Market Overview

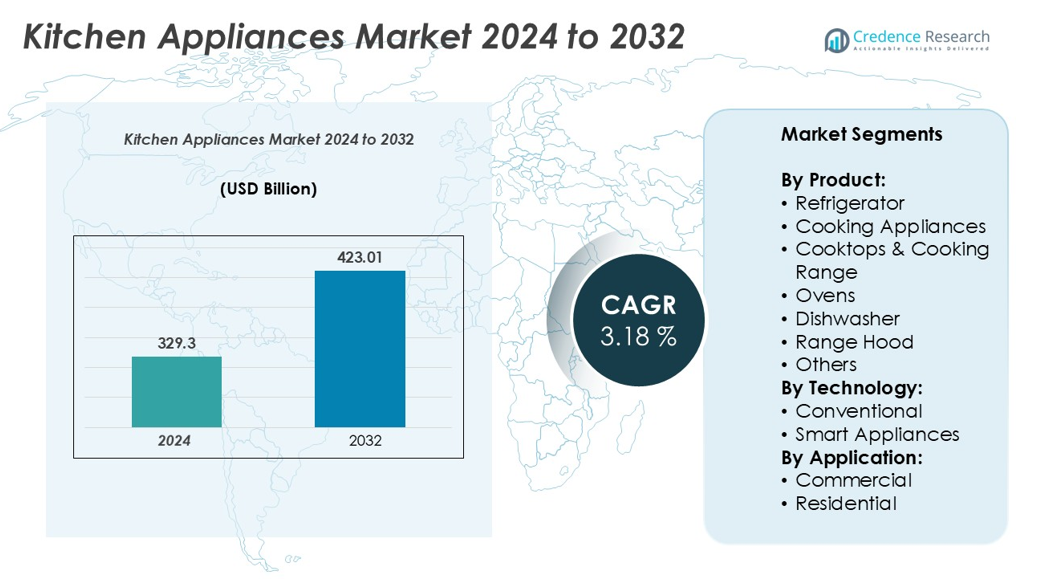

The Kitchen Appliances Market size was valued at USD 329.3 billion in 2024 and is anticipated to reach USD 423.01 billion by 2032, growing at a CAGR of 3.18% during the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Kitchen Appliances Market Size 2024 |

USD 329.3 billion |

| Kitchen Appliances Market, CAGR |

3.18% |

| Kitchen Appliances Market Size 2032 |

USD 423.01 billion |

The global kitchen appliances market is led by prominent players such as Haier Group, Whirlpool Corporation, LG Electronics, Panasonic Holdings Corporation, Robert Bosch GmbH, SAMSUNG, AB Electrolux, Morphy Richards, Koninklijke Philips N.V., and Dacor, Inc. These companies dominate through extensive product innovation, smart technology integration, and strong global distribution networks. Haier Group and Whirlpool Corporation hold notable leadership positions due to their broad product portfolios and technological advancements in smart and energy-efficient appliances. Asia-Pacific emerged as the leading region in 2024, capturing approximately 35% of the global market share, driven by rapid urbanization, rising disposable incomes, and growing adoption of connected kitchen solutions across China, India, and Japan.

Market Insights

- The global kitchen appliances market was valued at USD 329.3 billion in 2024 and is projected to reach USD 423.01 billion by 2032, growing at a CAGR of 3.18% during the forecast period.

- Market growth is primarily driven by rising urbanization, increasing disposable incomes, and growing consumer preference for energy-efficient and smart kitchen solutions across residential and commercial sectors.

- Key trends include the integration of IoT and AI technologies, expansion of smart kitchen ecosystems, and rising demand for premium, space-saving, and eco-friendly appliances among urban consumers.

- The competitive landscape is dominated by global players such as Haier Group, Whirlpool Corporation, LG Electronics, SAMSUNG, and Robert Bosch GmbH, focusing on innovation, sustainability, and product diversification.

- Regionally, Asia-Pacific leads with around 35% market share, followed by North America (28%) and Europe (25%), while by product, refrigerators hold the dominant share due to continuous technological advancements and energy-efficient designs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product:

The kitchen appliances market by product is dominated by refrigerators, accounting for the largest market share in 2024. The demand for energy-efficient and smart refrigerator models with advanced cooling technologies and connectivity features drives growth in this sub-segment. Increasing urbanization, rising disposable income, and the growing need for food preservation in households and commercial spaces further support demand. Other key contributors such as cooking appliances and ovens are witnessing consistent adoption, driven by lifestyle changes and the popularity of modular kitchens across urban regions.

- For instance, LG InstaView Door-in-Door refrigerators are equipped with the Linear Cooling system, maintaining temperature fluctuations within ±0.5°C, and SmartThinQ (now LG ThinQ) technology.

By Technology:

Based on technology, the conventional appliances segment currently holds a dominant market share due to affordability, ease of use, and widespread availability. However, the smart appliances segment is gaining strong traction, fueled by technological advancements and consumer inclination toward automation and energy efficiency. Features such as Wi-Fi connectivity, voice control integration, and real-time performance monitoring are influencing purchase decisions. Manufacturers are increasingly investing in IoT-enabled product portfolios to enhance convenience, sustainability, and control, which is expected to boost the adoption of smart kitchen appliances in the coming years.

- For instance, Haier’s IoT-enabled smart kitchen series integrates hOn App control, which connects to and manages smart kitchen and other home appliances to optimize energy use and cooking precision.

By Application:

In terms of application, the residential segment dominates the kitchen appliances market, driven by the growing adoption of modern, space-saving, and energy-efficient kitchen solutions among households. Rising urban housing projects, improved living standards, and the expanding middle-class population contribute to this trend. Consumers’ increasing preference for stylish and multifunctional appliances that complement modular kitchen designs further strengthens residential demand. The commercial segment, encompassing hotels, restaurants, and catering services, is also expanding steadily, supported by the hospitality sector’s emphasis on efficiency, hygiene, and automation in kitchen operations.

Key Growth Drivers

Rising Urbanization and Changing Lifestyle Preferences

Rapid urbanization and evolving consumer lifestyles are major growth drivers of the kitchen appliances market. Increasing migration toward urban centers has resulted in smaller living spaces, encouraging the adoption of compact, multifunctional, and energy-efficient appliances. Consumers are prioritizing convenience, aesthetics, and time-saving features, driving demand for advanced products such as smart ovens, induction cooktops, and high-efficiency dishwashers. Furthermore, the growing number of nuclear families and dual-income households has accelerated the need for automated and connected appliances that simplify daily cooking and cleaning tasks, thereby fostering market expansion across residential sectors globally.

- For instance, the Panasonic 27-liter NN-CD674M convection microwave oven integrates three cooking modes—microwave, grill, and convection (baking)—into a single unit. Using a combination of these cooking methods, particularly combining microwave and convection, can speed up the cooking process significantly compared to conventional methods.

Technological Advancements and Smart Appliance Integration

Technological innovation is reshaping the kitchen appliances market landscape. Integration of artificial intelligence (AI), Internet of Things (IoT), and machine learning (ML) has enabled manufacturers to offer appliances with enhanced energy management, voice control, and predictive maintenance capabilities. Smart refrigerators and connected cooking ranges are gaining popularity due to their ability to improve user experience through automation and remote monitoring. Additionally, the rising availability of mobile apps for appliance control and real-time energy tracking enhances convenience and operational efficiency. These advancements not only improve functionality but also align with the growing consumer focus on sustainability and energy conservation.

- For instance, Samsung’s Bespoke AI Family Hub Refrigerators use an “AI Vision Inside” system with internal cameras to automatically identify up to 37 fresh food items and track frequently used packaged foods. The system, connected through the SmartThings app, suggests recipes based on the available inventory and sends alerts for expiring food to help with meal planning and grocery shopping.

Growing Focus on Energy Efficiency and Sustainability

Increasing environmental awareness and stringent government regulations on energy consumption are driving the demand for energy-efficient kitchen appliances. Manufacturers are developing products that comply with eco-label certifications and use environmentally friendly refrigerants and recyclable materials. Energy-efficient refrigerators, induction cooktops, and convection ovens are increasingly preferred by consumers seeking to reduce electricity bills and carbon footprint. The integration of inverter technology, sensor-based operations, and automatic shut-off features further enhances performance efficiency. This growing alignment between sustainability goals and product innovation continues to support long-term market growth and strengthen consumer trust in green and efficient appliance solutions.

Key Trends & Opportunities

Surge in Smart Kitchen Ecosystems

The rise of connected living has transformed the kitchen into a smart ecosystem, creating significant growth opportunities for manufacturers. Consumers are adopting appliances that seamlessly integrate with smart home systems like Google Home and Amazon Alexa. This trend enables synchronized control of devices such as refrigerators, ovens, and dishwashers through voice commands or mobile apps. As AI-powered cooking assistance and recipe recommendations gain popularity, brands are focusing on developing interoperable platforms and data-driven personalization. The continuous evolution of 5G and cloud-based analytics will further accelerate the adoption of smart kitchen appliances globally.

- For instance, The GE Appliances Kitchen Hub is a real product featuring a 27-inch smart display and built-in Google Assistant. It provides voice control for its functions and other compatible smart home devices. The hub also offers access to thousands of recipes through its “Flavorly” app (now integrated into the SmartHQ app), with some models utilizing computer vision technology to assist with cooking and appliance functions.

Expanding E-Commerce and Omni-Channel Distribution

The proliferation of e-commerce platforms has become a major growth opportunity for the kitchen appliances industry. Consumers increasingly prefer online channels for comparing specifications, reading reviews, and accessing exclusive deals. Major appliance brands are leveraging omni-channel strategies that integrate digital sales with in-store experiences. The availability of virtual product demos, AR-based kitchen design tools, and online customization options enhances customer engagement. Additionally, the growth of logistics networks and digital payment systems supports quick and reliable product delivery. This shift toward digital-first retail strategies is reshaping the competitive dynamics of the market.

Growing Demand for Premium and Aesthetic Appliances

Consumers are showing increasing interest in premium kitchen appliances that combine advanced functionality with elegant design. Rising disposable incomes and home renovation trends are driving demand for products that enhance kitchen aesthetics and space utilization. Built-in appliances, sleek induction cooktops, and minimalist stainless-steel finishes are particularly popular in urban households. Manufacturers are responding by offering customizable product lines and color-matched designs that complement modern interiors. The convergence of luxury, technology, and sustainability continues to create lucrative opportunities in the premium kitchen appliance segment.

Key Challenges

High Product Costs and Limited Affordability in Emerging Markets

Despite growing demand, the high cost of advanced kitchen appliances poses a significant challenge, particularly in price-sensitive regions. Smart and energy-efficient models often involve premium pricing due to the inclusion of IoT components, advanced sensors, and high-quality materials. In developing economies, limited purchasing power and inadequate financing options hinder mass adoption. Additionally, fluctuating raw material prices and supply chain disruptions can further inflate production costs. To overcome this, manufacturers are focusing on localized production, modular designs, and financing schemes to make smart appliances more accessible to a broader consumer base.

Maintenance Complexity and Limited Consumer Awareness

The increasing technological sophistication of modern kitchen appliances has led to challenges related to maintenance, repair, and consumer awareness. Many users lack the technical understanding required to operate smart appliances efficiently or troubleshoot minor issues. Limited service infrastructure and inadequate after-sales support in emerging markets further exacerbate the problem. Additionally, data privacy concerns associated with connected devices have created hesitation among consumers. Addressing this challenge requires enhanced consumer education, robust customer service frameworks, and transparent data management policies to ensure trust and long-term product adoption.

Regional Analysis

North America

North America holds a significant share of the global kitchen appliances market, driven by high consumer purchasing power and widespread adoption of advanced home technologies. The region accounted for a notable market share of around 28% in 2024, supported by strong demand for smart and energy-efficient appliances. The United States dominates regional growth, fueled by innovations in connected kitchen ecosystems and increased remodeling activities. Rising awareness of sustainability and energy conservation, coupled with the presence of leading manufacturers such as Whirlpool, GE Appliances, and KitchenAid, continues to strengthen North America’s market position.

Europe

Europe captured approximately 25% of the global kitchen appliances market in 2024, primarily due to the region’s emphasis on energy efficiency, product quality, and design aesthetics. Countries such as Germany, the U.K., and France lead in the adoption of built-in and premium appliances, supported by evolving consumer lifestyles and smart home integration. Stringent EU regulations promoting eco-friendly technologies have encouraged manufacturers to innovate low-energy products. Furthermore, the growing popularity of modular kitchens and compact living spaces across urban centers continues to fuel demand for multifunctional and space-efficient kitchen appliances.

Asia-Pacific

The Asia-Pacific region dominated the global market, accounting for the largest share of about 35% in 2024, and is projected to exhibit the fastest growth during the forecast period. Rapid urbanization, rising disposable incomes, and expanding middle-class populations in countries like China, India, and Japan are key growth drivers. The surge in residential construction, coupled with increasing adoption of smart and compact appliances, is boosting regional demand. Additionally, local manufacturing capabilities, government incentives for energy-efficient products, and expanding e-commerce platforms contribute significantly to Asia-Pacific’s leadership in the global kitchen appliances market.

Latin America

Latin America accounted for nearly 7% of the global kitchen appliances market in 2024, supported by steady growth in residential construction and improved living standards. Brazil and Mexico are the key contributors, driven by urban expansion and increasing consumer awareness of energy-efficient products. The rise of online retail channels and affordable product launches by global brands have also supported market penetration. However, economic volatility and limited product accessibility in rural areas remain challenges. Despite this, demand for small and mid-sized appliances continues to grow, particularly among the region’s expanding urban middle class.

Middle East & Africa

The Middle East & Africa region represented about 5% of the global kitchen appliances market in 2024, with strong potential for future growth. Increasing urbanization, tourism expansion, and rising investments in residential infrastructure are driving demand for modern kitchen solutions. The UAE and Saudi Arabia are leading markets, supported by growing smart home adoption and preference for luxury appliances in premium housing projects. In Africa, improving electrification rates and expanding retail networks are encouraging gradual market penetration. Manufacturers are focusing on offering durable, cost-efficient products tailored to regional climatic and cultural cooking preferences.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Product:

- Refrigerator

- Cooking Appliances

- Cooktops & Cooking Range

- Ovens

- Dishwasher

- Range Hood

- Others

By Technology:

- Conventional

- Smart Appliances

By Application:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The kitchen appliances market is highly competitive, characterized by the presence of several global and regional players focusing on innovation, product diversification, and brand differentiation. Leading companies such as Haier Group, Whirlpool Corporation, LG Electronics, Panasonic Holdings Corporation, Robert Bosch GmbH, SAMSUNG, AB Electrolux, Morphy Richards, Koninklijke Philips N.V., and Dacor, Inc. dominate the market through extensive product portfolios and robust distribution networks. These players are investing heavily in research and development to introduce smart, energy-efficient, and sustainable appliances that cater to evolving consumer needs. Strategic collaborations, mergers, and acquisitions remain key approaches to expanding market reach and enhancing technological capabilities. Furthermore, increasing emphasis on connected technologies, premium aesthetics, and eco-friendly solutions is intensifying competition, encouraging manufacturers to integrate IoT, AI, and advanced energy management systems to strengthen brand positioning and capture emerging market opportunities globally.

Key Player Analysis

Recent Developments

- In February 2023, Electrolux widened its appliance lineup by offering built-in appliances in India. The new lineup includes microwaves, stoves, burners and cooker caps, dishwashers, and coffee machines. Electrolux appliances have an Eco program that aids in conserving water and energy. The entire line has pre-programmed meal settings and a steamy mode that can cook food while retaining all nutrients and moisture. Conventional choices such as conventional and fan-assisted cooking are also offered in these appliances.

- In February 2023, Philips Domestic Appliances partnered with Omnicom Media Group (OMG) as its global media agency. This partnership encompasses a wide range of products, including kitchen appliances, coffee makers, indoor climate control devices, clothes steamers, irons, and floor cleaning appliances, and will extend to over 100 countries. OMG’s involvement will be crucial in implementing a new marketing strategy and driving forward Philips Domestic Appliances’ ambitious growth plans, aiming to solidify its position as a leading global provider of home appliances.

- In December 2022, V-Guard acquired Sunflame Enterprises Private Ltd (SEPL) to establish a strong domestic market position. SEPL, operating under the Sunflame brand across India, holds a nationwide presence. This acquisition marks a crucial milestone for V-Guard as it aims to enhance consumer engagement through innovative products and experiences. With the iconic Sunflame brand deeply rooted in Indian households, V-Guard anticipates substantial progress in its ambition to become a leading player in the Indian kitchen appliances sector.

- In August 2022, Thomson launched a comprehensive selection of kitchen appliances, including juice blenders, sandwich makers, electric cookers, geysers, room radiators, and more. Indian consumers are turning to economical and long-lasting products to make household chores easier. Along with metro cities, tier 3 cities and beyond have boosted demand for small household appliances. Thomson’s new product line will provide clients with a wider assortment of best-in-class products while still delivering excellent quality at an affordable price.

- In June 2022, TTK Prestige and Ultrafresh collaborated to support TTK’s aim of becoming a comprehensive kitchen solutions brand. As part of Ultrafresh opened its inaugural experience center in Koramangala, Bengaluru. Spanning 2,700 square feet, the store showcases a variety of kitchen designs. With 120 studios in operation and the production of over 5,000 steel and wooden kitchens across the country, Ultrafresh is making significant strides.

Report Coverage

The research report offers an in-depth analysis based on Product, Technology, Application, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The kitchen appliances market will continue to expand steadily with rising global demand for energy-efficient and smart home solutions.

- Advancements in IoT and AI technologies will enhance automation, connectivity, and user convenience in modern kitchens.

- Smart appliances with voice control and mobile app integration will gain greater consumer adoption across residential sectors.

- Manufacturers will increasingly focus on sustainability through eco-friendly materials and energy-saving technologies.

- Premium and built-in appliances will see strong growth due to rising urbanization and luxury housing trends.

- E-commerce and omni-channel retail will play a key role in boosting product accessibility and customer engagement.

- Product innovation will emphasize compact, multifunctional designs suitable for smaller urban living spaces.

- Emerging economies in Asia-Pacific and Latin America will drive significant future market expansion.

- Strategic collaborations and mergers will strengthen global players’ technological and market capabilities.

- Continuous investment in design aesthetics and customization will influence consumer purchase decisions.