Market Overview:

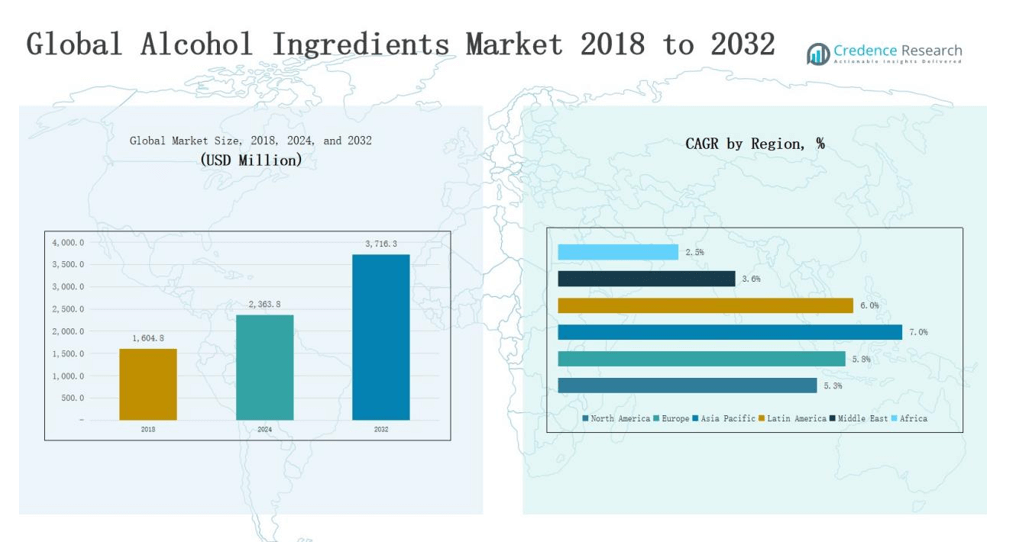

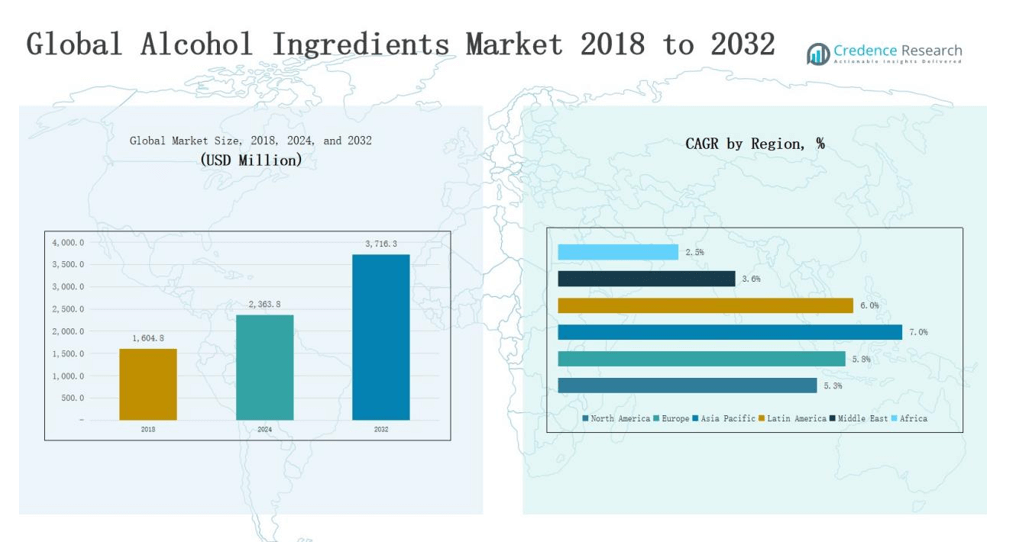

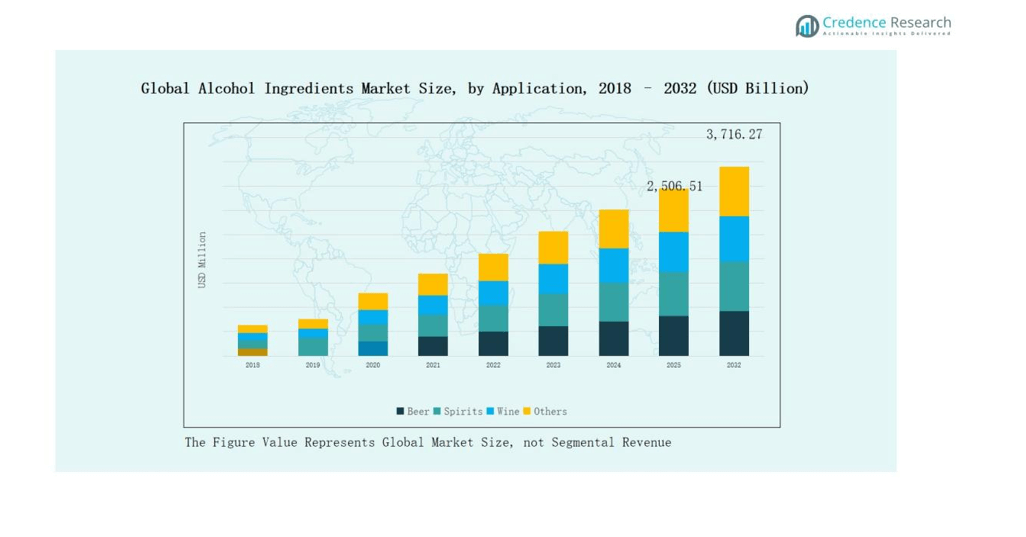

Global Alcohol Ingredients Market size was valued at USD 1,604.8 million in 2018 to USD 2,363.8 million in 2024 and is anticipated to reach USD 3,716.3 million by 2032, at a CAGR of 5.79% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Alcohol Ingredients Market Size 2024 |

USD 2,363.8 million |

| Alcohol Ingredients Market, CAGR |

5.79% |

| Alcohol Ingredients Market Size 2032 |

USD 3,716.3 million |

The Global Alcohol Ingredients Market is shaped by leading players such as AngelYeast Co., Ltd., Archer Daniels Midland Company, Döhler GmbH, Kerry Group Plc, Treatt Plc, Givaudan, Novozymes A/S, Sensient Technologies Corporation, and Ashland Inc. These companies maintain competitive strength through diversified product portfolios, global distribution networks, and continued investment in research and innovation. Their focus on advanced yeast strains, enzyme solutions, and natural flavoring agents supports growth across premium and craft beverage segments. Regionally, North America led the market in 2024 with a 32.8% share, driven by strong beer and spirits consumption, robust craft brewery expansion, and advanced fermentation technologies. This leadership highlights the region’s early adoption of innovative alcohol ingredients and sustained consumer demand.

Market Insights

- The Global Alcohol Ingredients Market was valued at USD 2,363.8 million in 2024 and is projected to reach USD 3,716.3 million by 2032, growing steadily.

- Yeast dominated with 42% share in 2024, driven by its critical role in fermentation across beer, wine, and spirits, supported by rising demand for specialty strains.

- By application, beer led with 48% share in 2024, fueled by high global consumption, craft brewery expansion, and increasing demand for premium lagers and ales.

- North America held the largest regional share at 32.8% in 2024, supported by robust beer and spirits markets, advanced brewing infrastructure, and innovation in yeast and flavors.

- Key players such as AngelYeast, ADM, Döhler GmbH, Kerry Group, Treatt Plc, Givaudan, Novozymes, Sensient Technologies, and Ashland Inc. are driving growth through innovation and global networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Product

The yeast segment dominated the Global Alcohol Ingredients Market in 2024 with 42% share. Its leadership is driven by extensive use in beer, wine, and spirits production due to its essential role in fermentation. Growing demand for specialty and customized yeast strains supports innovation and adoption in premium alcohol categories. Enzymes accounted for 27% share, supported by their ability to enhance efficiency and consistency in brewing and distillation processes. Colorants held 12% share, fueled by rising consumer preference for visually appealing beverages. Flavors & salts represented 14% share, with demand boosted by craft drinks and flavored spirits. The remaining 5% share came from other ingredients, including stabilizers and additives that extend shelf life and improve product quality.

- For instance, Lallemand Brewing introduced the LalBrew Farmhouse™ hybrid yeast in 2023, developed through natural crossbreeding to produce saison-style beers without phenolic off-flavors.

By Application

Beer emerged as the dominant application in the Global Alcohol Ingredients Market with 48% share in 2024. High global consumption, expansion of craft breweries, and demand for premium lagers and ales remain the key growth drivers. Spirits captured 28% share, supported by increasing demand for whiskey, vodka, and flavored spirits worldwide. Wine held 19% share, with growth sustained by rising consumption in Europe, North America, and emerging Asian markets. The other applications segment, which includes cider and ready-to-drink alcoholic beverages, accounted for the remaining 5% share, reflecting diversification in consumer preferences toward novel and convenient alcohol formats.

- For instance, Diageo’s Johnnie Walker brand launched Johnnie Walker Blonde in the U.S., which was designed for a younger demographic seeking lighter whiskey options, though its impact on brand sales has been modest.

Market Overview

Rising Global Alcohol Consumption

The steady rise in alcohol consumption, particularly in emerging economies, strongly drives the demand for alcohol ingredients. Increasing disposable incomes, urbanization, and cultural acceptance of alcoholic beverages expand the consumer base worldwide. Premium and craft segments further stimulate demand for specialized yeast, enzymes, and flavoring agents. Breweries and distilleries continue to scale production, supporting ingredient demand across beer, spirits, and wine categories. This growth reinforces the critical role of alcohol ingredients in ensuring product quality, consistency, and differentiation in a highly competitive global market.

- For instance, Diageo expanded production capacity in India to meet the rising preference for premium spirits, boosting their procurement of high-quality enzymes and flavoring agents to maintain product consistency.

Expansion of Craft and Premium Beverages

The surge in craft breweries, micro-distilleries, and premium wine producers creates significant opportunities for specialized alcohol ingredients. Consumers increasingly seek unique flavors, natural additives, and authentic brewing methods. This trend enhances the demand for customized yeast strains, natural colorants, and flavor blends. Manufacturers of alcohol ingredients collaborate with craft producers to deliver innovative solutions that improve product appeal. Premiumization strategies in developed markets further boost ingredient utilization, strengthening market growth. This driver positions specialty ingredients as central to innovation in the global alcohol industry.

- For instance, Lallemand Brewing supplies customized yeast strains to craft breweries, enabling distinctive beer styles and flavor profiles tailored to local markets.

Technological Advancements in Fermentation and Processing

Advancements in biotechnology and fermentation science play a vital role in expanding the alcohol ingredients market. Enhanced yeast strains, enzyme formulations, and flavor extraction techniques improve efficiency, reduce production costs, and ensure superior taste profiles. Digitalization and automation in brewing and distillation further support consistent ingredient application. These innovations also cater to sustainability goals by reducing waste and energy use. Ingredient suppliers leverage R&D investments to meet evolving industry needs, providing scalable solutions that align with both mass production and premium alcohol categories worldwide.

Key Trends & Opportunities

Shift Toward Natural and Clean-Label Ingredients

Growing consumer demand for clean-label products is driving the adoption of natural colorants, flavors, and organic yeast in alcoholic beverages. Producers are reformulating products with fewer synthetic additives to align with health-conscious preferences. This trend provides a strong opportunity for ingredient manufacturers to innovate with plant-based, sustainable solutions. Regulatory support for natural labeling across major regions further accelerates adoption. Companies that invest in clean-label alcohol ingredients stand to gain competitive advantage and capture a significant share of this evolving consumer-driven segment.

- For instance, Cargill incorporates proprietary natural sweeteners like stevia and monk fruit, which are non-GMO and plant-based, to meet consumer expectations while reducing artificial additives.

Rising Demand in Asia-Pacific Markets

Asia-Pacific is emerging as a high-growth region for alcohol ingredients, supported by rising urban populations, expanding middle-class income, and changing lifestyle preferences. Rapid growth in beer and spirits consumption, particularly in China, India, and Southeast Asia, fuels ingredient demand. International players are expanding partnerships and establishing local production facilities to strengthen supply chains in the region. This regional expansion presents a major opportunity for manufacturers to capitalize on untapped demand. Asia-Pacific is expected to remain the fastest-growing contributor to global alcohol ingredient revenue.

- For instance, Anheuser-Busch InBev opened a 7,400 sq. meter brewery in Putian, China in 2022, focusing on craft and premium beers like Goose Island and 059 Coastline Craft, supporting innovation and local ingredient sourcing.

Key Challenges

Stringent Regulatory Standards

The alcohol industry faces strict regulations regarding ingredient usage, labeling, and safety, which create challenges for manufacturers. Regulatory frameworks vary across countries, requiring constant compliance and reformulation efforts. Restrictions on synthetic colorants and additives increase pressure on producers to innovate within approved guidelines. Delays in regulatory approvals can slow down product launches, particularly for novel ingredients. These compliance complexities raise costs and limit flexibility for global operations. Navigating evolving regulations remains a key challenge that could hinder faster growth in the alcohol ingredients market.

High Raw Material Price Volatility

Fluctuations in the prices of raw materials such as grains, fruits, and natural extracts affect ingredient costs significantly. Supply chain disruptions, weather conditions, and geopolitical issues further contribute to instability. Ingredient manufacturers often struggle to maintain consistent pricing and margins when input costs rise. Smaller players face greater pressure compared to established global firms with stronger sourcing capabilities. This volatility directly impacts profitability and creates uncertainty in long-term planning. Managing raw material price risks remains a major challenge for the alcohol ingredients industry.

Competition from Substitute Products

The growing popularity of low-alcohol, alcohol-free, and functional beverages presents a competitive challenge to traditional alcohol markets. Producers of alternative drinks often use different ingredient bases, reducing dependency on traditional alcohol ingredients such as yeast or colorants. Increasing consumer preference for healthier and non-alcoholic options could limit market expansion. Ingredient manufacturers must diversify offerings to cater to both alcoholic and non-alcoholic sectors. Failure to adapt may result in declining demand for conventional alcohol ingredients, particularly in regions with strong wellness and health-focused consumer bases.

Regional Analysis

North America

North America led the Global Alcohol Ingredients Market in 2024 with a 32.8% share. The region’s dominance is supported by strong beer and spirits consumption, robust craft brewery expansion, and high demand for premium alcoholic beverages. The U.S. remains the largest contributor due to advanced brewing infrastructure and innovation in flavors and yeast strains. Canada and Mexico also show steady growth, driven by rising disposable incomes and evolving drinking culture. With a CAGR of 5.3%, North America is projected to reach USD 1,152.04 million by 2032, maintaining a leading position globally.

Europe

Europe accounted for a 25.2% share of the Global Alcohol Ingredients Market in 2024. Its strength is rooted in traditional wine and beer production, supported by long-established brewing industries in Germany, France, and the UK. Demand for natural colorants and flavors is accelerating due to clean-label preferences among European consumers. Regulatory frameworks also encourage innovation in sustainable and organic alcohol ingredients. With a CAGR of 5.8%, the region is set to reach USD 924.24 million by 2032, reflecting consistent growth and technological advancement in brewing and fermentation processes.

Asia Pacific

Asia Pacific captured 23.1% share of the Global Alcohol Ingredients Market in 2024, making it the fastest-growing region. Rising urbanization, middle-class expansion, and lifestyle changes in China, India, and Southeast Asia drive alcohol consumption. Beer remains the largest segment, while spirits and wine consumption are gaining popularity. International ingredient suppliers are investing in local partnerships to strengthen market presence. With a strong CAGR of 7.0%, Asia Pacific is projected to reach USD 885.96 million by 2032, highlighting its role as the key growth engine in the global market.

Latin America

Latin America held a 10.5% share in the Global Alcohol Ingredients Market in 2024. Brazil dominates the region, supported by a vibrant beer market and rising demand for premium alcoholic beverages. Argentina and other markets contribute through growing wine and spirits industries. Increasing investments in local production facilities enhance ingredient supply. The region shows a CAGR of 6.0% and is projected to reach USD 390.58 million by 2032. Expansion of flavored and craft segments continues to drive opportunities for yeast, enzymes, and natural flavoring agents across Latin America.

Middle East

The Middle East accounted for a 7.8% share of the Global Alcohol Ingredients Market in 2024. Growth is concentrated in GCC countries, Israel, and Turkey, supported by expanding hospitality sectors and tourism-driven alcohol demand. Despite cultural restrictions in certain areas, the premium spirits and wine segments are showing steady development. Ingredient suppliers focus on natural additives and premium formulations tailored for niche markets. With a CAGR of 3.6%, the region is projected to reach USD 297.67 million by 2032, reflecting moderate but stable growth potential.

Africa

Africa represented a 2.3% share of the Global Alcohol Ingredients Market in 2024, making it the smallest contributor. South Africa leads the region due to its strong wine and beer industries, while Egypt and other countries show gradual growth. Limited industrial capacity and lower disposable incomes constrain large-scale expansion. However, increasing investments in breweries and growing youth populations provide long-term opportunities. With the slowest CAGR of 2.5%, Africa is projected to reach USD 65.78 million by 2032, reflecting incremental but steady progress in alcohol ingredient adoption.

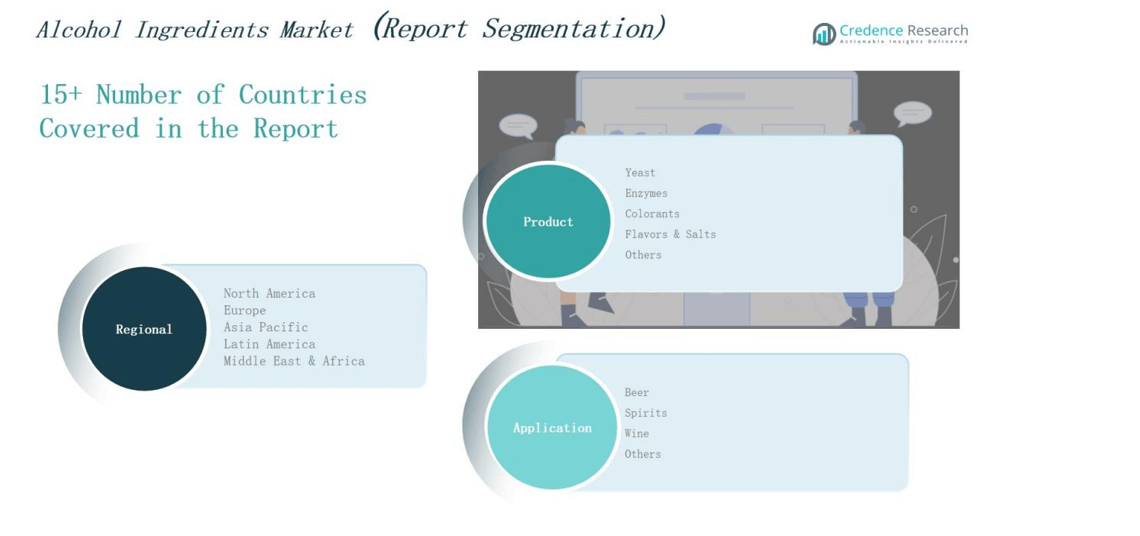

Market Segmentations:

By Product

- Yeast

- Enzymes

- Colorants

- Flavors & Salts

- Others

By Application

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The Global Alcohol Ingredients Market is highly competitive, with multinational corporations and specialized players driving innovation and market expansion. Leading companies such as AngelYeast Co., Ltd., Archer Daniels Midland Company, Döhler GmbH, Kerry Group Plc, Treatt Plc, and Givaudan maintain strong positions through diversified product portfolios, global distribution networks, and sustained investments in R&D. These players focus on developing advanced yeast strains, enzyme solutions, and natural flavors to meet rising demand for premium, craft, and clean-label alcoholic beverages. Strategic partnerships, mergers, and acquisitions are common, allowing firms to expand geographic reach and strengthen supply capabilities. For instance, collaborations between ingredient suppliers and breweries enhance product innovation and accelerate market entry. Regional players and niche companies also compete by offering localized, cost-effective solutions tailored to specific markets. Intense competition fosters continuous innovation, pricing strategies, and product differentiation, shaping a dynamic landscape where technological advancements and consumer-driven trends define long-term growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Treatt Plc

- AngelYeast Co., Ltd.

- Biospringer

- Givaudan

- Novozymes A/S

- Archer Daniels Midland Company (ADM

- Ashland Inc.

- Sensient Technologies Corporation

- Döhler GmbH

- Kerry Group Plc

- Others

Recent Developments

- In September 2024, IFF introduced DIAZYME NOLO an innovative enzyme solution made to optimize production of no- and low-alcohol (NOLO) beverages.

- In July 2025, Smirnoff launched three new flavors Mirchi Mango, Minty Jamun, and Zesty Lime designed for the Indian market to boost cocktail culture at home.

- In August 2025, Lewis Hamilton launched Almave Humo, a smoky, Mezcal‑inspired non‑alcoholic spirit. It’s part of his Almave brand, crafted using Espadin agave and designed for flavor without alcohol.

- In 2023, Greenfield Global Inc. expanded its production capability with a new warehouse in Toronto, Canada, to meet growing demand for various materials used in alcohol ingredient production.

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for natural and clean-label ingredients will continue to accelerate.

- Craft and premium alcoholic beverages will create sustained opportunities for specialty ingredients.

- Yeast innovation will remain central to driving product differentiation and efficiency.

- Enzyme applications will expand as producers seek improved process optimization.

- Asia-Pacific will strengthen its position as the fastest-growing regional market.

- Partnerships between ingredient suppliers and breweries will enhance product innovation.

- Flavor diversification will rise with growing consumer preference for unique taste profiles.

- Sustainability practices in sourcing and production will gain greater importance.

- Regulatory frameworks will influence product formulations and innovation strategies.

- Digitalization and advanced fermentation technologies will shape the next phase of growth.