| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Conductive Polymers (PEDOT, PANI) Market Size 2024 |

USD 5,372.27 Million |

| Conductive Polymers (PEDOT, PANI) Market, CAGR |

5.73% |

| Conductive Polymers (PEDOT, PANI) Market Size 2032 |

USD 8,665.93 Million |

Market Overview

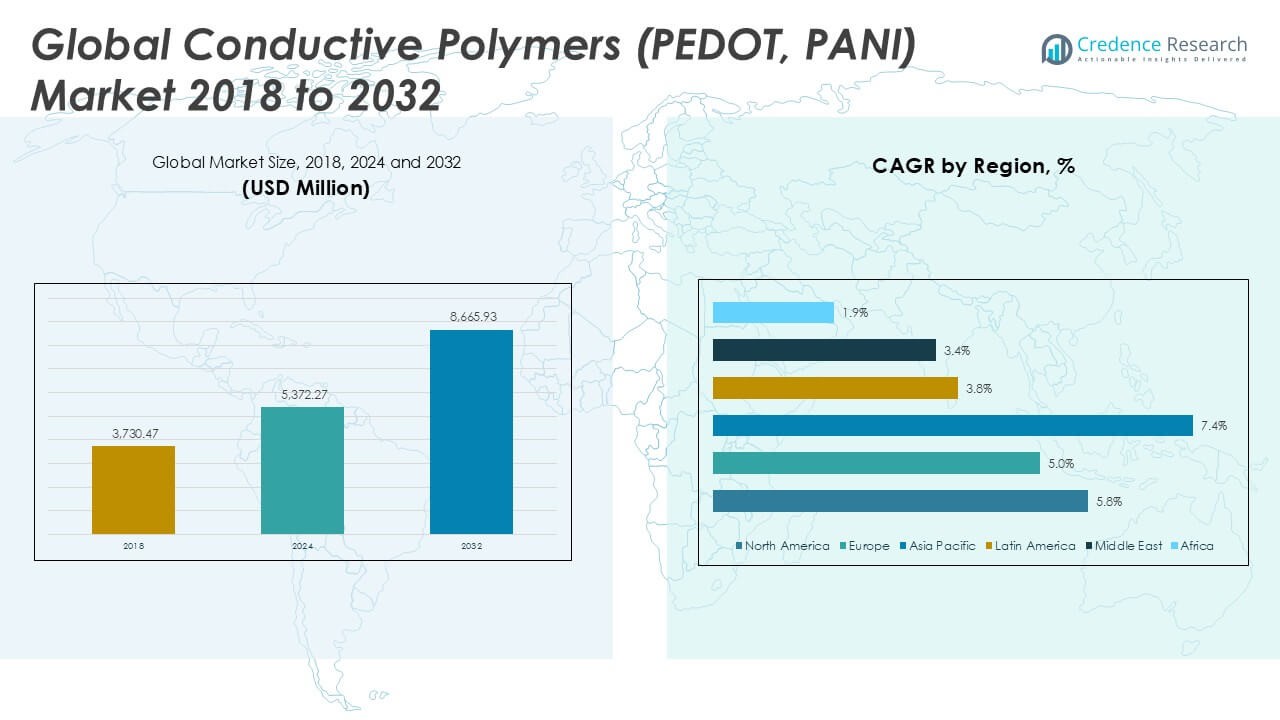

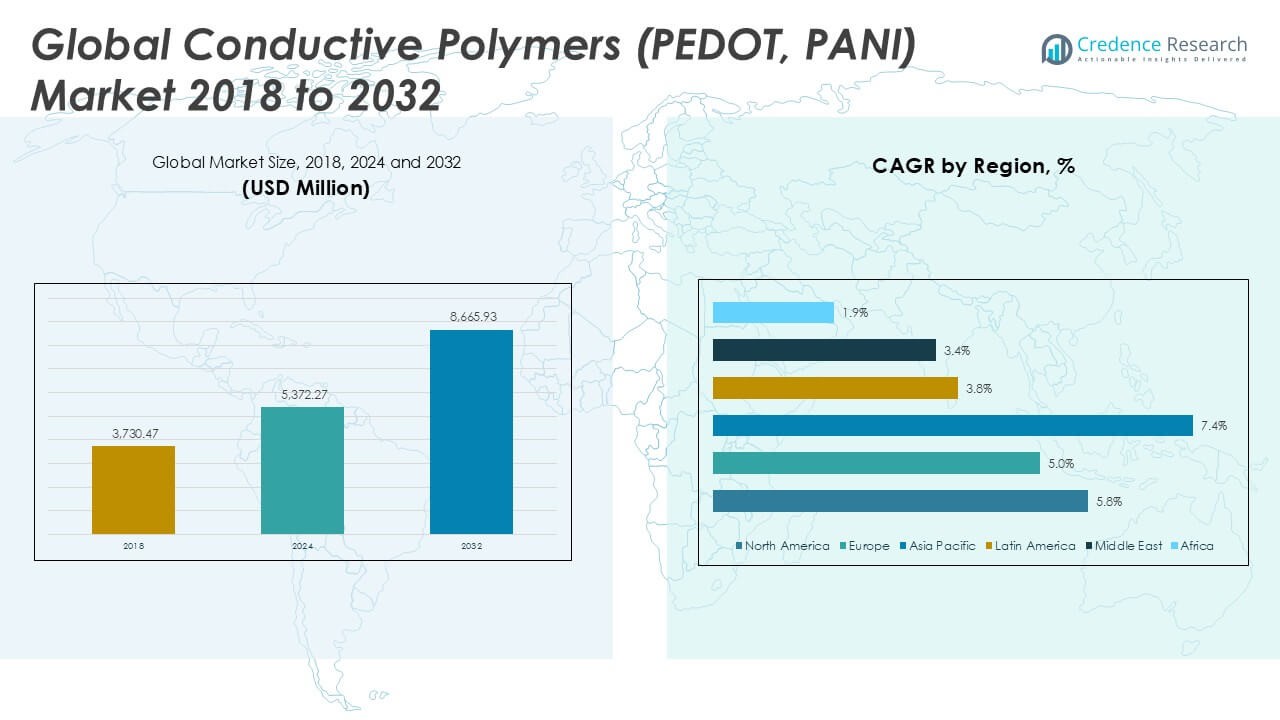

The Conductive Polymers (PEDOT, PANI) Market was valued at USD 3,730.47 million in 2018, reached USD 5,372.27 million in 2024, and is anticipated to reach USD 8,665.93 million by 2032, at a CAGR of 5.73% during the forecast period.

The Conductive Polymers (PEDOT, PANI) Market is driven by the rising demand for lightweight, flexible, and highly conductive materials across sectors such as electronics, energy storage, and automotive. Increasing adoption of these polymers in applications like antistatic coatings, sensors, and advanced batteries supports market expansion. Growth in consumer electronics and the shift towards electric vehicles further fuel demand for efficient energy storage and lightweight components. Ongoing research into improving the stability and conductivity of PEDOT and PANI enhances their competitiveness over traditional materials. Emerging trends include the integration of conductive polymers into wearable devices, organic photovoltaics, and next-generation medical devices, reflecting the market’s role in technological advancement. The industry benefits from ongoing innovation, expanding application possibilities, and growing investment in sustainable, high-performance materials, ensuring robust growth potential throughout the forecast period.

The geographical analysis of the Conductive Polymers (PEDOT, PANI) Market highlights strong growth in North America, Europe, and Asia Pacific, with significant demand driven by the electronics, automotive, and healthcare industries. North America, led by the United States, benefits from established R&D infrastructure and a high concentration of technology companies, while Europe sees robust adoption in Germany, France, and the United Kingdom, supported by innovation in sustainable materials. Asia Pacific, with key contributions from China, Japan, and South Korea, remains a pivotal region for manufacturing and rapid technological advancements. Prominent players shaping the competitive landscape include 3M Company, DuPont de Nemours, Inc., and Merck KGaA, each recognized for their broad product portfolios, extensive research capabilities, and focus on developing advanced conductive polymer solutions for diverse industrial applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Conductive Polymers (PEDOT, PANI) Market was valued at USD 3,730.47 million in 2018, reached USD 5,372.27 million in 2024, and is projected to hit USD 8,665.93 million by 2032, registering a CAGR of 5.73% during the forecast period.

- Rising demand for lightweight, flexible, and highly conductive materials across electronics, automotive, and energy sectors supports robust market growth.

- Integration of conductive polymers into wearable devices, organic light-emitting diodes, and energy storage solutions highlights key innovation trends.

- Leading companies such as 3M Company, DuPont de Nemours, Inc., and Merck KGaA maintain a competitive edge through broad product portfolios and investments in research and development.

- Market restraints include high production costs, technical limitations in long-term stability, and complex manufacturing processes compared to traditional materials.

- North America, Europe, and Asia Pacific lead regional demand, driven by advanced manufacturing capabilities and strong adoption in consumer electronics, automotive, and medical devices, with the United States, Germany, China, and Japan as key countries.

- The market continues to benefit from new application opportunities in healthcare, renewable energy, and flexible electronics, driven by sustainability initiatives and collaboration between industry and research institutes.

Market Drivers

Rising Demand for Flexible and Lightweight Electronic Components Drives Market Expansion

The Conductive Polymers (PEDOT, PANI) Market is witnessing strong demand due to the growing preference for flexible, lightweight, and efficient electronic components. Consumer electronics manufacturers are integrating these polymers into devices such as displays, sensors, and touchscreens, aiming to reduce weight and improve design flexibility. It supports innovations in foldable and wearable technology, meeting the market’s evolving expectations. The polymers’ unique electrical and mechanical properties enable their use in advanced electronic circuits and printed electronics, making them highly attractive for next-generation devices. Increased research in developing materials with better conductivity and durability further boosts adoption. The sector’s focus on device miniaturization underscores the strategic importance of these polymers in modern electronics.

- For instance, Samsung achieved a record-breaking fold radius of 1.4 mm in its latest foldable smartphones by using advanced PEDOT-based coatings from Heraeus, enhancing both flexibility and electrical performance.

Growing Electric Vehicle and Energy Storage Applications Support Market Growth

The global shift towards electric vehicles and renewable energy solutions strengthens the demand for conductive polymers in battery and energy storage technologies. The Conductive Polymers (PEDOT, PANI) Market benefits from their application in supercapacitors, lithium-ion batteries, and lightweight automotive components. It addresses the automotive industry’s need for improved energy efficiency, reduced emissions, and advanced onboard electronics. Enhanced electrochemical performance, long cycle life, and processability position these polymers as key materials for next-generation battery systems. Automakers increasingly invest in advanced materials that deliver high power density and lightweight design, which further boosts market adoption. Research partnerships between polymer suppliers and automotive OEMs accelerate product innovation and integration.

- For instance, Merck KGaA supplied over 400,000 square meters of PEDOT: PSS coatings for lithium-ion battery separators in 2023, supporting higher capacity cells for leading European EV manufacturers.

Increasing Adoption in Healthcare and Medical Devices Fuels Market Demand

The healthcare sector’s move towards smart, responsive, and minimally invasive technologies stimulates demand for conductive polymers in medical device manufacturing. The Conductive Polymers (PEDOT, PANI) Market is capitalizing on applications in biosensors, neural interfaces, and drug delivery systems. It provides the biocompatibility, conductivity, and mechanical flexibility required for modern wearable and implantable medical devices. Innovations in organic electronics and bioelectronics rely on these polymers for signal transmission and device reliability. Hospitals and healthcare providers seek materials that support continuous patient monitoring and remote diagnostics, further driving market penetration. Ongoing R&D is broadening the range of healthcare applications.

Supportive Regulatory Environment and Sustainability Initiatives Accelerate Adoption

A favorable regulatory environment and the global focus on sustainability encourage the development and commercialization of conductive polymers. The Conductive Polymers (PEDOT, PANI) Market gains from regulations promoting environmentally friendly, non-toxic materials and advanced waste management. It aligns with industry initiatives to reduce carbon footprints and enhance recyclability in manufacturing processes. Collaboration between governments, research institutes, and private companies promotes the adoption of green chemistry in polymer production. The market sees significant investment in technologies that lower energy consumption and reduce hazardous byproducts. These sustainability efforts strengthen the position of conductive polymers as preferred alternatives to traditional materials in various industrial sectors.

Market Trends

Integration of Conductive Polymers in Wearable and Flexible Electronics Shapes Product Development

The Conductive Polymers (PEDOT, PANI) Market is experiencing a notable trend toward the integration of its materials in wearable and flexible electronics. Companies are exploring new product lines that leverage the polymers’ inherent flexibility, conductivity, and lightweight properties. It supports the growth of smart textiles, fitness trackers, and health monitoring devices, reflecting rising consumer interest in personal health and connectivity. Manufacturers are designing next-generation displays, sensors, and energy storage solutions that require high performance and adaptability. Advancements in printing and fabrication technologies enable seamless incorporation of these polymers into complex device architectures. Research teams are actively pursuing ways to improve polymer processing and patterning for broader adoption in consumer electronics.

- For instance, DuPont developed stretchable PEDOT-based inks used in over 2 million smart shirts produced by Hexoskin, allowing accurate real-time monitoring of biometric data.

Expansion of Applications in Sustainable Energy and Environmental Solutions Gains Momentum

Sustainability remains a central trend in the Conductive Polymers (PEDOT, PANI) Market, as end users demand environmentally friendly alternatives. It is evident in the growing use of these polymers in organic solar cells, energy-efficient lighting, and recyclable electronic components. The market sees increasing collaboration between polymer manufacturers and renewable energy companies, aiming to lower production costs and minimize environmental impact. Scientists focus on enhancing polymer lifespans and reducing the need for rare or hazardous additives. Government policies supporting clean energy projects and green materials provide an added incentive for market participants. This focus on sustainability drives innovation and investment across the industry.

- For instance, Agfa-Gevaert’s PEDOT formulations have been used in more than 50 MW of installed organic photovoltaic capacity worldwide, demonstrating the scalability and environmental advantage of polymer-based solar cells.

Advancements in Medical and Bioelectronic Device Applications Accelerate Market Evolution

The trend of incorporating conductive polymers into medical and bioelectronic devices continues to accelerate in the Conductive Polymers (PEDOT, PANI) Market. It benefits from breakthroughs in biosensor technology, neural stimulation interfaces, and implantable devices. Hospitals and research institutions favor these polymers for their biocompatibility, electrical conductivity, and adaptability to complex device geometries. The rise of remote diagnostics, telemedicine, and continuous health monitoring pushes demand for reliable, high-performance materials. Academic and commercial partnerships are expanding the possibilities for organic electronics in healthcare. This ongoing collaboration enhances the polymers’ visibility and application potential in medical innovation.

Strategic Partnerships and R&D Investments Drive Technological Advancements

Intensive research and strategic partnerships shape the trajectory of the Conductive Polymers (PEDOT, PANI) Market. It attracts global companies and academic institutions seeking to unlock new functionalities and expand application horizons. Leaders in the field invest in pilot projects, joint ventures, and intellectual property development to maintain a technological edge. The industry’s commitment to R&D has resulted in breakthroughs in conductivity, mechanical strength, and ease of manufacturing. Open innovation platforms and collaborative research consortia facilitate rapid knowledge transfer and commercialization. These trends support the market’s ongoing evolution and strengthen its competitive landscape.

Market Challenges Analysis

Technical and Performance Limitations Constrain Widespread Adoption

The Conductive Polymers (PEDOT, PANI) Market faces challenges related to technical limitations and performance inconsistencies. It often struggles with long-term stability, degradation under environmental stress, and limited mechanical strength, especially when compared to inorganic alternatives. Manufacturers must address issues such as moisture sensitivity, temperature resistance, and the reproducibility of electrical properties. These shortcomings hinder the polymers’ deployment in demanding applications, requiring continuous R&D to enhance reliability and durability. Companies investing in advanced formulations and improved processing techniques seek to overcome these barriers. Meeting stringent industry standards for safety and performance remains a significant hurdle for broader commercial acceptance.

High Production Costs and Complex Manufacturing Processes Hinder Market Growth

Production costs and process complexity present significant challenges for the Conductive Polymers (PEDOT, PANI) Market. It faces difficulties in scaling up manufacturing due to the need for specialized equipment, high-purity raw materials, and precise synthesis conditions. The cost of production limits the polymers’ competitiveness against conventional conductive materials, especially in price-sensitive industries. Process optimization and material efficiency remain top priorities for industry players aiming to lower costs. Regulatory compliance for chemical synthesis and environmental safety further complicates the production landscape. Market participants must invest in technological innovation and process integration to achieve cost-effective and sustainable growth.

Market Opportunities

Emerging Applications in Next-Generation Electronics and Smart Devices Create New Growth Avenues

The Conductive Polymers (PEDOT, PANI) Market benefits from expanding opportunities in next-generation electronics and smart devices. It stands to gain from increasing integration into flexible displays, printed electronics, and wearable technologies, where demand for lightweight, adaptable, and efficient materials remains strong. Companies developing organic transistors, advanced sensors, and high-capacity energy storage solutions seek innovative polymer applications to enhance product performance. The evolution of the Internet of Things and connected devices creates a sustained need for materials that deliver both conductivity and flexibility. Market participants collaborating with tech innovators and electronics manufacturers will accelerate commercialization and scale adoption. Growth in consumer preferences for miniaturized and multifunctional devices further supports new market entrants and product launches.

Expansion into Medical, Energy, and Environmental Sectors Offers Strategic Opportunities

Diversification across healthcare, renewable energy, and environmental solutions provides the Conductive Polymers (PEDOT, PANI) Market with significant growth potential. It aligns with advancements in bioelectronics, implantable medical devices, and energy harvesting systems, where the unique properties of conductive polymers improve device functionality and patient outcomes. The trend toward sustainable and biodegradable materials positions these polymers as favorable alternatives in eco-conscious applications. Partnerships between research institutes and industry leaders support the development of cutting-edge solutions tailored to medical diagnostics, energy storage, and environmental monitoring. Strong global focus on green chemistry and regulatory support for sustainable materials create a conducive environment for further market expansion.

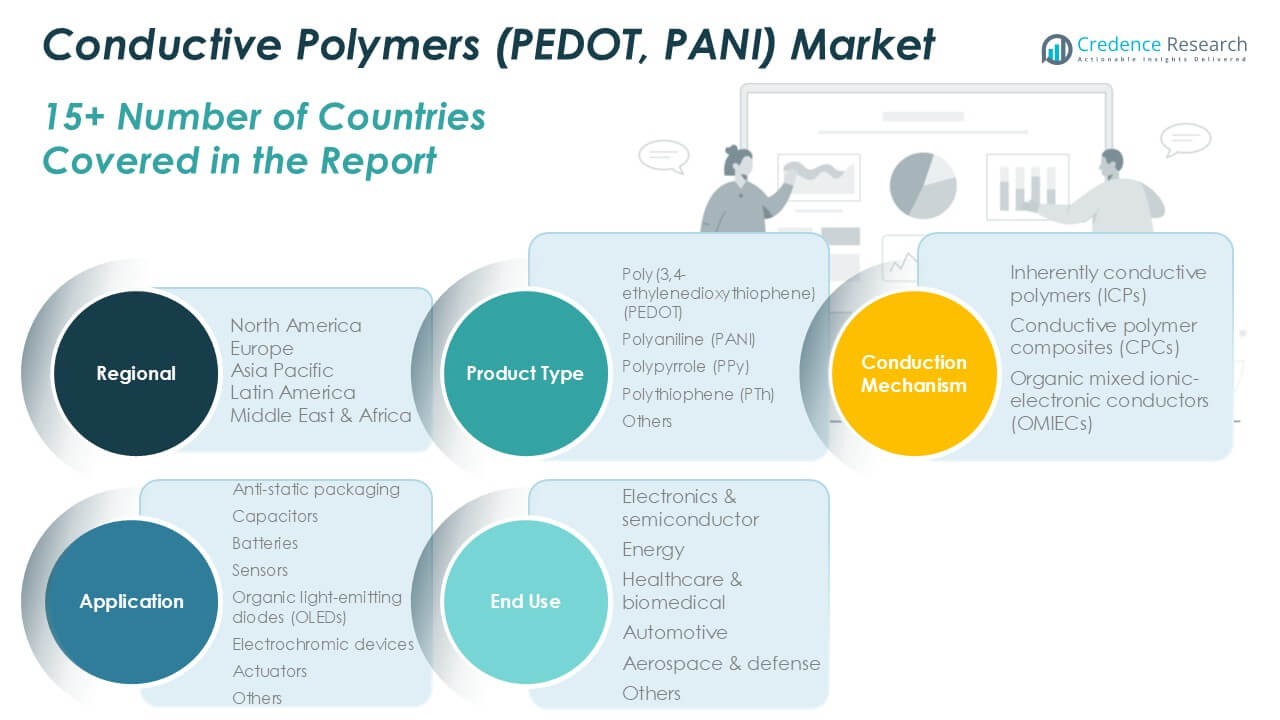

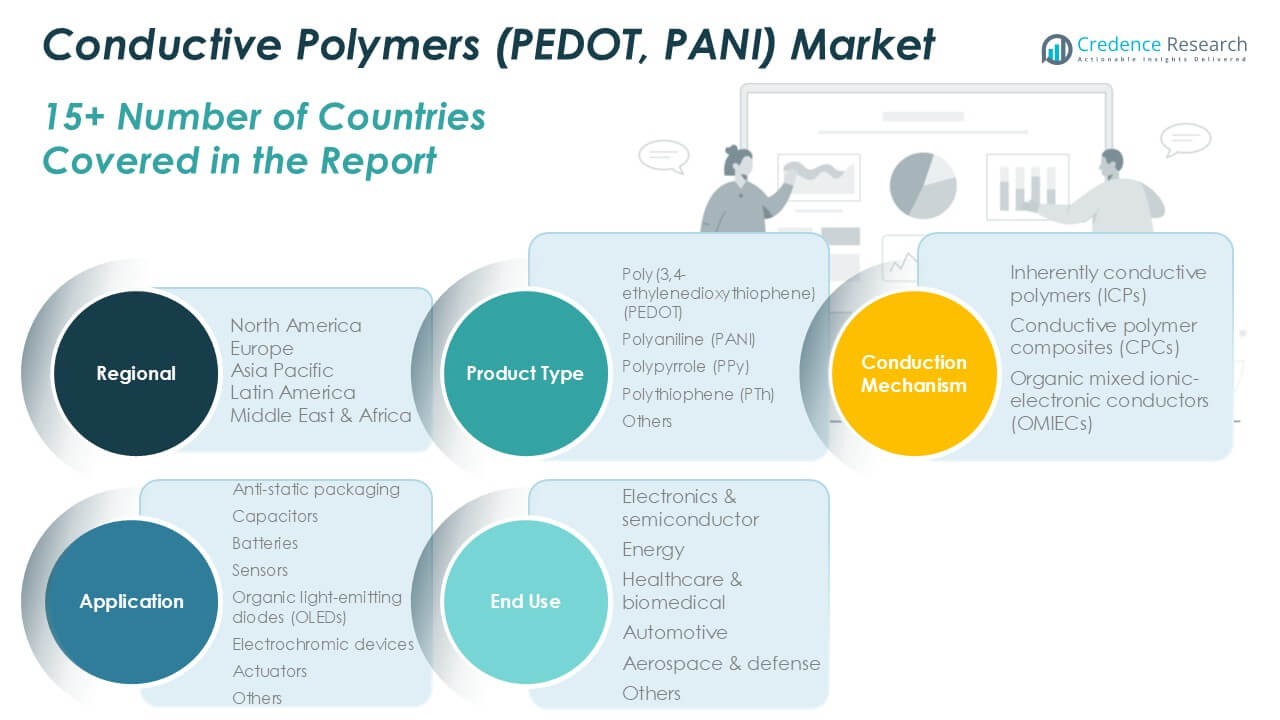

Market Segmentation Analysis:

By Product Type:

Poly(3,4-ethylenedioxythiophene) (PEDOT) and Polyaniline (PANI) lead the market due to their superior electrical conductivity, stability, and processability. It finds strong uptake in high-performance electronics and energy storage applications, while Polypyrrole (PPy) and Polythiophene (PTh) gain traction in sensors, actuators, and optoelectronic devices, supported by ongoing innovations in material science. The “Others” category includes emerging polymers that serve niche requirements and are under evaluation for specialized uses.

- For instance, Celanese Corporation’s production of high-purity PEDOT reached 1,200 metric tons in 2022, supplying major electronics firms with materials for antistatic and transparent electrode applications.

By Conduction Mechanism:

The market is segmented into inherently conductive polymers (ICPs), conductive polymer composites (CPCs), and organic mixed ionic-electronic conductors (OMIECs). ICPs represent the core of the market, delivering high conductivity and enabling the development of advanced electronics and flexible devices. Conductive polymer composites (CPCs) combine polymers with conductive fillers to enhance properties such as mechanical strength and environmental stability, supporting their use in automotive and industrial applications. Organic mixed ionic-electronic conductors (OMIECs) provide a unique blend of ionic and electronic conductivity, unlocking opportunities for bioelectronic devices, energy harvesting, and next-generation sensors.

- For instance, SABIC commercialized a new CPC line with a conductivity of 180 S/cm and tensile strength of 65 MPa, now used in more than 500,000 automotive sensor housings each year.

By Application:

The application landscape is broad, with anti-static packaging, capacitors, and batteries serving as key growth areas due to the need for materials that offer lightweight construction, efficient charge storage, and safety. Sensors and organic light-emitting diodes (OLEDs) reflect the market’s expansion into cutting-edge electronics and display technologies, where conductivity and flexibility are critical. Electrochromic devices and actuators highlight the adoption of these polymers in smart systems and advanced automation. The “Others” application segment captures innovative uses that continue to emerge as research and industry requirements evolve. The Conductive Polymers (PEDOT, PANI) Market remains positioned for growth through a well-defined segment structure, meeting the changing needs of technology-driven industries.

Segments:

Based on Product Type:

- Poly(3,4-ethylenedioxythiophene) (PEDOT)

- Polyaniline (PANI)

- Polypyrrole (PPy)

- Polythiophene (PTh)

- Others

Based on Conduction Mechanism:

- Inherently conductive polymers (ICPs)

- Conductive polymer composites (CPCs)

- Organic mixed ionic-electronic conductors (OMIECs)

Based on Application:

- Anti-static packaging

- Capacitors

- Batteries

- Sensors

- Organic light-emitting diodes (OLEDs)

- Electrochromic devices

- Actuators

- Others

Based on End Use:

- Electronics & semiconductor

- Energy

- Healthcare & biomedical

- Automotive

- Aerospace & defense

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Conductive Polymers (PEDOT, PANI) market

North America Conductive Polymers (PEDOT, PANI) market grew from USD 1,538.22 million in 2018 to USD 2,190.84 million in 2024 and is projected to reach USD 3,544.41 million by 2032, reflecting a compound annual growth rate (CAGR) of 5.8%. North America is holding a 41% market share. The United States leads regional demand, driven by advanced electronics manufacturing, significant R&D investments, and strong presence of key industry players. Canada contributes with growth in automotive and renewable energy applications. The region benefits from a mature end-user base and a focus on technological innovation in medical devices and energy storage.

Europe Conductive Polymers (PEDOT, PANI) market

Europe Conductive Polymers (PEDOT, PANI) market grew from USD 1,180.51 million in 2018 to USD 1,645.11 million in 2024 and is forecast to reach USD 2,515.05 million by 2032, at a CAGR of 5.0%. Europe holds a 29% market share. Germany, France, and the United Kingdom are key markets, with robust demand for conductive polymers in automotive electronics, healthcare devices, and industrial automation. The region emphasizes sustainable manufacturing practices and material innovation, supporting steady market growth. Strong collaboration between academia and industry drives advanced application development.

Asia Pacific Conductive Polymers (PEDOT, PANI) market

Asia Pacific Conductive Polymers (PEDOT, PANI) market grew from USD 717.54 million in 2018 to USD 1,120.01 million in 2024 and is set to reach USD 2,046.20 million by 2032, at a CAGR of 7.4%. Asia Pacific commands a 24% market share. China, Japan, South Korea, and India act as primary growth engines, underpinned by rising electronics production, investments in electric mobility, and expanding healthcare infrastructure. It benefits from rapid industrialization and favorable government policies supporting high-performance materials. The region’s competitive manufacturing costs and scale give it an edge in global supply chains.

Latin America Conductive Polymers (PEDOT, PANI) market

Latin America Conductive Polymers (PEDOT, PANI) market grew from USD 147.17 million in 2018 to USD 208.78 million in 2024 and is predicted to reach USD 290.33 million by 2032, with a CAGR of 3.8%. Latin America captures a 3% market share. Brazil and Mexico lead market activity, supported by automotive manufacturing and growing investment in consumer electronics. Regional development is supported by a gradual shift toward modern industrial technologies and government incentives for domestic production.

Middle East Conductive Polymers (PEDOT, PANI) market

Middle East Conductive Polymers (PEDOT, PANI) market grew from USD 101.99 million in 2018 to USD 133.95 million in 2024 and is projected to achieve USD 181.41 million by 2032, posting a CAGR of 3.4%. The Middle East represents a 2% market share. Key countries include Saudi Arabia and the United Arab Emirates, where diversification strategies and infrastructure investments create new opportunities in electronics, energy, and healthcare. The market is influenced by government-backed innovation initiatives and increasing adoption of smart technologies.

Africa Conductive Polymers (PEDOT, PANI) market

Africa Conductive Polymers (PEDOT, PANI) market grew from USD 45.05 million in 2018 to USD 73.58 million in 2024 and is anticipated to reach USD 88.53 million by 2032, growing at a CAGR of 1.9%. Africa accounts for a 1% market share. South Africa and Egypt are leading markets, focusing on emerging applications in telecommunications and renewable energy. Regional growth remains moderate, with challenges in infrastructure and technology transfer, but targeted investments and international partnerships support gradual market advancement.

Key Player Analysis

- 3M Company

- Agfa-Gevaert N.V.

- Celanese Corporation

- Covestro AG

- DuPont de Nemours, Inc.

- Heraeus Holding GmbH

- KEMET Corporation

- Merck KGaA

- Rieke Metals

- SABIC

Competitive Analysis

The competitive landscape of the Conductive Polymers (PEDOT, PANI) Market features established global players with strong technological expertise and broad product offerings. Key companies such as 3M Company, DuPont de Nemours, Inc., Merck KGaA, Covestro AG, Celanese Corporation, Agfa-Gevaert N.V., Heraeus Holding GmbH, KEMET Corporation, SABIC, and Rieke Metals set industry benchmarks in quality, innovation, and market reach. These leaders invest heavily in research and development to advance polymer formulations, enhance conductivity, and improve material performance in demanding applications. Strategic partnerships, mergers, and acquisitions strengthen their global presence and support expansion into emerging markets. Companies compete by offering customized solutions tailored to the needs of electronics, automotive, and healthcare sectors, leveraging extensive technical support and after-sales service. Regulatory compliance, sustainable product lines, and focus on scalability position these players as preferred partners for large-scale projects. The competitive environment remains dynamic, with firms prioritizing continuous product innovation, operational efficiency, and value-added services to maintain leadership and capture new growth opportunities across the evolving conductive polymers industry.

Recent Developments

- In April 2024, Covestro debuted a line of polycarbonate copolymer-based products at CHINAPLAS, offering enhanced properties and functionalities for diverse industrial applications.

- In March 2024, Covestro launches the world’s first solvent-free melt process production plant for polycarbonate copolymers, marking a significant advancement in polymer manufacturing technology.

- In December 2022, Scientists from Pusan National University introduced an energy-efficient method to improve the thermal conductivity of polymer composites.

Market Concentration & Characteristics

The Conductive Polymers (PEDOT, PANI) Market demonstrates a moderately concentrated structure, with a few leading multinational corporations controlling a significant portion of global revenues. It features high entry barriers due to the need for advanced technical know-how, substantial research investments, and regulatory compliance for chemical manufacturing. The market is characterized by continuous product innovation, driven by the demand for advanced materials in electronics, energy storage, and healthcare applications. Leading players prioritize R&D, sustainability, and collaboration with end-user industries to develop application-specific solutions. It requires manufacturers to maintain strict quality standards and supply reliability, supporting strong relationships with large OEMs and technology firms. Rapid technological change and evolving end-user requirements drive the pace of innovation, keeping competition intense among established and emerging firms. The Conductive Polymers (PEDOT, PANI) Market benefits from its ability to adapt to new application areas and integrate with next-generation technologies, ensuring ongoing relevance and long-term growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Conduction Mechanism, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Market expansion will follow increased demand for flexible electronics and advanced wearable devices.

- Ongoing research will enhance polymer stability and conductivity for long-term applications.

- Adoption in electric vehicles and renewable energy sectors will grow steadily.

- Integration in medical devices and bioelectronics will accelerate with improved biocompatibility.

- Breakthroughs in manufacturing processes will reduce production costs and complexity.

- Regulatory support for green materials will encourage adoption of sustainable conductive polymers.

- Collaborations between industry and academic institutions will drive innovation and shorten time to market.

- Role in IoT applications will increase as demand rises for lightweight, multifunctional materials.

- Development of next-generation sensors and electrochromic devices will open niche growth opportunities.

- Custom polymer formulations tailored to specific end uses will become a competitive differentiator.