Market Overview

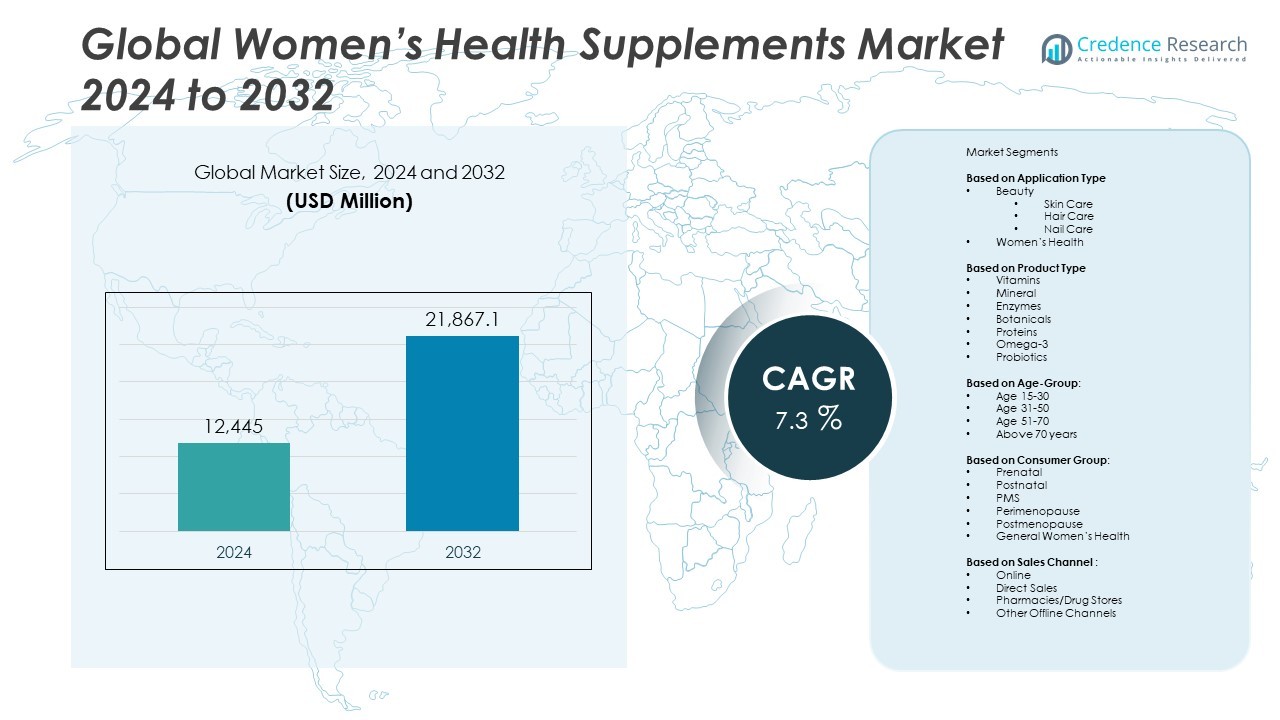

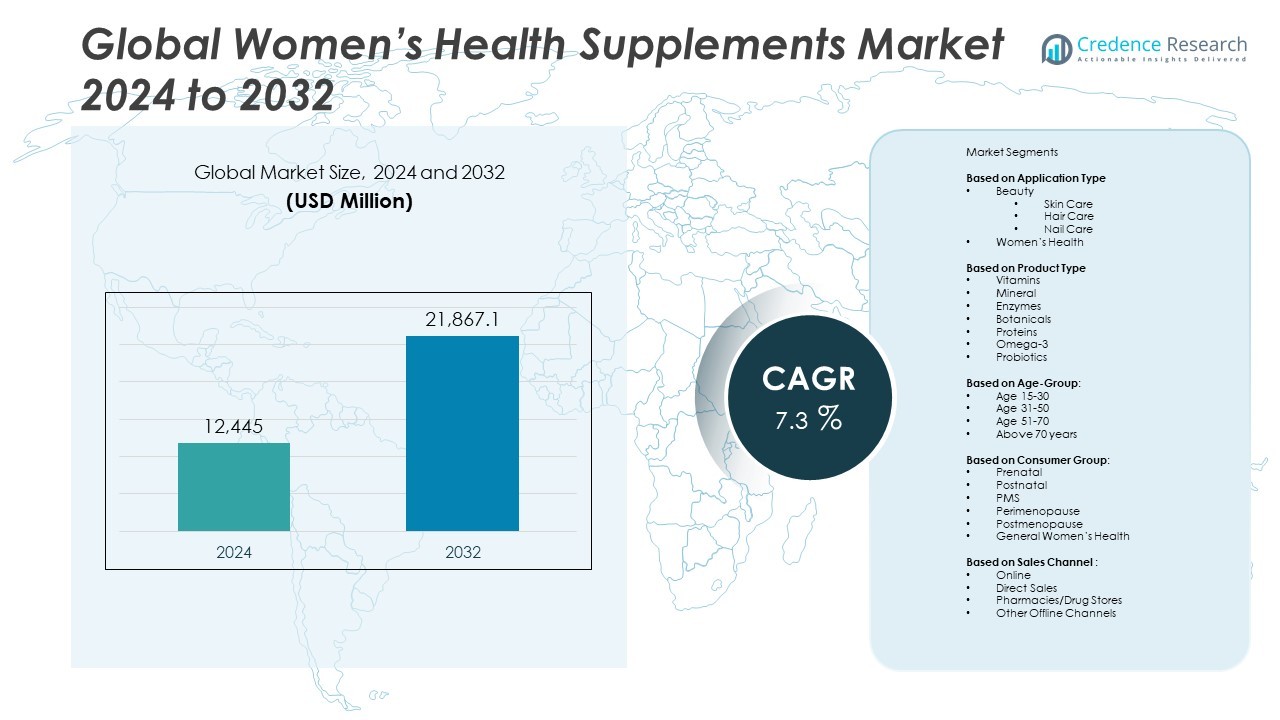

The Women’s Health Supplements Market stood at USD 12,445 million in 2024. It is expected to reach USD 21,867.1 million by 2032, registering a CAGR of 7.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Women’s Health Supplements Market Size 2024 |

USD 12,445 Million |

| Women’s Health Supplements Market , CAGR |

7.3% |

| Women’s Health Supplements Market Size 2032 |

USD 21,867.1 Million |

The Women’s Health Supplements Market is driven by rising awareness of preventive healthcare, increased focus on hormonal balance, and a growing aging female population seeking bone, heart, and reproductive health support. It benefits from greater access to personalized nutrition, digital health tools, and clean-label formulations. Key trends include rising demand for plant-based, vegan, and collagen-based products, along with innovations in supplement formats such as gummies and powders.

Geographically, the Women’s Health Supplements Market spans key regions including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America leads in product innovation and consumer awareness, supported by high healthcare spending and demand for clean-label supplements. Europe follows with strong regulatory oversight and rising interest in natural and vegan options. Asia Pacific shows rapid growth due to expanding urban populations, growing disposable incomes, and increasing focus on women’s wellness across China, Japan, and India. Latin America and the Middle East & Africa show potential through greater retail access and awareness campaigns.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Women’s Health Supplements Market was valued at USD 12,445 million in 2024 and is expected to reach USD 21,867.1 million by 2032, growing at a CAGR of 7.3% during the forecast period.

- Rising awareness around preventive health, hormonal balance, and nutritional needs continues to drive consistent demand for women-focused supplements globally.

- Consumers are increasingly seeking plant-based, clean-label, and hormone-free supplements targeting menopause, prenatal care, and bone health, reshaping formulation strategies across key brands.

- Competitive players such as Amway Corp., Herbalife Ltd., Bayer AG, and GNC Holdings lead the market through targeted product development, multichannel distribution, and strong consumer engagement.

- Lack of standardization, regulatory inconsistencies, and misinformation around supplement efficacy and safety challenge market penetration, especially in emerging economies.

- North America dominates due to advanced retail infrastructure and health-conscious consumers, followed by Europe with its stringent quality standards and growing demand for organic options. Asia Pacific shows the fastest expansion driven by urbanization and rising disposable income.

- Companies continue to expand their women’s health product portfolios by introducing specialized solutions for PCOS, fertility support, and menopause symptom management, supported by clinical claims and digital marketing strategies.

Market Drivers

Rising Focus on Preventive Healthcare and Nutritional Awareness Among Women

The growing emphasis on preventive health and lifestyle management continues to drive demand in the Women’s Health Supplements Market. Women are increasingly prioritizing nutritional intake to maintain hormonal balance, reproductive health, and bone density. Public health campaigns and digital content have improved awareness about the benefits of supplements in addressing deficiencies. Nutraceuticals for prenatal care, menopause support, and PMS relief gain traction among diverse age groups. The trend toward self-directed health choices supports consistent market demand. It benefits from a rising number of consumers integrating vitamins, minerals, and herbal blends into daily routines.

- For instance, Bayer AG reported a 12 million unit increase in sales of its One A Day Women’s supplement line between 2021 and 2023, with notable growth in its bone health and prenatal segments.

Growing Demand for Targeted Solutions Across Life Stages

Women seek age-specific supplements that support evolving health needs from adolescence to post-menopause. Brands offer personalized formulations for fertility, pregnancy, skin health, and aging-related concerns. The Women’s Health Supplements Market responds with expanded product lines addressing hormonal changes, iron levels, and calcium support. Product segmentation becomes sharper, with labels targeting lifestyle, immunity, and energy. Manufacturers design solutions aligned with medical guidance and consumer expectations. It creates new opportunities for growth through targeted innovation and outreach.

- For instance, GNC launched 38 new SKUs under its Women’s Ultra Mega range between 2022 and 2023 and sold over 4 million units of these targeted formulations across their wellness and lifestyle lines

Expansion of E-commerce and Direct-to-Consumer Sales Channels

Online platforms play a major role in the distribution of women’s health supplements. E-commerce enables easy access to a wide variety of products, user reviews, and transparent ingredient details. It drives global penetration for both premium and economy brands. The Women’s Health Supplements Market benefits from increased visibility through digital marketing and influencer collaborations. Subscription models and app-based reminders improve product usage consistency. It supports brand loyalty and consumer engagement beyond traditional retail environments.

Rising Preference for Natural and Plant-Based Ingredients in Health Products

Clean-label trends push demand for supplements made from organic, vegan, and non-GMO sources. Consumers favor botanical extracts such as ashwagandha, cranberry, and turmeric for their natural healing properties. The Women’s Health Supplements Market aligns with this shift by reformulating products and emphasizing transparency. Brands highlight allergen-free, gluten-free, and preservative-free claims to appeal to health-conscious buyers. Regulatory support for safe and certified herbal products enhances market credibility. It reinforces trust and accelerates adoption across various consumer segments.

Market Trends

Increased Personalization and Customized Nutritional Formulations for Women

Personalized supplementation becomes a defining trend across the Women’s Health Supplements Market. Consumers prefer solutions tailored to specific health needs such as fertility, immunity, mood support, and hormonal balance. Brands are leveraging genetic testing, health quizzes, and AI-based assessments to recommend precise formulas. This level of customization supports long-term adherence and better health outcomes. It enhances consumer engagement and positions companies as solution-driven providers. The market increasingly sees subscription services offering flexible plans based on age, lifestyle, and health goals.

- For instance, Persona Nutrition has recorded over 1 million users completing its online health assessment, enabling customizable daily vitamin packs informed by a comprehensive drug–nutrient interaction database comprising more than 1,000 medications.

Clean-Label and Natural Ingredient Focus Shapes Product Development

There is rising consumer preference for supplements free from artificial additives, preservatives, and allergens. Clean-label positioning now includes plant-based ingredients, organic sourcing, and cruelty-free certifications. The Women’s Health Supplements Market sees strong traction in botanicals like maca root, chasteberry, and evening primrose oil. Formulations with fewer synthetic compounds and higher bioavailability gain competitive edge. It pushes brands to invest in traceable supply chains and transparent labeling. The natural wellness movement is transforming product formulations across global regions.

- For instance, Ritual publishes traceable supply data for over 4.5 million tested batches of its vitamins, enabling users to verify ingredient origin and purity via its Made Traceable® platform.

Increased Role of Digital Health Tools in Supplement Consumption

Consumers now use digital tools to track supplement intake and monitor wellness outcomes. Apps offer reminders, dosage tracking, and feedback loops that support consistent usage. The Women’s Health Supplements Market benefits from this digital integration that improves consumer accountability. Health tech partnerships and smart packaging solutions are rising across premium product lines. It adds a layer of interactivity and data-driven personalization to routine consumption. Brands offering companion tech solutions strengthen user experience and product loyalty.

Growing Influence of Female-Centric Wellness Brands and Influencers

Female-focused wellness brands and influencers shape buyer behavior across social and e-commerce platforms. Authentic endorsements and educational content help bridge the knowledge gap around supplement use. The Women’s Health Supplements Market aligns with this trend by amplifying campaigns through community engagement and targeted messaging. Smaller brands with strong narratives are gaining rapid traction, challenging traditional supplement players. It builds emotional connection and trust through relatable marketing and transparent practices. This cultural shift supports a more informed and empowered consumer base.

Market Challenges Analysis

Regulatory Uncertainty and Lack of Standardization Impact Product Development

Inconsistent global regulations pose a serious challenge for manufacturers operating across multiple regions. The Women’s Health Supplements Market faces hurdles from varying guidelines around claims, ingredient approval, and labeling requirements. It limits product expansion and delays time-to-market for new formulations. Companies often struggle to validate health claims without extensive clinical backing, creating credibility risks. Navigating evolving regulations in regions like Europe and North America requires legal expertise and regular compliance updates. The absence of universally accepted standards affects consumer trust and makes product comparison difficult.

Consumer Misinformation and Oversaturation Reduce Brand Differentiation

An abundance of low-quality products and marketing hype creates confusion among consumers. The Women’s Health Supplements Market must address a lack of education about appropriate usage, dosage, and potential interactions. It leads to inconsistent results and skepticism, especially when users experience minimal benefits. Market oversaturation reduces brand visibility and forces companies to invest heavily in marketing to stay competitive. Misinformation spread by influencers and unverified sources compounds this issue, harming reputable brands. Building trust through transparency, clinical validation, and user education remains essential to overcome these obstacles.

Market Opportunities

Growing Focus on Preventive Healthcare Unlocks Product Diversification Potential

Rising health awareness among women creates strong momentum for preventive solutions. The Women’s Health Supplements Market can expand by aligning product portfolios with age-specific and condition-specific needs. It allows brands to target niche areas such as hormone balance, bone strength, fertility support, and prenatal care. Increased demand for clean-label and plant-based supplements also opens new product development routes. Consumers are actively seeking alternatives to pharmaceutical interventions, especially in areas related to mood, energy, and immunity. This shift offers companies a path to innovate with scientifically backed, consumer-trusted ingredients.

Digital Wellness Platforms and E-Commerce Channels Support Market Expansion

Technology integration creates new access points and enhances customer engagement. The Women’s Health Supplements Market benefits from the growing reach of e-commerce platforms, mobile health apps, and wellness subscriptions. It helps companies personalize product recommendations and track user outcomes in real time. Brands can use digital tools to educate users, gather feedback, and build loyalty. Telehealth growth also drives supplement adoption, especially in underserved regions. These channels provide cost-effective ways to scale operations and expand into new geographies without heavy infrastructure investment.

Market Segmentation Analysis:

By Product Type:

The Women’s Health Supplements Market demonstrates strong performance across several product categories. Vitamins and minerals dominate the segment due to their widespread use in addressing common deficiencies, particularly vitamin D, calcium, and iron. Protein supplements maintain steady demand among fitness-focused women, with whey and plant-based options both gaining traction. Herbal supplements such as evening primrose oil, black cohosh, and ashwagandha are also showing increased uptake for managing hormonal balance and stress. Omega-3 and fatty acid supplements remain vital in supporting heart and cognitive health, especially among older women. Collagen supplements continue to see growth, driven by beauty and anti-aging trends.

- For instance, Kinohimitsu sold over 1 million bottles of its Collagen Diamond 5300 mg drink in Southeast Asia, supporting sustained brand recognition across multiple markets.

By Application Type:

The Women’s Health Supplements Market is driven by increasing demand in bone and joint health, reproductive health, and general wellness categories. Bone health supplements, especially those with calcium, magnesium, and vitamin D3, address the widespread issue of osteoporosis. Reproductive health formulations cater to premenstrual, fertility, pregnancy, and menopausal needs. General wellness supplements with multivitamins and adaptogens help manage immunity and energy levels in urban, high-stress lifestyles. Mental health and mood-balancing supplements also show growing relevance.

- For instance, Caltrate by Haleon (formerly GSK) offers a tablet formulation with 600 mg of calcium carbonate plus supportive vitamins (D, K, magnesium), and its global sales exceed 10 million units annually in bone-support sub-segments.

By Age-Group Type:

Adult women represent the largest consumer base in the Women’s Health Supplements Market. Women aged 30–50 prioritize supplements for reproductive health, energy support, and bone strength. Teenage users are turning toward multivitamins and hormonal balance products to support menstrual health and skincare. The senior population, though smaller, demands supplements focused on joint care, cognitive support, and cardiovascular function. Product development in this space targets biological differences across life stages, influencing formulation complexity and delivery forms.

Segments:

Based on Product Type:

- Vitamins

- Mineral

- Enzymes

- Botanicals

- Proteins

- Omega-3

- Probiotics

Based on Application:

-

- Skin Care

- Hair Care

- Nail Care

- Women’s Health

Based on Age-Group:

- Age 15-30

- Age 31-50

- Age 51-70

- Above 70 years

Based on Consumer Group:

- Prenatal

- Postnatal

- PMS

- Perimenopause

- Postmenopause

- General Women’s Health

Based on Sales Channel :

- Online

- Direct Sales

- Pharmacies/Drug Stores

- Other Offline Channels

Based on the Geography:

- North America

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Denmark

- Sweden

- Norway

- Asia Pacific

- Japan

- China

- India

- South Korea

- Australia

- Thailand

- Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

Regional Analysis

North America:

The region maintains its lead due to a strong presence of established supplement brands, advanced healthcare infrastructure, and high consumer awareness. Women across the United States and Canada demonstrate a proactive approach to preventive health and wellness, particularly around bone health, menopause support, and beauty-from-within products. The U.S. alone contributes the majority of regional revenue, with strong demand for collagen, prenatal vitamins, and multivitamins. The growth of e-commerce platforms and personalized nutrition trends has further strengthened market expansion. Regulatory support from agencies like the FDA ensures high product quality and consumer confidence. North America is expected to retain its dominance throughout the forecast period.

Europe:

The region benefits from a well-informed consumer base and increasing focus on active aging and preventive care among women. Countries like Germany, France, and the United Kingdom drive regional growth through high demand for hormone balance supplements, bone support formulations, and herbal remedies. The growing vegan and plant-based movement in Europe supports increased adoption of botanical and clean-label supplements. Key manufacturers in the region emphasize sustainable packaging and organic certifications to meet evolving consumer expectations. Retail pharmacies and online platforms have increased their presence in Eastern Europe, expanding market access. The European market continues to mature with innovation in delivery formats such as gummies, powders, and drinkable supplements.

Asia-Pacific:

The region is experiencing the fastest growth, driven by rising disposable income, urbanization, and increasing awareness of women’s health issues. China, Japan, and India are the key markets, with Japan leading in innovation and China experiencing high volume consumption. Traditional health practices in countries like India are blending with modern nutraceutical solutions, boosting interest in Ayurveda-based and herbal supplements. Women in urban centers are adopting supplements to support menstrual health, reproductive well-being, and skin health. The market is also benefiting from regional expansion of international brands and growth in local manufacturing. Digital marketing, mobile health apps, and influencer promotions are accelerating consumer engagement in Asia-Pacific.

Latin America:

The market here is supported by improving healthcare access and rising awareness among younger female populations. Brazil and Mexico remain the dominant markets due to larger populations and an expanding middle class. Demand is growing for weight management, prenatal, and hair & skin health supplements. While regulatory frameworks are still evolving, they are gradually aligning with global standards. Increasing partnerships between regional pharmacies and supplement brands are helping expand availability. The market is expected to grow steadily, supported by cultural shifts in health awareness.

The Middle East & Africa:

This region shows modest but steady growth due to rising health literacy, especially in Gulf countries such as the UAE and Saudi Arabia. Cultural norms are gradually changing, allowing women greater access to preventive healthcare, including supplements. Key demand areas include fertility, prenatal, and general wellness products. Access to international brands is increasing through online retail and pharmacy chains. Africa’s share remains small, but potential exists due to urbanization and NGO-driven health initiatives. Challenges such as affordability and awareness remain, but the market outlook remains positive with sustained investment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Herbalife International of America, Inc.

- GNC Holdings, Inc

- Amway Corporation

- Suntory Holdings Limited

- Pharmavite LLC

- Blackmores

- Vitabiotics Ltd.

- Asahi Group Holdings, Ltd

- USANA Health Sciences, Inc.

- Nu Skin Enterprise, Inc.

- Unilab, Inc.

- The Himalaya Drug Company

Competitive Analysis

The Women’s Health Supplements Market remains competitive with leading players such as Amway Corp., Herbalife Ltd., Bayer AG, GNC Holdings, Nestlé Health Science, and The Nature’s Bounty Co. These companies maintain dominance through strong brand recognition, wide product portfolios, and global distribution. Amway and Herbalife benefit from direct selling models, while Bayer leverages its pharmaceutical expertise to offer clinically validated supplements. GNC Holdings targets women’s fitness and wellness segments, Nestlé Health Science focuses on medical-grade and functional nutrition, and Nature’s Bounty appeals to clean-label and plant-based consumers. Continuous investment in R&D, digital marketing strategies, e-commerce presence, and regional expansion helps these companies sustain market leadership and meet evolving consumer demands.

Recent Developments

- In January 2025, GNC launched its Premier Collagen line for skin health, offering two supplement formulas-Premier Collagen and Advanced Shot-featuring marine and bovine collagen peptides and vitamin C, designed for fast absorption and promoting youthful-looking skin in various formats.

- In June 2024, Amway highlighted women’s specific health needs, particularly focusing on nutritional support for iron deficiency, menstruation, menopause, and skin health. They emphasized the importance of tailored nutrition solutions to address these concerns, suggesting specific supplements.

Market Concentration & Characteristics

The Women’s Health Supplements Market exhibits moderate to high concentration, with a few major players accounting for a significant share of global sales. It features a mix of multinational corporations and region-specific brands that compete on product innovation, ingredient sourcing, and targeted health benefits. The market shows strong consumer loyalty toward well-established brands offering transparency, clinical validation, and clean-label formulations. It supports high product differentiation, with companies developing tailored supplements for hormonal balance, prenatal care, menopause support, and bone health. Regulatory compliance and product safety standards remain critical characteristics, shaping product development and global expansion strategies. It also favors companies with strong distribution networks across retail pharmacies, specialty stores, and e-commerce platforms. Increasing awareness about personalized nutrition and preventive health fuels demand, while manufacturers emphasize science-backed claims to build credibility. The market continues to shift toward natural, plant-based, and non-GMO supplements that align with consumer preferences for holistic wellness solutions.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application Type, Age-Group Type, Consumer Group Type, Sales Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Women’s health supplements market will witness steady growth due to rising awareness about preventive healthcare among women.

- Demand for hormonal balance and reproductive health supplements will increase across all age groups.

- Personalized nutrition and DNA-based supplements will drive innovation and consumer interest.

- E-commerce platforms will dominate distribution channels due to convenience and wide accessibility.

- Clean-label, organic, and plant-based supplements will gain more traction among health-conscious consumers.

- The geriatric female population will contribute significantly to demand for bone health and menopause-related supplements.

- Emerging markets in Asia-Pacific and Latin America will offer lucrative expansion opportunities for manufacturers.

- Technological advancements in formulation will improve product efficacy and consumer trust.

- Strategic collaborations between supplement brands and healthcare professionals will enhance market credibility.

- Regulatory developments will push companies to focus more on product transparency and safety standards.