Market Overview

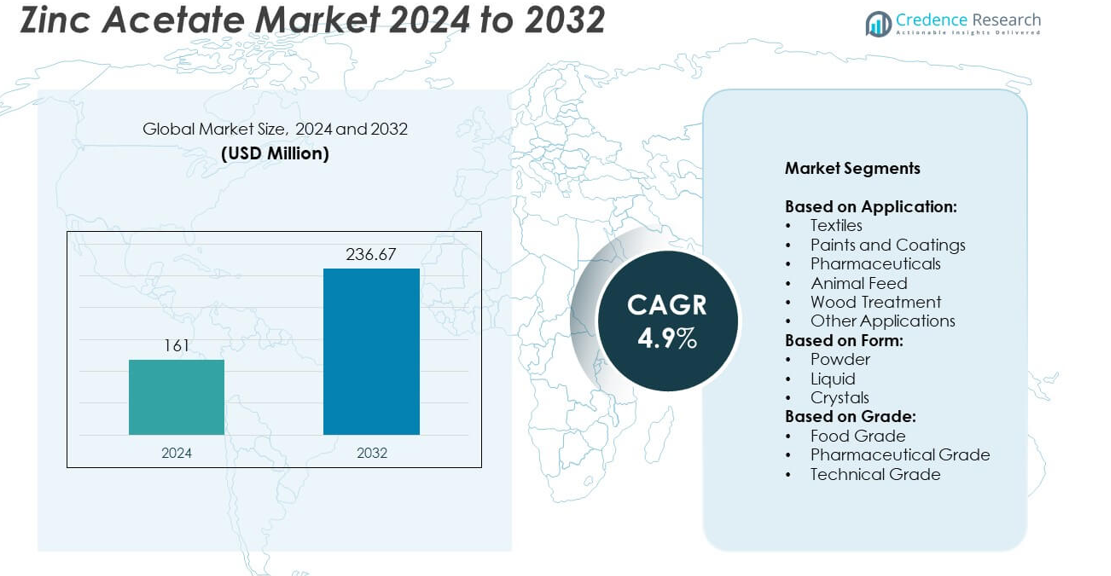

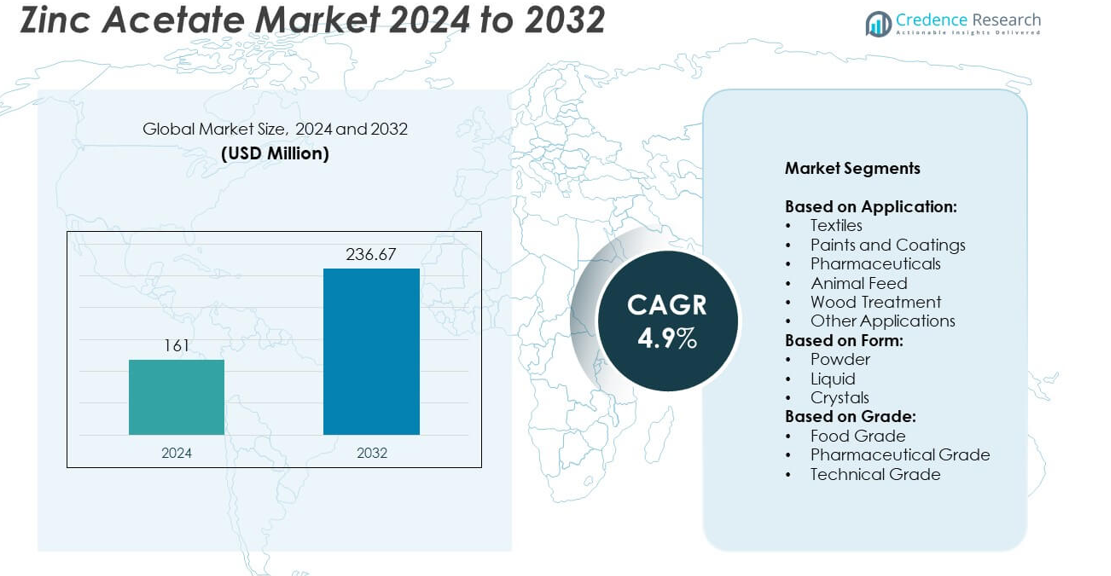

Zinc Acetate market size was valued USD 161 Million in 2024 and is anticipated to reach USD 236.67 Million by 2032, at a CAGR of 4.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Zinc Acetate Market Size 2024 |

USD 161 Million |

| Zinc Acetate Market ,CAGR |

4.9% |

| Zinc Acetate Market Size 2032 |

USD 236.67 Million |

The zinc acetate market is driven by key players such as Boston BioProducts, Inc., Noah Technologies Corporation, Axiom Chemicals, Krishna Chemicals, Global Medicines Limited, Powder Pack Chem, ProChem International, Mayschem, Global Calcium, and Niacet Corporation. These companies focus on producing high-purity pharmaceutical and technical grades to meet demand from pharmaceuticals, nutraceuticals, and industrial applications. Strategic expansions, process innovations, and partnerships strengthen their competitive positioning. Asia-Pacific leads the market with around 30% share, supported by large-scale manufacturing, growing healthcare infrastructure, and increasing consumption in animal feed and industrial sectors. North America follows with 32% share, driven by strong pharmaceutical demand.

Market Insights

- The zinc acetate market was valued at USD 161 Million in 2024 and is projected to reach USD 236.67 Million by 2032, growing at a CAGR of 4.9%.

- Rising demand from the pharmaceutical industry, particularly for supplements and cold treatment products, is a major growth driver.

- Increasing preference for high-purity pharmaceutical-grade zinc acetate and adoption of sustainable production processes are shaping market trends.

- The market is moderately fragmented with players focusing on capacity expansion, regulatory compliance, and strategic partnerships to strengthen their positions.

- Asia-Pacific holds around 30% share, North America accounts for 32%, and Europe represents 27%, with pharmaceuticals being the largest application segment followed by animal feed.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Application

Pharmaceuticals led the zinc acetate market in 2024, holding over 35% share. Demand is driven by its use in oral supplements, lozenges for cold treatment, and as a reagent in chemical synthesis. Rising prevalence of zinc deficiency and the growing nutraceutical industry support steady consumption. Animal feed applications follow closely, supported by livestock nutrition programs. Paints and coatings also use zinc acetate as a catalyst and cross-linking agent. Expansion of textile manufacturing and growing wood treatment usage further contribute to the segment’s growth, though on a smaller scale compared to pharmaceuticals.

- For instance, Noah Chemicals supplies zinc acetate dihydrate crystals with a purity of 99.95%. This product is manufactured in an ISO 9001:2015 certified facility and is suitable for high-purity applications.

By Form

Powder form dominated the market with more than 50% share in 2024. Its stability, ease of storage, and higher solubility in water make it the preferred option for pharmaceuticals, feed, and coating industries. Powdered zinc acetate also offers extended shelf life, which is crucial for industrial-scale applications. Liquid form finds use in specialized chemical synthesis and catalyst preparation, while crystals are utilized in laboratory-grade applications. The demand for powder form continues to rise due to its cost efficiency and compatibility with bulk handling and automated dosing systems in manufacturing plants.

- For instance, Sigma-Aldrich sells zinc acetate dihydrate reagent grade powder with an assay of ≥ 98 %.

By Grade

Pharmaceutical grade zinc acetate accounted for the largest share at around 40% in 2024. This grade is preferred due to its purity and compliance with stringent safety standards, making it suitable for dietary supplements and medicinal applications. Growing awareness of immune health and increased adoption of preventive healthcare measures are boosting this segment. Food-grade zinc acetate is also expanding as it is used as a fortifying agent in packaged foods and beverages. Technical grade serves industries like wood preservation, textiles, and coatings, but maintains a smaller share due to limited purity requirements.

Market Overview

Rising Demand from Pharmaceutical Industry

The pharmaceutical sector is the key growth driver of the zinc acetate market, accounting for major consumption. Zinc acetate is widely used in supplements, oral lozenges, and medications to treat zinc deficiency and Wilson’s disease. Increasing prevalence of immunity-related disorders and the rising focus on preventive healthcare are boosting demand. Expanding nutraceutical production in North America and Asia-Pacific also fuels growth. Pharmaceutical-grade zinc acetate’s high purity and regulatory compliance make it the preferred choice, reinforcing its position as a dominant driver of market expansion.

- For instance, Strem Chemicals, which is part of Ascensus Specialties, offers zinc acetate dihydrate (CAS 5970-45-6) with a purity of 98+% for laboratory and research applications. It is sold in crystalline or powder form and comes in various package sizes. While the purity is listed as 98+%, it’s important to note that this is not explicitly ACS grade, which may have additional specifications and is offered by other chemical suppliers with varying purity specifications.

Expanding Use in Animal Feed Applications

Animal feed applications are a major contributor to market growth. Zinc acetate is used as a dietary supplement for livestock to improve immunity, reproduction, and overall health. Rising global demand for meat, dairy, and poultry products is pushing farmers to adopt high-quality feed additives. Government initiatives promoting animal nutrition programs in Asia-Pacific and Latin America further support this segment. The consistent demand from feed mills and integrated farming operations ensures steady consumption and positions this segment as a significant driver of market development.

- For instance, Dr. Paul Lohmann GmbH & Co. KGaA provides zinc acetate 2-hydrate in grades that are manufactured and documented to be compliant with pharmacopeial standards, including Ph. Eur. (11th Ed.) and USP 43. This high-purity material is suitable for pharmaceutical applications and human food supplements.

Growth in Paints, Coatings, and Textile Sectors

The growing use of zinc acetate in paints, coatings, and textiles is driving market expansion. It acts as a cross-linking agent, catalyst, and dye mordant, making it vital for multiple industrial processes. Increasing infrastructure projects, automotive production, and demand for high-performance coatings boost zinc acetate consumption. Textile manufacturers also rely on zinc acetate for color fixation and finishing processes. Rapid industrialization in emerging economies, combined with rising construction activities, ensures continuous growth in these segments, further strengthening the overall zinc acetate market outlook.

Key Trends & Opportunities

Shift Toward High-Purity and Pharmaceutical-Grade Products

A key trend shaping the market is the shift toward high-purity and pharmaceutical-grade zinc acetate. Manufacturers are investing in advanced production technologies to meet stringent regulatory requirements set by agencies like the FDA and EMA. This trend is creating opportunities for suppliers to secure contracts with pharmaceutical and nutraceutical firms. The rise in preventive health supplements and fortified food products further boosts demand for premium-grade zinc acetate, encouraging companies to expand capacity and improve quality standards.

- For instance, CDH Fine Chemical produces zinc acetate pure (CAS 5970-45-6) with an assay between 98-102 % (ex Zn complexometric).

Sustainable and Eco-Friendly Production Practices

Sustainability is a growing opportunity in the zinc acetate market. Companies are adopting eco-friendly production processes, focusing on reducing waste and emissions. The demand for low-impact chemical manufacturing aligns with global sustainability goals and regulatory pressures. This shift opens opportunities for players investing in green chemistry and circular economy initiatives. Markets in Europe and North America particularly favor suppliers offering sustainable solutions, giving these companies a competitive edge and supporting long-term partnerships with major industrial customers.

- For instance, Oxford Lab Fine Chem LLP offers zinc acetate dihydrate extra pure with a purity of at least 98.0 %.

Key Challenges

Price Volatility of Raw Materials

One of the key challenges for the zinc acetate market is the price volatility of zinc and acetic acid, the primary raw materials. Fluctuations in global zinc supply, driven by mining output and geopolitical issues, can directly impact production costs. This unpredictability affects profit margins for manufacturers and forces them to adopt hedging strategies. High raw material prices can also discourage small-scale producers from expanding capacity, potentially leading to supply constraints and higher end-product prices in certain regions.

Stringent Regulatory and Quality Standards

Meeting stringent regulatory requirements remains a significant challenge, especially for pharmaceutical- and food-grade zinc acetate. Compliance with international standards such as USP, EP, and REACH requires continuous investment in quality assurance and testing infrastructure. Delays in certification can restrict market access, particularly in regulated regions like the EU and North America. Smaller producers may struggle to maintain consistent purity levels, limiting their ability to compete with established players that have robust compliance systems and well-established global distribution networks.

Regional Analysis

North America

North America accounted for around 32% of the zinc acetate market share in 2024, driven by strong demand from pharmaceutical and nutraceutical manufacturers. The U.S. leads the region due to high consumption of dietary supplements and cold treatment lozenges. The presence of major pharmaceutical companies and robust regulatory compliance supports steady growth. Rising investments in animal nutrition programs also boost demand from feed applications. Growth in the paints and coatings industry, supported by construction and automotive production, further drives market expansion. Canada contributes moderately, while Mexico’s market is growing with increasing industrial activity and expanding manufacturing facilities.

Europe

Europe held approximately 27% market share in 2024, supported by stringent quality standards and advanced chemical manufacturing infrastructure. Germany, France, and the UK are key contributors, with high adoption of pharmaceutical-grade zinc acetate. Demand is further fueled by the well-established nutraceutical and food fortification sectors. Rising construction projects and growth in the automotive coatings industry contribute to steady consumption. The EU’s focus on sustainability drives the use of eco-friendly production processes, giving regional manufacturers a competitive edge. Eastern Europe is witnessing gradual demand growth, supported by expanding industrial activities and improving healthcare infrastructure.

Asia-Pacific

Asia-Pacific dominated the zinc acetate market with nearly 30% share in 2024, driven by large-scale manufacturing and growing pharmaceutical production. China and India are major consumers due to rising population, expanding healthcare infrastructure, and increasing demand for supplements. Rapid industrialization, growing textile manufacturing, and strong demand for animal feed additives further support growth. Government initiatives to promote livestock health and infrastructure development add to consumption. Japan and South Korea contribute significantly with high standards for pharmaceutical and industrial chemicals. The region continues to be the fastest-growing market, attracting global manufacturers for capacity expansion and strategic partnerships.

Latin America

Latin America captured close to 6% market share in 2024, with Brazil and Mexico as the primary demand centers. Growth is fueled by the increasing use of zinc acetate in animal feed to improve livestock productivity and support the region’s strong meat export industry. Pharmaceutical and food fortification applications are also rising, supported by growing health awareness among consumers. Industrial applications in coatings and textiles are expanding in developing economies, driving additional demand. The region benefits from gradual infrastructure development and foreign investments, though market growth is slightly limited by economic fluctuations and supply chain challenges.

Middle East & Africa

The Middle East & Africa accounted for around 5% of the zinc acetate market share in 2024. Demand is led by the Gulf countries where investments in industrial development, construction, and food processing are rising. Pharmaceutical consumption is growing due to increasing healthcare expenditure and higher adoption of nutraceuticals. South Africa contributes through textile and coating industry applications, supporting market stability. However, the region’s growth is comparatively slower due to limited local production capacity and dependency on imports. Government initiatives for industrial diversification are expected to provide long-term opportunities for zinc acetate manufacturers in the coming years.

Market Segmentations:

By Application:

- Textiles

- Paints and Coatings

- Pharmaceuticals

- Animal Feed

- Wood Treatment

- Other Applications

By Form:

By Grade:

- Food Grade

- Pharmaceutical Grade

- Technical Grade

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The zinc acetate market is characterized by the presence of key players such as Boston BioProducts, Inc., Noah Technologies Corporation, Axiom Chemicals, Krishna Chemicals, Global Medicines Limited, Powder Pack Chem, ProChem International, Mayschem, Global Calcium, Vasa Pharmachem, GFS Chemicals, Niacet Corporation, Lianyungang Tongyuan Chemical Industry, TIB Chemicals AG, Alpha Chemika, Aldon Corporation, Viachem, and New Alliance Dye Chem Private Limited. The competitive landscape is moderately fragmented, with companies focusing on product quality, regulatory compliance, and expanding production capacity to meet growing demand from pharmaceuticals, animal feed, and industrial applications. Many players are investing in advanced purification technologies to produce high-purity grades suitable for pharmaceutical and nutraceutical applications. Strategic initiatives such as partnerships, capacity expansions, and geographic diversification are helping strengthen their market presence. Additionally, emphasis on sustainability and eco-friendly manufacturing processes is creating differentiation, as customers increasingly prefer suppliers with strong environmental compliance and consistent supply reliability.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Boston BioProducts, Inc.

- Noah Technologies Corporation

- Axiom Chemicals

- Krishna Chemicals

- Global Medicines Limited

- Powder Pack Chem

- ProChem International

- Mayschem

- Global Calcium

- Vasa Pharmachem

- GFS Chemicals

- Niacet Corporation

- Lianyungang Tongyuan Chemical Industry

- TIB Chemicals AG

- Alpha Chemika

- Aldon Corporation

- Viachem

- New Alliance Dye Chem Private Limited

Recent Developments

- In 2025, Boston BioProducts featured RNase-free acetate buffers and stable pH solutions for nucleic acid purification, supporting life science research and bioprocessing workflows.

- In 2025, Niacet updated its zinc acetate technical datasheet, listing new applications—such as use as catalyst in polyester, polyamide, and vinyl acetate production.

- In 2023, Aldon Corporation acquired by VION Biosciences (backed by Iron Path Capital), expanding the life science platform with a focus on laboratory chemicals and kitting solutions.

Report Coverage

The research report offers an in-depth analysis based on Application, Form, Grade and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The zinc acetate market is expected to witness steady growth driven by rising pharmaceutical demand.

- Increased use in nutraceuticals and dietary supplements will strengthen its market position.

- Growing livestock production will boost consumption in animal feed applications globally.

- Industrial applications in coatings, textiles, and catalysts will see consistent demand growth.

- Asia-Pacific will remain the fastest-growing region due to expanding manufacturing capacities.

- North America and Europe will focus on high-purity and pharmaceutical-grade zinc acetate production.

- Technological advancements in eco-friendly production processes will support sustainable growth.

- Strategic partnerships and capacity expansions will shape competitive strategies among major producers.

- Regulatory compliance and quality certification will remain critical to access global markets.

- Emerging economies will offer new opportunities with rising healthcare and industrial investments.