Market Overview:

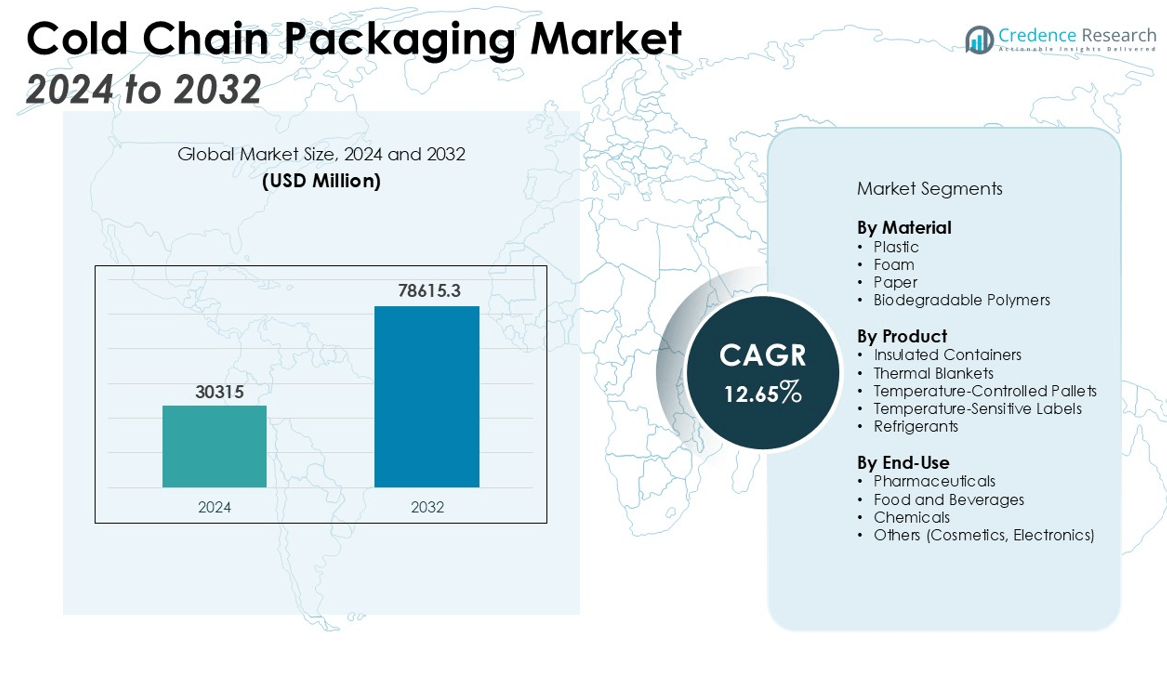

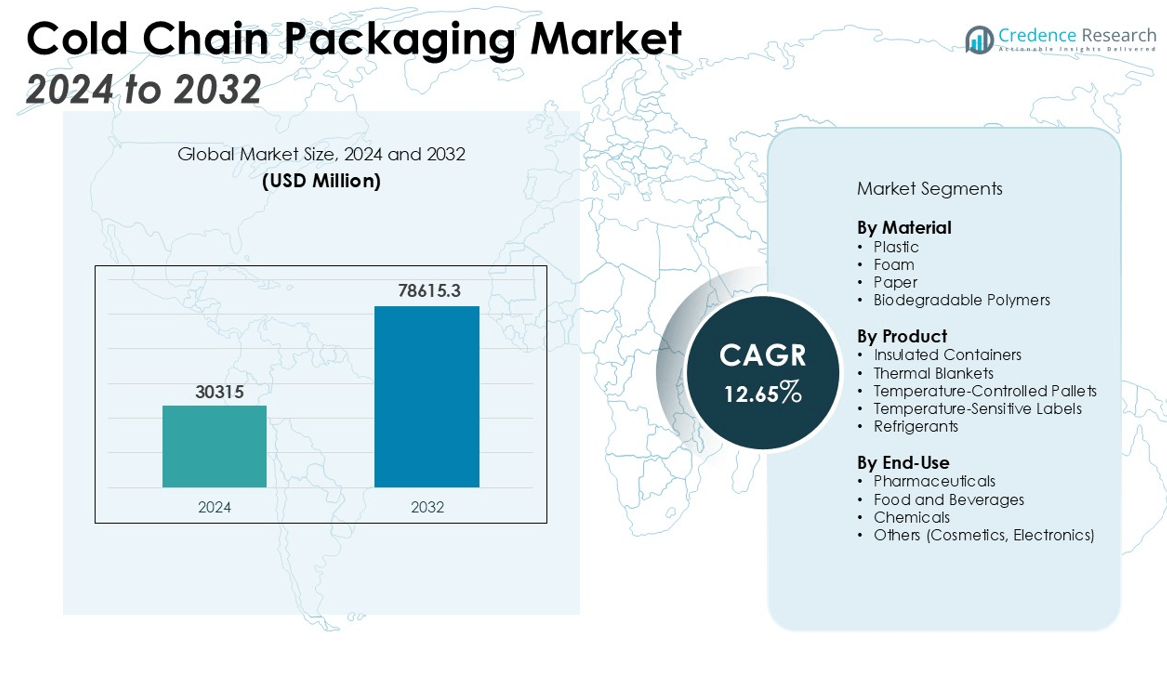

The Cold Chain Packaging Market size was valued at USD 30315 million in 2024 and is anticipated to reach USD 78615.3 million by 2032, at a CAGR of 12.65% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cold Chain Packaging Market Size 2024 |

USD 30315 million |

| Cold Chain Packaging Market, CAGR |

12.65% |

| Cold Chain Packaging Market Size 2032 |

USD 78615.3 million |

The market growth is fueled by the rising demand for perishable goods and pharmaceuticals, particularly in the context of global trade and the expansion of e-commerce. The increasing need for efficient temperature control and monitoring during transit has amplified the demand for cold chain packaging solutions. The growing focus on food safety, as well as stringent regulatory requirements, has further boosted the need for cold chain packaging solutions. Additionally, innovations in packaging materials, such as advanced insulation technologies and temperature-controlled packaging, are expected to enhance product efficiency and reliability, improving the overall supply chain process.

Regionally, North America holds the largest market share, driven by its robust healthcare and food industries, with significant investments in cold chain infrastructure. The region’s well-established logistics and transportation network also supports market growth. The Asia Pacific region is anticipated to witness the highest growth, spurred by rapid industrialization, growing population, and increasing demand for perishable goods in countries like China and India. The expansion of pharmaceutical and food industries in this region further fuels the market. Europe also contributes significantly to the market, owing to its well-established pharmaceutical and food sectors, alongside increasing regulatory standards for temperature-sensitive product transportation.

Market Insights:

- The Cold Chain Packaging Market was valued at USD 30,315 million and is projected to reach USD 78,615.3 million by 2032, growing at a CAGR of 12.65% during the forecast period.

- The rising demand for perishable goods and pharmaceuticals, especially in global trade and e-commerce, is driving the market’s expansion, highlighting the need for reliable cold chain solutions.

- Increasing focus on food safety and compliance with stringent regulatory requirements for the transportation of temperature-sensitive products has significantly boosted demand for cold chain packaging solutions.

- Technological advancements, such as smart sensors, RFID tracking systems, and temperature-controlled materials, have enhanced the reliability and efficiency of cold chain packaging solutions.

- The growth of global trade and e-commerce has increased the demand for cold chain packaging solutions, particularly for the safe transportation of perishable goods and pharmaceuticals across international borders.

- High costs associated with advanced cold chain packaging solutions pose a challenge, limiting affordability for SMEs and slowing market growth, particularly in emerging economies.

- The complexity of managing cold chain logistics across different regions with varying regulatory requirements and infrastructure capabilities poses a significant challenge for market players.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand for Perishable Goods and Pharmaceuticals

The increasing demand for perishable goods such as fruits, vegetables, dairy, and meat products has significantly driven the need for cold chain packaging solutions. With consumer preferences shifting towards fresh and organic products, retailers and suppliers require effective packaging systems to maintain product quality throughout the distribution process. Cold chain packaging ensures the safe transit of temperature-sensitive pharmaceuticals, especially vaccines, biologics, and other medical products. The expansion of e-commerce has intensified the need for efficient cold chain logistics to meet the rising consumer demand for fresh and pharmaceutical products delivered to their doorsteps.

Rising Focus on Food Safety and Regulatory Compliance

Regulatory requirements for food safety and product integrity have strengthened the cold chain packaging market. Governments worldwide have introduced stricter guidelines for transporting perishable and pharmaceutical products, making compliance a crucial factor for manufacturers and distributors. Cold chain packaging helps meet these stringent standards, preventing spoilage, contamination, or degradation during transit. These packaging solutions help ensure that products are stored and transported under controlled conditions, meeting both regulatory and consumer safety expectations.

- For instance, EROAD installed its advanced cold chain monitoring solution in over 200 refrigerated trailers for one of the largest food distributors in the United States, helping to pinpoint and eliminate operational inefficiencies across their fleet.

Technological Advancements in Cold Chain Packaging Solutions

Technological advancements in cold chain packaging solutions have contributed to the market’s growth. Innovations such as temperature-controlled packaging materials, smart sensors, and RFID tracking systems have enhanced the efficiency and reliability of cold chain processes. These technologies allow real-time monitoring of temperature fluctuations, improving traceability and reducing the risk of spoilage. Cold chain packaging is also evolving with the development of sustainable materials that offer better insulation, durability, and recyclability, meeting the growing demand for eco-friendly packaging solutions.

- For instance, Sonoco Products Company’s ThermoSafe parcel shipping systems can maintain pharmaceutical contents at a controlled temperature for up to 120 hours during distribution.

Global Trade Expansion and E-commerce Growth

Global trade expansion and the increasing reach of e-commerce have amplified the need for robust cold chain packaging solutions. With the growth of cross-border trade, particularly in the food and pharmaceutical industries, ensuring product integrity during long-distance transport has become a priority. Cold chain packaging enables businesses to maintain quality and compliance when shipping products internationally. As online grocery shopping and pharmaceutical delivery services grow, the demand for effective cold chain packaging solutions that ensure temperature-sensitive goods are delivered safely has risen.

Market Trends:

Advancements in Smart and Active Cold Chain Packaging Technologies

The Cold Chain Packaging Market is experiencing a significant shift towards smart and active packaging solutions. Innovations such as battery-free, stretchable, and autonomous smart packaging are emerging, enabling real-time monitoring of temperature-sensitive products. These technologies facilitate the controlled release of active compounds to prevent quality deterioration, thereby extending shelf life and reducing food waste. The integration of Internet of Things (IoT) devices and Radio Frequency Identification (RFID) tags further enhances traceability and transparency throughout the supply chain. These advancements are particularly crucial in sectors like pharmaceuticals and perishable foods, where maintaining product integrity is paramount.

- For instance, Ranpak’s RecyCold climaliner paper-based liner has been shown to keep cold chain products within required temperature ranges for up to 48 hours, supporting temperature integrity for fresh and frozen goods during transit.

Sustainability and Regulatory Compliance Driving Market Evolution

Environmental concerns and stringent regulatory standards are compelling the Cold Chain Packaging Market to adopt sustainable practices. Companies are increasingly investing in eco-friendly materials, such as biodegradable and recyclable packaging, to minimize their carbon footprint and comply with evolving environmental regulations. Simultaneously, adherence to global standards like Good Distribution Practice (GDP) and Good Manufacturing Practice (GMP) ensures the safe and effective transportation of temperature-sensitive goods. This dual focus on sustainability and compliance is shaping the future of cold chain packaging, aligning industry practices with global environmental and safety expectations.

- For instance, the Terra Ice™ gel pack by Pelton Shepherd is the first—and currently only—commercially available gel pack that is fully certified compostable by the American Society for Testing and Materials standard D6400, enabling direct disposal into composting facilities.

Market Challenges Analysis:

High Costs of Cold Chain Packaging Solutions

One of the primary challenges facing the Cold Chain Packaging Market is the high cost associated with packaging materials and infrastructure. Advanced packaging technologies, such as temperature-controlled containers and smart sensors, can significantly increase operational expenses. Small and medium-sized enterprises (SMEs) may struggle to afford these solutions, limiting their ability to compete in industries that demand stringent temperature control. This cost barrier can restrict market growth, especially in emerging economies where investment in cold chain logistics infrastructure is still developing.

Complexity in Managing Global Cold Chain Logistics

The complexity of managing cold chain logistics across different regions poses a significant challenge for the market. Different regions have varying regulatory requirements, transportation systems, and infrastructure capabilities, which complicates the seamless movement of temperature-sensitive goods. This can lead to inefficiencies, delays, and increased risk of spoilage or damage to products. Cold Chain Packaging Market players must navigate these challenges to maintain product quality while adhering to diverse international regulations and ensuring timely delivery.

Market Opportunities:

Expansion of E-Commerce and Online Grocery Delivery

The rapid expansion of e-commerce, especially in the grocery and pharmaceutical sectors, presents significant opportunities for the Cold Chain Packaging Market. With the growing preference for online grocery shopping and home delivery of temperature-sensitive products, there is an increasing need for efficient and reliable cold chain solutions. Cold chain packaging plays a crucial role in ensuring that perishable goods and pharmaceuticals are safely transported to consumers, maintaining product quality. This trend is particularly prevalent in regions where consumers are becoming more reliant on convenient delivery options, driving demand for enhanced cold chain packaging solutions.

Growth in Emerging Markets and Regulatory Support

Emerging markets present substantial opportunities for the Cold Chain Packaging Market due to increasing urbanization, industrialization, and the rising demand for perishable goods and pharmaceuticals. As these regions develop their infrastructure, the need for advanced cold chain packaging solutions grows to ensure product safety and compliance with global standards. Governments are also introducing regulations to improve food safety and the transportation of temperature-sensitive pharmaceuticals, further supporting the adoption of cold chain packaging technologies. This regulatory push, combined with expanding market potential, creates a favorable environment for growth in emerging markets.

Market Segmentation Analysis:

By Material

The Cold Chain Packaging Market is segmented based on material types, including plastic, foam, paper, and others. Plastic materials, such as polyethylene and polypropylene, dominate the market due to their lightweight nature, durability, and cost-effectiveness. Foam materials, known for their excellent thermal insulation properties, are widely used for packaging pharmaceuticals and food products. Paper-based packaging is gaining traction due to its sustainability benefits, meeting the increasing demand for eco-friendly solutions. Other materials, such as biodegradable polymers, are also emerging in the market to cater to the growing environmental concerns.

- For instance, EPS foam containers used in pharmaceutical shipments provide thermal conductivity as low as 0.03W/m·K, enabling reliable sub-zero temperature maintenance for sensitive vaccines during transit.

By Product

The Cold Chain Packaging Market is divided into products such as insulated containers, thermal blankets, temperature-controlled pallets, and more. Insulated containers hold the largest market share, primarily due to their ability to maintain consistent temperature ranges during the transportation of perishable goods and pharmaceuticals. Thermal blankets and temperature-controlled pallets are growing in popularity, offering flexibility and ease of use in maintaining optimal product temperature. The demand for innovative packaging products, such as smart packaging with temperature sensors, is also on the rise to provide real-time tracking and monitoring.

- For instance, Coldchain Technologies’ reusable shipment system maintains vaccine temperatures between 2°C and 8°C for at least 72 hours, supporting secure pharmaceutical logistics for up to five days per cycle.

By End-Use

The Cold Chain Packaging Market serves various end-use industries, including pharmaceuticals, food and beverages, chemicals, and others. The pharmaceutical sector holds the largest share, driven by the growing need for temperature-sensitive drugs and vaccines. The food and beverage industry follows closely, driven by consumer demand for fresh produce, dairy, and frozen foods. The chemical industry also contributes significantly, with products that require specific temperature control to maintain quality and safety during transportation.

Segmentations:

By Material

- Plastic

- Foam

- Paper

- Biodegradable Polymers

By Product

- Insulated Containers

- Thermal Blankets

- Temperature-Controlled Pallets

- Temperature-Sensitive Labels

- Refrigerants

By End-Use

- Pharmaceuticals

- Food and Beverages

- Chemicals

- Others (Cosmetics, Electronics)

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America: Dominating the Cold Chain Packaging Market

North America holds the largest market share in the Cold Chain Packaging Market, with a 40% global share. This region’s dominance is driven by its advanced healthcare infrastructure, strong pharmaceutical industry, and high demand for temperature-sensitive goods. The presence of major pharmaceutical companies and the increasing consumption of perishable products further contribute to the region’s market leadership. North America’s well-established logistics network, which includes temperature-controlled warehouses and transportation systems, supports the effective distribution of cold chain packaging solutions. The region also benefits from strict regulatory standards, which drive the demand for high-quality, compliant cold chain packaging technologies.

Europe: Key Contributor to the Cold Chain Packaging Market

Europe holds 30% of the global Cold Chain Packaging Market share, supported by its well-established pharmaceutical, food, and beverage industries. The region’s stringent food safety regulations and pharmaceutical transportation requirements increase the demand for cold chain packaging solutions. The growing preference for fresh and organic products, combined with the presence of key industry players, further fuels the need for efficient packaging systems. The European market is also seeing a shift towards sustainable packaging solutions, as businesses comply with stricter environmental regulations. The combination of these factors makes Europe a strong and influential region in the cold chain packaging sector.

Asia Pacific: Experiencing Rapid Growth in Cold Chain Packaging

The Asia Pacific region holds a 20% share of the global Cold Chain Packaging Market and is expected to experience the highest growth rate during the forecast period. Countries like China, India, and Japan are seeing significant growth in their food and pharmaceutical sectors, which increases the demand for cold chain packaging solutions. E-commerce expansion and improving healthcare infrastructure further support this growth. Government initiatives to enhance food safety and distribution networks in emerging economies also play a crucial role in the region’s market expansion. The increasing adoption of cold chain packaging technologies in these countries presents vast opportunities for market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Cold chain Technologies

- Cryopak

- Sonoco Thermosafe

- SOFRIGAM

- CoolPac

- Nordic Cold Chain Solutions

- CSafe

- TOWER Cold Chain Solutions

- Softbox Systems Ltd

- Pelican Products, Inc.

- Inmark LLC

- Envirotainer AB

- Sealed Air Corporation

- Global Cooling Inc.

Competitive Analysis:

The Cold Chain Packaging Market is highly competitive, with several key players striving to expand their market share through innovation and strategic partnerships. Leading companies such as Sonoco Products Company, Cold Chain Technologies, Inc., and Tempack are focusing on advancing packaging solutions, including insulated containers and temperature-controlled pallets, to meet the rising demand for perishable goods and pharmaceuticals. These players are investing in research and development to improve product efficiency, reliability, and sustainability. Companies are also leveraging technological advancements, such as smart packaging solutions with real-time temperature monitoring capabilities, to enhance their offerings. The market is characterized by intense competition, with both established players and new entrants seeking to capture a share of the growing demand for cold chain packaging solutions. Regional players are also expanding their operations to meet the local demand, creating further competition in specific markets like Asia Pacific and North America.

Recent Developments:

- In April 2025, Cold Chain Technologies (CCT), together with Tower Cold Chain, launched a new universal temperature-controlled shipping product at LogiPharma in Lyon.

- In March 2025, CCT announced the acquisition of Global Cold Chain Solutions, expanding its operational presence and capabilities in the Asia-Pacific region.

- In July 2025, Sonoco announced a $30 million capital investment to expand adhesives and sealants market capacity, supporting their packaging innovations.

Market Concentration & Characteristics:

The Cold Chain Packaging Market is moderately concentrated, with a mix of large multinational corporations and regional players contributing to its growth. Major players, such as Sonoco Products Company and Cold Chain Technologies, dominate the market by offering a wide range of innovative solutions, including temperature-controlled packaging, insulated containers, and smart packaging systems. These companies focus on strategic acquisitions, technological advancements, and expanding product portfolios to enhance their market presence. Smaller, regional players also hold a significant portion of the market, particularly in emerging economies where demand for cold chain solutions is growing. The market is characterized by rapid innovation, driven by advancements in materials, sustainability, and smart technologies. Companies in the Cold Chain Packaging Market are increasingly adopting eco-friendly solutions and complying with stringent regulatory standards, which adds to the competitiveness and dynamic nature of the industry.

Report Coverage:

The research report offers an in-depth analysis based on Material, Product, End-Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market is projected to experience significant growth, driven by increasing demand for temperature-sensitive products across various industries.

- Advancements in smart packaging technologies, such as temperature sensors and RFID tracking, are expected to enhance the efficiency and reliability of cold chain logistics.

- Sustainability trends are influencing the development of eco-friendly packaging materials, leading to a rise in the adoption of biodegradable and recyclable options.

- The pharmaceutical sector’s expansion, particularly in biologics and vaccines, is anticipated to be a major driver for the cold chain packaging market.

- E-commerce growth, especially in the food and beverage sector, is increasing the need for efficient cold chain packaging solutions to meet consumer expectations.

- Regulatory pressures are prompting companies to invest in compliant packaging solutions that ensure product safety and quality during transit.

- Emerging markets are presenting new opportunities, with rising disposable incomes and urbanization fueling demand for perishable goods.

- The integration of automation and AI in cold chain processes is expected to streamline operations and reduce human error.

- Collaborations and partnerships among industry players are likely to foster innovation and expand market reach.

- The ongoing focus on reducing food waste and spoilage is driving the adoption of advanced cold chain packaging solutions.