Market Overview

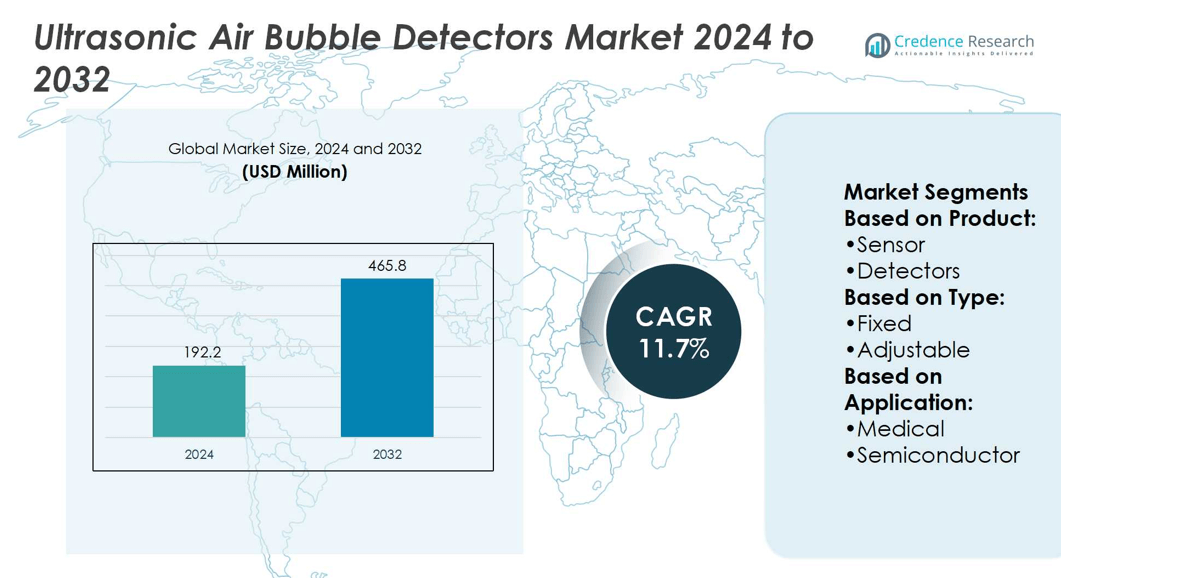

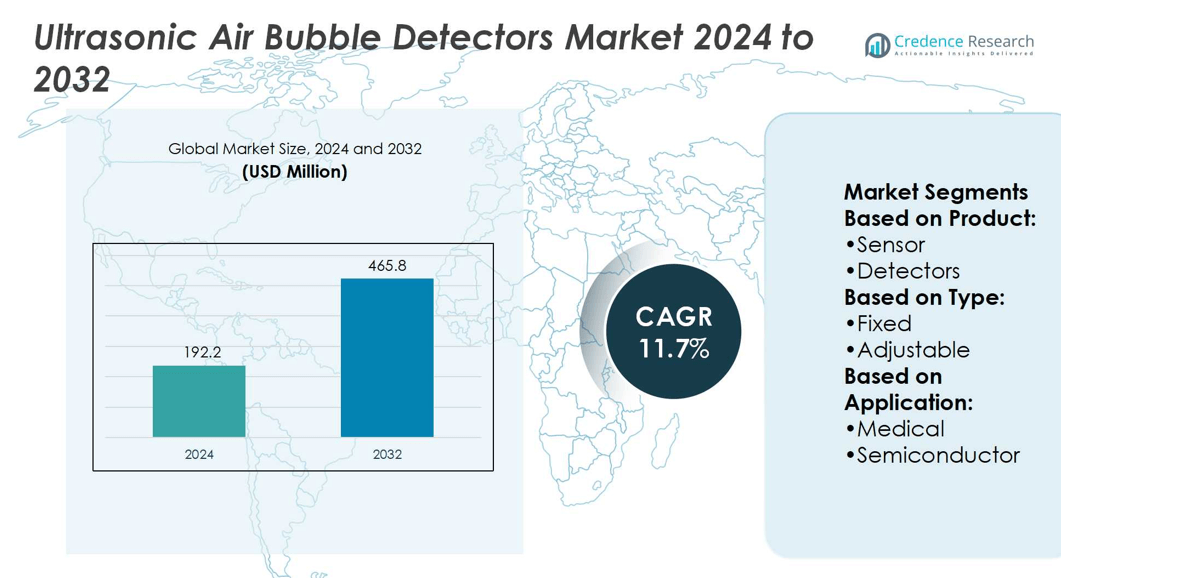

Ultrasonic Air Bubble Detectors Market size was valued at USD 192.2 million in 2024 and is anticipated to reach USD 465.8 million by 2032, at a CAGR of 11.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ultrasonic Air Bubble Detectors Market Size 2024 |

USD 192.2 million |

| Ultrasonic Air Bubble Detectors Market, CAGR |

11.7% |

| Ultrasonic Air Bubble Detectors Market Size 2032 |

USD 465.8 million |

The Ultrasonic Air Bubble Detectors Market grows through rising demand for patient safety, pharmaceutical quality, and precision in industrial processes. Hospitals adopt detectors in infusion pumps, dialysis machines, and transfusion systems to prevent risks from air embolism. Biopharmaceutical companies integrate them to maintain contamination-free production and meet strict regulatory standards. Industrial sectors such as food, chemicals, and semiconductors adopt detectors for accurate fluid handling. Advancements in ultrasonic sensing technology enhance accuracy, miniaturization, and integration into compact devices. Growing healthcare investments, industrial automation, and global focus on product safety strengthen adoption. It positions detectors as essential across medical and industrial applications.

North America holds the largest share of the Ultrasonic Air Bubble Detectors Market, driven by advanced healthcare infrastructure and strong pharmaceutical manufacturing. Europe follows with significant adoption in biopharmaceutical and food sectors, while Asia-Pacific records the fastest growth supported by expanding healthcare access and industrial automation. Latin America and the Middle East & Africa show gradual adoption with modernization efforts. Key players driving competition include Introtek International LP, Sensaras LLC, Piezo Technologies, PendoTECH, Moog Inc, and CeramTec GmbH.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Ultrasonic Air Bubble Detectors Market size was valued at USD 192.2 million in 2024 and is anticipated to reach USD 465.8 million by 2032, at a CAGR of 11.7%.

- Rising demand for patient safety in infusion, dialysis, and transfusion systems drives adoption.

- Biopharmaceutical companies integrate detectors to ensure contamination-free drug production and meet strict standards.

- Advancements in ultrasonic sensing improve accuracy, miniaturization, and integration into compact medical devices.

- High equipment cost and integration complexity act as restraints for wider adoption.

- North America leads with strong healthcare infrastructure, while Asia-Pacific records the fastest growth rate.

- Key players focus on innovation and regulatory compliance, strengthening competition in both healthcare and industrial applications.

Market Drivers

Rising Demand in Medical Devices

The Ultrasonic Air Bubble Detectors Market gains momentum from growing use in medical devices. These detectors prevent air embolism during infusion therapy and dialysis. Hospitals and clinics invest in advanced monitoring systems to enhance patient safety. The push for precision in drug delivery drives demand for sensitive bubble detection. Rising chronic disease cases increase usage of infusion and dialysis equipment worldwide. It creates strong adoption opportunities in healthcare infrastructure upgrades.

- For instance, Shenzhen Dianyingpu Technology Co., Ltd.’s L01 ultrasonic bubble detection module triggers an alarm at a minimum bubble volume of 10 µL. The device supports multiple interface options—TTL, NPN, or switch output—enabling seamless integration into automated bioreactor systems. It uses a non-contact design with IP67 protection to avoid contamination of sensitive biologics.

Growing Adoption in Biopharmaceutical Manufacturing

Biopharmaceutical production requires bubble-free liquid transfer in pipelines and bioreactors. Ultrasonic air bubble detectors ensure process reliability and reduce contamination risks. Manufacturers adopt them to maintain consistent flow and prevent product losses. Stringent regulatory standards on drug quality support wider installation in facilities. Rising investments in biologics and personalized medicines expand the need for monitoring equipment. It strengthens adoption across pharmaceutical manufacturing plants.

- For instance, Sensaras LLC’s Ultrasonic Point Level System 5600 Series, specifically their non-invasive air-in-line bubble detectors, detect bubbles ranging from 1 mm to 19 mm in diameter. These sensors are custom-built to match specific tube sizes, flow rates, and user specifications, which eliminates the need for field calibration.

Technological Advancements in Sensor Systems

Continuous innovation in ultrasonic sensing improves detection accuracy and sensitivity. Miniaturized designs allow integration into compact medical and industrial devices. Enhanced digital signal processing increases real-time monitoring capabilities. Companies develop detectors with advanced self-calibration features to boost performance. These upgrades reduce maintenance costs and improve operational safety. It pushes growth across multiple application areas, including biotechnology and food industries.

Expansion in Industrial and Food Applications

Industries use ultrasonic air bubble detectors to safeguard fluid handling in automated systems. The food and beverage sector deploys them for accurate filling and packaging. Air-free transfer prevents defects in final products and improves quality control. Industrial automation projects integrate bubble detectors to avoid process disruptions. Growing adoption in semiconductor manufacturing highlights their role in precision industries. It broadens the market’s reach beyond healthcare into diverse sectors.

Market Trends

Integration with Advanced Medical Equipment

The Ultrasonic Air Bubble Detectors Market shows a trend of integration with next-generation medical devices. Infusion pumps, dialysis machines, and blood transfusion systems increasingly rely on precise bubble detection. Hospitals prioritize devices that enhance patient safety during critical procedures. Manufacturers embed detectors into compact medical systems to reduce errors. The demand for high-accuracy sensors aligns with stricter patient care protocols. It creates strong adoption across healthcare applications worldwide.

- For instance, Piezo Technologies has delivered ultrasonic Air-In-Line (AIL) detectors with over 20 years of development specifically for medical infusion and enteral nutrition systems. Their devices support detection of both moving and stationary air bubbles.

Adoption in Biopharmaceutical Manufacturing

Biopharmaceutical facilities are deploying detectors to maintain uninterrupted liquid flow in production. They ensure contamination-free transfer in bioreactors and critical pipelines. The industry focuses on reliable quality control for high-value drug batches. Regulatory frameworks encourage integration of advanced bubble detection systems to meet compliance. The rise in biologics and cell-based therapies drives adoption at scale. It strengthens the role of detectors in pharmaceutical manufacturing.

- For instance, PendoTECH’s Air-in-Tube ultrasonic detector delivers a 5 V output when air is present and 0 V when liquid is detected, even in opaque tubing up to 1 inch outer diameter. The unit responds to a transition from liquid to air in under 200 microseconds and provides a continuous air-present output pulse of at least 11 milliseconds.

Technological Advancements in Sensing Capabilities

The market benefits from innovations in ultrasonic sensing and digital processing. Enhanced detection accuracy improves response times in both medical and industrial use. Miniaturized designs support integration into portable and compact equipment. Manufacturers introduce smart sensors with self-calibration and connectivity features. These advancements reduce downtime and enhance operational reliability. It accelerates adoption across multiple industries beyond healthcare.

Expansion into Food and Industrial Applications

Food and beverage companies adopt bubble detectors to optimize packaging and filling processes. Their use prevents air contamination and improves product quality consistency. Semiconductor and chemical industries integrate detectors into fluid handling systems. Automation projects increase reliance on sensors to avoid production interruptions. Rising demand for defect-free outputs highlights their value in precision industries. It broadens the market scope into diverse commercial sectors.

Market Challenges Analysis

High Cost and Integration Complexity

The Ultrasonic Air Bubble Detectors Market faces challenges due to high equipment cost and integration barriers. Advanced detectors require significant investment in design, calibration, and manufacturing. Smaller healthcare providers and mid-scale industrial players hesitate to adopt due to budget constraints. Integration into existing medical and biopharmaceutical systems also requires customization, raising development expenses. Compatibility with different device architectures increases complexity for manufacturers. It slows adoption in cost-sensitive regions where affordability plays a critical role.

Technical Limitations and Regulatory Constraints

Technical limitations also restrict wider deployment of ultrasonic bubble detectors across industries. Detection accuracy may decline under extreme fluid conditions, such as varying viscosity or temperature. High reliance on precise calibration creates operational challenges for end-users. Regulatory compliance for medical and pharmaceutical applications adds further complexity. Certification processes delay product launches and increase operational costs for suppliers. It creates hurdles for new entrants seeking to establish competitive positions in the market.

Market Opportunities

Expanding Role in Healthcare and Biopharmaceuticals

The Ultrasonic Air Bubble Detectors Market presents opportunities through rising adoption in healthcare and pharmaceutical sectors. Hospitals seek advanced detection systems to improve infusion, dialysis, and transfusion safety. Biopharmaceutical facilities depend on detectors to safeguard production lines and ensure product quality. The increasing global demand for biologics and personalized therapies strengthens long-term prospects. Integration into compact medical devices further expands commercial viability. It positions the technology as an essential component of modern patient care and drug manufacturing.

Growth Potential in Industrial and Food Applications

Industrial automation and food packaging sectors create new revenue streams for detector suppliers. Food and beverage companies integrate bubble detection to prevent contamination and improve product quality. Semiconductor and chemical industries deploy detectors to maintain precision in fluid handling processes. Expanding adoption in high-value industries diversifies market reach and reduces dependency on healthcare. The push for reliable, error-free manufacturing systems supports future demand. It establishes a broad platform for market expansion across diverse global sectors.

Market Segmentation Analysis:

By Product

The Ultrasonic Air Bubble Detectors Market segments by product into sensors and detectors. Sensors hold a strong share due to their role in real-time monitoring within medical devices and industrial systems. They provide high sensitivity, ensuring immediate identification of bubbles during infusion, dialysis, or chemical processing. Detectors, designed as standalone systems, are widely used in pharmaceutical manufacturing and food industries where consistent flow is critical. Demand for compact sensors is rising as integration into portable and digital medical devices expands. It supports product innovation across healthcare and industrial sectors.

- For instance, Siansonic offers air bubble detectors compatible with tubing diameters from 3 mm to 25 mm, usable across materials like PVC, PP, PTFE, PFA, silica gel, and even stainless steel or titanium alloy.

By Type

By type, the market divides into fixed and adjustable detectors. Fixed detectors are preferred in high-volume medical and pharmaceutical applications where standardization of detection is essential. They offer reliable performance with minimal calibration, reducing operational risks in critical systems. Adjustable detectors gain traction in industries requiring flexibility, such as semiconductors and chemicals, where varying fluid properties demand adaptable solutions. Their ability to adjust sensitivity levels supports adoption in research and specialized applications. It highlights the growing demand for customized bubble detection technologies.

- For instance, Moog’s LifeGuard Ultrasonic Air Bubble Detectors include models with sensor channel sizes of 0.100 in (2.5 mm), 0.130 in (3.3 mm), and 0.200 in (5.1 mm). Sensor body heights range from 0.719 in (18.3 mm) to 0.859 in (21.8 mm).

By Application

Applications drive significant diversification in market growth. Medical applications dominate due to rising use in infusion pumps, dialysis machines, and blood transfusion equipment. Semiconductor and pharmaceutical industries follow, relying on detectors to maintain contamination-free liquid transfer. The chemical sector integrates detectors for safe fluid management under variable conditions. Food and beverage industries use them in filling and packaging processes to improve product consistency and reduce defects. Industrial automation also contributes steadily, with detectors enhancing reliability in automated fluid handling systems. It strengthens adoption across both established and emerging application areas.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segments:

Based on Product:

Based on Type:

Based on Application:

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Ultrasonic Air Bubble Detectors Market, accounting for 38% of the global revenue. The region benefits from advanced healthcare infrastructure, strong adoption of infusion and dialysis equipment, and widespread regulatory enforcement of patient safety standards. Hospitals and clinics across the United States and Canada deploy bubble detection technologies to reduce risks during drug delivery and transfusion. Pharmaceutical companies in the region also integrate detectors into bioprocessing systems to ensure contamination-free drug production. Investments in R&D by both medical device manufacturers and biopharmaceutical firms drive steady innovation. It establishes North America as the leading market, supported by a mature ecosystem of healthcare providers, industrial automation projects, and strict regulatory compliance.

Europe

Europe follows with a significant 29% share in the global market. The region’s growth is supported by a strong biopharmaceutical sector and stringent regulatory frameworks that mandate safety in medical and pharmaceutical practices. Countries such as Germany, the United Kingdom, and France lead adoption due to advanced hospital networks and strong industrial bases. European pharmaceutical firms emphasize bubble-free production in biologics and biosimilars, creating steady demand. Food and beverage industries also contribute by deploying detectors to improve filling accuracy and product quality. Ongoing investments in automation and precision manufacturing enhance detector integration across diverse sectors. It reinforces Europe’s role as a key contributor with both healthcare and industrial applications driving growth.

Asia-Pacific

Asia-Pacific secures 22% of the market share, recording the fastest growth rate among all regions. Expanding healthcare infrastructure in China, India, and Japan supports rapid adoption of bubble detection technologies in hospitals and clinics. Growing prevalence of chronic diseases increases the demand for infusion therapy and dialysis equipment, which rely heavily on detectors. Pharmaceutical and semiconductor industries in the region accelerate integration due to rising exports and domestic production. Food and beverage companies also adopt bubble detection systems to meet international quality standards. Strong government investment in healthcare modernization and industrial expansion strengthens market penetration. It positions Asia-Pacific as a high-potential region with steady long-term opportunities.

Latin America

Latin America represents a smaller yet growing market, holding 6% of the global share. Adoption is concentrated in Brazil, Mexico, and Argentina, where healthcare modernization initiatives support installation of advanced medical devices. Hospitals gradually integrate ultrasonic bubble detectors into infusion systems to improve safety. Pharmaceutical companies in the region adopt detectors to meet international regulatory compliance for exports. The food and beverage industry also contributes modestly by incorporating detectors into packaging and filling operations. Limited affordability and budget constraints slow expansion compared to developed markets. It reflects gradual but promising growth, with industrial adoption expected to strengthen over the forecast period.

Middle East & Africa

The Middle East & Africa account for 5% of the global market share. Growth is driven by healthcare modernization programs in Gulf countries such as Saudi Arabia and the United Arab Emirates. Hospitals and specialty clinics are increasingly adopting bubble detectors to align with global patient safety standards. Pharmaceutical production in the region remains limited, but expansion in food and beverage sectors creates steady demand. Africa shows early-stage adoption, hindered by infrastructure and affordability challenges. Industrial automation projects in oil and chemical sectors provide niche opportunities for detectors. It positions the region as an emerging market with gradual uptake across healthcare and industrial applications.

Key Player Analysis

- Introtek International LP

- Shenzhen Dianyingpu Technology Co., Ltd.

- Sensaras LLC

- Piezo Technologies

- Physik Instrumente (PI) GmbH & Co. KG

- Biosoni

- PendoTECH

- Siansonic

- CeramTec GmbH

- Moog Inc

Competitive Analysis

The Ultrasonic Air Bubble Detectors Market include Introtek International LP, Shenzhen Dianyingpu Technology Co., Ltd., Sensaras LLC, Piezo Technologies, Physik Instrumente (PI) GmbH & Co. KG, Biosoni, PendoTECH, Siansonic, CeramTec GmbH, and Moog Inc. The Ultrasonic Air Bubble Detectors Market is highly competitive, driven by continuous innovation and growing demand across industries. Companies focus on developing detectors with higher accuracy, faster response times, and compact designs suitable for integration into advanced medical and industrial equipment. The market is influenced by strict regulatory standards, requiring suppliers to maintain consistent quality and compliance for healthcare and pharmaceutical applications. Competition also extends to cost optimization, as affordability plays a critical role in adoption across emerging economies. Industrial automation, biopharmaceutical production, and food processing create additional opportunities for differentiation through tailored solutions. The emphasis on precision, reliability, and scalability continues to shape competitive dynamics in this market.

Recent Developments

- In April 2025, MISTRAS Group launched MISTRAS Data Solutions, a unified platform integrating its inspection data services, digital twins, IoT-enabled sensors, and predictive analytics capabilities. This strategic move aims to provide customers across the energy, aerospace, and infrastructure sectors with centralized, real-time integrity data to improve maintenance efficiency.

- In January 2024, Antalis acquired 100 metros of Soluções de Embalagem, Unipessoal, a leading packaging distribution company in Portugal, further expanding its presence in the Iberia packaging market.

- In November 2023, Estonian startup RAIKU secured from the European Innovation Council from private sector investors to advance its chemical-free and compostable packaging material technology.

- In September 2023, Go Do Good Studio, a Pune-based material innovation company, developed a versatile film from algae harvested from India’s coastal regions, offering various packaging applications.

Report Coverage

The research report offers an in-depth analysis based on Product, Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow with rising demand for advanced medical safety systems.

- Biopharmaceutical manufacturing will remain a major driver for detector adoption.

- Integration into compact and portable medical devices will expand product usage.

- Industrial automation will create new opportunities for bubble detection solutions.

- Food and beverage companies will adopt detectors to improve product quality.

- Technological advancements will enhance detection accuracy and sensitivity.

- Regulatory compliance will continue to influence adoption across healthcare and pharma.

- Asia-Pacific will record the fastest growth due to expanding healthcare access.

- Partnerships and collaborations will strengthen product innovation and market reach.

- Increasing focus on precision manufacturing will support long-term market expansion.