Market Overview:

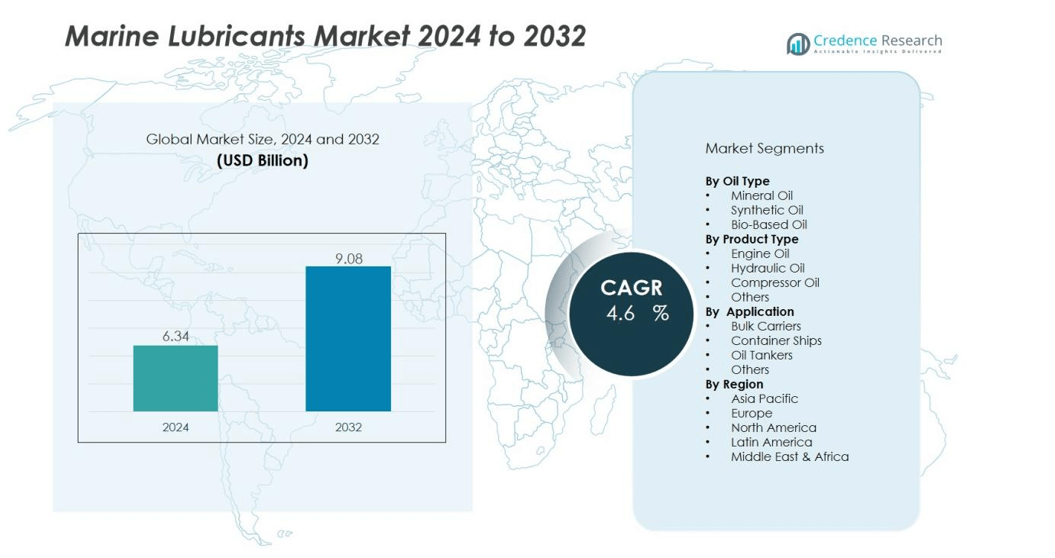

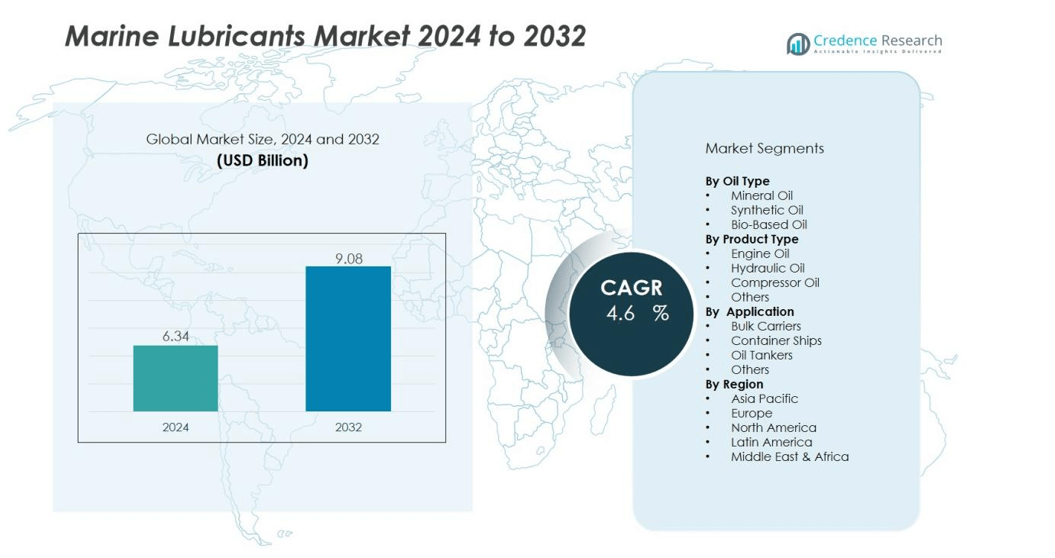

The marine lubricants market size was valued at USD 6.34 billion in 2024 and is anticipated to reach USD 9.08 billion by 2032, at a CAGR of 4.6 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Marine Lubricants Market Size 2024 |

USD 6.34 billion |

| Marine Lubricants Market, CAGR |

4.6% |

| Marine Lubricants Market Size 2032 |

USD 9.08 billion |

Key drivers shaping this market include the rising need for operational efficiency in commercial and naval fleets. Marine lubricants play a vital role in extending engine life, reducing maintenance downtime, and improving fuel efficiency. Stricter environmental standards, such as IMO 2020, are further pushing adoption of eco-friendly lubricants. Advancements in additive technologies are enabling better protection under extreme operating conditions, making these products essential for modern vessels.

Regionally, Asia-Pacific dominates the marine lubricants market, accounting for the largest share due to its strong shipbuilding industry and major ports in China, Japan, and South Korea. Europe follows, supported by stringent environmental regulations and a well-established maritime trade network. North America shows steady growth with rising demand for eco-compliant products, while the Middle East & Africa benefit from growing marine trade and oil tanker activities. Latin America is emerging gradually with increasing port infrastructure development.

Market Insights:

- The marine lubricants market size was valued at USD 6.34 billion in 2024 and is expected to reach USD 9.08 billion by 2032 at a CAGR of 4.6%.

- Rising global shipping volumes and expanding maritime trade routes continue to drive lubricant demand.

- Stricter international regulations such as IMO 2020 are pushing the adoption of low-sulfur and eco-friendly lubricants.

- Advancements in additive technologies are improving durability, thermal stability, and compatibility with modern marine engines.

- The market benefits from the focus on operational efficiency, cost optimization, and extended engine life.

- Compliance costs and raw material price volatility remain key challenges for manufacturers and operators.

- Asia-Pacific leads with 45% market share, followed by Europe with 25% and North America with 18%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand from Global Shipping and Trade Expansion:

The marine lubricants market is driven by growing global shipping volumes and expanding maritime trade routes. Increasing demand for containerized goods and bulk commodities has boosted vessel operations, creating higher consumption of lubricants. It supports smooth engine functioning, reduces friction, and ensures reliable performance under harsh marine conditions. The market benefits from fleet expansion across both commercial and naval sectors.

- For Instance, ExxonMobil launched Mobilgard M420 in 2019, engineered for four-stroke, medium-speed marine engines to support engine durability amid the industry’s transition to low-sulfur fuels

Stricter Environmental Regulations and Eco-Friendly Compliance:

The marine lubricants market gains momentum from stricter international maritime regulations focused on emissions and environmental safety. Policies like IMO 2020 mandate low-sulfur fuel use, raising demand for compatible lubricants. Operators seek bio-based and environmentally acceptable lubricants to meet sustainability goals. It encourages manufacturers to innovate eco-compliant formulations that reduce pollution while maintaining engine efficiency.

- For instance, ExxonMobil confirmed the development of IMO 2020 compliant marine fuels with 0.50 percent sulfur content, ensuring compatibility across residual grades and supporting global ports including Antwerp and Singapore for IMO-compliant bunkering.

Advancements in Additive Technology and Engine Design Compatibility:

The marine lubricants market benefits from advancements in additive technologies that improve durability and thermal stability. These innovations support protection against wear, corrosion, and deposit formation in high-output marine engines. Compatibility with modern, fuel-efficient engine designs further boosts lubricant adoption. It ensures reliable performance across varying operating environments, from cargo ships to offshore vessels.

Rising Focus on Operational Efficiency and Cost Optimization:

The marine lubricants market is supported by the need for better operational efficiency and cost management. Lubricants that extend engine life and reduce maintenance downtime deliver strong value to fleet operators. Fuel efficiency improvements also contribute to lowering total operating costs. It positions marine lubricants as a critical factor in achieving long-term profitability for shipping companies.

Market Trends:

Growing Shift Toward Environmentally Compliant and Bio-Based Lubricants:

The marine lubricants market is witnessing a significant trend toward environmentally compliant products and bio-based formulations. Shipping operators are prioritizing lubricants that meet international standards such as IMO and EAL requirements to reduce emissions and marine pollution. Bio-lubricants derived from renewable sources are gaining traction due to their biodegradability and lower toxicity. It reflects a broader industry movement toward sustainability and eco-friendly operations. Regulatory bodies across Europe and North America are pushing stronger adoption of such lubricants, while Asia-Pacific ports are also tightening compliance checks. This trend is reshaping product development strategies for lubricant manufacturers worldwide.

- For instance, ENOC Group launched a comprehensive range of Environmentally Acceptable Lubricants (EALs) for marine vessels, achieving European EcoLabel certification and expanding sales coverage to over 300 ports worldwide by 2025.

Increasing Demand for High-Performance and Digitalized Solutions:

The marine lubricants market is also shaped by the growing preference for high-performance products designed for advanced marine engines. Modern vessels require lubricants with enhanced thermal stability, wear protection, and fuel compatibility to operate efficiently under heavy loads. It is further supported by the integration of digital monitoring systems that optimize lubricant usage and maintenance schedules. Ship operators are adopting predictive analytics to improve fleet performance and reduce downtime. Smart lubricants with real-time condition monitoring capabilities are emerging as a differentiating factor in the market. This trend highlights the rising intersection of digitalization and lubricant technology in maritime operations.

- For instance, Shell’s Gadinia S3 SAE 30 lubricant offers a very high load carrying capacity with an FZG Gear Machine failure load stage of 12, ensuring excellent wear protection and cleanliness for severe service marine engines, thus enhancing overall engine performance under heavy loads.

Market Challenges Analysis:

Rising Compliance Costs and Regulatory Pressures:

The marine lubricants market faces challenges from increasing compliance costs linked to strict environmental regulations. IMO 2020 and other emission control rules demand low-sulfur and eco-friendly lubricants, which raise production expenses. It creates pricing pressure for manufacturers and ship operators balancing efficiency with affordability. Smaller players struggle to keep pace with constant regulatory updates, limiting competitiveness. Regional variations in compliance further complicate supply chain strategies. This challenge often forces companies to allocate more resources toward R&D and testing.

Volatility in Raw Material Prices and Supply Chain Disruptions:

The marine lubricants market is affected by fluctuations in raw material costs, particularly base oils and additives. Price instability creates uncertainty for producers and impacts profit margins. It is worsened by disruptions in global supply chains, especially during geopolitical tensions or shipping delays. High dependency on crude oil derivatives makes the market vulnerable to global energy price swings. Limited availability of specialized raw materials can delay production schedules and product delivery. These challenges underline the need for diversification of sourcing and greater investment in resilient logistics networks.

Market Opportunities:

Expansion of Eco-Friendly and Bio-Lubricant Solutions:

The marine lubricants market holds strong opportunities in the development of eco-friendly and bio-based lubricants. Rising regulatory pressure and environmental awareness create demand for sustainable alternatives that meet EAL and IMO standards. Ship operators are seeking biodegradable solutions that minimize ecological impact without compromising performance. It encourages manufacturers to innovate new formulations that balance durability, cost efficiency, and compliance. Growth in renewable raw materials further supports this transition toward greener products. Companies investing early in bio-lubricants are likely to gain a competitive advantage.

Adoption of Digital Monitoring and Smart Lubricant Systems:

The marine lubricants market also benefits from the adoption of digital monitoring tools and smart systems. Integration of sensors and analytics allows real-time tracking of lubricant condition and engine performance. It enables predictive maintenance, reduces downtime, and extends equipment lifespan for operators. Maritime firms are increasingly open to digital solutions that lower operating costs and improve fleet efficiency. Demand for connected technologies aligns with the broader digital transformation of the shipping industry. This opportunity supports lubricant producers in offering value-added services beyond traditional supply.

Market Segmentation Analysis:

By Oil Type:

The marine lubricants market is segmented into mineral oil, synthetic oil, and bio-based oil. Mineral oil dominates due to its wide availability and cost-effectiveness, making it the preferred choice for bulk shipping fleets. Synthetic oils are gaining ground with their superior thermal stability and longer service life. It supports advanced engine designs that demand higher performance. Bio-based oils are emerging in response to sustainability regulations, especially in Europe and North America. Growth in eco-friendly shipping practices will accelerate adoption in the coming years.

- For instance, a Cummins KTA38 marine diesel engine running on ExxonMobil’s Mobilgard 1 HSD 5W-40 fully synthetic oil achieved safe oil drain intervals of 3 000 hours—over ten times the engine builder’s recommendation—after logging 21 782 running hours with a single initial fill.

By Product Type:

The marine lubricants market includes engine oil, hydraulic oil, compressor oil, and others. Engine oil holds the largest share, driven by its critical role in protecting marine engines under high-pressure conditions. Hydraulic oils are essential for smooth functioning of onboard systems, while compressor oils support refrigeration and air systems. It reflects rising demand for specialized lubricants tailored to complex ship operations. Expansion of offshore activities continues to support consumption across product categories.

- For instance, Yantai Moon’s marine refrigeration compression units employ high-efficiency oil coolers and reliable oil separators that enhance compressor performance and durability, with units designed for power ratings up to 200 kW ensuring sustained operation under harsh marine conditions.

By Application:

The marine lubricants market serves bulk carriers, container ships, oil tankers, and others. Container ships account for a significant share due to global trade expansion and port activities. Oil tankers also contribute strongly, supported by high demand for crude and refined product transportation. It benefits further from naval and offshore vessels requiring advanced lubricants for reliability. Growth in global seaborne trade sustains application diversity across fleet types.

Segmentations:

By Oil Type:

- Mineral Oil

- Synthetic Oil

- Bio-Based Oil

By Product Type:

- Engine Oil

- Hydraulic Oil

- Compressor Oil

- Others

By Application:

- Bulk Carriers

- Container Ships

- Oil Tankers

- Others

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

Asia-Pacific:

Asia-Pacific holds 45% market share in the marine lubricants market, making it the leading region. It benefits from dominant shipbuilding industries in China, Japan, and South Korea along with strong port activities. Rising trade volumes across Southeast Asia further support lubricant consumption. The region also witnesses rapid adoption of low-sulfur and eco-friendly lubricants driven by compliance requirements. Expanding naval and commercial fleets boost demand for high-performance lubricants. Strong industrial base and investments in port infrastructure keep Asia-Pacific at the forefront of growth.

Europe:

Europe accounts for 25% market share in the marine lubricants market, ranking as the second-largest region. Stringent environmental regulations across the European Union accelerate adoption of bio-based and low-sulfur lubricants. Strong maritime trade routes and advanced port facilities sustain demand across major economies like Germany, the UK, and the Netherlands. It benefits further from active research and innovation in lubricant formulations. Adoption of digital monitoring solutions also enhances efficiency in European fleets. Growth in offshore energy projects supports sustained lubricant usage across the region.

North America:

North America holds 18% market share in the marine lubricants market, maintaining steady growth driven by eco-compliant product demand. The region benefits from well-developed shipping routes, offshore drilling activities, and naval modernization. It emphasizes adoption of sustainable lubricants supported by regulatory bodies and industry initiatives. Ship operators in the United States and Canada prefer high-performance lubricants that extend engine life and improve fuel efficiency. Offshore oil exploration further drives specialized lubricant requirements. Investments in smart shipping technologies create opportunities for lubricant producers to align with evolving fleet needs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Bel-Ray Co. Inc.

- Quaker Chemical Corp.

- Zeller+Gmelin GmbH & Co. KG

- Blaser Swisslube AG

- Repsol

- Kluber Lubrication

- Pennzoil

- Phillips 66

- PetroChina Co. Ltd.

- JX Nippon Oil & Energy Corp.

- Petrobras

- PetroFer Chemie

Competitive Analysis:

The marine lubricants market features strong competition driven by innovation, regulatory compliance, and global supply capabilities. Key players include Bel-Ray Co. Inc., Quaker Chemical Corp., Zeller+Gmelin GmbH & Co. KG, Blaser Swisslube AG, Repsol, Kluber Lubrication, Pennzoil, Phillips 66, and PetroChina Co. Ltd. Companies focus on expanding eco-friendly product portfolios to align with international emission standards and sustainability goals. It invests heavily in research and development to enhance lubricant performance, improve additive technologies, and extend service intervals. Strategic collaborations with shipping companies and distributors help strengthen global reach and secure long-term supply contracts. Regional players compete by offering cost-effective solutions, while multinational brands differentiate through premium formulations and digital monitoring support. Market competition remains intense as firms adapt to evolving customer needs and environmental regulations.

Recent Developments:

- In July 2025, Royal Purple and Bel-Ray launched a new one-gallon bottle design that is stronger, greener, ergonomically improved, and features a wider neck for better pouring.

- In March 2025, Quaker Houghton announced the acquisition of Dipsol Chemicals Co., Ltd., a leading supplier of surface treatment and plating solutions, expanding its advanced solutions portfolio.

- In March 2025, Zeller+Gmelin announced it would exhibit its high-performance NUVAFLEX® UV/LED curing inks and a new 16 Series UV/LED ink, planned for release in Summer 2025, at LabelExpo Mexico 2025.

Report Coverage:

The research report offers an in-depth analysis based on Oil Type, Product Type, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The marine lubricants market will see rising demand for eco-friendly and bio-based formulations as sustainability becomes central.

- Stricter international maritime regulations will continue to drive innovation in low-sulfur and environmentally acceptable lubricants.

- Adoption of digital monitoring systems will enhance lubricant performance tracking and predictive maintenance.

- Fleet modernization and the introduction of advanced marine engines will increase the need for high-performance lubricants.

- Expansion of global seaborne trade will sustain lubricant consumption across commercial and naval fleets.

- Growth in offshore oil and gas exploration will generate demand for specialized lubricants designed for extreme conditions.

- Investment in research and development will lead to improved additive technologies and longer lubricant lifecycles.

- Asia-Pacific will maintain its leadership position supported by strong shipbuilding and port operations.

- Europe will strengthen its role through regulatory support and innovation in eco-compliant lubricant solutions.

- Strategic partnerships between lubricant producers and shipping companies will shape supply security and long-term growth.