Market Overview

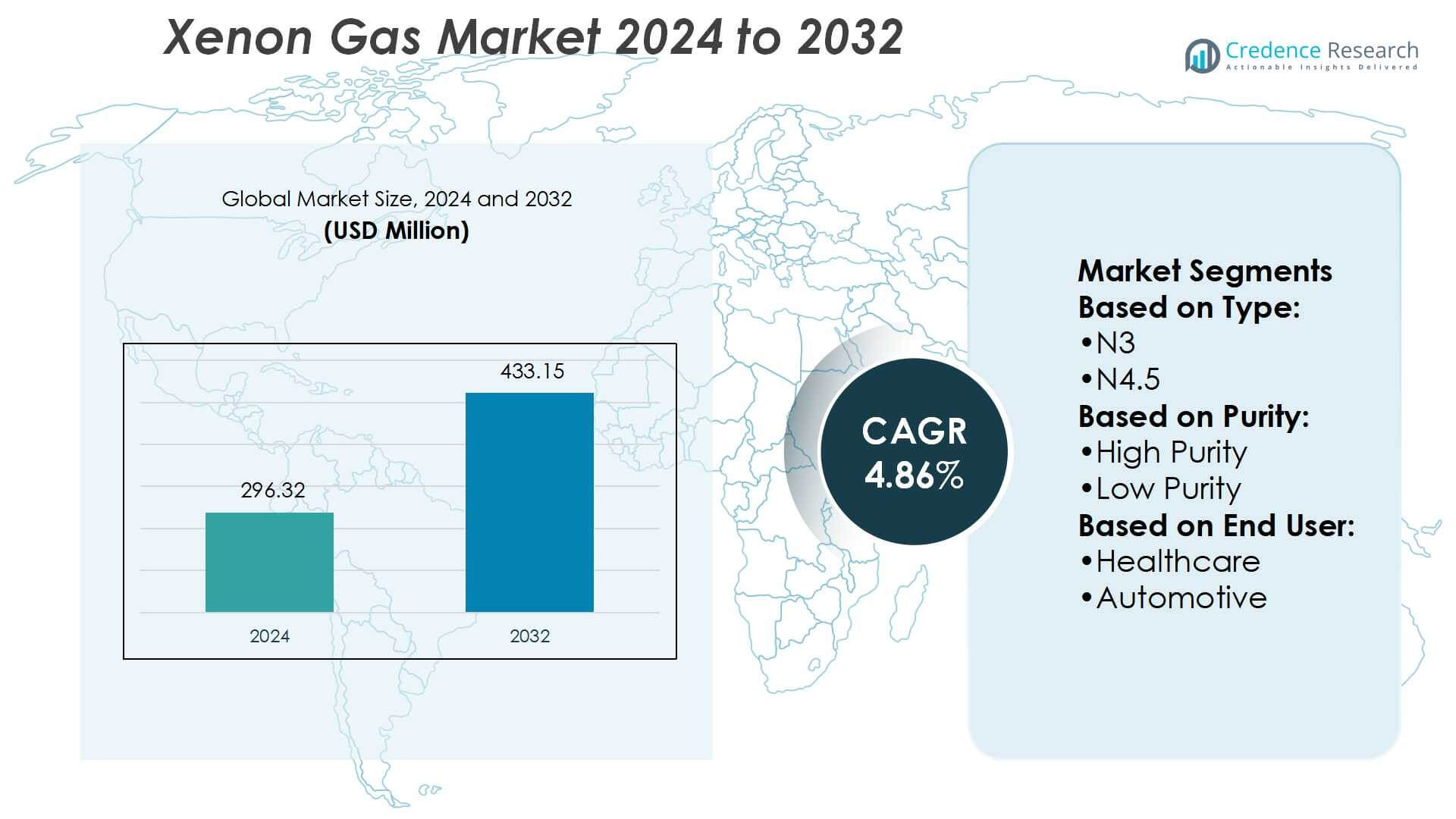

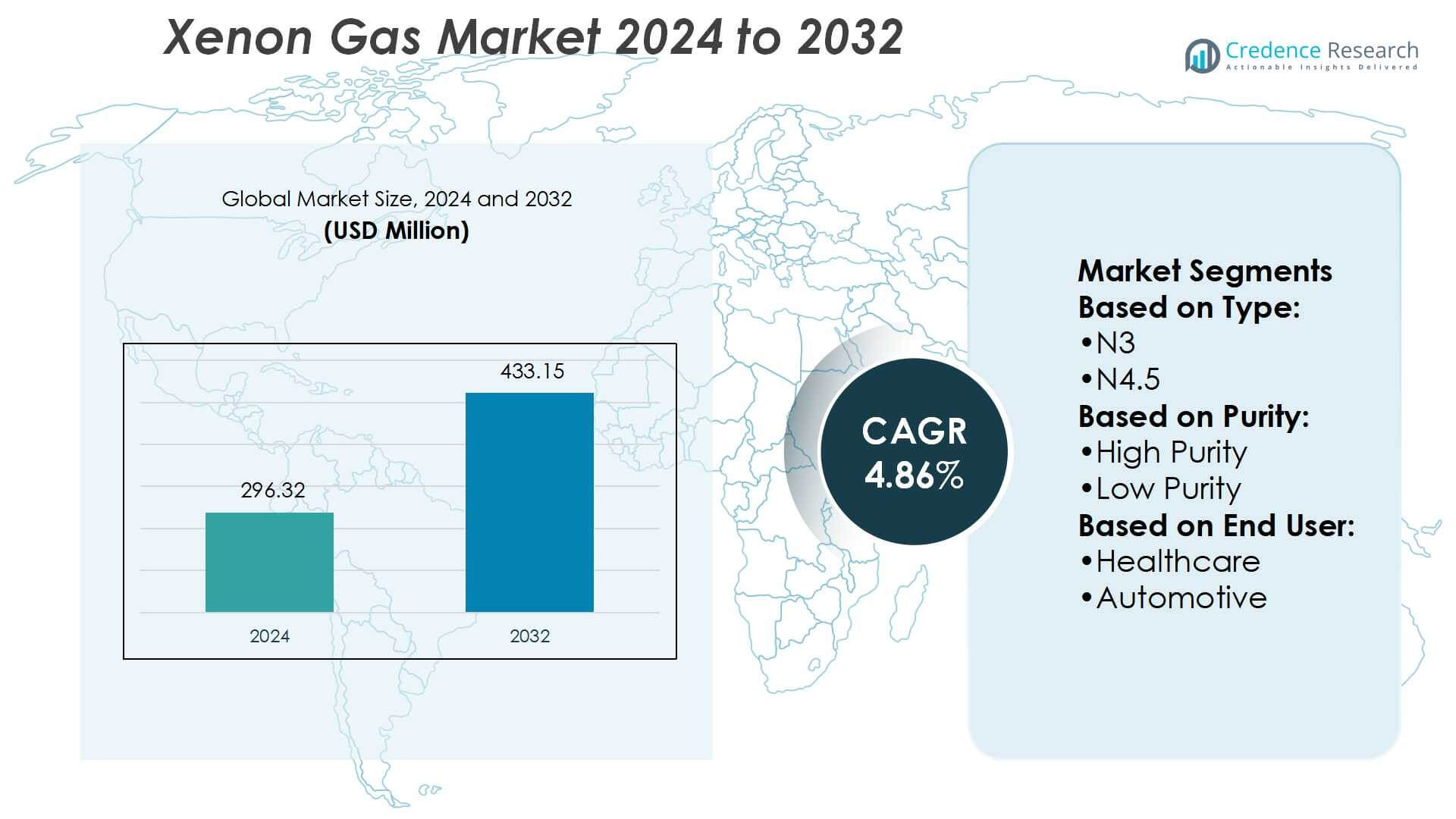

Xenon Gas Market size was valued USD 296.32 million in 2024 and is anticipated to reach USD 433.15 million by 2032, at a CAGR of 4.86% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Xenon Gas Market Size 2024 |

USD 296.32 Million |

| Xenon Gas Market, CAGR |

4.86% |

| Xenon Gas Market Size 2032 |

USD 433.15 Million |

The xenon gas market is driven by established players including Air Liquide, Linde PLC, Air Products & Chemicals, Inc., Messer Group GmbH, Matheson Tri-Gas, Inc., American Gas Products (AGP LLC), Proton Gases (India) Pvt. Ltd., Coregas Pty Ltd., Akela-p Medical Gases P. Ltd., and Electronic Fluorocarbons, LLC. These companies compete through technological advancements in high-purity xenon production, strategic partnerships, and global distribution networks. North America leads the market with a 35% share, supported by strong demand from healthcare, semiconductor, and aerospace sectors. The region’s advanced infrastructure and consistent investments in R&D reinforce its leadership position in the global xenon gas industry.

Market Insights

Market Insights

- The Xenon Gas Market was valued at USD 296.32 million in 2024 and is expected to reach USD 433.15 million by 2032, growing at a CAGR of 4.86%.

- Rising demand from healthcare, aerospace, and semiconductor industries acts as a key market driver, with high-purity xenon gaining dominance due to its critical role in anesthesia, medical imaging, and chip fabrication.

- A major trend shaping the market is the growing use of xenon in satellite ion propulsion systems and semiconductor lithography, supported by advancements in high-purity recovery technologies.

- The market remains competitive, with global players investing in technology upgrades, recycling processes, and strategic alliances to strengthen supply reliability, while high production costs and limited natural availability act as restraints.

- North America leads with 35% share, driven by healthcare and semiconductor adoption, while the N5 grade segment holds the largest share globally, supported by its use in advanced electronics and aerospace applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Within the xenon gas market, the N5 grade segment holds the dominant share, driven by its ultra-high purity level suitable for advanced applications. N5 xenon, with 99.999% purity, is widely used in semiconductors and high-performance lighting systems, where even minor impurities can impact functionality. Its growing adoption in excimer lasers for semiconductor lithography is a key driver, supported by the rising demand for microelectronics. While N3 and N4.5 grades are used in general lighting and industrial processes, the demand for N5 remains strongest due to its role in critical high-tech applications.

- For instance, Industrial gas suppliers offer high-purity xenon, typically in compressed gas cylinders, with purity levels of 99.995% or higher. These products are commonly available in various cylinder sizes, such as 50 L.

By Purity

High purity xenon dominates the market share, accounting for a major portion of demand across healthcare, aerospace, and electronics industries. Its superior quality makes it essential in ion propulsion systems for satellites and in anesthesia delivery systems where consistent performance is crucial. Electronics and semiconductor manufacturers rely on high purity xenon for precise processes in chip fabrication. Low purity xenon, though cost-effective, finds limited use in industrial or general-purpose applications. The preference for high purity is driven by stricter quality standards, technological advancement, and rising requirements for accuracy in critical end-use industries.

- For instance, Air Products offers xenon with a specification that limits carbon dioxide to ≤ 5.0 ppmv, making it suitable for use as an ion‐beam source or plasma etching atmosphere.

By End User

The healthcare sector leads the xenon gas market, holding the largest share due to its use in medical imaging, anesthesia, and neuroprotection research. Xenon’s non-toxic, fast-acting anesthetic properties make it ideal for sensitive surgeries and critical care. Increasing research into its therapeutic potential, particularly in brain injury treatment, further strengthens its adoption. Electronics and semiconductors represent another high-growth segment, driven by xenon’s use in lithography systems. Aerospace and defense also contribute significantly, with xenon applied in satellite propulsion. Healthcare dominance, however, remains steady, fueled by ongoing investments in advanced medical technologies.

Key Growth Drivers

Rising Demand in Healthcare Applications

The healthcare industry is a major growth driver for the xenon gas market. Xenon is increasingly used in anesthesia due to its non-toxic nature, rapid recovery properties, and minimal side effects. Its application in neuroprotection and medical imaging enhances treatment outcomes for brain injuries and critical care. Ongoing clinical research continues to expand its potential therapeutic uses, strengthening demand. The growing preference for safe, high-performance anesthetics and advanced diagnostic tools positions healthcare as a vital sector driving xenon gas consumption globally.

- For instance, Air Products supplies xenon with total purity 99.995%. This grade has impurity limits of carbon dioxide to 5.0 ppmv, carbon monoxide to 1.0 ppmv, and oxygen to 5.0 ppmv.

Expanding Role in Aerospace and Defense

Xenon’s adoption in aerospace and defense significantly boosts market growth, particularly in satellite propulsion systems. Ion propulsion technology relies heavily on xenon due to its high atomic mass and efficiency in space travel. This demand aligns with the rising number of satellite launches for communication, navigation, and defense purposes. Governments and private space agencies increasingly integrate xenon-based propulsion to reduce fuel weight and extend mission lifespans. Expanding investments in space exploration and defense projects ensure steady growth in this segment, making it a long-term market driver.

- For instance, Xenon, used in medical and aerospace applications, is commonly supplied in standard cylinder sizes such as 40 L and 50 L, pressurized up to 150 bar. Such cylinders typically contain gas volumes exceeding 5 cubic meters.

Growing Use in Electronics and Semiconductors

The electronics and semiconductor industry is a critical growth engine for the xenon gas market. Xenon is essential in excimer lasers used for photolithography, a process central to advanced chip manufacturing. As demand for miniaturized and high-performance devices grows, chipmakers rely on xenon to achieve precise etching and patterning. The rising adoption of 5G networks, AI, and IoT devices amplifies this need. Strong semiconductor demand, coupled with continuous investment in manufacturing technologies, reinforces xenon’s strategic role in supporting the global electronics supply chain.

Key Trends & Opportunities

Advancements in Semiconductor Lithography

The increasing complexity of semiconductor design creates strong opportunities for xenon use in lithography systems. With the transition toward smaller nodes, excimer lasers powered by xenon enable precision at nanometer scales. This trend supports next-generation technologies such as AI processors and 5G chips. Companies investing in EUV and advanced lithography tools depend on consistent xenon supply. As the global semiconductor industry expands, the market benefits from both volume growth and higher technical requirements, opening opportunities for suppliers to target this high-value application segment.

- For instance, Linde supplies xenon under its HiQ® Xenon 5.0 specification, guaranteeing purity of 99.999% Xenon by volume. This grade has a water vapor limit of ≤2 ppm.

Expansion of Space Exploration Initiatives

The surge in satellite launches and deep-space missions creates new opportunities for xenon gas suppliers. Governments, commercial operators, and private space ventures increasingly adopt xenon-based ion propulsion systems for their efficiency and extended operational life. Growth in satellite constellations for internet connectivity, Earth observation, and defense adds further demand. As reusable launch vehicles and small-satellite platforms gain traction, xenon consumption will rise. This expansion offers suppliers opportunities to collaborate with aerospace firms and strengthen their presence in the global space economy.

- For instance, High-purity xenon, such as Grade 5.0 (99.999%), is required for applications like aerospace ion-thrusters, which require strict impurity control. Industrial gas suppliers offer a range of cylinder sizes and pressures to meet the specific requirements for such advanced technologies.

Sustainable and High-Purity Innovations

Manufacturers are focusing on improving xenon recovery and recycling technologies to meet rising purity demands. High-purity xenon supports critical applications in healthcare and semiconductors, where precision is key. Sustainable practices, including enhanced extraction from air separation units, reduce costs and environmental impact. This trend creates opportunities for companies to differentiate through eco-friendly processes and consistent quality. With increasing emphasis on green technologies and efficient production, suppliers adopting sustainable innovations stand to capture a competitive advantage in the evolving xenon market landscape.

Key Challenges

High Production and Supply Costs

The limited natural availability of xenon and its complex extraction process from air separation units drive high production costs. These costs are further impacted by energy-intensive recovery methods and low yield rates. As a result, xenon remains one of the most expensive industrial gases, restricting adoption in cost-sensitive sectors. Supply volatility due to constrained production capacities also challenges consistent availability. Addressing these cost pressures requires technological innovation and efficient recycling solutions to maintain competitiveness while meeting the growing demand across industries.

Dependence on Semiconductor and Aerospace Cycles

The xenon gas market faces challenges from its reliance on cyclical industries such as semiconductors and aerospace. Demand fluctuates with variations in chip production, satellite launches, and defense spending. Economic downturns or delays in technology investments can reduce xenon consumption sharply. Supply chain disruptions, particularly in semiconductor manufacturing, further impact demand stability. This dependency creates vulnerability for market players, emphasizing the need to diversify end-user bases and develop long-term supply agreements to reduce exposure to cyclical downturns in these key industries.

Regional Analysis

North America

North America holds a leading position in the xenon gas market, accounting for 35% of the global share. The region benefits from advanced healthcare infrastructure, with strong adoption of xenon-based anesthesia and medical imaging technologies. A robust semiconductor industry in the United States further drives demand, supported by continuous investment in photolithography and chip manufacturing. Additionally, aerospace and defense programs contribute to steady consumption, particularly in ion propulsion for satellites. The combination of technological leadership, high R&D expenditure, and well-established industrial applications secures North America’s dominance in the global xenon gas market.

Europe

Europe represents 27% of the global xenon gas market, driven by its strong aerospace sector and growing healthcare adoption. Countries such as Germany, France, and the United Kingdom lead demand due to advanced medical research and rising use of xenon anesthesia in specialized procedures. The European Space Agency’s expanding missions and commercial satellite launches further enhance market consumption. Moreover, Europe’s semiconductor industry increasingly adopts xenon for lithography applications. A supportive regulatory framework and focus on sustainable technologies strengthen the region’s growth, positioning Europe as a key contributor to the xenon market’s global expansion.

Asia-Pacific

Asia-Pacific captures 30% of the xenon gas market, fueled by rapid growth in electronics and semiconductor industries. China, Japan, South Korea, and Taiwan dominate demand due to large-scale semiconductor manufacturing and strong investment in advanced chip fabrication. The region’s rising healthcare spending and growing adoption of xenon in imaging and anesthesia also support expansion. Additionally, national space programs in China and India increase xenon demand for satellite propulsion systems. With accelerating industrialization, government support for technology, and cost-effective manufacturing hubs, Asia-Pacific is expected to record the fastest growth rate in the xenon gas market.

Latin America

Latin America holds a modest 5% share of the global xenon gas market, with demand concentrated in healthcare and research institutions. Brazil and Mexico lead regional consumption, supported by expanding medical infrastructure and growing awareness of xenon-based applications. While the region lacks significant semiconductor or aerospace industries, opportunities exist in specialized healthcare use and limited industrial applications. Imports largely fulfill regional supply due to limited local production capabilities. Market growth in Latin America is expected to remain steady, driven by gradual advancements in healthcare technologies and partnerships with international suppliers.

Middle East & Africa

The Middle East & Africa account for 3% of the xenon gas market, reflecting relatively low but emerging demand. Healthcare expansion in Gulf countries, particularly the UAE and Saudi Arabia, is a primary driver for xenon applications in anesthesia and imaging. Additionally, government-backed space programs in the UAE contribute to niche demand for xenon-based propulsion systems. However, limited semiconductor manufacturing and high reliance on imports constrain broader market growth. With rising investments in healthcare and technology, the region shows potential for gradual expansion, albeit from a smaller base compared to other global markets.

Market Segmentations:

By Type:

By Purity:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the xenon gas market is shaped by key players such as Proton Gases (India) Pvt. Ltd. (India), American Gas Products (AGP LLC) (U.S.), Air Liquide (France), Akela-p Medical Gases P. Ltd. (Russia), Messer Group GmbH (Germany), Matheson Tri-Gas, Inc. (U.S.), Linde PLC (Ireland), Coregas Pty Ltd. (U.S.), Electronic Fluorocarbons, LLC (U.S.), and Air Products & Chemicals, Inc. (U.S.). The xenon gas market is highly competitive, driven by increasing demand across healthcare, aerospace, and semiconductor industries. Companies focus on developing advanced recovery and purification technologies to enhance efficiency and reduce costs, given the limited natural availability of xenon. Strategic initiatives such as capacity expansions, partnerships, and investments in sustainable production methods are shaping market dynamics. The push for high-purity xenon to meet stringent requirements in medical imaging, anesthesia, and semiconductor lithography fuels innovation. Competitive advantage is built on consistent supply reliability, technological expertise, and the ability to address diverse end-user needs across global markets.

Key Player Analysis

- Proton Gases (India) Pvt. Ltd. (India)

- American Gas Products (AGP LLC) (U.S.)

- Air Liquide (France)

- Akela-p Medical Gases P. Ltd. (Russia)

- Messer Group GmbH (Germany)

- Matheson Tri-Gas, Inc. (U.S.)

- Linde PLC (Ireland)

- Coregas Pty Ltd. (U.S.)

- Electronic Fluorocarbons, LLC (U.S.)

- Air Products & Chemicals, Inc. (U.S.)

Recent Developments

- In September 2025, Saudi Aramco established strategic alliances with Chinese energy companies through which they initiated joint ventures for refining and petrochemical production and LNG supply programs.

- In January 2025, Baker Hughes has secured an order from Tecnicas Reunidas to deliver six propane compressors and six gas compression trains for 3rd phase development of Aramco’s Jafurah gas field located in Saudi Arabia. Strengthening its expertise in natural gas value chain, the company will also supply electric motor driven by compression solutions.

- In January 2025, BP has successfully commenced gas flow from wells at the Greater Tortue Ahmeyim Phase 1 LNG project, directing output to its FPSO vessel for next stage of commissioning. Once its completed, the GTA phase 1 is set to deliver over tonnes of LNG annually.

- In April 2024, Air Liquide broke ground on a state-of-the-art krypton and xenon purification plant in Cheonan, Chungnam Province. Leveraging their deep cryogenics know-how, the facility is set to be operational by 2025. It will harness Air Liquide’s cutting-edge technologies to supply ultra-high purity gases, catering primarily to the semiconductor and space sectors.

Report Coverage

The research report offers an in-depth analysis based on Type, Purity, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The xenon gas market will expand with rising adoption in advanced semiconductor manufacturing.

- Demand from healthcare will grow as xenon gains traction in anesthesia and neuroprotection.

- Aerospace applications will strengthen with increased use in satellite ion propulsion systems.

- Recycling and recovery technologies will play a key role in reducing production costs.

- High-purity xenon will dominate due to strict performance requirements in critical industries.

- Growth in space exploration projects will create new opportunities for market participants.

- Emerging economies will increase consumption as healthcare and electronics sectors advance.

- Strategic collaborations will enhance supply chain stability and global distribution networks.

- Sustainable extraction methods will gain importance amid environmental and energy concerns.

- Market competition will intensify as regional suppliers target niche high-value applications.

Market Insights

Market Insights