the product-format side. Among these, Powder typically dominates, capturing an estimated 35-45% share globally. Its dominance stems from easier formulation, longer shelf life, and lower production cost. Gummies and chewable tablets follow, boosted by consumer preference for convenience and taste. Ready-to-feed liquids and liquid drops see faster growth rates because of rising demand for child-friendly and midlife women supplements needing easy-to-swallow formats. The “Others” category (sachets, capsules etc.) retains smaller but stable shares due to traditional use and cost advantages.

For instance, SmartyPants Vitamins launched Kids Fiber & Veggies gummy supplements formulated to aid digestive health in children aged 4 and up, expanding their gummy product portfolio with a focus on targeted wellness benefits.

By Strain Type

Strain types include Lactobacillus, Streptococcus, Bifidobacterium, Propionibacterium, Enterobacteria, and Saccharomyces. Lactobacillus is the dominant strain type estimated to hold 30-40% share due to its strong backing in clinical studies for vaginal, urinary, and digestive health in women. Bifidobacterium ranks next, especially valued for gut balance and immune support. Saccharomyces and Streptococcus are niche but growing in specialized products. Propionibacterium and Enterobacteria carry minor shares because of stricter regulatory and safety scrutiny.

For instance, Osel, Inc. developed LACTIN-V, a live biotherapeutic containing the Lactobacillus crispatus strain CTV-05. Clinical trials have documented its benefits in significantly reducing the recurrence of bacterial vaginosis episodes in women who have completed antibiotic treatment

By Sales Channel

Sales channels cover hypermarkets/supermarkets, specialty stores, e-commerce, drug stores & pharmacies, health & wellness stores, convenience stores, departmental stores, and others. Currently, Drug Stores & Pharmacies and E-Commerce are the most dominant channels. Pharmacies hold 30-35% share owing to consumer trust in medically endorsed guidance, while e-commerce is growing rapidly, possibly 25-30%, due to ease, privacy, and global access. Hypermarkets/supermarkets and health & wellness stores follow, benefiting from broad product display and bundling. Specialty and convenience stores have smaller but important roles in urban and emerging markets. “Others” (direct selling, pop-ups, etc.) fill gaps in niche or rural markets.

Key Growth Drivers

Key Growth Drivers

Rising Awareness of Women’s Health and Preventive Care

Women are increasingly aware of issues like vaginal health, urinary tract infections, and hormonal balance. Medical research linking the microbiome to women’s wellness boosts demand for targeted probiotics. Preventive care becomes a priority over treatment, so women incorporate probiotics in daily routines. Increasing health education, social media, and wellness campaigns reinforce this shift. This awareness drives growth in new product launches, enabling brands to capture expanding customer segments focused on female-specific health.

For instance, ADM, in partnership with Biohm Health, introduced the women’s health probiotic ViviFem™ in North America, featuring patented microbiome strains aimed at supporting vaginal health, healthy aging, and reinforced immunity in women.

Innovation in Product Formats and Delivery Methods

Manufacturers develop formats like gummies, chewable tablets, ready-to-feed liquids, powders, and liquid drops to improve convenience and compliance. These formats appeal to different age groups, taste preferences, and lifestyles. For example, gummies and chewables attract younger consumers; liquids or powders serve those who dislike swallowing pills. Innovations around multi-strain blends, better stability, clean-label formulations, and personalized dosing enhance product differentiation. Such product innovation helps brands stand out and expand market share.

For instance, DSM-Firmenich unveiled its Humiome B2 probiotic powder at Vitafoods Europe, highlighting heat-stable formulations that allow flexible applications in functional drinks and sachets.

Distribution Expansion and E-Commerce Growth

Traditional channels like pharmacies and supermarkets still play a strong role, but e-commerce is accelerating strongly. Direct-to-consumer (D2C) brands and online retailers remove geographic barriers and offer broader access. Increased internet penetration, improved delivery logistics, and digital marketing allow even smaller brands to reach niche audiences. Emerging markets benefit especially from online growth. Wider distribution also improves visibility, helping newer products to gain trust and trial.

Key Trends & Opportunities

Clean Label, Plant-Based and Natural Formulations

Consumers increasingly prefer products with simple, recognizable ingredients, vegan or plant-based sources, non-GMO, and fewer additives. Women tend to trust formulations that claim “natural” or “organic.” Brands that deliver clinically backed strains with transparent sourcing and labeling reap trust and premium pricing. The shift toward cleaner, more natural probiotic products presents opportunity for those who align R&D and supply chain to meet these demands.

For instance, Danone launched Activia+ Multi-Benefit Probiotic Yogurt Drinks in the U.S., highlighting non-GMO ingredients, added vitamins, and live probiotics to appeal to health-conscious women seeking natural solutions.

Personalization and Clinical-Backed Strains

There is growing interest in probiotics tailored to individual needs—such as strains for skin health, hormonal balance, prenatal care, or gut-vaginal axis. Clinical studies validating strain-specific benefits help consumers choose with confidence. Personalized offerings—adjusted by age, health status, or microbiome testing—add value. Brands that partner with clinical researchers or health practitioners enhance credibility. This specialization opens up premium segments and fosters customer loyalty.

For instance, Chr. Hansen introduced FloraFIT® Probiotics for personalization, including strains like BB‑12® and LGG®, which are clinically backed for digestive balance and immunity and allow tailored formulations for age or health conditions.

Key Challenges

Regulatory and Efficacy Claims Complexity

Regulations for probiotics differ greatly across regions; verifying health claims demands rigorous clinical evidence. Many markets require proof of safety, strain specification, dosage, and mechanism. Brands risk legal challenges or consumer mistrust if product labeling or promised benefits are not backed by science. Achieving compliance adds time and cost to product development. The regulatory burden often delays product launches, limits innovation, and requires companies to allocate significant resources for scientific trials, documentation, and approvals, making it especially difficult for smaller firms to compete effectively.

Maintaining Probiotic Viability and Stability

Ensuring live microbes survive manufacturing, storage, and passage through stomach acid is technically difficult. Issues include strain sensitivity to heat, moisture, and oxygen. Delivery formats like gummies or liquids pose additional stability hurdles. Poor viability undermines efficacy and can lead to negative reviews or regulatory issues. Brands need robust encapsulation, cold-chain logistics, and quality assurance. Investments in advanced preservation technologies, protective packaging, and continuous testing are necessary, increasing operational costs while also forcing firms to carefully balance innovation with consistent product reliability and consumer expectations across diverse climates.

Price Sensitivity and Market Competition

Women probiotics belong to the premium wellness/supplement category. High production costs (clinical trials, strain development, packaging) often translate into higher consumer prices. In many markets, consumers are price sensitive. Also, competition from general probiotics (non-women-specific), traditional supplements, or home remedies exerts pressure. Brands must balance cost, quality, and differentiation to maintain profit margins and market share. Intense competition fosters frequent price wars, aggressive promotions, and heavy reliance on marketing to build trust, which further strains profitability while making it harder for new entrants to secure strong consumer loyalty.

Regional Analysis

North America

The North America Women Probiotic Market accounted for 42.7% in 2018, rising to 42.3% in 2024, and projected at 42.4% by 2032, supported by a CAGR of 16.8%. Market value grew from USD 241.64 million in 2018 to USD 640.75 million in 2024, reaching USD 2,413.15 million by 2032. Strong awareness of women’s health, advanced retail channels, and rising e-commerce adoption fuel growth. The U.S. leads the region with innovation in probiotic formulations, while Canada and Mexico expand through increasing pharmacy and wellness store penetration.

Europe

Europe held 28.7% share in 2018, 27.7% in 2024, and is forecasted to reach 27.0% by 2032, with a CAGR of 15.9%. Market revenue rose from USD 162.42 million in 2018 to USD 419.79 million in 2024, and is expected to hit USD 1,485.46 million by 2032. Growth is driven by high consumer preference for clean-label, natural probiotics and strong regulatory focus on safety and efficacy. Countries such as Germany, France, and the UK lead innovation, while southern and eastern European markets show emerging adoption, expanding the consumer base.

Asia Pacific

Asia Pacific captured 19.4% of the market in 2018, 21.0% in 2024, and is projected to rise to 23.8% by 2032, recording the fastest CAGR at 18.6%. Regional revenue increased from USD 109.77 million in 2018 to USD 318.64 million in 2024, and is projected at USD 1,353.94 million by 2032. Growth is supported by large populations, rising middle-class spending, and government initiatives promoting digestive and women’s health. China, Japan, and India drive major consumption, while Southeast Asia and Australia expand rapidly through e-commerce and direct-to-consumer models.

Latin America

Latin America represented 4.7% of the market in 2018, 4.7% in 2024, and is expected to hold 4.1% by 2032, expanding at a CAGR of 15.0%. Market size rose from USD 26.71 million in 2018 to USD 70.69 million in 2024, reaching USD 234.98 million by 2032. Brazil leads the region, followed by Argentina, with growth supported by rising disposable incomes and awareness of women’s wellness products. Although penetration remains lower than mature markets, e-commerce and pharmacy chains are expanding probiotic availability and supporting adoption.

Middle East

The Middle East accounted for 2.7% share in 2018, 2.5% in 2024, and is projected at 2.1% by 2032, posting a CAGR of 14.2%. Market value grew from USD 15.40 million in 2018 to USD 37.63 million in 2024, and is expected to reach USD 118.53 million by 2032. GCC countries dominate due to high awareness, premium product adoption, and urban retail expansion. Israel and Turkey show steady growth supported by rising health consciousness. Market penetration remains limited compared to Western economies, but targeted women’s health campaigns open opportunities.

Africa

Africa represented 1.7% share in 2018, 1.8% in 2024, and is expected at 1.5% by 2032, growing at a CAGR of 13.7%. Regional revenue increased from USD 9.52 million in 2018 to USD 27.96 million in 2024, reaching USD 85.20 million by 2032. Growth is concentrated in South Africa and Egypt, supported by rising urbanization and growing middle-class populations. Limited access, affordability challenges, and weaker healthcare infrastructure restrict broader adoption. However, increased pharmacy networks and e-commerce expansion across emerging African economies create long-term opportunities.

Market Segmentations:

By Product

- Liquid Drops

- Powder

- Ready-to-Feed Liquids

- Chewable Tablets

- Gummies

- Others

By Strain Type

- Lactobacillus

- Streptococcus

- Bifidobacterium

- Propionibacterium

- Enterobacteria

- Saccharomyces

By Sales Channel

- Hypermarket/Supermarket

- Specialty Stores

- E-Commerce

- Drug Stores & Pharmacies

- Health & Wellness Stores

- Convenience Store

- Departmental Stores

- Others

By Region

North America

Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Argentina

- Rest of Latin America

Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The competitive landscape of the Global Women Probiotic Market is characterized by strong participation from multinational corporations, nutraceutical companies, and emerging regional players. Leading firms such as Nestlé, Bayer, Unilever, Procter & Gamble (P&G), NOW Health Group, Amerifit Brands, and Reckitt dominate through extensive product portfolios, robust R&D investments, and wide distribution networks. These companies leverage brand equity and clinical research to strengthen consumer trust, particularly in premium women-focused formulations. Strategic collaborations, acquisitions, and product launches play a vital role in expanding market presence and addressing diverse health concerns, from digestive balance to reproductive wellness. Smaller and mid-sized players differentiate by focusing on clean-label, vegan, or personalized probiotic solutions, catering to niche consumer preferences. E-commerce and direct-to-consumer strategies are increasingly used across the competitive spectrum, enabling broader reach and targeted marketing. Intense rivalry, regulatory requirements, and pricing pressures drive continuous innovation and push companies to invest heavily in strain development and consumer education.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Nestlé

- Bayer

- Unilever

- Procter & Gamble (P&G)

- NOW Health Group

- Amerifit Brands

- Reckitt

Recent Developments

- In May 2023, TruBiotics introduced a range of women’s health probiotic supplements addressing gastrointestinal, vaginal, urinary, skeletal health, and hair, skin, and nail benefits.

- In January 2024, Dr. Reddy acquired the full range of MenoLabs supplements from Amryis Inc., enhancing their women’s health portfolio focused on perimenopause and menopausal support.

- In June 2025, Danone acquired The Akkermansia Company to expand its gut health and next-generation biotics portfolio.

- In May 2025, Florastor introduced Her Florastor Digest + De-Stress Probiotics and Digest + Metabolic Support Gummies for women.

Report Coverage

The research report offers an in-depth analysis based on Product, Stain Type, Sales Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as women increasingly adopt preventive healthcare solutions.

- Personalized probiotic products will gain traction with strain-specific formulations.

- Clean-label and plant-based probiotics will expand consumer adoption.

- E-commerce will emerge as a leading distribution channel worldwide.

- Clinical validation will strengthen trust and boost premium product sales.

- Emerging markets will see faster adoption driven by urbanization and awareness.

- Innovative delivery formats like gummies and ready-to-feed liquids will expand appeal.

- Strategic partnerships and acquisitions will accelerate portfolio diversification.

- Education campaigns on gut and vaginal health will drive product penetration.

- Technological advances in strain preservation will improve stability and shelf life.

Market Segment Insights

Market Segment Insights Key Growth Drivers

Key Growth Drivers